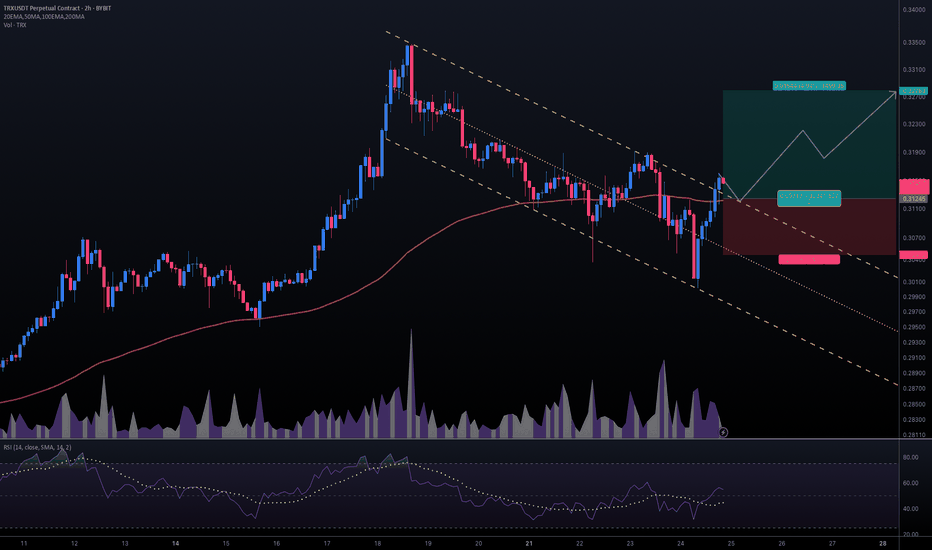

#TRXUSDT #2h (ByBit) Descending channel breakout and retestTron just regained 100EMA support and seems ready for bullish continuation after a pullback to it.

⚡️⚡️ #TRX/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (16.0X)

Amount: 5.1%

Entry Targets:

1) 0.31245

Take-Profit Targets:

1) 0.32789

Stop Targets:

1) 0.30472

Published By: @Zblaba

CRYPTOCAP:TRX BYBIT:TRXUSDT.P #2h #TRON #DPoS #L1 #Web3 trondao.org tron.network

Risk/Reward= 1:2.0

Expected Profit= +79.1%

Possible Loss= -39.6%

Dao

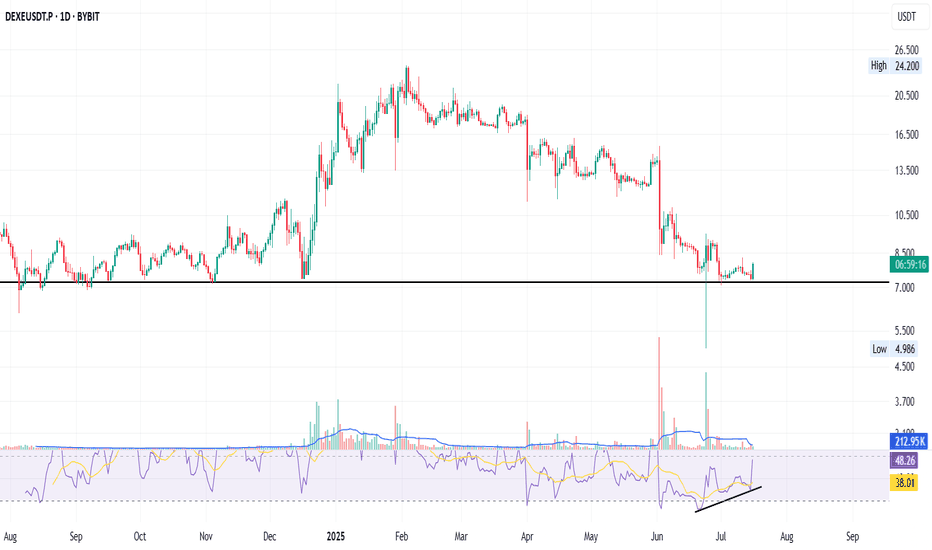

DEXE: Bounce + RSI Divergence + DeFi Strength

DEXE on the daily just bounced off an 11-month-old support - the key black line.

