Bearish drop?DAX40 (DE40) is reacting off the pivot which acts as a pullback resistance and could drop to the overlap support.

Pivot: 23,758.06

1st Support: 23,381.73

1st Resistance: 24,078.12

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Dax40short

From Euphoria to Exhaustion: DAX 8H Short LoadedAfter an impressive rally, DAX has now returned to its previous highs. But this upward move looks more like an engineered push rather than a healthy breakout. From a technical and sentiment-based perspective, it feels overextended. That’s why I initiated a short position from this level. No need to predict the top—just follow the setup and manage risk.

Technicals:

• Price has returned to previous highs after a sharp V-shaped recovery.

• The rally lacks structure—no clear consolidation or volume support.

• We’re also near a historical EQ level that has acted as a turning point before.

Fundamentals:

• Philips cut its 2025 profit margin forecast citing U.S. tariffs as a major drag—this isn’t an isolated signal.

• Hugo Boss and other exporters confirmed revenue weakness due to U.S. trade tensions, adding to the bearish bias for European equities.

• President Trump’s warning about additional tariffs on pharmaceuticals could severely affect key European sectors.

• Global trade uncertainty and tariff retaliation fears have returned. These external shocks are significant for export-heavy indices like the DAX.

• With the Fed’s policy decision pending and no concrete trade deals, markets are shaky. Sentiment remains fragile.

This isn’t just a chart move — it’s a narrative setup. Markets can push higher on euphoria, but engineered rallies without backing tend to snap. I don’t need to catch the top perfectly — just be in when reality bites back.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

DAX at a Crossroads: Will Resistance Trigger a Pullback?The German 40 (DAX) has been on a strong bullish run, now trading into a key resistance zone near previous range highs. This area is likely packed with liquidity (buy stops), making it a potential turning point. Given the overextended price action and current fundamentals, a retracement is likely as profit-taking and stop orders trigger. While sentiment has been bullish, caution is warranted at these levels. I am expecting a pullback before any further upside. Not financial advice.

Bearish reversal?DAX40 (DE40) is rising towards the pivot which has been identified as a pullback resistance and could reverse to the 1st support which acts as a pullback support.

Pivot: 22,248.86

1st Support: 21,516.36

1st Resistance: 22,712.27

1st Resistance: 34.50

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish reversal off pullback resistance?DAX40 (DE40) is rising towards the pivot which has been identified as a pullback resistance and could reverse to the 1st support.

Pivot: 22,166.64

1st Support: 21,307.07

1st Resistance: 22,712.27

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

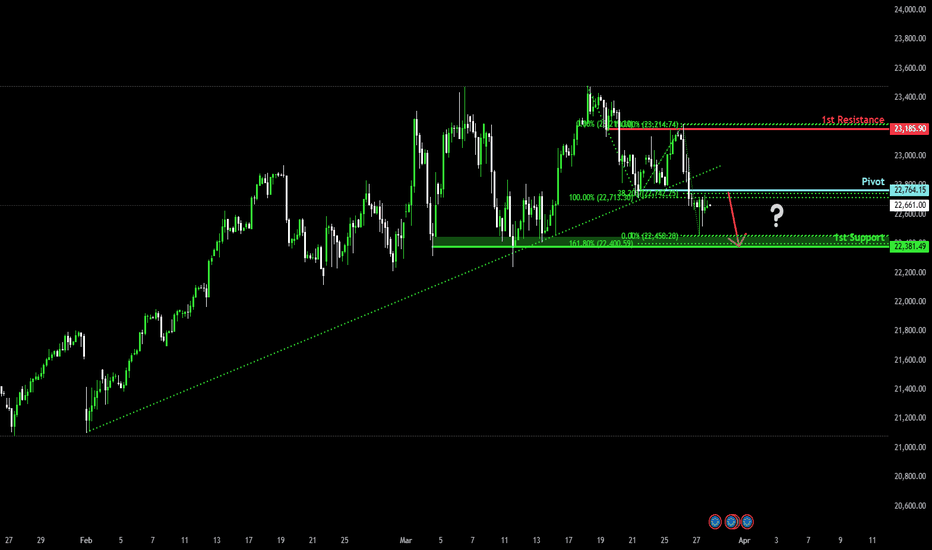

Bearish drop?DAX40 (DE40) is rising towards the pivot which is a pullback resistance and could drop tot he 1st support which acts as a pullback support.

