TradeCityPro | Bitcoin Daily Analysis #65👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indicators. In this analysis, as usual, I want to review the New York futures session triggers for you.

🔄 Yesterday, the market was range-bound again, and none of my triggers were activated. Today, a high has formed that could be suitable for opening an early position.

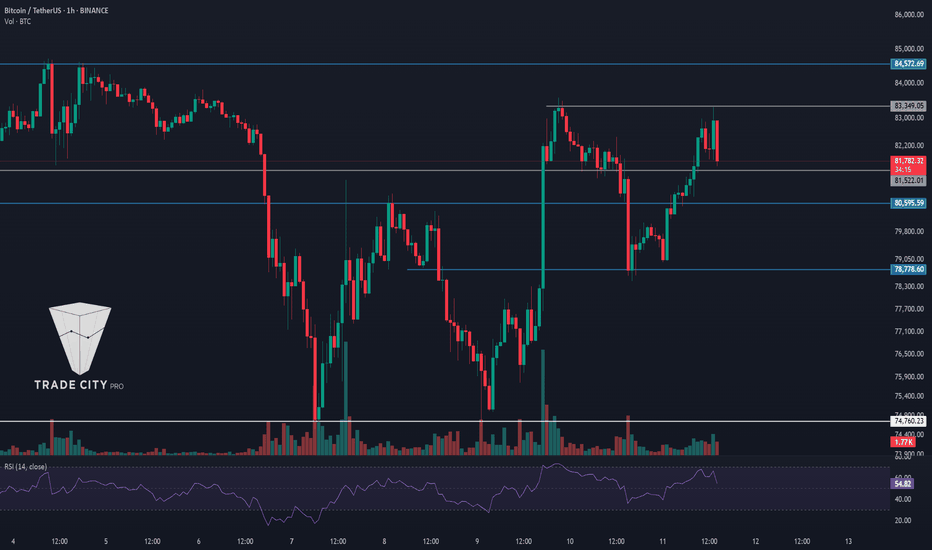

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the price is within a box between 83,233 and 85,550, and market volume has decreased compared to yesterday. I recommend keeping an eye on the market today because the volume is very low, and the likelihood of a sharp move is high.

✔️ Today, we have a new trigger for a long position. In yesterday's analysis, I said that the price is creating a new high that could be used as a trigger if it reacts to this area again. As you can see today, the price reacted to this area and was rejected from it.

💥 So, considering that a sharp move is likely, it wouldn’t be bad to open a long position on the breakout of 85,126 so that if we can’t get a proper confirmation from the candle on the breakout of 85,550, we already have a position open.

⚡️ However, for a short position, the 83,233 trigger is still valid and this area is very important. If the price stabilizes below this support, the next supports the price could reach are the areas of 80,595 and 78,778.

👑 BTC.D Analysis

Let’s move on to Bitcoin dominance. As you can see in the chart, I told you yesterday that if the price is supported from the 63.87 area and breaks the previous high, the next bullish leg could begin. However, although dominance was supported at this area, it failed to break the previous high, formed a lower high, and is now again at the 63.87 support.

🔼 If this support is broken, we can temporarily confirm a bearish move in dominance. The next key supports for Bitcoin dominance are the areas of 63.61 and 63.23.

📈 For Bitcoin dominance to become bullish again, in my opinion, we need to wait for it to break the previous high at 64.12.

📅 Total2 Analysis

Let’s move on to the Total2 analysis. The condition of this index is very similar to Bitcoin, but because Bitcoin dominance is bullish, Total2 is one level lower than Bitcoin. Although Bitcoin is struggling with its main resistance, Total2 has moved away from the 980 area and has formed its box between 954 and 932.

🔽 If the 954 area is broken and Bitcoin dominance is bearish, you can open a long position. But if dominance is bullish, Bitcoin will be a better choice.

🎲 If the 932 bottom is broken, you can confirm a bearish trend in altcoins. In this case, I think dominance will become bullish and altcoins will drop more than Bitcoin.

📅 USDT.D Analysis

Let’s look at Tether dominance. The entire market is waiting to see what Tether dominance does with the 5.39 area. If it is supported at this area and breaks the 5.59 high, we can say that dominance is bullish and the market may drop.

🔍 But if dominance can first break the 5.48 area and then the 5.39 area, the market could start a new bullish move and Bitcoin will definitely break the 85,550 high.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Dailyanalysis

TradeCityPro | Bitcoin Daily Analysis #64👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

⏳ 1-Hour Time Frame

Yesterday, the market continued to range within the same box and didn’t make any significant moves, but today we still have triggers and can open positions.

