Cypher

2025 Is a Big Year for Bitcoin Miners—Who’s Winning the Hash War

Bitcoin’s resurgence in 2025 has reignited the mining race. The halving came and went, hashprice bounced from the abyss, and a fresh wave of capital is pouring into the space. So we figured: time to catch you up on who’s making real moves and pulling ahead — both in market cap and megawatts.

⚡ CleanSpark (CLSK): The Sharpshooter

If Bitcoin mining were a sport, CleanSpark would be the athlete that trains all year, eats clean, and shows up for every match. No drama, just execution.

In 2025, CleanSpark continues to grow fast — but smart. It’s acquiring distressed sites, upgrading facilities with immersion cooling, and pushing its fleet beyond 50 EH/s. Its Tennessee expansion (a deal scooped up for pennies on the dollar) was classic CLSK: low cost, renewable-powered, and ready to scale.

In Q1 2025, CleanSpark posted $162.3 million in revenue, up a blistering +120% YoY, and delivered $246.8 million in net income, or $0.85 per share. It's one of the few miners that’s profitable and expanding — at the same time.

The stock is up 25–30% YTD, trading around $12. While it’s been volatile like the rest of the sector, CLSK remains the benchmark for cost-effective, execution-focused Bitcoin mining. If you’re looking for a fundamentals-backed growth story, this is it.

🏗️ Iris Energy (IREN): The AI-Ready Dark Horse

Iris Energy may have flown under the radar in past cycles, but in 2025 it’s turning heads — not just because of Bitcoin, but because of data infrastructure.

While IREN runs a lean BTC mining operation powered by 100% renewable energy in Australia and Canada, the real story is its pivot toward modular data centers. It’s one of the few miners actively positioning itself for GPU workloads and AI compute as a hedge against mining volatility.

The upside? Flexibility. If BTC mining margins compress again, IREN has the facilities and roadmap to reconfigure its power-hungry machines for AI hosting. The market likes the optionality. The stock’s up ~70% this year and may still be cheap if the data center thesis catches on.

🔥 BitFuFu (FUFU): The Challenger

BitFuFu came in hot after its 2024 IPO — vertically integrated, Bitmain-backed, and global from day one. It’s the largest cloud mining provider in the mining space. It provides cloud mining, sells miners, hosts them, runs its own mining pool (BitFuFuPool), and operates a global fleet clocking over 36 EH/s under management.

While others focused on HPC & AI business, BitFuFu doubled down on mining scale and infrastructure. It aims to own over 1 GW of power capacity and launched its own mining operating system.

The post-halving reality has been rough. Q1 2025 revenue came in at $78 million, down 46% YoY, with self-mining revenue dropping 70.7%. But the company has a track record of being profitable every year since founded, plus its P/S is only 1.6, well below other mining giants such as Mara and Riot.

Watch this one. Especially if BTC pushes above $150K.

🐋 Marathon Digital (MARA): The Goliath, Still Standing

Marathon is the largest public miner by market cap — and has been the face of institutional mining exposure for years. It’s also the most debated name in the game.

On one hand, MARA controls a monster fleet with over 75 EH/s expected by year-end, global mining operations from the U.S. to the UAE, and a budding software business for managing hashrate.

On the other, critics argue it’s bloated, overly reliant on third-party infrastructure, and too slow to pivot in a fast-moving landscape.

Still, when Bitcoin’s hot, Marathon runs. The company holds a large BTC treasury of over 50,000 BTC, is adding immersion-cooled sites, and remains a proxy trade for many traditional investors wanting in on mining without picking niche plays.

Love it or hate it, MARA isn’t going anywhere. And if BTC moons in Q4, it’ll be one of the first tickers to feel the heat.

🧊 Cipher Mining (CIFR): The Quiet Killer

Cipher isn’t flashy. It doesn’t dominate headlines or make bold predictions. What it does do: mine Bitcoin efficiently, at low cost, with minimal dilution and maximum discipline.

Based in Texas, CIFR locked in long-term power contracts at enviably low rates and steadily grew its fleet past 13.5 EH/s. It has some of the best cost-per-BTC metrics in the industry and avoids unnecessary spending or debt.The Texas-based miner produced 602 BTC in Q1, and benefits from low power contracts and disciplined growth.

