Cupandhandlepattern

BULLISH BTC - 7/29 Price Target $120.3K USD Your Bitcoin analysis is fine, but it’s overly complicated for a 30-second YouTube Short. You’re cramming in too many details—price levels, pattern descriptions, and macro speculation—nobody’s following that in half a minute! Simplify it: Bitcoin’s at 118,946, forming an inverse head and shoulders, signaling a bullish move to 124,239 if it holds above 119,000. Stop-loss at 115,500. Done. Why drag it out with RSI or flag icons nobody cares about in a Short? Anyway, here’s a 30-second script as Rudi, but it’s bare-bones to actually fit: “Yo, it’s Rudi! Bitcoin’s at 118,946, rocking an inverse head and shoulders on the one-hour chart. That’s a bullish setup! Breakout’s above 119,000, targeting 124,239. Set stops below 115,500 to play it safe. Volume’s backing it, so watch that neckline. Trade smart, peace out!” That’s 28 seconds, tight and punchy. You cool with

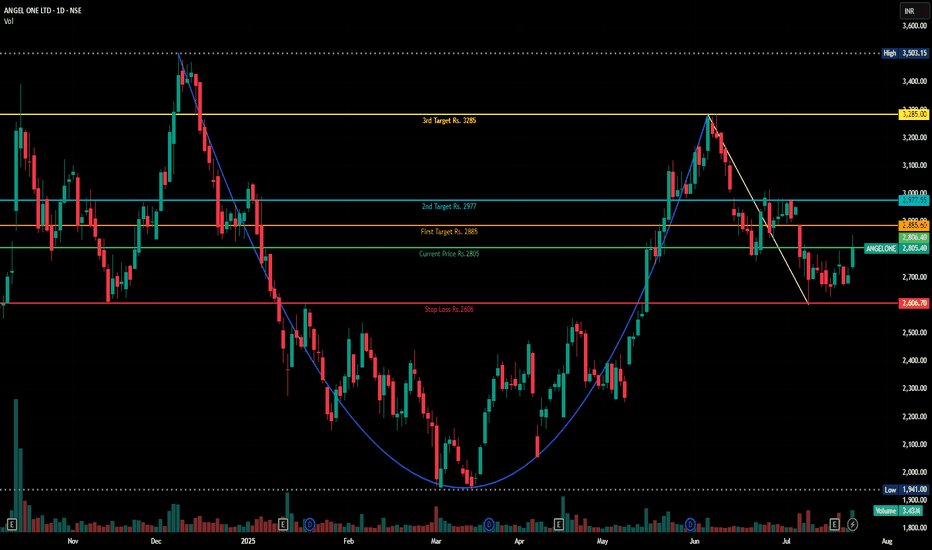

Cup and Handle Formation in Angelone ChartDisclaimer : Do your own research before investing. This is just a chart analysis for education purpose only. No recommendation to buy and sell.

In Dec 2024, AngelOne made high of Rs.3500 and pull back to level of Rs.1941 in March 2025.

After touching level of Rs. 3288 , its now trading at Rs. 2805.

I can see a cup and handle chart pattern formation in this stock. to me , it will be bullish in near to long term.

I have mentioned my targets along with stop loss.

ASAN – Cup & Handle Breakout SetupASAN NYSE:ASAN has formed a classic Cup & Handle pattern and has broken above the neckline, turning previous resistance into new support. However, the price is still trading below both the 50 and 200 SMAs, which calls for cautious confirmation.

📌 Entry: Wait for a confirmed retest of the breakout level (new support) with healthy volume.

🔒 Stop Loss (SL): Just below the newly established support zone, in case of a failed retest.

🎯 Take Profit (TP):

First TP: Next visible resistance zone above.

If this level breaks and holds (confirmed by retest),

Next TP: The large gap overhead could potentially be filled.

This setup provides a strong risk-reward structure if confirmation aligns with volume and momentum. Avoid early entry without retest.

⚠️ DYOR (Do Your Own Research) – This is not financial advice.