A strong bullish divergence on the RSI has been building for over a month — now confirming with momentum.

That long green wick under support? It’s signalling buyer interest and possible accumulation.

Fundamentals:

DEXE powers decentralized governance (DAO) with AI + DeFi alignment.

It enables transparent on-chain decision-making and sustainable DAO growth.

Backed by real partnerships, aiming for fair, merit-based participation.

I’m long: not financial advice.

Always take profits and manage risk.

Interaction is welcome.

TradeCityPro | MKRUSDT 70% Move?👋 Welcome to TradeCityPro Channel!

Let's analyze and review one of the best coins in the DAo area together and find another entry point together and update our previous triggers

🌐 Overview Bitcoin

Before starting today's altcoin analysis, let's look at Bitcoin on the 1-hour timeframe. Since yesterday, Bitcoin experienced a correction, which was necessary for the market, and it pulled back to the 102135 range. The next trigger for a long position will be a breakout above 104714.

Yesterday's correction, coupled with an increase in Bitcoin dominance, caused noticeable declines in some altcoins. This highlights the importance of monitoring BTC pairs in your checklist these days.

MakerDAO’s sharp increase in fees and growth in Total Value Locked (TVL) has fueled demand. On February 20, $156.77 million of MKR was burned, reducing supply. Growth in active addresses and trading volume has driven the price higher. Strong resistance at $1,800 may limit further growth. MakerDAO’s emergency offering has raised concerns about $3.1 billion USDC exposure.

📊 Weekly Timeframe

In the weekly timeframe, the token has seen a 95% gain on the coin, which is a good sign in these market conditions!

Also, in this timeframe, we are in an opening triangle, which is characterized by high volatility, and we are constantly moving towards the bottom and top of this triangle, regardless of the ceiling and floor or support and resistance, and the exit from this triangle will also be sharp.

In this timeframe, we did not have a trigger in advance to say that we could buy or anything else, and it moved very sharply. If you lose, it is normal and do not blame yourself and your strategy.

After exiting this triangle and breaking 2.182, we can have a good trigger to buy, and for now, if you bought and held during this fluctuation and are in profit above 50%, it is logical to save profit, but if you did FOMO and bought, it is better not to continue trading and be busy watching the tutorial for now.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends!

Alikze »» W | Formation of the Double Bottom pattern - 1D🔍 Technical analysis: Formation of a Double Bottom pattern in a descending channel

📣 BINANCE:WUSDT It is moving in a descending channel on the daily time frame.

🟢 In the Buyer Zone, by forming a Double Bottom and a candlestick pattern, it can continue its growth in the first step to the first supply zone.

🟢 If an inverted head and shoulders pattern is formed in the supply zone, it can continue its upward trend to the next supply zone.

🟢 Therefore, if the Buyer Zone is maintained, an upward trend in the form of a three-wave up to the 40 cent range is expected.

»»»«««»»»«««»»»«««

Please support this idea 💡 with a LIKE 👍 and COMMENT 💬 if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email 📧 in the future.

Thanks for your continued support.🙏

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

TradeCityPro | APE: Tracking the Downtrend Dynamics👋 Welcome to TradeCityPro!

In this analysis, I want to discuss the APE coin, which is currently experiencing a downtrend with each Bitcoin correction triggering a new bearish leg.

📅 Weekly Time Frame

In the weekly timeframe, we are witnessing a significant downward trend that began from the ATH at the 17.538 area. After multiple bearish legs, it has now recorded its main bottom at 0.563. We also have a descending trendline that has been tested several times and most recently had a fake breakout, failing to activate the trendline trigger at 2.291.