🔄 Yesterday I told you that after the fake breakout of the box top, strong bearish momentum could enter, increasing the likelihood of the box bottom breaking, and that we could enter a short position upon its break.

✔️ That’s exactly how it seemed—there was strong bearish momentum and the price tested the 83233 zone once. But it couldn’t break that area, and after a strong bearish candle, market volume dropped significantly, and the market became range-bound again, which still continues.

📈 Our key resistance remains the 85482 zone, and breaking this level could initiate the next bullish wave. So, we can enter a long position if this level breaks.

🔽 For a short position, the 83233 zone is still valid. As I mentioned, the price tested this level again yesterday, reinforcing its importance—so make sure to have a short position ready if this zone breaks.

👑 BTC.D Analysis

Let’s check Bitcoin Dominance. Today, dominance is in a corrective phase and has returned to the 63.87 zone and is retesting it.

💫 If this zone breaks and dominance continues its correction, we can consider dominance as bearish for now. But if dominance finds support here, it can continue its upward move and form a higher high.

📅 Total2 Analysis

Yesterday, the Total2 index had a fake breakout at the 932 zone, re-entered its box, and with the momentum that entered the market, moved upward. It has now broken the 947 zone and is retesting it.

🔍 If the price pulls back to this zone and is supported, it could start an uptrend and move toward 980.

💥 But if the price fails to stabilize above 947 and drops below it, we can confirm a bearish trend in Total2 with a break of 932 and open short positions on altcoins.

📅 USDT.D Analysis

Now for Tether Dominance: a small box has formed above the 5.39 zone, with the box bottom at 5.49 and the top at 5.59.

🎲 If the 5.49 zone breaks, we can confirm a bearish move in dominance down to 5.39. The main trigger for a bearish shift in dominance is the break of the 5.39 zone.

✨ For a bullish move in dominance, the 5.59 level is very important, and breaking it could begin a new upward trend for dominance.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #63👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

⏳ 1-Hour Time Frame

Yesterday, a short position could have been opened that might have already brought you good profit.

🔄 In yesterday’s analysis, I told you that if the price pulls back to the 85482 zone, gives a confirmation candle, and buying volume increases, you could open a long position. That didn’t happen—there was no confirmation candle, and the zone turned out to be a fake breakout.

👀 For a short position, I also mentioned that if the price fakes the breakout of this zone, you could enter a short position on lower time frames after the break of a short-term trigger, targeting 83233. This scenario played out exactly, and the price gave a trigger on lower time frames and dropped to 83233.

📉 But today we also have a trigger for opening a position, so don’t worry too much—you haven’t missed a lot. Yesterday’s position was opened in a risky context, and if you followed proper risk management, you shouldn’t have taken much risk on that position, and naturally, wouldn’t have made a large profit either.

🔑 A fake breakout of a box top indicates strong seller momentum, so currently, bearish momentum is stronger than bullish, and the price leans more toward decline. On the other hand, the 83233 zone is very significant, and the price has reacted to it several times, making it an important support zone.

📚 So, with that in mind, if the 83233 zone breaks, you can enter a short position. If, before breaking this zone, the price creates a lower high compared to 85482, we’ll have even more confirmation—because based on Dow Theory, when price fails to reach its previous high, it shows that buyers are weakening. So breaking the low, which overlaps with the 83233 support, gives us a very solid position.

💫 But an important point to consider is that the price formed several bullish legs before creating this box, so overall, the current market momentum is still more bullish, and all short positions carry more risk than long positions.

📈 For a long position, the 85482 zone remains a valid trigger, and if the price stabilizes above it, we might see the next bullish leg. Personally, I prefer that the price tests the 85482 zone once more so we can get a more accurate level, and then break it on a subsequent attempt, which would make opening a position easier.

✔️ Of course, even if the zone is broken on the first try, I’ll open a long position, but if it's broken on the second or third attempt, we can enter with more confidence and take more risk.

📊 After the range box was broken, market volume has been declining, and only a few candles have significant volume—these are considered outliers and can be ignored. So the most important thing is that if a trigger is activated, the volume should align with that direction and support the price move, showing convergence.

👑 BTC.D Analysis

Let’s take a look at Bitcoin dominance. It’s still bullish and, after breaking above 63.87, has continued its new bullish leg.

