SECRET Indicator Says LINK Will Moon🚨MartyBoots here , I have been trading for 17 years and sharing my thoughts on BINANCE:LINKUSDT here.🚨

.

🚨 BINANCE:LINKUSDT is looking beautiful , very interesting chart for more upside

and is now into support🚨

Do not miss out on BINANCE:LINKUSDT as this is a great opportunity

The SECRET Indicator says it will moon

Watch video for more details

D-LINK

Chainlink: Your Altcoin ChoiceI was about to call it quits for today but several people requested an analysis for LINK, so here it is.

Oh, by the way, I like Chainlink also and tend to publish many updates. Just lately I was out but now I am back healthy and with full force.

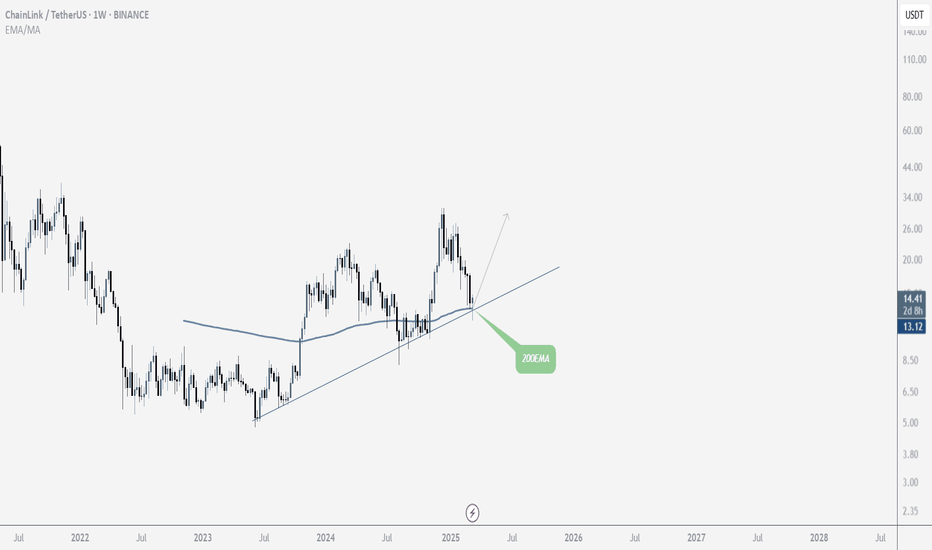

There are two main dynamics playing out on this chart that are of interest to us:

1) A perfect falling wedge pattern. This pattern is a classic reversal signal and one of the most accurate. It simply works.

2) A long-term support/accumulation zone. The falling wedge is enough to predict a reversal, but the action just entered the late 2024 buy zone and long-term support. This makes it even stronger.

I am sure we have positive signals coming also from the MACD and RSI.

This chart is based on the long-term. Again, if you would like to find the 2025 ATH for this or any other pair, just go to my profile by typing on my username and search for the pairs name. In this case, LINKUSDT, you will find many publications that are still good and valid when it comes to the numbers and ATH potential. I published many in 2024 and some even in 2023.

Now, the apex of the falling wedge is a higher low compared to the bottom in August 2024. This is good and works to support the other signals.

Trading volume is very low on the drop and this is also very good for the bulls. The market is on autopilot. It is dropping just because it needs to drop. Bot selling. Bot selling ends when real buying starts. We are about to experience a massive influx of money into the market.

Now, money is already "programmed." The exchanges already have the whales money. Money has been moving around for months now and the entire game is already setup. The start of the next bullish cycle has been programmed, you know everything works with algorithms and bots. The big players pay the exchanges and the exchanges take care of the rest. The only way for small players like us to win is by playing the long-term game. If we play short-term, we get killed because we are looking for 20-30% or more, while the whales can profit with 1-2%. While we try to complete a trade, they shake us out over and over, again and again. So instead of fighting the whales we use a strategy that works. We wait for the market bottom, when the market hits bottom or is close to the bottom, near support, we buy and hold.

We then just wait and let the bullish cycle unfold. When everything is up, we collect profits and move on.

There is also a play to short the market after the end of the bullish phase. I also play this hand and give guidance to my followers and traders, but this is far away.

Right now your only concern should be buying, buying like the world is about to end. Why? Because once the market starts moving there is no going back; once great entry prices are gone, they are gone forever.

The time is now.

Chainlink is good and trading near long-term support.

Buy when prices are low, it will soon start to grow.