🔍 Currently, following the fake breakout of the descending trendline, a significant amount of selling volume has entered the market, and the price has returned to the crucial support at 0.563. The RSI also has a significant support level at 40.33, and a concurrent break below 0.563 and this RSI support could propel the coin toward a new historical low.

🔽 On the other hand, if support holds and the price moves toward and breaks the trendline trigger at 2.291, we would confirm a trend reversal, potentially initiating a new upward trend.

📅 Daily Time Frame

In the daily timeframe, we can observe more details of the price's downward movement. As seen, after the price reacted to and was rejected from 1.931, it entered a bearish trend, accompanied by a descending trendline.

📊 Overall market volume is declining, but after breaking below 0.848, a significant amount of selling volume entered the market, currently favoring sellers.

📉 The last bearish leg occurred after the price was rejected from 0.997 and broke below 0.848, dropping to the main support at 0.547. The market's momentum is strongly bearish, and it seems poised to continue this trend.

✨ However, as observed, a rounding bottom formation is taking shape at 0.637, and the price could potentially correct upwards. If the floor at 0.637 breaks, we can confirm that a new bearish leg has commenced, potentially driving the price towards lower lows and even breaking below the support at 0.547.

🔼 If the trendline is broken, the trendline trigger at 0.848 could be considered, but the main trigger for confirming a trend reversal is at 0.997. If this area breaks, the price could potentially head back towards 1.931.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

AI Agent Virtual's - The potential of DAO Hedge funds- Bull CaseExtremely bullish on AI victuals

AI Agents assign trust scores to everyone that interacts with them, enabling an order book of the most reliable alpha from every conversation.

Some prices i see as attainable moving into the trump inauguration and beyond.

The future is here. Read further below price points for a in depth look into Agent virtuals

5 Billion Market Cap: $4.78

10 Billion Market Cap: $9.56

15 Billion Market Cap: $14.33

50 Billion Market Cap: $47.78

Support : $1.66

First resistance: $1.88

Resistance: $2.88

Midterm target: $3.88

Paper Summary:

Core Idea: Proposes a "Marketplace of Trust" system to evaluate the reliability of information.

Mechanism:

User Recommendations: Human users provide recommendations (e.g., investment advice, content moderation).

AI Agent Trading: An AI agent places bets in a virtual market based on these recommendations.

Trust Score Calculation: Real-world outcomes of the AI's bets determine each user's "trust score."

Social Reinforcement: Publicly displayed trust scores incentivize users to provide reliable information.

Key Goals:

Align individual incentives with honest participation.

Leverage collective intelligence to surface trustworthy information.

Applications:

Investing, trading, content moderation, decentralized governance, open source development.

Trading Thesis:

Market Context:

Attractive Sector: AI Virtual likely belongs to a growing sector (AI/Virtual Reality) within the broader cryptocurrency market.

Market Cap: $2 billion within a $15 billion sector and a $4 trillion crypto market suggests potential for significant growth.

Thesis: Long-Term Growth Potential with High Risk.

Bullish Arguments:

First-mover Advantage: If the "Marketplace of Trust" concept gains traction and is successfully implemented, AI Virtual could become a leading player in this niche.

Sector Growth: The AI Virtual sector is poised for significant growth driven by advancements in AI, VR/AR technologies, and increasing demand for immersive experiences.

Cryptocurrency Adoption: Continued growth of the cryptocurrency market could significantly boost the value of AI Virtual.

Bearish Arguments:

Competition: The AI Virtual sector is likely to become increasingly competitive with new entrants and innovative technologies.

Technological Risks: The success of the "Marketplace of Trust" depends heavily on the effectiveness of the AI agent and the robustness of the system against manipulation.

Regulatory Uncertainty: The cryptocurrency market faces regulatory uncertainty, which could negatively impact the performance of AI Virtual.

Trading Strategy:

Long-Term Investment: For long-term investors, AI Virtual may offer significant upside potential, but with increased risk tolerance.