🧩 As a reminder, as long as BTC Dominance hasn’t changed trend or turned bearish on higher time frames like the daily or weekly chart, buying any altcoin isn’t logical. We need to wait for a trend change. For now, we see dominance as bullish, so long positions on Bitcoin and short positions on altcoins are suitable choices.

📅 Total2 Analysis

Now for Total2 analysis: yesterday, both short triggers I gave were activated, and the price moved downward.

🧲 Currently, a low has formed around the 932 zone, and if this zone breaks, the price could continue its downtrend. On the other hand, if the 947 zone breaks and the price moves back above it, we can consider opening a short-term long position in lower time frames.

📅 USDT.D Analysis

Let’s look at Tether dominance. Yesterday, I mentioned that dominance was interacting with the 5.39 zone and that if it breaks, the market could move upward.

🚀 But that didn’t happen—instead, the price moved upward and even broke above the 5.53 ceiling. Currently, it’s returning to its range box again and may head back toward the 5.39 level. If that zone breaks, we can still take it as a confirmation of a bearish shift in dominance.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #62👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the price has a bullish structure that is still ongoing, and currently, one of the resistance levels at 85482 has been broken, and the probability of a bullish price move is high.

✔️ If you already have a position from the break of 85482, you have likely hit neither the target nor the stop-loss yet. The target for this position could be the 88502 zone.

✨ But if you don’t have an open position and are looking for a trigger, a price pullback to the 85482 zone with confirmation, or even a break of one of the short-term resistances in lower time frames, can be a suitable trigger for a short position.

📉 For a short position, if the price fakes the breakout of the 85482 resistance and moves downward, with confirmation in lower time frames and a break of the Fake Breakout trigger, we can enter a short position. The main short trigger is the break of the 83233 zone.

👑 BTC.D Analysis

Let’s take a look at Bitcoin dominance. As you can see, dominance has started another bullish leg and after breaking 63.61, it reached 63.80, and now with the break of 63.80, it's ready to carry out its main bullish move.

🔼 For now, we see the trend in dominance as bullish, so long positions on Bitcoin and short positions on altcoins are suitable.

📅 Total2 Analysis

Let’s take a look at the Total2 analysis. As I mentioned, since dominance is bullish, Bitcoin is moving more than altcoins. Right now, we can also see this in Total2, where momentum is less than Bitcoin and it has moved slightly away from its top, while Bitcoin has broken its high.

🔍 For a long position, the break of the 980 zone is still valid, and if it breaks, the price could move up to the 1.2 zone. For a short position, we have two triggers.

📉 The first trigger is the 956 zone, which is a good entry point but risky, and the chance of hitting stop-loss is high. The second trigger is the 947 zone, which is a more reliable trigger, but if it breaks, opening a position will be harder and we might not get a solid confirmation candle.

📅 USDT.D Analysis

Let’s move on to Tether dominance. You could say the entire market is waiting for Tether dominance to move, and even Bitcoin, despite breaking its resistance, hasn't moved yet because the 5.39 zone in dominance hasn't broken.

🎲 This zone is a very important one, and if it breaks, we could see a bearish leg down to the 5.24 zone, which would push the market upward. The bullish trigger for dominance for now is the break of 5.53.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #61👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

🔍 Yesterday, one of our short position triggers was activated. Let’s get into the analysis to see how we can open a position today.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the trigger we gave yesterday at the 84382 level was activated and the price moved down toward the 82813 area. Today, I’ve adjusted the position of these lines since the price has created a better structure and the placement of the levels can change accordingly.

✔️ Currently, the price has formed a box between 83233 and 85482 and continues its ranging structure.

📈 For a long position, we can act if 85482 breaks. If this level breaks, since the trendline has also been broken, this time the price can move upward with more momentum, and the first target of this position would be 85482.

📊 Market volume is currently ranging, and we can’t extract specific data from this tool. But if volume increases along with an upward price movement, it would be a very good signal for the continuation of the bullish trend.

🔽 If that doesn’t happen and the price moves downward, the 83233 trigger is a very good one, and a break of this area gives us confirmation of a trend reversal, and the price can move further down.

👑 BTC.D Analysis

Let’s look at Bitcoin dominance. Dominance is still ranging and hasn’t moved much compared to yesterday.

⭐ A break of 63.61 would be suitable for a bullish move, and a break of 63.23 would be suitable for a bearish move.

📅 Total2 Analysis

Let’s move on to the Total2 analysis. This index is acting very similarly to Bitcoin and is currently near its long trigger.

