Sterling Remains Firm Despite Inflationary PressuresGBP/USD traded around 1.2830 on Wednesday, holding gains from the previous session. However, ongoing global trade tensions and fears of goods dumping from China and Europe weighed on sentiment. Though U.S. tariffs are relatively lower on the UK, broader economic concerns persist. At the same time, rising inflation risks may lower expectations for rate cuts, providing some support to the pound.

If GBP/USD breaks above 1.2850, resistance levels are at 1.2900 and 1.2940. Support is at 1.2715, followed by 1.2650 and 1.2600.

Dailyanalysis

Dollar Under Pressure from Recessionary SignalsEUR/USD climbed about 80 pips to 1.1040 on Wednesday as the dollar index slipped below 105.5, marking a second day of losses. The U.S. dollar weakened amid growing fears of recession, triggered by President Trump's sweeping tariffs. China now faces a 104% levy, with Beijing vowing to "fight to the end." Market sentiment remained cautious as trade negotiations stalled, despite Trump’s outreach to major partners. Concerns that the escalating trade war may tip the U.S. into recession have increased expectations of further Fed rate cuts, weighing on the dollar.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.0900, then 1.0850 and 1.0730.

Yen Appreciates with Trade TurmoilThe Japanese yen rose above 146 per dollar on Wednesday, extending gains as Trump's looming tariffs drove safe-haven flows. The dollar weakened on recession fears tied to escalating trade tensions and potential Fed rate cuts. New U.S. tariffs include a 24% duty on Japanese goods and a 25% car import levy. Trump confirmed that Japan will send a delegation to renegotiate terms, while PM Ishiba urged a policy rethink. Domestically, Japan's current account surplus hit a record in February, supported by strong exports and reduced imports, boosting the yen further.

Key resistance is at 148.70, with further levels at 152.70 and 157.70. Support stands at 145.60, followed by 143.00 and 141.80.

TradeCityPro | Bitcoin Daily Analysis #55👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and key crypto indices, focusing today on the New York futures session triggers as usual.

🔄 Yesterday, the market was in a corrective phase of a downward trend, coinciding with news about the date of a meeting between Iran and the USA, which caused a slight upward movement in the market.

📊 As I mentioned, due to the low market volume, any news from the USA can significantly impact the price. The news was that Iran and the USA have scheduled a meeting for Saturday to negotiate an agreement.

📰 However, a more significant news item that the whole world is waiting for is China's reaction to the 35% tariffs imposed by the USA. Trump has declared that if China does not accept these tariffs within the next few days, he will increase them to 50%.

🎲 If this happens, the next downward leg in price might begin. However, if news comes out that these two countries are nearing an agreement and are ready to negotiate tariffs, the market will undoubtedly move upwards, and this news could even be the start of a new bullish trend.

Let's move on to the chart to find the technical triggers.

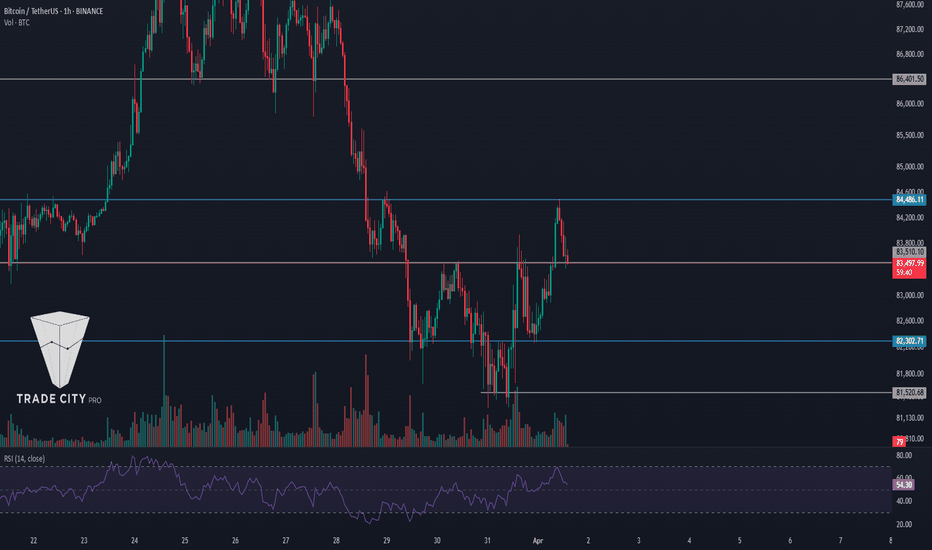

⏳ 1-Hour Timeframe

As I said yesterday, with the breaking of the 50 area in the RSI, the price underwent a deeper correction and moved upwards.

⭐ It appears that an ascending structure is forming, and the price is steadily moving upwards. However, this movement doesn't have much upward momentum, and its volume isn't very high.

🔽 Today, for a short position, we can open a position in line with the trend at a high risk with the break of the 78913 area. The price has corrected to a reasonable extent and has pulled back near the SMA99. If the price moves towards this SMA and gets rejected, the importance of breaking 78913 will increase.

📉 The main trigger is currently the 74760 area, which is the market's primary floor. However, in general, I believe that the market structure isn't yet in a state where we should open major positions, and we should wait for more structure to form. This way, we can open more secure and precise positions, which would allow us to take higher risks and ultimately make more profit.