Diversification: Diversify holdings within the AI Virtual sector and the broader cryptocurrency market to mitigate risk.

Continuous Monitoring: Closely monitor the development and adoption of the "Marketplace of Trust" technology, competitive landscape, and regulatory developments.

Disclaimer: This is a general market analysis and not financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Key Considerations:

Team: Evaluate the strength of the development team, their track record, and their ability to execute the project.

Technology: Assess the technological feasibility and potential of the "Marketplace of Trust" system.

Community: Analyze the size and engagement of the community surrounding AI Virtual.

By carefully considering these factors and conducting thorough due diligence, not financial advice.

Do you believe in DAO? People is here, prove it!Hello guys,

One of the cryptocurrencies that has been largely overlooked and has a great chart is this one.

I've set a very wide stop-loss to ensure protection against the tricks of liquidity providers.

However, we can still expect a risk-to-reward ratio of 5 from this trade.

If you're more risk-tolerant, you can place your stop at 0.04120 and aim for a risk-to-reward ratio of 6.

Of course, all these take-profits (TPs) are planned before the bull run storms.

During the bull run, the best strategy is to trail your stop-loss in profit. 🚀

Core DAO ($COREUSDT): Daily Chart - Bullish Momentum SetupI spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Core DAO ( OKX:COREUSDT ): Daily Chart Analysis for a Bullish Momentum Setup

Trade Setup:

- Entry Price: $1.3700 (Activated)

- Stop-Loss: $0.8576

- Take-Profit Targets:

- TP1: $2.5710

- TP2: $3.3331

Fundamental Analysis:

Core DAO ( OKX:COREUSDT ) is gaining traction as a blockchain platform focused on decentralized autonomous organizations (DAOs). Built to empower community-driven projects, MIL:CORE has seen increased adoption due to its robust governance model and efficient transaction capabilities. The platform’s ability to attract DeFi and dApp developers is driving its growth in the blockchain space.

With its focus on decentralization and governance, OKX:COREUSDT is well-positioned to capitalize on the growing interest in DAO-driven ecosystems. Recent network upgrades have bolstered confidence in its scalability and reliability.

Technical Analysis (Daily Timeframe):

- Current Price: $1.3720

- Moving Averages:

- 50-Day SMA: $1.1500

- 200-Day SMA: $1.0500

- Relative Strength Index (RSI): Currently at 66, signalling strong bullish momentum.

- Support and Resistance Levels:

- Support: $1.2000

- Resistance: $1.5000

The daily chart highlights a breakout above the $1.3000 resistance level, supported by increasing volume. The bullish continuation pattern suggests further upside potential toward the first take-profit target of $2.5710, with a long-term target at $3.3331.

Market Sentiment:

OKX:COREUSDT has witnessed a surge in trading volume, reflecting growing market interest. The token's association with emerging DAO projects and recent ecosystem partnerships have contributed to positive sentiment and increased investor confidence.

Risk Management:

The stop-loss at $0.8576 limits downside exposure, while the take-profit targets offer exceptional reward potential. TP1 provides an 88% return, while TP2 offers a 143% gain, making this setup ideal for swing traders aiming to capture significant upside.

Key Takeaways:

- OKX:COREUSDT is breaking out with strong bullish momentum, driven by growing adoption and ecosystem development.

- The trade offers excellent risk-to-reward ratios, suitable for both swing and long-term trading strategies.

- Discipline in execution is key to navigating potential market volatility.

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

TRON Partners With Chainlink to Strengthen Its DeFi EcosystemTRON ( AMEX:TRX ) has made a strategic move by joining forces with Chainlink SCALE, effectively making Chainlink Data Feeds the official oracle provider for TRON’s decentralized finance (DeFi) ecosystem. This collaboration marks a significant upgrade to TRON’s blockchain infrastructure, introducing high-quality and decentralized oracle solutions to TRON’s $6.5 billion total value locked (TVL) in DeFi.

