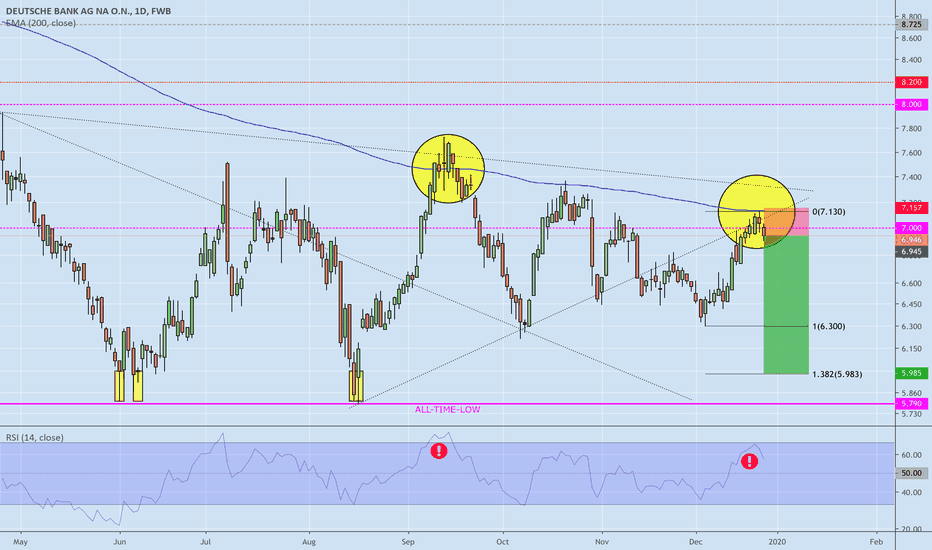

Deutsche Bank: Projected top and long term Sell Entry.Deutsche Bank (DB) has been on a strong medium term rise on the 1W chart since the August low (RSI = 65.146, MACD = 0.232, ADX = 21.619, Highs/Lows = 0.9691). This rise is the bullish leg of the long term Channel Down (since 2012), that is aiming for a Lower High inside the pattern.

The previous Lower High bounces have been 85% on average and the last one made a peak on the 0.500 Fibonacci retracement level. Currently this level is at 11.35, which fits the +85% rise model. This is also where the price meets the technical rejection point of the 1W MA200 (orange line) which has been acting as a Resistance since May 2008.

With the RSI already inside the Sell Zone, we believe it is best to wait for this top to form and sell back towards the 6.45 Low.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Dbk

Deutsche Bank updateThe longs still running from the uptrend line. Now wave count suggests continuation up. Adding another long on the break of the 200SMA and then waiting for the test of the downtrend line for next setup.

As DBK trading open in the morning in Europe, could wait for the break and retest before adding for more confirmation and better stop placement.

Good Luck!

Deutsche Bank - Next Target € 8,50 or 24 PercentOnly the chart counts and without the following fundamental things in mind: feelings, financial crisis 2.0, zero or negative interest rates, margin erosion, Dr. Markus Krall, Zombibanken, personell overcapacities, Overbanking - too many branches, target 2 balances, Google Pay, Paypal, Alipay, Payoneer, Skrill, WePay, Wirecard, Adyen, FinTecs, IoT, Blockchain, RTP, BS PayOne, .....

If shareprice hit € 7.00 again, target of € 8.50 will be activated. However, shareprice should not fall below € 6.44 any more. At a current entry price of € 6.82, the chance/risk ratio CRR would be 4.2 to 1.

DBK Deutsche Bank falls through Support and TrendlineHello to all watching my charts.

Today hav been a bad day for Deutsche Bank

Fall through the Major Support to 6.66 at the end of the day

Now SHORT

Please check my picture

Good trades

If you want to support my work , please be so kind and like them

-

My posts are not and advice to buy or sell something

always do your own research

-

Renkotrade

----------

DBK Deutsche Bank SHORT Trendline Break EDUCATION 1 DAYHello to all watching my charts

Here the next example to trade a trendline brake

in DBK / German Bank

1. Break the black suppport line at 7.00 SHORT

2. Break the blue short trendline at 6.20 /6.30 LONG

3. Break of the next supoort line RED and break of the Long trendlne SHORT 6.70

Only a few trades to made profit.

Good trades

If you want to support my work and my charts, please like ethem

Renktrade

Why Deutche Bank is NOT GOING TO ZEROI have read an article today about the possible merger between Commerzbank and Deutsche Bank, few people seem to be reading up on it! Very soon we will hear about how EU banks are a zero and Deutsche will be the first to collapse. A backdoor bailout is likely to change that.

Deutsche Bank ($DBK): Weekly - Fractal - Default Risk increasingAs the default risk for Deutsche Bank keep increasing by the day it is now technically ready to move lower towards it's default target of 0.11€ it is still to date the most obvious contagion to the stock market crash of this decade.

However the most likely target on the way down will first be 2.5€ which sits on the trendline from the top notation in May of 2007 which will hit once the fractal from the period 2007-02-26 - 2008-11-17 is activated.

I remain a seller on Deutsche Bank ($DBK) till that target is hit.

Deutsche Bank ($DBK): Weekly - Default Risk before year 2020 This is the real market risk, the most obvious contagion to date that will most likely cause the next financial crisis because of the amount of debt that the bank holds within the banking system when this stock moves down the market also follows.

Technically below that trendline and Deutsche Bank moves towards default and 0.11€