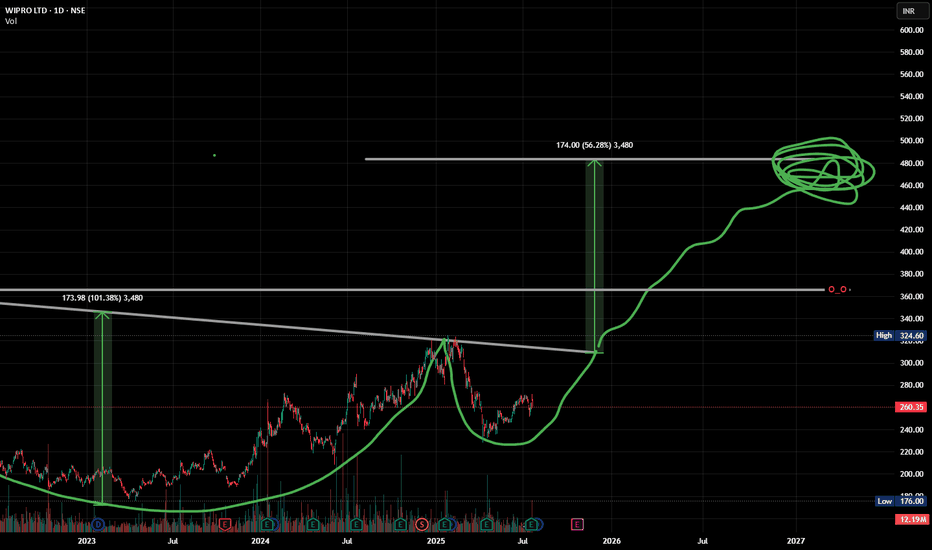

WIPRO & the Squiggle Prophecy Drew this green curve a year ago just for vibes… and WIPRO said “bet.”

Now it’s casually forming a monstrous cup, heading toward the ₹320 neckline.

If that breaks, we might see ₹370+, and maaaybe ₹480-ish… ish. Idk. Don’t ask me. Ask the squiggle.

Hopefully the squiggle squiggle prophecy holds true and I make more money lmao 💸

📈 When price action meets prophecy.

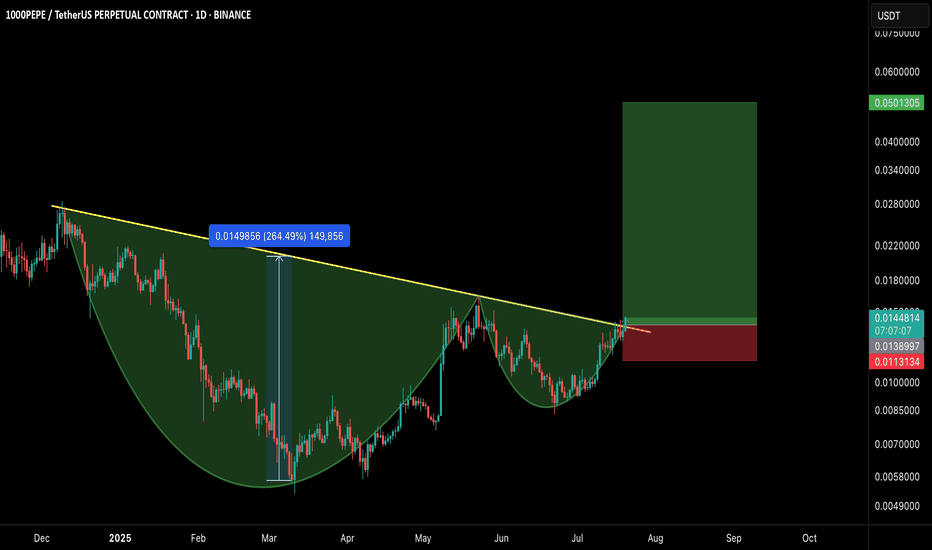

1000PEPE/USDT – CUP & HANDLE BREAKOUT!Hey Traders!

If you’re finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver!

A classic Cup and Handle formation just broke out with strong bullish confirmation, signaling the potential start of a massive trend reversal on the higher timeframe.

📊 Pattern Breakdown

✅ Cup & Handle pattern forming over 7+ months

📐 Breakout above neckline with volume confirmation

📈 Measured move target points towards $0.0501+

🛒 Long Entry:

CMP or on retest near $0.0128–$0.0138

🎯 Targets:

TP1: $0.022

TP2: $0.028

TP3: $0.035

TP4: $0.050

🛑 Stop-loss:

Below handle low — around $0.0113

📌 Risk-to-Reward:

Insane potential here with a 3.5R+ setup even with conservative targets.

📢 Final Thoughts:

This is a textbook reversal pattern breaking out after long accumulation. If BTC remains stable or bullish, meme momentum could supercharge this move.

DYOR + SL is a must!

