DB

Douche Bank; Poor Credit, No Inovation, Bad Books, Just Trash...Hello Traders,

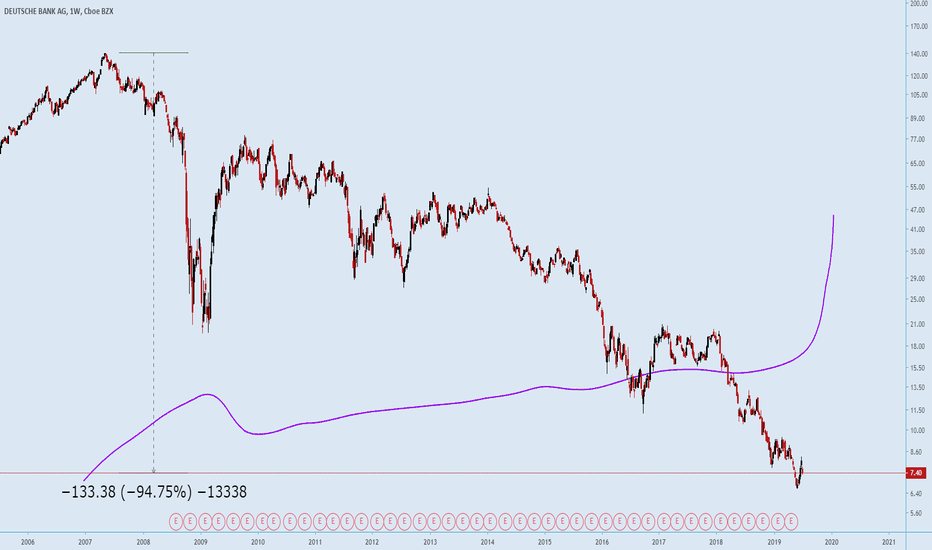

Looking here at DB I think we could possibly retest resistance but overall I might be going short once we start downward momentum. I think coming down and testing the 200ma would make sense, but then after that, there are a ton of gaps to fill. Assuming that the macro tops out soon or more Douche Bank weakness gets exposed on the balance sheet or otherwise, those gaps should fill. This is could play out into a longer time frame and go sideways, or it might fail completely. None of this is financial advice.

What Has Gone Wrong According To Forbes?

"Deutsche has been engulfed in a spiral of declining revenue, enduring expenses, a declining credit rating and hence, a rising cost of capital. There has been an issue of having stuck with outdated technology instead of investing in the latest equipment that could have boosted efficiency and a drain of top talent. Finally, there have been a series of fines worth $18 billion since the financial crisis as the bank was found guilty of misconduct.

Of course, the era of low to negative interest rates has made the ability to earn money on margin increasingly difficult and the shares are down about 90% from their 2007 peak." www.forbes.com

Anti Money Laundering - www.fool.com

"Deutsche Bank's anti-money laundering (AML) issues date back to at least 2017. That January, the bank agreed to pay a $629 million fine to regulators in New York and the United Kingdom for actions that regulators called "highly suggestive of financial crime." The bank's Moscow office helped parties conduct what looked like a transfer of rubles into $10 billion, which then allowed customers to transfer the money out of Russia to banks in Cyprus, Estonia, and Latvia, according to U.K. authorities.

Later in 2017, Deutsche Bank paid another $41 million to the Federal Reserve for "unsafe and unsound" anti-money laundering practices.

Media outlets eventually revealed that the Federal Reserve had secretly designated Deutsche Bank's U.S. division as being in "troubled condition" as early as 2017. That designation, according to The Wall Street Journal, resulted in the bank pulling back on certain trading and lending activities. It also meant the bank had to clear decisions about hiring and firing senior management and reassigning job duties with the Fed.

But Germany's largest bank struggled to stay out of the spotlight. The bank again found itself facing scrutiny in 2018 when an internal review found that it had handled about $150 billion of suspicious transactions carried out by the Danish lender Danske Bank. At the time, U.S. law enforcement agencies were investigating because $230 billion had allegedly flowed through one of its small branches in Estonia.

