LTC/USDT Review 4H Analysis Hello everyone, welcome to the LTC review on a four-hour interval. Currently, with the help of blue lines, we will mark the downtrend channel, from which the price is fighting for an upper exit.

Now let's move on to marking the support spots for the price and we see that the price is currently holding a very strong support at $94.76, however when it leaves the support below, we can see a drop to the second support at $82.24.

Looking the other way, we can similarly determine the places of resistance that the price has to face. And here we see that the first resistance is at $99.53, then we have the second resistance at $104.49, and then price needs to break a strong resistance zone of $108 to $112.

The CHOP index indicates that most of the energy has been used, the MACD is struggling to return to the local uptrend, while the RSI is moving in the lower part of the range, which may also affect the reversal of the uptrend.

Dailyanalysis

BNB/USDT 1DReview Resistance an SupportHello everyone, welcome to a review of the BNB vs. USDT pair, taking into account the one-day timeframe. First of all, using the blue lines, we can mark the sideways trend channel in which the price is currently approaching its upper limit.

Now let's move on to marking the places of support. We will use the Fib Retracement tool to mark support, and here we will first mark the strong support zone from $234 to $228, however, if the price falls below this zone, we can see a drop to around $220.4.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we see that the price is moving towards the upper border of the channel, where we have a strong resistance zone from $244 to $250, only when we exit it upside, we can attack the resistance at $256.8.

Index CHOP indicates that there is still energy to continue this movement. The MACD indicator, despite corrections in the channel, maintains an upward trend. On the other hand, on the RSI we approached the middle of the range, despite everything we can see an attempt to attack the first resistance zone.

XRP/USDT 1D Review ChartHello everyone, welcome to the XRP chart review on a one-day timeframe. As we can see after defining the uptrend line, the price has fallen slightly below, but remains close to this line.

Let's start by marking the support areas for the price and we see that first we have a support zone from $0.45 to $0.42, which is holding the price so far, but if the zone is broken, the next support is at $0.39.

Looking the other way, we can similarly determine the places of resistance that the price has to face. And here we see that the price is currently bouncing off the $0.48 resistance. Then we can mark a resistance zone from $0.51 to $0.52, and a second very strong zone from $0.54 to $0.57.

The CHOP index indicates that a lot of energy has been collected, the MACD is struggling to return to the downtrend, while the RSI has a further rebound, which may positively affect the change of the price direction to an upward one.

ETH/USDT ReviewHello everyone, let's look at the ETH to USDT chart on a single day time frame. As you can see, the price has fallen below the local uptrend line.

After unfolding the trend based fib extension grid, we see that the price stayed in the first support zone from $1864 to $1828, and then there is the second support zone from $1793 to $1742.

Looking the other way, we will check the resistances in the same way and here we see that the price must first break the resistance zone from $1909 to $1959, when it breaks it it will move towards the second zone from $2041 to $2101.

The CHOP index indicates that there is a lot of energy for a move, the MACD is on the verge of returning to a downtrend, while the RSI has a pullback to the middle of the range, which may translate into an upward price move.

XRP/USDT Review 1DayInterval Hello everyone, I invite you to review the BNB chart on a one-day timeframe. As we can see after defining the uptrend line, the price has fallen slightly below, but remains close to this line.

Let's start by marking the support areas for the price and we see that first we have a support zone from $0.45 to $0.42, which is holding the price so far, but if the zone is broken, the next support is at $0.39.

Looking the other way, we can similarly determine the places of resistance that the price has to face. And here we see that the price is currently bouncing off the $0.48 resistance. Then we can mark a resistance zone from $0.51 to $0.52, and a second very strong zone from $0.54 to $0.57.

The CHOP index indicates that a lot of energy has been collected, the MACD is struggling to return to the uptrend, while the RSI has a further rebound, which may positively affect the change of the price direction to an upward one.

Daily Market Analysis - FRIDAY JULY 07, 2023Key News:

USA - Average Hourly Earnings (MoM) (Jun)

USA - Nonfarm Payrolls (Jun)

USA - Unemployment Rate (Jun)

During Thursday's trading session, the Dow Jones Industrial Average recorded a decline as robust job market data sparked expectations of further interest rate hikes by the Federal Reserve. This development subsequently led to a surge in Treasury yields, which raised concerns among market participants. The Dow Jones Industrial Average experienced a notable decrease of 1.1%, resulting in a loss of 366 points. Similarly, the Nasdaq and the S&P 500 also faced declines of 0.8% and 0.8% respectively.

NASDAQ, SPX, and DJI indices daily charts

Amidst the broader market decline, Microsoft Corporation (NASDAQ: MSFT) bucked the trend and achieved a gain of nearly 1% driven by optimism surrounding its advancements in artificial intelligence (AI). Morgan Stanley, a prominent financial institution, expressed confidence in Microsoft's position within the software industry, particularly in relation to the projected $90 billion growth opportunity in generative AI by fiscal 2025. In light of this positive outlook, Morgan Stanley increased its price target on Microsoft from $355 to $415, indicating a favorable investment potential for the company.

Microsoft stock daily chart

Despite the launch of its Twitter competitor app called Threads and the announcement by Meta CEO Mark Zuckerberg that it had garnered over 30 million sign-ups since its recent introduction, Meta (formerly known as Facebook) faced a reversal of its early-day gains. The company's stock failed to maintain its upward momentum, and the gains dissipated as the trading session progressed. The market response to Threads and Meta's overall performance suggests that investors and traders may have reacted differently to the news, leading to the subsequent decline in the stock price.

Meta Platforms stock daily chart

In the Eurozone, inflation expectations for the medium term experienced a decrease in May. The gauge measuring the 12-month expectation dipped from 4.1% to 3.9%. Despite this decline, the long-term (three-year) inflation expectations, which hold greater significance for the European Central Bank (ECB), remained unchanged at 2.5%. This level is notably higher than the ECB's target inflation rate of 2%.

The latest flash core Consumer Price Index (CPI) estimates for June further strengthen the argument for proponents of tighter monetary policies within the ECB. These estimates provide substantial justification for those who advocate for a more stringent approach to monetary policy, given that inflationary pressures persist in the Eurozone.

The ECB, as the central bank responsible for maintaining price stability, closely monitors inflation expectations and aims to keep them in line with its target. The fact that long-term inflation expectations remain above the ECB's target suggests that there may be a need for increased vigilance and potential policy adjustments to curb inflationary pressures.

The divergence between medium-term and long-term inflation expectations underscores the complexity of managing inflationary dynamics in the Eurozone. The ECB will need to carefully assess economic data, including CPI estimates, to make informed decisions regarding monetary policy and strike a balance between supporting economic growth and maintaining price stability.

