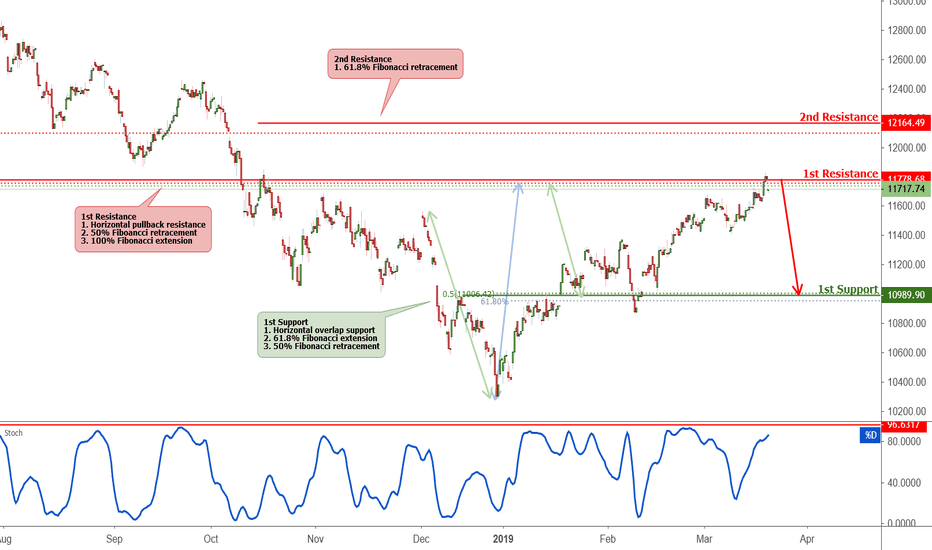

DAX approaching resistance, potential drop!DAX is approaching our first resistance at 11778.68 (horizontal pullback resistance, 50% fibonacci retracement , 100% fibonacci extension ) where a strong drop might occur below this level pushing price down to our major support at 10989.90 (horizontal overlap, 50% fibonacci retracement , 61.8% fibonacci extension ).

Stochastic (21,5,3) is also approaching resistance where we might be seeing a corresponding drop in price.

Daxshort

DAX approaching resistance, potential drop!DAX is approaching our first resistance at 11778.68 (horizontal pullback resistance, 50% fibonacci retracement , 100% fibonacci extension ) where a strong drop might occur below this level pushing price down to our major support at 10989.90 (horizontal overlap, 50% fibonacci retracement , 61.8% fibonacci extension ).

Stochastic (21,5,3) is also approaching resistance where we might be seeing a corresponding drop in price.

DAX approaching resistance, potential drop! DAX is approaching our first resistance at 11778.68 (horizontal pullback resistance, 50% fibonacci retracement, 100% fibonacci extension) where a strong drop might occur below this level pushing price down to our major support at 10989.90 (horizontal pullback support, 61.8% fibonacci extension, 50% fibonacci retracement).

Stochastic (89,5,3) is also approaching resistance where we might see a drop in price.

SHORT DAX approaching resistance, a further drop could occur!DAX is approaching our first resistance at 11778.68 (Horizontal pullback resistance, 50% fibonacci retracement , 100% fibonacci extension ) where a strong drop might occur below this level pushing price down to our major support at 10989.90 (horizontal pullback support, 61.8% fibonacci extension , 50% fibonacci retracement ).

Stochastic (21,5,3) is also approaching resistance where we might see a corresponding drop in price.

DAX approaching resistance, potential drop! DAX is approaching our first resistance at 11778.68 (Horizontal pullback resistance, 50% fibonacci retracement , 100% fibonacci extension ) where a strong drop might occur below this level pushing price down to our major support at 10989.90 (horizontal pullback support, 61.8% fibonacci extension , 50% fibonacci retracement ).

Stochastic (21,5,3) is also approaching resistance where we might see a corresponding drop in price.

DAX - Short setup with 1:4 risk ratioI see some rejection from resistance level and closed below the area. There are also untested targets below. I believe DAX is going down to test support zones.

I'm planning to use multiple entries. I will; short at the beginning; add if the price goes up little bit more and add if i see a close below 11608. This is 1:4 short setup so stop is very tight. If stopped out and price goes back down, I'll jump back into the train.

There's also another trade idea for me. I only go short if i see a close below 11608 with the same stop and target.