Reuters reported last October that Deutsche Bank supposedly waited five years after a whistleblower sounded the alarm about suspicious activity at Danske to report the 1 million money transfers it believed were suspect.

All of the issues at the bank spooked investors in 2018, with shares of Deutsche Bank dropping roughly 58% that year. The company's share price remained relatively flat in 2019, a poor performance during a year in which the banking sector performed well.

www.fool.com

POTENTIAL EURUSD BREAKOUT AND DB BREAKOUTPrice has been rejected this week at the zone at 1.07921 and has now formed a double bottom which will potentially lead to a trend reversal. There was a lot of trapped liquidity at the lows and we should see a lot of it play out over the period of this trade as there will be a greater momentum on the pair. Good R:R, trade with proper risk management.

Deutsche Bank (DB) is close to the 4-Years Low!We can open Sell in Zone.

Reasons:

- the price is close to the 4-Years Low 11.20;

- the trend has changed direction by trading large volumes;

- potential profit will be in 3...5 times bigger than risk.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Write your comments and questions here!

Thanks for your support!

Deutsche Bank: Projected top and long term Sell Entry.Deutsche Bank (DB) has been on a strong medium term rise on the 1W chart since the August low (RSI = 65.146, MACD = 0.232, ADX = 21.619, Highs/Lows = 0.9691). This rise is the bullish leg of the long term Channel Down (since 2012), that is aiming for a Lower High inside the pattern.

The previous Lower High bounces have been 85% on average and the last one made a peak on the 0.500 Fibonacci retracement level. Currently this level is at 11.35, which fits the +85% rise model. This is also where the price meets the technical rejection point of the 1W MA200 (orange line) which has been acting as a Resistance since May 2008.

With the RSI already inside the Sell Zone, we believe it is best to wait for this top to form and sell back towards the 6.45 Low.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

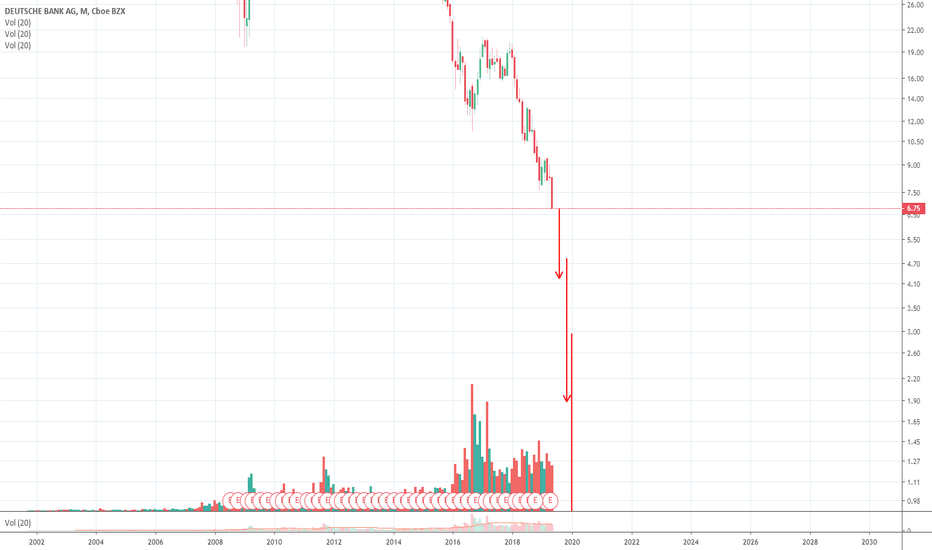

Deutsche Bank LongNYSE:DB

Entry - $7.60

Target 1 - $8.30

Target 2 - $9.65

Target 3 - $12

Stop loss - $6.79

DB is at an important Fib level as well as showing Bullish Divergence.

