GER/DAX - TIME FOR RECOVERTeam, this morning, the DAX target hit our target 1, we took some profit, we set a stop loss at BE, and it got stopped out

Time for us to re-enter the DAX again at 23880-23855

STOP loss 23780

Once the price move at 23950 - bring STOP LOSS TO BE

Target 1 at 23985-24015

Target 2 at 24065-24096

lets go

Daxanalysis

DAX / GER - ANOTHER ROUND OF ENTRY LONGTeam, we have successfully short DAX.GER earlier today with more than 300 points. both target hit

However the market has exceeding the dropping. We decide to go LONG

at the price range 23964-23945

With STOP LOSS at 23865-82

Once the trade hit above 21030-45 - BRING STOP LOSS TO BE

Target 1 at 21080-24115 = please take 50-70% volume target

30% Target remaining at 24165-24196

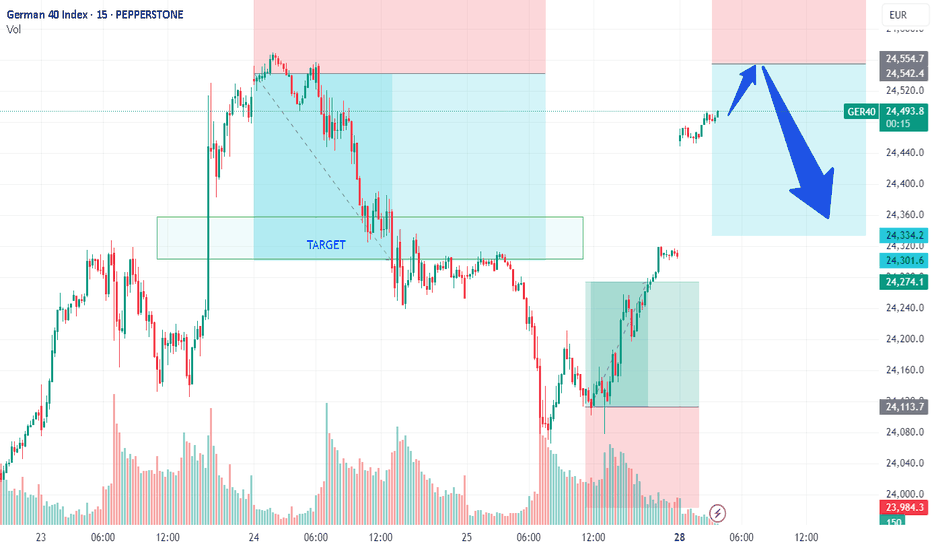

DAX/GER - PREPARE TO SHORT on DAX market opening Team,

We all know that the European Union and the United States agreed on Sunday to a broad trade deal that sets a 15 per cent tariff on most E.U. goods, including cars and pharmaceuticals.

The 27-nation bloc also agreed to increase its investment in the United States by more than $600 billion above current levels.

If the DEAL does not go through, it would be nasty to the market—especially to the Europeans, who are likely to get hurt by the export cost to the United States, especially the Car. The EUROPEAN is currently facing many challenges from Chinese car manufacturing.

We have been trading very well with the DAX in the past. We expect that when the market opens, we should short-range at 24530-60 - GET READY.

Stop loss at 24620-50

Please NOTE: once the price pulls back toward 24475-50, bring our STOP LOSS TO BE (Break even)

Our 1st target at 24425-24400

2nd Target at 24350-24300

Last Friday, in OUR LIVE TRADING, we mentioned that LONG DAX at 24100

The DAX Index Is Losing Its Bullish MomentumThe DAX Index Is Losing Its Bullish Momentum

At the end of May, we noted that the German stock index DAX 40 was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone.

Two months have passed, and the chart now suggests that bearish signals are intensifying.

From a technical analysis perspective, the DAX 40 formed an ascending channel in July (outlined in blue). However, each time the bulls attempted to push the price above the 24,460 level (which corresponds to the May high), they encountered resistance.

It is worth noting the nature of the bearish reversals (indicated by arrows) – the price declined sharply, often without intermediate recoveries, signalling strong selling pressure. It is likely that major market participants used the proximity to the all-time high to reduce their long positions.

From a fundamental standpoint, several factors are weighing on the DAX 40:

→ Ongoing uncertainty surrounding the US–EU trade agreement, which has yet to be finalised (with the deadline approaching next week);

→ Corporate news, including disappointing earnings reports from Puma, Volkswagen, and several other German companies.