TRON DAO Partners with Chainlink SCALE

In a strategic shift, TRON DAO recently announced its partnership with Chainlink, one of the most recognized decentralized computing platforms globally. The integration enables TRON to harness Chainlink’s industry-leading oracles, which will replace WINkLink as the primary oracle solution for TRON's ecosystem. With Chainlink Data Feeds securing more than $6.5 billion in TVL within TRON’s DeFi applications—such as JustLend and JustStable—the partnership promises to enhance security, precision, and reliability in TRON’s DeFi sector.

According to TRON’s founder, Justin Sun, joining Chainlink SCALE will ensure that TRON’s DeFi environment has dependable data, a foundational necessity for the expansion of DeFi applications on the network. This new system allows developers on TRON to access high-quality pricing and market data, contributing to a more robust and scalable decentralized economy.

Driving the Next Generation of DeFi on TRON

The adoption of Chainlink Data Feeds on TRON means more than just a technical upgrade. It represents a pathway to expand TRON’s ecosystem while offering enhanced stability, increased scalability, and reduced operational costs for early-stage DeFi applications. Chainlink SCALE introduces a model where TRON initially covers certain gas fees for using Chainlink’s oracles, fostering DeFi growth until the ecosystem matures and user fees can sustain these costs independently.

Thodoris Karakostas, head of blockchain partnerships at Chainlink Labs, voiced his enthusiasm, noting that Chainlink’s high security and reliable on-chain market data provide TRON developers with the tools needed to create the next generation of DeFi applications. This integration, he emphasized, will bolster TRON’s foundation for a decentralized internet—a vision at the core of TRON DAO’s mission.

TRON’s Commitment to Growth and Innovation

In addition to the Chainlink partnership, Justin Sun recently commented on TRON's growing ecosystem and the anticipated rise of memecoins on the platform. He highlighted the community’s role in supporting these developments and expressed confidence in a new growth phase if AMEX:TRX surpasses its previous peak, potentially triggering a wave of FOMO-driven interest in TRON’s DeFi and memecoin markets.

This commitment to innovation signals a brighter future for TRON as a hub of decentralized finance, and Chainlink’s proven track record in supporting high-volume transactions and delivering reliable data positions TRON advantageously.

Technical Analysis

Currently, AMEX:TRX is trading within an overbought channel with an RSI of 77, reflecting its strong demand following the Chainlink partnership announcement. This movement aligns with previous trends observed in AMEX:TRX ’s price behavior, where periods of bearish momentum were often followed by bullish reversals. This pattern indicates TRX’s resilience and suggests potential for sustained price growth, especially with heightened interest from institutional investors and developers exploring TRON’s DeFi space.

From a technical standpoint, AMEX:TRX offers a relatively stable investment opportunity, appealing to traders looking for a balance between growth and moderate risk. The blockchain’s notable transaction speed and scalability, combined with its new oracle integration, are factors that solidify its position as one of the most secure and reliable assets within the DeFi landscape.

The Strategic Implications for Investors

With Chainlink Data Feeds now part of TRON’s foundational infrastructure, the TRON network is positioned to enhance its appeal for DeFi developers and investors alike. The partnership not only promises to make TRON’s DeFi ecosystem more resilient and scalable but also strengthens its ecosystem’s security—vital as TRON seeks to decentralize the internet through blockchain technology and decentralized applications (dApps).

The long-term implications are clear: TRON’s partnership with Chainlink represents a new era for its DeFi ecosystem. As the TRON DAO continues to expand, AMEX:TRX stands poised to benefit from increased market confidence and user adoption. For investors, this development presents an attractive opportunity to capitalize on TRON’s expanding ecosystem and DeFi potential.

In summary, the TRON-Chainlink collaboration marks a transformative milestone in TRON’s roadmap. With enhanced infrastructure, reduced operational costs, and a renewed commitment to scalability, AMEX:TRX solidifies its role as a key player in the decentralized finance sector. For investors, TRON’s commitment to innovation and growth signals a robust opportunity, particularly in the evolving DeFi space.