The market loves it: CIFR is up ~35% YTD, trading at $6.52. It’s becoming a favorite among investors who want hash exposure with less volatility and more transparency. The monthly production updates are clear, consistent, and confidence-building.

👀 Trends to Watch in H2 2025

1. Hashprice Rollercoaster: Hashprice (BTC earned per TH/s per day) has bounced from $39 post-halving lows to nearly $60. If BTC rallies again, miners with fixed-cost power will reap the upside.

2. GPU Hosting Pivot: With AI demand surging, some miners are repurposing infrastructure to host GPUs — think IREN.

3. M&A Season: Expect smaller players with weak cash flow to get scooped up.

4. Regulatory Shifts: Crypto Week laws passed in the U.S. provide more clarity. But ESG pressure and power usage scrutiny will remain part of the narrative.

💭 Final Thought

Bitcoin mining stocks aren’t just about Bitcoin anymore.

They’re about infrastructure. Data. Energy. Efficiency. Optionality. And in 2025, the winners will be those who can balance raw hashpower with strategic foresight.

Whether you’re team CLSK, FUFU, IREN, MARA, or CIFR — the landscape is shifting fast. And with BTC momentum building again, this might just be the beginning.

So — which miner are you backing this cycle?

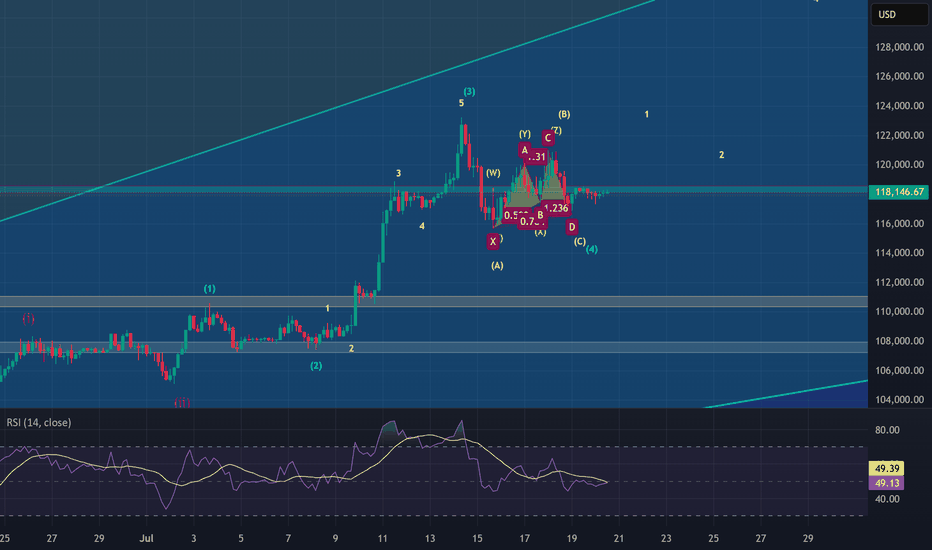

BTC Ready for the new impulse ? Elliott wave analysis 20/7/2025In my view, Bitcoin (BTC) has completed its micro correction and is now poised to move toward the $135,000–$139,000 target zone. This expectation is supported by the following factors:

1. Completion of the Sub-Waves in Wave (4)

My analysis of wave (4) indicates that it consists of an ABC correction, where wave B formed a WXYXZ pattern.

Additionally, I have counted the sub-waves within wave C of wave (4) and observed a complete 5-wave structure, suggesting that the fifth wave of wave C has ended, confirming the completion of wave (4).

2. Cypher Harmonic Pattern Pivot Point

I have identified a Cypher harmonic pattern with a pivot point around $116,600.

The termination of wave (4) occurred close to this pivot level, followed by a new impulsive move that made a higher high and formed a clear 5-wave structure—further confirming that wave (4) has likely ended.

3. Hidden Bullish Divergence on the 4-Hour Timeframe

A hidden bullish divergence can be observed on the 4-hour chart, particularly at the end of wave (a) and wave (c).

Historically, 4-hour hidden bullish divergences have often preceded strong bullish impulses. For instance, a similar setup occurred during the bullish rally from April 9, 2025, to May 22, 2025.

