BTC may become bullish again#BTC

Yesterday, immediately after breaking through the bottom of the triangle, we were warned about the likelihood of a decline. At the moment the market has returned back (above 8100) and the current level again looks good support, since it does not allow the price to go lower. If, on a 1-day scale, a new candle opens above 8100, the probability of a decline will be minimal and you can count on a further positive scenario, perhaps even open long margin transactions.

DAY

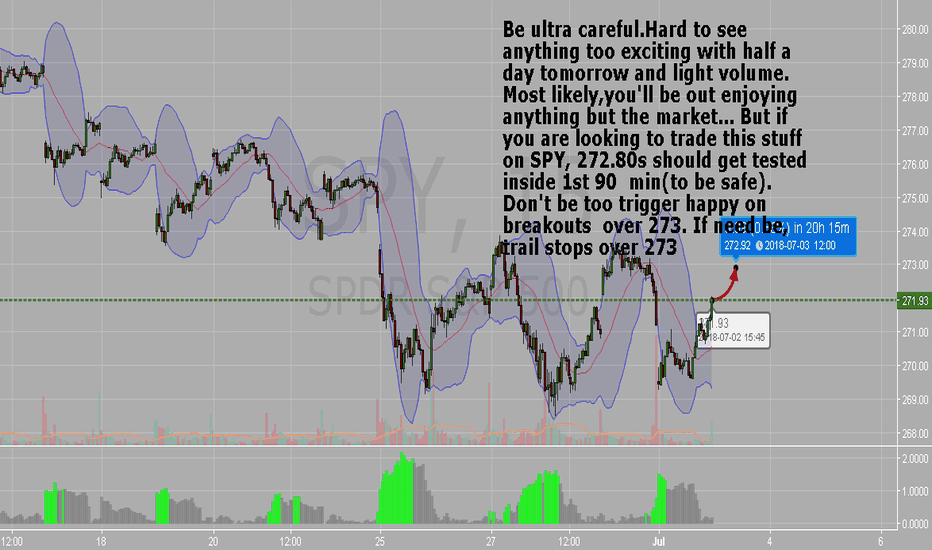

SPY half day dragEvery now and then, 'they'll pull a surprise half day rally.

It's design to complete some orderbooks when no one is looking. Not the only reason of course,but it helps when volume is low to help market makers shift the market to their benefit easier.

That said,I'm not going to be going too frenzied after the 273 attempt tomorrow,price now 271.84.

I've seen the machines go bonkers into the half day close decently.

Crude is retesting the broken up trend lineCrude broke a year long up trend line earlier this month. It has now tested the bottom of the up trend line several times and looks ripe for drop.

Take your loss on a daily candle close back above the trend line .

Target the three indicated levels. You can even hold a portion of the trade for the June 2017 low.

Follow your stops as the trade moves in your direction.

Be sure to size your trade according to your risk parameters. NEVER BET THE FARM!

No trade is guaranteed 100% to work. You NEVER know what the market will do.

Your first job is to protect your trading account.

Time to short!Hi guys,

it seems it's selling time. Price is in overbought, at the resistence of the channel. This channel has been already tested many times, so everything I see tells me to go short.

Target area is around @102.00 Nice move with a very tight SL @111.50 more or less.

Enjoy your wallet!

Tari.

RTRX new highslooks like RTRX is holding onto new highs! Another day another dollar! gains are being made on a daily!!! basis

EURUSD DAY DRAGON BULLISH REVERSAL PATTERNThis trade was brought to our attention by Tex3rdgen from the strike-trader-signals-chatroom. Here is his comments "I'm seeing a very definite Dragon Pattern on EURUSD daily chart. For those who haven't heard of it, it is a reversal pattern, it looks left with head at the top of a typical long neck with front feet lower than back feet with a hump in between. Confirmation comes at the break of the down TL drawn from back of head to back of hump. May confirm on Monday."

Thanks Tex

NZDUSD wave signalsI don't normally trade the NZDUSD but the chart looks very clean we the Pro-Trading System on it. Started to nibble on the short side today. I know the Dollar is playing out a 4th wave retracement and so we should be seeing the NZDUSD pushing higher but, we are I think this could be a good area to enter. Stop placement wouldn't be so far away and the reward would be down at wave 5. So good risk reward.

I don't know how to put videos on here because I wanted to show you why and how I took 100 points out of oil this morning.

