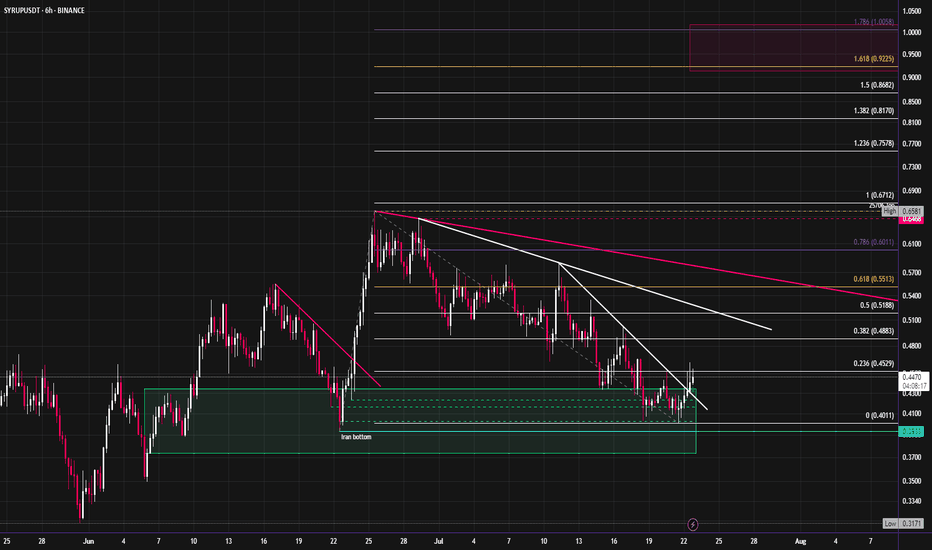

Syrup looks ready to start moving towards new ATH'sCRYPTOCAP:SYRUP has started to break out of its downtrend after revisiting the June lows. It has outperformed most of the market since April, with this month's pullback being an exception. I expect an aggressive move up into new highs. The fibs around $1 look like a good target for the short term, this would also be ~1b mc.

Cyrptocurrency

Gamestop Mascot $BUCK - Is it Destiny?At the time of writing, BUCK, a Solana-based meme token (also named "GME Mascot") is easily dismissed as a joke - with a sub $2m marketcap.

Just yesterday it had $1.3 million total invested into it, having today confirmed a MAJOR breakout as NYSE:GME stock also did the same. Is it one to ignore though? Should we just monitor it or jump straight into this token? Consider some thoughts below:

Technical

Buck is beginning what seems to be an Elliott Wave 3 of larger Wave 3 awaits (green line).

This is the phase of adoption seen of the Crypto industry that gains the most jaw-dropping price action. A phase when major exchanges acquire the token for ANY price - when observing insatiable demand and an explosion of consumer interest. If this comes to pass, this might just be the fastest monetisation of an asset in history.

This would be the same move that catapulted CRYPTO:PEPEUSD and COINBASE:DOGEUSD to stardom. Except this tokens rise could be even more swift than even either of those 2.

Speaking of PEPE, underlaid THIS chart is a dark green bar pattern extracted from the CRYPTO:PEPEUSD chart then scaled to all historical price action. This helps demonstrate that this sort of monetisation is a real possibility and HAS been witnessed before.

If we take the height of the flagpole (yellow) from the initial move of its creation in November 2024 and apply it on top of today's breakout - we get a marketcap of $4.5bn (2,250x). And that could happen in just 2-3 short weeks.

On breakouts of such patterns, price tends to want to extend itself into the "golden pocket" between the 1.414 (turquoise) and 1.618 (blue) fibonacci lines.

Target 1 is $4.5 (meaning buck is to reach several bucks) - which coincides with the 1.414 fibonacci level.

Target 2 is the $25 level - a value that even would exceed today's Gamestop company marketcap.

For such targets to hit, we will of course need to see at least some signs of the much anticipated #MOASS for Gamestop to finally unveil itself in NYSE:GME stock. That or for them to at least announce their recent BTC or ETH purchase.

