Cycles

Lasta chance for a long on GASThe price has almost reached the last static support placed at about 2.56 $, after it there is a gap of 30/50 cents that could be covered in the very short term if the level just mentioned was broken downwards. The main trend, so far, has been reversed: technically the EMA20 and 200 periods on medium / long term tf are above the price and this means that the trend has basically become bearish; with the end of January, however, historically, begins a period of laterality that bounces the price in this channel between $ 2.60 and $ 3.10 approximately, until late spring / summer does not violate the downside support to test the areas around 2.20. For the next few weeks we will trade it by entering and exiting the market, when the opportunity arises, and then keeping a short position in the portfolio for the short / medium term that we will close towards the autumn. Obviously if the scenario changes, we will change the analysis and the strategy.

Join us for further analysis on:

Instagram : www.instagram.com

Telegram: t.me

Facebook Page: www.facebook.com

Web: www.bfcminvest.com

Bitcoin Long Term CycleIndicators are more powerful when looking on the weekly or monthly.

If we look at the 2014 cycle, I think we are around the same point today when it bottomed.

As in my previous ideas on BTC, I expect a retest of 200 weekly EMA soon that could bring down price to 3200 or 3000 $, making a double bottom and starting a new cycle for the bulls.

Good luck guys.

--------------------------------------------------------------------------------------------------------------

My Website - Automated Strategies with Backtest and Alert Setup

Looking for a Long in Bitcoin I covered my last short yesterday and I'm now focusing on finding a long position. Cycles helping me with the timing.

Bitcoin trades on a 55 day cycle. This doesn't mean it makes an exact low on day 55. It means that every 45-60 days we need to be on alert to make a low. That yellow box is what I call a "timing band." It mainly helps us know that we are in a timing area where the chances of finding a low are higher than normal. That is all. The cycle also helps me from taking profits too early. In this choppy mess last week I guarantee most traders covered as they were confused. I covered some short term trades, but I held my main short through that mess because of cycles.

We need price action to help us find the low. We don't just buy blinding. There always cycles that are off just like a rogue wave in the ocean. So we have to use stops and we have to look for signs that we are going to turn. And by all means, you will get stopped out trying to buy lows, but once you get a position, your profits should outperform your losses.

We are at day 45 in the cycle. So what else can we see here:

1. The last cycle was long so I'm on a alert for a short cycle. That means that it is possible today could be a low.

2. The last 40 days has been incredibly choppy which tells me that there is a lot of indecision.

3. We are on week 25 of a 25-30 week cycle. Which means it would be a perfect time to find a weekly cycle low.

That said, I'm not quite ready to buy. We are still in a bear market. There are no signs of a bottom just yet. We could tank next week and capitulate lower. There are 10 days left in the cycle, so take a cautious approach.

My plan is to watch lower time frames. I may take a shot at this $3350-3400 area but I'll have a tight stop. I don't normally like diagonals but its respected this line 5 times. If we got to that orange zone, I will definitely looking to buy. I believe there is a high probability that we at least bounce in that area.

Will there be a Bull Run?The market situation is increasingly beginning to resemble the beginning of 2015. Then, starting in February and ending in June, we observed an almost exponential decrease in monthly volatility. After that, the long-awaited "Bull Run" lasted more than two years. Now, in 2019, we may be seeing an accelerated version of these cyclical events. In December 2018, a sharp drop in volatility was observed, which also continued throughout January 2019.

Looking at these similarities, the theory of 4-year cycles of Bitcoin price movements, authored by Bob Lucas, seems more and more truthful. Based on his theory, in 2019 we will observe the beginning of a new cycle, characterized by an asset growth of 70-75% of the total time, with a maximum value near the end of the upward movement.

Bottom line: if Bitcoin is still cyclical in its movement, then in the next couple of months the sideways movement will continue. We will observe small fluctuations in volatility with a bias towards its fall. Bitcoin price should NOT fall below $ 3,100-3,000. And in the future will begin to slowly gain "bullish" momentum. Perhaps due to the informational and utilitarian development of the global cryptocurrency sphere, you and I will observe a more accelerated version of the previous cycles.

