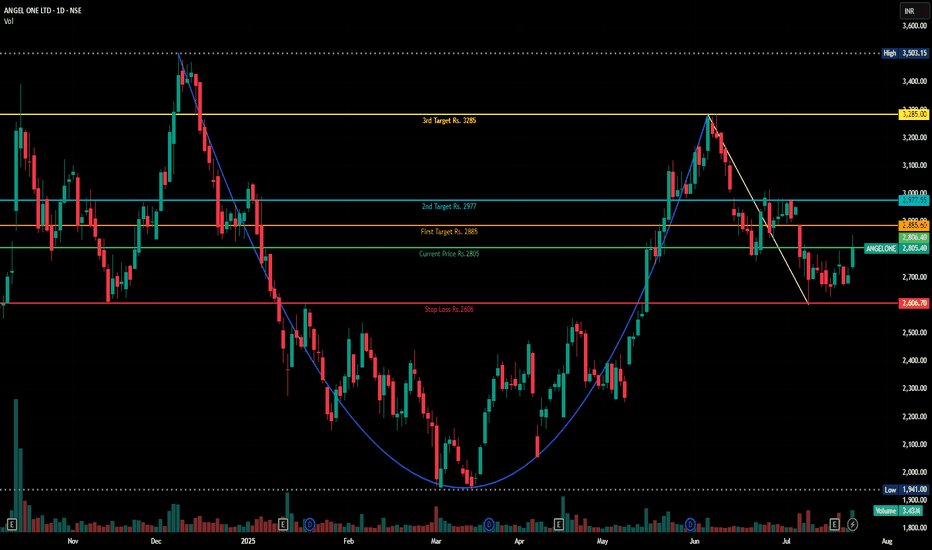

Cuppattern

Cup and Handle Formation in Angelone ChartDisclaimer : Do your own research before investing. This is just a chart analysis for education purpose only. No recommendation to buy and sell.

In Dec 2024, AngelOne made high of Rs.3500 and pull back to level of Rs.1941 in March 2025.

After touching level of Rs. 3288 , its now trading at Rs. 2805.

I can see a cup and handle chart pattern formation in this stock. to me , it will be bullish in near to long term.

I have mentioned my targets along with stop loss.

TRX Approaching Cup Breakout – Market Decision Imminent

TRX/USDT – Daily Chart Analysis

TRX is shaping a textbook Cup Pattern on the daily timeframe — a strong bullish continuation signal if confirmed. Price has gradually curved upward, and we are now testing the key resistance area at 0.29–0.30.

📌 Key Scenarios:

🔹 Bullish Breakout Scenario:

A confirmed breakout and daily close above 0.30 would validate the cup formation and set the stage for a rally toward the next target zones at 0.35 and 0.45 — measured based on the cup’s depth.

🔹 Bearish Rejection Scenario:

If the resistance holds, expect a pullback toward the midline (~0.24) for potential accumulation and base-building before the next move.

💡 Volume confirmation and breakout momentum are critical to watch here. The market is approaching a decision point.

🟢 Our directional bias remains bullish — we anticipate the breakout to occur, leading to an upward continuation. However, we’ll wait for confirmation of the breakout and completion of the pattern before entering a long position.

TOTAL CRYPTO MARKET CAP is back-testing the cup & handle patternIt's no mystery that the crypto market has been getting hit pretty hard since mid-December. However, the total market cap—which had previously broken out of a nice cup-and-handle pattern—is now backtesting the rim line and looks to be setting up for what could be an incredible move upward over the next 6 to 9 months, with the potential for a double within that timeframe.

Good luck, and always use a stop loss!

SILVER | The longest timeframe cup & handle in history!SILVER has been forming a cup-and-handle pattern for the past 45 years. And even though SILVER has made some incredible moves during that time, its price has been blatantly manipulated by the LBMA (London Bullion Market Association), central banks around the world, and a completely fraudulent derivatives market that circulates fake paper silver at hundreds of times greater than the underlying asset. Prices have been artificially suppressed for decades to prop up the global fake fiat currency Ponzi scheme and tighten the grip of control over nearly every asset and human being—making these fake currencies appear legitimate when they are clearly instruments of debt and deception.

This artificial suppression of SILVER and many other commodities is coming to an end as the debt-and-death paradigm unravels before our very eyes.

The day is rapidly approaching when SILVER will enter true price discovery, and people will not believe the price points it will reach in the very near future. Silver is one of the most—if not the most—undervalued physical assets of all time.

Good luck, and always use a stop-loss!

ONDO has nice potential if it pulls back to the proper buy zone.ONDO has been on a tear lately with the rest of the crypto market, and some really good opportunities could present themselves 'if' it pulls back into the proper discount buy zone. The fair value gap, or just above it, could present the perfect opportunity for a lower risk entry. Higher risk entries could present themselves within the corresponding fib zones. But I wouldn't chase price. Instead, have patience and let the price come to you.

