BUY DAX ON WEEKLY CHARTThe European market kept its collective head on Monday morning, avoiding another plunge despite the alarming losses in China.

One of the more curious aspects of the coronavirus situation is that, while the rest of the world’s indices suffered, the Shanghai Composite was side-lined by the Lunar New Year holidays. Well, Monday saw it play catch-up. The Chinese index lost close to 8%, investors bailing at the first chance they got – this as the death toll jumped by 57, the single one-day increase since the virus was detected.

Instead of treating this as another chance to sell, Europe was level-headed after the bell. The DAX rose 0.2%, while the CAC eked out a 0.1% increase. The FTSE was a bit more energetic, adding 0.3%, though that’s because of the pound’s early February retreat. As for the Dow Jones, the futures are currently pencilling in a 100 point bounce later this afternoon.

Dax30long

DE30 DAX GE30 BUY ON WEEKLY CHARTGermany stocks were higher after the close on Wednesday, as gains in the Basic Resources, Transportation & Logistics and Financial Services sectors led shares higher.

At the close in Frankfurt, the DAX gained 0.16%, while the MDAX index added 0.56%, and the TecDAX index gained 0.19%.

The best performers of the session on the DAX were Vonovia SE (DE:VNAn), which rose 1.49% or 0.76 points to trade at 51.78 at the close. Meanwhile, MTU Aero Engines NA O.N. (DE:MTXGn) added 1.44% or 4.00 points to end at 281.90 and Deutsche Bank AG NA O.N. (DE:DBKGn) was up 1.32% or 0.104 points to 7.974 in late trade.

DAX30 GER30OUTLOOK: BULLISH

Past few days DAX30 has been confounding forecasters - and whipsawing short-sellers - by rebounding sharply.

DAX Futures: European equities due in for a correctionWhile our outlook on the Eurozone and markets remain supportive, a technical opportunity to fade highs in the European stock market has arisen. We will initially look to fade highs into our liquidity bloc targets however will allow ECB/Lagarde commentary to provide ultimate macro direction across our portfolios. Sensitivity remains from the downside from here.

- Put exposure added to all of our directional portfolios.

DAX nears all-time highs, next target 14530!The DAX is finally catching up to the rest of the worlds equity markets. It's about 100 points away from the all-time high which is not a big distance for the German Index. The support structure at 13000 held extremely well and the buyers managed to bid the price up from there. The pop came fast and in a matter of days on strong volume. From here we could see a new all-time high fast. The Fib extension level suggests price is going to move into the 14530 area and that would bring the DAX level with other global indices.

This idea is for educational purposes only, this does not constitute as trading or investment advice. TRADEPRO Academy is not liable for any market activity.

DAX continues to show strength, upside to 13800Equity markets have been hitting all-time highs day after day throughout the world throughout the holidays. While the DAX has been somewhat of a lagger and has the potential to break into new highs and beyond based on structure, volume and more.

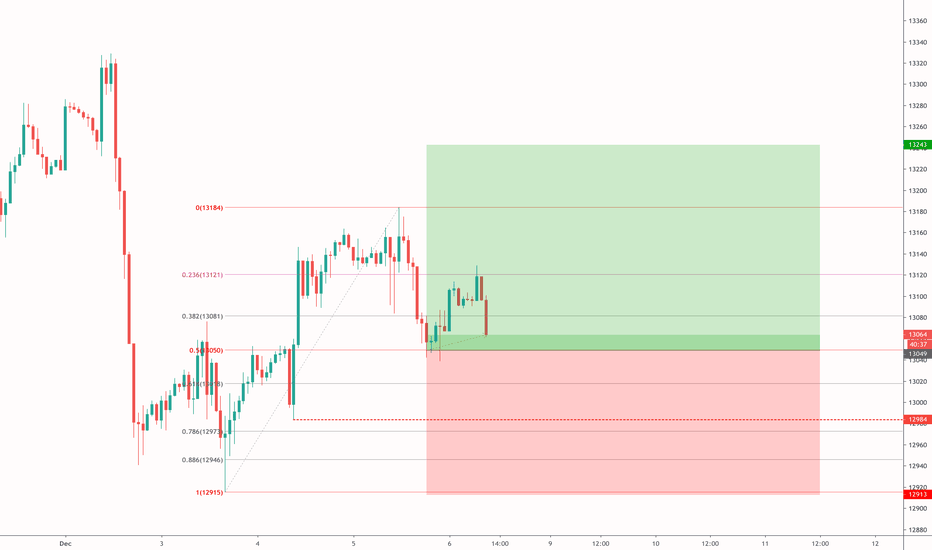

So far over the holiday season has held up the structure on DAX well suggesting more upside, a new temporary high was hit at 13400 before a slight fail. We could see price into the 13050 level where the impulse started for the next press higher. The support level was rejected well by buyers that came in, so the next move is into the all-time high around 13600. The drops were on weak volume for the retraces, while each rally higher was on strong volume. The bulls have this in the bag and as long economic expansion continues throughout the world then the DAX will strengthen to catch up.

As long as price doesn't break through the support structure on the medium term at 13050 the bull side is the right side, below that level, 12900 has to hold support.