Ethereum: Technical Analysis. Bull or Bear, possible weeks aheadHi everyone, this is my first post here on TradingView. A little bit about me: I'm an Economics nerd (although, compared to some of the folks here, I feel like a total noob). I graduated from the University at Albany in 2011 with a major in Economics and minor in Computer Applications in Business. Currently I work as a Business Systems Analyst for one of the top hospitals in the Albany, NY region. I got into Cryptocurrencies beginning of last year when BTC shot through the roof, started my own mining and then trading. But unlike many who got in because of FOMO and then got out because of FUD, I've become a superfan of the crypto-currency asset class, primarily because I truly see the future of transactions and contracting through various blockchain technology and secondly (luckily) my knowledge and intuition in Economics has helped me navigate this CRAZY space with a little bit more calm and insight than some who may not be as into Economics and Economic theories as I am.

Before I get into my first analysis I just want to clarify a few things:

* This is not trading advice for others, just my analysis for myself that I wanted to share.

* I hold (XRP, TRX, XLM) and trade (ETH, BTC, BCH) cryptocurrencies.

* I trade conservatively. ALWAYS DISCARD EXTREME PEAKS AND TROUGHS.

* Mathematics is the language of the universe, and it is the same in anything that can form a trend.

* Layman's terms are the best. As long as you have common sense and intuition in numbers, it's all a game of averages.

* Knowledge is power. Especially in the Crypto world. Game of averages only get affected by ** major news/breakthroughs/breakdowns **

Alright so looking at the following chart, what do we see?

During the gut-punch that was November 2018, Ethereum like most major CCs, crumbled. Between Nov 12th and 14th, the price plummeted from ~$210 to ~$165, briefly trying to form a support to bounce from, which failed. Between Nov 18th and 20th, another drop happened to ~$128, which basically continued until finding the bottom around December 7th @ $83.00 and a double bottom on December 15th.

This allowed us to draw some parallel lines which would indicate, on average, what channels the prices should be moving. As we've already established, $128 failed to provide support on Nov 18th to bounce back from, and we've had solid support from ~$83 onwards. We can see from the following graph, that upward movement following the double bottom has been consistent over a fairly long period of time (30+ days now).

The issue that traders such as myself are (were?) facing is basically finding solid support above the $83 zone. Now if you follow the chart above, again, you'll see that following bounce from $83 between Dec 10th - 17th, prices moved up pretty nicely until Dec 24th. By nicely, I mean steady, sustainable upward movements. The sudden sharp upward movement of Dec 24th was always going to be heavily corrected in this bear market, and that is what happened, although the Bulls (myself included) tried to sustain the $150 support levels until Jan 9th when another massive sell bear-attack happened which broke the $130 support line, and we were able to find some solid support between ~$113 and ~120.

What does all this mean? We've been moving in a narrow channel between $114 and $120 since January 13th. We've seen some major pumps and some even more massive dumps which show strong resistance above $120, possibly up to $130. Mathematically, if you look at these parallel lines, you can see clearly, how the prices are moving "ON AVERAGE" around those lines. Today is Sunday, January 20th. Prices for Ether are around $117 after another huge drop this morning, BUT 1 HR RSI indicators show that Ethereum remains in undersold condition and MACD shows that volume is pretty low, so there's room for improvement.

The important thing to remember is if you look at the 3 possible patterns I've drawn out, you can clearly see (in layman's perspective) what needs to happen.

* Scenario 1 Blue line: Best case scenario if price breaks $120, $130 and then hovers between $130-$134 (lean bull-ish). Means MAJOR solid support has formed from $116.

* Scenario 2 Green line: Best case scenario if price breaks $125, $135, then holds between $135 - $140 (DEF lean bull-ish). Means MAJOR solid support formed from $120.

* Scenario 3 Red line: Worst case scenario most of us wouldn't want to see. Price barely breaks $120, and then hovers between $120-$124. If this happens, another lower parallel line will need to be drawn as an average of the lower prices. Means MINOR support has formed around $114 and is susceptible to the Bear.