Good luck, and always use a stop-loss!

There is currently a MASSIVE Cup & Handle in SOLANA!!SOLANA (SOL) has been building a massive cup-and-handle formation on the weekly chart that has taken 3 years and 8 months to achieve. If SOL breaks out of this pattern to the upside, the gains could be unbelievable!

Good luck, and always use a stop-loss!

SOLANA has formed a Cup & Handle Pattern on the weekly/daily.SOLANA known for making some incredibly big moves over short periods of time. It is currently forming the handle of a large Cup & Handle formation, which could signal substantial price appreciation over the coming year or so.

Good luck, and always use a stop loss.

TOTAL CRYPTO MARKETCAP CUP & HANDLE FORMATION!The massive cup & handle formation currently forming the handle in the Total Crypto Market cap is stunning. When this plays out, it's going to create more millionaires than kung fu circus.

There will be a massive liquidity grab previous to the bottom, and this will be followed by an incredible breakout over the coming months.

Soon!

Cup with handle

Incorporated in 1998, Allsec Tech is a global leader in outsourcing solutions offering future-ready, resilient business transformation services to industry heavy-weights, Fortune 100 companies, and growth-focused organizations. The services provided by the Company include data verification, processing of orders received through telephone calls, telemarketing, monitoring quality of calls of other call centers, customer services and HR and payroll processing. The Company has delivery centers at Chennai, Bengaluru and NCR.

With 4,000+ FTEs spread across 5 contact centers in the US, Philippines, and India, the company manages over 1 Million customer contacts per day, via multiple touchpoints.

Grab a Cup of Coffee We'll Handle ThisA cup and handle formation is a technical pattern that can be found in financial charts. It is considered a bullish pattern, meaning that it may indicate a potential opportunity for a price increase.

The pattern is named after its resemblance to a cup with a handle. The cup portion of the pattern is created when the price of an asset forms a rounded bottom over a period of time, followed by a pullback that forms the handle. The handle is usually a smaller, downward-sloping price movement that retraces a portion of the cup's advance.

Traders often look for a cup and handle formation as a signal that the price of an asset may be poised to break out to the upside. However, it's important to note that technical patterns are not foolproof and should be considered in conjunction with other forms of analysis.

If you have identified a cup and handle formation in a chart and believe it may be an opportunity, it's a good idea to confirm your analysis with other indicators or signals before making any trading decisions. Additionally, it's important to always practice proper risk management and consider factors such as your investment goals, time horizon, and overall market conditions.

Stellar Lumens - Looks good technical and fundemental - 2023!!This is not financial advise to go all in big, DCA and use risk management otherwise if you like go big on this investment

Stellar Lumens is more than an investment hold to 2025 and more, you can trade it if you like

On the fundamentals side Stellar Lumens has so much going for it. Too many turning a blind eye on this because it moves slowly

Would not be surprised if intuitional investors buy up big in big volumes for 2023

Some links to do with Stellar Lumens for own research

www.coindesk.com (IBM partnership with Stellar Lumens to issue stablecoins through World Wire)

stellar.org (USDC stable coin running on the Stellar Network)

stellar.org (Moneygram partnership with Stellar for remittance payments)

satoshipay.medium.com (SatoshiPay partnership with Stellar for micropayments)

stellar.org (Representing Blockchain on the Commodity Futures Trading Commission’s Global Market Advisory Committee)

Stellar Lumens Coffee Cup pattern on the Weekly chart - see the handle of the coffee cup? Once break it on the weekly, it has to close above $0.175 US and than it can do 10x - believe it reach $1.75 US, instead of the $0.82 US last high. Now it can bottom out 1 more time till about April 23 around $0.0676 US, the last bottom on the weekly was $0.07 US and believe it has bottom out. You can wait or DCA now. I believe it's still a very good buy now, trying to work out the perfect bottom forget it. On Weekly Stellar Lumens can still be bearish around June 23rd however for that case it going up slowly till it breakouts

If you confident about Stellar Lumens I would like this article post to have more research links for other bullish scenarios for the Stellar Network

Could SWIFT payments be replaced on the Stellar Lumens network as the alternative faster and reliable form of payment transfers?

Could Nasdaq exchange allow digital payments for trading on the Stellar Lumens network?

MEGAPHONE PATTERN ...!!!!! UP?????Hello, everybody! If you like the concept, don't forget to like and follow it.

T he megaphone and cup pattern's development began with the price.

Please show your support for me by liking and following my ideas.

Also, let us know what you think in the comment section.