💫 If you want to open a short position with the break of 78913, the RSI moving below the 50 area could be a good confirmation, but be careful not to involve too much risk.

👑 BTC.D Analysis

Let's move to the analysis of Bitcoin dominance, which is still ascending and has created a temporary support floor at 63.30. If this area breaks, we might temporarily confirm a decline in dominance.

🚀 Keep in mind that the dominance trend is bullish in all market cycles, and breaking this area does not mean a bearish trend. However, if it breaks 63.30, dominance might pull back to 63.07 and could enter a correction phase for a few days, which would impact our position choices.

✔️ If dominance is supported from this area, the likelihood of its continued growth increases.

📅 Total2 Analysis

Moving on to the analysis of Total2, as you can see, with the slight correction of Bitcoin dominance, this index has performed slightly better than Bitcoin and has currently reached a similar peak at 920.

📉 The short trigger I gave on Bitcoin at 78913 is a better trigger compared to Total2, where the 896 area has not yet been tested and is riskier than Bitcoin.

🔼 For long positions, you can open one with the break of 920, but I do not recommend it because the market is in a downward trend, and there is a downward momentum in the market, and since I do not trade against the trend, I also do not recommend that you take a long position against the downward trend.

📅 USDT.D Analysis

Finally, the analysis of Tether dominance is performing similarly to Total2 and is currently fluctuating between 5.73 and 5.84.

✨ Both of these areas could be used as triggers, but as I mentioned, it's better to wait for the market to create more structure and reveal the main triggers.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Silver Holds Ground as Markets Eye Fed CutsSilver hovered around $30 per ounce on Monday, staying volatile as markets reacted to Trump’s escalating trade war. The metal dropped 16% over three sessions as recession fears sparked a broad selloff, with traders liquidating metals to cover losses. China retaliated with tariffs after the US imposed levies on all countries, with others expected to follow. Trump’s tariffs excluded copper, gold, energy, and certain minerals. Despite the slump, silver may regain support as markets bet on more Fed rate cuts this year.

Technically first resistance level is located at 30.90. In case of its breach 31.40 and 32.50 could be monitored respectively. On the downside, the first support is at 29.00. 28.40 and 27.50 would become the next support levels if this level is passed.

Gold Jumps on Fresh Trade War WorriesGold rose above $2,995/oz on Tuesday, rebounding from a 4-week low as trade war fears fueled haven demand. Trump threatened a 50% duty on China starting Wednesday unless it drops its 34% tariffs, while the EU proposed 25% counter-tariffs on U.S. goods. Markets await Fed minutes (Wed), CPI (Thu), and PPI (Fri) for policy clues. Despite recent losses, gold is still up over 14% YTD.

Key resistance is at $3,050, followed by $3,085 and $3,105. Support stands at $2,956, then $2,930 and $2830.

Euro Firms as U.S.-China-EU Trade Rift WidensThe euro hovered near $1.10, its highest since October 2024, as the dollar weakened and trade tensions escalated. China plans to impose 34% tariffs on all U.S. goods from April 10, following Trump’s 10% tariff on all imports, including 20% on EU and 34% on Chinese goods. France urged firms to halt U.S. investments, and the EU is preparing countermeasures. Markets now price in a 90% chance of an ECB rate cut in April, with the deposit rate seen falling to 1.65% by December from 2.5%.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.0900, then 1.0850 and 1.0730.

TradeCityPro | Bitcoin Daily Analysis #54👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and key crypto indices. As usual, I will review the New York futures session triggers for you.

⚡️ The market has experienced a drop since yesterday, and I had identified the triggers for this drop in the previous analysis. Let's analyze today to see what we can do in the market.

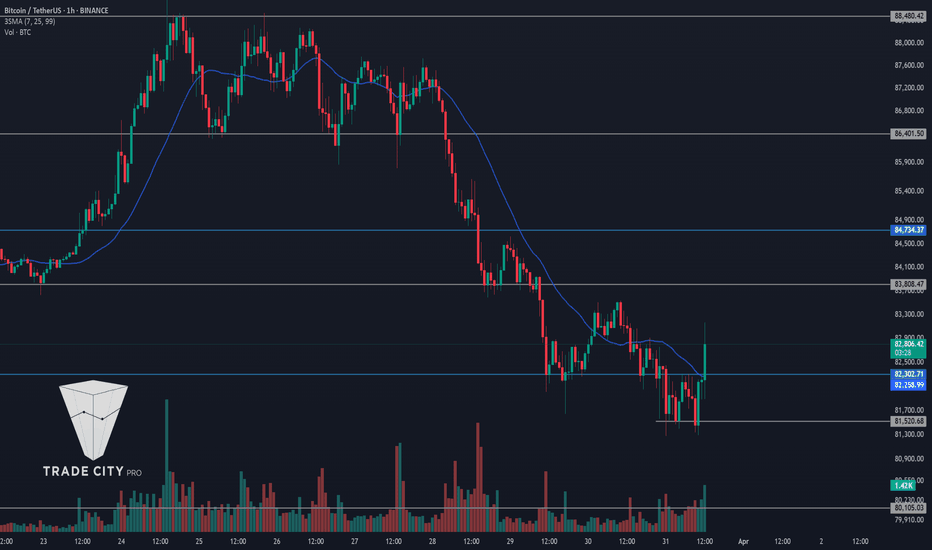

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the price made a downward move after the triggers at 82633 and 81473 were activated, even breaking the important support at 79120 and now has rebounded from the area of 74760.