EUR/USD daily chart

Today, the economic calendar in the Eurozone is relatively light, implying that the movement of the EUR/USD exchange rate will primarily be influenced by the market's reaction to data releases from the United States.

The market's response to US data is of particular significance, as it has a notable impact on shaping the direction of the EUR/USD exchange rate. Positive data releases from the US could strengthen the US Dollar and potentially lead to a decline in the EUR/USD pair, while weaker-than-expected data could exert downward pressure on the US Dollar, potentially favoring an upward movement in the EUR/USD pair.

Additionally, the market remains highly sensitive to price-related developments. In this context, there is ongoing concern regarding the Bank of England's aggressive tightening expectations. Speculation suggests that the BoE could implement a significant 140 basis point increase in interest rates by January 2024. This projection, if realized, raises the possibility of a reassessment in the market. If investors revise their expectations and perceive the tightening as too aggressive or potentially detrimental to economic growth, it could pose downside risks for the British Pound. Consequently, the GBP/USD exchange rate could experience downward pressure.

GBP/USD daily chart

The EUR/GBP pair has witnessed a decline over the past two sessions; however, it may find support at its current levels and potentially make a move towards the 0.8600 mark once again. This shift in the pair's direction could be driven by the potential threat of a repricing of the previously overbought British Pound, influenced by the actions of the Bank of England.

The recent weakening of the EUR/GBP pair suggests that the Pound has gained strength against the Euro. However, the current levels may act as a support zone, potentially leading to a reversal in the pair's direction. If the support holds, it could provide an opportunity for the EUR/GBP pair to regain some ground and move towards the 0.8600 level.

The potential repricing of the Pound is a significant factor that could influence the pair's movement. If market participants perceive that the British Pound had become overbought or overvalued in relation to its fundamentals, they may adjust their positions accordingly, leading to a corrective move in the currency. This adjustment could contribute to a potential reversal in the EUR/GBP pair, benefiting the Euro and causing the pair to move higher towards the 0.8600 mark.

EUR/GBP daily chart

Yesterday's market sell-off was primarily triggered by the release of the minutes from the Federal Reserve, which revealed a greater inclination for further tightening of monetary policy than previously anticipated. This direction gained further momentum with the release of strong employment-related data, namely the ADP payrolls and ISM services reports, which indicated that the US labor market remains robust and is expected to continue performing well.

The ADP payrolls report for June showcased an impressive addition of 497,000 new jobs. However, it is important to note that a significant portion of these positions were in lower-paid service roles, which could have implications for wage growth and overall economic recovery.

In addition to the employment data, the prices paid component of the ISM services report indicated a slowdown, reaching its lowest level in three years. This decline in price pressures suggests that inflationary pressures might be easing, potentially influencing the Federal Reserve's decision-making process regarding future monetary policy actions.

The combination of the Federal Reserve minutes highlighting a stronger inclination for tightening, along with positive employment data and easing price pressures, contributed to the market sell-off observed. Investors and traders reacted to these factors, reassessing their positions and adjusting their expectations accordingly.

US Employment Change

The resilience of the labor market presents a challenge for the Federal Reserve in its pursuit of achieving its target inflation rate. Despite the possibility of a potential decrease in headline Consumer Price Index (CPI) to 3% in June, the task of returning inflation to the desired level becomes increasingly difficult.

Today's release of the US nonfarm payrolls report for June has the potential to further reinforce optimism about the US economy. A strong jobs report would provide evidence of a robust labor market, indicating economic strength and potential future growth. However, there is also a concern that such a positive report could lead the Federal Reserve to overestimate the economy's resilience and prompt them to raise interest rates more aggressively than necessary.

The market has already priced in these expectations, as reflected by the recent rise in yields. The anticipation of a stronger economy and the possibility of more aggressive rate hikes by the Federal Reserve have contributed to an increase in yields. This pricing-in of expectations suggests that there is a level of caution in the market regarding the potential actions of the central bank and the impact they may have on various sectors.

Balancing the need to support the labor market with the goal of achieving the desired inflation rate remains a challenge for the Federal Reserve. The nonfarm payrolls report for June will be closely watched by market participants and policymakers alike, as it has the potential to shape future monetary policy decisions and market expectations.

As always, it is important to monitor economic data releases, central bank statements, and market sentiment to gain a comprehensive understanding of the current landscape and make informed decisions regarding investments and trading strategies.

ETH/USDT Short-Term Review 1HIntervalHello everyone, let's look at the ETH to USDT chart taking into account the timeframe of one hour. As we can see, the price leaves the local downtrend line sideways.

When we unfold the trend based fib extension tool, we see that we first have a support zone from $1872 to $1859, but when the price goes lower, then the support is at $1836.

Looking the other way, we can mark a resistance zone from $1879 to $1889 where the price is struggling to break out, then we have a second zone from $1904 to $1915 and then strong resistance at $1930.

The CHOP index indicates that the energy has been used, the MACD indicates the continuation of the local downtrend, and the RSI shows a significant rebound that may change the direction of the price to an upward one.

BTC/USDT Short-Term 1HInterval ReviewHello everyone, let's look at the BTC to USDT chart on a one hour time frame. As you can see, the price is bouncing off the local downtrend line.

After unfolding the trend based fib extension grid, we see the first support zone from $30,309 to $30,138, and then the second support zone from $29,856 to $29,658.

Now let's move on to the resistances, and here in the first place the price has to break the zone from $30661 to $30804, when it does it has a second strong resistance zone from $30949 to $31150.

The CHOP index indicates that the energy is starting to gather strength, the MACD is on the verge of returning to the local uptrend, and the RSI after a strong recovery shows that there is room for price growth.

ETH/USDT Long-Term Review 1DIntervalHello everyone, I invite you to review the chart of ETH in pair to USDT, taking into account the one-day interval. Using the yellow line, we will mark the uptrend line, which, as we can see, holds the price nicely in corrections.

Now let's move on to marking the places of support. We will use the Fib Retracement tool to mark support, and here in the first place it is worth marking the support zone from $ 1845 to $ 1662, however, when the price drops below, we can see a return to a very strong support zone from $ 1363 to $ 1150.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we have the first very strong resistance at the price of $2237, before which the price once again turned back, the next resistance is at the price of $2552, and then the third resistance at the price of $3007.

When we turn on the EMA Cross 50 and 200, we can see the place of transition into a strong uptrend and how far the price stays in this trend.

The CHOP index indicates that we have a lot of energy to use. The MACD indicator is in an uptrend. On the other hand, we have a rebound on the RSI, however, looking at the fact that we are in the upper part of the range, the price may go down to a lower level.