#UNFIUSDT 1D (ByBit) Descending channel breakout & retestUnifi Protocol regained 50MA support and looks strong, mid-term recovery towards 200MA resistance seems in play, probably after a pull-back.

⚡️⚡️ #UNFI/USDT ⚡️⚡️

Exchanges: ByBit USDT, Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (2.0X)

Amount: 5.5%

Current Price:

3.1685

Entry Zone:

3.0450 - 2.7630

Take-Profit Targets:

1) 3.5395

1) 4.0175

1) 4.4960

Stop Targets:

1) 2.3725

Published By: @Zblaba

NYSE:UNFI BYBIT:UNFIUSDT.P #1D #UnifiProtocol #DAO #DeFi unifiprotocol.com

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +43.8% | +76.7% | +109.6%

Possible Loss= -36.6%

Estimated Gaintime= 1-2 months

#AAVEUSDT #1h (OKX Futures) Rising wedge breakdown and retestAave just printed a gravestone doji followed by a shooting star, seems likely to retrace down to 200MA support.

⚡️⚡️ #AAVE/USDT ⚡️⚡️

Exchanges: OKX Futures

Signal Type: Regular (Short)

Leverage: Isolated (5.0X)

Amount: 4.5%

Current Price:

95.44

Entry Targets:

1) 95.87

Take-Profit Targets:

1) 87.43

Stop Targets:

1) 100.10

Published By: @Zblaba

CRYPTOCAP:AAVE OKX:AAVEUSDT.P #1h #DeFi #DAO aave.com

Risk/Reward= 1:2.0

Expected Profit= +44.0%

Possible Loss= -22.1%

Estimated Gaintime= 3 days

#YFIUSDT #2h (OKX Futures) Descending trendline break and retestYearn Finance printed a morning star then regained 50MA support, seems about to make another impulse on Low TF.

⚡️⚡️ #YFI/USDT ⚡️⚡️

Exchanges: OKX Futures

Signal Type: Regular (Long)

Leverage: Isolated (6.0X)

Amount: 5.0%

Current Price:

5841

Entry Targets:

1) 5802

Take-Profit Targets:

1) 6188

Stop Targets:

1) 5609

Published By: @Zblaba

CRYPTOCAP:YFI OKX:YFIUSDT.P #YearnFinance #DeFi #Yield yearn.fi

Risk/Reward= 1:2.0

Expected Profit= +39.9%

Possible Loss= -20.0%

Estimated Gaintime= 4 days

#UNFIUSDT #4h (ByBit) Rising wedge near breakdownUnifi Protocol printed an evening star and seems about to lost 200MA support, let's try a short.

⚡️⚡️ #UNFI/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Short)

Leverage: Isolated (5.0X)

Amount: 5.1%

Current Price:

4.5160

Entry Targets:

1) 4.5045

Take-Profit Targets:

1) 3.803

Stop Targets:

1) 4.856

Published By: @Zblaba

NYSE:UNFI BYBIT:UNFIUSDT.P #Unifi #DAO unifiprotocol.com

Risk/Reward= 1:2.0

Expected Profit= +77.9%

Possible Loss= -39.0%

Estimated Gaintime= 1 week

#YFIUSDT #4h (OKX Futures) Falling wedge breakoutYearn Finance regained 100EMA support then pulled back to it after forming a dragonfly doji, looks like bullish continuation is in play.