✔️ If we draw a Fibonacci from this downward leg, we can find potential resistance levels. A few moments ago, there was also a fake news report from Trump stating that he would give 90 days to all countries except China to start tariffs, which, although fake, had a significant impact on the market.

📊 The market volume is very low, which makes it susceptible to such short and small news about tariffs to react this way.

📰 If such news continues and the market acts emotionally, the technical analysis I perform for you will not be very reliable, and the price will move more emotionally.

🔼 However, if these emotional moves end and the price stabilizes in these areas, the potential resistances we have are the Fibonacci levels of 0.5, 0.618, and 0.786, where the 0.5 and 0.786 areas overlap with static price resistances, and the 0.618 area, being the golden Fibonacci, could prevent further price drops.

💥 The RSI oscillator, after a sharp fall and being mostly in Oversell yesterday, has finally exited this area and now reached around 50. If this area is broken in the RSI, the likelihood of a deeper correction will increase.

📉 Today, for a short position, we only have the break of the 74760 area, which I also suggest not opening a position with this trigger because the market has recently moved and needs to create a new structure.

📈 For long positions, according to the strategy I have, it does not make sense for me to open a position in this trend that has so much downward momentum. The best analogy is that when a knife is falling, you shouldn't try to catch it mid-air because it might cut your hand; you should wait for it to fall to the ground so you can pick it up safely without risk.

Let's look at the indices to take a look at the situation with altcoins.

👑 BTC.D Analysis

Bitcoin dominance has made another upward move after breaking 63.07. This caused altcoins to fall more than Bitcoin during this drop, and short positions on altcoins would have given us more profit compared to Bitcoin.

🚀 In the analyses of Bitcoin and altcoins, I've repeatedly told you that for buying altcoins, we should wait until Bitcoin dominance starts to drop. That hasn't happened yet, and it still has a strong upward trend, so today if the market gives a short trigger, altcoins would be more logical.

📅 Total2 Analysis

As you can see, this index has fallen much more than Bitcoin, experiencing a very sharp downward leg upon activating the trigger at 965.

⭐ Currently, I've only added the 949 line to the chart, which overlaps with the 0.786 Fibonacci of this downward leg, and I haven't added any other lines and am waiting for the price to create its structure.

✨ The nearest support the price has is 816, which is very important, and there is nothing else notable about Total2 yet, and we need to wait until a structure is created that can be analyzed.

🎲 The only opinion I can give for now is that the 816 area is very important, and reaching this area in Total2 could end its downward trend, which is more like a prediction than an analysis and is a gut feeling and currently has no logical reason.

📅 USDT.D Analysis

Let's move on to the analysis of Tether dominance, which is very similar to Total2 but seems like a reverse of it.

👀 Yesterday, the trigger at 5.53 activated simultaneously with 965 in Total2, and the dominance moved upward. There's not much I can analyze about this chart, and the main resistance is in the area of 6.34, which acts like the 816 in Total2.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Yen Fluctuates on Global Tariff VolatilityThe yen fluctuated on Monday, rising to 145 per dollar before easing to 147, as global trade tensions and reciprocal tariffs triggered market volatility. Fears of a global recession drove demand for safe havens like the yen, Swiss franc, and bonds. Japan’s February wage growth offered some optimism, and the Bank of Japan is still expected to raise rates this year despite ongoing uncertainty.

Key resistance is at 147.00, with further levels at 152.70 and 157.70. Support stands at 145.60, followed by 143.00 and 141.80.

Silver Rebounds Sharply on Risk AversionSilver rebounded Monday, rising 2.3% to $30.22 an ounce after hitting a seven-month low. The recovery followed sharp market volatility and recession fears from rising U.S.-China trade tensions. While silver benefits from safe-haven demand, its industrial use remains a weakness. Broader market sell-offs could keep price action choppy, but intensified risk aversion and Fed easing could support silver demand.

If silver breaks above $30.90, resistance levels are at $31.40 and $32.50. Support stands at $29.00, followed by $28.40 and $27.50.

Gold Stabilizes Near 3-Week LowGold steadied around $3,030 per ounce on Monday after falling over 1% to a three-week low. The drop sparked speculation that investors were taking profits or covering losses amid broader market declines driven by recession fears from escalating trade tensions. Fed Chair Jerome Powell warned that tariffs could raise inflation and slow growth, underscoring challenges for policymakers.

Key resistance is at $3,050, followed by $3,085 and $3,105. Support stands at $2,980, then $2,930 and $2830.

GBP/USD Softens in Risk-Off TradeThe GBP/USD pair dipped 0.11% to $1.289 in Asian trading, pressured by global recession fears and rising U.S.-China trade tensions. While expectations of Fed rate cuts have weighed on the dollar, the pound remains weak amid economic uncertainty and an unclear Bank of England outlook. With no strong catalysts, GBP/USD may stay vulnerable, especially if risk aversion intensifies.