🔼 For a long position, a break of 980 is suitable, and for a short position, a break of 947 is appropriate.

📅 USDT.D Analysis

Let’s check out Tether dominance. We’re still waiting for a break of 5.39, which is a very important level, and if it breaks, the price could have a long-term bearish move.

💫 For a bullish move in dominance, breaks of the 5.53 and 5.59 levels are also suitable.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #60👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

🔍 Yesterday, both of the long triggers I gave were activated, and the price moved upward. Today is also an important day, and we can look for both long and short positions.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, our long triggers from yesterday — the 83899 and 84572 levels — were activated, and the price moved up to the 85552 zone.

✔️ If the position you opened had a small stop-loss, it likely already hit your target. But if you entered with a wider stop-loss, it probably hasn't reached the target yet, which is reasonable, as your position is longer-term.

⚡️ Now for today, as you can see, the price has broken its ascending trendline and it seems the trendline trigger is getting activated. If a candle closes below the 84382 level, the price is likely to move downward.

📊 The next support the price has is at 82813, and if this level breaks, we can say that the trend has changed and the price might head toward lower lows.

💥 The 50 level on the RSI is also significant, and if the break of 84382 coincides with a break below 50 on the RSI, strong bearish momentum could enter the market.

👑 BTC.D Analysis

Let’s look at Bitcoin Dominance. This index is in a range box between 63.23 and 63.80. There’s also a mid-range level at 63.51 — breaking it would give us temporary confirmation of a bullish move in dominance.

🔽 For bearish confirmation, breaking 63.23 would be suitable.

📅 Total2 Analysis

Now onto Total2: this index hasn't fully stabilized below its trendline yet and still shows slightly more bullish momentum compared to Bitcoin.

📉 For a short position, we have a 966 trigger, but it’s quite risky. Personally, I wouldn’t open my main position with this trigger — I’d wait for confirmation using Dow Theory with a lower high and lower low.

🔼 For a long position, the trigger is clear: we can enter if the 980 level breaks.

📅 USDT.D Analysis

Let’s check Tether Dominance. This index has made a bearish move and dropped to 5.39.

⭐ The next drop trigger is the same 5.39 level, which is a very good one. For a bullish scenario, we currently need to wait for a new structure to form.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | ARB: Key Levels in DeFi Coin’s Descending Channel👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ARB coin for you. It's one of the DeFi coins, currently ranked 54 on CoinMarketCap with a market cap of $1.41 billion.

⏳ 4-Hour Time Frame

In the 4-hour time frame, as you can see, we're witnessing a downtrend within a descending channel, and the price is moving downward.

✔️ There is a very important support at the 0.2501 level, which is the main support, and the price has already reacted to it once, bounced from the bottom of the channel, and is now positioned above the channel’s midline.

🔽 If the price fails to reach the top of the channel and gets rejected from lower levels such as the 0.3172 resistance, the probability of the channel breaking to the downside increases, and more bearish momentum may enter. When the price gets rejected before reaching the channel top, it indicates weakening buyer strength.

✨ So, if the price gets rejected from the 0.3172 resistance, we can open a suitable position. The lower the rejection, the higher the probability of a drop. A rejection from the channel top or even a fake breakout can also act as a valid trigger.

📉 The main trigger for a short position is the break of the 0.2501 level, which is a very strong support, and its break can lead to a significant bearish leg.

⚡️ For a long position, the first trigger is the break of 0.3172, which is a good area but very risky, because just above it lies the channel ceiling, and the price might get rejected from there and move downward.

🔼 Therefore, it's better to wait for the channel to be broken first and then look for a long trigger. Currently, the most reliable trigger for a long position after a channel breakout is at 0.4018, but this level is quite far. So, for a long position, we can also enter on a pullback to the channel or after getting confirmation from Dow Theory.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Weekly Support is around 80000.Weekly Support is around 80000.

However, 72500 - 73000 is its previous

breakout level & probably a Best Buying Rage

(if it touches) which is also a Confluence area of

Trendline Support+Important Fib. level.

Bullish Divergence on Shorter Time Frame +

Weekly Support around 80000 (if Sustained)

may push the Price up towards 87000 &

then around 95000 - 96000.

Ultimate Resistance is around 110000.

Crossing this level may open new Highs

Targeting around 136000.

On Shorter Timeframe, 85000 - 86000 is

the Immediate Resistance & Support is

around 80000.

TradeCityPro | Bitcoin Daily Analysis #59👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. In this analysis, as usual, I’ll review the futures session triggers for New York.