Pivot: 22,764.15

1st Support: 22,381.49

1st Resistance: 23,185.90

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

"GERMANY40" GER40/DAX Indices Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY40" GER40/DAX Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 23000

Sell Entry below 22100

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

-Thief SL placed at 22600 for Bullish Trade

-Thief SL placed at 22600 for Bearish Trade

Using the 30min period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 24100 (or) Escape Before the Target

-Bearish Robbers TP 21200 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

"GERMANY40" GER40/DAX Indices market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

🔰Fundamental Analysis

The GER40 index has experienced a moderate decline of 2.5% in February, with the index currently standing at 22,500 points.

Company earnings have been mixed, with some companies exceeding expectations while others have disappointed.

The dividend yield for the GER40 is around 2.5%, which is relatively attractive compared to other major European indices.

🔰Macro Economics

The European Central Bank (ECB) has maintained its hawkish stance, keeping interest rates at 4.25% to combat inflation.

Germany's GDP growth rate is expected to slow down to 1.5% in 2025, due to the ongoing economic uncertainty.

Global trade tensions, particularly between the US and China, continue to impact the German market.

🔰Global Market Analysis

The GER40 is experiencing a bearish trend, with a 0.5% decline in the last 24 hours.

The index is currently trading at 22,500, with a high of 22,600 and a low of 22,400.

🔰COT Data

Speculators (Non-Commercials): 45,011 long positions and 30,015 short positions.

Hedgers (Commercials): 25,019 long positions and 40,011 short positions.

Asset Managers: 30,015 long positions and 20,019 short positions.

🔰Market Sentiment Analysis

The overall sentiment for the GER40 is bearish, with a mix of negative and neutral predictions.

55% of client accounts are short on this market, indicating a bearish sentiment.

🔰Positioning Analysis

The long/short ratio for the GER40 is currently unknown.

The open interest for the GER40 is approximately €10 billion.

🔰Quantitative Analysis

The GER40 has a relatively high volatility, with an average true range (ATR) of 150 points.

The index is currently trading below its 50-day moving average, indicating a bearish trend.

🔰Intermarket Analysis

The GER40 is highly correlated with the Euro Stoxx 50 index, with a correlation coefficient of 0.85.

The index is also highly correlated with the DAX index, with a correlation coefficient of 0.90.

🔰News and Events Analysis

The GER40 has been impacted by the ongoing economic uncertainty in Europe.

The index has also been affected by the decline in German industrial production.

🔰Next Trend Move

Bearish Prediction: Some analysts predict a potential bearish move, targeting 22,000 and 21,800, due to the ongoing economic uncertainty and decline in German industrial production.

Bullish Prediction: Others predict a potential bullish move, targeting 23,000 and 23,200, due to the attractive valuations and potential economic recovery.

🔰Overall Summary Outlook

The overall outlook for the GER40 is bearish, with a mix of negative and neutral predictions.

The market is expected to experience a moderate decline, with some analysts predicting a potential bearish move targeting 22,000 and 21,800.

🔰Real-Time Market Feed

As of the current time, the GER40 is trading at 22,500, with a 0.5% decline in the last 24 hours.

🔰Future Prediction

Short-Term: Bearish: 22,200-22,000, Bullish: 22,800-23,000

Medium-Term: Bearish: 21,800-21,600, Bullish: 23,200-23,400

Long-Term: Bearish: 21,400-21,200, Bullish: 24,000-24,200

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX GE40 Counter Trend Trade IdeaThe DAX is currently overextended, having reached all-time highs and trading at the top of its range. I'm anticipating a pullback on GE40 down to equilibrium for a potential counter-trend short. Once price retraces and establishes support, I'll be watching for a bullish market structure break as a signal to go long. This is not financial advice.