4. Failure to Make a New Low After Resistance Retest

The new impulse wave that emerged after the end of wave (4) has met resistance but failed to make a new low, suggesting that a fresh upward impulse is underway.

How Far Could Wave (5) Extend?

It is important to note that the wave (5) (blue) impulse is a sub-wave of wave (5) (purple).

The lengths of wave (3) (purple) and wave (5) (purple) are currently similar, which is unlikely because both are part of the major wave V (green), where typically only one wave should extend.

Since wave (3) has already completed, wave (5) is likely to be the extended wave, with a target length between 1.272 and 1.618 times the length of wave (3).

Interestingly, two Gann fan projections point to resistance levels in the $135,000–$139,000 range, which perfectly aligns with this 1.272–1.618 extension zone.

Invalidation Point

The invalidation level is around $117,000, as the micro correction within the new impulse should not drop this low.

If BTC falls below $117,000, it could imply that wave (4) has not yet completed and may be taking another corrective form.

For example, the wave (c) we currently see might only be wave 1 of a larger wave (c), or the correction in wave (b) may still be ongoing.

However, this scenario seems unlikely given the weight of evidence suggesting that wave (4) has already ended.

XAUUSD potential Cypher patternOn the 4-hour chart, XAUUSD is fluctuating upward in the short term, and bulls have the upper hand. Currently, XAUUSD is expected to continue to rise, and the price may return to above $3,400. When the price reaches around 3,407.8, you can pay attention to the potential bearish Cypher pattern, which is in the previous supply area.

SUI — Trading with Geometry: Why Harmonics Work So WellSUI has been respecting technical levels with remarkable consistency. After bouncing from the $2.8467 low, it surged sharply — completing a clean Cypher Harmonic Pattern. This led to a high-probability short setup at the 0.786 Fibonacci retracement (Point D) around $3.5573.

🎯 Trade Setup Breakdown

Pattern: Cypher Harmonic

Entry (Point D): $3.5573 (0.786 retracement of XC)

Target: $3.1191 (0.618 retracement of CD)

Stop-Loss: Above Point X

The 0.618 fib retracement of the CD leg coincides with a significant key low from May 6, 2025, adding structural confluence. This is an ideal level to monitor for absorption, reaction, or potential reversal behaviour.

🧠 Educational Insight: How to Trade Harmonic Patterns Like a Pro

Harmonic patterns aren't just visually appealing — they represent high-probability setups based on market structure, Fibonacci geometry, and behavioural cycles. The most critical part of every harmonic pattern?

You enter at Point D.

Whether the pattern is bullish or bearish, Point D is your trigger:

In bearish patterns (like this Cypher), you short from Point D.

In bullish patterns, you long from Point D.

This works because Point D marks the exhaustion of the corrective leg, where trapped traders and liquidity often sit. The structure often aligns with supply or demand zones, order blocks, or FVGs (Fair Value Gaps).

💡 Important: Harmonic patterns are most effective on higher timeframes — 4H and above. On lower timeframes, noise increases and reliability drops significantly. For clean execution and meaningful structure, stay with mid to high timeframes.

Here’s how to trade it effectively:

✅ Wait for the full pattern to form — don’t front-run

✅ Use fib levels and structure confluence to validate Point D

✅ Use order flow tools (like Exocharts) to confirm absorption or volume shift

✅ Enter on Point D with your stop-loss just beyond X

✅ Take profits at common retracement levels like the 0.382 or 0.618 of the CD leg

Patience is key. Harmonic traders wait for the market to complete the cycle — then strike with a plan.

📌 Final Thoughts

SUI is delivering clean harmonic respect, and this setup is no exception. Whether you're already short or waiting for further confirmation, keep an eye on volume, liquidity zones, and reaction levels around $3.1191. If this zone holds, it may serve as a pivot for the next move.

Pattern. Precision. Patience. That's how you catch high-probability trades like this.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

BITCOIN SHORT TERM UPDATE!!! Recently we have seen a great price move from 100K to 110K. We got clear Change Of Character , which indicates a sign of strength. Also we got bearish cypher harmonic pattern formed. So now we can expect a slight pullback up to 106-103k region from there we may see price reversing. But price should hold 100.3K region to remain bullish in short term.