It can take weeks or days, but it won't be long. The next bullish cycle should last between 6-8 months. It can expand at last 12 months or more. We will have to see about this part because market conditions are so different now, who knows if we will enter a 10 years strong/long bull market cycle, it is possible, just like it happened with stocks. But we can only prepare based on what we know, and what we know is that most of the market will grow really strong. If it gets better, great. If the bull market ends up being a standard one, this would still be awesome.

Thanks a lot for your continued support.

Namaste.

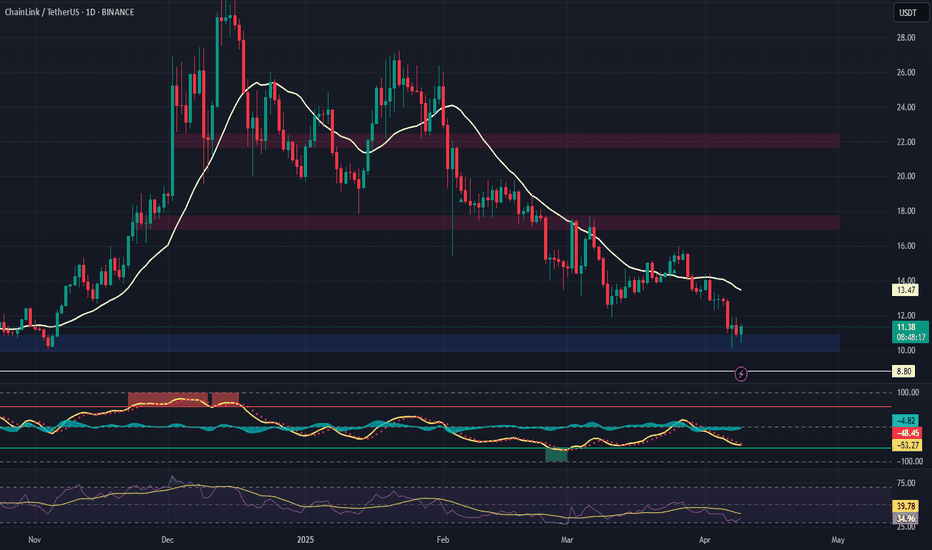

LINK Long Spot Trade Setup – Major Support TestLINK has retraced sharply and is now sitting at a critical support zone ($10.00–$11.00), historically a strong base for reversals. This offers a solid risk/reward opportunity for a potential bounce and test of upper resistance zones.

📌 Trade Setup:

Entry Zone: $10.00 – $11.00

Take Profit Targets:

🥇 $17.00 – $17.70

🥈 $21.70 – $22.40

Stop Loss: Around $8.80

We've now hit our level 6.1-6.2% precisely! We’ve finally hit our ultimate target of 6.1-6.2% (3-drive pattern ✅), which we first talked about back in March after taking the 5W/5D HOB at 5.3%. We said that as long as USDT.D stays above the 4.76% SL, 6.1-6.2% would be the next target - and here we are.

We did see a very decent reaction from the level, as mentioned before. Scalp longs could’ve been taken, but personally, I only took a small, quick scalp long on BTC. I’m not really interested in longs until CRYPTOCAP:BTC takes its 🗝️level.

I got asked a few times today about my plans for BTC, as the boss hasn’t taken the 🗝️ level yet (though it’ll very likely take it eventually). While it’s difficult to know exactly what’s going to happen or how it’ll play out, I’m simply going to focus on the USDT.D 6.5-6.8% resistance levels/EP (no liquidity). If that matches with 72K on BTC, it’d give us additional confluence to open a long.

So yeah, even though it’s hit our level perfectly - including other majors like CRYPTOCAP:TOTAL and #ETHBTC - BTC hasn’t taken its 🗝️ level yet, which probably means we’ve got a tad higher to go on USDT.D. That level could be the HTF resistance/EP at 6.5%-6.8%.

Conversely, if we reject and see a pullback, watch the 18H HOB at 5.63% and potentially even the 17H Demand at 5.49% (wickfishing), where some profits on longs could be taken. Watch 5.03% - if it breaks below this = MTF bullishness on assets.

Chainlink LongAfter a few months of waiting on the sidelines we are back with a chainlink long after a deep retrace.

Link is showing bullish divergence on the lower timeframes after double bottoming at this crucial support and completing an 886 retracement of an informal Gartley. The support level can be seen across time below.

The only question would be to either wait until the end of the day for this support candle to print or to go in now before confirmation. We will go in with 50% of our ideal position size now and then allocate at the end of the day or tomorrow.

Chainlink LINK price analysisThe 6-year trend line has been keeping the #LINK price “in play” by 4 times

The next is patience and observation.