This idea is for educational purposes only, this does not constitute as trading or investment advice. TRADEPRO Academy is not responsible for any market activity.

DAX30 triple witching–a trigger for a break above 13,400 points?As we approach the weekly close, and the last trading day of the year which carries a realistic chance of seeing some elevated volatility before the holiday season kicks off (Trading Hour Schedule for the 2019 Christmas & New Year Holiday Period), we want to take a look at the DAX30 CFD again.

Traders could see some heavier swings in the German index today since today is the last big expiration in the DAX-Future with data from the EUREX showing that there is relatively high interest at the 13,400 point mark.

Price action over the last days has clearly shown that market participants are interested in holding the DAX30 CFD below 13,400 points.

But if bulls gain control and we get to see an attack and break before 12pm GMT (this time Futures and Options expire at the EUREX), a short-squeeze could be the result, pushing the German index in an expected thin market environment up to 13,600 and into the region of current all-time highs.

In general, and from a technical basis, this stays an option as long as the DAX30 CFD trades above 13,080/100 points, and if we don’t get to see such a push higher today (which seems likely, given the fact that the DAX30 CFD currently trades substantially below 13,400 points), such a run has an elevated chances to be seen into the start of 2020.

Ready to start trading the live markets? Then open a free account with Admiral Markets - 8,000+ instruments to choose from, some of the market's tightest typical spreads, and the world's #1 multi-asset trading platform. www.admiralmarkets.com

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

DAX breaks a recent high, next target 13600! DAX manages to break through the 13305 high on decent volume after holding the support structure we had mapped out at 12910. The fact that it broke into 13400 and retested the broken high at 13290 means that there could be immediate support here for an all-time high move or a slight retrace into 13050 before we see the all-time high again. For the move to come out into the all-time high we need to see a new higher-low form so that means a move below 12910 ultimately would disqualify this long.

Disclaimer: This idea is for educational purposes only, this does not constitute as investment or trading advice. TRADEPRO academy is not responsible for any market activity.

DAX30 CFD to reach new All-Time Highs for Christmas?After last Thursday's developments in the US-Chinese trade deal, the UK's general election, and the Fed's liquidity announcement, the outlook for the DAX30 CFD is very bright as we start the trading week.

The main driver for the bullish action, and the ensuing break above 13,180/200 points resulting in new yearly highs, was certainly the "deal" between the US and China where both sides are said to have agreed on a reduction on existing tariffs, and a delay in those planned to go into effect on December 15.

In addition to this, there was the landslide victory of UK prime minister Johnson's Tories in the General election which made a near-term Brexit deal likely and diminished uncertainties among market participants, as well as the Fed's announcement that it will flood markets with $500 Billion in liquidity to avoid a year-end repo crisis (and will thus extend the Fed balance sheet to new record highs by mid-January).

That said, we project a bullish DAX30 CFD for the yearly close, with a high likelihood of new all-time highs and thus a push to and above 13,600 points in the coming days.

A short-term correction finds a potential Long trigger in the region around 13,280/300 points and a littler deeper around 13,180/200 points, with the mode staying bullish on an Hourly time-frame above 13,080/100 points.

Ready to start trading the live markets? Then open a free account with Admiral Markets - 8,000+ instruments to choose from, some of the market's tightest typical spreads, and the world's #1 multi-asset trading platform. www.admiralmarkets.com

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

DAX30 Still Looks Neutral in Short-termThe DAX30 index currently faces a challenging resistance area at 13,190. The index is holding the rebound from the 23.6% Fibonacci retracement of the October 4 low (13,879) to November 19 high (13,338.25) rally at 12,970. The 55-day moving average has risen to 12,827. Yet the positive slope in the 55-day SMA that increases distance above the 200-day EMA suggests that the bullish trend is intact and an eventual reversal could come later rather than sooner.

On upside, if the price break above upper border of Bollinger Bands at 13,350, our first target is Nov. high 13,374.27. A clear break of which could see the bulls to retest the all-time high level of 13,597 registered in late January 2018.

A closing price below Tuesday’s low of 12,927 and the 55-day SMA could encourage more selling pressure. However, only a significant fall below 12,660 would put the current uptrend under speculation, shifting the medium-term picture from positive to neutral first. There is located also 50% Fibo level on the above-mentioned rally.

DAX hits first level of support and rallies, new all-time high?The DAX managed to pull back, as anticipated through rotations at the top of a structure area it failed to break above into its all-time high and into a new high after several attempts and the downside was expected. We had 2 levels identified as potential targets, the first being the cluster of support that was mapped out based on where the price started its rally which was between 12930 and 12965 which happened to be the inflection point at which the DAX recent bounced off.

The second target area for the downside on the retrace was 12615 which was a Fib level that we were watching, but the rejection at the first level suggests that this move lower was just enough to get some new buyers interested. Now, what is the move higher? Where is the upside target? With the Christmas rally ahead we may see new highs across the board in equities. From here we really need to break through the 13305 level that is holding resistance and get into the previous all-time high.

If price breaks above 13305 into 13320 then we will anticipate the move into the high at 13600 or so. For that, some good European trade talks will help out a lot.

Disclaimer: This idea is for educational purposes only, this does not constitute as trading or investment advice. TRADEPRO Academy is not responsible for any market activity.