Daily Market Analysis - WEDNESDAY JULY 05, 2023Key News:

USA - FOMC Meeting Minutes

Following a shortened regular session on Monday, US stock futures displayed a varied pattern during evening deals. Notably, Tesla Inc (NASDAQ: TSLA) witnessed a significant surge of 6.9% as a result of exceeding delivery and production expectations.

The trading session concluded on a mixed note, with US stock futures reflecting divergent trends as investors reacted to the latest developments. Tesla Inc, the renowned electric vehicle manufacturer, emerged as a standout performer during this period. The company experienced a remarkable upswing of 6.9%, largely attributed to surpassing expectations in terms of both deliveries and production figures.

Investors responded positively to Tesla's impressive performance, fueling optimism about the company's growth prospects. The notable surge in stock value serves as a testament to the market's confidence in Tesla's ability to deliver strong results and capitalize on the growing demand for electric vehicles.

While other stock futures exhibited a more varied pattern, Tesla's exceptional performance contributed to the overall mixed nature of the evening deals. As investors assess the broader market landscape and navigate various factors impacting the financial markets, the strong showing by Tesla stands out as a notable highlight, capturing attention and generating excitement among market participants.

Tesla stock daily chart

At 19:00 ET (23:00 GMT), the futures for the Dow Jones Industrial Average showed no significant change, maintaining stability in the evening trading session. Concurrently, the futures for the S&P 500 experienced a slight uptick of 0.1%, indicating a modest increase in value. In contrast, the futures for the Nasdaq 100 observed a minor decline of 0.2%, signaling a slight decrease in anticipated performance for the tech-heavy index.

During this time, market participants closely monitored these futures indicators, seeking insights into the potential direction of the broader stock market. The stability in Dow Jones futures suggested a steady outlook for the industrial average, while the slight increase in S&P 500 futures indicated a positive sentiment among investors. However, the modest decline in Nasdaq 100 futures hinted at a relatively weaker performance for technology stocks.

These movements in futures reflected the ongoing dynamics and sentiments surrounding the financial markets. Traders and investors assessed various factors, such as economic data, corporate earnings, geopolitical events, and market trends, to make informed decisions regarding their positions and strategies.

While Dow Jones futures remained unchanged, and S&P 500 futures showed a modest increase, the slight decline in Nasdaq 100 futures added a layer of caution to the market environment. It highlighted the potential challenges and uncertainties faced by technology companies and the influence they might have on the overall market performance.

As the trading session progressed, market participants continued to monitor these futures indicators, along with other relevant factors, to gain further insights and make informed decisions about their investment strategies.

DJI and SPX indices daily chart

In the afternoon of the previous day, the Australian dollar witnessed a decline in response to the Reserve Bank of Australia's (RBA) decision to leave the policy rate unchanged at 4.10%. The AUD/USD exchange rate dropped towards 0.6650, indicating a decrease in the value of the Australian dollar against the US dollar. Similarly, the AUD/NZD rate approached 1.0825, reflecting a weakening of the Australian dollar relative to the New Zealand dollar.

The decision by the RBA to keep the policy rate unchanged surprised some market participants who had adjusted their expectations for consecutive rate hikes. This adjustment reflected a shift towards a more cautious approach from the RBA in terms of tightening monetary policy. Prior to the announcement, economists surveyed by Bloomberg held mixed views on whether the RBA would choose to implement another rate hike or maintain the existing policy rate.

The divergence in expectations among economists and market participants underscores the uncertainty surrounding the RBA's future policy decisions. Traders and investors closely monitored the central bank's statements and actions for any indications of the direction of monetary policy. The outcome of the RBA's decision had a direct impact on the Australian dollar's performance, leading to fluctuations in currency pairs such as AUD/USD and AUD/NZD.

As the market continues to digest the RBA's decision and assess the potential implications for the Australian dollar, market participants will closely follow any updates or communications from the central bank that could provide further insights into its future monetary policy stance. These developments will shape market sentiment and influence trading strategies related to the Australian dollar in the days ahead.

AUD/USD daily chart

The Reserve Bank of Australia (RBA), in its policy statement, provided reasoning for its decision to keep the policy rates unchanged for the current month. The central bank highlighted the importance of assessing the effects of previous rate increases and closely evaluating the overall economic outlook before making any further adjustments to the rates.

While the RBA acknowledged a decline in the May monthly Consumer Price Index (CPI) indicator, they maintained the view that inflation levels were still "too high" and expected to remain elevated for a significant period. This suggests that the RBA is keeping a close eye on inflationary pressures in the economy and is cautious about taking any actions that could potentially exacerbate the situation.

By opting to maintain the current rates, the RBA aims to monitor the impact of its past policy decisions on inflation and the broader economy. This approach allows them to gather more data and assess the effectiveness of their previous rate increases. By doing so, the central bank can gain a better understanding of the overall economic conditions and make informed decisions about the future course of monetary policy.

The RBA's emphasis on the elevated inflation levels suggests that they are committed to managing price stability and ensuring that inflation remains within their target range over the long term. This cautious stance is likely driven by their objective to strike a balance between supporting economic growth and preventing any significant inflationary pressures that could harm the economy.

US Dollar Currency Index

The Dollar Index, a measure of the value of the U.S. dollar against a basket of major currencies, showed stability at 103.07, indicating a slight increase from the previous day's level of 102.92. This stability came amidst the expansion of the yield curve inversion in the United States between the 2-year and 10-year treasury yields.

A yield curve inversion refers to a situation where shorter-term government securities, such as the 2-year treasury bonds, yield higher returns compared to longer-term bonds, such as the 10-year treasury bonds. This inversion is often seen as a potential signal of an economic downturn or recession, as it reflects investors' concerns about the future outlook of the economy.

The expansion of the yield curve inversion implies that the gap between the yields of the 2-year and 10-year treasury bonds has widened. This can be interpreted as an indication of increased uncertainty and risk aversion in the market. Investors may be seeking the safety of longer-term bonds, pushing their yields lower, while demanding higher returns for holding shorter-term bonds.

The impact of the yield curve inversion on the Dollar Index is multifaceted. On one hand, the inversion can be viewed as a sign of economic weakness, which may undermine confidence in the U.S. dollar and potentially lead to a decline in its value. On the other hand, the U.S. dollar is often seen as a safe-haven currency during times of market uncertainty, and increased risk aversion could lead investors to seek the relative stability of the dollar, supporting its value.

The stability of the Dollar Index at 103.07 suggests that market participants are currently weighing the implications of the yield curve inversion and assessing its impact on the overall currency market. As economic data and market conditions evolve, investors will continue to monitor the yield curve dynamics and their potential influence on the U.S. dollar and other currencies.