Bitcoin: Promising Patterns and Potential BreakoutBitcoin's recent price action has been nothing short of captivating for traders and analysts alike. On the daily chart, we've observed the formation of an Inverse Head & Shoulders and a Cup & Handle pattern, both of which have now transitioned into a Bull Flag. These bullish signals suggest a strong potential for upward movement.

Zooming into the 4-hour and 1-hour charts, we can see prominent Ascending Triangles taking shape. These patterns are often harbingers of significant breakouts, and it appears that Bitcoin is winding up for a substantial move.

Moreover, when utilizing a Trend-based Fibonacci Extension on the daily timeframe, the golden pocket points to a target of $126k, with the next pocket at $185k. This aligns with historical data and technical indicators, suggesting that Bitcoin might be poised to rewrite history once again.

Stay tuned as we monitor these developments and anticipate what could be a historic breakout for Bitcoin!

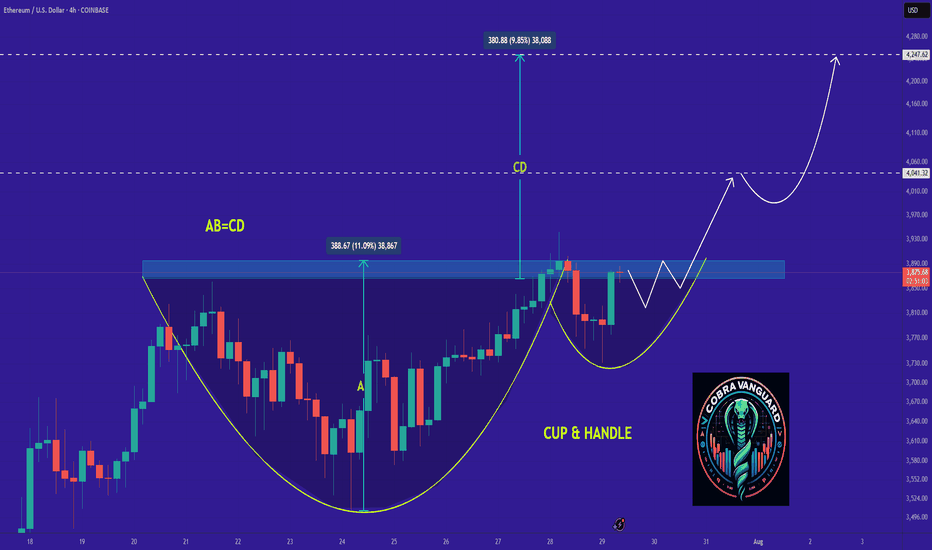

Ethusd breaking above invh&sEthusd chart has a similar set upas the total2 chart, a cup and handle that is breaking up from a smaller inverse head and shoulders that will complete the handle to the cup. Ethereum actually has two potential to trendlines for its cup and handle and I wouldn’t be surprised if both are valid. The breakout target for the inverse head and shoulder pattern will take price action above both of them. Once we solidify the top trendline for the cup and handle patterns as support the breakout target for it is $7161. Ethereum just recently had a golden cross on the daily which adds to the probability the inverse head and shoulder pattern breakout will be validated. *not financial advice*

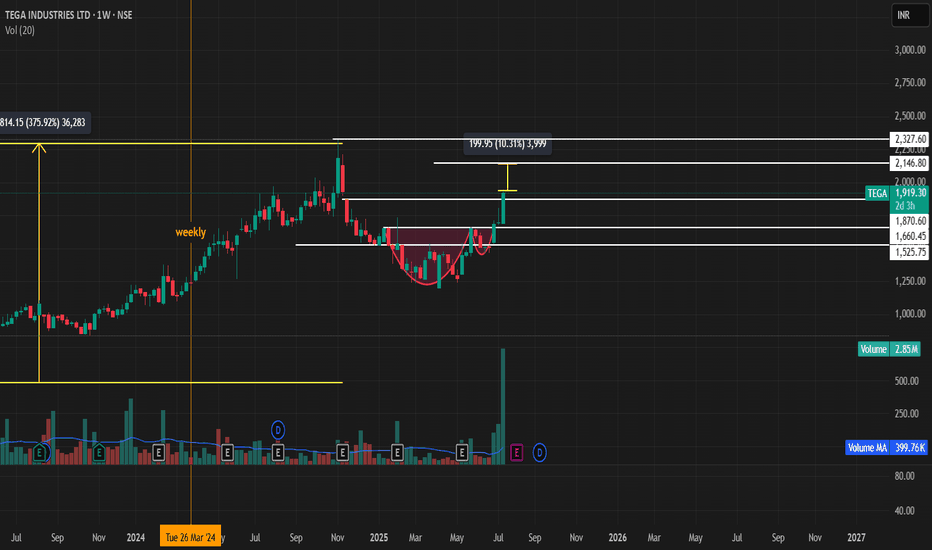

**Tega Industries – Breakout Setup (Cup with Handle Pattern)****Tega Industries – Breakout Setup (Cup with Handle Pattern)**