If GBP/USD breaks above 1.3000, resistance levels are at 1.3050 and 1.3120. Support is at 1.2900, followed by 1.2850 and 1.2800.

EUR/USD Edges Higher Amid Fed Cut BetsThe EUR/USD rose 0.03% to $1.0967 in Asian trade, supported by expectations of Fed rate cuts amid U.S.-China trade tensions. However, gains were limited by concerns over European growth and global trade disruptions. Without signs of market stability, the pair may stay range-bound under risk aversion pressure.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.1000, then 1.0850 and 1.0730.

TradeCityPro | Bitcoin Daily Analysis #53👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, I want to review the New York futures session triggers for you.

💥 If you missed yesterday's analysis, I highly recommend checking it out. I cleared all the lines from all charts yesterday and redrew them from scratch, and now we have new areas that are optimized compared to before.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, there was a symmetrical triangle that has broken downwards, and now it's ready to activate its trigger if it breaks and move downwards.

⚡️ So, for opening a short position, you can enter upon breaking the short-term support at 82633. Preferably, keep a small stop loss so that if the price reaches 81473, the target of the position becomes active.

🎲 Although the triangle has broken, no significant selling volume has entered the market yet, and it's evident that the price is waiting for a good volume to enter to bring momentum.

📊 If no selling volume enters the market, the price could potentially move upwards towards the trigger at 83555. This trigger is risky for a long position, and breaking this area, we can open an early long position.

👑 BTC.D Analysis

Moving on to the analysis of Bitcoin dominance, as you know from yesterday's analysis, we concluded that the dominance trend is upward, and recently, with the breaking of 62.24, the next leg has started.

✔️ Currently, in this timeframe, a ranging box has formed between 62.65 and 63.07, and breaking the top of this box could continue the upward trend. On the other hand, breaking the floor at 62.65 could disrupt the upward trend for now, but as long as this doesn't happen, I still think the dominance has an upward trend.

📅 Total2 Analysis

Moving on to the Total2 analysis, this index is on a very important support floor in the area of 965B, and given the downward momentum that this index has had before, there is a possibility that this area might break.

🔑 If this support breaks, the next downward leg can start. Conversely, the same reason might cause this support to become so strong that it doesn't break.

📈 If the price is supported from this area and moves upward, the first risky trigger for long is at 989B, and the main trigger will be at 1.02T.

🔽 For short positions, as I mentioned, the 965B area is very important, and breaking this area could open a long-term position.

📅 USDT.D Analysis

Moving on to the analysis of Tether dominance, this index is dealing with an important resistance in the area of 5.53, and breaking this area would be akin to breaking the 965B in Total2.

☘️ For confirmation of a long position, 5.41 is suitable.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #52👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and the key cryptocurrency indices. Today, we have a detailed analysis on hand, and I want to start from scratch by drawing all the lines for Bitcoin and other indices so we can get informed about the higher time frames without drawing unnecessary lines.

🔍 Let's get into the analysis, where the charts will be examined in weekly, daily, and 4-hour time frames.

🦁 Bitcoin Analysis

📅 Weekly Time Frame

Let's explore the weekly timeframe. As you can see, the market trend is bullish, and since the price reached the low of 16,000, a bullish structure has formed, and the price has moved upward along a curved trendline. The trendline isn’t very clear on the chart, so I'll put another chart below for you if needed.

✔️ Currently, after two powerful bullish legs that occurred after breaking 31,000, the price has reached the resistance of 104,000 and has entered a corrective phase. The price was moving up with high momentum and no divergence until it reached 71,000, but the next peak at 104,000 was accompanied by divergence, and now the RSI is near triggering this divergence.

⚡️ Overall, the price is in a very critical and sensitive area, and breaking the 44.83 area on the RSI could activate the divergence, and simultaneously, the price may also break the curved trendline, which is not a good sign for the bullish trend and could indicate a trend reversal.

🔼 We must consider that the last bullish leg from 54,000 to 104,000 was much shorter compared to the leg from 31,000 to 71,000. However, I personally see the trend as bullish until the price drops below the 71,000 area, and until a lower high and low are seen below this area, the trend will remain bullish.

📊 If the price sharply falls, breaking 54,000 will confirm a trend change. However, we can get confirmation of a trend change sooner in lower time frames, which I will discuss in the continuation of the analysis.

💥 But everything is set for Bitcoin to rise. The RSI oscillator is at its main bottom, and in this bullish cycle, each time the RSI reached this area, the next bullish leg started. On the other hand, the price has reached the curved trendline, and there is positive news like Bitcoin's strategic reserves in the US, so conditions are ripe for a rise.

📈 Thus, with a break of 104,000, we can confirm the next leg and buy Bitcoin targeting a new ATH.

🎯 To find the target, we can use Fibonacci Extension. As you see, the price has moved up to the 0.618 Fibonacci level and reached the 104,000 area, currently in a corrective phase to 0.382. If it can rise above 0.618 again, the next targets are 0.786, 1, and 1.272, which correspond to areas 123,000, 154,000, and 204,000, respectively.

👀 Let’s go to the daily timeframe to observe the price details more closely.

