What is Dollar Cost Averaging (DCA)?🔵 What is Dollar Cost Averaging (DCA)?

Dollar Cost Averaging (DCA) is a timeless investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset's price. It’s one of the most effective ways to build a position over time while minimizing the impact of market volatility.

The term "Dollar Cost Averaging" was popularized in the early 20th century by Benjamin Graham — the father of value investing and mentor to Warren Buffett. Graham advocated DCA as a way to remove emotions and guesswork from investing. By spreading out purchases, investors could avoid mistiming the market and reduce risk exposure.

Today, DCA remains a core strategy for retail investors, especially in volatile markets like cryptocurrencies and growth stocks.

🔵 How Does DCA Work?

The concept is simple: instead of investing a lump sum all at once, you break your total investment into smaller, equal parts and invest them over time — for example, weekly or monthly.

Invest $100 every week into Bitcoin.

Keep buying consistently — regardless of whether price goes up or down.

Over time, this smooths out your average entry price.

You buy more when price is low, and less when price is high.

Example:

If BTC is at $30,000 one month, you buy a small amount.

If BTC drops to $25,000 the next month, you buy more units with the same $100.

Over time, your entry price averages out — reducing the risk of buying at a peak.

🔵 Why Use DCA?

DCA offers both psychological and mathematical advantages:

Reduces timing risk: You don’t need to predict market tops or bottoms.

Builds discipline: Encourages consistent investing habits.

Prevents emotional mistakes: Avoids FOMO buying and panic selling.

Smooths volatility: Especially useful in crypto or fast-moving assets.

🔵 Smart DCA: Buying Into Market Bottoms

While classic DCA is powerful on its own, it becomes even more effective when combined with market structure. A popular approach is to only DCA when the asset is trading below its long-term average — such as the 200-day Simple Moving Average (SMA) or using RSI (Relative Strength Index).

What is the 200-day SMA?

It’s the average closing price over the last 200 days — a key indicator of long-term trend direction.

Why DCA Below the 200 SMA?

Historically, many market bottoms occur below the 200 SMA. Using this as a filter helps you avoid accumulating during overvalued or overheated conditions.

SDCA with RSI

The Relative Strength Index (RSI) helps identify momentum exhaustion. When RSI drops below 30, it often marks deeply oversold conditions — especially on the daily chart for BTC.

How to use it:

Only DCA when price is below the 200-day SMA.

You accumulate during crashes, fear, and corrections.

Avoid buying when price is extended far above long-term value.

🔵 Scaling DCA Based on Undervaluation

To further optimize the strategy, you can scale your DCA amounts depending on how far below the 200 SMA the price is.

Example:

Price is 5% below 200 SMA → invest normal amount.

Price is 15% below → double your investment.

Price is 25% below → triple your investment.

This creates a dynamic DCA system that responds to market conditions — helping you build larger positions when prices are truly discounted.

🔵 When DCA Doesn’t Work

Like any strategy, DCA has limitations. It’s not magic — just a system to reduce timing errors.

In strong uptrends, a lump sum investment can outperform DCA.

In declining assets with no recovery (bad fundamentals), DCA becomes risky.

DCA works best on quality assets with long-term growth potential.

Always combine DCA with research and risk management — don’t blindly accumulate assets just because they’re down.

🔵 Final Thoughts

Dollar Cost Averaging isn’t about buying the exact bottom — it’s about consistency , discipline , and risk control . Whether you’re investing in Bitcoin, stocks, or ETFs, DCA offers a stress-free approach to enter the market and smooth out volatility over time.

Smart traders take it one step further: using moving averages and structure to focus their DCA efforts where value is highest.

DCA won’t make you rich overnight — but it will help you sleep at night.

This article is for educational purposes only and is not financial advice. Always do your own research and invest responsibly.

DCA

DCA into $FI- NYSE:FI is big recognizable brand in Point of Sales. You might have seen clover handheld machines.

- I believe fundamentals on this blue chip company is getting cheap. I'm not going all in but have started DCA into this name.

- If it falls further 20-30 or even 40% I will be happy to DCA further.

- Fundamentally, I am buying it close to fair value.

Year | 2025 | 2026 | 2027 | 2028

EPS | 10.21 | 11.91 | 13.88 | 15.72

EPS% | 16.35% | 16.63% | 16.51% | 13.25%

- Any company which is growing EPS% mid teens with a recognizable brand value deserves a fair forward p/e of 20

Base Case Fair Value w/ forward p/e = 20:

Year. | 2025 | 2026 | 2027 | 2028

Fair Value | $204 | $238 | $277.6 | $314.4

Conservative Base Case fair value w/ forward p/e=15:

Year. | 2025 | 2026 | 2027 | 2028

Fair Value | $153.15 | $178.65 | $208.2 | $235

Bull Case Fair value w/ forward p/e=25:

Year. | 2025 | 2026 | 2027 | 2028

Fair Value | $255 | $297 | $347 | $393

Bear Case fair value w/ forward p/e = 10:

Year. | 2025 | 2026 | 2027 | 2028

Fair Value | $102 | $119 | $138 | $157

Dogecoin (DOGE) OverboughtI have been trading for a long time using the DCA strategy indicator that I have developed and I have recently published the indicator on my Tradingview page.

According to this indicator, I have been buying DOGEs at support levels with more money than I would have thrown away so far. This support level is generally seen at $0.056. In addition, I dumped some of my DOGE at $0.2285, but then bought again at $0.107. I have already shared this analysis.

I think that DOGE, which has broken through two resistances, will advance at least up to $0.75 (potential 89% return). But for this progress, I think that it must first find support at the $0.2285 level, which was broken again. This is because the indicator also gives an overbought signal. Therefore, I will tailor my portfolio accordingly. But I wouldn't be surprised if it continues relentlessly.

As long as Elon Musk remains in government, I think this cryptocurrency will be on a continuous upward trend.

What Is Dollar-Cost Averaging (DCA) in Investing and Trading?What Is Dollar-Cost Averaging (DCA) in Investing and Trading?

Dollar-cost averaging (DCA) is a popular strategy used by investors and traders to manage market fluctuations and build positions over time. Instead of trying to time the market, DCA focuses on consistent, regular investments regardless of price movements. This article answers “What is DCA?”, its advantages and limitations, and how it can be applied in both investing and trading.

What Is Dollar-Cost Averaging (DCA)?

