Dax daily: 04 Jul 2019 Welcome to the last analysis of this week. Tomorrow's analysis will be skipped due to a national holiday. Yesterday's statistics for breaking Tuesday's high was successfully passed. Dax rose all day and closed near its intra-day high. Today, we open with a smaller descending gap.

Important zones

Resistance: NIL

Support: 12 597, 12 543

Statistics for today

Detailed statistics in the Statistical Application

The statistical probability of breaking yesterday's high is 90%

Macroeconomic releases

USA - National holiday of Independence day

Today's session hypothesis

Today's plan is pretty straight forward. Just as yesterday, we have an increased statistical probability of breaking yesterday's high, hence all the trades have a clear target. We could find some buyers at 12 597 or even lower at 12 543. In case bulls are aggressive enough, it is likely they will start aiming higher right from the beginning of the session.

Daxlong

Dax LONG DEU30 LONG 1 HR Chart

#Dax #Deu30 #Renkotrade

Hello to all watching my charts-

For the end of the day after finished trading Dax for today

lets have a look what has happen.

LONG : So we are long in all timeframes, and my shortchannel

is totally parallel included Long in the longer channel, thats the reason

i have included here as always, but it sends us no new information

for today.

So stay long is what i suggest.

If you want to support my work and my charts, please like them...

Good trades

Renkotrade

DAX DEU30 LONG 1 HR 20.06. 4.00 p.m. german timeHello to all watching my charts

Dax LONG

Today the Dax is since the EZB announcements

and FED meeting in the bullish aerea again

And the Dax is exact in the middle of my channel , so at the moment

nothing in front what for me can change the setup quickly

We have some resistance at around 12400 from may

but in may oppinon "Trend beats resistance" and i would stay

long. Thats my personal view, no trading advice.

Good trades

Renkotrade

DAX 1HR SHORTHello to all watching my charts.

Dax now is in a consolidation mode.

I prefer at the moment the lower side

with a 60 to 40 percentage.

The reason i have no fine feeling for staying long is

that we see lower lows and lower highs.

I tried to marked it whit the red lines.

In classic charting thats a downtrend.

But after the strong rally from 11640 to the level 12100

we must be carefull to indicate that directly as short-

Maybe as i told you above its only a consolidation

Break 12050 as another lower low would be a short confirmation

I think no position here at the moment is the best position in my oppionion.

If you had been on the long side take the money and go.

Good trades

Renkotrade

Dax daily: 17 Jun 2019Welcome to a new trading week. Friday’s session turned out exactly as expected. From the beginning of the session, Dax went through our first support level at 12 121 to retest the second support level laying at 12 054 where the price bounced and even formed a daily low there. Later on, Dax slowed down in the consolidation area from Wednesday and we even closed in this range.

Important zones

Resistance: 12 148

Support: 11 987

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

19:00 CEST – ECB President Draghi Speaks

Today’s session hypothesis

The gap has already been closed so we’re short of one daily target. If we find bearish momentum, the price could head lower to retest the weaker support at 11 987. Talking about higher levels, there is one weaker resistance level at 12 148, however, if the price gets all the way there, it is likely Dax will retest the Friday’s high and the zone of 12 200.

Dax daily: 11 Jun 2019 Yesterday, we expected a retest of 12 139 and the drop towards the trend line. Dax did not reach all the way towards the resistance zone, but the return to 12 046 level worked well. The market met both of our indications – the support zone of 12 046 and the trend line. Bulls were not strong enough in the afternoon session and the price closed slightly negative at 12 084.

Important zones

Resistance: 12 139

Support: 12 046

Statistics for today

Detailed statistics in the Statistical Application

The statistical probability to close the gap is only 38%

Macroeconomic releases

NIL

Today’s session hypothesis

The price opened with an ascending gap sized 50 points, right at the mentioned resistance level. The statistical probabilities incline the gap closure is unlikely for today’s session and this indicates a bullish bias. Should the uptrend be formed and confirmed, we estimate the price is to reach 12 207 level.