USD/JPY daily chart

The US Dollar held its ground against the Japanese Yen, trading at 144.45, a marginal increase from the previous level of 144.40. This stability came in response to warnings issued by Japanese officials regarding excessive selling of the Yen. Masato Kanda, Japan's top currency diplomat, emphasized that authorities were in close communication with US Treasury Secretary Janet Yellen and maintaining ongoing dialogue with various countries regarding currency matters.

The comments from Japanese officials aimed to address concerns about the weakening of the Yen, indicating their willingness to take appropriate measures if the currency were to weaken excessively. Such warnings and efforts to maintain communication with international counterparts demonstrate Japan's commitment to stability in the foreign exchange market.

The US Dollar's stability against the Yen can be attributed to the market's response to these statements. Traders may have refrained from excessive selling of the Yen out of caution, given the potential intervention by Japanese authorities. This balanced approach helps to mitigate significant fluctuations in the USD/JPY exchange rate.

The USD/JPY pair is influenced by a variety of factors, including economic indicators, monetary policy decisions, and geopolitical developments. In this case, the comments from Japanese officials added an element of stability to the currency pair, as market participants assessed the potential implications of any intervention measures that may be taken.

As the situation evolves, traders will continue to monitor the communications between Japanese and US authorities, as well as other factors that can influence the USD/JPY exchange rate. Market sentiment, economic data releases, and geopolitical developments will all play a role in shaping the future direction of the pair.

EUR/USD and GBP/USD daily charts

In a quiet trading session, the Euro (EUR/USD) faced a slight decline, slipping from 1.0910 to 1.0882. Conversely, the British Pound (GBP/USD) showed strength, rallying by 0.20% to 1.2715 compared to the previous level of 1.2695. The Pound's upward movement was spurred by a statement from UK Prime Minister Rishi Sunak, highlighting the government's commitment to employ both monetary and fiscal policies fully in order to address concerns about inflation.

Sunak's remarks reassured market participants, signaling that the UK government is prepared to take necessary measures to tackle rising inflationary pressures. This proactive stance from policymakers boosted confidence in the Pound, leading to its gains against the US Dollar.

The Euro's dip in value against the US Dollar can be attributed to the subdued trading conditions and perhaps a lack of significant catalysts during the session. The Eurozone's economic performance and other factors influencing the Euro may have contributed to the minor decline.

As the market awaits further developments, traders will closely monitor any updates regarding inflation and the actions taken by central banks and governments to address the economic challenges. Economic data releases, monetary policy decisions, and geopolitical events will continue to influence the dynamics of the EUR/USD and GBP/USD pairs in the days ahead.

XAU/USD daily chart

Gold has shown a modest recovery in the past three sessions after dropping below the key support level of $1,900 per ounce last week. The main driver of the downward pressure on gold prices has been the concern over increasing US interest rates.

Investor attention is currently focused on the release of the minutes from the Federal Reserve's June meeting, as they seek further insights into the future trajectory of US interest rates. While the central bank decided to keep rates unchanged last month, they had indicated the possibility of at least two more rate hikes this year due to persistently high inflation.

Federal Reserve Chair Jerome Powell has reiterated this stance in recent testimonies and speeches over the past two weeks. Market expectations currently indicate an 88% probability of a 25 basis point rate increase by the central bank in July. Although recent data showed a decline in overall US inflation, core inflation remains stubbornly high and above the Fed's target range.

This trend suggests potential further pressure on gold in the coming months, although the metal has also witnessed some safe-haven demand due to expectations of a potential US recession.

Analysts at IG have mentioned that they would adopt a positive stance on spot gold if it manages to surpass a resistance level ranging between $1,925 to $1,935 per ounce.

In today's economic calendar, the Eurozone will release its June Producer Price Index (PPI) data, with a forecasted month-on-month decrease of -1.8% (compared to -3.2% previously) and a year-on-year decrease of -1.3% (compared to -1.0%).

Meanwhile, the United Kingdom will publish its S&P Global Final Services Purchasing Managers' Index (PMI) for June, with a forecasted reading of 53.7 (compared to 55.2 previously).

In the United States, the May Factory Orders data will be released, with a forecasted month-on-month increase of 0.8% (compared to 0.4% previously). Additionally, the May Core Factory Orders, excluding transportation, are expected to show a month-on-month increase of 0.3% (compared to -0.2% previously).

Lastly, the US will release the IBD/TIPP Economic Optimism Index for July, with a forecasted reading of 43 (compared to 41.7 previously). These data releases will provide further insights into the economic conditions and sentiment, potentially impacting the financial markets including gold.

BTC Short-Term Review 4HIntervalHello everyone, let's look at the BTC to USDT chart on a 4-hour time frame. As you can see, the price stays on the local uptrend line.

After unfolding the trend based fib extension grid, we can determine the first support zone from $ 30,701 to $ 30,490, but when the price drops lower, we have a second strong zone from $ 30,280 to $ 29,981.

Now let's move on to the resistances and here we see that the price cannot break through the first zone from $31256 to $31530, when it does it will move towards the second very strong zone from $31974 to $32289.

Looking at the CHOP indicator, we see that it collects more and more energy for the move, MAC is struggling to maintain the uptrend, while the RSI is at the upper limit, which may give a greater price rebound.

Daily Market Analysis - TUESDAY JULY 04, 2023Key News:

USA - United States - Independence Day

Australia - RBA Interest Rate Decision (Jul)

Wall Street's main indices closed with modest gains on Monday in a shortened session, as Tesla (NASDAQ: TSLA) surged and bank shares showed resilience, signaling a subdued start to the second half of the year.

Driven by news of record-breaking vehicle deliveries in the second quarter, Tesla saw a notable increase of 6.9% in its shares.

Wells Fargo stock daily chart

Citigroup stock daily chart

In the realm of the financial markets, major banks emerged victorious as they adeptly navigated the rigorous annual health assessment conducted by the Federal Reserve, which, in turn, paved the way for them to raise their dividends. This accomplishment reverberated positively through the stock market, propelling their share prices to soar.

Wells Fargo (NYSE: WFC), one of the prominent players in the banking sector, witnessed a remarkable 1.7% increase in the value of its shares, demonstrating its resilience and strategic prowess in the face of regulatory scrutiny. Meanwhile, Citigroup (NYSE: C), another heavyweight contender in the financial arena, experienced a solid ascent of 1.5% in its share price, attesting to its strong financial footing and ability to maintain stability in a constantly evolving economic landscape.

The impact of the banks' successful performance was not confined to individual entities but had a broader effect on the industry. The S&P 500 banks index, serving as a barometer of the overall health and performance of major banking institutions, closed with a notable 1.5% gain, showcasing the collective strength and positive sentiment surrounding the financial sector as a whole.

