D-DAX

DAX H4 | Rising into resistanceDAX (GER30) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 23,093.36 which is a swing-high resistance that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 23,260.00 which is a level that sits above the 61.8% Fibonacci retracement and a pullback resistance.

Take profit is at 22,708.85 which is a swing-low support that aligns with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

DAX WILL GO UP|LONG|

✅DAX is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the index is about to retest the rising support

Thus, a rebound and a move up is expected

With the target of retesting the level above at 23,200

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX Index: Further Upside Ahead? On the DAX chart, we’re tracking a very large diagonal pattern to the upside, which is likely not yet complete. We are probably in the late stages of circle wave C, within a larger third wave in the yellow scenario.

Upside Targets

Next resistance levels: 24,205 and 25,715 EUR

Support Zone for Wave 4

Support area: 22,512 to 21,610 EUR

This zone would become more relevant if the current rally completes and Wave 4 begins.

On the very small time frame, it’s possible that the internal fourth-wave pullback within circle wave C has already started.

Micro support remains between 22,512 and 21,610 EUR

A break below 22,260 EUR would help confirm that wave 4 is underway

However, one more high is still possible before that pullback begins—this would align with the white scenario, where the current move finishes wave 3 before wave 4 kicks in.

DAX Growth Ahead! Buy!

Hello,Traders!

DAX is going down

And will soon retest the

Rising support and after

The retest we will be

Expecting a bullish rebound

Because we are bullish biased

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

German $DAX ($EWG) Topping Out?Originally posted on 3/12, but blocked b/c I referenced my X account. Looks like a bearish move could be materializing alongside broader risk asset weakness:

Is the XETR:DAX topping out? Monthly RSI @ 80+ w/ weekly nosing over and daily bearish divergences observable. Index high from 3/6 coincided with the 261.8% Fibonacci extension of the 11/2021-10/2022 uptrend correction.

Confirmation short setup could materialize $FDAX closes below pivot low of the 1D uptrend (22226), bounces off of short-term demand (ex: 22142-21691, and trades into supply ≥ 22226. This scenario is speculative - the market needs to show its hand.

Presently, DAX is up > 1.5% alongside US stocks, which dipped into intermediate-term demand and benefited from softer-than-expected CPI prints. However, DAX (and domestic) bulls haven't proven anything yet. Unless buyers manage to push the DAX higher - initially above 22900 and secondarily through 23000-23200 - on accelerating momentum, risk remains to the downside (IMO). German stocks have been global relative strength leaders as of late, so if they do correct, other equity indexes may retreat in tandem.

Long-term charts for US indices ( SP:SPX , NASDAQ:NDX , TVC:RUT ) look more bearish vs. bullish (I still have some shorts on), though a near-term recovery is plausible. If domestic equities do trade lower, selling could materialize in Asian and European markets. Use LTF charts to monitor price action/manage risk and splice into shorts if German stocks AMEX:EWG start to crack.

My $0.02. Feedback welcome.

Jon

DAX Trade Log DAX Buy Setup with Ichimoku Confluence

Geopolitical tensions—especially the ongoing conflict in Eastern Europe—continue to influence risk sentiment, while inflation and central bank policy remain in the spotlight. The European Central Bank’s more hawkish stance contrasts with fears of slowing growth in the Eurozone. Despite these headwinds, the DAX could see a near-term bounce, supported by technical signals:

1. Ichimoku Confluence : Price is testing the Kijun and the lower edge of the cloud, aligning with a daily pivot. A close back above the Kijun/cloud area suggests potential upside.

2. Volume Spike : Recent volume surge around this support zone may indicate bullish absorption—watch for follow-through.

3. Macro Backdrop : Although persistent inflation and geopolitical uncertainties loom large, short-term volatility can present trading opportunities. Keep an eye on ECB communications and any unexpected developments in global tensions.

4. Risk Management : A 120-point SL (around 2% account risk) below the key support could help protect against false breaks. Targets include the top of the cloud or previous swing highs.

5. 8-Day Cycle : Day 2 in your cycle analysis suggests a potential upswing—confirmation will come if price holds above this confluence zone.

Stay vigilant, monitor news flow, and maintain discipline in your trading plan. This is not financial advice—always do your own due diligence.

2025-03-19 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: We oscillate around 23300 and not moving much. It’s a bull flag but one that has been going on for too long now. The longer we move sideways, the more neutral the market is. Clear invalidation prices for both sides. Breakout above the bull flag and 23400 could mean another try at 500 and if they crack that, 24k comes in play. Bears need strong closes below 23000 and then we could accelerate down again.

current market cycle: trading range

key levels: 23000 - 24000

bull case: Bulls have two big open gaps and if they defend them, they can continue to try and get a new ath above 23505 and maybe 24000 if momentum is there. On the daily chart this looks bullish and nothing else but on the 1h chart it get’s more neutral with every 1h bar. Not much else to write in favor of the bulls tbh. Either they break above the bull flag tomorrow or they better lock in those profits.

