Curvefinance

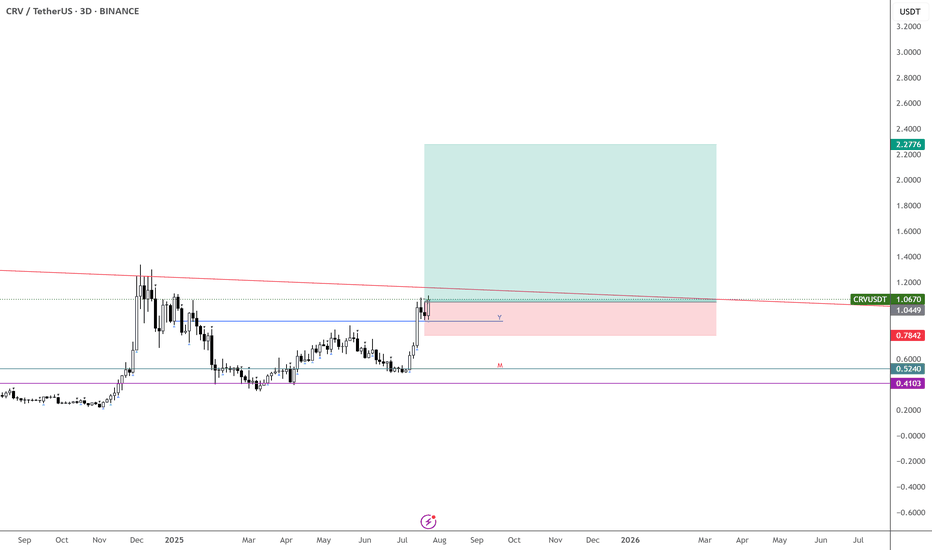

CVR – Ready to Run, Monthly Confirmation In

Tons of strength showing on $CVRUSDT—expecting continuation from here and even more once the trendline breaks.

The monthly candle is confirming the move, pointing to a potential 6-month uptrend. Looks like this one is finally ready for the run we’ve been waiting for.

Buying here and stacking more around 90c if given the chance.

First target: above $2.

BINANCE:ENAUSDT may have gotten away—but this one won’t.

TradeCityPro | CRV: Navigating Curve's DEX Dynamics👋 Welcome to TradeCityPro!

Today, I'll analyze the cryptocurrency CRV from the Curve project, a decentralized exchange (DEX).

📅 Weekly Timeframe

We observe a trading range from $0.3903 to $1.2502. The price once dipped below this range to $0.2237 before rebounding, and it has now reached the upper boundary again.

🔍 Breaking the resistance at $1.2502 could signify an exit from the accumulation zone, potentially propelling the price toward higher resistances. The key weekly resistance is $6.1038, which is the all-time high, but intermediate resistances exist at $1.8428 and $2.8814.

📊 The market volume became bearish after reaching $1.2502, aligning with a market correction. The RSI has reset from the overbought region, ready to display new momentum as the market structure evolves.

🔽 If selling pressure enters the market and the price breaks below the $0.3903 support, it might suggest the previous uptrend was merely a dead cat bounce, preparing for a drop to new lows.

📅 Daily Timeframe

More details of the bullish run can be observed here. As mentioned, the price has reached up to the $1.2502 resistance and has entered a corrective phase.

✨ The correction established a floor at $0.7942, coinciding with the 0.236 Fibonacci level, though this support has now been breached. The price is forming a descending trendline, moving toward lower support levels.

🧩 The first minor support is the 0.382 Fibonacci level, not strongly backed by static price supports. The main supports are at $0.4970 and $0.3490.

📉In my view, breaking below $0.4970 would necessitate a new upward structure aiming back towards the range's ceiling. Conversely, a break below $0.3490 would end the bullish trend completely. A break below $0.2237 would initiate a bearish phase in the High Wave Cycle. Breaking below 30 on the RSI would further confirm the bearish trend.

🔼 If the price rebounds above $0.7942 and negates the current downward trend, we could consider a long position following a break of the descending trendline. The target would be modest, aimed at the top of the current box. The critical trigger for a long position remains the breach of $1.2502, a strong indicator for the start of a new bullish leg.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Curve (crv)Crv usdt Daily analysis

Time frame 2hours

Risk rewards ratio >2.3 👌👈

Technical analysis

CRV is caught in a triangle. In similar cases, the price breaks out from the bottom or top of the triangle.And we'll have to wait and see where it comes from.

