CVXUSDT

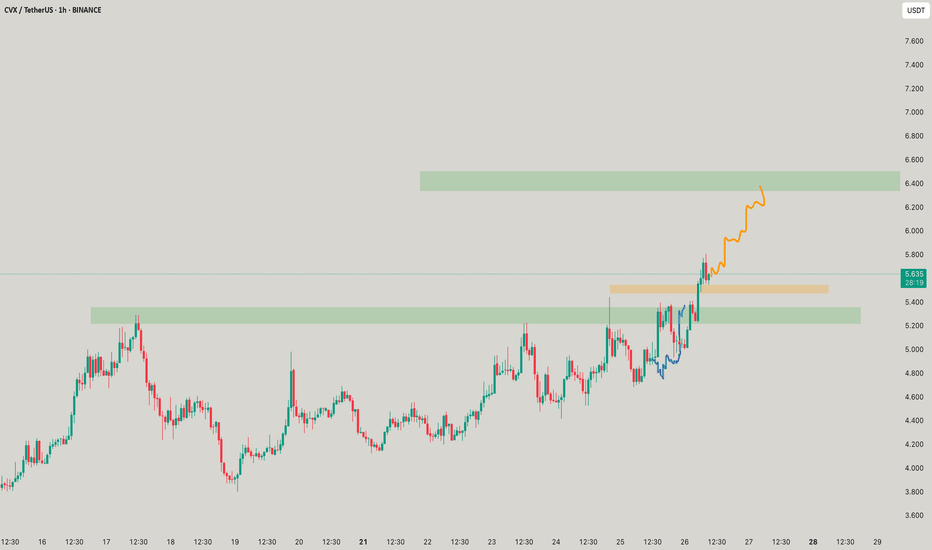

CVX/USDT Weekly Analysis — Strong Reversal Zone CouldTechnical Analysis:

1. Strong Demand Zone (Key Reversal Area)

CVX price has repeatedly tested a strong support zone around $1.43 – $2.20 (highlighted in yellow). This area has acted as a major accumulation zone, showing strong buyer interest and serving as a critical base support.

2. Potential Double Bottom Formation (Bullish Reversal Pattern)

A potential Double Bottom or Adam & Eve pattern is forming within this demand zone — a classic bullish reversal structure, indicating a possible trend shift to the upside.

3. Key Resistance Levels (Bullish Targets):

$2.90 – Minor resistance, likely to be tested in the short term.

$3.46 – Significant psychological and technical resistance.

$4.98 – Major resistance and neckline of the double bottom pattern.

$6.76 – Strong weekly resistance, a potential medium-term target.

$15.77 & $47.97 – Long-term targets if a macro bullish trend emerges.

Bullish Scenario:

If the price holds above the $2.20 support zone:

Gradual upward movement expected toward $2.90 → $3.46 → $4.98.

A confirmed breakout above $4.98 could trigger a rally toward $6.76.

Full bullish confirmation would occur if the price breaks and holds above $6.76, indicating a longer-term trend reversal.

Bearish Scenario:

If price breaks down below the $1.43 support level with a weekly close:

The double bottom structure would be invalidated.

Price could enter new price discovery territory, potentially heading below $1.00.

Market sentiment would turn significantly bearish.

Strategic Conclusion:

CVX/USDT is currently at a critical decision point. A strong historical support zone suggests a high potential for bullish reversal. Confirmation of the bullish structure requires a breakout above $4.98. However, caution is needed if price breaks below $1.43, as it may indicate structural failure.

#CVXUSDT #ConvexFinance #CryptoAnalysis #DoubleBottom #ReversalPattern #BullishSetup #AltcoinAnalysis #SupportResistance #CryptoBreakout #TechnicalAnalysis

#CVX best zone for make some money SOON ?#CVX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a bounce from the lower boundary of the descending channel. This support is at 2.30.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 2.23, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 Moving Average.

Entry price: 2.41

First target: 2.46

Second target: 2.55

Third target: 2.65

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.644.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 2.730

First target: 2.800

Second target: 2.860

Third target: 2.924

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 2.97.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 3.30

First target: 3.43

Second target: 3.59

Third target: 3.77

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 3.00, which acts as strong support from which the price can rebound.

Entry price: 3.14

First target: 3.26

Second target: 3.42

Third target: 3.58

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 2.98.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 3.05

First target: 3.14

Second target: 3.24

Third target: 3.36

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 2.72, which acts as strong support from which the price can rebound.

Entry price: 2.83

First target: 2.90

Second target: 2.97

Third target: 3.06

CVXUSDT | Critical Resistance Zones – Precision Trading Required🚨 High-Importance Levels Identified – Stay Ahead of the Crowd

The red box and red line represent key resistance zones where sellers are likely to be aggressive. Blindly longing into resistance is how most traders lose money, but we trade with precision and confirmations.

🔴 Short Scenario (Rejection from Red Zones):

✔️ If price rejects from these levels with clear LTF breakdowns, I will look for shorts.

✔️ Volume & CDV Confluences – We need confirmation that selling pressure is increasing before entering a position.

✔️ No Confirmation = No Trade – We don’t chase, we execute with discipline.

🟢 Long Scenario (Break & Retest Above Red Line):

✔️ If price breaks above the red line with volume and successfully retests it as support, I will look for long opportunities.

✔️ Confirmation on LTFs is crucial – Without it, there’s no reason to go long.

