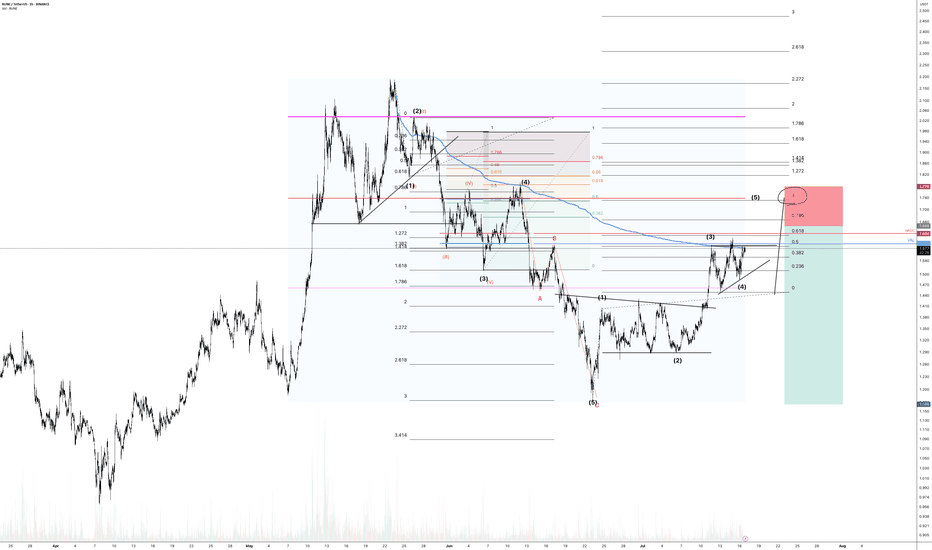

RUNE (Y25.P2.E1).Looking to short the macroHi Traders,

RUNE has some more highs to do, however based on the structure, I would not bet it will go much. My interests is finding that trade to short when it comes to Alt coins.

With my TA approach, Wave 5 might just equal Wave 1 length. Along with some confluences of FVP levels, we might just get this right. Time will time.

All the best,

Regards, S.SAri

Cypto

BITCOIN MIGHT SEE $160KWe have a vey similar movement for bitcoin compare to few months ago

1) Pass the 20MA on weekly

2) Bullish cross on MACD

3) Cross and stay above the weekly resistance ( yellow trendline )

4) +60% upside movement

Im not saying 60% raise is coming to bitcoin ( may be come ), but at least $134k - $140k is very likely IMO

HelenP. I Bitcoin may break support level and fall to trend lineHi folks today I'm prepared for you Bitcoin analytics. A few days ago, the price made a small upward move before dropping to Support 2, which aligned with the support zone, breaking through Support 1 in the process. After that, BTC attempted to rise but failed and continued to decline, breaking Support 2 and reaching the trend line. Following this move, Bitcoin reversed direction and started to climb, soon reaching the 80100 level and breaking it again. It then pushed up nearly to Support 1 before correcting back to Support 2, after which it made a strong impulse move back to Support 1. The price consolidated around this level for some time before correcting back to the trend line, from where it resumed its upward movement. In a short time, BTC broke through Support 1, climbed to 87500, and then corrected back to the support zone. At this stage, I expect BTCUSDT to pull back to the support level, make a small upward move, and then continue declining, breaking the support level. If this scenario plays out, I anticipate the price falling to 83000, which aligns with the trend line. If you like my analytics you may support me with your like/comment ❤️

Demand Zone Signals Opportunity for WLDUSDT

The market structure for BINANCE:WLDUSDT remains bullish as long as the swing low at $1.58 is not broken. Recent price action suggests a favorable entry point in the demand zone between $1.58 and $1.92 .

The next significant target is at $4.19 , a historically reactive zone where previous price movements have faced strong resistance. This level aligns with the bullish market structure and offers a high-profit potential.

This trade setup presents an impressive risk-to-reward ratio of 1:6 , making it an appealing opportunity for traders. Maintaining the structure above the demand zone is crucial for bullish continuation. However, a break below $1.58 would invalidate this idea and could signal a bearish shift.

👨🏻💻💭 Do you think WLDUSDT can hold the bullish structure and hit $4.19? Share your thoughts or ideas below and let’s discuss this setup!

__________________________________________________________________

The information and publications within the 3Commas TradingView account are not meant to be and do not constitute financial, investment, trading, or other types of advice or recommendations supplied or endorsed by 3Commas and any of the parties acting on behalf of 3Commas, including its employees, contractors, ambassadors, etc.

Bearish Warning for MORPHOUSDT! Is a Bigger Drop Coming?Yello, Paradisers! Could #MORPHOUSDT be setting up for a bigger drop, or is it just a short-term pullback? Let's break it down.

💎#MORPHO recently broke its bullish support trendline, which is a clear bearish signal. However, before we see further downside, there’s a high chance the price will retest the $2.90 to $3.10 resistance zone. This is a key area to watch.

💎If the price gets rejected at that resistance, the most likely scenario is a continued move downward toward the demand zone around $2.30 to $2.20. This demand area may cause a brief pullback, but if it fails to hold, we could see the price drop further to the stronger support zone below.