Entries:

1. Beginning of the new hourly bar

2. 11670 (sell limit)

3. 11605 (I will wait for a close)

Total risk: 3% of account balance (1% for each trade)

Risk to reward ratio: 1:4

Stop Loss: 11711 (73 pips)

Profit Target: 11346 (292 pips)

Trail: I will trail the stop loss accordingly...

Disclaimer: This is not financial advice. Educational purposes only.

Trade safe

Atilla

DAX approaching resistance, potential drop! DAX is approaching our first resistance at 11778.68 (Horizontal pullback resistance, 50% fibonacci retracement, 100% fibonacci extension) where a strong drop might occur below this level pushing price down to our major support at 10989.90 (horizontal pullback support, 61.8% fibonacci extension, 50% fibonacci retracement).

Stochastic (21,5,3) is also approaching resistance where we might see a corresponding drop in price.

DAX approaching resistance, potential drop!DAX is approaching our first resistance at 11574.22(horizontal swing high resistance, 61.8% Fibonacci extension , 50%Fibonacci retracement) where a strong drop might occur below this level pushing price down to our major support at 11087.34(38.2% Fibonacci retracement , Horizontal swing low support)

Stochastic (55,5,3) is also approaching resistance where we might see a corresponding drop in price.

Trading CFDs on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

DAX approaching resistance, potential drop!DAX is approaching our first resistance at 11574.22(horizontal swing high resistance, 61.8% Fibonacci extension , 50%Fibonacci retracement) where a strong drop might occur below this level pushing price down to our major support at 11087.34(38.2% Fibonacci retracement , Horizontal swing low support)

Stochastic (55,5,3) is also approaching resistance where we might see a corresponding drop in price.

Trading CFDs on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Dax 30 Index Analysis+SignalWe see in the graph above some points that strengthen our opinion about Sell position:

1. According to the Ichimoku Indicator, we are totally bearish as we are under the cloud and the blue line above the red line in W1

2. we can see that we are in a bearish channel with lower points each time and right now we are in the resistance

3. As soon as the price touched the moving average 100 he did not manage to cross it and it caused a drop

Sell Dax

Entry Price: 11230

Stop Loss: 11410

Take Profit: 10550

DAX INDEX 30 Short Signals!We are currently on very serious and important resistance that will determine the direction of the DAX for the coming days, According to Ichimoku indicator we are still in a downward trend, despite recent increases!

And we are also on the resistance of the Fibonacci retracement (23.6) Which means continue to move in the original direction.

For all the reasons are written above we recommend entering a sell position

Sell DAX

Entry Price: 11186

Take Profit: 10508

Stop Loss: 11540

DAX bounced off support, potential for further rise!DAX bounced off our first support at 11008 ( Inverse head and shoulder neckline support, 23.6% fibonacci retracement ) where a further rise might occur pushing price up to our major resistance at 11757.29 (50% Fibonacci retracement , 100% Fibonacci extension, Inverse head and shoulder porfit potential ).

Ichimoku Cloud shows bullish trend where we might see a corresponding rise in price.

DAX approaching resistance, potential drop! DAX is approaching our first resistance at 11778.68 (horizontal pullback resistance, 50% Fibonacci retracement, 100% Fibonacci extension) where a strong drop might occur below this level pushing price down to our support at 10989.90 (Horizontal pullback support, 61.8% Fibonacci extension, 50% Fibonacci retracement).

Stochastic (21,5,3) is also approaching resistance where we might see a corresponding drop in price.

DAX approaching resistance, potential drop! DAX is approaching our first resistance at 11778.68 (horizontal pulllback resistance, 50% Fibonacci retracement, 100% Fiboancci extension) where a strong drop might occur below this level pushing price down to our major support at 10989.90 (Horizontal overlap resistance, 50% Fiboancci retracement, 61.8% Fibonacci extension).

Stochastic (21,5,3) is also approaching our resistance where we might see a corresponding drop in price.

DAX approaching resistance, potential drop!DAX is approaching our first resistance at 11036.41 (Horizontal overlap resistance, 23.6% Fiboancci retracement, 61.8% Fibonacci extension ) where a strong drop might occur below this level pushing price down to our major support at 10181.14 (61.8% fiboancci extension, horizontal swing low support, 78.6% fibonacci retracement ).

Stochastic (21,5,3) is also approaching resistance where we might see a corresponding drop in price.