As investors and market participants alike acknowledged the banks' resilience and ability to meet regulatory requirements while delivering returns to shareholders, confidence in the stability and growth potential of the banking industry surged. This boost in investor sentiment bodes well for the financial sector, indicating a more optimistic outlook and paving the way for potential future expansions and innovations in the realm of banking and finance.

S&P 500 daily chart

The week ahead holds the promise of heightened volatility for the US dollar, as market participants brace themselves for potential fluctuations. At present, the Dollar Index reflects a downward trend, indicating a weaker position for the American currency. However, there is a possibility that it may undergo a significant test, aiming to reach the 104 level in the near future. Such a scenario would likely be influenced by a combination of economic factors, global events, and market sentiment, which can swiftly impact currency valuations.

On the other hand, the Euro, serving as a key counterpart to the US dollar, is anticipated to maintain a relatively stable trading range. Market projections suggest that the Euro will continue to fluctuate within the boundaries of 1.08 to 1.10 against the US dollar. This range highlights a level of consistency in the Euro's performance and reflects the current equilibrium between the two major currencies. Factors influencing the Euro's movement may include economic indicators, political developments in the Eurozone, and any major policy decisions made by the European Central Bank.

US Dollar Currency Index daily chart

The EUR/JPY currency pair faces a crucial hurdle in order to avoid being stuck in a sideways range. A decisive breakthrough above the 158 level is necessary to signal a potential upward momentum. Such a breakthrough would indicate a shift in favor of the euro against the Japanese yen, potentially opening up further opportunities for the pair to appreciate. Traders and investors will closely monitor the price action around this level to determine if the pair can gather enough strength to break free from the sideways range and establish a new upward trend.

On the other hand, the USD/JPY pair faces a different scenario. If the pair remains below the 145 level, there is a possibility of a decline towards the 144 level. This implies that the US dollar might weaken against the Japanese yen, reflecting a potential shift in favor of the yen. The 145 level acts as a crucial resistance, and failing to surpass it could indicate a lack of buying pressure for the US dollar. Traders and investors will carefully monitor the price dynamics and market sentiment surrounding this level to assess whether the pair will continue its downward movement and potentially target the 144 level.

EUR/JPY and USD/JPY daily chart

persistent inflation, robust economic data, and the resulting anticipation of higher interest rates. These factors have collectively exerted downward pressure on the price of gold, contributing to a challenging environment for the precious metal.

Despite a minor recovery witnessed in the past few trading sessions, during which the price briefly dipped below the $1,900 mark, the overall trajectory for gold remains bearish. This implies that the prevailing sentiment and market dynamics are tilted towards further downward movement in the price of gold.

The persistence of inflationary pressures has been a primary factor influencing the demand for gold as a safe haven and inflation hedge. Strong economic data, indicating a robust and expanding economy, has bolstered market confidence and reduced the appeal of holding gold as a protective asset. Additionally, the expectation of higher interest rates has amplified the attractiveness of alternative investment options, potentially diverting capital away from gold.

While short-term fluctuations and temporary recoveries are not uncommon in financial markets, the broader trend for gold suggests a bearish outlook. Traders, investors, and market participants will closely monitor key economic indicators, central bank actions, and any shifts in market sentiment that may impact the future trajectory of gold prices.

XAU/USD daily chart

Indeed, there are indications of weakening momentum around the $1,900 level for gold, which raises the possibility of a corrective move in the near future. This observation suggests that the selling pressure and downward momentum may be losing steam, potentially paving the way for a temporary rebound or consolidation in the price of gold. However, it's crucial to note that a loss of momentum alone does not guarantee an immediate and decisive reversal in price direction.

If there is a significant break below the $1,900 level, it could potentially trigger another downward plunge for gold, especially if momentum gains strength. Such a scenario would reflect a shift in market sentiment, with increased selling pressure overpowering any temporary recovery or consolidation. The extent of the downward move would depend on various factors, including market dynamics, investor sentiment, and the overall economic landscape.

Considering the nearly 9% decline in gold prices since early May, a correction would not come as a surprise. Corrections are natural and healthy price movements that often occur after a significant rally or decline. They allow the market to reassess the prevailing trend, absorb new information, and establish a more sustainable price level.

Traders, investors, and market participants closely monitoring the gold market will keep a watchful eye on key levels, momentum indicators, and other relevant factors to gauge the potential for a corrective move.

BTC/USD daily chart

The cryptocurrency Bitcoin has been displaying notable volatility, primarily fluctuating between the range of $30,000 to $31,000. This range-bound movement can be seen as encouraging by the crypto community, especially considering Bitcoin's recent impressive rally. Although Bitcoin has not experienced further significant gains, the fact that it has not retraced a substantial portion of its recent surge suggests that traders and investors maintain an optimistic outlook. They perceive the current phase as a consolidation period within a larger upward movement.

It is important to note that the ultimate outcome and direction of Bitcoin's price movement will depend on future news developments and market factors. The hypothesis of this consolidation phase serving as a stepping stone for a potential continuation of the upward trend is speculative and will require time to confirm or refute.

However, based on the information available thus far, the current market behavior surrounding Bitcoin is generally viewed as positive. The absence of a significant retracement following a substantial rally can be interpreted as a sign of resilience and underlying strength in the market. It demonstrates that there is ongoing support and demand for Bitcoin, even amidst fluctuations and uncertainty.

As with any investment or trading activity involving cryptocurrencies, it is crucial for participants to exercise caution, conduct thorough research, and stay informed about market developments. Cryptocurrency markets are known for their volatility and can be influenced by various factors, including regulatory decisions, adoption trends, and overall market sentiment.

LTC 1DInterwal Rewiew - Long-TermI invite you to review the LTC chart on a single day interval. As we can see, the price stayed above the uptrend line, and including the corss 50 and 200 emas, we see confirmation of the uptrend.

Let's start by marking the support spots for the price and we see that first we have a support zone that starts at $97 and ends at $876, however if the price goes lower, the next very strong zone is from $68 to $56.

Looking the other way, we can similarly determine the places of resistance that the price has to face. And here we see that the price bounced off a very strong resistance at $114, only when it breaks it and positively tests it will move towards the resistance at $134.

The CHOP index indicates that the energy has been consumed, the MACD indicates that the uptrend is maintained, while the RSI rebounded from the upper limit of the range, which confirms the initiated price correction.

BNB Review 4HInterval Looking at BNB vs USDT, also on a four-hour timeframe. First of all, using the blue lines, we can mark the downtrend channel from which the price went up.

As we can see from the unfolding of the fib based trend extension tool, the price stays just above the first support zone from $247 to $242, however, when the price falls below this zone, we can see a drop around the second strong zone from $234 to $229.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we have the first very strong resistance at the price of $ 253, only when the price positively tests it should try to attack the level of $ 261.