But why is my analysis a bullish one?

This bullish analysis is solely for the purpose of examining market sentiment.

Given the positive news we hear in the cryptocurrency market and the positive sentiment of buyers in this market, we come to this bullish analysis.

Risk rewards ratio is another good point for this analysis

Ratio 2.3 makes me a brave heart analyzer.

Only by introducing a false selling pressure can this analysis be failed. So , I put my LS in correct place. Of course I know the power of stop hunters.

TradeCityPro | CRV: Daily & 4H Correction Patterns👋 Welcome to TradeCityPro!

In this analysis, I will examine the CRV coin, which belongs to the Curve project, a DEX platform in the DeFi space. The analysis is conducted on both daily and 4-hour timeframes.

📅 Daily Timeframe: Beginning of Correction In this timeframe, after negative news for CRV, the price reached the support level at $0.2309, forming its main bottom there and starting its upward movement after accumulating.

📊 With the influx of buying volume, resistances at $0.3425 and $0.4070 were easily broken, and the price reached the resistance at $1.2630 with high momentum. The buying volume peaked and, with a Blowoff candle, the price correction began.

✨ The RSI exiting the Overbuy zone triggered the start of the price correction down to $0.382. Currently, the bottom of the correction is forming at $0.7890, and breaking this area could reach the $0.5 and $0.618 Fibonacci levels, which I have marked as limited areas for you. If these areas break, the next supports will be at $0.4070 and $0.3425.

🔍 If the price wants to continue in the same cycle with the next upward wave, it should not lose the range between $0.5 to $0.618 Fibonacci. Breaking this range would reset the market momentum, and the chart would need to create a new structure.

📈 For going long, the best trigger is breaking $1.2630 targeting $1.9116. If this area breaks, the volume and RSI should converge with the price. A divergence in volume greatly increases the likelihood of a fake break. For riskier triggers, it's better to look into the 4-hour timeframe.

⏳ 4-Hour Timeframe: New Price Structure in the Correction Phase

In the 4-hour timeframe, we can see the last upward leg in more detail and apply a new Fibonacci Retracement.

🧩 Currently, the price has corrected to the $0.5 Fibonacci zone, which overlaps with $0.7890, forming the primary bottom of the correction.

🔼 For an early and risky long position, breaking the resistance at $1.0451 is suitable. However, as mentioned in the daily timeframe analysis, the main resistance and trigger for going long is $1.2630.

🔽 For a short position, breaking the $0.382 Fibonacci, which overlaps with $0.9069, is suitable, but be cautious as you are shorting in a correction of an upward trend. Engage minimal risk so that if the upward trend continues, you do not incur significant losses.

🔑 The market volume has been decreasing since the peak at $1.2630 and is now at its lowest. The RSI is also ranging between 39.82 to 59.27, with a break of either area potentially introducing new momentum into the market.

📉 If further correction occurs, the next supports are the $0.618 Fibonacci at $0.69, and the areas at $0.5553 and $0.4661.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | CRVUSDT Favorite Among Ethereum Whales👋 Welcome to TradeCityPro Channel!

Let’s analyze CRV, one of the older and more popular coins in the DeFi space, previously a staple in many crypto whales' wallets.

🌟 Bitcoin Overview

Before diving into CRV, let’s take a quick look at Bitcoin. It recently hit a new ATH but faced a heavy rejection on the 1-hour timeframe, triggering significant selling pressure in the market.

Remember, these kinds of candles are typical during bull runs. They may appear bearish on higher timeframes, but they often induce FOMO and panic selling, leading to potential buying opportunities.

📅 Weekly Timeframe Analysis

After losing its critical support at 0.4107, CRV dropped to 0.2219. Following a decrease in selling pressure, the coin consolidated for several weeks in a box range.

With renewed whale interest, significant buying volume pushed the price up by 350%, breaking the box and daily resistance. The rally was capped at 1.2060, where CRV has been trading below for the past two weeks.

If you entered the market after the box breakout, you should already have a reasonable profit. You can either take partial profits or withdraw your initial investment, holding the remaining position as "free tokens."

