Currencystrength

Our CURRENCY STRENGTH Meter Readings: 09/06/21 (See on Chart)NB; These readings fluctuate from time to time. They apply to daily to weekly timeframes (Not so much on smaller timeframes).

Make use of it to trade the best pair (by pairing the weaker currencies to the stronger currencies). For example, taking the current strongest currency - GBP and pairing it to the weakest currency - JPY; = GBPJPY LONG.

Thank you. Trade smartly.

DXY continuing to push higherAnother strong day for the dollar index as the bulls push higher. We now wait patiently for the 200EMA to be tested.

Is this fundamental data being priced in early? We have seen a volatile bond market recently and key economists predicting a strong dollar before the end of the year.

We covered this in our last publish looking at the DXY and how we could be looking to set up in the coming weeks/months under a new Biden administration. Vaccination numbers also continue to rise across the US, prompting more economic upturn coupled with the continued stimulus package being received by a large percentage of American citizens.

Biden has spoken about his plans, But where will the money come from? another $3trillion is going to be challenging.

AUD/JPY - Trade idea We are seeing minor strength in the AUD and continued weakness in the JPY so fundamentals are to the upside, therefore we look for technical entries in that direction. we are seeing minor consolidation now on the 1h timeframe, probably due to the AUD not being as strong as most currencies at the moment. So we will be interested in placing a trade when this consolidation is broken to the upside, possibly breaking previous high too, exhaustion then we would look for entry confirmation for a trade to our next major area of sell pressure.

Could USD/JPY see a major move?With Biden due to sign a 1.9T stimulus package could we see major strength in the USD? and if we do which currency will see the biggest move? well the JPY has been consistently one of the weakest if not the weakest currency for a few weeks now so if we are going to see major strength in the USD id be placing my bests on USD/JPY being the biggest mover and having the most buy pressure enter the market, this could be a great opportunity to have an aggressive entry to the upside and trail our stop loss to make the most of this move, taking small profits at area of sensitivity.

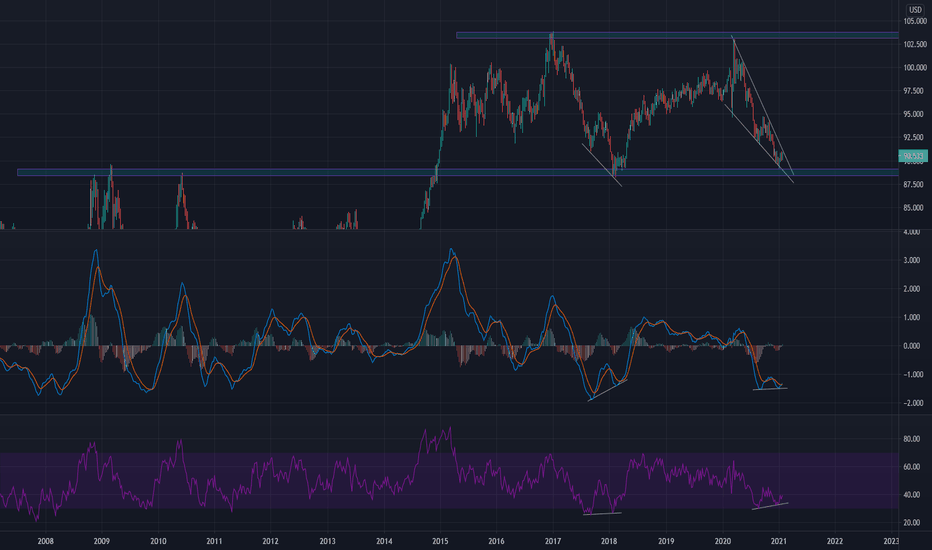

US Dollar Potential BreakoutThe US Dollar Currency Index (DXY) is trading near the bottom of a falling wedge.

A breakout to the upside is probable given that:

- Bottom of wedge coincides with a major price structure (horizontal support / resistance).

- Bullish divergence on MACD and RSI.

If a breakout does occur, expect a downturn in the stock market (DXY is inversely proportional to the SPX).

EURUSD breakout to test 2018 highs Weekly perspective, $EURUSDEURUSD breakout to test 2018 highs Weekly perspective, $EURUSD. Weekly candle for past week held support and rallied into the end of the week with a bullish close. Look for 2018 highs next couple weeks in 2021. Strength in the EUR and Weakness in the dollar is expected with new US administration and the possibility of passing trillions more in stimulus.

short-term bullish dollar play UUPThe dollar has bounced off its bottom trend line. After having such a long period of weakening, it is due to bounce back a bit. It is extremely rare for the dollar to not reverse the trend after an extended period of strength or weakness.

It may not rally back much, but it will give you some gains in the short-term. Sell half when it hits the upper trend line and let the other half ride. There have been some contrarian calls on Wall Street for a surprisingly strong dollar.

UUP is a way to play the bullish dollar. I currently have a vertical call spread expiring 2/19 with the buy-strike being $24 and the sell-strike being $26.

EURUSD 1HR CHART UPDATEEU IS SETTING UP NICELY FOR A BUY. AT THE ENTRY PRICE YOU WILL SEE PRICE TOUCHED IT THEN REJECTED DOWN TO TEST THE DAILY FLOOR. IT HAS NOW CREATED A ENGULFING CANDLE HEADED TO THE UPSIDE.

THERE IS NON FARM NEWS FOR USD RELEASED TODAY AT 13:30, KEEP A TIGHT SL

www.fxstreet.com

CURRENCY STRENGTH IS OK RIGHT NOW FOR EU

www.livecharts.co.uk

btc/usdHello traders, here is the analysis from our team :

This won't be a normal post.

We feel, BTC/USD is poised for Super Run . You don't see a set up like

this often. buy: 12009.

Target: 12109/ unlimited. Money management

stop: 11909

Stop will be up to Individual. This could shoot to moon.

Let us know in the comment section below if you have any questions.😉

PHPUSD Outlookphilippines is struggling alot, offshore workers going back. so foreign remittance decreased alot. Tourism decreased by 75% + -, unemployment is going to keep going up and the government have to keep borrowing money from outside. GDP -16.5&, GNI -17%, Inflation 2.7% July 2020, trade exports: $5.33 p Imports: $6.63 p =balance of trade $-1.3p )fob value in billions(June 2020 stats), The country though, would benefit from a much weaker php, focus on more export, and you need to be price competetive, cut imports. Weaker php also means increased tourism boom once covid start normalizing. Just my thoughts.

AUDCAD is going to CRASH DOWN! BloodhoundST!After analyzing Fish-qantum-pattern, 3D-triangule-pattern, Frequency waves, Ellipses, Trend, Currency strength ... etc...

I've found this 'qantum-gravity-price-zone', and ... just don't let it go. Let's wait for #Bloodhound'sEffect! And #BePatient!

"I just understood the quantum-universe and its extension, and I applied-it to trading (in collaboration with Sniper'sBrothers), I feel good to know that I was the first to develop Quantum-trading, Qantum-time-analysis and Qantum-patterns (in my first 3 months of trading, maybe I was born as a crack ...), with this, you have the market in your hands, basically... 5-17 hours a day of trading's study were worth it, although it almost killed me... but, I'm here now for breaking the market as always. We're going to change the history of trading so far". -JBPip

#FirstQantumTrader

Info: I don't use SL these SL are for reference.

Correlations:

AUDJPY,

AUDUSD,

AUDCHF,

EURUSD,

EURJPY,

EURCHF.

GBPJPY

GBPUSD

GBPCHF ...