When we turn on the EMA Cross 10 and 30, we can see the confirmation of the uptrend. The CHOP index indicates that we have a lot of energy for the next move. The MACD indicator struggles to maintain a local uptrend. On the other hand, on the RSI we are moving in the upper limit, but we have some space for the price to try to attack the first resistance.

BTC/USDT 4H Interval Review Hello everyone, I invite you to check the current situation on the BTC pair to USDT, taking into account the four-hour interval. First, we will use blue lines to mark the local channel of the sideways trend, from which the price goes up, in the situation of exiting by the height of the channel, we will find ourselves in the place of the last peak, which could reverse the direction of the price.

Now we can move on to marking the places of support in the event of a correction. And here, in the first place, it is worth marking the support zone from $ 30,673 to $ 30,389, however, when we fall below this zone, we can see a drop around the second zone at the levels of $ 30,163 to $ 29,936.

Looking the other way, in a similar way, using the trend based fib extension tool, we can determine the places of resistance. First, we will mark the resistance zone from $31,215 to $31,463, when we manage to break out of it upwards and positively test, we will see a movement towards the second zone from $31,858 to $32,137.

When we turn on the moving average ema cross 10 and 30, we will notice that they are in a local uptrend.

The CHOP index which indicates that energy is starting to be recovered, the MACD indicator indicates a strong upward move, while the RSI is moving in the upper part of the range, which may affect the price rebound in the coming hours.

Daily Market Analysis - MONDAY JULY 03, 2023Key News:

USA - Independence Day - Early close at 13:00

UK - Manufacturing PMI (Jun)

USA - ISM Manufacturing PMI (Jun)

Friday marked a momentous day on Wall Street as the three major indices experienced a robust surge, igniting a wave of optimism among investors. Notably, the Nasdaq, renowned for its focus on technology stocks, achieved an extraordinary feat by posting its largest first-half gain in the past 40 years. This remarkable milestone underscored the resiliency and strength of the technology sector, which has been a driving force behind the market's upward trajectory.

Adding to the positive sentiment was the phenomenal achievement of tech giant Apple, as it soared to a market valuation of $3 trillion. This significant milestone was a testament to the company's enduring appeal and relentless pursuit of innovation. Not since January 2022 had Apple reached such heights, and this remarkable accomplishment further solidified its position as one of the most influential and valuable companies in the world.

Apple's stock performance on Friday was nothing short of impressive. Closing at $193.97, it recorded a notable increase of 2.3%, with the stock even reaching a new all-time high of $194.48. This surge in Apple's stock price was fueled by a combination of factors, including the growing investor enthusiasm for growth stocks and the unwavering confidence in Apple's ability to conquer new markets.

Investors' renewed faith in growth stocks, particularly in the technology sector, has been a driving force behind the recent market surge. The allure of exponential growth potential and groundbreaking innovations has captivated market participants, leading to increased allocations in companies like Apple. Moreover, Apple's unwavering commitment to excellence and its track record of success have bolstered investor confidence, making it an attractive choice for many.

Apple's ability to penetrate and thrive in new markets has further fueled investor optimism. The company's forays into various sectors, such as healthcare, augmented reality, and autonomous vehicles, have been met with great anticipation. Investors believe that Apple's strong brand, vast resources, and exceptional product ecosystem position it favorably to succeed in these emerging industries. This confidence in Apple's long-term prospects has propelled its stock to new heights.

As the market continues to evolve and navigate through various challenges, the impressive performance of the Nasdaq and Apple serves as a beacon of hope and optimism. Their achievements not only symbolize the resilience of the technology sector but also provide a glimmer of possibility for future growth and innovation. Investors are closely watching these developments, eager to capitalize on the momentum and potential opportunities that lie ahead in the ever-evolving world of technology.

Apple stock daily chart

On the last day of the second quarter, investors displayed a heightened level of interest, primarily influenced by the Federal Reserve's closely observed indicators, which pointed to a moderation in US inflation. According to a report released by the Commerce Department, the Personal Consumption Expenditures (PCE) index showed a 3.8% increase, lower than the 4.3% figure recorded in April. When excluding the volatile prices of food and energy, the core PCE index saw a growth of 0.3%, slightly lower than the previous month's 0.4% rise.

BEA, US Personal Consumption Expenditures (PCE) index

The release of this data has instilled optimism among investors, raising the possibility that the Federal Reserve's cycle of raising interest rates could be approaching its conclusion. The decrease in Treasury yields, which was triggered by the alleviation of inflationary pressures, has played a role in fostering this positive market sentiment. Burns McKinney, a portfolio manager at NFJ Investment Group in Dallas, Texas, emphasized the impact of declining yields on the overall market conditions.

In terms of performance, the Nasdaq index delivered its strongest first-half showing in four decades, delivering a remarkable gain of over 31%. Notably, the Nasdaq 100 index, comprising prominent technology stocks, achieved its highest first-half gain on record, surging by approximately 39%.

On Friday, the S&P 500's growth index experienced a rise of 1.4%. Alongside Apple, other popular stocks favored by investors, including Microsoft, Nvidia, Amazon, and Meta Platforms, significantly contributed to the positive performance of the S&P 500. These stocks registered gains ranging from 1.6% to 3.6%, capitalizing on their impressive rallies propelled by strong earnings and the increasing interest in artificial intelligence.

S&P 500 indice daily chart

NASDAQ indice daily chart

As we embark on the first full week of July, there are several noteworthy events lined up on the economic calendar.

One such event is the Reserve Bank of Australia (RBA) rate decision, scheduled for Tuesday at 5:30 am GMT+1. This decision holds significant interest as market participants eagerly await to see whether the central bank will increase its Official Cash Rate (OCR) by 25 basis points (bp) to 4.35% or maintain the status quo. The RBA's rate decisions have been closely monitored, particularly due to the surprise 25bp rate hikes in the previous two meetings.

The most recent monthly Consumer Price Index (CPI) data revealed a 5.6% increase in the twelve months leading up to May. Although this figure is lower than April's 6.8% and market expectations of 6.1%, it still plays a role in shaping the RBA's decision-making process. Additionally, strong employment data and uncertainties surrounding China's economic recovery have contributed to a 63% probability of the RBA keeping rates unchanged this week.

Market participants will be closely watching the outcome of the RBA rate decision as it has the potential to impact not only the Australian economy but also global market sentiments.

Australia interest rate

In the United States, the upcoming releases of the ISM Manufacturing and Services Purchasing Managers' Index (PMI) will draw considerable attention. The Services PMI has been indicating contractionary conditions for several months, and the release scheduled for Monday at 3:00 pm GMT+1 is expected to continue this trend. Forecasts suggest a range between 48.3 and 46.7 for the Services PMI.

