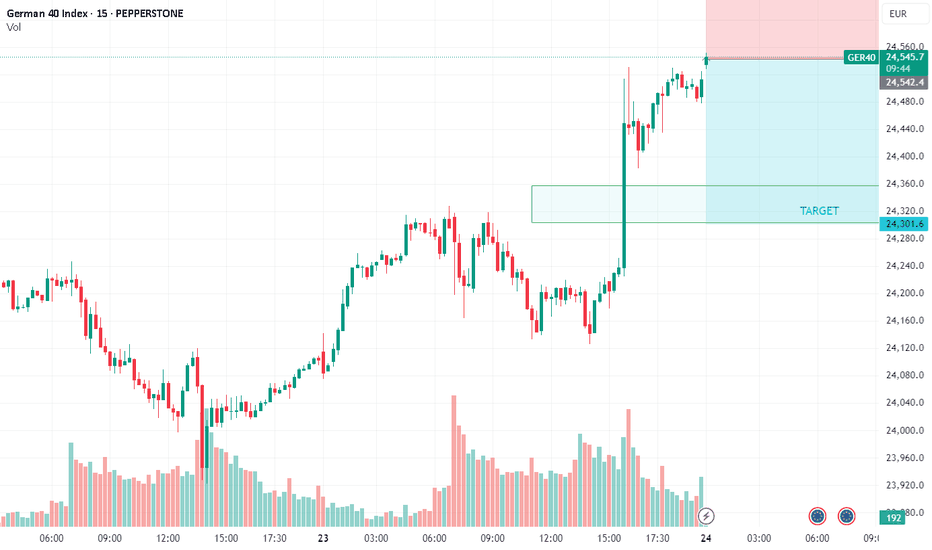

DAX/GER30 - TIME TO SHORT AT CURRENT PRICETeam, great win for the US30 on trade surplus 26 billion last month

expect to have great trade surplus over 300 billion

the Japanese went crazy 3.5% due to tariff drop from 25% down to 15%

The whole market has been pumping

We find an opportunity to SHORT THE DAX/GER 30 at the current level 24543-24556

STOP LOSS AT 24650

WITH TARGET at 24360-24320

PLEASE NOTE: once the price drop below 24500, bring stop loss to BE to protect your trade.

STICK TO THE PLAN.

Dax30

DAX / GER TIME TO PRINT MONEY ON SHORTTeam, i have not been posting DAX/GER for almost 3-4 weeks

now it is time to attack the DAX.

I have set two different target ,

ensure you take 60% and bring stop loss to BE

I also want to give you the time frame for target to hit.. do not expect today, however we could see the target for tomorrow or early next week

Sometimes i wait for the right moment to trade. DAX is very sophisticated to trade with, but if you have the patience, you can make money on them.

Surprising ups and downs in global indicesJune brought contrasting moves across global stock markets: while the U.S. and Asia posted gains, Europe struggled under pressure. Rising tensions between Iran and Israel, political instability in the EU, and shifting rate expectations fueled volatility. In search of stability, investors turned to U.S. tech and exporters — pushing the S&P 500 (#SP500) and Nasdaq 100 (#NQ100) higher.

Key market movers in June:

• #SP500 (+0.96%), Dow Jones (#DJI30) (+0.89%), #NQ100 (+0.94%) – buoyed by dovish Fed tone and Iran’s restrained response to U.S. strikes. #Tesla surged 8.2%, with #IBM also among top gainers.

• Hong Kong 50 (#HSI) (+3%) – lifted by strong retail data and hopes of new stimulus from China.

• Australia 200 (#ASX) (+1.25%) – boosted by RBA rate cut expectations and strong tech sector performance.

• France 40 (#CAC40) (–2.76%) – weighed down by political risks and weakness in luxury stocks.

• Europe 50 (#ESTX50) (–1.8%) – hurt by soft ECB tone and weaker business activity.

• DAX 30 (#DAX30) (–3%) – pressured by weak industrial data and fading Chinese demand.

S&P 500 and Nasdaq 100 continue to rise on solid macro data, a softer Fed stance, and strong earnings from major tech players. Analysts at FreshForex believe investor confidence in the U.S. recovery supports the ongoing bullish trend.

DAX/GER - TIME TO KILLHi everyone, I have been very patience on DAX

last week, we kill them nicely

and now we are waiting for them to hit our short zone and kill more

when you look at the chart, ensure to add extra short at those price ranges.

There will be two target

70-110 points - take 50% profit and bring stop loss to BE

Aim for second target between 120-230 points

Today we did LIVE trading on NAS and very profitable. In fact everyday we kill the market well.