Invalidation is below 23000.

bear case: Bears have many arguments on their side but until we see prices below 23000, they are mostly hopes and dreams. Even the most bullish news one could make up about the big spending bill, could not get us a new ath, which means big bois are reducing their positions above 23300 (at least for now). Bears also see the big double top on the daily chart and if we break below 23000, it could accelerate down big time. Bulls have also tried 4 times on the 1h chart to get above 23300/23400 and failed each time. Market has turned mostly neutral and bears have a chance of closing the week below 23000.

Invalidation is above 23550.

short term: Neutral. 23300 is the fair price. Set alerts for the given invalidation prices and see if we can get a big trend before end of week. Chop is more likely though.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

trade of the day: Buying below 23200, which was support yesterday and today it was good for 150+ again.

DAX strong bullish conditions. Targeting 24200.DAX is trading inside a Channel Up since the October 15th 2024 High.

Since March 11th 2025 it is on a MA200 (4h) rebound and the last time it did so was on January 13th 2025.

It then initiated a +9.12% rebound, which throughout the Channel Up pattern, has been a quite common bullish wave.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 24200 (+9.12% rise from the MA200 low).

Tips:

1. The RSI (4h) has print a Channel Up pattern that is seen on the last three major Lows of the pattern. Strong bullish signal.

Please like, follow and comment!!

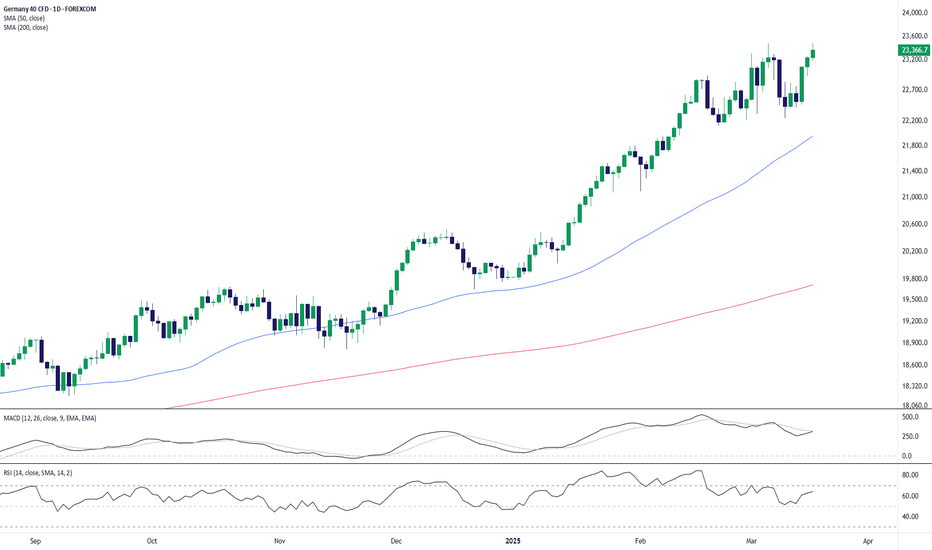

Germany's DAX Hits Fresh Highs as Uptrend StrengthensThe Germany 40 (DAX) continues its impressive rally, climbing to 23,378.7, up 0.60% on the session. The 50-day SMA (21,954.8) remains firmly below price action, signaling sustained bullish momentum, while the 200-day SMA (19,713.1) provides a solid long-term support base.

Momentum indicators support the uptrend:

✅ MACD remains in bullish territory, showing sustained strength.

✅ RSI at 64.04 suggests the index is trending strongly but isn’t overbought yet.

Key Levels to Watch:

📌 Support: 22,800 (recent pullback level), 21,950 (50-day SMA)

📌 Resistance: 23,600 (psychological level), 24,000 (round number target)

As long as 23,000 holds as support, bulls may push for 24,000+ in the near term. A drop below 22,800 could signal a deeper pullback.

-MW

2025-03-17 - priceactiontds - daily update - dax

Good Evening and I hope you are well.

comment: Weekly outlook gave clear invalidation points and bulls broke above. We have a clear measuring gap down to 22800 now and until that is closed, it’s bullish all the way to new ath and maybe 24k.

current market cycle: trading range but we could see the resumption of the bull trend tomorrow

key levels: 22260 - 24000

bull case: Bulls defended the breakout and had a perfect retest with last weeks close. Every pullback now should stay above 23000 and then we are free to test 23500 and maybe even 24000. Bulls are in full control again.