On Thursday at 3:00 pm GMT+1, the ISM Services PMI will be released, which has remained in expansionary territory but experienced a decline from 51.9 in April to 50.3 in May. The median expectation for June's release is 51.0. It is worth noting that the past three months have exhibited a range between 52.0 and 50.0 in the Services PMI readings.

These PMI releases provide valuable insights into the health of the manufacturing and services sectors in the US. Market participants will be closely monitoring these indicators as they can influence market sentiment and provide indications of economic trends and business activity levels.

US ISM Purchasing Managers Index (PMI)

One of the most highly anticipated data releases in the United States this week will be related to the labor market indicators. On a day preceding the non-farm payroll report for June, both the ADP non-farm employment change and JOLTS job openings data will be published at 1:30 pm GMT+1.

Market participants will closely watch these indicators as they provide crucial insights into the state of the labor market. They serve as important precursors to the official non-farm payroll report, which is scheduled for release on Friday. The median consensus among analysts is for an addition of 225,000 new payrolls in June, which marks a decrease from the robust figure of 339,000 recorded in May.

In addition, the unemployment rate is expected to remain unchanged at 3.7%, while average hourly earnings are projected to match the previous month's value of 0.3%. It is worth noting that a strong jobs report for June would increase the likelihood of a rate hike later in the month.

These labor market indicators are closely monitored as they provide valuable insights into the overall health of the US economy, the pace of job creation, and potential wage growth. The data can significantly impact market sentiment and influence monetary policy decisions.

US Unemployment rate

In its June meeting, the Federal Open Market Committee (FOMC) decided to maintain the Federal Funds target rate at its existing level. However, the committee signaled a hawkish stance, indicating a potentially more aggressive approach to monetary policy. This was reflected in the FOMC's dot plot, which outlines individual policymakers' projections for interest rates.

Based on the dot plot from May, the FOMC projected two additional rate increases by the end of 2023. This suggests a tightening monetary policy in the near future. Market participants have taken note of this guidance, and as of now, they are pricing in an 80% probability of a 25 basis point hike at the next FOMC meeting scheduled for July 26.

Following the anticipated rate hike in July, there is speculation that the FOMC may pause its tightening cycle and potentially even consider rate cuts in 2024. However, it's important to note that market expectations and projections can change based on incoming economic data and the evolving policy stance of the Federal Reserve.

These market expectations regarding future rate movements are crucial for investors and can significantly impact various asset classes and market sentiment. Traders and market participants closely monitor such probabilities and projections to make informed decisions and position themselves accordingly in the financial markets.

FTM/USDT 4H ReviewHello everyone, let's look at the FTM to USDT chart on a 4-hour timeframe. As you can see, the price has broken out of the local downtrend line.

Let's start with the support line and as you can see the first significant support is at $0.25, then we have the second support at $0.20 and then the third support at $0.16.

Looking the other way, we can determine a significant resistance zone that the price has to face from $0.35 to $0.39, only when we move up from this zone, the price can move towards resistance at $0.46.

The CHOP indicator indicates the ending energy, which gives small price movements, the MACD tries to return to the local uptrend, while the RSI after a visible rebound, we have an attempt to return to the uptrend.

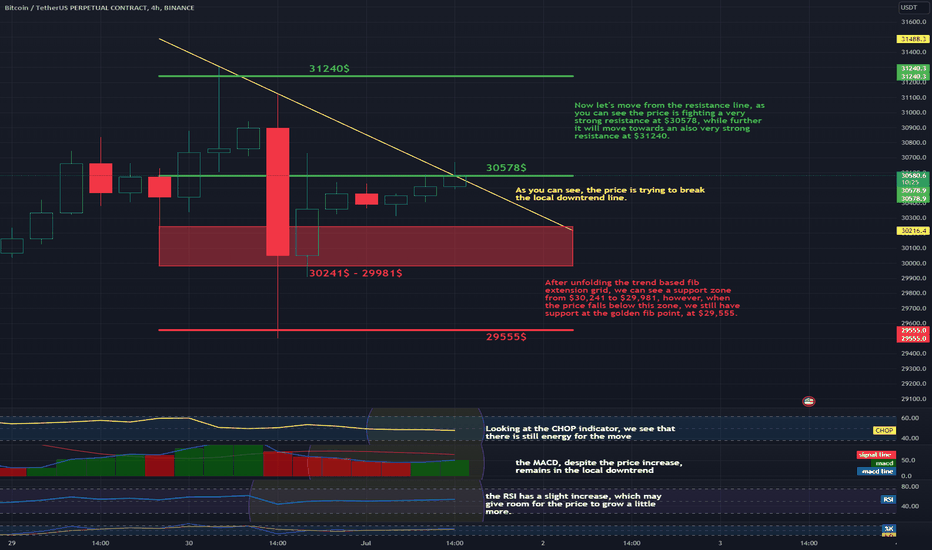

BTCUSDT 4H Interval ReviewHello everyone, let's look at the BTC to USDT chart on a 4-hour timeframe. As you can see, the price is trying to break the local downtrend line.

After unfolding the trend based fib extension grid, we can see a support zone from $30,241 to $29,981, however, when the price falls below this zone, we still have support at the golden fib point, at $29,555.

Now let's move from the resistance line, as you can see the price is fighting a very strong resistance at $30578, while further it will move towards an also very strong resistance at $31240.

Looking at the CHOP indicator, we see that there is still energy for the move, the MACD, despite the price increase, remains in the local downtrend, and the RSI has a slight increase, which may give room for the price to grow a little more.

BNB/USDT 4H Interval ReviewI invite you to the third chart, this time BNB on a four-hour interval. As we can see, the price moved down from channel A of the uptrend, then the price moved in channel B of the downtrend, in which the low was higher than in channel A. Which gave us an upward exit from channel two and a move along the local uptrend line.

Using the trend based fib extension tool, we will check support places for the BNB price. And here you can immediately see that we have a support zone from $234 to $229, which is currently holding the price. However, when we fall below this zone, the price has a second very strong support zone from $221 to $216.

Looking the other way, we can similarly determine the places of resistance that the price has to face. And similarly, we will mark two zones through which the price must pass in order to continue its growth. The first zone starts at the price of $238 and ends at the level of $242, when the price goes up from it, it will move towards the second zone at the levels of $247 to $253.

Here it is worth looking at the EMA cross 10 and 30, as we can see that the red line of the cross 10 ema is approaching the intersection of the green 30 from below, which should result in an uptrend change.