Watch for the live CAT bounceThis is a short term trade.

to specify, short term meaning no more than 2 hour trade(Perhaps max) I'm pretty sure we break above the close Tuesdays 152.95. The quicker you are in the morning, the better. Hopefully we get a quick bounce off of 152.70s to launch into 153.50s.

And the final reminder, this trade is no longer than 2 hours. At the very least, trail a stop loss just in case it runs beyond 153.70s.

Lets see how I do on the CAT call(s)

POSSIBLE FUTURE FOR AUGJPY FIRST OF WEEKHere are some signs of possible bullish bias for next week for the AUDJPY

Day Chart double bollinger bands - price closed above BB midline bullish bias

4H Chart - Macd crossed above zero line and Price closed above 100 sma bullish bias

1H showing possible bearish retracement back to the 50 sma area, macd over bought

15m showing possible bearish retracement back to 50/100 sma, macd over bought

Take Profits will be in updates below

Best Indicators for Day/Swing Traders and How to Use Them

An Introduction

This is a quick overview of three of the best trading indicators for day and swing traders alike. If you are a new trader then it is very important for you to understand that no indicator or oscillator is going to make you trade profitably immediately, so don’t go on a wild goose chase to find one that will. Learn a select few indicators and the methods and strategies to use them effectively. Master them, and then learn more.

“Your strategy will be more profitable using fewer indicators that you have mastered. Then more indicators that you haven’t.”

Let’s begin.

GBPAUD 4H REVERSAL - DAY RANGE TRADESGBPAUD is in a Day range pattern

Price is at the bottom of the range and also at a long term sup/res level

Price can bounce off range bottom or breakout and continue the trend

Day Breakout trade -

Sell Stop @ 1.7520

Take Profit @ 1.7420

Watch Macd to cross below Red signal line - close trade if Macd crosses above Red signal line again

4H Reversal Trade

1st Buy Stop @ 1.7775

2nd Buy Stop @ 1.7805

3rd Buy Stop @ 1.7875

Take Profit 2 options

Opt 1 - 1st and 2nd Trades take 1/2 profit at 50 pips each - run with balance to take profit

Opt 2 - Run all 3 trades to take profit

Take Profit @ 1.7920

BTCUSD DAY TRADEABLE SPACEPrice paused a Day Support

Price will either break bullish or bearish

Bullish Trade

Use your trading plan for entry

Take Profit at 0% fib

Bearish Trade

Bearish side has a trade-able space to the left clear of consolidation

15m break-hook-go pattern for entry short

Take Profit from a Day support level

Simple BTC USD 1% per day (compound that for a couple years)Money Flow index is similar to RSI but I feel presents more buying opportunities, however it's hard to use RSI and MFI to decide when to sell reliably - however making 1% profit per day (on average, don't try to force a trade if the RSI and MFI is high, just wait until it is low) can be done with this method and adds up over time.

Still Bearish on Day Chart BTCBTC price is currently being supported by 100 day EMA. Also large support exists given the price volume profile visible range around 8800. CMF looks to have hit the top and will now see more selling pressure as it declines. We are not seeing spikes and dips in the OBV so volume has been relatively constant. Ichimoku Cloud is in the red zone with the Base line (pink) still above the Conversion line (Orange), a bearish signal.

Still a very bearish outlook on the Day chart. Price will need to break 12k for a bull reversal.

GLOW Hammer Forming Looks like GLOW may be signaling a bottom. With a green hammer forming on the daily chart this could be a change in the trend. GLOW has been flirting with sub $.19 but held up well. GLOW has a p/e of nearly 1.28 and total assets of 15.42 mil. Could be a short squeeze coming.

GOLD / XAUUSD / ELLIOT WAVES / DAY ANALYZISWIZARD OF FARTS AND CHARTS AT YOUR SERVICE!

Just because I was in a good mood I decided to calculate an estimate for you guys how we are moving in 1D chart counting to Elliot Waves.

The wave targets are subjective at this point because we dont have enough data but this is my rough estimation.

THIS IS NOT AN INVESTMENT ADVICE!

Rally and Crash on Evening of 4/418Given the periodic motion of the bearish BTC market in the prior week, we can expect a short rally to the low 7000s before the next selloff, which will test the critical support levels of the mid 6000s. As the price of BTC reaches mid-November levels, the market is reaching a crossroads. I expect the overcorrection in the market to rally back to the expected levels around 9k in the next few weeks.