So if we see continued lower highs followed by CONSISTENTLY HIGHER lows or HIGHER HIGHS, that's a good sign. Scenario 1 is the middle of the line scenario, without extreme peaks and troughs. Scenario 2 confirms bear market is slowly retreating FOR SURE. Scenario 3: bear is still not hibernating/we're just not sure. By end of January/early Feb, if Ether prices are not "ON AVERAGE" over $132, I'd be concerned, but anything over $130 CONSISTENTLY is a good sign. If however, prices are STAGNATING around $116-$120, I'd be concerned.

So trade carefully, if you have your hard earned money invested here or do day trade, don't be too greedy. Try to take profits between narrow channels the best you can. My analysis basically takes into account the average, middle of the lines movement, to give a picture on where the average position should be following bounces in parallel channels. There might be extreme highs or extreme lows but as long there's not a pattern forming, you can't take the extreme highs or lows as indicators of bull or bear.

Finally, definitely don't pay attention to analysis that say BTC will drop to $200 or similar nonsense. I've seen some analysis by some very scrupulous posters, and I want to make the community aware that these are just really messed up people who just want to create FUD among even a few of our community members, and profit off their naivety. CCs are the future of trade and commerce. Invest into meaningful projects, trade some, HODL some, and read read read!!! Be smart and don't be super greedy. Thanks for reading. Please like my post if you find it interesting! :)

SPX500: Daily - Fractal & Super Wolf Blood MoonLast time we had a move like this was almost 1 year ago in February 2018 right after the Super Blood Moon Eclipse on January 31st, that is the fractal that is being copied here from the period 2018-01-02 - 2018-02-07 and the move started right after the Super Blood Moon.

We now have the new eclipse on 2019-01-21 and the markets are expected to move down like last time it happened 1 year ago.

1 Year = 360° = Return of Events/History Rhyming

Historical Time by Degree Bitcoin CyclesThis kind of analysis is not easy to visualize.

Basically you can see the 22.5,30,45,60 & 90deg cycles (within a ten year cycle) forming over time here.

When the cycles meet there are big moves. Starting date is a bit unclear, I began 45 deg previous to the top of the june 2011 bubble.

Could move earlier to june 2010 bubble if I had that kind of data available.

I THINK this is the furthest back a tradingview chart can go back with bitcoin, if not please enlighten me.

According to this chart, we will see a major bottom March 2020. I would avoid going all in until after this date.

(obviously this chart is a bit rough as I cannot enter decimals of daily bars when placing these cycle tools)

HYPERWAVES. Amazon and Bitcoin live examples.Hyperwaves are a subset of bubbles, there are MASSIVE bubbles.

When I saw this was made public I whined inside because it means then it stops working, but the wall street market cycle thing has been available for a while, and it still works PERFECTLY. PERFECTLY. It is as if the more information is made available, the more people fall for the same mistakes again and again. Some self fulfilling prophecy by the hands of whales? (That got big by being good and following the rules).

The rules about Hyperwaves are basically:

* Must look at weekly charts. And draw trendlines. Nothing else. Weekly closes have to be above every phase trendline (except 1 of course).

* Once you are at Phase 3, a Hyperwave is very likely.

* By Phase 4-5 it is almost certain. As 5 starts... It is important to get in early when a bubble goes exponential, and stay in as long as weekly closes remain above the bubble hypermove up trendline, which can last for weeks. Amazon went up > 100%, that's low, alot of things go even more up. Everything is relative thought. Things that go up more often mean your risk is bigger so you go in smaller anyway... Crypto's went up massively, but the downside was very important too (crypto ATR is 10 times that of FX or more). Bitcoin phase 5 only lasted a few weeks... It can last months.

* When you have phase 5, you have a hyperwave. 100% sure.

* In 20% cases, the hyperwave is a "funky hyperwave" (I am not the one that choose the name), which will bounce on phase 2 trendline. 20% odds.

* In 100% of cases according to the creator of this theory (which anyone can backtest on the few hundreds of examples available...),

if phase 2 does not hold, the price goes back to phase 1. After that it is the end of the hyperwave. Can bounce on 1, can go below, can make another hyperwave a few decades later...