The CHOP index indicates that we have the energy to continue the move, the MACD indicates maintaining an uptrend, while the RSI is moving in an uptrend, with small rebounds, but there is room for the price to go higher in the current moves.

ETH/USDT 1D Review Hello everyone, let's look at the ETH to USDT chart on the 1D time frame. As you can see, the price is holding at the local uptrend line.

Let's start with determining the supports. And here we see that first we have a zone from $1866 to $1822 where the price is holding, then we have a second very strong support zone from $1752 to $1701.

Now let's move to the price resistance, in this situation the first zone is $1890 to $1934, once price breaks it it will go towards the $1971 to $2008 zone.

Looking at the CHOP indicator, we see that there is more and more energy, the MACD indicates the maintenance of the local uptrend, while the RSI shows that small price corrections give the indicator a rebound, which creates room for another increase.

Daily Market Analysis - FRIDAY JUNE 30, 2023Key News:

UK - GDP (YoY) (Q1)

UK - GDP (QoQ) (Q1)

Eurozone - CPI (YoY) (Jun)

USA - Core PCE Price Index (MoM) (May)

Thursday witnessed a modest upturn in US stock indices, primarily driven by a surge in bank shares following the Federal Reserve's positive outcome of the annual stress test. Moreover, the release of robust economic data further fueled expectations of additional interest rate hikes by the central bank.

Prominent financial institutions like Wells Fargo, Goldman Sachs, and JPMorgan Chase experienced notable increases in their share prices, surpassing 3% and 4% respectively. This surge can be attributed to the stress test results, which showcased their resilience and ability to withstand a severe economic downturn.

The S&P 500 banks index, reflecting the performance of major banks, witnessed a noteworthy climb of over 2%. This rise contributed to a broader relief rally, which in turn boosted the KBW Regional Banking index by 1.5%.

Wells Frago stock daily chart

Goldman Sachs stock daily chart

S&P 500 daily chart

Investors exhibited a clear inclination towards economically sensitive sectors, while growth sectors tied to interest rates experienced less activity, thanks to positive data that alleviated concerns of an imminent recession.

The Russell 2000 index, which encompasses small-cap stocks, witnessed a notable gain of over 1%. This rise indicated investors' confidence in smaller companies and their potential for economic growth.

Among the sectors within the S&P 500, the materials index emerged as the leader of the upswing. This sector's strong performance further reinforced the market's preference for areas tied to economic expansion and industrial activity.

Nasdaq daily chart

The US dollar index, a measure of the USD's performance against a basket of major currencies, surged to a two-week high in response to encouraging economic data that highlighted a strong labor market. This positive development potentially grants the Federal Reserve the flexibility to continue its trajectory of raising interest rates. The dollar index experienced a 0.35% climb, reaching a level of 103.310. This marks its highest point since June 13 when it peaked at 103.44. The strengthening of the US dollar indicates the market's response to the optimistic economic indicators, suggesting an increased likelihood of further interest rate hikes by the Federal Reserve.

US Dollar Currency Index daily chart

Market expectations for a 25 basis-point rate hike by the Federal Reserve at its upcoming July meeting experienced an increase, rising from 81.8% in the previous session to 86.8%, as reported by CME's FedWatch Tool. This higher probability indicates a growing anticipation among market participants for the central bank to raise interest rates.

Furthermore, the likelihood of a rate cut occurring later in the year has been entirely ruled out. This suggests that market sentiment has shifted towards a more hawkish outlook, with reduced expectations for accommodative monetary policy measures such as rate cuts. The market's assessment aligns with the evolving economic landscape and positive data that may provide the Federal Reserve with the impetus to tighten monetary policy in response to a robust economy.

USD/JPY daily chart

The US dollar continued to exhibit strength against the Japanese yen, extending its streak for the third consecutive day and reaching a fresh 7.5-month high at 144.90 yen. The persistent divergence in monetary policy plans between the US Federal Reserve and the Bank of Japan is expected to contribute to the yen's ongoing weakness against the dollar. The yen declined by 0.23% against the greenback, resulting in an exchange rate of 144.83 yen per dollar. Investors are attentively monitoring any potential intervention by the Bank of Japan in the currency, as it has occurred previously around the 145 yen level.

Meanwhile, gold prices remained relatively unchanged and reflected significant losses for the month of June. This decline can be attributed to robust economic data from the United States, which bolstered risk appetite and raised concerns about potential interest rate hikes by the Federal Reserve.

Earlier in the week, gold prices hit three-month lows, largely driven by a series of hawkish signals from Fed officials, with particular emphasis placed on comments made by Chair Jerome Powell.

On Friday, the release of the Personal Consumption Expenditure Index (PCE), the Fed's preferred measure of inflation, is scheduled for May. Economists surveyed by Reuters anticipate that core rates will remain stable at 4.7%, providing insight into the level of inflationary pressures.

DOT 4Hinterval ReviewAs the third, we will check the DOT chart on the four-hour interval. As we can see, the price is above the uptrend line marked in yellow.

Let's start by marking the price support spots and we see that we first have support at $4.84 but if the price goes lower then we have another support at $4.72 and then we have a very strong support zone at $4.60 $ to $4.42.

Looking the other way, we can similarly determine the places of resistance that the price has to face. And here we see that currently DOT does not have enough strength to break the resistance zone from $5.04 to $5.27, but when this happens, we have another very strong resistance at $5.56, only after a positive test of this resistance we will be able to see a further price increase.

When we turn on the EMA Cross 200, we will see an attempt to return the price to a strong uptrend, but at the moment the price is fighting to maintain this trend.

The CHOP index indicates that there is still a lot of energy to be used, the MACD indicates a return to the local downtrend, while the RSI is in the process of recovering and we are approaching the lower end of the range, which may indicate the imminent end of the current recovery.

BNB/USDT Review 4hinterval - Resistance and SupportHello everyone, I invite you to review the chart of BNB in pair to USDT, on a four-hour interval. In the first place, using the yellow line, we can mark the uptrend line that did not hold the price, while currently, using the blue lines, we can mark the downtrend channel from which the price goes sideways.

Now let's move on to marking the places of support. We will use the Fib Retracement tool to mark the supports, and as you can see, we have the first very strong support at the price of $ 234.4, it is equal to 0.618 Fib, the so-called golden fibon point, the second support at the price of $ 228.2, and then we can see a decrease around 220 .1$, which is the location of the last price low.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we see that the price has no strength to break through the resistance at $238.3, however when it does, it still needs to break through the strong resistance from $243 to $249 for the price to move further towards the resistance at $257.4.

Please pay attention to the CHOP Index, which indicates that there is a lot of energy to move. The MACD indicator maintains a local downtrend. On the other hand, the RSI is moving around the lower border, which may give the price an increase in the coming hours.