📅 Daily Timeframe

In the daily timeframe, as you can see, in the bullish leg that occurred after breaking 71,000, the price moved upward and reached 106,000 and, after breaking the 0.236 Fibonacci overlapping with 92,000, went into a deeper correction to 0.5.

⭐ In this corrective leg, the price has created a descending trendline that has been touched several times by the price and is now still engaging this area. If it can break this trendline, the correction will end, and we could see a price increase again.

🧩 In the RSI oscillator, a resistance has formed at 52.26, and breaking this area could bring bullish momentum into the market, which increases the likelihood of breaking the trendline and activating its trigger.

⚡️ There is also a temporary support in the area of 82,124, and if the price gets rejected from the trendline, the likelihood of breaking this support increases, and the price could undergo another bearish leg down to areas 76,000 or 71,000.

🛒 Currently, for buying Bitcoin in spot, the first trigger is the breaking of 87,740, which is a trendline trigger and will be activated after the trendline is broken. The main trigger will be after breaking 106,546, which is the ATH, and a new bullish phase could start.

☘️ The next trigger for Bitcoin is further falls and reaching lower support areas. If the price reaches areas 76,000 or 71,000 and forms a structure there, with the break of the ceiling of the structure, we can carry out a spot purchase, and if this happens, I will specify its triggers in future analyses.

⏳ 4-Hour Time Frame

Let's go to the 4-hour timeframe to review the triggers for Bitcoin futures.

🎲 As you see in this timeframe, a descending triangle has formed, and the price is moving inside it. The dynamic line of this triangle is the daily trendline, and the static line of this triangle is the 81,509 area, which both are important areas and can have a significant impact on the price.

✔️ We are currently in the latter half of the triangle, which is why behaviors and irrational fluctuations have increased, and as you can see, the price has once broken the ceiling of this triangle but couldn’t reach the trendline break trigger and has returned to the triangle.

📈 Currently, for a long position with the break of 84,414, you can enter a position. This position is risky because the trigger is inside the triangle and will be a prelude to breaking the daily trendline. The next main trigger will be after breaking the trendline and activating the 88,344 trigger.

🔽 For a short position, the bottom 81,509 is a very important floor, and with the break of this area, the price can move towards the triangle's target and the 78,620 support.

👑 BTC.D Analysis

📅 Weekly Time Frame

Let's move on to the analysis of Bitcoin dominance. In the weekly timeframe, as you see, a slow and steady bullish trend has been created after breaking 47.33, moving upward along with a bullish trendline, and has once broken this trend from below but has returned above this dynamic area.

🧲 As long as this index is bullish in the bullish legs of the market, Bitcoin will move up more than altcoins, and the increase in Bitcoin dominance causes altcoins to behave very similar to Bitcoin, and it is less likely that the trends of altcoins and Bitcoin diverge.

📚 You can see the impact of this trend inside the Bitcoin and altcoin charts. Bitcoin has registered its previous peak at 106,000 and has recorded a much higher ATH compared to 69,000, but most altcoins in this leg that the market had didn't even reach their previous peaks.

✨ The trend is still bullish without any weakness, and recently, an important ceiling in the area of 60.37 has been broken and has pulled back to it, and now it is moving towards the next resistance, namely 71.43.

💥 But I think dominance will fall before it reaches 71.43 because the dominance is very high right now, and any correction that Bitcoin has causes very severe falls inside the chart, and well, when altcoins fall enough, whales and major investors will enter the altcoin market, which naturally causes Bitcoin dominance to fall.

🔑 So to know when major investors and whales enter altcoins, we have to wait until Bitcoin dominance falls, and this event is currently happening in the weekly timeframe after breaking the trendline and confirming a trend change below this trendline, and until then, Bitcoin will be the capital for better purchases.

📅 Daily Timeframe

Let's move to the daily timeframe. As you can see, after breaking the resistance of 60.37, dominance created a box between 60.37 and 62.16, and now with the break of the box's ceiling, a new bullish leg of dominance has started.

✔️ I usually analyze dominances only with simple tools like support and resistance, but now because I can't get any targets out for dominance, I took help from Fibonacci, and as you see, the potential resistances of dominance are 63.31, 65.15, and 66.49.

🔍 Currently, there is no sign of weakness or trend change in this timeframe, but if for any reason dominance falls and returns below 62.16, we will take the main confirmation of trend change from 60.37.

😎 Let's go to the 4-hour timeframe to find suitable triggers for these dominance futures.

⏳ 4-Hour Time Frame

In this timeframe, we have a temporary ceiling in the area of 63.02, and if it is broken, the price can continue its bullish movement.

💫 For dominance to fall, we currently don't have any triggers in this timeframe and have to wait for a bearish structure to form.

📈 Total2 Analysis

📅 Weekly Timeframe

Let's move on to the analysis of Total2. In this chart, we can very clearly see the impact of Bitcoin dominance on altcoins.

👀 As you can see, the conditions of Total2 are very similar to Bitcoin and are converging, but Bitcoin in the last bullish leg it had registered a new ATH, and Total2 could not do this. On one hand, Bitcoin has just reached its curved trendline and is reacting to it, but Total2 has broken this trend line and has performed a bearish leg. For example, Bitcoin has not yet reached the 71,000 area, but Total2 has long broken 1.21T and is moving towards the bottom of 816B.