If you're looking for leverage on top of GameStop's elevating price - options may not be your best bet. RAYDIUM:BUCKSOL_DGOS4P.USD could be an alternative play with even higher upside than even RAYDIUM:GMESOL_9TZ6VY.USD or RAYDIUM:GILSOL_58DNVL.USD - other meme tokens from the community.

Fundamental

You might be thinking that meme tokens have no fundamentals. But remember we're in 2025.

You might also believe that the NYSE:GME company has no reason to want to see this meme token rise and for it to take attention away the fundamental investment thesis of Gamestop. However let's think about that for a second.

By achieving a marketcap of $4.5bn it would be ranked #29 of all crypto tokens. At $25bn it would become a Top 10 token in just 2 months (see blue line).

Gamestop the business would benefit from a large appreciation of their IP. Buck would become a household name.

Seeing the appreciation of this tool is FREE marketing for Gamestop.

Buck today is a trademarked character and will allow them to sell a bucket-load of merchandise and hardware/accessories.

In prior decades was seen in several video games like "Buck and the Coin of Destiny". You can imagine future titles too like "Buck to the future". It's a catchy name.

The creators of this token seem to have been working on a video game of some sort behind the scenes.

Note however that this token is not linked officially with Gamestop in ANY capacity. It's apparently been a community takeover after its sharp drop from $0.12 (Nov-2024) to 0.7c (March 2025).

Last but not least.. if you have considered what seemed to propel COINBASE:DOGEUSD , CRYPTO:PEPEUSD , COINBASE:SHIBUSD into the public eye - consider that BUCK too has a short snappy name. It also features a heavily marketable animal character.

Buck too has a chip on his shoulder and is very popular in the community - for kids, teens & adults alike.

As outrageous as it is, to be talking about meme fundamentals, consider that Elon often says "the most entertaining outcome is the most likely outcome".

Not to mention...

As Neo once witnessed on his computer screen in the Matrix...

Follow the white rabbit 🐰

-------------

In a months time.. you too might just not regret it...

Bitwise Bitcoin ETF | BITB | Long at $46.25It definitely should get everyone's attention when a US Senator (David McCormick) is willing to dish out up to $600,000 in a Bitcoin ETF ( AMEX:BITB ):

Feb. 27: Bought $50,000 to $100,000

Feb. 28: Bought $15,000 to $50,000

March 3: Bought $50,000 to $100,000

March 5: Bought $15,000 to $50,000

March 10: Bought $50,000 to $100,000

March 11: Bought $15,000 to $50,000

March 13: Bought $15,000 to $50,000

March 20: Bought $50,000 to $100,000

Something may be brewing this year with the "U.S. crypto reserve" and I'll throw down a couple grand at $46.25 with a self-proclaimed wild prediction into 2026: Bitcoin to $120,000.

Bitwise ETF Targets:

$50.00

$55.00

$60.00

$65.00

ARC Bullish Reversal? Perfect Harmonic Setup + Break of LHs#ARC has been in a downtrend, but a perfect harmonic pattern has now formed on the 2H timeframe, signaling a potential bullish move.

Key Bullish Signs:

✅ #Harmonic Pattern Completion

✅ Bullish Divergence on #RSI

✅ Break of Previous #LHs (Sign of Reversal)

✅ Strong Support Zone Identified

🔥 Trading Plan: Long at CMP with SL below the harmonic low. TP1, TP2 and TP3 marked on the chart.

💬 What do you think? Are we ready for a bullish breakout? Drop your thoughts below! 👇👇

XRP - Food For ThougtThe total supply of XRP tokens is capped at 100 billion, ensuring that no more than 100 billion XRP tokens will ever be created. As of now, approximately 52% of the total supply is in circulation, with the remaining tokens held in escrow accounts by Ripple Labs.

Currently priced at $2.54 per token, transferring $1 billion via the XRP Ledger (XRPL) would require 393,700,787.4 XRP. However, if XRP were valued at $100,000 per token, only 10,000 tokens would be needed for the same transaction.