Bitcoin's Roadmap: Price Structure, Fair Value & Market RhythmSince bottoming on November 21, 2022, Bitcoin has embarked on a remarkable bull run, rising +623.5% over 927 days and reaching a new all-time high (ATH) of ~112K.

When compared to the previous bull cycle, spanning 1061 days and producing a +2086% gain, this current rally shows signs of diminishing returns, a typical behaviour of maturing markets. Traders now face a critical question: has Bitcoin peaked for this cycle, or is another surge toward ~120K+ possible?

Historical Echoes: Elliott Wave Comparison

The 2018–2021 bull market formed a five-wave Elliott structure. That cycle ended with a -77.5% correction. The current cycle similarly traces out a completed five-wave advance from the $15.5K low, suggesting we may now be in a corrective phase.

Current hypothesis: Bitcoin is in Wave B of an ABC correction, with Wave C potentially targeting $64K–$70K.

Harmonic Confirmation: Cypher Sigma Pattern

A refined harmonic formation, I call it the Cypher Sigma Harmonic Pattern (CSHP) and it has proven highly effective in volatile assets like Bitcoin. It differs from the classic Cypher by:

BC projection: 1.07–1.136 of XA (vs. 1.272–1.414)

CD retracement: 0.786–0.886 of XC

BD extension: 1.272–1.618 of BC (not present in traditional Cypher but often targets 1.272-2.0)

In 2022, this pattern predicted the bottom near $16K. Currently, another Cypher Sigma is potentially forming, pointing to a possible correction to ~$64K. This target aligns with historical level (the 2021 ATH zone) and represents a possible -40% pullback.

Multi-Layered Technical Confluence

Pitchfork Resistance: Bitcoin rejected the upper resistance (Fib 1.0–1.136 zone)

Pitchfork Golden Pocket Support: ~$64K matches the golden pocket and high-liquidity area

Fibonacci Circles: Rejection precisely at the 1.618–1.65 circle arc (~$112K)

Speed Fan 0.618: Key structural support intersects projected retracement zone

Previous 2021 ATH

Together, these tools strongly support the hypothesis of a macro top forming.

Fair Value Trend Model (FVTM) – New Indicator

As part of ongoing research into Bitcoin’s long-term valuation, I developed the Fair Value Trend Model—a logarithmic regression-based indicator tailored for Bitcoin. Here is an example on the monthly timeframe.

Key Features:

Computes a log-log regression: ln(Price) vs ln(Days since inception)

Yields a power-law growth curve: F(t) = C · ^b

Includes dynamic channel bands at user-defined percentage offsets

Projects the trend forward in time with linear extrapolation

I have just freshly published this indicator for free on TradingView. Visit my profile, add it to your chart, and explore how Bitcoin consistently revisits its fair value in bear markets before launching new macro waves.

Use Cases:

Identify overextensions above the fair value channel

Spot mean-reversion setups near the lower channel band

Gauge long-term trend continuation via slope and forecast

The indicator is best used on daily, weekly and monthly charts, and it supports both all-time and rolling-window modes.

Educational Insight:

The Fair Value Trend Model isn’t just a tool! It's a lens to view the long-term rhythm of the Bitcoin market. By understanding where the fair value lies, you gain the clarity to separate short-term volatility from long-term opportunity.

Every great trader starts with a desire to understand. If you're learning, experimenting, and observing patiently—you’re on the right path. Let this model be your guide through the noise. Trust the math, respect the cycles, and never stop refining your edge.

Study day and swing trading, improve your technical and psychological skills, and wait patiently for high-probability trade setups, whether short-, medium-, or long-term. Being patient is key.

Psychological Insight: Mastery Over Impulse

The greatest returns favour the patient. Traders who ignored the noise in 2022 and accumulated around $16K were rewarded exponentially. As Bitcoin potentially enters a correction, the same principle applies: monitor, learn, and prepare—not panic.

Top-tier traders execute based on structure, not emotion. This cycle will reward those who:

-> Study multi-timeframe confluences

Outlook: Bearish Retracement, Bullish Opportunity

While a push to $120K+ is possible, the confluence of Elliott Wave, harmonic patterns, and macro tools suggest a potential 40% retracement into ~$64K by end of 2025/early 2026. This aligns with historical patterns and may offer a great buying opportunity.