GER40 "Germany 40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "Germany 40" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The heist is on! Wait for the breakout (21250.00) then make your move - Bearish profits await!"

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑:

Thief SL placed at 21500.00 (swing Trade) Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

First Target 20800.00 (or) Escape Before the Target

Final Target 20300.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GER40 "Germany 40" Indices Market is currently experiencing a Neutral (there is a high chance for Bearish trend)., driven by several key factors.

🟠Fundamental Analysis

1. Earnings Growth: The Germany 40 index has experienced a decline in earnings growth, with a 5-year average earnings growth rate of 5%.

2. Dividend Yield: The dividend yield of the Germany 40 index is currently 2.5%, which is relatively low compared to historical standards.

3. Valuation: The price-to-earnings (P/E) ratio of the Germany 40 index is currently 15.6, which is slightly above its historical average.

⚪Macro Analysis

1. GDP Growth: The German economy has experienced a slowdown in GDP growth, with a 2022 growth rate of 1.4%.

2. Inflation: The inflation rate in Germany has remained relatively low, with a 2022 inflation rate of 1.4%.

3. Interest Rates: The European Central Bank (ECB) has maintained a dovish stance, keeping interest rates low to support economic growth.

🟢COT Analysis

1. Non-Commercial Traders: Non-commercial traders, such as hedge funds and institutional investors, have increased their short positions in the Germany 40 index, with a net short exposure of 10,000 contracts.

2. Commercial Traders: Commercial traders, such as banks and brokerages, have decreased their long positions in the Germany 40 index, with a net long exposure of 5,000 contracts.

⚫Sentiment Analysis

1. Retail Trader Sentiment: Retail traders have a bearish sentiment towards the Germany 40 index, with 55% being bearish.

2. Institutional Investor Sentiment: Institutional investors have decreased their bullish sentiment towards the Germany 40 index, with 50% being bullish.

3. Hedge Fund Sentiment: Hedge funds have increased their bearish sentiment towards the Germany 40 index, with 60% being bearish.

🟤Positioning Analysis

1. Long Positions: Long positions in the Germany 40 index have decreased, with a net long exposure of 50,000 contracts.

2. Short Positions: Short positions in the Germany 40 index have increased, with a net short exposure of 10,000 contracts.

3. Open Interest: Open interest in the Germany 40 index has decreased, with a current open interest of 500,000 contracts.

🟣Based on this analysis, the Germany 40 index is expected to trend bearish in the short term, with a 60% chance of a downtrend and a 30% chance of an uptrend. However, please note that market predictions can be unpredictable and influenced by various factors.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bearish reversal?DAX40 (DE40) is reacting off the pivot and could reverse to the 1st support which is a pullback support.

Pivot: 21,520.45

1st Support: 21,115.47

1st Resistance: 21,794.60

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

DAX Daily Short Setup: Targeting 19,700The DAX approached its previous high but failed to break through, signaling potential exhaustion at these levels. In response, I have initiated a short position, targeting a retracement to the 19,700 price zone.

Fundamental Insights:

1. Economic Uncertainty: Disappointing inflation data from China has sparked concerns about demand for German goods, which weighed heavily on DAX futures during the Asian session.

2. Sector Weakness: The auto sector, including Porsche, BMW, and Volkswagen, saw significant declines due to lingering tariff threats and softening demand.

3. US Jobs Report Impact: Friday’s US Jobs Report could further dictate market sentiment. A weaker report may boost expectations for rate cuts, providing temporary support to the DAX. Conversely, stronger data may reinforce bearish momentum.

4. German Economic Indicators: While November’s industrial production showed a 1.5% rise, weak factory orders suggest limited optimism. Imports fell 3.3%, signaling declining demand, further justifying a cautious short bias.