🔑 The reason for all these events is that Bitcoin dominance is bullish and causes more money relative to altcoins to enter Bitcoin, and this also makes the bullish trend of Bitcoin more powerful than this index.

🛒 For buying altcoins, the triggers of Total2 are areas 1.21T and 1.61T, but until Bitcoin dominance falls and its trendline is broken, do not pay attention to these triggers and enter the market with Bitcoin triggers while dominance is bullish.

📅 Daily Time Frame

Let's move to the daily timeframe. Concurrent with the fall of Total2, a descending channel has formed, which in Bitcoin was a descending trendline, but here, as you can see, Bitcoin is involved in breaking the trendline and starting an upward wave, but Total2 has long been rejected from the trendline and is involved in breaking the middle line of the channel, which overlaps with the 961B area, and with the break of this area, the next price leg can start.

⚡️ This is another example of the impact of Bitcoin dominance on the market. I mentioned these examples to get you to take dominances seriously and know how important they are and can help us in analysis.

🔽 The trigger for the fall and bearish turn of Total2, as I said, is the breaking of 961B, and if this area is broken, the price can move to the static supports of 816B and 683B. The dynamic support is the bottom of the channel, which can act as a support to prevent the price from falling.

📈 For bullishness and buying spot, breaking 1.1T is suitable. Again, I remind you that until Bitcoin dominance falls, these triggers are not very useful and do not initiate the trend of altcoins.

⏳ 4-Hour Time Frame

Let's move to the 4-hour timeframe to review the triggers for futures.

⭐ In this timeframe, I don't have much to say, and I just want to specify the triggers for you. For a long position, the area of 1.02T is suitable, but it is better that this happens after breaking the channel, which would turn it into a better trigger. The main long position will occur after breaking 1.1T.

📉 But for a short position, we have a very good and important trigger in the area of 961B, and I suggest that you definitely have a short position on an altcoin if this area is broken.

✔️ USDT.D Analysis

📅 Weekly Time Frame

In the weekly timeframe, Tether dominance has created a large box between 3.78 and 6.21 and has been moving between these two areas since early 2024.

💥 On the other hand, it has a descending trendline that the price has touched twice, and now it has reached it for the third time. A trendline that has been reacted to twice is not a very reliable trendline, but if the price returns from this area this time, we can confirm that this trendline exists and is a dynamic supply area.

☘️ Currently, with the range box that has formed, we have a very easy job for Tether dominance. With the break of 6.21, we confirm bullishness, and with the break of 3.78, we confirm bearishness.

📅 Daily Time Frame

Let's move to the daily timeframe, where we can witness more details.

🎲 As you can see, the price is very close to the trendline that was evident in the weekly timeframe and can activate its trigger.

⚡️ If the trendline is broken, a very important trigger exists in the area of 5.68, and with the break of this area, we can get confirmation of the bullishness of dominance at least until the ceiling of 6.34.

🧲 On the other hand, if dominance is rejected from this trendline, with the break of 5.03, dominance can create another bearish leg down to 5.37 or 3.78.

💣 I have nothing else to say about Tether dominance because its trend is ranging, and its situation is clear for now, let's move to the 4-hour timeframe to review the triggers for futures.

⏳ 4-Hour Time Frame

In this timeframe, we can change the trigger for bullishness a bit and bring it to the area of 5.56. If this area is broken, dominance can start a bullish leg.

🧩 For Tether dominance to fall, we also have a riskier trigger in the area of 5.43, and the main trigger will still be the area of 5.03.

🚨 This was a complete analysis of Bitcoin and the indices. It had been a while since we had looked at the higher timeframes, so I decided to review all the symbols in three timeframes. I hope this helps you and you can use this analysis.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #51👋 Welcome to TradeCity Pro

Let's move on to the fiftieth analysis of Bitcoin and key crypto indices. In this analysis, as usual, I want to review the New York futures session triggers for you.

⏳ 1-hour timeframe.

As you can see in the 1-hour timeframe, after the news of US tariffs, the market experienced a drop to the support zone, and now, for the second time, it has penetrated this area.

🔍 If this range between 81520 and 82302 is broken, the price could start the next bearish leg, but another important support is located at 80105, which might prevent further decline.

🔽 For a short position, breaking this range is suitable. For a long position, it's better to wait until a new structure forms.

👑 BTC.D Analysis

Moving on to Bitcoin dominance, the 62.64 zone has also been broken, and dominance has pulled back to it and is now moving upward.

💫 I cannot determine a resistance level at the moment, and we need to wait until the price structure forms new resistance levels.

⚡️ For now, I see Bitcoin dominance as bullish, so it's better to choose Bitcoin for long positions and altcoins for short positions.

📅 Total2 Analysis

Moving on to the Total2 analysis, yesterday the price pulled back to 990 and has now reached 953.

✔️ If this zone is broken, the price could experience a sharp bearish movement and start the next leg. For a long position, like Bitcoin, we need to wait for a new structure to form.

📅 USDT.D Analysis

Moving on to USDT dominance, a very sharp upward move with strong momentum has occurred, and a higher low compared to 5.05 has been formed.