Given the above, it is reasonable to assume that bearish activity could result in an attempt to break below the lower boundary of the ascending blue channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

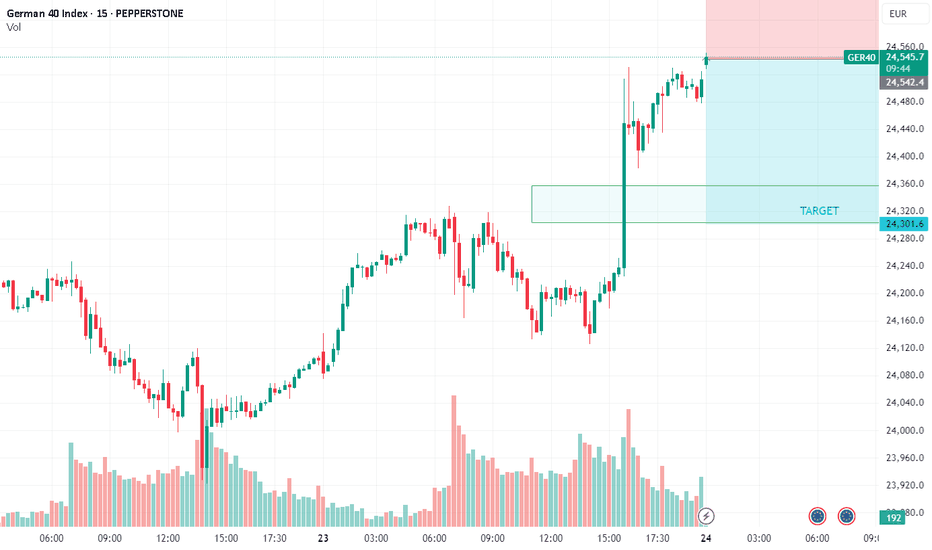

DAX/GER30 - TIME TO SHORT AT CURRENT PRICETeam, great win for the US30 on trade surplus 26 billion last month

expect to have great trade surplus over 300 billion

the Japanese went crazy 3.5% due to tariff drop from 25% down to 15%

The whole market has been pumping

We find an opportunity to SHORT THE DAX/GER 30 at the current level 24543-24556

STOP LOSS AT 24650

WITH TARGET at 24360-24320

PLEASE NOTE: once the price drop below 24500, bring stop loss to BE to protect your trade.

STICK TO THE PLAN.

Dax Breaks Higher to keep the bullish toneDax has moved back above the 24245-24295 zone impulsively and we retain the overall bullish tone

Retests of this area can provide an opportunity to get long

Stops need to be below 24170

Targets can be back towards 24400 and even hold a runner back to the All time highs

DAX Stock Index Declines Amid Trump Tariff ThreatDAX Stock Index Declines Amid Trump Tariff Threat

The German stock index DAX 40 (Germany 40 mini at FXOpen) is showing bearish momentum at the start of the week. This may be driven by a combination of factors, the most significant of which is the threat of tariffs on Europe from the United States.

According to Reuters, US President Donald Trump has announced a 30% tariff on most goods from the EU, set to come into effect next month. However, the decision is not yet final. Analysts caution against premature panic, suggesting that negotiations could still result in a trade agreement — nonetheless, the chart reflects a sense of unease among investors.

Technical Analysis of the DAX 40 Chart

The price surge in July above the previous all-time high near the 24,500 level appears to be a false bullish breakout — a sign of market weakness.

Buyers may hope that the market will find support at the former resistance line (marked in red), drawn through the local highs of June.

However, if news surrounding the US–EU negotiations turns negative, the DAX 40 index could fall towards the 23,650–23,750 support area, which is reinforced by the lower boundary of the medium-term ascending channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DAX / GER TIME TO PRINT MONEY ON SHORTTeam, i have not been posting DAX/GER for almost 3-4 weeks

now it is time to attack the DAX.

I have set two different target ,

ensure you take 60% and bring stop loss to BE

I also want to give you the time frame for target to hit.. do not expect today, however we could see the target for tomorrow or early next week

Sometimes i wait for the right moment to trade. DAX is very sophisticated to trade with, but if you have the patience, you can make money on them.