If you missed the rally, it’s currently not an ideal entry point due to the large stop loss required. Wait for either a time-based correction (range-bound movement) or a price correction to 0.8065, which serves as the next major support level.

🌞 Daily Timeframe

On the daily chart, CRV moved upward after breaking out of the 0.2219 – 0.3169 range and is now trading below the 1.251 resistance.

Support: 1.0522 (lower timeframe), 0.7985, and 0.6217 for potential price corrections.

Resistance: A break above 1.251 could lead to higher price targets, with the first at 1.9109.

breakout above 1.2510 may provide a momentum-based entry, but it’s riskier than the earlier entry at 0.3169. Wait for confirmation, such as volume increase and RSI movement, before entering.

⏰ 4-Hour Timeframe

On the 4-hour chart, CRV has tested the 1.2693 resistance twice. This level could act as a key trigger for future positions.

📈 Long Position Trigger

Open a long position after breaking 1.2693, with confirmation through increased volume and RSI entering the overbought zone. This is a weekly resistance, so a fake breakout is likely if volume is low.

📉 Short Position Trigger

No short positions are being considered for now, as they go against the current trend. Instead, focus on finding setups in other coins or monitoring CRV for better opportunities.

💡 BTC Pair Insight

Against Bitcoin, CRV has been in a prolonged downtrend but recently started to recover after breaking 0.00000528. However, the real bullish movement will begin only after breaking 0.00001223, forming higher lows, and continuing its upward trend.

Avoid FOMO. If you miss CRV, there are plenty of other opportunities in the market.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

CRVUSDT Potential Long Term Accumulation-DistributionIn this analysis, we focus on a long-term accumulation strategy for CRVUSDT.

Accumulation Zones:

$0.4720: Identified as an accumulation entry point for 10-20% of your position. Potential price movement of approximately 10-15%.

$0.4300: Stronger accumulation zone for an additional 5-10%. Potential price movement of 20-25%.

$0.3750-0.3300: Critical demand zone, optimal for accumulating 10-20% of the position. Potential price movement of 35-45%.

Distribution Zones:

$0.7000: First major distribution zone for partial distribution of accumulated assets (1-5%). Potential price movement of 50%.

$1.1410: Next distribution zone for further distribution (5-10%). Potential price movement of 145%.

$2.0974: Higher distribution zone, ideal for 10-20% distribution. Potential price movement of 305%.

Volume Analysis: Increased volume at support levels indicates strong buying interest and validates accumulation zones.

Current market sentiment shows a mix of consolidation with potential bullish reversal signals, supported by the harmonic pattern and volume spikes at lower levels.

This long-term accumulation strategy for CRVUSDT focuses on systematically entering positions at identified accumulation zones and distributing at key distribution zones. This methodical approach aims to capitalize on both the technical patterns and market sentiment, ensuring a balanced risk-reward ratio.

Additional Details about Curve DAO Token (CRV):

Market Cap: Approximately $400 million

Fundamentals: Curve DAO Token is a decentralized exchange optimized for stablecoin trading. It provides low slippage and low fee swaps between stablecoins, making it an essential component of the DeFi ecosystem.

Potential: Increasing adoption of DeFi and the need for efficient stablecoin trading solutions.

CRV/USDT Trading Scenario UpdateThe asset is currently trading at $0.2568, which is significantly lower than its local high of $6.7862—a decline of over 97%. However, despite this drop, the Curve Finance platform continues to draw attention from market participants, maintaining a Total Value Locked (TVL) of $1.8 billion, indicating a high level of trust in the ecosystem.

Volume profile analysis shows considerable interest in the asset within the current price range, which could signal the formation of a strong support level. Increased trading volumes further suggest heightened buyer activity, creating potential for a price recovery.

Curve DAO Crv price will surprise all of us?)And the award for the most unpredictable coin goes to CRYPTOCAP:CRV !)

While the price of OKX:BTCUSDT is correcting and the vast majority of altcoins are following it, #CRV holders woke up after 2.5-3 years of hibernation and said: "Ooooh, now is the best time to buy OKX:CRVUSDT ".

Or how else to explain the 2-months of increased trading volumes in the #CRVUSDT pair and the fact that the price of the #CurveDAO token has been growing quite actively for the last 3 days, if such a phrase is legitimately used with CRV at all )))

‼️ The critical level for August-September for the #CRVUSD price is around $0.60

If they can gain a foothold above that, then maybe we will see CRYPTOCAP:CRV at $1.2 before the end of 2024 !)