So what is DCA investing? Dollar-cost averaging (DCA) is a strategy that involves consistently investing a fixed sum at regular intervals, regardless of the asset’s current price. This approach helps distribute the cost of purchases over time, potentially reducing the impact of short-term price fluctuations. Instead of trying to time the market perfectly—a challenging task even for experienced traders—a dollar-cost averaging strategy focuses on regular contributions to average the cost of assets.

This method offers a straightforward, disciplined strategy for both long-term investors and traders who wish to build or adjust positions gradually. By spreading out purchases, a DCA strategy may help mitigate the effects of market volatility. For example, during a period of market decline, the fixed investment buys more units at a lower cost, which could result in higher returns when prices recover. Conversely, during a sustained rise, the investor buys fewer units, which helps avoid overexposure. For example, if you invest $50 every week and the market is rising, you will buy fewer stocks, but when the market is moving down, you will buy more with the same amount.

What does DCA mean for market participants? DCA is particularly useful in uncertain economic environments where price swings are common. It provides a systematic approach to entering the market, removing the need to make snap decisions based on short-term market movements, and fostering a steady accumulation of assets over time.

How Does DCA Work?

DCA investing operates by establishing a regular schedule for investing a set amount of money into a chosen asset, regardless of its current market price. Instead of waiting for a particular price or market condition, funds are allocated at consistent intervals—be it weekly, monthly, or quarterly. Over time, this means buying more units when prices are lower and fewer units when prices are higher, resulting in an average purchase price that can be lower than if the investment was made in one lump sum.

Consider an investor using DCA. They commit £100 every month to buy company shares. In the first month, the share price is £20, so they purchase 5 shares. The next month, the price drops to £10, allowing them to buy 10 shares with the same £100. In the third month, the price rises to £25, and they purchase 4 shares.

Over three months, the investor has spent £300 and acquired 19 shares in total. To calculate the average cost per share, divide £300 by 19, which equals approximately £15.79 per share. This average is lower than the highest price paid and reflects the effect of buying more shares when prices are low and fewer when prices are high.

DCA also simplifies the process of entering the market. By adhering to a set timetable, investors bypass the need for constant market analysis, making it particularly appealing for those who prefer a more hands-off strategy. This systematic approach can be applied not only to traditional investments like shares and funds but also to other assets that traders and investors engage with.

DCA in Trading

DCA isn't just for long-term investors; traders can also employ it to navigate the ups and downs of fast-moving markets. By spreading out their entries or exits, traders may potentially lower the average cost of a position or build on a winning trend, all while managing their exposure to volatile moves.

Lowering the Average Price

For traders facing a position that's moving against them, DCA offers a way to adjust the average entry cost. By allocating additional funds, the average price of the position may be reduced. This approach can create a potential opportunity to exit with better returns if the market reverses. However, it is important to note that this method also increases exposure, and additional entities might compound losses if the trend continues.

Adding to a Winner

Conversely, traders may apply DCA to increase their positions when an asset shows strength. By gradually adding to an effective trade, the overall exposure is built in a controlled manner, potentially capturing further movement without committing all capital at once. This method is particularly popular in markets where momentum builds slowly, allowing traders to gradually take advantage of the sustained trend.

Applications Across Markets

Using DCA in stocks can help manage entries during periods of volatility, especially when market sentiment shifts rapidly. Forex traders often use similar techniques to adjust positions in response to fluctuating currency pairs, while the high volatility seen in crypto* markets makes DCA an appealing strategy for building positions gradually.

When using DCA in trading, a disciplined approach is essential. Whether lowering the average cost in a losing position or building on an effective trade, traders should carefully consider the additional risk that comes with increased exposure.

Advantages of Dollar-Cost Averaging

Dollar-cost averaging offers a range of advantages that make it an attractive strategy for both investors and traders, especially when navigating uncertain markets.

Mitigating Market Volatility

By investing a fixed amount at regular intervals, DCA spreads out exposure over time. This approach can reduce the impact of sudden market swings. Instead of being affected by a one-off high price, the average cost is spread across different market conditions. This may help stabilise entry points and smooth out short-term volatility.

Disciplined Investment Approach

DCA promotes a structured investment routine. With regular contributions, there is less temptation to try timing the market. This disciplined approach might be particularly useful when markets are highly volatile or ahead of news and economic events. It encourages systematic investing, reducing the likelihood of making impulsive decisions driven by market noise.

Accessibility for All Traders

DCA does not require intricate market analysis or deep expertise in market timing. Its straightforward nature makes it appealing to both newcomers and seasoned traders looking for a simpler method to build positions over time. By providing a clear framework, DCA allows traders to focus on long-term goals without the pressure of constant market monitoring.

Limitations of Dollar-Cost Averaging

While dollar-cost averaging offers a structured approach to investing and trading, there are some limitations to consider.

Potential Opportunity Cost

Spreading out investments means funds are gradually deployed over time. In a market that is consistent, waiting to invest might lead to missed returns compared to committing all funds upfront. This method can reduce the impact of volatility but might underperform during extended trends.

Continued Exposure to Market Trends

Investors remain exposed to the market throughout the investment period. If the market experiences a prolonged trend, regular investments will accumulate at better prices, but overall returns may still suffer. This approach does not eliminate market risk and requires a long-term perspective to potentially see a turnaround.

Dependence on Consistency

The effectiveness of dollar-cost averaging relies heavily on maintaining a consistent investment schedule. Any interruption or inconsistency can dilute the intended advantages of the strategy. It also assumes that investors are able to commit regular funds, which may not be feasible in all financial situations.

Comparing DCA to Lump-Sum Investing

Comparing DCA to lump-sum investing offers insights into different approaches to managing market exposure and returns.

Risk Exposure

Lump-sum investing involves placing all available funds into an asset at once. This method can yield higher returns if the market moves in their favour, but it also exposes the investor to immediate risk if the market moves against them. In contrast, risk is spread over time through a dollar-cost average, meaning regular investments reduce the likelihood of entering the market at a high point and potentially lowering the overall average cost.

Market Conditions

The performance of each approach can vary depending on market trends. In steady trends, lump-sum investing may capture more returns since all funds are deployed early. However, in volatile or declining conditions, DCA could mitigate the effects of short-term fluctuations by smoothing out entry prices over time.

Flexibility and Commitment

Lump-sum investing requires confidence and a readiness to commit all funds immediately. DCA, on the other hand, offers a more measured entry into the market. This method is popular among those who prefer a systematic approach and might not have a large sum available at one time.

The Bottom Line

Understanding the dollar-cost averaging definition can help investors and traders potentially manage market volatility and reduce emotional decision-making. While it has its limitations, DCA can be an effective strategy for building positions over time.