💎For the bearish outlook to be invalidated, the price would need to break above $3.66 and close a daily candle above it. If that happens, we’ll likely see a bullish continuation instead of further downside.

💎This is a critical moment for MORPHOUSDT. Be patient and wait for confirmation before making any moves. Remember, the market often tricks impatient traders before revealing its true direction.

Stay patient, stay disciplined. The next big move will reward those who wait for confirmation.

MyCryptoParadise

iFeel the success🌴

Litecoin, Shitecoin: An OpportunityAs much as I blast Litecoin, I think there's a trading opportunity here. Some other OG cryptocurrencies have gone up 5x recently - XLM and XRP, for instance. I don't mind this, because I actually think those coins are at least a little more viable as currencies than Bitcoin.

I'm keeping this short. Just taking advantage of volatility. A 40%+ pullback with the potential of a 200% move? I'll take it. Here to have fun, not here to question things right now.

Litecoin active addresses are stable around 300k, though having steadily moved up over the last couple of years from 200K. bitinfocharts.com

Bitcoin active addresses have climbed a bit recently up to 750K, after actually declining the last couple years. bitinfocharts.com

As crappy as price behavior has been for LTC over the years, I like its growth pattern to an extent.

It's important to keep in mind that while on a very slow long term uptrend, Litecoin has broken down out of its major long term uptrend (orange) This was why I had assumed more downside was to come.

Given that LTC tends to pump last in the cycle, I'm taking a gamble on this thing flying back into the long term uptrend. There's A LOT of resistance overhead, especially at the broken uptrend, near $150-160 currently. Here's the shorter term structure, with some bullish arrows drawn.

Taking out the recent low near $85 would be a bearish sign and could send price quickly back to $66 support.

Let's see what happens. If the market has already topped, oh well. Risking a neglegable amount here. R/R seems decent to me.

This meant for speculation and entertainment only.

-Victor Cobra

XRP price forecast for early December 2024 & beyondCycles analysis indicating near term resistance to form at 2.5-2.8 levels, to be followed by retracement to 1.50 zone as the FINAL discount buying opportunity before price explodes to 7-10$ range in early Q1 2025.

Analysis for longer term indicates we may run to 100$ sometime in 2026 based on broader buy cycle and the current comprehensive overhaul of finance/banking sector infrastucture taking place...

This is one of the those you don't want to trade in and out of, imho. HODL to 2026 AT LEAST, possibly into 2028-2030.

Patience will always pay when you're dealing with high quality innovation!

Expansion exposure -- Recap of MKRWe analyzed the fundamentals and technical aspects of Maker DAO in early April. Let's take a look at the changes after a month.

Fundamentally, as the head protocol of RWA, MakerDAO is famous for its security. But after ONDO established cooperation with BlackRock fund BUIDL. MakerDAO chose to expand its $600 million DAI exposure to Ethena’s USDe and sUSDe. This may be due to the continued strength of ONDO. However, it is dangerous for an over-collateralized stablecoin to open up exposure to a centralized stablecoin (USDe is based on the funding rate arbitrage model to generate high returns and high risks. We will explain it in a subsequent analysis if we have the opportunity). After its implementation, multiple DeFi protocols that adopted DAI, such as AAVE, began to consider reducing the share of DAI to avoid risks.

We represent ENA (Ethena’s token) with a yellow line in the figure. MakerDAO said on April 9 that it was expanding its exposure. The impact of this aggressive move on the price was obvious. After that, MKR continued to pull back and the bulls weakened.

On the TSB indicator we can see that although the bar bounced back after touching the wavy zone multiple times, the bulls were encouraged. However, the TSB indicator prompted a SELL signal today, which shows that at the daily level, MKR's bullish trend is temporarily over. If you are long MKR based on the TSB indicator, you can first consider taking profits.

Introduction to indicators:

Trend Sentinel Barrier (TSB) is a trend indicator, using AI algorithm to calculate the cumulative trading volume of bulls and bears, identify trend direction and opportunities, and calculate short-term average cost in combination with changes of turnover ratio in multi-period trends, so as to grasp the profit from the trend more effectively without being cheated.

KDMM (KD Momentum Matrix) is not only a momentum indicator, but also a short-term indicator. It divides the movement of the candle into long and short term trends, as well as bullish and bearish momentum. It identifies the points where the bullish and bearish momentum increases and weakens, and effectively capture profits.

Disclaimer: Nothing in the script constitutes investment advice. The script objectively expounded the market situation and should not be construed as an offer to sell or an invitation to buy any cryptocurrencies.

Any decisions made based on the information contained in the script are your sole responsibility. Any investments made or to be made shall be with your independent analyses based on your financial situation and objectives.

Bitcoin and the Engineering of a Mass 2-Way LiquidationBitcoin is set up to perform a two way liquidation any moment now - as it corresponds to DXY.

The chart is loaded with stop orders shown respectively as buy orders in green and sell orders in red.

This is how the chart engineers such moves to perform at such speed without reliance on retail traders at all - the orders are embedded in the chart itself.