🧩 Currently, there is an important resistance at 5.56, and the price has reached this level. If this zone is broken, dominance will turn bullish.

💥 For a bearish move in dominance, like other indices, we need to wait for a new structure to form.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

SOLANA at key support zone - Is $160 within reach?BINANCE:SOLUSDT has reached a major support level, an area where buyers have previously shown strong interest. This zone has acted as a key zone, increasing the likelihood of a bounce if buyers step in.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers take control, the price could rally toward the $160 target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This isn’t financial advice, just my take on how I approach support and resistance zones. Best to wait for clear confirmation, like a strong rejection or a volume spike, before making a move.

Every trader has a unique perspective. Let’s discuss this setup within the TradingView community!

TradeCityPro | Bitcoin Daily Analysis #50👋 Welcome to TradeCity Pro

Let's move on to the 50th analysis of Bitcoin and key crypto indices in this analysis as usual I want to review the New York futures session triggers for you

🫶 Before starting the analysis I want to thank you for all the support you have given us along the way so that we could reach the 50th analysis I hope that the number of these analyses increases much more and that we are always with you and that you also benefit from the analyses❤️

⏳ 1-hour timeframe

Yesterday Bitcoin rose from the 82302 zone and moved upward finally forming a base after the sharp and deep decline it had and even managed to go above the 83808 zone

⚡️ I slightly adjusted this zone and moved it to 83510 because the price reacted better to this zone

💫 Currently, we are witnessing a rejection from the 84486 zone which has pushed the price back towards 83510 if selling volume increases the price may drop further

✔️ If the price goes below the 83510 zone again in lower timeframes and with the activation of the fake breakout trigger we can open a short-term short position the main trigger is in the 82302 zone

🔼 For a long position breaking 84486 is suitable and with this breakout, the price can start the next bullish leg the entry of RSI into Overbuy will also be a momentum confirmation and can cause us to see large bullish candles

👑 BTC.D Analysis

Moving on to Bitcoin dominance today dominance faced a rejection from 62.35 which could cause dominance to decline

💥 The trigger for confirming this rejection and the downtrend is in the 62.06 zone and breaking this zone could move the price towards the 61.81 and 61.63 zones

📈 Stabilization of dominance above 62.35 will also confirm the uptrend again

📅 Total2 Analysis

Moving on to the Total2 analysis yesterday the 1.01 trigger was activated and the price has also pulled back to it but today we have a trigger for both long and short positions

🔽 For a short position breaking 990 and for a long position breaking 1.02 can confirm opening positions on altcoins

📅 USDT.D Analysis

Moving on to USDT dominance a Head and Shoulders pattern has formed where the neckline in the 5.41 zone has also been broken and the price is pulling back to it

📉 If the price is rejected from the 5.41 zone we will confirm the activation of this pattern and with the break of 5.33 we can confirm the downtrend of dominance

⭐ For an uptrend in dominance breaking 5.41 and invalidating the pattern can be a suitable trigger

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #49👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, I will review the futures session triggers for the New York market.

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the downtrend continues, and yesterday the price dropped below 82,302, now reaching 81,520.

📊 Selling volume has increased in the market, and the SMA 25 has been tracking the price movement effectively in this cycle. Currently, as the price pulls back to 82,302, it is also testing the SMA 25, placing it in a critical zone.

🔽 For a short position, considering this pullback to the SMA 25, you can enter a trade if 81,520 breaks. The next support level in case of a further decline is 80,105.

📈 For a long position, we still need to wait for a proper trend reversal structure to form. There is no valid trigger for a long entry at this moment.

👑 BTC.D Analysis

Now, let’s analyze Bitcoin dominance. Yesterday, the ascending trendline was broken, but the trigger at 62.06 was not activated, leading to a bullish move instead.

⚡️ Currently, 62.30 has broken, and if this breakout holds, dominance could rise to 62.66.

💥 However, if the 62.30 breakout turns out to be a fakeout, a break below 62.06 would confirm a bearish trend reversal.

📅 Total2 Analysis

Moving on to Total2, yesterday the 0.984 support broke, but it now appears to be a fakeout, as the price is stabilizing back above this level.

💫 For a short position, confirmation will come if the price closes below 0.984. If that happens, the next downside target would be 0.953.

🔼 For a long position, a break above 1.01 would confirm the trend reversal, given the fakeout at 0.984.

📅 USDT.D Analysis

Now, let’s analyze USDT dominance. A range has formed between 5.41 and 5.56, and dominance has rejected from 5.41, now moving downward again.

✔️ If 5.41 breaks, it would be the first confirmation of a trend change.

✨ For a bullish continuation, a break above 5.56 would confirm the next bullish leg.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #48👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, in this analysis, I will review the futures session triggers for the New York market.

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, yesterday the price made a pullback and a correction, briefly moving above the SMA 25, but now it has dropped back below this level.

🔍 This correction has reinforced the 82,302 level as a stronger support, making a break below this area even more significant.

💫 If 82,302 breaks, I strongly recommend having a short position, as breaking this level could initiate the next bearish leg.

🔼 For a long position, our current trigger is 83,808, but this is a risky trigger, and I believe it's better to wait for the market to establish a new structure.