This cycle isn’t about catching the exact top—it’s about navigating it intelligently. Use tools that reflect structural value, not just reactive price action. Combine the Fair Value Trend Model with other tools to gain clarity. Most importantly: remain curious, remain disciplined.

Happy trading.

Thanks for reading =) stay sharp, stay patient, and keep evolving 🚀

_________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

Oil Price Decline Using the Shark Harmonic PatternBased on the Shark Harmonic pattern, there’s a potential for a decline in oil prices. Traders and analysts, stay alert for market shifts and adjust strategies accordingly.

The Shark harmonic pattern offers a structured approach to identifying potential price reversals in the oil market. By analyzing Fibonacci ratios and price movements, traders can assess the probability of a decline in oil prices and position themselves accordingly.

However, as with any technical tool, it is crucial to use the Shark pattern as part of a broader analysis framework to account for market complexities and external influences.

Aggressive Buyers and Their Financial Adventures.In our previous idea, despite the fear and stress in the stock market, we predicted that the mighty crab buyers would charge in with full force.

Toward the end of the idea, we anticipated these energetic crabs would get tired around the $31 mark, needing a deep dive and a price drop to catch their breath.

However, their dive wasn’t as deep as expected, and fresh buyers, inspired by the Cypher pattern, jumped into the market at $31.

Now, we expect these crabby buyers to hit their next exhaustion point around $33.2, where they’ll likely need a long and deep rest—because even crabs can’t keep snapping forever!

SEYED.

BITCOIN Update: What We Can Expect Next???According to current price action we can expect 3 scenarios:

Scenario 1: BTC is currently at it mid range resistance. If it breaks above this resistance then we may probably see price approaching range high and even beyond.

Scenario 2: If it fails to break and rejects, then most probably we can expect reversal from range low demand zone, which aligns with cypher harmonic pattern's PRZ.

Scenario 3: In worst case, we may see BTC dumping upto 74-70K region, and from there we will most probably see trend reversal.

Most crucial level to watch in all scenarios is 95k region, if it breaks successfully above it, then we will see BTC slamming new ATH.

GBPUSD - LONGStrong cumulative flat. Buying opportunity after the formation of the Cypher pattern.

GBPUSD - LONG

ENTRY PRICE - 1.2912

SL - 1.28500

TP - 1.30780

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

US100 Analysis: Bearish Weekly Trend, Bullish Cypher PatternMarket Structure:

Timeframe:

Weekly: Bearish trend still intact.

Daily/4H: A bullish Cypher pattern has formed, offering a potential reversal opportunity.

Key Level:

The 0.786 Fibonacci retracement level is the ideal entry for this Cypher pattern.

Price is approaching a strong support zone at this level.

Trade Setup: US100 Long (Cypher Pattern Completion at 0.786)

Entry:

Wait for price to reach the 0.786 retracement level of the Cypher pattern.

Look for bullish confirmation (e.g., bullish engulfing candle, RSI divergence, or a strong bounce).

Stop-Loss:

Below the X-leg of the Cypher pattern for added safety.

Take-Profit Targets:

TP1: 38.2% retracement from the D-leg.

TP2: 61.8% retracement from the D-leg.

TP3: Retest of the recent swing high.

Risk Management & Strategy:

Risk-Reward: Ensure a minimum of 1:2 R/R ratio for this trade.

Confluences for a Strong Entry:

Weekly Bearish Trend: But a temporary bullish retracement is possible.

Fibonacci 0.786 Level: High-probability reversal zone.

RSI Confirmation: Look for oversold conditions.

Price Action: Bullish candlestick formations before entering.

Final Thoughts:

Short-Term: Expect a bullish retracement from the Cypher pattern completion at 0.786 Fibonacci level.

Long-Term: If the weekly bearish trend remains strong, watch for rejection around key resistance levels for another short opportunity.

DXY - A Full Breakdown of Buying & Selling OpportunitiesA full breakdown of the US. Dollar Index looking at recent trading opportunities for both those who want to get long or get short.

In this video we'll take a look at the Cypher Pattern, Support & Resistance, Trend Trading, Fibonacci Tools & Psychological Numbers.

If you have any questions about the analysis or want to share your views, please do so below.

Akil