Here is an example:

An example of the majority of cases, with a recent one which is very interesting, Bitcoin, my 2nd favorite chart after the almighty DOW:

If you look at a tulip chart you can see phases 1 to 4 and 7, the bounce (6) is missing, but I am sure it happened, it is just not represented.

I want to find more info on the past, would be wonderful to see this in really old things... Not just in the past 100 years but the past millenia's. Would be amazing to me.

A few more examples:

These are the ones I know...There are supposed to be a few hundred examples... The creator has a channel, maybe there is more.

Even 2-3 hundred is not that much, well it is starting to be decent if there really are that many.

The problem with this is if there are only a few dozen examples... Well it gives an idea of what to expect, and buying and staying in as long as we are above trendline is always good anyway.

What is almost certain is:

Amazon going to (2).

Bitcoin going to sub $2000.

I might have made some mistakes I do not know the details I am by no means an expert on this thing, but I find this interesting and might add it to my arsenal over the next few years (My expertise is on Denial & capitulation following a period of complacency uniquely, which are waves 4 - denial - 5 capitulation and ABC - bounce following capitulation).

If you want to learn more on Hyperwaves, Tyler Jenks is the inventor of this method and backtested it extensively, since 1929 (Down Jones <3). He has been making money since the 70's with this method, keeping it secret, and now that he is past 60 years old he is just sharing it with every one he just does not care anymore.

So, for Amazon, is his wife going to sell? That would make a big wave 7 ;)

And for Bitcoin. God I wish there were options to bet on the price of Bitcoin ending at 1000 ish. Warren Buffet would have shorted the entire supply thought so...

VERY IMPORTANT: Want to hear something funny? Some financial advisor of sorts told me his clients 1 year ago could not stop ask him about crypto. Any presentation/meeting, there would be a crypto question. 1 year ago...

Lately, it has been the same with FANG stocks.

You know what this means ;) Textbook.

Bitcoin 4 Year Cycle...Time to AccumulateLook at the 4 year cycle of Bitcoin. If history is going to repeat itself, we are very close the starting the next cycle. During the cycles, Bitcoin sees upward price action for 3 years with a parabolic run at the end. Then it sees downward movement for 1 year with capitulation at the end. Not sure if we've seen capitulation yet but we are close. So if this holds true, we could see sideways price movement until the end of 2019 before we gain traction. ALTS you ask?? Well it depends on bitcoin. If it goes sideways, that's good for alts. If it goes up it's very good for alts. Sometime at the beginning of the next cycle, we could see the next big alt run.

Looking to Short Bitcoin in this AreaYesterday I closed longs from my last swing trade (a little too early). We had a big 15 minute candle but no follow through. Went lower and retesting the overnight consolidation. So I'll short this area.

The basic situation is that we are in a bear market until we aren't. We had a rally then 2 weeks of chop and a rally that couldn't start a trend. We are in a cycle band for a high and hitting this horizontal resistance area. So this isn't a tough decision.

If we pick up buyers and can get past $4100 then I'll take my stop loss and wait to see if we get a liquidity hunt or if we can make $4100 support. Higher daily close today would be bullish so don't want to stay short if we break this resistance. Either we fail here or we look for short at next area of weakness. I'm expecting to short price in that blue box. Either we got it yesterday or will come sometime this week.

What Will it Take to Go Bullish?

If we can start a strong bullish trend and make it past 30 days and over $4500 then that would set up a potential bullish cycle. That would be welcome because I would rather trade bullish. Those green boxes would something to look for maybe go 35+ days then pullback and retest $4500. That would be ideal. Then if the next cycle could get over $6000, we'd have a weekly swing high and I shift to a neutral/bullish stance and start looking for bullish long term swing trades.

But at this stage in the cycle and still in a long term bearish trend, its too late for me to trade bullish. In other words, I want the market to prove its ready to turn before I hold out for higher prices.

Forecast S&P 500Here is my forecast based on Fibonacci, moon cycles, and Elliott. My thinking should be fairly obvious for anyone who understands the methods. If you have a question please let me know

I have not taken fundamentals actively into account, but it is interesting to ponder the following:

(1) The trade sanctions can come into effect March 1.