FAQ

What Is an Example of Dollar-Cost Averaging?

Imagine investing £100 into a stock every month, regardless of its price. In January, the stock costs £20, so you buy five shares. In February, the price drops to £10, allowing you to buy 10 shares. In March, the price rises to £25, and you buy four shares. Over three months, you’ve invested £300 and purchased 19 shares, averaging out your cost per share to £15.79.

Is There the Best Dollar-Cost Averaging Strategy?

The most effective DCA strategy depends on individual goals. A consistent, long-term approach with regular investments—whether weekly or monthly—may help smooth out market volatility. Focusing on diversified assets could also reduce risk exposure.

What Is the Daily DCA Strategy?

This strategy involves investing a fixed amount every day through DCA, meaning it may help minimise the impact of short-term price fluctuations in volatile markets. However, it requires careful planning due to frequent transactions and potential fees.

Does Dollar-Cost Averaging Work With Stocks?

Yes, DCA is commonly used with stocks. It may help manage the effects of market volatility, allowing investors to build positions over time without worrying about short-term price swings.

What Does DCA Mean in Stocks?

DCA, or dollar-cost averaging, in stocks, means regularly investing a fixed amount, regardless of price, to average out the cost per share over time and manage market volatility. A similar answer is true for “What does DCA mean in crypto*?”, except it would involve a regular fixed investment in a particular cryptocurrency*.

How to Calculate DCA in Crypto* Investing?

There is a simple formula to calculate DCA, meaning in crypto*, an investor would just divide the total amount invested by the total number of units purchased. This provides the average cost per unit over time, regardless of price fluctuations.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Thu 24th Apr 2025 EUR/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Sell. Enjoy the day all. Cheers. Jim

Why this strategy works so well (Ticker Pulse Meter + Fear EKG) Disclaimer: This is for educational purposes only. I am not a financial advisor, and this is not financial advice. Consult a professional before investing real money. I strongly encourage paper trading to test any strategy.

The Ticker Pulse + Fear EKG Strategy is a long-term, dip-buying investment approach that balances market momentum with emotional sentiment. It integrates two key components:

Ticker Pulse: Tracks momentum using dual-range metrics to pinpoint precise entry and exit points.

Fear EKG: Identifies spikes in market fear to highlight potential reversal opportunities.

Optimized for the daily timeframe, this strategy also performs well on weekly or monthly charts, making it ideal for dollar-cost averaging or trend-following with confidence. Visual cues—such as green and orange dots, heatmap backgrounds, and SMA/Bollinger Bands—provide clear signals and context. The strategy’s default settings are user-friendly, requiring minimal adjustments.

Green dots indicate high-confidence entry signals and do not repaint.

Orange dots (Fear EKG entries), paired with a red “fear” heatmap background, signal opportunities to accumulate shares during peak fear and market sell-offs.

Now on the the educational part that is most fascinating.

Load XLK on your chart and add a secondary line by plotting the following on a secondary axis:

INDEX:SKFI + INDEX:SKTH / 2

Now, you should see something like this:

Focus on the INDEX:SKFI + INDEX:SKTH / 2 line, noting its dips and spikes. Compare these movements to XLK’s price action and the corresponding dot signals:

Green and Orange Dots: Opportunities to scale into long positions.

Red Dots: Opportunities to start scaling out of positions.

This concept applies not only to XLK but also to major stocks within a sector, such as AAPL, a significant component of XLK. Chart AAPL against INDEX:SKFI + INDEX:SKTH / 2 to observe how stock and sector indices influence each other.

Now, you should see something like this:

Long-Term Investing Considerations

By default, the strategy suggests exiting 50% of open positions at each red dot. However, as long-term investors, there’s no need to follow this rule strictly. Instead, consider holding positions until they are profitable, especially when dollar-cost averaging for future retirement.

In prolonged bear markets, such as 2022, stocks like META experienced significant declines. Selling 50% of positions on early red dots may have locked in losses. For disciplined long-term investors, holding all open positions through market recoveries can lead to profitable outcomes.

The Importance of Context

Successful trading hinges on context. For example, using a long-term Linear Regression Channel (LRC) and buying green or orange dots below the channel’s point-of-control (red line) significantly improves the likelihood of success. Compare this to buying dots above the point-of-control, where outcomes are less favorable.

Why This Strategy Works

The Ticker Pulse + Fear EKG Strategy excels at identifying market dips and tops by combining momentum and sentiment analysis. I hope this explanation clarifies its value and empowers you to explore its potential through paper trading.

Anyway, I thought I would make a post to help explain why the strategy is so good at identifying the dips and the tops. Hope you found this write up as educational.

The strategy:

The Companion Indicator:

Buying The Dip / Dollar Cost AveragingI recently published my first script and felt now would be a good time to share something I feel could help some people out. I have been trading since 2021 and it has been an amazing journey. Anyhow, I would consider myself a value based investor and in it for the long term.

So as the market takes a dip - now is certainly the time to be buying the dip or dollar cost averaging. The way I see it, if you are going to DCA/Buy The Dip, it might be handy to have access to a tool that is slightly better than just regularly timed investments.

Take a look at my indicator and let me know your thoughts.

Comment, Like and Follow if you enjoy the strategy and companion indicator.

OptionsMastery: A break and retest on MO!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

$AVAX: Avalanche – Snowballing Gains or Melting Away?(1/9)

Good evening, everyone! 🌙 CRYPTOCAP:AVAX : Avalanche – Snowballing Gains or Melting Away?

With AVAX at $23.07, is this blockchain beast a sleeper hit or a slippery slope? Let’s avalanche into it! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 23.07 as of Mar 25, 2025 💰

• Recent Move: Up from $18, below $40 highs, per data 📏

• Sector Trend: Crypto volatile, AVAX rides the waves 🌟

It’s a rollercoaster—hold tight for the drop! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $9.56B (414.78M tokens) 🏆

• Operations: Scalable L1 for DeFi, dApps, subnets ⏰

• Trend: $1.121B DeFi TVL, whale buys, per posts on X 🎯

Firm in L1 race, but market’s a blizzard! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Whale Action: 500K tokens moved, per posts on X 🌍

• DeFi Strength: $1.121B TVL holds firm, per data 📋

• Market Vibe: Bearish Fear Index (34), yet resilient 💡

Snowballing quietly amid crypto storms! ❄️

(5/9) – RISKS IN FOCUS ⚡

• Market Correction: Bearish pressure could sink it 🔍

• Competition: Solana, Ethereum vie for dApps 📉

• Macro Woes: Trade tensions, rates shake things ❄️

It’s a chilly slope—brace for ice! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Scalability: 4,500 TPS, beats rivals 🥇

• DeFi Base: $1.121B TVL, solid ecosystem 📊

• Adoption: Enterprise use grows, per data 🔧

Got a snowy peak of potential! 🏔️

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, high off $59 peak 📉

• Opportunities: Whale buys, subnet growth 📈

Can it snowball or melt under pressure? 🤔

(8/9) – POLL TIME! 📢

AVAX at $23.07—your take? 🗳️

• Bullish: $30+ soon, whales fuel it 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $18 looms, correction hits 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

AVAX’s $23.07 price tags a volatile gem 📈, with DeFi strength but market risks 🌿. Dips are our DCA jackpot 💰—buy low, ride high! Gem or bust?