👑 BTC.D Analysis

Now, let’s analyze Bitcoin dominance. The dominance remains bullish and is currently stabilizing above 62.30.

✔️ If this level holds, the next resistance will be 62.66, and dominance could initiate another bullish leg toward this zone.

🔽 For a bearish move, we need to wait for the ascending trendline to break and then confirm the downtrend with Dow Theory before considering short positions.

📅 Total2 Analysis

Moving on to Total2, yesterday the price closed below 1.01, and now it has pulled back to retest this level. It seems ready to initiate the next bearish leg.

📉 For a short position, breaking 0.984 remains the key trigger. If this level breaks, you can enter a position.

🔼 For a long position, we need to wait until the strong bearish momentum fades and buyers start entering the market.

📅 USDT.D Analysis

Now, let’s analyze USDT dominance. As you can see, dominance has completed a bullish leg, followed by a slight correction, and now it has regained bullish momentum and is moving upward again.

💥 For further upside, breaking 5.49 is the key trigger to enter a long position.

⚡️ For a bearish move, we need to wait for a new bearish structure to form before considering short positions.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

NAS100: Likely rebound at major point within Ascending ChannelCAPITALCOM:US100 is likely to be undergoing a corrective move as it tests the lower boundary of the ascending channel, as shown on my chart. This boundary serves as dynamic trendline support and a significant bullish reaction could happen if buyers step in at this level.

A successful rebound from this support could lead to a move toward the midline of the channel, with the next target at around 22,000 . This scenario would maintain the overall bullish trend structure.

However, a clear breakdown below the trendline support would weaken the bullish outlook and could lead to further downside.

Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities. Proper risk management is advised, always confirm your setups and trade with solid risk management.

If you have any thoughts on this setup or additional insights, drop them in the comments!

TradeCityPro | Bitcoin Daily Analysis #47👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, in this analysis, I will review the futures session triggers for the New York market.

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, yesterday the 83,808 trigger was activated, and the price moved down to the next support at 82,302.

⚡️ The 19.70 level in the RSI is a crucial area, as the price has reacted to this level in the last two bearish legs, leading to slight corrections.

✔️ Today, it might be a bit late to open new positions, as the price is slightly oversold, suggesting that the move has already extended sufficiently.

🔽 This situation means we should enter positions with lower risk today. The short trigger for today is 82,302, and if this level breaks, the price could decline even further.

📈 For a long position, we need to wait for confirmation of a trend reversal. First, the SMA 25 must reach the price, and then a Dow Theory confirmation should establish a new bullish trend.

👑 BTC.D Analysis

Now, let’s analyze Bitcoin dominance. As you can see, this index increased yesterday as the market dropped. It briefly faked out above 62.14 before reversing downward again.

🎲 At the moment, 62.14 remains a key trigger for bullish dominance, while the main support level is 61.81.

📅 Total2 Analysis

Moving on to Total2, this index is in bad shape. It has broken its key support at 1.01 and is now moving toward 0.984.

💥 I can't provide any specific trigger for this chart today because it has dropped significantly without any corrections. For now, we need to wait for a new structure to form.

📅 USDT.D Analysis

Now, let’s look at USDT dominance. Yesterday, dominance finally stabilized above 5.34, which triggered a market drop.

🔍 Currently, USDT dominance has reached the next resistance at 5.48 and has shown a reaction to this level. To confirm further upside, we need a break above 5.48. If a correction starts and we see more red candles, the price could retrace back down to 5.34.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #46👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, in this analysis, I will review the futures session triggers for the New York market.

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, yesterday the 86,401 trigger was activated, and the price moved downward. Since the price was making lower highs, I anticipated this move yesterday, and now the price is near 83,808, approaching this support level.

✔️ At this point, I believe the price has declined sufficiently, and it may start forming a base around 83,808. However, for a short position, this same 83,808 level is key, and we can enter a position if it breaks below this area.

🔼 For a long position, we need to wait until at least the SMA 25 reaches the price and the price stabilizes above this zone. Once the trend turns bullish, we can consider opening a long position.

👑 BTC.D Analysis

Moving on to Bitcoin dominance, as the market declined and Bitcoin broke support, dominance increased. This helped Bitcoin hold up better than other coins, which experienced heavier losses.

📊 Currently, dominance has reached 62.14 and faced a strong rejection from this level. If a corrective phase begins, the key support area for price is 61.81, and the price could retrace to this level.

✨ For a bullish move in dominance, a break above 62.14 is required, with the next resistance at 62.30.

📅 Total2 Analysis

Now let’s analyze Total2. As I mentioned, altcoins have experienced a much sharper decline than Bitcoin, and after breaking 1.06, Total2 started a strong downtrend, even breaking through 1.04.

🎲 Currently, the price is fluctuating between 1.01 and 1.04, and it seems that the trend is showing signs of weakness, indicating that this bearish leg may be ending. If a correction begins, the price could move up to 1.04. However, for the next short position, the trigger level to watch is 1.01.

📅 USDT.D Analysis

Now let’s analyze USDT dominance. This index broke through the key 5.19 level and has risen to 5.34.

🌩 If a candle closes above this level, the next major resistance is at 5.45. In case of a pullback, the key support to watch is 5.25.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.