Daxlong

#Dax - 300 Points Move? #GRXEUR #DAX30Is there just a countermove or is capital now flowing back into the markets? Is the bottom in and the markets are now heading for new highs?

Decisive for this is the outcome of the election on Super Tuesday in the USA and which of the 3 pensioners will be sent into the race for the presidency by the Democrats. More about this later in the video on YT.

DAX gaining power after rejection at the fib leveldax is gaining power after the last horror week. we see a rejection of the fib level the forming of a pinbar. also, we see a clear rejection at the green highlighted area which is an important neckline. that level has multiple support and resistance zones. price has the potential to develop upside in the upcoming 3 days.

BUY DAX ON WEEKLY CHARTThe European market kept its collective head on Monday morning, avoiding another plunge despite the alarming losses in China.

One of the more curious aspects of the coronavirus situation is that, while the rest of the world’s indices suffered, the Shanghai Composite was side-lined by the Lunar New Year holidays. Well, Monday saw it play catch-up. The Chinese index lost close to 8%, investors bailing at the first chance they got – this as the death toll jumped by 57, the single one-day increase since the virus was detected.

Instead of treating this as another chance to sell, Europe was level-headed after the bell. The DAX rose 0.2%, while the CAC eked out a 0.1% increase. The FTSE was a bit more energetic, adding 0.3%, though that’s because of the pound’s early February retreat. As for the Dow Jones, the futures are currently pencilling in a 100 point bounce later this afternoon.

DAX30 GER30OUTLOOK: BULLISH

Past few days DAX30 has been confounding forecasters - and whipsawing short-sellers - by rebounding sharply.

DAX nears all-time highs, next target 14530!The DAX is finally catching up to the rest of the worlds equity markets. It's about 100 points away from the all-time high which is not a big distance for the German Index. The support structure at 13000 held extremely well and the buyers managed to bid the price up from there. The pop came fast and in a matter of days on strong volume. From here we could see a new all-time high fast. The Fib extension level suggests price is going to move into the 14530 area and that would bring the DAX level with other global indices.

This idea is for educational purposes only, this does not constitute as trading or investment advice. TRADEPRO Academy is not liable for any market activity.

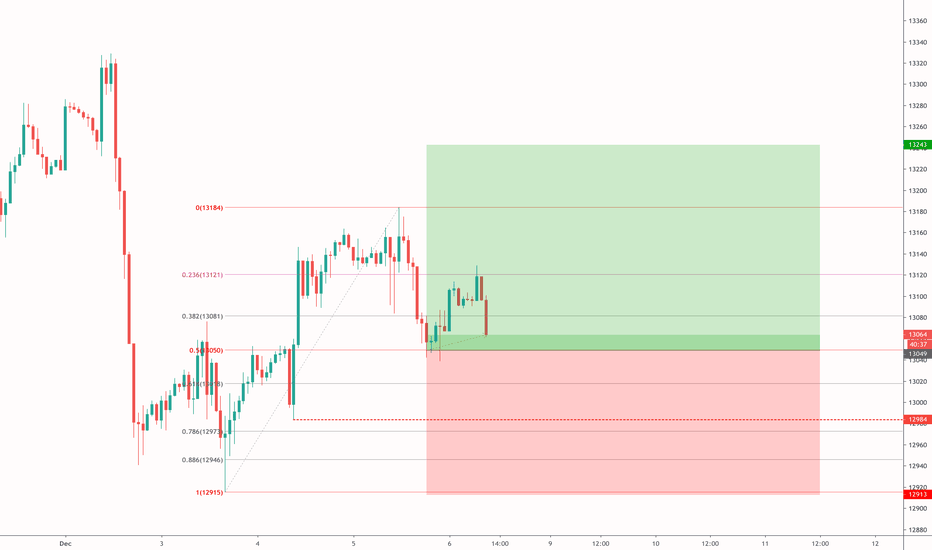

DAX breaks a recent high, next target 13600! DAX manages to break through the 13305 high on decent volume after holding the support structure we had mapped out at 12910. The fact that it broke into 13400 and retested the broken high at 13290 means that there could be immediate support here for an all-time high move or a slight retrace into 13050 before we see the all-time high again. For the move to come out into the all-time high we need to see a new higher-low form so that means a move below 12910 ultimately would disqualify this long.