You might be thinking, "That would mean the XRP ecosystem, if fully distributed, would be worth $100 trillion... IMPOSSIBLE!" But let's delve into some numbers. Every day, approximately $5.7-6 trillion is transacted in the foreign exchange (FOREX) market. Annually, this equates to $2.1 quadrillion. If just 5% of that volume were moved across the XRPL, it would amount to $105 trillion. And this doesn't even account for the tokenization of stocks or real estate, which also see trillions in volume.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) system processes an average of nearly 50 million messages per day. While the exact monetary value of these transactions isn't publicly disclosed, it's estimated to be in the trillions of dollars daily. It's important to note that SWIFT and FOREX serve different functions in the financial world. So, in addition to FOREX moving $2.1 quadrillion annually and SWIFT handling another quadrillion, that's a massive volume of transactions. We now know that the XRPL ledger has recently been connected to SWIFT.

So, is a $100,000 XRP a pipe dream? Far from it. Bitcoin has hovered around $100,000 based on user sentiment. XRP represents an infrastructure of value.

SPX-USDT Trading Plan: From Demand Zone to ATH Zone

SPXUSDT is currently showing strong bullish momentum after a rebound from the demand zone around 0.5922. The price is advancing toward the ATH zone, with an immediate target set at 1.1000.

Key Observations

1. Demand Zone (Support Area):

- The 0.5922 level acted as a critical demand zone, prompting a strong bounce.

- Buyers stepped in at this level, indicating accumulation and bullish sentiment.

2. Rising Channel:

- The price is trading within a clear upward channel, suggesting a strong bullish trend.

- Breakouts from this channel, particularly to the upside, could accelerate momentum.

3. Resistance Levels:

- The ATH Zone represents a key resistance where the price may face some selling pressure.

- A breakout above the ATH Zone will pave the way toward the 1.1000 target.

4. Trend Continuation:

- The price appears to be following a zigzag pattern, respecting the channel structure.

Momentum and Indicators

1. Volume:

- Increased volume near the demand zone signals strong buying pressure.

2. Projection:

- Price is projected to continue climbing as long as the trendline remains intact.

- Any retracement could provide new entry opportunities near the channel’s lower boundary.

Trading Plan

1. Entry Points:

- Accumulate near 0.5922 if the price retests this demand zone.

- For breakout traders, consider entering after the price clears the ATH Zone with volume confirmation.

2. Stop-Loss:

- Place a stop-loss below 0.5500 to manage downside risks.

3. Profit Targets:

- Primary Target: 1.0000 (psychological level).

- Extended Target: 1.1000, as highlighted on the chart.

4. Risk Management:

- Risk no more than 2% of total capital on this trade.

---

Scenarios

1. Bullish Scenario:

- Price continues to respect the rising channel and breaks above the ATH Zone, targeting 1.1000.

2. Bearish Scenario:

- Failure to sustain above 0.5922 may lead to further downside, targeting lower levels of the channel.

Pro Summary

SPXUSDT is exhibiting strong bullish behavior, with a potential move toward the ATH Zone and beyond. Traders should closely monitor the key levels and align their entries with the trend to maximize profits while managing risks effectively.

Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies and other financial instruments carries significant risks, including the risk of loss of capital. Always trade responsibly and consider consulting a financial advisor before making any investment decisions 📊

DYOR (Do Your Own Research) 🔔

#CryptoMarketCycles #BullMarket #TechnicalAnalysis #CryptoTrading #MarketPhases

Cycle Top Indicator [CTI] | Deep Dive AnalysisIn this post we will look at some of the long-term trends identified with the tracking of the CTI indicator (Red and Green Moving averages in the price chart), and what we can learn from the observed behaviors over Cycle 1 / 2 / 3 and possible implications for Cycle 4.

INDICATOR RECAP

The CTI indicator attempts to model the cycle top based on observed historic price over extension from Cycle 1 / 2. Indicator marks a cycle top when the 'Fast MA' (Red Line) crosses above the 'Slow MA' (Green Line). I.e. the condition where both MAs price value is equal. I should be noted that this condition was achieve for every cycle to date so far, and that the condition was met twice for the experienced 'double peak top' in Cycle 1 but was only met for the first of the two peak tops during Cycle 3.

OSCILLATOR: % DISTANCE MODELLED BETWEEN SLOW (GREEN MA) & FAST (RED MA) – NORMALISED TO PRICE

The below oscillator models the %Distance away from each other the Green Line and the Red line gets over BTC's cycles (Normalised to Price).