🔄 Yesterday, one of the long triggers was activated, and the price moved up to the 83899 zone. Let’s see what triggers we can identify from today’s price action.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the price broke through the 83349 level yesterday and moved up to 83899. However, the candles weren’t strong enough to break this zone, and the price reached the resistance range between 83899 and 84572, then got rejected.

✨ An ascending trendline that started from the 74760 low has been accompanying the price, and each time the price has touched this trendline, the following bullish leg has been shorter, indicating a gradual weakening in bullish momentum.

✔️ Currently, the price is near the trendline, and if bearish momentum enters the market and selling volume increases, breaking the trendline trigger can give us a short position.

💫 The current trendline trigger is at 83813, and if it breaks, the price could open positions down to 80595 or even 78778.

💥 As mentioned, there is a resistance zone above the current price, which seems quite strong. The first trigger to break this resistance is 83899, and the second is 84572. The first trigger is riskier and more likely to hit the stop-loss. The second trigger, being higher, might not give a good candle setup, making it harder to enter a position, but it’s more reliable.

📊 If buying volume increases, a bullish move toward 88502 is likely. If selling volume increases, the likelihood of the trendline breaking also rises.

🔑 The RSI oscillator is also oscillating in the upper half. Entering the overbought zone could be a signal for long positions, while a break below 50 would be suitable for shorts.

👑 BTC.D Analysis

Let’s take a look at Bitcoin Dominance. Yesterday, BTC.D had a bullish move up to 63.80 but got rejected from that area and has now returned to the range between 63.30 and 63.50.

⭐ Today, a bearish confirmation for BTC.D comes with a break below 63.30, while a bullish continuation is confirmed with a break above 63.50.

📅 Total2 Analysis

Moving on to Total2: today this index continued its bullish movement and even broke the 957 trigger. If this move continues up to 989, altcoins could experience significant growth—especially considering the weakening momentum in BTC Dominance.

🧲 Today, there is no long trigger for Total2, but if this move turns out to be a fakeout, the 934 zone will be a good trigger for a short position.

📅 USDT.D Analysis

Now for Tether Dominance: its short trigger has been activated. The next support level is at 5.41, and if this zone breaks, we could see a sharp downward move.

⚡️ For a bullish reversal in dominance, the first trigger is the 5.59 area, and if dominance stabilizes above this level, we can consider opening short positions on Bitcoin and altcoins.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #58👋 Welcome to TradeCity Pro!

Today, we'll delve into the analysis of Bitcoin and key crypto indices. As usual, I want to review the triggers for the New York futures session.

🔄 Yesterday, the price broke through the support zone between 80,595 and 81,522, retracing down to 78,778. Let's see what triggers the market could offer us today.

⌛️ 1-Hour Timeframe

On the 1-hour timeframe, as you can see, after breaking the 78,778 level, the price quickly recovered and climbed back above the 81,522 zone. Currently, it is hovering near 83,349.

🔍 Today, for a long position, we can consider opening a trade upon breaking the 83,349 resistance. The next resistance level at 84,572 could act as the following trigger point.

🔽 For short positions, we need to wait for a new market structure to form and observe whether the 81,522 or 80,595 zones can serve as our triggers.

⭐️ The RSI oscillator is near the Overbought zone, and a breakout above 70 into Overbought territory would provide good confirmation for a long position.

📊 Market volume has been increasing since the bullish leg started from 78,778. If this volume growth continues, the probability of breaking through the 83,349 resistance will rise.

👑 BTC.D Analysis

Now, let's move to Bitcoin Dominance (BTC.D). Yesterday, the 63.50 resistance was broken, and as Bitcoin's price climbed, its dominance also rose. This has caused altcoins to underperform compared to Bitcoin.

🔼 Currently, the next resistance for BTC.D is at 63.86. A break above this level would confirm the next bullish leg in Bitcoin Dominance.

📉 For a bearish move in dominance, the Futures triggers are at 63.50 and 63.30. However, for a confirmation in spot trading, we would need a break below 62.65.

📅 Total2 Analysis

Moving on to the Total2 (altcoin market cap excluding Bitcoin), I've slightly adjusted the zones and updated the triggers for altcoins.

✨ As I mentioned in the Bitcoin Dominance analysis, altcoins have been lagging behind Bitcoin. Even though Bitcoin reached 83,349, Total2 failed to retest its previous highs and instead formed a lower high.