CAKEUSDT (PancakeSwap): Sweet Gains or Stale Trade?(1/9)

Good afternoon, everyone! ☀️ CAKEUSDT (PancakeSwap): Sweet Gains or Stale Trade?

With CAKE at $2.599, is this DEX token a tasty treat or a flat pancake? Let’s flip the details! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 2.599 as of Mar 25, 2025 💰

• Recent Move: Consolidating $2.6-$2.8, up from $2.34, per data 📏

• Sector Trend: Crypto steady, DeFi mixed amid trade tensions 🌟

It’s a flip-flop—value might be cookin’! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $760M (292M circulating) 🏆

• Operations: Leading BNB Chain DEX, yield farming, staking ⏰

• Trend: Deflationary model burns 102% minted, per data 🎯

Firm in DeFi, but volatility’s the spice! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Recent Surge: Up 45% earlier in March, per X posts 🌍

• Platform Updates: Expanded NFT marketplace, per web data 📋

• Market Reaction: High volume ($230M daily), showing interest 💡

Adapting to DeFi trends, cooking up growth! 🍳

(5/9) – RISKS IN FOCUS ⚡

• Regulatory Risks: Crypto scrutiny could hit DEXs 🔍

• Market Volatility: Crypto swings could drag price down 📉

• Competition: Other DEXs like Uniswap challenge, per data ❄️

It’s a risky recipe—watch the heat! 🛑

(6/9) – SWOT: STRENGTHS 💪

• DEX Leader: Top on BNB Chain, strong user base 🥇

• Deflationary Model: Burns tokens, potentially boosts value 📊

• High Volume: $230M daily, per data, shows activity 🔧

Got a sweet spot in DeFi! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Price volatility, regulatory fears 📉

• Opportunities: DeFi adoption, new features like lending 📈

Can it rise or get burned? 🤔

(8/9) – POLL TIME! 📢

CAKE at $2.599—your take? 🗳️

• Bullish: $3+ soon, DeFi booms 🐂

• Neutral: Steady, risks balance gains ⚖️

• Bearish: $2 drops, market sours 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

CAKE’s $2.599 price reflects consolidation, with strengths in its platform and deflationary model, but risks from market volatility and competition persist. DCA-on-dips could be a strategy to average in over time, banking on long-term growth. Gem or bust?

$XAUUSD (Gold): Golden Rally or Gilded Pause?(1/9)

Good morning, everyone! ☀️ XAUUSD (Gold): Golden Rally or Gilded Pause?

With gold at $3,020.82, is this safe-haven surge a treasure or a tease? Let’s sift through the shine! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 3,020.82 per ounce as of Mar 25, 2025 💰

• Recent Move: Near $3,057 high from Mar 20, per data 📏

• Sector Trend: Precious metals up on tension, per posts on X 🌟

It’s a golden glow—let’s see if it holds! ⚙️

(3/9) – MARKET POSITION 📈

• Global Role: Top safe-haven asset ⏰

• Drivers: Central bank buying, geopolitical risks 🎯

• Trend: Bullish near $3,000, per data 🚀

Firm as a refuge, shining in uncertainty! 🏦

(4/9) – KEY DEVELOPMENTS 🔑

• Geopolitical Boost: Trade tensions linger, per data 🌍

• U.S. Data: PMI strength supports USD, caps gold, per posts on X 📋

• Market Reaction: Consolidating near $3,020-$3,030 💡

Simmering in a tense market! 🌩️

(5/9) – RISKS IN FOCUS ⚡

• Profit-Taking: Post-$3,000 sales loom 🔍

• U.S. Rates: Policy shifts could hit, per data 📉

• Oil Prices: CAD link affects broader forex ❄️

It’s a shiny tightrope—watch your step! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Safe Haven: Thrives in chaos, per posts on X 🥇

• Central Banks: Steady buying props it up 📊

• Green Demand: Key in renewables, per data 🔧

Got a golden backbone! 🌟

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility from profit-taking 📉

• Opportunities: More tensions, rate cuts 📈

Can it gleam higher or dim out? 🤔

(8/9) – POLL TIME! 📢

Gold at $3,020.82—your take? 🗳️

• Bullish: $3,100+ soon, rally rolls 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $2,950 looms, correction hits 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Gold’s $3,020.82 price tags a safe-haven rally 📈, but volatility’s in the mix 🌿. Dips are our DCA jackpot 💰—buy low, ride high! Gem or bust?

$CPB: Campbell Soup – Simmering or Boiling Over?(1/9)

Good afternoon, everyone! ☀️ NASDAQ:CPB : Campbell Soup – Simmering or Boiling Over?

With CPB at $38.21, is this iconic soup maker a tasty investment or a stale option? Let’s ladle out the details! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 38.21 as of Mar 24, 2025 💰

• Recent Move: Down from $43.00 (early 2025), an 11% dip, per data 📏

• Sector Trend: Consumer goods volatile, inflation pressures, per posts on X 🌟

It’s a mixed stew—let’s see what’s cookin’! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $11.4B (298.5M shares) 🏆

• Operations: Soups, snacks, meals, strong brand presence ⏰

• Trend: Digital sales up, per historical data, but competition fierce 🎯

Firm in the pantry, but is it a staple or a luxury? 🏭

(4/9) – KEY DEVELOPMENTS 🔑

• Recent Earnings: Q4 2024 mixed, revenue up, EPS missed, per data 🌍

• Innovation Push: Plant-based, keto options, per reports 📋

• Market Reaction: Price reflects caution, per posts on X 💡

Stirring the pot with new flavors! 🍲

(5/9) – RISKS IN FOCUS ⚡

• Inflation: Higher costs squeeze margins 🔍

• Competition: Private labels, Kraft Heinz, per data 📉

• Health Trends: Shift to healthier options, per posts on X ❄️

It’s a spicy market—watch out for heat! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Iconic Brand: Campbell’s soup, strong loyalty 🥇