Technical Outlook:

• The DAX remains above its 50-day and 200-day EMAs, indicating bullish momentum. However, failure to sustain above 20,523 strengthens the likelihood of a retracement.

• The RSI near 59 suggests room for further downside before approaching oversold conditions.

As always, maintain disciplined risk management. Let’s see how this setup unfolds!

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Could the price reverse from here?DAX40 (DE40) is reacting off the pivot and could drop to the 1st support which acts as an overlap support.

Pivot: 20,260.59

1st Support: 20,041.10

1st Resistance: 20,490.67

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Falling towards 50% Fibonacci support?DAX40 (DE40) is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 19,681.24

1st Support: 19,244.23

1st Resistance: 20,427.78

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GDAX DAX 40 (German 40) Technical Analysis & Trade IdeaTheres a full video analysis posted before this.

The DAX 40's recent bullish surge reveals signs of exhaustion on the monthly and weekly charts. Lower timeframes suggest a manipulative price structure primed for a potential trend reversal.

Here's the breakdown:

- Overextension: Extended trends often succumb to corrections or shifts in direction. The DAX 40 appears ripe for such a move.

- Liquidity Engineering: The 4-hour and daily price action hints at manipulation. The downside breakout followed by a stop-loss raid indicates possible accumulation to fuel a bearish move.

- Reversal Pattern: This market behavior aligns with recurring reversal setups I've observed consistently throughout my trading experience.

Trade Idea

- Direction: Short (with the potential for significant downside)

- Timeframe: Expect bearish momentum through February and March.

- Monitor: Watch for validation on lower timeframes (e.g., a bearish break of the current range).

- Risk Management: Set appropriate stop-loss levels based on your risk tolerance.

Disclaimer

This analysis is for informational purposes and does not constitute financial advice. Before making any trades, perform your own in-depth research and exercise prudent risk management.

GDAX DAX 40 (German 40) Technical Analysis & Trade IdeaGDAX DAX 40 (German 40) Technical Analysis & Trade Idea

The DAX 40's recent bullish surge reveals signs of exhaustion on the monthly and weekly charts. Lower timeframes suggest a manipulative price structure primed for a potential trend reversal.

Here's the breakdown:

- Overextension: Extended trends often succumb to corrections or shifts in direction. The DAX 40 appears ripe for such a move.

- Liquidity Engineering: The 4-hour and daily price action hints at manipulation. The downside breakout followed by a stop-loss raid indicates possible accumulation to fuel a bearish move.

- Reversal Pattern: This market behavior aligns with recurring reversal setups I've observed consistently throughout my trading experience.

Trade Idea

- Direction: Short (with the potential for significant downside)

- Timeframe: Expect bearish momentum through February and March.

- Monitor: Watch for validation on lower timeframes (e.g., a bearish break of the current range).

- Risk Management: Set appropriate stop-loss levels based on your risk tolerance.

Disclaimer

This analysis is for informational purposes and does not constitute financial advice. Before making any trades, perform your own in-depth research and exercise prudent risk management.

Critical 4 weeks for DAX Following weekly chart.

The last time when I get a short signal to in weekly chart was 4 weeks before COVID crash. (red area in the chart)

Now I got the same signal and unfortunately this is the most trustworthy signal for me.

I think this 4 weeks are really critical and what I expect is we might way to go to gaps below.

Be careful and be careful!

DAX40 - Sell SignalDAX40 H4

Same thing applies here for DAX, you can see clearly how high we are trading from the D1 timeframe, analysis scaled into the H4 however. Alerts adjusted slightly for that 16005 sell zone price now. Really hoping to catch something right down towards 15740. Patience pays. US100 no doubt looking more attractive, but more susceptible to US figures manipulation.

Ger30I laid everything on the charts refer to it and you'll find yourselves in a good swing entry, be patient and yoou'll find your rhythm, it all depends on price action.