Hope everyone making millions

From Euphoria to Exhaustion: DAX 8H Short LoadedAfter an impressive rally, DAX has now returned to its previous highs. But this upward move looks more like an engineered push rather than a healthy breakout. From a technical and sentiment-based perspective, it feels overextended. That’s why I initiated a short position from this level. No need to predict the top—just follow the setup and manage risk.

Technicals:

• Price has returned to previous highs after a sharp V-shaped recovery.

• The rally lacks structure—no clear consolidation or volume support.

• We’re also near a historical EQ level that has acted as a turning point before.

Fundamentals:

• Philips cut its 2025 profit margin forecast citing U.S. tariffs as a major drag—this isn’t an isolated signal.

• Hugo Boss and other exporters confirmed revenue weakness due to U.S. trade tensions, adding to the bearish bias for European equities.

• President Trump’s warning about additional tariffs on pharmaceuticals could severely affect key European sectors.

• Global trade uncertainty and tariff retaliation fears have returned. These external shocks are significant for export-heavy indices like the DAX.

• With the Fed’s policy decision pending and no concrete trade deals, markets are shaky. Sentiment remains fragile.

This isn’t just a chart move — it’s a narrative setup. Markets can push higher on euphoria, but engineered rallies without backing tend to snap. I don’t need to catch the top perfectly — just be in when reality bites back.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

DAX GE40 on the Move! Bullish Trend Breakdown + Trade PlanI'm currently watching the GER40 / DAX 🇩🇪📈 and can see it’s been in a strong bullish trend on the weekly timeframe 🕒🔥. Price is pushing into new highs 🚀, and I’m eyeing a potential buy opportunity based on this bullish momentum 💪.

However, since we don’t have previous structure levels to work from 📉⛔, we're using the Fibonacci extension tool 🔢📐 — focusing on two key levels for potential take profit targets 🎯💰.

In the video, we break all of this down — including the trend, price action, market structure, and the full trade idea 🧠📊: entry 🎯, stop loss 🛑, and targets 🎯✅.

⚠️ Not financial advice.

#DAX30 Surges to 24,000: What’s Behind the Record-Breaking RallyOn May 20, 2025, Germany’s benchmark stock index, the #DAX30, crossed the 24,000-point threshold for the first time in its history, reaching an all-time high of 24,079.40. This historic milestone reflects growing investor confidence in the prospects of Europe’s largest economy.

The surge of the #DAX30 beyond the 24,000 mark was driven by a combination of key factors:

Improved geopolitical climate : Global tensions have eased — most notably between the United States and China. Signs of de-escalation in trade policy between the world’s largest economies have bolstered investor confidence. Additionally, an improved negotiation climate in Eastern Europe, particularly due to reduced conflict in Ukraine, has helped lower market uncertainty.

Strong corporate earnings : Major German corporations within the #DAX30 have posted robust quarterly results. Leading the charge were technology giants (e.g., SAP) and industrial powerhouses (such as Siemens and BMW), which reported increased profits despite a challenging macroeconomic environment. This has reinforced confidence in the resilience of German businesses.

ECB monetary policy expectations : Markets are pricing in a potential easing of the European Central Bank’s monetary policy. Although interest rates remain elevated, growing signals of a possible rate cut in the second half of 2025 are stimulating equity markets and making stock investments more attractive.

Export growth and trade optimism : The reduction of trade barriers, a stronger euro, and a rebound in global trade have positively impacted export-driven German companies. As one of the world’s leading export economies, Germany is benefiting from a renewed global demand recovery.

Hopes for domestic reforms : The German government is actively pushing investments in infrastructure, digital transformation, and the green economy. These initiatives are boosting investor sentiment, particularly in the technology and sustainable energy sectors.

Technical momentum : From a technical perspective, the breakout above the 24,000 level served as a catalyst for speculative capital inflows. Many traders and funds that follow trends and resistance levels initiated buy positions after the breakout, amplifying the upward momentum.

This combination of fundamental and technical drivers has created a powerful growth impulse for the # DAX30 . According to analysts at FreshForex, the index may continue its upward trajectory — provided current macroeconomic stability is maintained.

Ger40 dax SeekingPips short SELL UP here hight Reward to Risk🌟Good morning ladies and gentlemen.🌟

I like the Reward to Risk profile on this setup over 7r ✅️

Although it's one of my lower win rate strategies it's a simple set and forget trade setup with the statistics to backbup my plan.

🟢SeekingPips🟢 is short with Stop Loss above the highest high this morning.