Be aware that this is a contrarian play and a countertrend trade. However, this area has a good chance of being a medium term bottom and we might be catching a trend reversal here which can be very powerful.

I plan on taking a 100 share position and selling calls against it on the way up as we hit important fib levels/moving averages.

Trade at your own risk and remember, this is not financial advice and I am not a financial advisor. Do your own research and due diligence.

What kind of pump & dump is this ? Hello everyone,

Today I would love to point that not only altcoins are loosing big.

Shares of Deutsche Bank (NYSE:DB), Germany´s largest bank closed above $7 which is more than 95% down from the stock´s all-time high over $139 in the summer of 2007.

The bank is operational in 58 countries with a large presence in Europe, the Americas and Asia. Deutsche Bank is the 17th largest bank in the world by total assets. As the largest German banking institution, it is a component of the DAX stock market index.

DB investors waiting patiently for over twelve years for a recovery !!

While some of you calling cryptocurrencies fraud, others see the truth as the opposite.

In my opinion BIG CHANGES COMING to the financial industry.

Interesting: Deutsche Bank Robinhood baghodlers went parabolicAnother fun story :D

By the way, the number of baghodlers on Tesla is down now that the price went up. Got their chance to break even on idiotic buys.

DB baggies spiked during the whole day of the 08 July. Did some guru tell his gullible paid group to buy the "bottom"? Or whale uses Baginhood?

DB baggies have been following the usual baggy path: exact opposite to what price does.

After being down 90% I guess baggies that lucked out and bought closest to the bottom, when it eventually goes back up, will get their shot at breaking even, and others will just ride it to zero.

Not making any speculation on this. Just watching and laughing.

Not even a good counter indicator as they just opposite-shadow the price just like alot of funds simply shadow the price.

Does not tell us anything we do not already know.

I have to finish my series...

Trading styles. Part 1/5. The 4 different kinds of bottoms.

Trading styles. Part 2/5. Buying pullbacks.

Trading styles. Part 3/5. Trend continuation breaks.

4/5 countertrend

5/5 other (ranging or exotic strats)

The count is wrong 1/5 is an intruder. I want to throw that and restart.

But I don't really know... I guess there are not that many type of strategies it's either pullbacks continuation countertrend or trading ranges?

With all the hate I got for shorting BTC as it was going up this makes zero sense. The peons all want to go against the trend.

The difference is they only go against the trend when it goes down I guess... "Buy cheap". How dumb. Just flip the chart then...

Noobs will buy absolutely anything when they see something down 95%. I bet there are some "educator" that teaches idiots to scan for poop and buy it.

Probably alot of those in penny stocks. Maybe they imagine other people than them are buying and they are not just scamming each other?

(With Tim making most of the dumping, on his followers).

Tim is a name I made up for the example. It is a totally made up character, let's call him Tim S. and he does not represent anyone existing in real life.

DEUTSCHE BOMB - Sorry I meant 'BANK'Some may not have heard of Deutsche Bank. Some may not know what 'systematic risk' is. Well, whether you heard of any of this before listen up. DB has been in serious trouble for years and in recent weeks there is more trouble.

As the rules do not allow me to reference what I say here, people will need to Google some of this.

Deutsche Bank has been over leveraged to the tune of Trillions. Then recently there has leveraging of the leveraging, to put that in a nutshell.

Read up on level 3 assets in relation to Deutsche Bank. Germany's domestic economy relies heavily on Deutsche Bank. DB is totally wired into major banks globally.

Share holder confidence in DB has been galloping south in recent weeks. Would you buy shares in DB? Some say when there's blood on the streets that's the best time to jump in. Sorry - some can go right ahead. I like my money in my pocket.

Looking into the derivatives fiasco looming on DB the whole world is at risk! If DB falls watch out for shockwaves globally.

Disclaimer: This educational post is not intended for trading or investing decision-making. No liabilities accepted.