* RED HORIZONTAL LINE: When the oscillator is equal to 1, this models the price value of the Green and Red moving averages as equal (or the CTI cycle top condition)

* ORANGE HORIZONTAL LINE(s): These mark the maximum over extension the Red MA exceeded the Green MA during a cycle top condition.

* GREEN HORIZONTAL LINE(s): These mark low levels of the oscillator, indicator maximum distance of the Red MA below the Green MA during each cycle.

BLACK SLOPING TREND LINE(s): Represent the diminishing trend of overlap between the Green and Red Mas each cycle.

* VERTICAL RED AND GREEN LINES: Show cycle tops and bottoms as triggered by the CTI and CBI (Cycle Bottom Indicators) – NOTE: CBI moving averages not shown.

SIGNIFICANCE OF ORANGE HORIZONTAL & BLACK TREND LINES

It is observable that each peak of the Oscillator is lower than the previous cycle peak (each peak is marked with an Orange horizontal line). This diminishing trend is shown with each orange line marked lower than the line before, and modeled with the Black downward sloping trend line(s) connecting the peaks.

A reminder that the Red Horizontal line shows the condition with the CTI models the cycle top and conditions above the Red Horizontal line show the % distance the Red MA reaches above the Green MA each cycle. For example:

* Cycle 1 Peak = 1.58

* Cycle 2 First peak = 1.25

* Cycle 2 Second peak = 1.20

* Cycle 3 First peak = 1.07

The diminishing trend of this relationship over each cycle (if historic behavior continues) suggest that the CTI overlap condition for cycle 4 my not eventuate. This would be modeled by our oscillator not exceeding the red line in Cycle 4.

The learnings for this analysis could suggest that waiting for the CTI indicator to Fire may result in a non-event for Cycle 4.

SIGNIFICANCE OF GREEN HORIZONTAL LINES

A surprising finding from this analysis show for all cycles to date that when the modeled oscillator reaches levels between -1.11 and -1.82 and particularly for Cycles 2 / 3 & 4 between -1.50 & -1.82 (Red MA % distance below the Grean MA), Historically BTC has found its cycle bottom. These findings are summarized below for quick reference.

* CYCLE 1-4 Bottom Oscillator Condition: -1.11 <> -1.82

* CYCLE 2-4 Bottom Oscillator Condition: -1.50 <> -1.82

Feel free to include any other observations I may have missed in the comments below. i intend to do a similar analysis for the CBI indicator when I find the time.

Long time no see..It’s been a while since I’ve reviewed the charts, but remember, it’s always best to focus on long-term charts and avoid getting caught up in short-term noise . Leverage is gambling —it’s like a casino and can destroy your trust in the crypto system. Stay away from it, and stick to spot trading only for reliable and safe growth.

Bitcoin is currently around 60,285 USDT, holding strong. After a long break from the charts, I'm anticipating a significant bullish move in the coming weeks . The price action suggests that Bitcoin could hit major resistance levels at 82,000 USDT , 102,000 USDT , and potentially 123,000+ USDT .

The upcoming rate cuts and presidential elections are likely to impact the economy, potentially driving a major increase in Bitcoin and crypto values. The flood of crypto news already circulating the internet reflects the growing bullish sentiment, which aligns with the expected price targets and underscores the potential for substantial upward movement.

Cage Cycle Values for ENSUSDT.PCage Cycle Values: If the price is above 26.770 (Buy Point), the price target is 35.330, and if it is below 26.623 (Sell Point), the price target is 18.103. You can find the details of the Cage Cycle strategy attached. (MAKE SURE TO FOLLOW THE NEW TAKE PROFIT POINTS PUBLISHED AS TAKE PROFIT POINTS ARE INCREASED ACCORDING TO THE TRADING CYCLE)

Long Position:

Entry: 26.770

Profit: 35.330 (Will be updated if necessary in the positive direction)

Stop: 26.623

Short Position:

Entry: 26.623

Profit:18.103 (Will be updated if necessary in the positive direction)