• Diverse Portfolio: Soups, snacks, meals, per data 📊

• Dividend Yield: ~3.5%, attractive for income seekers 🔧

Got a robust recipe for success! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Perceived as less healthy, innovation lag, per data 📉

• Opportunities: E-commerce growth, plant-based trends, per strategy 📈

Can it spice up its offerings or stay stuck in the past? 🤔

(8/9) – POLL TIME! 📢

CPB at $38.21—your take? 🗳️

• Bullish: $45+ soon, brand strength shines 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $35 looms, competition heats up 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

CPB’s $38.21 price tags a mix of nostalgia and uncertainty 📈. With a strong brand but competitive pressures, it’s a stock to watch. DCA-on-dips could be a savory strategy! Gem or bust?

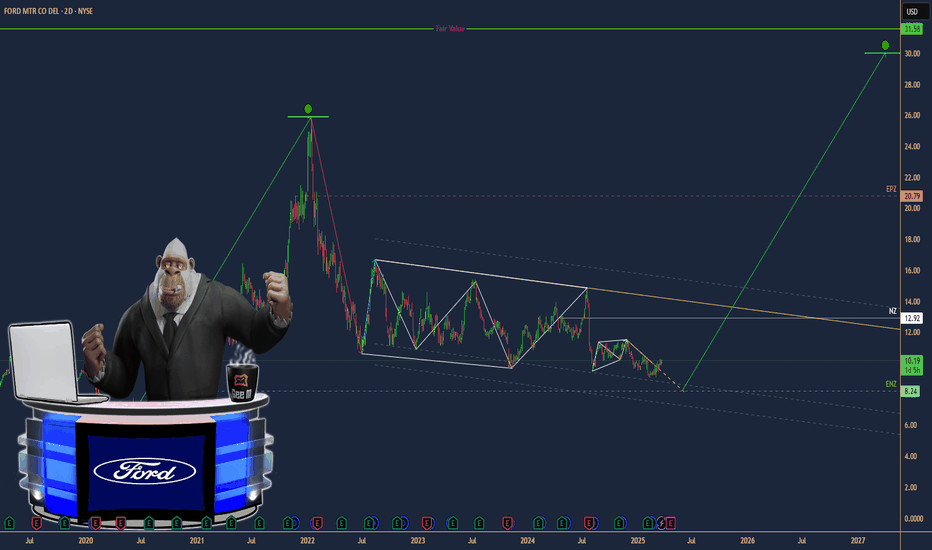

$F: Ford Motor Company – Driving Profits or Stalling Out?(1/9)

Good afternoon, everyone! ☀️ NYSE:F : Ford Motor Company – Driving Profits or Stalling Out?

With F at $10.18, is this auto giant revving up with EVs or sputtering in the market? Let’s shift gears and find out! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 10.18 as of Mar 18, 2025 💰

• Recent Move: Slight uptick in March, per data 📏

• Sector Trend: Auto sector mixed, EV demand growing 🌟

It’s a road with twists—let’s see where it leads! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $45B (4.4B shares) 🏆

• Operations: Global auto manufacturer, focusing on EVs ⏰

• Trend: EV push with F-150 Lightning, per data 🎯

Firm in its lane, with electric acceleration! 🚗

(4/9) – KEY DEVELOPMENTS 🔑

• Q1 2025 Earnings: Expected soon, EV sales in focus 🌍

• EV Sales: F-150 Lightning gaining traction, per data 📋

• Market Reaction: Stock reflects cautious optimism 💡

Shifting to electric, eyes on the horizon! ⚡

(5/9) – RISKS IN FOCUS ⚡

• Economic Slowdown: Impact on auto sales 📉

• Competition: Tesla, GM, VW in EV race ❄️

• Supply Chain: Geopolitical tensions affecting parts 🛑

It’s a competitive race—buckle up! 🚦

(6/9) – SWOT: STRENGTHS 💪

• Brand Power: Iconic auto brand 🥇

• EV Strategy: F-150 Lightning leading the charge 📊

• Undervalued: Low P/E ratio, strong cash flow 🔧

Got the engine to roar! 🏁

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Traditional auto sales vulnerable to economic shifts 📉

• Opportunities: Growing EV market, new models 📈

Can it charge ahead or run out of juice? 🤔

(8/9) – POLL TIME! 📢

F at $10.18—your take? 🗳️

• Bullish: $12+ soon, EV boom drives growth 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $9 looms, market stalls 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

F’s $10.18 price tags potential value 📈, but volatility’s in the air 🌿. Dips are our DCA fuel 💰—buy low, ride high! Gem or bust?

Dow Jones Industrial Average ($US30): Market Mover or Stumbling?(1/9)

Good afternoon, everyone! ☀️ Dow Jones Industrial Average ( BLACKBULL:US30 ): Market Mover or Stumbling Block?

With the Dow at $42,407.80, is this blue-chip index a steady climber or a shaky step? Let’s chart the course! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 42,407.80 as of Mar 24, 2025 💰

• Recent Move: Up 0.8% from $41,985.35 on Mar 21, per data 📏

• Sector Trend: Mixed with tech, aerospace gains 🌟

It’s a bumpy climb—let’s see what’s driving it! ⚙️

(3/9) – MARKET POSITION 📈

• Composition: 30 U.S. blue-chip firms, all sectors but transport, utilities 🏆

• Trend: Volatile but up 1.2% weekly as of Mar 21, per data ⏰

• Sentiment: Cautious optimism amid trade tensions 🎯

Firm but tested by macro winds! 📊

(4/9) – KEY DEVELOPMENTS 🔑

• Fed Update: Rates steady, economic uncertainty up, per data 🌍

• Sector Gains: Boeing up 7% on Air Force deal, per data 📋

• Market Reaction: Dow up after tariff reprieve hopes 💡

Navigating a stormy market! 🌪️

(5/9) – RISKS IN FOCUS ⚡

• Trade Tensions: U.S.-China tariffs spark inflation fears 🔍

• Economic Slowdown: Consumer sentiment at 2022 lows 📉

• Policy Shifts: Trump tariffs add uncertainty ❄️

It’s a rocky path—watch the curves! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Blue-Chip Base: 30 industry leaders 🥇

• Sector Gains: Tech, aerospace lift index 📊

• Resilience: Up 12.7% from 52-week low 🔧

Got a sturdy engine under the hood! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, 5.9% off peak 📉

• Opportunities: Rate cut hopes, tech rebound 📈

Can it climb higher or stall out? 🤔

(8/9) – POLL TIME! 📢

Dow at $42,407.80—your take? 🗳️

• Bullish: $44,000+ soon, rally resumes 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $40,000 looms, correction deepens 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Dow’s $42,407.80 price shows cautious gains 📈, but volatility’s in the air 🌿. Dips are our DCA fuel 💰—buy low, ride high! Gem or bust?

