DB

DAX 30 Deutsche Aktienindex ~10 Year log trendChart of a ~10 year-ish long trendline on DAX 30. Do trendlines mean anything? Maybe. Maybe not.

CBK.DE

MRK.DE

HEI.DE

ADS.DE

IFX.DE

DPW.DE

ALV.DE

BAS.DE

SAP.DE

BEI.DE

LIN.DE

SIE.DE

DTE.DE

MUV2.DE

VOW3.DE

BAYN.DE

LHA.DE

BMW.DE

CON.DE

DAI.DE

HEN3.DE

PSM.DE

DB1.DE

FRE.DE

EOAN.DE

VNA.DE

FME.DE

TKA.DE

DBK.DE

RWE.DE

'german bank'could be a 6-36 month play and this could drop to single digits but TONS of volume around this area shows for interest in making a return play

down over 90% from highs

I would buy here and all the way down to 7.5 and start selling above 25. Risky becauase it's some yung price discovery

/snatched this idea from @cryptohustle and did my own analysis. Give him a follow!

Deutsche_Bank_(NYSE:DB)_May_29_2018Deutsche Bank is one of the largest banks in the world by assets. Along with DB’s home market of Germany, it has a presence in more than 50 countries around the world stretching from the Americas (North and South), Asia-Pacific, Central /Eastern Europe, Middle East and Africa.

The bank has three primary business segments:

1) Private & Commercial Banking

2) Asset Management

3) Corporate and Investment Banking

Since 2014, the stock has been in a downtrend due to a variety of issues (As per Wikipedia, since 2016 the bank has been involved in some 7800 legal disputes). These controversies range from tax evasion, market rigging, money laundering and sanctions violations.

However, I believe the price has dropped to levels that make it extremely attractive for long term value investors. Yes, there are certainly concerns of declining revenue, flight of key human resources and more potential fines; however if there is one lesson from history that stock investors should take note off is “Buy Low and Sell High”.

The price has dropped below key support levels and reached all time lows. The 20 day and 50 day moving averages indicate a downtrend while the AD indicator indicates an uptrend which usually occurs when the trend is poised for a reversal. However, this should to be confirmed by price action.

For contrarian investors, I believe this is an excellent price to buy into the stock. For more risk averse investors, you want to wait till there is a confirmation from the price action such as the price crosses the Moving Average and the slope of the average is positive.

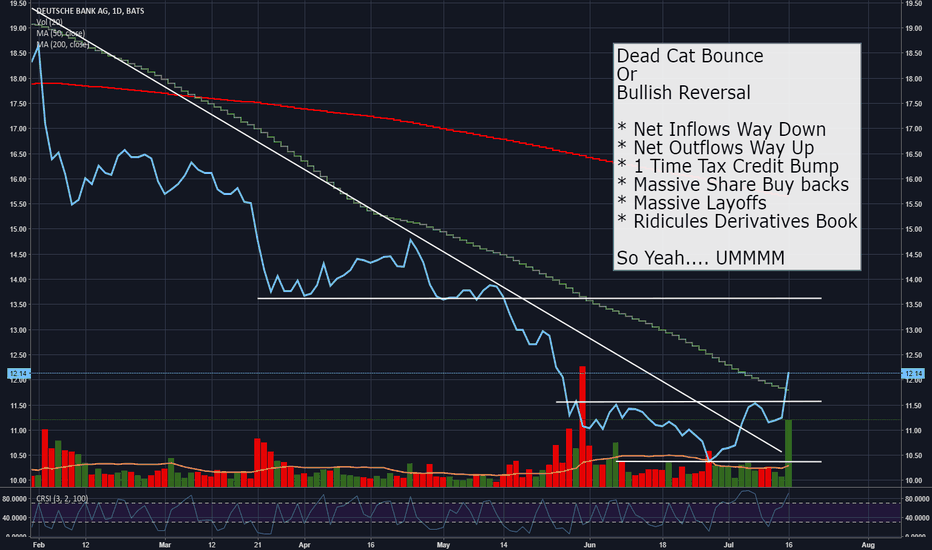

Deutsche Bank is a textbook shortI think DB is fundamentally one of the weakest DAX stocks.

Notice DAX opened today with a 150 point up-gap, but DB is opening at the same level - no demand for this stock.

Selling is the way to go, plus we can see from a chart technical perspective that there is still much room to the downside to be filled.

This is a beautiful corrective small uptrend in a large downtrend, bears are breaking lower.

I am looking to short above 14€.

Blessings to you.

Deutshe Bank: DB All set for a short term bullish movement?I believe that successful trading strategies rely heavily upon identifying consolidation zones. Consolidation zones provide us the right direction of the market. Consolidation happens when a market move sharply upside or downside. Later, a trader can use these consolidation zones to identify patterns, whether it be a continuation or reversal.

It requires attention and care. Rather than turning out to be a factory of producing signals, it is better to sit down and look for a setup. Setups are important because we are planning a trade and execute them on time. If you fail to plan a setup, then you are planning to fail.

Another advantage of trade setup is that we know where to get out and the right time to go in. Know the market. Study the price movements and make your trades.

My charts use price movements, patterns, structures and indicators such as moving averages and oscillators. Trading intelligence is combining multiple knowledge to produce a favorable trade setup and plans.

DEUTSCHE BANK @ Trading Zone above ATL´s"disaster"

"bombed out"

"insane pressure"

"worse as it gets"

I can not think of anything more - after friday ...

12.97 1st Yearly low 2016 @ February

11.22 2nd Yearly low 2016 @ July

11.06 3rd Yearly low 2016 @ August

Trading Zone between 11.06 & 12.97 !!!

Break Up/Down of this range could accelerate the share ...

Take care

& analyzed it again

- it`s always your choice ...

Best regards

4XSetUps

DBKD @ daily @ with -23% worst DAX Share (2016), but breaked outTake care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Buying/Selling or even only watching is always your own responsibility ...

DAX 30 Index & Shares (2016 yearly Performance) @ drive.google.com

Best regards

Aaron

Can it be anymore clearer than this?Clear wave pattern seen in the XLF -0.25% ETF .

I'm expecting one final push up from 23.54 right now in the next few weeks with a target of 24.76 (76.4% retracement of 2008 highs).

It would have been pretty good level to accumulate some long term puts up to a year.

The anti-bank sentiment is far from over, and almost certainly not right now. Trump rally at least in the short term is not going to unwind the fact that we're in a deflationary cycle and it will only get worst.