Acuity Brands Cup and Handle Pattern Acuity Brands, Inc (AYI) is an industrial technology company. They provide lighting and building management solutions in North America and internationally. The company was incorporated in 2001 and is headquartered in Atlanta, Georgia. AYI is a component of the S&P 400 Mid Cap Index

Market Cap: 5.968B

Beta (5Y Monthly): 1.54

PE Ratio (TTM): 16.75

Average Volume: 277,357 (1)

Cup and Handle (Bull Market Stats):

Overall performance rank (1 is best): 3 out of 39

Breakeven failure rate: 5%

Average rise: 54%

Throwback rate: 62%

Percentage meeting price target:

The above numbers are based on 913 perfect trades. (2)

AYI

Daily Volatility (Standard deviation YTD): 2.20%

Annualized Volatility (Standard Deviation YTD): 34.24%

S&P 400 Mid Cap Index

Daily Volatility (Standard deviation YTD): 1.59%

Annualized Volatility (Standard Deviation YTD): 24.76%

(The above were calculated using historical data)

The data above shows the daily and annualized volatility for AYI and the index it is a component of. As you can see AYI has a higher daily and annualized volatility. This can be good or bad. Depending on the way the stock goes and your position. For this pattern, I would say this is a good thing - the pattern requires volatility to breakout and reach the price target.

AYI has formed a cup and handle chart pattern. This pattern, as the name suggests, looks like the top ridge of a cup and the handle. The pattern forms as follows: price rise - left peak forms - price goes down at an angle and forms a trough - price rises again at an angle to form a peak. Sometimes, as in this case, the right peak may form a flag/consolidation pattern as well.

The blue line on the chart above represents a line of support for the stock. The red box represents what could possibly be a previous cup and handle position. However, in this pattern and the one on the right, I'm not that convinced of their authenticity.

The price rise before the pattern formations is not that convincing. I would ideally like to see an upwards trend for at least 3 months. The price has been in a downward trend YTD and then moving horizontally for nearly six months. However, this horizontal movement may be useful - if there is a upward breakout, the momentum could be strong.

Cup and handle patterns are ranked 3/34 patterns - meaning when done right, the pattern can bring good performance. The Breakeven failure rate is 5% which is low and hence a good signal. The Throwback rate is 62% which may be a concern. Especially if the pattern is not that strong - as in this case.

Totaling this all together, I would give this pattern a rating is 3/5. The ROI may not seem sufficient to justify a long position. Henceforth this is a riskier position.

The main issues are:

A previous cup and handle position formed before that did not breakout

Lack of a strong upwards trend before the pattern formation

The pattern duration is around 10 weeks. This is within the range of ideal 7 - 65 weeks, albeit at the lower end of the spectrum.

The price target is the difference between the right peak and trough * the percentage meeting price above:

$204.54

From the current price that represents a 9.13% ROI.

Macroeconomic considerations:

Interest rates are rising and so will inflation. We are most likely already in a recession. I would not be concerned about this for this trading idea. This will most likely be a short-term trade for a couple of weeks once the stock breaks out with a close above the trendline.

Fundamental analysis:

Since this will be a short-term trade, I did not find the need to include any further research- the next earnings is not until January so no concerns.

References:

1 finance.yahoo.com/quote/AYI

2 thepatternsite.com/cup.html

VET Bullish Long!VET is going to finish the cup on a bullish trend and then go on to inverse head and shoulders! I see this heading to the first black line drawn on the chart in early December and the head and shoulders inverse completed in early January. After the new all time highs will be established!

#VET is #bullish in every way in my opinion.

This is my opinion and not financial advice.

Happy #CryptoTrading!

⚠️🍵 #Bitcoin Short-Term "Cup" Could End W/ Short Squeeze $BTCA small #shortsqueeze seems to have already occurred for $BTC, with a false break of the support trend bringing in shorts and either stopping them out or liquidating a low volume of orders. I have not shown the RSI's on here as they are both at mid-levels (50/50 chance of moving up or down), however the may be overheating slightly. This could mean a second "fake-out" break of the upper trend with a larger drop down to the $18K level. However, if this pattern plays out, this could be what reverses the crypto market in the short term. There are confluences with both the measured move and the 1.618 fib retracement level of the most recent, short-term wave down, as well as the expected pivot for a retracement back down to the upper trend, should a confirmed breakout occur. As I already stated, there is still a strong chance for either scenario to play out, so this is something I (personally) will just be tracking for the moment, but not actually trading until one of these two scenarios confirm.

How I Might be Trading this:

For a "fake-out" and break of the support-trend, I will be looking for a buy/long around $18,700-$18,800. I may consider shorting the break of support, however I don't really know ( yet ) if the risk/reward will be worth it, especially because this range being the bottom price-range seems likely to me, IMO.

For a break of upper, medium-term trend, I would be possibly shorting around the target zone (shown with the box), then a buy/long upon retracement and testing of the upper trend. However, where the RSI's are upon testing that level would mostly determine whether I go forward with that trade.

*This is all my opinion, based on chart data, and what I'm personally doing with my trades. This is not financial advice.*