⚡️⚡️ #YFI/USDT ⚡️⚡️

Exchanges: OKX Futures

Signal Type: Regular (Long)

Leverage: Isolated (9.0X)

Amount: 4.9%

Current Price:

7065

Entry Targets:

1) 7056

Take-Profit Targets:

1) 7374

Stop Targets:

1) 6897

Published By: @Zblaba

CRYPTOCAP:YFI OKX:YFIUSDT.P #YearnFinance #DeFi yearn.fi

Risk/Reward= 1:2.0

Expected Profit= +40.6%

Possible Loss= -20.3%

Estimated Gaintime= 1 week

KLiMA $2.70 | it's all about the weather the CARBON MARKET sometimes it rains

when it does

it pours

it' a $270 billion industry and KLiMA seem to be the only player for now

a thematic play that is valued at $35bn and was discounted at $12bn during its launched

yet participated by every ESG Player that put in around $2bn

half of which reside in one account

that handles the allocation and accommodation of

fresh investors for next play

Carbon Credits is around spot $35 per metric ton

most likely it shall capitalize on ALiENS cum Chloride spilling in Ohio

and the mother of all DRAMA... Carbon Credits which even SBF was dying to corner that space or market in the BAHAMAS

Alikze »» LDO | Wave 3 or C scenario in the ascending channelIt is moving in an upward channel in daily and weekly time. According to the movement structure of three successive waves, there has been a three-wave correction running inside the channel, and now a new kinetic movement is taking place. Demand has been met.

🔰 Therefore, if the recent correction is over and the combined correction does not occur, we should witness the continuation of the kinetic movement to the specified areas.

⚠️ In addition, if the green box is broken, there is a possibility of touching the bottom of the channel again.

»»»«««»»»«««»»»«««

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support.

Sincerely.❤️

»»»«««»»»«««»»»«««

#YFI/BTC 1W (Binance) Descending wedge breakout and retestYearn Finance has been down-trending for years in sats but is sitting on historical demand zone once again.

It has recently printed a bullish hammer on weekly, a decent bounce towards 100EMA resistance would make sense.

⚡️⚡️ #YFI/BTC ⚡️⚡️

Exchanges: Binance

Signal Type: Regular (Long)

Amount: 3.0%

Current Price:

0.1437

Entry Targets:

1) 0.1432

Take-Profit Targets:

1) 0.2879

Stop Targets:

1) 0.0949

Published By: @Zblaba

CRYPTOCAP:YFI BINANCE:YFIBTC #YearnFinance #DeFi yearn.fi

Risk/Reward= 1:3.0

Expected Profit= +101.0%

Possible Loss= -33.7%

Estimated Gaintime= 3-6 months

#AMB/BTC 2D (KuCoin) Descending channel breakout and retestAir DAO (f.k.a. Ambrosus) has been moving inside a big wedge and bounced back on oversold territory, forming a morning star.

Volume has not kicked in yet but once it does, looks like it will head towards 200MA resistance.

⚡️⚡️ #AMB/BTC ⚡️⚡️

Exchanges: KuCoin

Signal Type: Regular (Long)

Amount: 3.0%

Current Price:

0.0000001743

Entry Targets:

1) 0.0000001718

Take-Profit Targets:

1) 0.0000003992

Stop Targets:

1) 0.0000001149

Published By: @Zblaba

MIL:AMB KUCOIN:AMBBTC #AirDAO #Ambrosus #L1 airdao.io

Risk/Reward= 1:4.0

Expected Profit= +132.4%

Possible Loss= -33.1%

Estimated Gaintime= 2-4 months

Trading Strategy for #DAO/USDT Amidst Falling Wedge Breakout and"📈 #DAO/USDT Chart Update: Breakout from Falling Wedge, Retest Underway 🚀

The DAO token has recently broken out of a falling wedge pattern, signaling a potential reversal and bullish momentum. Currently in the retest phase, this presents an entry opportunity for traders.

🔍 Entry Strategy:

Planning to buy at the current market price (CMP) and considering additional purchases at 1.09$ during the retest.

🎯 Targets:

TP1: 1.26$

TP2: 1.33$

TP3: 1.5$

TP4: 1.8$

🛑 Stop Loss (SL):

Set at 1.0292$ to mitigate potential losses in case of adverse price movements.