✔️ For long positions on altcoins, a break above 940 would be ideal. For short positions, you can look for confirmation if 903 is broken.

📅 USDT.D Analysis

Finally, let's analyze USDT Dominance (USDT.D). Yesterday, it bounced from the 5.53 support level, climbing to 5.84 before starting a new downtrend, now approaching 5.53 again.

⚡️ To continue the bearish move, a break below 5.53 would be significant. Conversely, for a bullish move, the first trigger is at 5.84.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

XAG/USD Climbs on FOMC WorriesSilver prices climbed above $31 per ounce on Thursday, extending gains for a second straight session as commodities rebounded following President Trump’s rollback of his reciprocal tariff policy. The new measure lowers tariffs on most trade partners to 10% for 90 days to support negotiations. However, China, a key silver consumer, still faces a steep 125% tariff, keeping geopolitical tensions elevated and sustaining safe-haven demand. Meanwhile, FOMC minutes revealed growing concerns about stagflation and the impact of Trump’s trade agenda on the Fed’s dual mandate of price stability and full employment.

Resistance starts at 31.50; if breached, the next levels are 32.15 and 33.30. Support sits at 30.20, with 29.50 and 29.20 below if that level gives way.

Gold Surges, Hits Record Above $3,200Gold spiked to a new record above $3,200 per ounce on Friday, driven by safe-haven demand and a weakening dollar amid intensifying U.S.-China trade tensions. The U.S. hiked tariffs on China to 145%, while easing duties for other partners. At the same time, U.S. consumer prices unexpectedly fell in March, fueling bets on a Fed rate cut in June and a full percentage point cut by year-end. Despite this, inflation risks remain due to ongoing tariff pressure. Gold is set for its strongest weekly gain since November.

Key resistance is at $3,250, followed by $3,300 and $3,350. Support stands at $3165, then $3135 and $3090.

Pound Gains on Dollar Softening, GBP/USD at $1.30The pound extended gains to $1.30 for a third session, as the dollar softened following Trump’s 90-day tariff pause for most countries. However, the 145% hike on Chinese goods kept risks elevated. While volatility persists, traders now expect 66 bps of BoE rate cuts this year, down from 79 bps a day earlier. UK GDP is forecast to grow 0.1% in February, suggesting a slow recovery.

If GBP/USD breaks above 1.3050, resistance levels are at 1.3100 and 1.3200. Support is at 1.2960, followed by 1.2900 and 1.2850.

EU Tariff Relief Drives Euro Above $1.13The euro climbed above $1.13, its highest since September 2024, after the EU suspended new U.S. tariffs for 90 days to allow trade talks. This followed President Trump’s move to cut tariffs to 10% for non-retaliating countries while raising Chinese duties to 125%. While easing global slowdown fears, the mixed signals fueled uncertainty. Money markets adjusted ECB expectations, pricing the deposit rate at 1.8% by December, up from 1.65%, and lowered the probability of an April cut to 90%.

Key resistance is at 1.1390, followed by 1.1425 and 1.1500. Support lies at 1.1260, then 1.1180, and 1.1100.

Yen Gains on Recession FearsThe yen rose past 144 per dollar, a six-month high, as U.S. recession fears and a Treasury selloff boosted demand for safe-haven assets. Although Trump paused new tariffs for 90 days, total U.S. tariffs on China now stand at 145%, prompting retaliation with China imposing 84% tariffs on U.S. goods. The U.S.-Japan trade outlook remains in focus, with Japan still facing a 10% U.S. tariff but seeking better terms.

Key resistance is at 145.80, with further levels at 148.00 and 152.70. Support stands at 142.00, followed by 139.65 and 138.00.

TradeCityPro | Bitcoin Daily Analysis #57👋 Welcome to TradeCity Pro!

Today, we'll delve into the analysis of Bitcoin and key crypto indices. As usual, I want to review the triggers for the New York futures session.

🔄 Yesterday, there was news from Trump granting a 90-day tariff reprieve to all countries except China, which activated both long triggers I outlined for you yesterday—one before the news and one after.

⏳ 1-Hour Time Frame

In the hourly time frame, as you can see, after the price was supported at 74760 in yesterday's analysis, I mentioned that breaking 77735 could be a risky long entry and breaking 80595 would activate the Double Bottom long trigger.

🔍 As observed, the first trigger at 77735 provided a very good entry, allowing us to open a robust position. However, the 80595 position, as it activated a four-hour pattern, naturally takes longer to reach the target or stop-loss.