(2) FOMC take place Jan 20, Feb 20, and April 1. A rate hike might happen Feb 20 (or April 1). This will be negative. However, no rate hike might be even more negative because that would signal that the economy is not as strong as believed. Furthermore, miscommunication by Powell could scare the market.

(3) The 10-year treasury yield is down from 3.2% to 2.8%. Lacking further data I would assume that the trend will continue down. I don't think the Fed will meddle any more with long-term interest rates. There can easily be an inversion of the yield curve, even if the Fed does not increase the short term borrowing rate. An inversion would be very strong evidence of a recession in 2020. However, when the inversion happens, the market will already have taken the recession into account. If the trend in treasury yield reverses, the stock market will be boosted. However, I do not expect this to happen.

(4) Trump might also create his own volatility (e.g. leaving Syria, impeachment, the border wall) which would increase price volatility and drive prices down.

It is best to consider the next month a forecast and the subsequent months a roadmap that can change depending on what happens during the first month. The time dimension is tricky. The moon cycle has been extremely accurate the last year and I assume it will continue. However, declining markets can drag. So it is very possible that some of the patterns get dragged out another moon cycle or two.

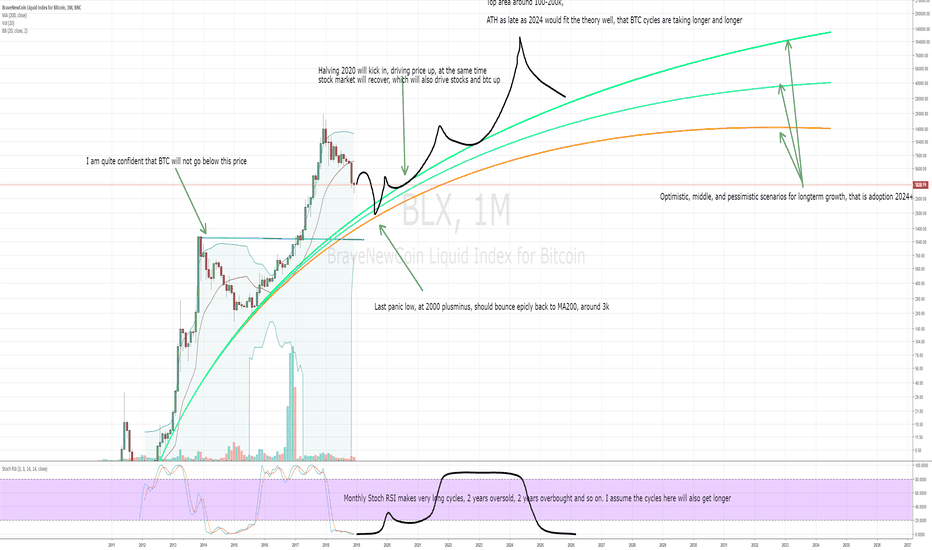

BTC monthly view and possible future scenarioIt's time for another view at the longterm picture, and for that, we must zoom out again to the monthly timeframe.

It is apparent that this structure here is a bit different from the last bearmarkets.

The subsequent bullmarket could therefore also be different.

I think that BTC cycles are getting longer.

One must think of BTC as a physical pendulum. The more mass it acquires, the more people are in it if you will, the more inertia it has, and the slower

it reacts to changes.

Therefore, I think that the next ATH might be as late as 2024 (latest possible date), but I don't see it make new ATHs before 2022, that is for me the earliest possible date

for prices well above 20k.

I still am convinced that another shakeout will occur, this would also fit the theory that BTC is currently coupled to the stock market.

Stocks will probably see a brutal sell-off sometime in 2019, and that could co-incide with the BTC low.

If it goes to the 2k area, it should bounce strongly.

So for me, everything significantly below 3k is a very strong buy and longterm hold.

Halving 2020 WILL come, and WILL drive up the price again, I am absolutely certain of that.

Look at daily transactions, they are rising again, and will make new ATHs too. Rising Tx, rising users, plus halving will drive up price. This is like a law of nature, hehe.

Since I am a physicist, I tend to see BTC as a physical system, with certain laws. And for me, these are laws, which will push BTC up again, no matter what.