Why This Analysis Matters

Most traders are lost, making impulsive decisions with no strategy. That’s why my high success rate stands out. I identify the key levels before anyone else, giving you the edge needed to dominate the market.

Trading isn’t about hope—it’s about execution. If you’re serious about winning, follow the right approach.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ENAUSDT UPDATEENAUSDT is a cryptocurrency trading at $0.4483. Its target price is $0.7500, indicating a potential 70%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about ENAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. ENAUSDT is poised for a potential breakout and substantial gains.

If it receives support at 2.179-2.862, it is time to buy

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(CVXUSDT 1D chart)

The key is whether it can receive support near 2.835-2.862 and rise above 3.267.

Since the StochRSI indicator is showing signs of entering the overbought zone again, if it does not receive support near 2.835-2.862,

1st: 2.472

2nd: 2.179

It is expected to fall to the 1st and 2nd levels above.

Since the HA-Low indicator of each chart is located in the 2.179-2.862 range, if it is supported within this range, it is a time to buy.

The fact that the HA-Low indicator was created means that it has moved out of the low range.

-

Since the HA-High indicator of the 1W chart is formed at the 3.267 point, if it is supported at this point, I think that a full-scale uptrend is likely to begin.

However, since the M-Signal indicator of the 1M chart is passing around 4.086, the point to watch is whether it can rise above this point and maintain the price.

-

If it falls below 2.179, you should check whether it is supported when the HA-Low indicator is created again and determine whether trading is possible.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, we can see that the increase is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we do not expect to see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

#CVX/USDT Ready to launch upwards#CVX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.85

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 3.15

First target 3.26

Second target 3.41

Third target 3.61

CVXUSDT %184 Daily Volume Spike! Strategic Blue Box LevelsCVXUSDT has shown a 184% daily volume increase , highlighting heightened interest in this asset. You may have noticed that my blue boxes are progressively moving lower. This is a conscious decision , as the current market conditions demand targeting only highly meaningful levels to justify taking risks.

Key Points:

Volume Spike: A 184% increase indicates elevated activity in CVXUSDT.

Blue Box Strategy: Positioned at significant demand zones to minimize unnecessary risk.

Confirmation Indicators: I use tools like CDV, liquidity heatmaps, volume profiles, and volume footprints to confirm trades at the blue box.

Learn With Me: If you want to master how to use CDV, liquidity heatmaps, volume profiles, and volume footprints to pinpoint accurate demand zones, just DM me. I'd be happy to guide you!

Reminder: Be aware of the market's current state and approach it with caution. Successful trading relies on meaningful levels and robust confirmations.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you! Wishing everyone success in their trades.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

CVXUSDT (ConvexFinance) Updated till 01-12-24CVXUSDT (ConvexFinance) Daily timeframe range. PA moving very nicely till now . still long way to go and it can if retail interest keeps up. very close to 5.479 a little bit push can break through. it can take a cooldown but staying above 3.540 is optimal.

#CVX/USDT#CVX

The price is moving in a downward channel on the 4-hour frame upwards and is expected to continue

We have a trend to stabilize above the moving average 100 again

We have a downward trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.50

Entry price 1.71

First target 1.87

Second target 2.20

Third target 2.55

CVX Technical Analysis in a Weekly TimeframeHello everyone, I’m Cryptorphic.

I’ve been sharing insightful charts and analysis for the past seven years.

Follow me for:

~ Unbiased analyses on trending altcoins.

~ Identifying altcoins with 10x-50x potential.

~ Futures trade setups.

~ Daily updates on Bitcoin and Ethereum.

~ High time frame (HTF) market bottom and top calls.

~ Short-term market movements.

~ Charts supported by critical fundamentals.

Now, let’s dive into this chart analysis:

CVX recently hit its all-time low at $1.80, where the support trendline is holding the price. The chart shows an expanding triangle pattern, while the RSI is forming a bullish divergence, suggesting that the price may accelerate toward the resistance trendline.

Key levels:

- Support/Accumulation: $1.6 to CMP.

- Resistance/Target: $4.

- Higher Target: $7.5.

DYOR, NFA.

Please hit the like button to support my content and share your thoughts in the comment section. Feel free to request any chart analysis you’d like to see!

Thank you!

#PEACE

CVXUSDT(Convex Finance) Daily tf Range Updated till 30-07-24CVXUSDT(Convex Finance) Daily timeframe range. its on Monitoring state at binance so gotta trade it carefully. now reached very close to 3.649. above it is not that positioned packed zone, depend on retail interest whether it picks up. recent retrace point at 2.731.

CVX/USDT NEW INCREASE VOLUMEThe last data shows that CVX/USDT has a good chance to create a new volume in the coming time frames, we will follow up to see if this coin is able to have confirmation in the coming time frames.

CVX/USD has a history of breakdown trends, we will follow the coin to see if this is the reversal trend.

#CVX/USDT#CVX

The price is moving within a descending channel pattern on the 12-hour frame, which is a retracement pattern

We have a bounce from a green support area at 2.12

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum and the price is based on it

Entry price 2.26

First target 2.46

Second goal 2.73

Third goal 3.03

Positive divergenceCVX is showing a significant trend alongside positive divergence. The price is currently moving above a strong trendline, which has been tested multiple times, indicating a robust support level. The positive divergence in the RSI suggests that the bearish momentum is weakening, and there is potential for upward movement.