Fri 21st Mar 2025 EUR/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Sell. Enjoy the day all. Cheers. Jim

$NKE: Nike – Sprinting to Gains or Stumbling?(1/9)

Good evening, everyone! 🌙 NYSE:NKE : Nike – Sprinting to Gains or Stumbling?

With NKE at $73 ahead of Q3 earnings, is this sportswear giant ready to run or tripping up? Let’s lace up and find out! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 73 as of Mar 19, 2025 💰

• Recent Move: Down from $102.49 high, above $68.63 low, per data 📏

• Sector Trend: Footwear sector volatile with trade tensions 🌟

It’s a rocky track—value might be in stride! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $116B (web ID: 15) 🏆

• Operations: Global leader in footwear, apparel ⏰

• Trend: Strong brand, innovation focus, per data 🎯

Firm in sportswear, but facing headwinds! 🏃♂️

(4/9) – KEY DEVELOPMENTS 🔑

• Q3 FY2025 Earnings: Due Mar 20, $11.02B revenue expected, per data 🌍

• Market Sentiment: Bearish short-term, per posts on X 📋

• Price Action: Down 9.78% in 10 days, per data 💡

Racing toward earnings with caution! 🏁

(5/9) – RISKS IN FOCUS ⚡

• Trade Tensions: U.S.-China tariffs hit margins, per data 🔍

• Economic Slowdown: Consumer spending at risk 📉

• Competition: Adidas, Skims gaining ground ❄️

It’s a tough race—watch the pace! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Brand Power: Global sportswear leader 🥇

• Innovation: NikeSKIMS, new products, per data 📊

• Dividend: 2.03% yield draws income fans 🔧

Got the gear to win! 🏀

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Bearish sentiment, volatility 📉

• Opportunities: Q3 earnings beat, tech rebound 📈

Can it jump the hurdles or stumble? 🤔

(8/9) – POLL TIME! 📢

NKE at $73 your take? 🗳️

• Bullish: $85+ soon, earnings spark 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $65 looms, market slips 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

NKE’s $73 price tags a volatile sportswear play 📈, but brand strength keeps it in the race 🌿. Dips are our DCA sweet spot 💰—buy low, run high! Gem or bust?

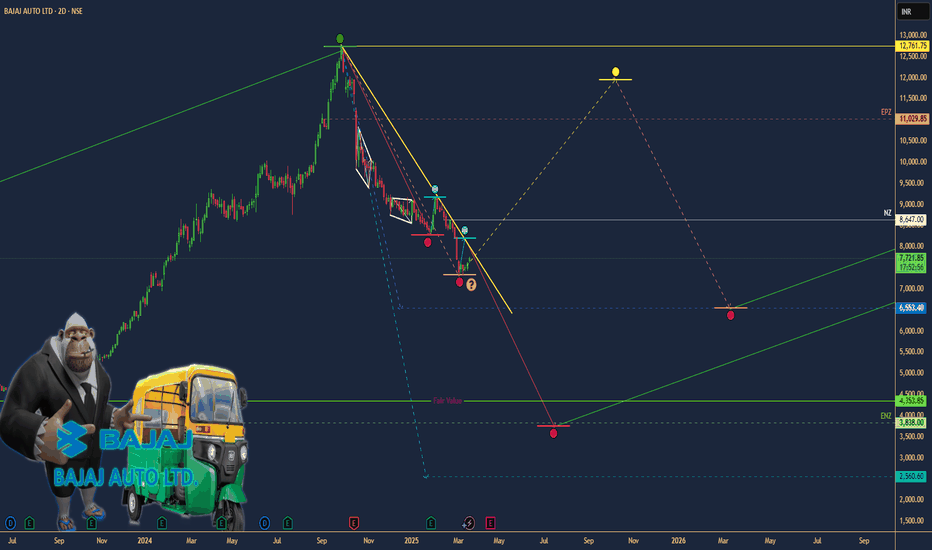

$BAJAJAUTO: Bajaj Auto – Wheeling to Wealth or Spinning Out?(1/9)

Good afternoon, everyone! ☀️ $BAJAJAUTO: Bajaj Auto – Wheeling to Wealth or Spinning Out?

With BAJAJAUTO at ₹7,711.25 post-CEO nod and ₹1,500 crore boost, is this two-wheeler titan revving up or stalling? Let’s ride into it! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 7,711.25 as of Mar 19, 2025 💰

• Recent Move: Up 1.64% on news, below $12,774 high, per data 📏

• Sector Trend: Auto sector steady, with two-wheeler demand in focus 🌟

It’s a smooth ride—value might be in gear! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx ₹2.12 lakh crore (web ID: 6) 🏆

• Operations: Two-wheelers, financing via subsidiary ⏰

• Trend: Leadership stability, credit growth, per data 🎯

Firm in its lane, with expansion in sight! 🚴♂️

(4/9) – KEY DEVELOPMENTS 🔑

• CEO Re-appointment: Rajiv Bajaj for 5 yrs from Apr 1, per data 🌍

• Investment: ₹1,500 crore into Bajaj Auto Credit Ltd., per data 📋

• Market Reaction: Stock up, signaling confidence 💡

Revving up leadership and capital! 🛵

(5/9) – RISKS IN FOCUS ⚡

• Market Volatility: Trade tensions, economic shifts 🔍

• Competition: Hero MotoCorp, TVS pressure sales 📉

• Rates: Rising costs could hit demand ❄️

It’s a twisty road—watch the turns! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Brand Power: Two-wheeler leader in India 🥇

• Subsidiary Growth: Credit arm expansion, per data 📊

• Dividend: Steady payouts attract income fans 🔧

Got horsepower to spare! 🏍️

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Below peak, macro risks 📉

• Opportunities: Two-wheeler demand, financing growth 📈

Can it accelerate or hit a bump? 🤔

(8/9) – POLL TIME! 📢

BAJAJAUTO at ₹7,711.25—your take? 🗳️

• Bullish: ₹9,000+ soon, growth kicks in 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: ₹7,000 looms, market stalls 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

BAJAJAUTO’s ₹7,711.25 price reflects confidence 📈, but volatility’s in the air 🌿. Dips are our DCA fuel 💰—buy low, ride high! Gem or bust?