🆗 As long as the OKX:LINKUSDT price is above the blue trend line, then the medium-term targets of $38 and $53 are still relevant.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

LINK/USDT: Strong Momentum Points to Higher TargetsThe LINK/USDT pair has shown strong bullish momentum on the 1-hour timeframe, breaking above both the 15.00 level and a downward trendline. On the daily chart, four consecutive bullish candles reflect persistent buying pressure.

Recent movements suggest an ABC pattern is unfolding, hinting at a potential push toward the 17.00 resistance level. With momentum building, the market may soon test this zone, barring any negative news that could prompt a sell-off. A pullback may occur short term, but the overall outlook remains bullish, with a mid-term target at the resistance zone around 16.45

LINKLINK

March 26, 2025

8:02 AM

CRYPTOCAP:LINK just had a clean bounce off the +W OB (not a full-on impulsive move, but definitely a solid reaction)

Also, the MA100 and MA200 are forming a golden cross on both weekly and 4H TF — pretty bullish signal overall.

Looks like we’re setting up for W3. Right now, we’re in W2 and potentially about to enter W3 of W3, which is usually the strongest leg.

LINK Trade Setup - Higher Low ConfirmationLINK is showing early signs of reversal from a key higher timeframe support zone. We anticipate a short-term dip into the buy zone before shifting into an expansion phase.

🛠 Trade Details:

Entry: $13 – $14 (Buy Zone)

Take Profit Targets:

$17.00 - $17.70 (Initial Resistance)

$21.70 - $22.40 (Breakout Target)

Stop Loss: Daily close below $12

Looking for higher low confirmation before the move up. 📈🚀

Chainlink Set for 100% Surge Amidst Strategic Partnership The Price of Chainlink ( CRYPTOCAP:LINK ) is set for a comeback with a potential 100% surge in sight- amidst striking a potential partnership with the Abu Dhabi Global Market (ADGM).

The asset is currently depicting multiple signs of a bullish renaissance with the daily price chart hinting at a bullish symmetrical triangle. Similarly, the daily Relative Strength Index (RSI) is at 52 hinting at a potential bullish surge incoming coupled with the falling wedge depicted in the chart.

Chainlink ( CRYPTOCAP:LINK ) entered into a strategic partnership with the Abu Dhabi Global Market (ADGM) to promote tokenization in the UAE. As part of the collaboration, Chainlink and ADGM have signed an MoU to create a secure and legally sound environment for asset tokenization in financial markets.

Significantly, ADGM will provide regulatory guidance, frameworks for secure tokenization, and expertise in asset tokenization. At the same time, Chainlink will contribute its technical expertise, blockchain-based solutions, and tokenization infrastructure.

What Is Chainlink (LINK)?

Founded in 2017, Chainlink is a blockchain abstraction layer that enables universally connected smart contracts. Through a decentralized oracle network, Chainlink allows blockchains to securely interact with external data feeds, events and payment methods, providing the critical off-chain information needed by complex smart contracts to become the dominant form of digital agreement.

Chainlink Price Live Data

The live Chainlink price today is $15.47 USD with a 24-hour trading volume of $326,378,851 USD. Chainlink is up 2.47% in the last 24 hours, with a live market cap of $10,167,634,903 USD. It has a circulating supply of 657,099,970 LINK coins and the max. supply is not available.

The key is whether it can be supported around 15.45

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(LINKUSDT 1D chart)

How to interpret the OBV indicator

1. If OBV is rising from the 0 point, it is interpreted as an increase in buying power, and if it is falling, it is interpreted as an increase in selling power

2. How to create an EMA indicator for OBV and interpret it as rising or falling above the EMA indicator

3. How to add the price channel formula to the OBV indicator and interpret it like Bollinger Bands

-

If the price is maintained at the current price position, it is expected to attempt to rise above 15.45.

However, since the StochRSI indicator is showing a downward trend in the overbought zone, the key point is whether there is support near 15.45.

If it fails to rise, we should check whether there is support near 13.13.

-

I think we are facing a golden opportunity to turn into an upward trend.

If it fails to turn into an upward trend this time, there is a possibility that it will eventually fall to around 10.0, so we should think about a response plan for this.

Therefore, what we should pay close attention to is whether there is support near 15.45 and it can rise.

If support is confirmed near 15.45, it is the time to buy.

The first sell zone is 19.52-20.51.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, you can see that the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, I expect that we will not see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

Levels in LINK: Breakdown or Breakout?If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

### **Technical Overview**

- **Current Price**: $14.35 (approx.)