DAX - Waiting for BullrunIt is not yet time to Buy but my traningplan for the next bull run is ready. So the only what i can do is wait and trink one, two, three,... bottle of beer. :-)

Wish you all a nice Father's Day and who it is not yet, maybe just Beginning today ;-)

Greetings from Hannover

Stefan Bode

Dax daily: 16 May 2019 Yesterday’s session corresponded with our analysis. After the open, Dax began to descend towards the support at 12 946 where we haven’t encountered any buyers and the price continued lower. Later in the NY session, Dax unexpectedly jumped up and today we open with a descending gap.

Important zones

Resistance: 12 097, 12 190

Support: 11 917

Statistics for today

Detailed statistics in the Statistical Application

The statistical probability of breaking yesterday’s high is 83%

Macroeconomic releases

10:15 CEST – German Buba President Weidmann Speaks

All day – Eurogroup Meetings

Today’s session hypothesis

Today, we estimate that the gap could be closed and find some sellers around the resistance zone of 12 097 for a possible correction. However, the probabilities today are more inclined to a buyers favour who could take the price all the way towards 12 190.

Dax daily: 15 May 2019For a change, yesterday’s session was in the hands of buyers. We first found some sellers at the resistance zone of 11 956 and they pushed the Dax some 50 points lower before buyers stepped in. Dax is opening with an ascending gap today.

Important zones

Resistance: 12 139

Support: 11 946

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

11:00 CEST – Eurozone – Flash GDP q/q

Today’s session hypothesis

Today, we expect buyers to continue in the correction with the first target laying at 12 190 and then 12 455 in the following days. The probability of closing the gap is not any high today, but the market structure of the recent days signifies the initial short. We could find some buyers at the support level of 11 964 which we could use as a bounce area to enter into a long position targeting 12 195. Sellers have a possible level of interest around the 12 139 zone.

DAX Chart 1 HR 30.04.2019 13:0 German time Hello to all watching my charts.

Dax moved out from the long channel

and is now drifting sideways.

In my view no time to act at the moment in long or short direction.

On the sownside to short there is support at around 12260

(blue lower line)

If it breaks that also its short time in m< view.

On the upside the next barrier resistance is 12350 aerea.

(blue upper line )

If Dax will breake these level maybe Dax can move up in the long channel again

and its time for a procyle action long.

Best is to wait what will happen.

Good trades

DAX HR update end of 25.4.2019 Close longAs DAX now crossed the DC 11 channel (Donchian Channel 11)

i suggest to be custious on the long positions and for me

it seems to be best for long positions to close at 15:00 german time

In addition Dax has fallen under the red EMA which is in system trading a long close signal

At the moment it not a position to switch in short.

We have to wait what happens tomorrow

whether we wil touch the lower line of the channel or not,

Dax at the decisiion 8.4. 3.pm Long but trendchange may come nowDax 15:00 german time at the decision point

Smaller support have been broken right now at 11975

Please check there the upper red line

But the bigger support at 11960 holds at the moment.

If these 11960 line will brake at end of 1HR Chart

(16.00/17.00 or tomorrow)

We should sell long positions and go short.

If the support will hold LONG is to stay

Good trades

DAX LONG end of 05.04. My traying diary 970 Points Gain Hello to all who watch my charts.

I brought you here my trading journal in the DAX of the last weeks.

Timeframe is the 1 HR chart.

We had a long signal until 27.3. 9:00 clock german time

then we got a short signal at 11714

After that we were short to the ground at about 11370.

(Difference about 340 points)

So the signal turned on Long at 11370.

Since then, the Long signal has reached around 12,000 points

Difference about 600 points

Overall, this makes a success of

940 Dax points in 14 days

Soon you can subscribe to my actions if you want

If you are interested send me an email.