Invalidation is below 23000.

bear case: Bears failed in breaking below the breakout of 22800ish and they had to give up after we printed 4 consecutive 1h bars with big tails below. 1h 20ema is support and until bears get consecutive closes below it again, they don’t have much. I think most bears will wait how high this one goes and start looking for shorts above 23500.

Invalidation is above 23600.

short term: Bullish for 23500 and maybe 24000. Bearish only below 22900.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

trade of the day: Bullish above invalidation point yesterday given. Hope you made some.

DAX Post Election Potential Bullish ContinuationDAX price still seems to exhibit signs of potential bullish continuation (during the current post election period) as the price action may form another credible Higher Low with multiple confluences from key Fibonacci and Support levels.

Trade Plan :

Entry @ 22653

Stop Loss @ 22014

TP 1 @ 23292 (Before All Time High)

TP 2 @ 23931 (After All Time High)

Move Stop Loss to Break Even if TP1 hits.

#202511 - priceactiontds - weekly update - dax futuresGood Evening and I hope you are well.

comment: Wild week where market reversed the huge selling on Friday and the daily bear bar looks more bullish than bearish. 23k is the battleground right now. If bears keep it a lower high, we could test further down but if they don’t, bulls could try and go for 24k. News certainly help in fueling this right now.

current market cycle: Bull trend until consecutive daily closes below 22000

key levels: 22000 - 24000

bull case: Above 23500 we could go for 24000 next week. This did not change since market went nowhere last week. Bulls defended the gap to 22000 and that is as bullish as it get’s. Plan for bulls is clear, keep market above the adjusted bull trend line around 22500 and make new ath above 23500, likely going for 24000. The channel looks still good, so trade it like it’s valid.

Invalidation is below 22400 because it would invalidate the channel but only a print below 22000 would change the character of this market.

bear case: Bears have shown decent selling pressure for 1200 points but that does not matter if they can not get below 22000 again. I do think it’s not unlikely that the bears have the argument for a head & shoulders, if 23000 proves to be bigger resistance now. I’d still favor the bulls for now but if we fail below 23200 for the next 3-6 days, the bull trend line would be broken and market could test lower, if overall sentiment shifts again after the expected short squeeze. Yes, I do keep in mind that German stocks are likely profiting big time from the spending spree Germany will likely go on but I am a price action daytrader. I read the chart and develop a thesis would could happen and if it does I put on risk. This front-running could very well reverse. Bears only have their confirmation below 22000 and for now market has tested 22147 - 22300 enough that bears gave up.

Invalidation is above 23500.

short term: Neutral around 22800/23200. Above 23200 we will retest 23500 and above that we likely try for 24000. 22400-22800 is the dead zone and only below 21900 bears have good reasons for lower prices. For now I can’t see any reason why this would fall below 22000 next week.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

chart update: Nothing

DAX to rise further?DAX Poised for Further Gains

Risk sentiment remains positive, and the DAX could benefit from a potential market turnaround. Despite recent weakness, hedging options suggest a recovery, with put option levels possibly marking a bottom. Meanwhile, a declining VIX signals easing market anxiety.

DAX Outlook:

- Supported by improving global sentiment

- Potential Ukraine ceasefire could boost momentum

- Falling oil prices may further support economic growth

At the same time, uncertainty could drive gold and silver higher, with silver benefiting from the positive stock market environment.

Conclusion: The DAX remains well-positioned for further gains. A decisive breakout above resistance levels could fuel the next leg of the rally.

Booze Wars... How DAX could react?Now it's time for US and EU to have their public tariff battle. Given that wine, champagne and beer are a huge part of EU export into the US, there might be some pain felt among the MARKETSCOM:DE30 bulls. Let's dig in.

XETR:DAX

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

2025-03-13 - priceactiontds - daily update - dax

Good Evening and I hope you are well.

comment: Bulls making higher lows and closing 4h bars at the highs. They need a 1h close above 22900 for more upside. Until the bear trend line is broken, bears are still in control though. 22600 is a bad spot to trade. Either wait for a bigger pullback or a breakout. We are currently inside the big bear channel and a smaller bull channel. Breakout mode and will likely see a bigger move over the next 1-2 days.

current market cycle: trading range - bull trend clearly broken now

key levels: 22000 - 24000

bull case: Bulls need a 1h close above 22900 and they should not let the market drop below 22500 again. That’s all there is to it. Wait for the breakout.

Invalidation is below 21900.

bear case: Not making more stuff up here. Bears need lower lows again and stay inside the bear channel. Below 22500 we likely sell off to 22300 or finally for 22000.