📈 Currently, the price has made a bullish leg and is in a correction phase, and we need to see how far this correction can continue. A new support is forming at 81522, where the price had previously shown support and is now being supported again.

✔️ With 80595 and 81522 being close, we can say that a yet unconfirmed support zone has formed around this area, and the price could start its next bullish move after correcting into this zone.

🔼 Thus, for a long position, reacting to this support zone and breaking the short-term ceiling in lower time frames can give us a position. The next trigger is breaking the ceiling at 83349, which could start the next bullish leg upon making a higher high.

💫 However, the main trigger for going long is breaking 84572, which is a major resistance. Since this area is very significant, I wouldn't open a position with just the break of 83349, as a rejection from 84572 could hit our stop-loss and poses a high risk.

✨ If you recall, in analysis number 52, I drew a trendline in the daily time frame that now coincides with this price area, and the trigger for breaking this trendline overlaps with 84572, another reason this resistance is significant and why its breach is crucial.

🔽 For short positions, as you know from following my analyses, I trade based on the current momentum and market trend. Since we have entered a bullish momentum and no bearish structure has been formed yet, there is no reason for a short position. However, if you still want to open one no matter what, breaking areas 81522 or 80595 could be very risky but suitable.

👑 BTC.D Analysis

Yesterday, there was a detailed analysis of Bitcoin dominance, complete with explanations of its utility and why we use it. I strongly recommend reviewing that analysis to understand why this chart needs to be checked and what's happening in its higher time frames.

☘️ Yesterday, the dominance faked out from the area of 63.30, then returned above this area, moving towards the ceiling of the box it had created, 63.50, and now it seems to be faking this area too.

⚡️ When this occurs in the chart, it indicates that the chart is not analyzable correctly, and we must wait until a proper structure is formed. Until then, we can decide candle by candle, following the momentum of each candle.

📅 Total2 Analysis

Moving on to the analysis of Total2, triggers in the areas of 896 and 920 were activated, and the price movement continued near the area of 965, now entering a corrective phase.

📊 The support floor being formed is slightly above 920, and we should wait for a new structure. Until then, breaking 965 for a long and breaking 920 for a short are suitable.

📅 USDT.D Analysis

Let's turn to Tether dominance, which, like Total2 and Bitcoin, has had its triggers activated and moved downward, reaching the support area at 5.53.

🎲 We confirm the continuation of the downtrend with the break of this 5.53, and for further correction, breaking 5.73 gives us confirmation.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Silver Remains Volatile Amid Trade War and Recession FearsSilver stayed above $30.50 per ounce on strong safe-haven demand amid U.S.-China trade tensions. Prices held a 3.5% gain after President Trump announced a 90-day tariff pause and a 10% rate for all but China, which now faces a 125% tariff. China raised tariffs on U.S. goods to 84%, and the EU approved duties on €21 billion of American exports. Fed minutes showed concerns about stagflation and the impact of Trump’s trade policies. Markets now await March U.S. inflation data on Thursday for clues on the Fed’s next move.

Technically, the first resistance level is located at 31.50. In case of its breach 32.15 and 33.30 could be monitored respectively. On the downside, the first support is at 30.20. 29.50 and 29.20 would become the next support levels if this level is passed.

Gold Jumps 3% on U.S.-China Tariff BattleGold jumped over 3% to above $3,095 per ounce on Wednesday as U.S.-China trade tensions escalated. President Trump announced a 90-day tariff pause and a reduced 10% rate for all but China, which now faces a 125% tariff. Treasury Secretary Bessent said the lower rate would apply during talks, excluding China and some sectors. In response, China raised tariffs on U.S. goods to 84%, and the EU approved levies on €21 billion worth of American exports. Fed minutes showed policymakers expect higher inflation from tariffs but remain uncertain about its scale and duration.

Supporting gold’s rally further, the World Gold Council reported that gold-backed ETFs attracted 226.5 metric tons in inflows during Q1, totaling $21.1 billion in value.

Key resistance is at $3,135, followed by $3,165 and $3,200. Support stands at $3030, then $3010 and $2956.

GBP/USD Awaits CPI After Tariff-Driven GainGBP/USD hovered near 1.2830 on Thursday morning, holding its upward momentum for a third straight session. The pair remained supported as market sentiment improved following Trump’s tariff pause. All eyes are now on today’s U.S. inflation data, which is expected to influence the next move.

If GBP/USD breaks above 1.2860, resistance levels are at 1.2900 and 1.2940. Support is at 1.2715, followed by 1.2650 and 1.2600.