Think of lighting the fuse of a chain of explosives that accumulate more and more momentum in a big chain reaction.

Look at my levels shown here for liquidation top and bottom - Bottom is the entry of a bull market to 60,000 or more.

God speed and be safe.

TRX/USDT pumping is near?Hi Dears

Do you heard about WOW TRADE strategy?

We have a higher time frame trendline line (weekly). We are near the demand in control zone of higher timeframe. We break the trendline and after that we have a pullback to the trendline, base that cause this breaking or break even zone.

After that the price will be in the moon.

And now we are watching this strategy for trx usdt.

I hope it works properly.

Sincerely

Hosein Poursaei

Great opportunity with this new HDX coin We all know that new coins that come into the market tend to o pretty well. Price has retraced to a fair value gap and on the daily and this is the best price to enter on a limit order. I will make two trades one with target to the next resistance and the other i just let run for at least a year.

Bitcoin 1 hout REFERENCE onlySo the real question we face here now is will PA break over that diagonal trendline or will it get rejected and drop further.

Daily MACD is still over sold and turning Bearish so it is a possibility.

On th escreen there is the "Local " retracement fibs, just below that is the larger scale retracement line of 0.236, first line of support should we drop more.

Next 2 days will be possibly Volitile as we have FOMC and the rate hike tomorrow.

ExpectationsIt's important to have some expectations. Not much has changed since I last posted, at least not in terms of going risk-on. If anything the fundamentals are even more bearish, technicals are reflective of that, and thirdly mechanicals such as derivatives are not looking hot.

In order to even consider anything risk-on, the price action will have to severely disobey the bearish structure marked in the chart. There's a lot of margin calls going on right now behind the scenes, among other things, and I don't see these being priced in at this moment. The BOE says it will stop its corporate bond buying program on Friday and the market is going to reveal if that's true or not. I think there will be more "rescue" buying after the next projected leg down, and not a moment before.

To void this idea, I would need to see BTC break hard above 20k and take out 24k, DXY break bearish for several months, and bonds rally and not just keep lingering down. With the Nasdaq setting new lows it's hard for me to envision any sincere buying while big players are capitulating. Liquidiations are ongoing and I do not believe this is any sort of long-term bottom, although possibly a bottom for some sort of insane short midterm elections rally, which technically speaking could happy, but the chance of that is becoming less and less, UNLESS a crash were to happen first. One more reason to anticipate lower prices. All of this manufactured monetary expansion has baked failure into the heart of the system, specifically at the corporate and central bank levels, and it needs to fail in a speculator way before risk-taking is profitable again. And by speculator I meant something like the Euro collapsing and GBP failing much further, something along those lines, and not just some modest price corrections.

In order to come up with the 80 weeks or 230 weeks moving averages used in the chart, I simply looked at where support was established and then violated (red circles), with further downward price action. The latest action (2) has all the ingredients, it's just missing the further price action. This makes me think that downward prices have a higher probability.

Good luck and don't forget to hedge your bets!

RLinda ! ETHUSD-> Bears show strength. What to expect?ETHUSDT is in the phase of continuation of the global trend.

The descending price channel is forming and there are new preconditions to the fact that the fall may continue. Let's look into it:

Last weekend we saw the biggest surge in new addresses for 2022. Within days, the number of new addresses appearing on the network reached 135,780, an 11.1% increase.

At the end of those days, not only did ETH quotes not rise, which many expected as a reaction, but they collapsed by 3%. If you compare the current surge to those before it, the network's reaction has always been accompanied by a 10% to 15% increase.

Ethereum has fallen below support at $1279.75. The second flagship crypto-asset is showing bearish signs, and there is a risk of a strong price decline down to 1050 and even worth considering the 2021 - 2022 global low: $881.56 liquidity zone

ETHUSDT forms a price channel that coincides with the global trend

- The price breaks through a strong support level of 1280

- A Triangle pattern is forming on the local chart. At the moment, the support of the pattern is being broken

-Price is trading below MA200 and MA50

On the local chart, we can see the formation of the pattern "triangle" and an attempt by the price to break the support level.

This maneuver already indicates the mood of the market to continue its downward fall.

I expect a breakdown of the triangle support and a breakdown of the strong support level at 1279.75 and a continuation of the downfall in the direction of the global trend. The short-term target is support at 1018

Regards R. Linda!

$CRO spot buy 15th of july at 0.1227As I mentioned in my $ALGO spot buy, the 50 MA also crossed the 200 MA what could lead to a bullish sentiment. At the right side of the chart you see the VWAP indicator. The big candles stands for the volume at that price range, at that price range I searched for S/R levels.

If we flip the first higher low (green cup drawing) I believe the uptrend will follow up, TP's are in the chart.

If you have any tips or feedback let me know pls!

Enjoy your evening!

BTC: ROAD TO $70K AND BEYOND!July seems to be a very important month in the price history of Bitcoin. Despite recent volatility, we have not seen any major/decisive orders since July 2021. As of today, the next major resistance is at $42,xxx and the next major support is at $26,xxx.

So, bear flag or rising wedge? ...Hint, look at the decreasing volume ;)

___