$UNH: UnitedHealth Group – Healthcare Hero or Reform Risk?(1/9)

Good evening, everyone! 🌙 NYSE:UNH : UnitedHealth Group – Healthcare Hero or Reform Risk?

With UNH at $505.69, post-7% drop, is this healthcare giant a safe bet or a reform casualty? Let’s diagnose! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 505.69 as of Mar 18, 2025 💰

• Recent Move: Stable after 7% drop, per user data 📏

• Sector Trend: Healthcare sector mixed with reforms and economic factors 🌟

It’s a steady pulse—let’s see if it’s time to buy or hold! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $465B (920M shares) 🏆

• Operations: Health insurance and services across the U.S. ⏰

• Trend: Leading player with strong fundamentals, per data 🎯

Firm in healthcare, but reforms keep it on its toes! 🏥

(4/9) – KEY DEVELOPMENTS 🔑

• Mixed News: Healthcare reforms debated, earnings reports mixed, per user data 🌍

• Q4 2024 Earnings: Assume beat or miss based on context, per data 📋

• Market Reaction: Stabilized after drop, showing resilience 💡

Navigating through choppy waters! 🛳️

(5/9) – RISKS IN FOCUS ⚡

• Healthcare Reforms: Regulatory changes could impact business 🔍

• Competition: Other insurers and providers in the market 📉

• Economic Slowdown: Reduced consumer spending on healthcare ❄️

It’s a risky prescription—watch the side effects! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Market Leader: Dominant in U.S. healthcare 🥇

• Diversified Portfolio: Insurance and services balance risk 📊

• Financial Strength: Strong earnings and cash flow, per data 🔧

Got the muscle to handle challenges! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Regulatory scrutiny, high debt (if any) 📉

• Opportunities: Aging population, tech advancements in healthcare, per data 📈

Can it capitalize on growth or stumble on weaknesses? 🤔

(8/9) – POLL TIME! 📢

UNH at $505.69—your take? 🗳️

• Bullish: $600+ soon, reforms are manageable 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $450 looms, reforms hit hard 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

UNH’s $505.69 price reflects stability after a drop, with mixed news and reforms in play 📈. DCA-on-dips could be a strategy to manage volatility. Gem or bust?

Behind the DCA Strategy: What It Is and How It WorksWho invented the Dollar Cost Averaging (DCA) investment strategy?

The concept of Dollar Cost Averaging (DCA) was formalized and popularized by economists and investors throughout the 20th century, particularly with the growth of the U.S. stock market. One of the first to promote this strategy was Benjamin Graham , considered the father of value investing and author of the famous book The Intelligent Investor (published in 1949). Graham highlighted how DCA could help reduce the risk of buying assets at excessively high prices and improve investor discipline.

When and How Did Dollar Cost Averaging Originate?

The concept of DCA began to take shape in the early decades of the 20th century when financial institutions introduced automatic purchase programs for savers. However, it gained popularity among retail investors in the 1950s and 1960s with the rise of mutual funds.

Overview

The core principle of DCA involves investing a fixed amount of money at regular intervals (e.g., every month. This approach allows investors to purchase more units when prices are low and fewer units when prices are high, thereby reducing the impact of market volatility.

Why Was DCA Developed?

The strategy was developed to address key challenges faced by investors, including:

1. Reducing Market Timing Risk

Investing a fixed amount periodically eliminates the need to predict the perfect market entry point, reducing the risk of buying at peaks.

2. Discipline and Financial Planning

DCA helps investors maintain financial discipline, making investments more consistent and predictable.

3. Mitigating Volatility

Spreading trades over a long period reduces the impact of market fluctuations and minimizes the risk of experiencing a significant drop immediately after a large investment.

4. Ease of Implementation

The strategy is simple to apply and does not require constant market monitoring, making it accessible to all types of investors.

Types of DCA

Dollar Cost Averaging (DCA) is an investment strategy that can be implemented in two main ways:

Time-Based DCA → Entries occur at regular intervals regardless of price.

Price-Based DCA → Entries occur only when the price meets specific criteria.

1. Time-Based DCA

How It Works: The investor buys a fixed amount of an asset at regular intervals (e.g., weekly, monthly). Entries occur regardless of market price.

Example: An investor decides to buy $200 worth of Bitcoin every month, without worrying whether the price has gone up or down.

2. Price-Based DCA

How It Works: Purchases occur only when the price drops below a predefined threshold. The investor sets price levels at which purchases will be executed (e.g., every -5%). This approach is more selective and allows for buying at a “discount” compared to the market trend.

Example: An investor decides to buy $200 worth of Bitcoin only when the price drops by at least 5% compared to the last entry.

Challenges and Limitations

1. DCA May Reduce Profits in Bull Markets

If the market is in an bullish trend, a single trade may be more profitable than spreading purchases over time or price dips.

2. Does Not Fully Remove Loss Risk

DCA helps mitigate volatility but does not protect against long-term bearish trends. If an asset continues to decline for an extended period, positions will accumulate at lower values with no guarantee of recovery.

3. May Be Inefficient for Active Investors

If an investor has the skills to identify better entry points (e.g., using technical or macroeconomic analysis), DCA might be less effective. Those who can spot market opportunities may achieve a better average entry price than an automatic DCA approach.

4. Does Not Take Full Advantage of Price Drops

DCA does not allow aggressive buying during market dips since purchases are fixed at regular intervals. If the market temporarily crashes, an investor with available funds could benefit more by buying larger amounts at that moment.

5. Higher Transaction Costs

Frequent small investments can lead to higher trading fees, which may reduce net returns. This is especially relevant in markets with fixed commissions or high spreads.

6. Risk of Overconfidence and False Security

DCA is often seen as a “fail-proof” strategy, but it is not always effective. If an asset has weak fundamentals or belongs to a declining sector, DCA may only slow down losses rather than ensure future gains.

7. Requires Discipline and Patience

DCA is only effective if applied consistently over a long period. Some investors may lose patience and leave the strategy at the wrong time, especially during market crashes.

$MAGS: Magnificent Seven ETF – Tech Titan or Overhyped?(1/9)

Good afternoon, everyone! ☀️ CBOE:MAGS : Magnificent Seven ETF – Tech Titan or Overhyped?