- **Trend Structure**: Elliott Wave count suggests Wave 3 has wrapped up. Wave 4 and 5 are likely next.

---

### **Key Observations**

- **Impulse Invalidation Level**: $19.190

→ A break above this invalidates the current bearish impulse.

- **Bullish Barriers**:

- *Minor Resistance*: $15.002

- *Major Resistance*: $17.677

These are the key spots bulls need to reclaim to regain control.

- **Crucial Support**: $12.426

→ If this breaks, expect more downside—likely toward the final Wave 5 zone.

- **Bearish Target**: $9.283

→ Probable landing spot for Wave 5 (of C). Could shape up as a longer-term accumulation zone.

---

### **Elliott Wave Context**

- A possible running or expanded flat scenario is in play, with Wave (B) topping around the 1.382 extension.

- Wave 3 appears to have completed near the 1.618 extension, a textbook zone for this kind of move.

---

### **Potential Scenarios**

1. **Bullish Reversal Case**:

- Price reclaims $15.00 and ideally $17.677.

- The bearish count falls apart.

2. **Bearish Continuation Case**:

- Price stalls under resistance.

- A break of $12.426 sets the stage for continuation down to $9.283.

3. **Neutral Scenario**:

- Choppy consolidation between $12.5–$15 while the market sorts itself out.

---

### **Strategic Considerations**

- **Short-term Bulls**: Watch $15–$17.6. Any strong reclaim could offer clean long setups.

- **Bears & Shorts**: Prime fade zone if price gets rejected near resistance.

- **Long-term Investors**: If we hit $9.283, that’s a potential loading zone for the next cycle.

Trade safe, trade smart, trade clarity.

My current LINK charts with estimated April 'flash crash' levelsHere is my current LINK chart, which I recently went over in detail. It assumes that the bottom isn't in on the 4th wave. If the bottom is in and price is moving into the 5th wave, you can simply adjust the 4th wave bottom to the previous low accordingly.

It also includes the likely level that would be hit during the April "flash crash" around the pattern’s 3rd support level line and FVG (fair value gap), as well as the likely areas above that it will need to break through in order to reach new all-time high territory—assuming that's even possible in this cycle.

Keep in mind that the "flash crash in April" is a theory of mine and may or may not come to fruition, or could be off in timing. And while these levels may be likely, they may not actually be the levels that get hit, even if the thesis itself is correct.

Good luck, and always use a stop loss!

LINKUSD Channel Up bottomed. Get ready for $44.LINK is trading inside a 2 year Channel Up.

The price is under the 1week MA50, which is about to form a Bearish Cross which the 1day MA50. Last time that happened, the bottom came 10 days later.

If the waves are symmetric inside this Channel Up, then we're already at or very close to the bottom, given also that the 1day RSI got oversold and this has been an instant buy signal previously.

Buy and target $44.00 (1.382 Fib extension and +300% rise).

Follow us, like the idea and leave a comment below!!

LINK/USDT 1H: Bullish Breakout – Targeting $15.45LINK/USDT 1H: Bullish Breakout – Targeting $15.45?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence: 9/10):

Price at $14.77, confirming a strong breakout above resistance.

RSI at 66.12, signaling bullish momentum with room to push higher.

Clear market maker accumulation pattern, supporting a continued uptrend.

Hidden bullish divergence on RSI vs price, reinforcing strength in the move.

LONG Trade Setup:

Entry: $14.70 - $14.77 zone.

Targets:

T1: $15.20 (first resistance).

T2: $15.45 (extended liquidity target).

Stop Loss: $14.20 (below recent support).

Risk Score:

8/10 – Strong structure but requires follow-through above $15.20.

Market Maker Activity:

Accumulation phase is complete, marked by a clean breakout above $14.60.

Strong support established at $14.20, reinforcing a high-probability long setup.

Minimal overhead resistance until $15.20, increasing the likelihood of a sustained move higher.

Recommendation:

Long positions remain favorable within the $14.70 - $14.77 entry range.

Monitor price action at $15.20, as this level may lead to a temporary pause or consolidation.

If volume continues to increase, expect a move toward $15.45.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

LINK Setup: Breakout Play or Breakdown Risk?LINK is in a local uptrend, pressing against the 13.66 level. A breakout should trigger a swift reaction and push higher 13.99-14.55 looks like a very realistic target.

On the downside, 11.85 remains the key support. If bears step in aggressively and break the lows, we could see a fast drop toward 11.68-11.19.

Long on a breakout above 13.66.

TP: 13.99/14.2/14.55

Short if 11.85 fails.

TP: 11.68/11.5/11