Disclaimer: This idea is for educational purposes only, this does not constitute as investment or trading advice. TRADEPRO academy is not responsible for any market activity.

Weekly suggests retrace to 12620 on DAX, then up to 13775!Immediate short on DAX makes sense if you look at it on a weekly basis there is reversal structure forming at the current price, the long wicked dojis and red candle pinbars are associated with a move lower. The volume is accumulating for a slight retrace as the DAX cannot catch up to the US equities at all-time highs. The retrace is still the previous broken level which happens to be the 50% retrace from the impulse move. That would mean that a 5% pullback is to be expected in the DAX and that can be ignited by a pullback in the S&P 500 market which we are anticipating as well. The upside move is the extension based on recent impulses right at 13375.

Disclaimer: This trade idea is for educational purposes exclusively, this does not constitute investment or trading advice. TRADEPRO Academy is not responsible for any market activity.

DAX short to 12620 before an all-time high!The Dax has recently played off of our short level the endless rotation at the 13305 was the indication that there is a stall in momentum from the upside. Meaning we could see a retrace. It's not as strong as the US equities due to the European economy, German economy and the monetary policy.

We are watching the retrace into the 12880 support as the first pitstop based on market structure. Then the next level is the 50% retrace at 12615 based on the impulse move that brought it to the high. Then we could see rotations for the high.

DAX LONG but watch out 12900 LevelMarked with a black arrow

This is the Level which should not break

Please notice that he channel system startet

to slow the uptrend.

Good trades

If you want to support my work , please be so kind and like them

-

My posts are not and advice to buy or sell something

always do your own research

-

Renkotrade

DAX30 CFD bulls are likely in charge of the action till the FEDAs expected, the ECB's key interest rate decision last Thursday didn't provide any significant volatility in the DAX30 CFD. And, with the economic calendar being thin today, it's difficult to see significant impulses on either side.

Currently, the German index has stabilised between 12,800 and 12,900 points, but this is on an Hourly time-frame above 12,600 points with a clear bullish tendency.

In fact, given the latest news around the massive liquidity injections from the FED, conducting nearly 65 billion USD in overnight repurchase agreements and another 35 billion USD in repo operation last Tuesday alone, it's difficult to see Equities come under serious pressure in the near-term, especially with the FED rate decision taking place next Wednesday.

The reason for that: since 1980 research shows a clear bullish tendency "Pre-FOMC", not only in US-equities, but also in the DAX30 CFD. That's especially true with a flattening US-yield curve and volatility being solid. Here, on average, nearly 80% of all profits in the S&P 500 were made within eight days leading up to the interest rate decision.

With that in mind, and the DAX30 CFD trading above 12,800 points, another push up to last week's and current yearly highs around 12,920 has a higher probability than a push lower and test of the region around 12,600 points.

Ready to start trading the live markets? Then open a free account with Admiral Markets - 8,000+ instruments to choose from, some of the market's tightest typical spreads, and the world's #1 multi-asset trading platform. admiralmarkets.com/start-trading/

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Dax daily: 16 Oct 2019We saw another bullish happiness for Dax. After the initial long, buyers took a lunch break and the price resumed its climb later in the afternoon session. The resistance zone at 12 598 was broken and functioned as a support. Dax formed a new high of the recent past weeks but didn't hold the throne for long. The price then closed the day at 12 624.

Important zones

Resistance: 12 676

Support: 12 598

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

NIL

Today's session hypothesis

Dax opened with a descending gap today. Before we finished writing this analysis, the gap has closed quickly. Buyers respected the support zone at 12 598. If the current bullish sentiment holds up, the retest of yesterday's high at 12 676 is very likely. That level is now an important resistance zone and should it be broken, we see another target at 12 730 which is the August high. Dax traders seem to be optimistic also due to the favourable Brexit echoes we hear recently. On the other hand, if the market mood changes, we are looking at a decline towards 12 483.

