DB

Deutsche Bank Commerzebank Merger Good for EquitiesThe fundamental analysis of this is fairly easy. Mergers are good for stocks. Why? Because it usually means increasing profitability. Why? Because it oftentimes leads to reducing inefficiencies and eliminating two teams that could be consolidated into one whether its with commercial banks, foreign exchange desks, etc. This merger would lead to the cutting of 30,000 jobs in Germany which would clearly help push the mega bank in a positive direction towards profitability. If talks progress positively, expect both Deutsche Bank (bars) and Commerzebank (pink) to edge up. But let's not forget, these two banks' stocks have been in the gutter since the 2008 Financial Crisis and both greatly underperformed the DAX (dark blue) and the Eurostoxx 50 (light blue). More words on this here: anthonylaurence.wordpress.com

Why Deutche Bank is NOT GOING TO ZEROI have read an article today about the possible merger between Commerzbank and Deutsche Bank, few people seem to be reading up on it! Very soon we will hear about how EU banks are a zero and Deutsche will be the first to collapse. A backdoor bailout is likely to change that.

Deutsche Bank ($DBK): Weekly - Fractal - Default Risk increasingAs the default risk for Deutsche Bank keep increasing by the day it is now technically ready to move lower towards it's default target of 0.11€ it is still to date the most obvious contagion to the stock market crash of this decade.

However the most likely target on the way down will first be 2.5€ which sits on the trendline from the top notation in May of 2007 which will hit once the fractal from the period 2007-02-26 - 2008-11-17 is activated.

I remain a seller on Deutsche Bank ($DBK) till that target is hit.

Deutsche Bank ($DBK): Weekly - Default Risk before year 2020 This is the real market risk, the most obvious contagion to date that will most likely cause the next financial crisis because of the amount of debt that the bank holds within the banking system when this stock moves down the market also follows.

Technically below that trendline and Deutsche Bank moves towards default and 0.11€

EURUSD DB Long Opportunity EURUSD is seemingly attracting demand around the 1.1300 double bottom area. The Median Line of this inside set is also tested here. If this area fails, sellers will target 1.1000-1.0800 for further downside. However there are good odds that this will get picked up here for at least a minor correction towards the 1.1475 area. Buying with stops below 1.1300 and looking for 1R-2R targets here.

Buyer beware! DB can go in any direction indefinitely!It's not exactly a secret! The ECB owns Deutsche Bank! And they can make the price anything they want it to be - $1 or $100!

The only certainty is that public investors will be the ones holding the bag! Don't be a sucker - stay out of this toxic mess! The dumps and short squeezes will be legendary - and prices will be nonsensical for sure! They'll even hold it steady for years if that's what it takes for people to bail!

DEUTSCHE BANK pattern like Bitcoin (BTC/USD)We have a standard falling wedge pattern like on BTC/USD chart.

Also we have a strong divergence with MACD indicator and volume rising.

The stock after a great fall and now is located near its bottom.

LONG TERM TRADE(month chart).

And the first target is x2 of it price => 20$.

I will update the idea.

Good Luck!

Douche Bank – A Horse Man of the ApocalypseYou ever see Weekend at Bernie’s? A lot of parallels here in that the ECB has found DB involved in all kinds of financial fraud, but after arriving in Draghi’s Ctrl-P Party in Paradise, the ECB finds Doobie Banks lifeless body. To the ECB’s amazement, the guest are too engrossed in their partying to notice the bank is dead, with the dopey grin from a fatal injection of derivatives and sunglasses concealing its lifeless state. Wanting to enjoy Draphi’s luxurious Paradise while they can, the ECB continues to parade DB around the Halls of Europe, manipulating its limbs to make the bank appear to still be alive, and swishing away the inevitable flies…

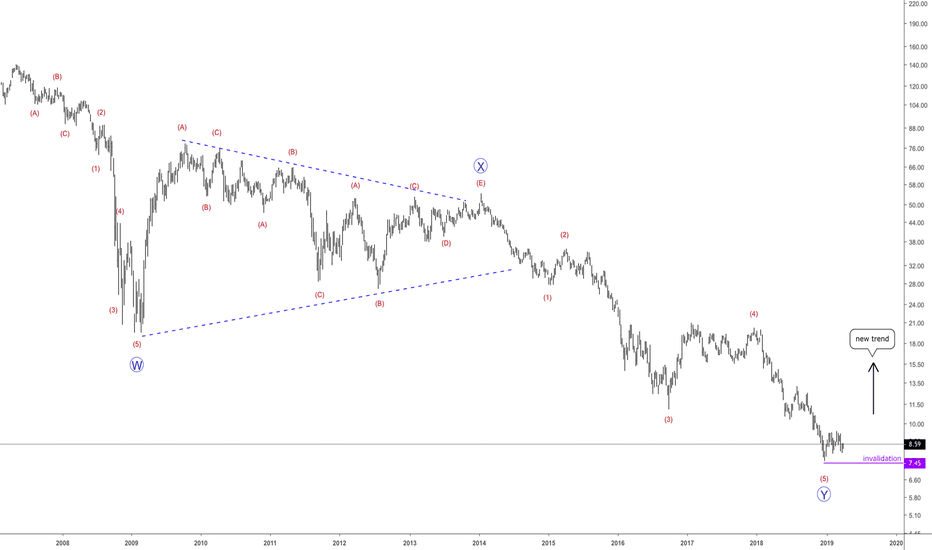

So here is an Overly Optimistic Neo-Wave interpretation of Doom Bank’s chart, showing it trading down to $4. What the chart really says to me is the valuation is headed to negative $20… Buying this stock is like asking for a poke in the eye.

DB may face another decline...DB may face another decline. German Deutsche Bank AG. there were better times in exchange rates as well. Last week, he left his biggest shareholder. The exchange rate is expected in the coming days. Thereafter, we expect a larger downward wave, with a target price of 6.17 usd.