Stop: 26.770

The Cage Cycle Strategy is a model that emerges from analyzing approximately 2 over 20 data points (1,000,000 and above tick data). The price definitely reaches one of the specified Take Profit Points as a price target. It is not possible to determine the direction with a hundred percent certainty in financial markets. Therefore, success rates are attempted to be increased by using certain models. The Cage Cycles end when the price reaches the price target in any direction in the Cage Cycle Strategy. Although it is not an investment advice, an example of use is as follows: A Long position is opened at the price level of 26.770, the Stop Loss is 26.623, and the Take Profit is 35.330. When the price reaches 26.623, instead of the Long position that was stopped, a Short Position is opened, with the Stop Loss of the Short Position being 26.770 and the Take Profit being 18.103. Transactions are monitored by stopping until the market direction is determined. Considering the number of stopped transactions and the expected time, Take Profit points are updated to increase profits (Updated Take Profit Points will never be lower than the initially specified Take Profit points). By recalculating the Take Profit points to increase profits, the aim is to compensate for the losses of the stopped transactions when the Cage Cycle ends. In the data analysis of the last 10 years, the average number of stops is 12, and the highest number of stops is calculated as 83 (These figures may vary in the future). Although it is not an investment advice, in the Cage Cycle, if the amount to be stopped is set at $1, by increasing the position by half of the initial lot amount for every 10 stops (0.5 $ for every 10 stops), a higher profit can be targeted along with the increased Take Profit point. Using the Cage Cycle data provided above as an example for Ensusdt, after 15 stops, when the cycle ends, the profit-loss calculation (Initial Stop Amount to be stopped is $1): For the first 10 stops, the loss will be 10$*1=10$, and between 10 and 15 stops, the loss will be 5*1.5$= 7.5$, resulting in a total loss of 17.5$. The profit to be obtained with the updated Take Profit points will be 1.5*27= 40.5$. The net profit, excluding commission, will be 40.5-17.5= 23$. The Cage Cycle helps you determine the Take Profit point in your own trades as well, as it is known that the price will definitely reach one of the Take Profit points. Enjoy and Good luck with your trades.

THIS IS NOT AN INVESTMENT ADVICE. Made by Yourcages

Trade Setup: DOGE Long PositionMarket Context:

DOGE is reclaiming its range low after a change of character (CHOC).

It is setting a higher high and a higher low into the 21-day and 200-day EMAs.

The range low is being treated as invalidation if the price closes below this support level.

Trade Parameters:

Entry: Enter a trade around $0.129 to $0.13.

Take Profit:

First target: $0.157

Second target: $0.187

Third target: $0.22

Stop Loss: Set at a daily close below $0.115

📊 Monitor the price action around the 21-day and 200-day EMAs. Adjust your trade based on market conditions and be cautious of any signs of reversal or further downside. #DOGE #CryptoTrading #TradeSetup 🎯

Cage Cycle Values for OmusdtCage Cycle Values: If the price is above 0.67647 (Buy Point), the price target is 1.13913, and if it is below 0.66245 (Sell Point), the price target is 0.19979. You can find the details of the Cage Cycle strategy attached. (MAKE SURE TO FOLLOW THE NEW TAKE PROFIT POINTS PUBLISHED AS TAKE PROFIT POINTS ARE INCREASED ACCORDING TO THE TRADING CYCLE)

Long Position:

Entry: 0.67647

Profit: 1.13913 (Will be updated if necessary in the positive direction)

Stop: 0.66245

Short Position:

Entry: 0.66245

Profit: 0.19979 (Will be updated if necessary in the positive direction)