Dax daily: 27 Aug 2019 Monday's session started with a sharp upside move. As expected, sellers entered the market at our resistance level of 11 611 to correct the uprun, but not for long. The same scenario occurred once more at the following resistance zone of 11 645 which also didn't have long lasting. The 11 611 zone functioned as the support for another bullish push towards the end of the intraday session.

Important zones

Resistance: 11 707

Support: 11 561

Statistics for today

Detailed statistics in the Statistical Application

The statistical probability of breaking yesterday's high is 83%

The statistical probability of closing outside of yesterday's session is 83%

Macroeconomic releases

NIL

Today's session hypothesis

Today we have a strong statistical probability of breaking yesterday's high. Right above this level, we have a nice resistance zone at 11 707 where we may anticipate seeing some bearish correction. Nevertheless, there is another strong card for the bullish sentiment as the statistics suggest the price is likely to close outside of yesterday's range. As always, we advise all traders to be vigilant and have a clear trade plan.

Two way scenario for playing DAXLet's start with daily chart;

Downtren started in January 2018 still continues. Value tested the resistance 3rd time on July 25th and than steep fall has been started.

Now when we come to 2hours chart, we can see steep fall trend line started on July 25th better. Today the price is going up and seems like that it will test the resistance of trendline 4th time. Let's wait and see the reaction of value once it hits to resistance;

Scenario1 in purple arrow (More likely to happen);

Resistance will work one 4th time and push the price down to 11276 support line

Strategy: Play short on DAX target should be around 11300. Stop loss will be the orange triangle resistance.

Scenario2 in green arrow (Less likely to happen):

Price will break the resistance and go up. We need to see narrowing bollinger bands for this movement and RSI should break the downtrend line. Another indicator we should be looking is moving average, if it can pass thorough the bollinger middle line upwards.

Strategy: Play long by the time of breaking point (most probably around 11650), Target1 will be 11830. Than we can see some slow down and than continue to upper channel and Target2 will be around 12100.

RSI is also confirming both movements, we have to check it closely to see the move.

Dax daily: 29 Jul 2019 Welcome to the first analysis of the 31st week. Friday's session turned out really nice. We found buyers at a good Thursday close support level and there was an intraday low formed there as well. Besides only one significant short candle at 2pm, Dax was drifting upwards for the whole intraday trading. The price then closed near its high.

Important zones

Resistance: 12 421, 12 479

Support: 12 354

Statistics for today

Detailed statistics in the Statistical Application

The statistical probability of breaking Friday's high is 87%

Macroeconomic releases

NIL

Today's session hypothesis

For today, we have a high statistical probability of breaking Friday's high, which is also distanced relatively far away. Long trades then have a clear target. Contrary, should the Friday's low be broken, then the previous hypothesis becomes invalid. The chances of having both swings retested are as low as 7%. Taking advantage of shorting today's price, we can use a pullback around 12 421 and then 12 479.

Dax daily: 24 Jul 2019 Our Statistical Application did a great job again. As per the statistical probabilities, it was very likely that Dax would continue its upward move and so it happened. The price went up just to slow down at the resistance level of 12 380 and then went over the roof, making a strong upward momentum for the entire intraday trading.

Important zones

Resistance: 12 540, 12 576

Support: 12 437, 12 338

Statistics for today

Detailed statistics in the Statistical Application

The statistical probability of closing the gap is 69%

The statistical probability of breaking yesterday's high is 90%

Macroeconomic releases

09:15 - 10:00 CEST - Eurozone PMIs

Today's session hypothesis

Yesterday's session was very bullish. The statistics play for today's continuation as well. The combination of probabilities suggests we could retest 12 541. Another resistance we have lays around 12 576. The start of the session is great as well as the price drops slightly which is a positive key for us as the long trades have a better filling. Let's not forget that although we have a strong bullish confluence, the market might go its own way. Be careful around PMIs releases from Eurozone.