CRV to move higher towards $1BINANCE:CRVUSDT tested the range low twice since 2023. After its latest test, it began to move upwards. The level of 0.70 was a significant testing point, where liquidity was absorbed. Within 2024, I anticipate the movement to continue towards $1.0 first and then towards $1.3.

Curve Finance Approves $49M Payout for July Hack VictimsCurve Finance community votes to reimburse $61 million in losses from July hack, ensuring trust in decentralized finance security.

The decentralized finance (DeFi) community of Curve Finance has taken a decisive step toward addressing the aftermath of a significant security breach in July. In a recent development, most of Curve’s token-holders, accounting for 94%, voted in favor of a plan to reimburse liquidity providers (LPs) who were financially impacted by the $61-million hack. This approval, confirmed through on-chain data on December 21, sets the stage for distributing over $49.2 million worth of tokens.

The proposed reimbursement scheme is designed to cover losses across several pools, including Curve (CRV), JPEG’d (JPEG), Alchemix (ALCX), and Metronome (MET). This calculation considers the Ethereum and CRV tokens present in these pools before the hack and the CRV emissions that LPs missed out on in the ensuing months. The Curve community fund will provide the necessary CRV tokens for this compensation. The final sum also accounts for the tokens that were recovered post-incident.

Curve Finance Community Votes on Post-Hack Reimbursement Plan

The security breach that triggered this series of events occurred on July 30, exposing vulnerabilities in various DeFi protocols and raising concerns about their impact on the broader crypto ecosystem. Curve’s total value locked (TVL) was nearly $4 billion. The affected pools included alETH/ETH, pETH/ETH, msETH/ETH, and CRV/ETH.

Although a significant portion of the stolen funds was recovered, the affected pools still faced a deficit due to the actions of Maximal Extractable Value (MEV) bots. The Curve proposal aims to rectify these shortfalls and ensure that affected LPs are made whole.

The identified vulnerability was in stable pools utilizing certain versions of the Vyper programming language, commonly used in DeFi protocols for its compatibility with the Ethereum Virtual Machine. Versions 0.2.15, 0.2.16, and 0.3.0 of Vyper were found to be susceptible to reentrancy attacks, which the attacker exploited.

Curve’s Response to Incident Strengthens Community

This incident and the subsequent response by the Curve community highlight the evolving challenges and responsibilities faced by DeFi protocols. It underscores the importance of robust security measures and continuous vigilance against potential vulnerabilities. The Curve community’s proactive stance in addressing its members’ losses is significant in building trust and stability within the DeFi ecosystem.

CRV/USDT Back to try breakout or break down the ascending ??💎 CRV has been a major point of focus in the market, recently facing a tough rejection upon reaching the supply area. Observing CRV's movement within an ascending or bullish channel, it's clear that a recovery is needed for CRV to attempt another breakout of the supply area. Successfully achieving this could probability CRV towards our target in the strong resistance area.

💎 However, if CRV trends downwards and reaches the support trendline of the ascending channel, a robust bounce from this level is crucial to maintain the bullish trend. Failure to sustain its position at the support trendline and a potential breakdown of the pattern would indicate a shift to a bearish stance, suggesting a readiness for a downward move towards the support area.

💎 At the support level, it's essential for CRV to demonstrate a strong rebound and attempt to re-enter the ascending channel pattern. If CRV only consolidates at the support over a few days without a significant bounce, it could signal a continued downward trend, leading to a break of the support and moving towards the demand area.

CRV give it to me straightIf you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment! Also, check out the links in my signature to get to know me better!

CRV update,

followed the orange and bounced out of algo zone in, what looks like a 3 wave move down.

The turn at the 1:1 is a concern, tbf.

Staying above .747 is ideal for me atm.

Cheers!

Elliottwave Altcoins Defi

Key Factors in #CRV's Mid-Term Outlook💎 The mid-term trend for #CRVUSDT is undergoing a shift from bearish to bullish. This transformation is supported by the recent price action, which has witnessed the formation of higher highs and higher lows. Adding to the positive outlook, the Volume Profile level has transitioned from acting as resistance to becoming a support zone, as evidenced by three consecutive bounces over the past week. Moreover, #CRV is currently trading within an ascending channel, with a recent bounce from its lower boundary.