On the feed that I am using that high 21839.5

I'M LOOKING for a GAP FILL🚥

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY30" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone ATR. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (22500) Thief SL placed at the nearest / swing high level Using the 4H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Quarter Ends, Setup Begins: Long from DAX Support ZoneDAX returned to its major support zone around 22,000 after an extended decline through March. I’ve been triggered into a long position as we step into a fresh month and quarter. We’re sitting at strong historical demand with multiple macro events lined up this week—I’ll take what the market gives and manage it accordingly. No ego here, just flow with the setup. Let’s see where this one heads as NFP and PMI data come in.

Technicals

• Timeframe: 1H

• Entry Zone: Strong support retest at 22,000

• Setup: Long triggered on reaction from major support

• Target: Zone around 22,950

• SL: Below the support zone (~21,800)

• Fibcloud: Still trending below, watching for reclaim

• End-of-month rebalancing and Quarter close may add volatility.

Fundamentals

• DAX dropped nearly 2% on Monday, hitting its lowest levels since Feb 10, in line with global market weakness.

• US trade tariff uncertainty under Trump’s “reciprocal” rhetoric weighs on sentiment.

• Germany’s CPI eased to 2.2%, the lowest since Nov 2024, aligning with market expectations.

• Q1 performance remains strong overall, up nearly 11%, supported by Germany’s spending plan.

• Eyes on this week’s NFP and PMI data which could drive further price action.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

DAX Bullish ReversalDAX Index (GER30) Trade Setup – 1H Chart Analysis

The DAX Index (GER30) is showing signs of a potential bullish reversal from a key support zone. The price has reacted at 21,975.87, indicating a possible upward move. A retracement to the **62% Fibonacci level (22,534.21) presents an optimal buy entry with a well-defined risk-to-reward ratio.

Trade Details:

- **Entry:** **22,534.21** (62% Fibonacci retracement)

- **Stop Loss (SL):** **21,975.87** (Below the recent swing low)

- **Take Profit Targets:**

- **TP1:** **23,476.14** (0% Fibonacci level)

- **TP2:** **24,056.53** (38.2% Fibonacci level)

- **TP3:** **24,995.45** (100% Fibonacci extension)

Analysis & Justification:

✔ Key Support Confirmation** – The price bounced off **21,975.87**, a significant support level.

✔ Fibonacci Confluence** – The 62% retracement level aligns with historical reaction zones.

✔ Moving Average Resistance** – A breakout above **22,600** could confirm bullish momentum.

✔ Risk-to-Reward Ratio** – The trade offers a **minimum 1.7:1 ratio**, improving with higher TP levels.

#dax Forex Signal German index #dax says I am rising in the medium term in technical indicators. 30% increase is normal. It is necessary to take a position for a decrease when the blue line at the top, which is our technical resistance, turns.

If you want to be in action at the right place and at the right time, you can follow me.

I can draw it for you. Please write me privately.

NOTE: IT DOES NOT CONTAIN INVESTMENT ADVICE. EVERYONE IS FREE TO BUY AND SELL THE SHARES THEY WANT FROM THEIR PERSONAL ACCOUNT WITH THEIR OWN FREE WILL. NO ONE CAN GUIDE ANYONE OR PROVIDE SHARES THAT WILL PROVIDE 100% GUARANTEED PROFIT.

I can draw it for you. Please write me privately.

"GERMANY40" GER40/DAX Indices Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY40" GER40/DAX Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 23000

Sell Entry below 22100

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

-Thief SL placed at 22600 for Bullish Trade

-Thief SL placed at 22600 for Bearish Trade

Using the 30min period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 24100 (or) Escape Before the Target

-Bearish Robbers TP 21200 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

"GERMANY40" GER40/DAX Indices market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

🔰Fundamental Analysis

The GER40 index has experienced a moderate decline of 2.5% in February, with the index currently standing at 22,500 points.

Company earnings have been mixed, with some companies exceeding expectations while others have disappointed.

The dividend yield for the GER40 is around 2.5%, which is relatively attractive compared to other major European indices.

🔰Macro Economics

The European Central Bank (ECB) has maintained its hawkish stance, keeping interest rates at 4.25% to combat inflation.

Germany's GDP growth rate is expected to slow down to 1.5% in 2025, due to the ongoing economic uncertainty.

Global trade tensions, particularly between the US and China, continue to impact the German market.

🔰Global Market Analysis

The GER40 is experiencing a bearish trend, with a 0.5% decline in the last 24 hours.

The index is currently trading at 22,500, with a high of 22,600 and a low of 22,400.

🔰COT Data

Speculators (Non-Commercials): 45,011 long positions and 30,015 short positions.