DAX/GER - TIME TO KILLHi everyone, I have been very patience on DAX

last week, we kill them nicely

and now we are waiting for them to hit our short zone and kill more

when you look at the chart, ensure to add extra short at those price ranges.

There will be two target

70-110 points - take 50% profit and bring stop loss to BE

Aim for second target between 120-230 points

Today we did LIVE trading on NAS and very profitable. In fact everyday we kill the market well.

Hope everyone making millions

From Euphoria to Exhaustion: DAX 8H Short LoadedAfter an impressive rally, DAX has now returned to its previous highs. But this upward move looks more like an engineered push rather than a healthy breakout. From a technical and sentiment-based perspective, it feels overextended. That’s why I initiated a short position from this level. No need to predict the top—just follow the setup and manage risk.

Technicals:

• Price has returned to previous highs after a sharp V-shaped recovery.

• The rally lacks structure—no clear consolidation or volume support.

• We’re also near a historical EQ level that has acted as a turning point before.

Fundamentals:

• Philips cut its 2025 profit margin forecast citing U.S. tariffs as a major drag—this isn’t an isolated signal.

• Hugo Boss and other exporters confirmed revenue weakness due to U.S. trade tensions, adding to the bearish bias for European equities.

• President Trump’s warning about additional tariffs on pharmaceuticals could severely affect key European sectors.

• Global trade uncertainty and tariff retaliation fears have returned. These external shocks are significant for export-heavy indices like the DAX.

• With the Fed’s policy decision pending and no concrete trade deals, markets are shaky. Sentiment remains fragile.

This isn’t just a chart move — it’s a narrative setup. Markets can push higher on euphoria, but engineered rallies without backing tend to snap. I don’t need to catch the top perfectly — just be in when reality bites back.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

DAX GE40 on the Move! Bullish Trend Breakdown + Trade PlanI'm currently watching the GER40 / DAX 🇩🇪📈 and can see it’s been in a strong bullish trend on the weekly timeframe 🕒🔥. Price is pushing into new highs 🚀, and I’m eyeing a potential buy opportunity based on this bullish momentum 💪.

However, since we don’t have previous structure levels to work from 📉⛔, we're using the Fibonacci extension tool 🔢📐 — focusing on two key levels for potential take profit targets 🎯💰.

In the video, we break all of this down — including the trend, price action, market structure, and the full trade idea 🧠📊: entry 🎯, stop loss 🛑, and targets 🎯✅.

⚠️ Not financial advice.

DAX/GER - setting up a perfect SHORTTeam, please carefully review the chart.

We have a soft short position at this market price of 24037-24056

However, I would love to ADD extra volume at 23135-23155

Our first target at 23950-23925

NOTE: once it reaches the target - take 30-50% volume partial and bring stop loss to BE

Our second target is 23865-23825

Please follow the instructions carefully.

DAX at a Crossroads: Will Resistance Trigger a Pullback?The German 40 (DAX) has been on a strong bullish run, now trading into a key resistance zone near previous range highs. This area is likely packed with liquidity (buy stops), making it a potential turning point. Given the overextended price action and current fundamentals, a retracement is likely as profit-taking and stop orders trigger. While sentiment has been bullish, caution is warranted at these levels. I am expecting a pullback before any further upside. Not financial advice.

DAX 40 starts to show neutrality around the 22,000 levelThe German index has posted steady gains, rising nearly 7% over the last four trading sessions, mainly driven by the low interest rates maintained by the ECB at 2.25%, as well as the easing of potential trade war tensions, which has allowed the index’s bullish bias to remain strong in recent weeks. However, buying candles have been gradually diminishing over the last sessions, and it is likely that a selling candle may appear in today’s session, reinforcing short-term neutrality as the index trades above the 22,000 level.

Accelerated Trend: Since April 9, the DAX has shown significant upward movements, resulting in a fairly steep bullish slope and giving way to an accelerated uptrend. If the DAX fails to hold the recent weeks’ highs in the short term, this accelerated price movement could lead to corrective pullbacks. However, the dominant bias in the longer term remains bullish.

ADX: The ADX line has begun to decline and is now facing the neutral area marked around the 20 level. Frequent oscillations around this level indicate that volatility has decreased and could lead to sustained price neutrality in the short term.

MACD: The MACD histogram remains above the indicator’s 0 level but has shown a steady deceleration, which may signal a lack of momentum in the average movement of the moving averages. As the MACD histogram continues to narrow, it could pave the way for slight bearish momentum in the DAX’s daily chart over the short term.