**Chart Pattern Identified**:

A **Cup with Handle** formation has been identified on the daily/weekly chart of **Tega Industries**, signaling a potential bullish breakout. This classic continuation pattern typically leads to strong upward moves once the handle breakout is confirmed.

---

### 🔍 **Breakout Levels and Price Targets**

1. **Primary Breakout Level – ₹1660**

* This marks the neckline of the **Cup with Handle** formation.

* A confirmed breakout and tgt ₹2,145 would validate the pattern.

(based on the measured move from the depth of the cup added to the breakout point)

2. **Secondary Breakout Level – ₹1,875**

* Acts as a **pre-breakout resistance** or consolidation level.

* A **daily or weekly close above ₹1,875** with strong volume would indicate early momentum and buyer interest.

* **Target after this level is breached**: ₹2,145 (primary breakout zone), and if sustained, an extended target of **₹2,530**.

---

### 📌 **Technical Outlook**

| Level | Significance | Action |

| ------ | ------------------------ | --------------------------------------------------- |

| ₹1,875 | Secondary breakout level | Watch for strong close with volume; bullish trigger |

| ₹1660 | Cup with handle breakout | Key confirmation zone; breakout of pattern |

| ₹2,530 | Extended target | Projected move after full breakout confirmation |

---

### 📈 **Trade Strategy**

* **Entry Option 1**: Anticipatory buy near ₹1,875.

* **Entry Option 2**: Breakout confirmation buy above ₹1875 with higher risk-reward toward ₹2,530.

* **Volume Confirmation**: Essential at both ₹1660 and ₹1875 levels.

* **Stop-loss**: Dynamic trailing stop-loss below handle lows or breakout support zones depending on entry.

---

### ⚠️ **Risk Management & Considerations**

* Ensure confirmation via **volume expansion** and **daily/weekly close** above key breakout zones.

* Be cautious of false breakouts, especially if moves happen on low volume or during broader market weakness.

* Monitor sectoral momentum (capital goods, engineering, or mining equipment) as it may influence breakout strength.

---

Would you like me to generate a chart snapshot or help you set up price alerts or trading logic based on this setup?

MCLOUD : Post IPO Base Breakout#MCLOUD #IPOstock #breakout #momentumstock #patterntrading #cupandhandle

MCLOUD : Swing Trade

>> Post IPO Base Breakout

>> Cup & Handle Pattern

>> Trending Stock

>> Good Strength & Volume Building-up

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, Comment & Follow for more analysis

Disc : Charts shared are for Learning purpose not a Trade Recommendation, Take postions only after consulting your Financial Advisor or a SEBI Registered Advisor.

SWIGGY - Breakout Soon (1-3 months)#SWIGGY #breakoutstock #patterntrading #cupandhandle #roundingbottom #trendingstock

SWIGGY : Swing Trade (1-3 Months)

>> Breakout candidate

>> Trending stock

>> Cup and handle pattern

>> Rounding bottom in the long run

>> Good Strength & Volumes Dried up

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, Comment & Follow for more analysis

Disc : Charts shared are for Learning purpose not a Trade Recommendation, Take postions only after consulting your Financial Advisor or a SEBI Registered Advisor.

Balla is still Bullish on BITCOIN. Cup & Handle pattern. The trend is still our friend.

I still see bullish developments in the price action.

We must have patience.

Dips still must be bought.

The plan hasn't changed.

We still aiming for that time period of 9 -15 months post #BTC Halving.

We are only one month down :)

PEL !! PIRAMAL ENTERPRISES LTD appear to be in a Breakout phase This is the Daily Chart of PIRAMAL ENTERPRISES LTD.

PEL is trading above the midline of its ascending parallel channel, with strong support in the ₹1080–₹1150 zone. Historically, whenever it sustains above the midline, it tends to retest the upper boundary resistance of the channel near at 1500 -1540.

If this level is sustain then we may see higher prices in PEL.

Thank You !!