Euro Steady as EU Retaliates on TariffsThe euro hovered around 1.0980 on Thursday, supported by rising trade tensions and renewed political stability in the Eurozone. Sentiment favored the currency after China raised tariffs on all U.S. goods to 84% from 34%, retaliating against Washington’s hike to 104% on Chinese imports. The European Commission also approved retaliatory tariffs on €21 billion worth of U.S. goods, including soybeans, motorcycles, and orange juice. The escalation pushed investors away from typical safe havens like the dollar and Treasuries. Political stability in Germany further supported the euro, as the CDU/CSU and SPD finalized a coalition, clearing the way for Friedrich Merz to become Chancellor next month. The ECB is also expected to cut rates by 25 basis points later this month.

Key resistance is at 1.1020, followed by 1.1100 and 1.1150. Support lies at 1.0880, then 1.0810 and 1.0730.

TradeCityPro | Bitcoin Daily Analysis #56👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. Today, as usual, I will review the New York futures session triggers.

✔️ Yesterday, the short trigger we discussed was activated, and the price moved downward to the area of 74760.

👀 Today, the market conditions are favorable for opening positions, both long and short.

⏳ 1-Hour Timeframe

As I mentioned yesterday, the price executed another downward leg after pulling back to the 80595 area, activating our trigger at 78913 and moving to the main support floor. Today, I have adjusted this area, and we will explore why this adjustment was made.

📚 Positions like the one yesterday, which are opened for scalping, I usually set with a risk to reward ratio of 2 or 3, and I don’t leave them open for long, opting instead to secure profits. If you also open such positions, I recommend not holding them long term.

💥 However, today, as you can see, the price is forming more structure and giving us more logical triggers. The SMA99 indicator is nearing the price, and the RSI is showing divergence compared to the first bottom that the price made at 74650, which was accompanied by divergence.

🔼 For the divergence in RSI to activate, it needs to break the area of 59.87. If this happens, we can say that the divergence is active, and we can look for a price trigger for a long position.

⚡️ The first trigger for a long position is the 77735 area, which is considered risky, and with the breaking of this area, you can open a scalping position. The main long trigger is the breaking of 80595, which, if broken, activates a Double Bottom pattern that could change the market trend.

⭐ Keep in mind, there is currently no Double Bottom, and only if the 80595 area breaks will this pattern form.

📉 For a short position, the 74760 trigger is still appropriate, and you can enter a short position if this area breaks. However, it is important to note that this area is very close to the 71779 area, and opening a position on the break of 74760 will be risky.

👑 BTC.D Analysis

Let's now analyze Bitcoin dominance, which continues to range between the areas of 63.30 and 63.50. Breaking this box could define the positions we open today.

💫 If the 63.30 area breaks, dominance might temporarily decline, allowing more capital to flow into altcoins. Conversely, if the dominance breaks upwards at 63.50, more capital will flow into Bitcoin. Soon, we will have a comprehensive analysis of Bitcoin dominance that I highly recommend not to miss.

📅 Total2 Analysis

Moving on to the analysis of Total2, yesterday the Total2 trigger at the 896 area was activated, and altcoins, like Bitcoin, declined, causing this index to drop to the area of 860.

🔍 Today, for a short position, breaking the 860 area is appropriate. However, for a long position, I recommend seeking confirmation from Bitcoin itself and its dominance.

📅 USDT.D Analysis

Finally, for the Tether dominance analysis, this index activated its upward trigger at the 5.84 area and performed an upward leg to 6.13.

📊 Currently, confirmation for the next upward leg in dominance will be with the breaking of 6.13, and the confirmation for a downward turn remains at the 5.73 area.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Yields and Trade Wars Induce Silver InstabilitySilver dropped below $30 per ounce, hitting $29.57 on April 4, its lowest since mid-January, as rising U.S. Treasury yields made non-yielding assets less attractive. The U.S. announced a 104% tariff on Chinese imports starting at midnight, intensifying trade war concerns. Although over 70 countries have reportedly requested tariff relief, market sentiment remains cautious. The EU’s retaliatory tariff plans further fueled risk aversion, pressuring industrial metals. Still, expectations of Fed rate cuts and safe-haven demand offer some support.

Technically, the first resistance level is located at 30.90. In case of its breach, 31.40 and 32.50 could be monitored respectively. On the downside, first support is at 29.00. 28.40 and 27.50 would become the next support levels if this level is passed.