Key levels to watch:

22,000 points: A nearby support area coinciding with an important psychological level, which could act as a significant barrier against potential short-term price pullbacks.

21,400 points: A distant support area aligning with the 100-period simple moving average. Bearish movements reaching this level could threaten the bullish formation currently seen on the chart.

23,000 points: A definitive resistance level coinciding with the area marked by the DAX’s all-time highs. Buying movements returning to this level could trigger a consistent bullish bias and a much more relevant uptrend in the short term.

Written by Julian Pineda, CFA – Market Analyst

Bullish bounce?DAX40 (DE40) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 21,518.66

1st Support: 21,157.88

1st Resistance: 22,031.65

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Quarter Ends, Setup Begins: Long from DAX Support ZoneDAX returned to its major support zone around 22,000 after an extended decline through March. I’ve been triggered into a long position as we step into a fresh month and quarter. We’re sitting at strong historical demand with multiple macro events lined up this week—I’ll take what the market gives and manage it accordingly. No ego here, just flow with the setup. Let’s see where this one heads as NFP and PMI data come in.

Technicals

• Timeframe: 1H

• Entry Zone: Strong support retest at 22,000

• Setup: Long triggered on reaction from major support

• Target: Zone around 22,950

• SL: Below the support zone (~21,800)

• Fibcloud: Still trending below, watching for reclaim

• End-of-month rebalancing and Quarter close may add volatility.

Fundamentals

• DAX dropped nearly 2% on Monday, hitting its lowest levels since Feb 10, in line with global market weakness.

• US trade tariff uncertainty under Trump’s “reciprocal” rhetoric weighs on sentiment.

• Germany’s CPI eased to 2.2%, the lowest since Nov 2024, aligning with market expectations.

• Q1 performance remains strong overall, up nearly 11%, supported by Germany’s spending plan.

• Eyes on this week’s NFP and PMI data which could drive further price action.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

DAX Bullish ReversalDAX Index (GER30) Trade Setup – 1H Chart Analysis

The DAX Index (GER30) is showing signs of a potential bullish reversal from a key support zone. The price has reacted at 21,975.87, indicating a possible upward move. A retracement to the **62% Fibonacci level (22,534.21) presents an optimal buy entry with a well-defined risk-to-reward ratio.

Trade Details:

- **Entry:** **22,534.21** (62% Fibonacci retracement)

- **Stop Loss (SL):** **21,975.87** (Below the recent swing low)

- **Take Profit Targets:**

- **TP1:** **23,476.14** (0% Fibonacci level)

- **TP2:** **24,056.53** (38.2% Fibonacci level)

- **TP3:** **24,995.45** (100% Fibonacci extension)

Analysis & Justification:

✔ Key Support Confirmation** – The price bounced off **21,975.87**, a significant support level.

✔ Fibonacci Confluence** – The 62% retracement level aligns with historical reaction zones.

✔ Moving Average Resistance** – A breakout above **22,600** could confirm bullish momentum.

✔ Risk-to-Reward Ratio** – The trade offers a **minimum 1.7:1 ratio**, improving with higher TP levels.

"GERMANY40" GER40/DAX Indices Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY40" GER40/DAX Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 23000

Sell Entry below 22100

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

-Thief SL placed at 22600 for Bullish Trade

-Thief SL placed at 22600 for Bearish Trade

Using the 30min period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 24100 (or) Escape Before the Target

-Bearish Robbers TP 21200 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

"GERMANY40" GER40/DAX Indices market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

🔰Fundamental Analysis

The GER40 index has experienced a moderate decline of 2.5% in February, with the index currently standing at 22,500 points.

Company earnings have been mixed, with some companies exceeding expectations while others have disappointed.

The dividend yield for the GER40 is around 2.5%, which is relatively attractive compared to other major European indices.

🔰Macro Economics

The European Central Bank (ECB) has maintained its hawkish stance, keeping interest rates at 4.25% to combat inflation.

Germany's GDP growth rate is expected to slow down to 1.5% in 2025, due to the ongoing economic uncertainty.

Global trade tensions, particularly between the US and China, continue to impact the German market.

🔰Global Market Analysis

The GER40 is experiencing a bearish trend, with a 0.5% decline in the last 24 hours.