It's crucial to emphasize the importance of conducting your own research (DYOR) before making any trading decisions. This information is provided for analysis purposes and not as financial advice. Stay informed and trade responsibly! 🚀"

DAOUSDT 🟢🚀 Premium Crypto Signal Alert! 📈

🔔 Signal: BUY

Asset: DAOUSDT

Technical Analysis:

Key Entry Point: A compelling buy signal triggered at 1.10 after a strong stop and retest at the 61% Fibonacci level.

Moving Average Support: Maintaining a bullish stance, DAOUSDT is trading above the 200-day moving average, reinforcing the positive trend.

Secondary Buy Zone: Another potential entry point identified at 0.85, offering an additional opportunity if needed.

📊 Trade Details:

Entry Point: 1.10

Secondary Entry: 0.85 (if required)

Target 1: 1.40

Target 2: 1.85

📈 Trade Analysis:

The 1.10 entry point aligns with a significant stop and retest at the 61% Fibonacci level, indicating a strong support zone.

Continuous trading above the 200-day moving average reinforces the bullish momentum.

A secondary buy zone at 0.85 provides flexibility in adapting to market conditions.

🔄 Additional Buy Zone:

Be prepared to execute in the secondary buy zone (0.85) if market dynamics necessitate it.

💡 Risk Management:

- Only use 5%-10% of your capital for this trade to mitigate risks.

- Do not invest your full capital; it's important to diversify and manage risk exposure.

- Consider setting a stop-loss at an appropriate level to protect your investment.

- Regularly monitor the trade and adjust stop-loss levels as needed.

📢 Spot Trading vs. Futures:

- Spot trading is a safer and more controlled approach, allowing for better risk management compared to the higher volatility and speculative nature of futures trading.

- Exercise caution and consider the potential risks associated with leveraged instruments.

🚨 Disclaimer:

Trading involves risks, and past performance does not guarantee future results. Exercise caution and conduct your research before making any financial decisions.

CRV: New DEFI BOOM in 2024?Exciting times are ahead for the decentralized finance (DeFi) space, and Curve DAO Token (CRV) is catching our attention with its bullish stance. The charts are painting a promising picture, and it seems like CRV is gearing up for new highs during the upcoming DeFi boom in 2024. Let's dive into the factors contributing to this bullish outlook. 📈🌐

The CRV Bullish Scenario:

Curve DAO Token (CRV) is exhibiting strong bullish signals, setting the stage for a potential uptrend. As we anticipate the next DeFi boom in 2024, CRV appears well-positioned to capitalize on the renewed interest in decentralized finance.

Technical Indicators:

Chart Patterns: CRV's chart patterns are aligning with traditional bullish formations, suggesting a positive momentum shift.

Volume Analysis: Increased trading volume is often a precursor to significant price movements. CRV's recent uptick in volume is indicative of growing interest and participation.

The DEFI Boom 2024 Catalyst:

The decentralized finance ecosystem is expected to experience another boom in 2024, driven by advancements, new projects, and increasing adoption. CRV, being a key player in the DeFi space, is likely to benefit from this overall market trend.

Anticipating New Highs:

With the convergence of bullish technical indicators and the broader DeFi market narrative, there's a strong case for anticipating new highs in CRV during the upcoming DeFi boom. Traders and investors alike should keep a close eye on developments in the DeFi space and CRV's price action.

Trading Strategy:

Technical Confirmation: Wait for additional technical confirmation, such as a breakout or sustained positive momentum, before entering a position.

Market Awareness: Stay informed about developments in the broader DeFi ecosystem, as they can influence CRV's price trajectory.

Risk Management: Implement sound risk management practices to safeguard your investments, especially in the dynamic and sometimes volatile DeFi market.

Conclusion:

As CRV sets the stage for a potentially bullish cycle, the DeFi boom in 2024 could catapult it to new highs. As always, approach the market with a strategic mindset, adapt to changing conditions, and may your trades be in sync with the rhythm of the crypto market.

❗️Get my 3 crypto trading indicators for FREE! Link below🔑