Stop: 0.67647

The Cage Cycle Strategy is a model that emerges from analyzing approximately 2 over 20 data points (1,000,000 and above tick data). The price definitely reaches one of the specified Take Profit Points as a price target. It is not possible to determine the direction with a hundred percent certainty in financial markets. Therefore, success rates are attempted to be increased by using certain models. The Cage Cycles end when the price reaches the price target in any direction in the Cage Cycle Strategy. Although it is not an investment advice, an example of use is as follows: A Long position is opened at the price level of 0.67647, the Stop Loss is 0.66245, and the Take Profit is 1.13913. When the price reaches 0.66245, instead of the Long position that was stopped, a Short Position is opened, with the Stop Loss of the Short Position being 0.67647 and the Take Profit being 0.19979. Transactions are monitored by stopping until the market direction is determined. Considering the number of stopped transactions and the expected time, Take Profit points are updated to increase profits (Updated Take Profit Points will never be lower than the initially specified Take Profit points). By recalculating the Take Profit points to increase profits, the aim is to compensate for the losses of the stopped transactions when the Cage Cycle ends. In the data analysis of the last 10 years, the average number of stops is 12, and the highest number of stops is calculated as 83 (These figures may vary in the future). Although it is not an investment advice, in the Cage Cycle, if the amount to be stopped is set at $1, by increasing the position by half of the initial lot amount for every 10 stops (0.5 $ for every 10 stops), a higher profit can be targeted along with the increased Take Profit point. Using the Cage Cycle data provided above as an example for Peopleusdt, after 15 stops, when the cycle ends, the profit-loss calculation (Initial Stop Amount to be stopped is $1): For the first 10 stops, the loss will be 10$*1=10$, and between 10 and 15 stops, the loss will be 5*1.5$= 7.5$, resulting in a total loss of 17.5$. The profit to be obtained with the updated Take Profit points will be 1.5*27= 40.5$. The net profit, excluding commission, will be 40.5-17.5= 23$. The Cage Cycle helps you determine the Take Profit point in your own trades as well, as it is known that the price will definitely reach one of the Take Profit points. Enjoy and Good luck with your trades.

THIS IS NOT AN INVESTMENT ADVICE. Made by Yourcages

Spotting a Bull Flag Pattern in Wave Coin (But Stay Cautious)Wave Coin is currently showing a promising bull flag pattern on the chart. This pattern typically indicates a continuation of the previous uptrend, suggesting potential for further gains. However, it's important to stay cautious as the price could also fall if the pattern fails to hold. The consolidation phase within the flag gives a chance to enter the market before the next breakout, but be mindful of key support and resistance levels. Always use stop-loss orders to protect your position and trade wisely!"

The Magic $Spell decision line. MAKE OR BREAK?COINBASE:SPELLUSD token has been what I can call the gem hidden in plain sight, they are non-US based liquidity platform. They battle through so much including the war in Ukraine, which is obviously still on going. At one point they have over SEED_TVCODER77_ETHBTCDATA:1B in TVL, the team has never waived the white flag and pressed on to deliver everything they can to the community that has instilled so much trust, Romi is a master of his craft. If you believe in the founders of something, you better invest with them.

I love $spell and its future.

Looking at the chart here, you see that anytime it has hung around this line, it's made a decision to go up or down. Based on its recent bullish signal and reversal based on the bottom arrow, I see Spell headed back up to where it belongs, respected with the rest of the crypto community for what they provide.

US30 HEAD AND SHOULER??Simple trading - Head and shoulders

Us30 has broken the neck-line of the Head and shoulder pattern on the 4hr. US30 is bullish on the higher time frames so always be ready for a pullback to the upside. Looking at the daily chart to see if the price will retest previous support and turn resistance.

Due to the lack of bullish momentum on the smaller timeframes, I would NOT advise taking a buy trade to previous support as the market is making lower highs and lower lows. This clearly indicates that the bears are in control. At any moment the price could drop and you do not want to be caught in that.

Be patient and wait for the price to play out. Look to take a sell positions

in the short term at respectable levels

BTCUSD Update - 52k?Seem to be going perfectly as predicted. BTC is dropping, retesting Supports to regain its bullish momentum. For how long will BTC continue to drop?

For start, this is just the beginning. BTC has completed the 4hr M pattern. BTC has just broken under major SUPPORT. This support is also the neckline for the Head and shoulder pattern from the ATH. Waiting for a confirmation by a retest. If BTC rejects the Daily support at 63500, look for sell pressure to 52k.

Pre halving BTC: institutional greed, chaos and orderWith less than 100 days remaining until the next halving, BTC has followed the projected trajectory. Given the buzz surrounding ETFs and the current market conditions, a pullback seems probable. The initial support rests at 36k, with the subsequent support at 32k. The initial support will probably uphold the price, so I'd suggest a 65/35 liquidity split between these two zones. Until the all-time high is broken, discussing the next bull run may seem premature, but it's important not to underestimate institutional greed and Bitcoin's inherent scarcity.