Hedgers (Commercials): 25,019 long positions and 40,011 short positions.

Asset Managers: 30,015 long positions and 20,019 short positions.

🔰Market Sentiment Analysis

The overall sentiment for the GER40 is bearish, with a mix of negative and neutral predictions.

55% of client accounts are short on this market, indicating a bearish sentiment.

🔰Positioning Analysis

The long/short ratio for the GER40 is currently unknown.

The open interest for the GER40 is approximately €10 billion.

🔰Quantitative Analysis

The GER40 has a relatively high volatility, with an average true range (ATR) of 150 points.

The index is currently trading below its 50-day moving average, indicating a bearish trend.

🔰Intermarket Analysis

The GER40 is highly correlated with the Euro Stoxx 50 index, with a correlation coefficient of 0.85.

The index is also highly correlated with the DAX index, with a correlation coefficient of 0.90.

🔰News and Events Analysis

The GER40 has been impacted by the ongoing economic uncertainty in Europe.

The index has also been affected by the decline in German industrial production.

🔰Next Trend Move

Bearish Prediction: Some analysts predict a potential bearish move, targeting 22,000 and 21,800, due to the ongoing economic uncertainty and decline in German industrial production.

Bullish Prediction: Others predict a potential bullish move, targeting 23,000 and 23,200, due to the attractive valuations and potential economic recovery.

🔰Overall Summary Outlook

The overall outlook for the GER40 is bearish, with a mix of negative and neutral predictions.

The market is expected to experience a moderate decline, with some analysts predicting a potential bearish move targeting 22,000 and 21,800.

🔰Real-Time Market Feed

As of the current time, the GER40 is trading at 22,500, with a 0.5% decline in the last 24 hours.

🔰Future Prediction

Short-Term: Bearish: 22,200-22,000, Bullish: 22,800-23,000

Medium-Term: Bearish: 21,800-21,600, Bullish: 23,200-23,400

Long-Term: Bearish: 21,400-21,200, Bullish: 24,000-24,200

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX Index: Further Upside Ahead? On the DAX chart, we’re tracking a very large diagonal pattern to the upside, which is likely not yet complete. We are probably in the late stages of circle wave C, within a larger third wave in the yellow scenario.

Upside Targets

Next resistance levels: 24,205 and 25,715 EUR

Support Zone for Wave 4

Support area: 22,512 to 21,610 EUR

This zone would become more relevant if the current rally completes and Wave 4 begins.

On the very small time frame, it’s possible that the internal fourth-wave pullback within circle wave C has already started.

Micro support remains between 22,512 and 21,610 EUR

A break below 22,260 EUR would help confirm that wave 4 is underway

However, one more high is still possible before that pullback begins—this would align with the white scenario, where the current move finishes wave 3 before wave 4 kicks in.

DAX Breakout or Fakeout? Long Setup to 23,300The German DAX index presents an opportunity for a long position, targeting the 23,300 price zone. The current price action suggests a retracement toward previous highs before confirming a continuation. With this in mind, I have executed a long position, monitoring key technical levels for potential reactions.

On the fundamental side, the market remains sensitive to geopolitical and economic developments. President Trump’s renewed tariff threats on EU exports have introduced fresh uncertainty, while domestic tensions in Germany over fiscal policy further contribute to volatility. Additionally, corporate earnings are mixed, with Daimler Truck reporting strong Q4 results, whereas BMW shares plummeted due to weaker-than-expected forecasts.

Given these factors, the DAX remains in a reactive phase, and the upcoming macroeconomic events, particularly Eurozone inflation data and Federal Reserve commentary, will play a crucial role in shaping sentiment.

Technical Analysis:

• Entry: Long position initiated at key structural support.

• Target: 23,300 price zone, assessing momentum near previous highs.

• Support Levels: Watching the 22,600–22,700 range for potential rebounds.

• Indicators: The price remains above key moving averages, and the Fib retracement aligns with bullish continuation potential.

Fundamental Analysis:

• Trade Tensions: Trump’s tariff threats on EU exports and reciprocal measures could introduce short-term uncertainty.

• Domestic Politics: German fiscal policy debates may weigh on market sentiment.

• Corporate Earnings: Daimler Truck outperforms, while BMW struggles, adding mixed signals to investor outlook.

• Upcoming Catalysts: PMI data and inflation reports from the Eurozone could determine the next major move.