DAX LONG 1HR end of 04.04.2019Hello to all who watch my charts.

For days DAX is in an upward movement and in a fairly wide Long channel.

As you can see, the distance to the lower channel band is quite large.

It currently runs at about 11860 and that is a good 120 points below today's closing price.

In addition, we are at a round number

Having arrived at 12000, that has always shown the past of similar marks leading to a breather of the market straight up.

Today we have developed a new resistance at about 12028

what leads me to the assessment together:

Long continues, yes, but only once is a break in the Long Trend

expected.

The Dax can fall but without problems until just 11860 without that should lead to a short position.

I would not start new positions because of the 12000 points mark.

If you want to make a channel trading, which would have been very successful in recent times, is a fall on the 11860 or the equivalent value of the lower Long Channel the next few days to wait.

And if you have checked my last post of DAX here at teh bottom of

11330 found, you are more than 600 points up and maybe a rich man..

Good Trades to all

USDJPY approaching resistance, potential drop!USDJPY is approaching our first resistance at 110.89 (horizontal overlap resistance, 100% extension, 50% Fibonacci retracement ) where a strong drop might occur below this level pushing price down to our major support at 110.30 (50% Fibonacci retracement , horizontal overlap support).

Stochastic (34,5,3) is also approaching resistance where we might see a corresponding drop in price.

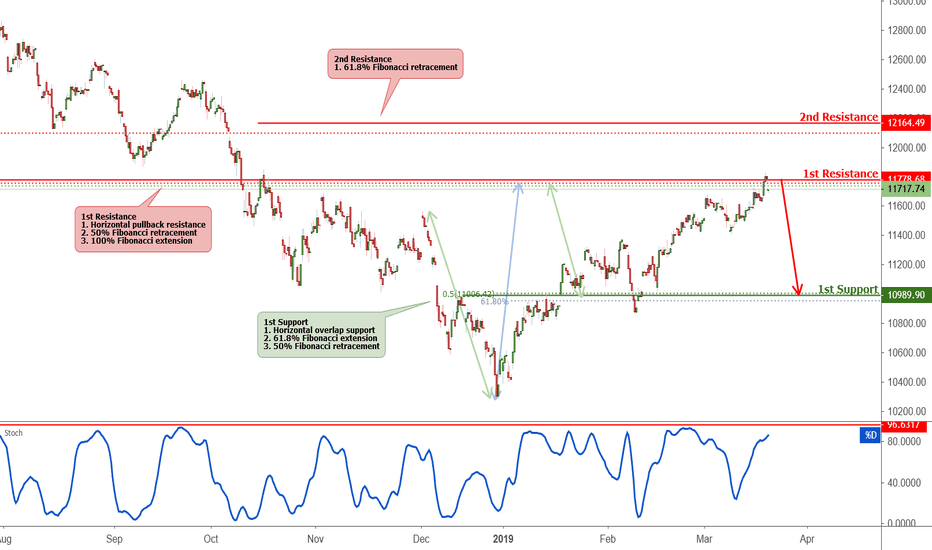

DAX approaching resistance, potential drop!DAX is approaching our first resistance at 11778.68 (horizontal pullback resistance, 50% fibonacci retracement , 100% fibonacci extension ) where a strong drop might occur below this level pushing price down to our major support at 10989.90 (horizontal overlap, 50% fibonacci retracement , 61.8% fibonacci extension ).

Stochastic (21,5,3) is also approaching resistance where we might be seeing a corresponding drop in price.

#DAX30 A mine on the way!An obstacle in the way, in the last few days we are on the upward trend that is still real today, so to those who ask how long will the gains continue? The answer in the graph above, We expect the dax30 will continue rise to the 200 Moving average and then it can give a downward correction Once this happens we will have to follow and see whether the decline will be just a correction or that it is a decline that will change the trend

Buy Dax 30:

Take Profit: 11790