💎 If #CRV manages to hold above the current demand zone, we can anticipate a swift upward movement, targeting $0.81 level. This represents a potential 20% price increase, which is remarkable considering the prevailing market conditions. The $0.81 price level holds significant importance, as it coincides with the top of the ascending channel, a previous demand zone, and the downtrend trendline. This convergence of key features makes it an enticing target for bullish traders.

💎 While the odds currently favor an uptrend, it is essential for Paradisers to remain cautious and prepared for a potential downside breakout. Such a development would likely alter the direction of the mid-term trend. Nevertheless, bullish traders are likely eager to seize such a compelling risk-reward opportunity.

Trade wisely and seize the opportunities that lie ahead, Paradisers! Your ParadiseTeam 🌴

CRV price - "Inverted Head and Shoulders" pattern on a chart ?Today we will analyze the price movement of CRVUSDT on the global chart.

It can be assumed that the global "Inverted Head and Shoulders reversal pattern" has been forming on the CRVUSD chart for the past year. At least, the price structure and the falling trade volumes from the left to the right shoulder correspond to those described in the Encyclopedia of Trading Patterns.

A surge in trading volumes should occur after the price of CRV tries to break through, and hopefully breaks through and consolidates above the $1.18 level . As you can see from the trading history, there was a lot of struggle between buyers and sellers around this level.

But before that, buyers need to break through and gain a foothold above the local level of $0.80-0.82. Buyers have a lot of work to do to revive speculators' interest in the CRV

Well, after the CRVUSDT price is firmly established above $1.18 , the Inverted Head and Shoulders pattern will finally activate. At the same time, the long-term target for the growth of the CRV price, which is in the range of $3.50-4.50 , will be activated, and we were remembering the average - $4 per Curve DAO token.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Curve may see Double-Bottom vs BitcoinCurve has primarily been within a parallel downtrend on its logarithmic chart (3 day chart shown here). It broke above that channel and moved nearly a channels width above it, before breaking back down into the same trend. Often when we see a strong channel breakout that eventually falls back into the channel, crypto charts have a tendency to test a breakout on the opposite end. I've drawn channels of equal length above and below to illustrate this.

I'm expecting there is a decent chance this occurs again here, where we break down below the channel and move nearly a channels width below. This would put us in the same range as Curve's ATL vs. Bitcoin, and could stop there or move closer towards the full length of the channel, to have a slightly lower 2nd bottom on its double-bottom.

This is just an idea based on trends I've noticed in crypto. I didn't look for much confluence - but MACD is trending down and volume is still unusually low.

Should this actually happen, expect a strong move back up from the 2nd low or ATL. Short until then, long when it reaches the green box or near lower channel bottom.

$CRV - stucked in a rangeHello my Fellow TraderZ,

This is beautiful to see $CRV is ranging within a Range. If breaks above, it will blast to $1.42-1.55.

Currently, this is holding 200 Daily EMA which is quite good sign. If this comes down to the bottom of the range which also can be good area to LONG. But stay a bit #SAFU with tight SL if range breaks down.

CHEERS!!!

Curve DAO Token CRV price has a chance for another leap upToday we will take a look at the CRVUSDT trading pair.

Our attention was drawn to the fact that during yesterday's market decline, CRV buyers kept the price above the strong mirror level of $0.95-1. As you can see from the trading history of CRVUSDT, this zone has often played the role of critical support and resistance levels.

In general, the growth of the CRVUSD price in January 2023 was x2.

If buyers of Curve DAO token manage to keep the price above the liquidity zone of $0.90-1 in the coming days, there is a good prospect of another +50% growth to the range of $1.35-1.50

An additional fact that Curve Finance has prospects can be evidenced by the Top of protocols with assets placed and blocked in them (TVL) (at the time of writing this idea):

1. Lido Finance ~ $8.0 billion,

2. MakerDAO ~ $7.0 billion,

3. Curve ~ $4.75 billion.

4. AAVE ~ $4.5 billion

5. Convex Finance ~ $4 billion

6. Uniswap ~ $3.8 billion

7. JustLend ~ $3.6 billion

8. PancakeSwap ~ $2.5 billion

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more