Invalidation is above 22900.

short term: Neutral around 22600. Watch the chart. Contracting range and 2 channels. Wait for better structure or clear breakout.

medium-long term from 2024-02-26: As much as I would love to see this 30% lower, it’s not happening anytime soon. Market will probably has to move sideways for some weeks before this could go down. Daily close below 22000 is needed to turn this neutral and end the bull trend-.

current swing trade: None

trade of the day: Yesterday I told you to be bullish. Bullish it was. 500 points.

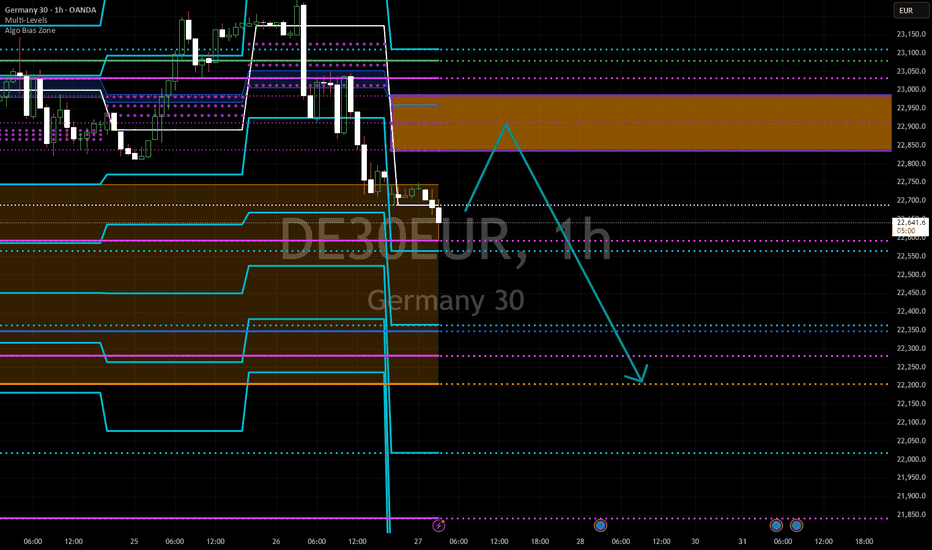

DAX H1 | Overlap resistance at 50% FiboDAX (GER30) is rising towards an overlap resistance and could potentially reverse off this level to drop lower.

Sell entry is at 22,840.05 which is an overlap resistance that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 23,037.00 which is a level that sits above the 61.8% Fibonacci retracement and the descending trendline.

Take profit is at 22,251.40 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

2025-03-11 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Bears are clearly in control and we have two bear trend lines above us. One around 22600 and the bigger one around 23000. Bulls need to claim 22900 and bears obviously want 22k. Absolutely no idea what we get first. Buying volume increased big time at previous low around 22300 but overall market sentiment has to reverse. I can not see dax rallying 2%+ if us indexes stay at the lows. 22400 is the neutral price, so don’t trade it.

current market cycle: trading range - bull trend clearly broken now

key levels: 22000 - 24000

bull case: Bulls need to get back above 22800 if they want further upside. For now they have buy new lows and scalp. For bulls to reverse this, they would need to print a clear higher low and trapping late bears. Market can not rally, if we make lower lows the whole time. Not much for bulls here and it could be because they expect 22k to be hit and want to buy that.

Invalidation is below 21900.

bear case: Bears want to finally print 22000 again. last time we did was early February. Problem for them is, we are at huge previous support. Should you bet that the breakout will happen? Never. Wait for it to happen and join along and wait for a bounce to sell higher. Any bounce has to stay below 22600 and then we can continue down. Selling below 22400 is bad, no matter what. Bears remain in control until the current bear channel is broken.

Invalidation is above 23600.

short term: Neutral around 22400. Bearish above 22500 if we stall too much and bears come around again. If bulls stay above 22300/22400 and print a lower high, I will join them if us markets do the same. I expect a huge bounce soon.

medium-long term from 2024-02-26: As much as I would love to see this 30% lower, it’s not happening anytime soon. Market will probably has to move sideways for some weeks before this could go down. Daily close below 22000 is needed to turn this neutral and end the bull trend-.

current swing trade: None

trade of the day: Buying during the Globex session was fun and then selling above 22800 again, since it was resistance from yesterday. Where should you have sold? Market hit 22835 and then only printed lower highs for 7 15m bars. That was certainly strong enough to cover longs.

DAX H1 | Overlap support at 50% Fibo retracementThe DAX (GER30) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 22,860.31 which is an overlap support that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 22,640.00 which is a level that lies underneath a swing-low support.

Take profit is at 23,443.01 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.