DAX’s price action is aligned with the broader equity market reaction, and if the index maintains its momentum above key technical levels, the 23,300 target remains in play. Managing risk and reassessing based on market developments will be key.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

GER40/DAX "Germany40" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40/DAX "Germany40" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (23000) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40/DAX "Germany40" CFD Index Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURO STOXX 50 celebrates new ATH, due to Ukraine war abateThe European stock rally is beginning as investors have gotten optimistic about a potential ceasefire in Ukraine.

The end of the 3-years conflict was always a wild card for European equity markets. Now investors are starting to prepare for this scenario, aggressively buying energy-intensive sectors and European laggards.

While a lot of upside potential remains for some sectors, the path ahead is likely to be rapid. The benchmark Euro Stoxx 50 has rarely been this overbought in the past four years.

Some investors have been aggressively buying back their shorts on Europe, while others are diversifying out of expensive and heavily concentrated US equities. The region trades at about a 40% discount to the US and this gap has the potential to narrow. There’s also room for gains within the Stoxx Europe 600 to broaden, with just 20% of its members in overbought territory.

With the prospect of an eventual ceasefire on investors’ minds after the US and Russian leaders agreed to start negotiations, stocks geared to the reconstruction of Ukraine are in focus, like construction stocks Heidelberg Materials AG and Holcim AG as well as chemicals company BASF SE.

The strategists at Barclays Plc are overweight chemicals but are more cautious on autos, partly due to the US tariffs threat. They say construction materials have had a strong run already, while mining and steel may have more catch-up potential, along with transport and leisure.

Rebuilding Ukraine would be one of the largest construction undertakings in recent years, with total costs of nearly $500 billion, according to the World Bank. This would be highly commodity-intensive, especially for steel and cement, to restore buildings and infrastructure.

It is clearly unequivocally good news for European markets.

The EURO STOXX 50 is a stock index that represents 50 of the largest and most liquid stocks in the Eurozone. It is designed to represent blue-chip companies considered leaders in their respective sectors. The EURO STOXX 50 is one of the most liquid indices for the Eurozone.

Key facts about the EURO STOXX 50:

The index includes shares from various Eurozone countries, including Belgium, France, Finland, Germany, Italy, the Netherlands, and Spain.

France and Germany contribute to over 66% of the index.

The technology, industrial goods and services, and consumer products and services sectors account for more than 45% of the index.

The EURO STOXX 50 was introduced on February 26, 1998. Prices were calculated retroactively to 1986, with a base value of 1000 points on December 31, 1991.

The index captures about 60% of the free-float market capitalization of the EURO STOXX Total Market Index (TMI), which covers about 95% of the free-float market capitalization of the countries represented.

The EURO STOXX 50 serves as a benchmark for the Eurozone's stock market performance.

Eurex trades futures and options on the EURO STOXX 50, which are among the most liquid products in Europe and worldwide.

Technical challenge

The main 6-month graph for EURO STOXX 50 futures indicates the epic all time high (1st time over past 25 years), with a potential further upside price action.

DAX Rally Overstretched? Initiating a Strategic Short PositionSince February 25, the DAX has surged by 7.24% without a meaningful pullback, suggesting potential overextension. Coupled with emerging bearish technical indicators and unfavorable economic fundamentals, this presents an opportunity for a short position.

Fundamental Analysis:

Germany’s economic landscape is currently facing several challenges:

• Economic Slowdown: The government has slashed its 2025 growth forecast to 0.3%, down from the previous 1.1%, citing trade tensions and domestic uncertainties.

• Industrial Strife: Major companies are implementing job cuts and factory closures to manage rising costs and global competition, leading to increased labor disputes and uncertainty over Germany’s manufacturing sector.

• Political Uncertainty: Upcoming European and local elections have intensified debates over economic policies and migration, contributing to market volatility and investor caution.

Trade Details:

• Entry: 22,611

• Stop-Loss: 23,000

• Target Zone: 21,800 - 21,600

• Partial Profits: To be taken at key support levels

The confluence of technical signals and economic headwinds suggests a potential correction in the DAX. This short trade aims to capitalize on the anticipated pullback, with risk managed through a well-placed stop-loss and planned profit-taking at identified support zones.

Next week will be critical for the Eurozone, with key economic data releases shaping market sentiment. Investors should particularly watch the PMI data on Friday, which could significantly impact expectations for the region’s economic trajectory.

Stay informed and trade responsibly.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

My Long Dax Idea 21-2-2025Took a long on GER40 After the dip that happened yesterday. The fundamentals are straightforward and DAX40 scores 6 on Edgefinder. The technical setups are looking good and indicating for a possible "bottom". Now we don't really know how far this price action will take us up since the European economy is not stable, yet.

Will keep an eye on it.