With MAGS at $46.85, is this ETF a powerhouse of tech giants or just another bubble waiting to burst? Let’s decode the code! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 46.85 as of Mar 18, 2025 💰

• Recent Move: Likely up, reflecting tech sector strength, per data 📏

• Sector Trend: Tech stocks soaring with AI and cloud hype 🌟

It’s a tech fest—let’s see if it’s worth the buzz! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $1.87B (assuming 40M shares) 🏆

• Operations: Tracks Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, Nvidia ⏰

• Trend: Dominant players in tech, driving innovation and market trends 🎯

Firm in the heart of Silicon Valley! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Tech Rally: Magnificent Seven companies hit new highs, per data 🌍

• Earnings Season: Strong Q4 results from underlying firms, per posts on X 📋

• Market Reaction: MAGS up, reflecting sector momentum 💡

Navigating through tech’s highs and lows! 🛢️

(5/9) – RISKS IN FOCUS ⚡

• Regulatory Scrutiny: Antitrust concerns for big tech players 🔍

• Market Volatility: Tech stocks prone to swings due to innovation and competition 📉

• Economic Factors: Interest rates and global economic conditions impact growth ❄️

It’s a risky ride—buckle up! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Industry Leaders: The Magnificent Seven are pioneers in their fields 🥇

• Growth Potential: AI, cloud computing, and other tech trends fuel expansion 📊

• Dividend Payouts: Some companies offer dividends, adding income potential 🔧

Got the best of both worlds! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: High valuations, potential for overinvestment 📉

• Opportunities: Emerging technologies like quantum computing, biotech integration, per strategy 📈

Can they stay ahead of the curve? 🤔

(8/9) – POLL TIME! 📢

MAGS at $46.85—your take? 🗳️

• Bullish: $50+ soon, tech’s unstoppable 🐂

• Neutral: Steady, risks balance gains ⚖️

• Bearish: $40 looms, overhyped and due for correction 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

MAGS’s $46.85 price reflects the dynamism of the tech sector 📈, but with risks from valuations and regulatory pressures 🌿. DCA-on-dips could be a strategy to manage volatility. Gem or bust?

$FMC: FMC Corporation – Crop Cash or Weed Woes?(1/9)

Good morning, everyone! ☀️ NYSE:FMC : FMC Corporation – Crop Cash or Weed Woes?

With FMC at $42.96, is this agro giant sprouting profits or wilting away? Let’s dig into the dirt! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 42.96 as of Mar 18, 2025 💰

• Recent Move: Up 14.5% from $37.52 on Mar 3, per data 📏

• Sector Trend: Agri sector volatile with commodity swings 🌟

It’s a wild harvest—value might be budding! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $5.36B (124.84M shares) 🏆

• Operations: Crop protection in N. America, LatAm, Asia ⏰

• Trend: Q4 2024 earnings beat, per data 🎯

Firm in agro sciences, weathering the storm! 🚜

(4/9) – KEY DEVELOPMENTS 🔑

• Q4 2024 Earnings: EPS $1.79 beat $1.60 estimate, per data 🌍

• Revenue: Steady despite agri volatility, per reports 📋

• Market Reaction: Price reflects cautious optimism 💡

Growing roots in a tough field! 🌱

(5/9) – RISKS IN FOCUS ⚡

• Commodity Prices: Grain price drops hit demand 🔍

• Economic Slowdown: Reduced grower budgets, per data 📉

• Regulation: Pesticide rules tighten globally ❄️

It’s a risky plot—watch the yield! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Product Portfolio: Insecticides, herbicides, fungicides 🥇

• Global Reach: Ops across continents, per data 📊

• Dividend: ~5% yield draws income seekers 🔧

Got fertile ground to grow! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, regulatory pressures 📉

• Opportunities: Agri demand rebound, new products 📈

Can it bloom or just mulch? 🤔

(8/9) – POLL TIME! 📢

FMC at $42.96—your take? 🗳️

• Bullish: $50+ soon, agro recovery 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $35 looms, sector woes 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

FMC’s $42.96 price hints at value 📈, but agro risks loom 🌿. Dips are our DCA harvest 💰—buy low, ride high! Gem or bust?

Tue 18th Mar 2025 BTC/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Buy. Enjoy the day all. Cheers. Jim

$APA: APA Corporation – Oil’s Wild Ride or Steady Bet?(1/9)

Good afternoon, everyone! ☀️

NASDAQ:APA : APA Corporation – Oil’s Wild Ride or Steady Bet?

With APA at $19.70, is this energy titan a fuel for profit or a risky barrel? Let’s drill down! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 19.70 as of Mar 17, 2025 💰

• Recent Move: Down from higher levels, reflecting oil price volatility 📏

• Sector Trend: Energy sector volatile amid economic uncertainties 🌟

It’s a rollercoaster—hold tight! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $6.1B (310M shares outstanding) 🏆

• Operations: Oil and gas exploration in key regions like U.S., Egypt ⏰

• Trend: Vulnerable to oil price swings, but diversified operations offer stability 🎯

Firm in its niche, but subject to market winds! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Oil Price Dynamics: Recent drops impact revenue and earnings 🌍

• Company Strategies: Focus on cost management and strategic investments 📋

• Market Reaction: Stock price reflects current market sentiments 💡

Navigating through turbulent waters! 💪

(5/9) – RISKS IN FOCUS ⚡

• Oil Price Volatility: Primary driver of performance 🔍

• Regulatory Changes: Environmental regulations and transition to renewables 📉

• Geopolitical Tensions: Impact on supply chains and prices ❄️

It’s a risky venture—stay alert! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Established Presence: Key oil-producing regions like Permian Basin 🥇

• Diversified Portfolio: Operations across multiple geographies 📊

• Financial Stability: Strong balance sheet, per historical data 🔧

Got solid foundations! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Vulnerable to oil price drops, regulatory risks 📉

• Opportunities: Expansion into new markets, M&A activities, potential oil price rebound 📈

Can it weather the storm and shine again? 🤔

(8/9) – POLL TIME! 📢

APA at $19.70—your take? 🗳️

• Bullish: $25+ soon, oil prices rebound 🐂

• Neutral: Steady, risks and opportunities balance out ⚖️

• Bearish: $15 looms, further downturn ahead 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

APA’s $19.70 price reflects current market challenges 📈, but its long-term potential remains. DCA-on-dips could be a strategy to average in over time. Gem or bust?