The index is currently trading at 22,500, with a high of 22,600 and a low of 22,400.

🔰COT Data

Speculators (Non-Commercials): 45,011 long positions and 30,015 short positions.

Hedgers (Commercials): 25,019 long positions and 40,011 short positions.

Asset Managers: 30,015 long positions and 20,019 short positions.

🔰Market Sentiment Analysis

The overall sentiment for the GER40 is bearish, with a mix of negative and neutral predictions.

55% of client accounts are short on this market, indicating a bearish sentiment.

🔰Positioning Analysis

The long/short ratio for the GER40 is currently unknown.

The open interest for the GER40 is approximately €10 billion.

🔰Quantitative Analysis

The GER40 has a relatively high volatility, with an average true range (ATR) of 150 points.

The index is currently trading below its 50-day moving average, indicating a bearish trend.

🔰Intermarket Analysis

The GER40 is highly correlated with the Euro Stoxx 50 index, with a correlation coefficient of 0.85.

The index is also highly correlated with the DAX index, with a correlation coefficient of 0.90.

🔰News and Events Analysis

The GER40 has been impacted by the ongoing economic uncertainty in Europe.

The index has also been affected by the decline in German industrial production.

🔰Next Trend Move

Bearish Prediction: Some analysts predict a potential bearish move, targeting 22,000 and 21,800, due to the ongoing economic uncertainty and decline in German industrial production.

Bullish Prediction: Others predict a potential bullish move, targeting 23,000 and 23,200, due to the attractive valuations and potential economic recovery.

🔰Overall Summary Outlook

The overall outlook for the GER40 is bearish, with a mix of negative and neutral predictions.

The market is expected to experience a moderate decline, with some analysts predicting a potential bearish move targeting 22,000 and 21,800.

🔰Real-Time Market Feed

As of the current time, the GER40 is trading at 22,500, with a 0.5% decline in the last 24 hours.

🔰Future Prediction

Short-Term: Bearish: 22,200-22,000, Bullish: 22,800-23,000

Medium-Term: Bearish: 21,800-21,600, Bullish: 23,200-23,400

Long-Term: Bearish: 21,400-21,200, Bullish: 24,000-24,200

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX Post Election Potential Bullish ContinuationDAX price still seems to exhibit signs of potential bullish continuation (during the current post election period) as the price action may form another credible Higher Low with multiple confluences from key Fibonacci and Support levels.

Trade Plan :

Entry @ 22653

Stop Loss @ 22014

TP 1 @ 23292 (Before All Time High)

TP 2 @ 23931 (After All Time High)

Move Stop Loss to Break Even if TP1 hits.

DAX Breakout or Fakeout? Long Setup to 23,300The German DAX index presents an opportunity for a long position, targeting the 23,300 price zone. The current price action suggests a retracement toward previous highs before confirming a continuation. With this in mind, I have executed a long position, monitoring key technical levels for potential reactions.

On the fundamental side, the market remains sensitive to geopolitical and economic developments. President Trump’s renewed tariff threats on EU exports have introduced fresh uncertainty, while domestic tensions in Germany over fiscal policy further contribute to volatility. Additionally, corporate earnings are mixed, with Daimler Truck reporting strong Q4 results, whereas BMW shares plummeted due to weaker-than-expected forecasts.

Given these factors, the DAX remains in a reactive phase, and the upcoming macroeconomic events, particularly Eurozone inflation data and Federal Reserve commentary, will play a crucial role in shaping sentiment.

Technical Analysis:

• Entry: Long position initiated at key structural support.

• Target: 23,300 price zone, assessing momentum near previous highs.

• Support Levels: Watching the 22,600–22,700 range for potential rebounds.

• Indicators: The price remains above key moving averages, and the Fib retracement aligns with bullish continuation potential.

Fundamental Analysis:

• Trade Tensions: Trump’s tariff threats on EU exports and reciprocal measures could introduce short-term uncertainty.

• Domestic Politics: German fiscal policy debates may weigh on market sentiment.

• Corporate Earnings: Daimler Truck outperforms, while BMW struggles, adding mixed signals to investor outlook.

• Upcoming Catalysts: PMI data and inflation reports from the Eurozone could determine the next major move.

DAX’s price action is aligned with the broader equity market reaction, and if the index maintains its momentum above key technical levels, the 23,300 target remains in play. Managing risk and reassessing based on market developments will be key.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.