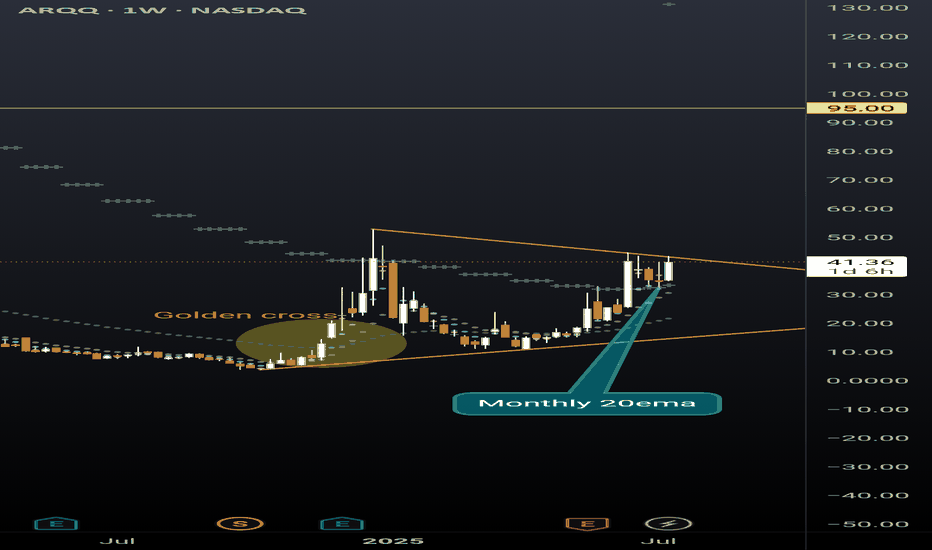

ARQQ weekly pennantBeautiful weekly pennant on ARQQ weekly timeframe. This chart is coiling nicely for a continuation. Still early in the process of reaching breakout but given the recent momentum in this sector a premature break to the upside can happen at any moment.

The ticker is currently sitting above the monthly 20ema (overlayed on this weekly chart), and just had a strong bounce off the daily 20ema (overlayed on this weekly chart). Golden cross is also highlighted that occurred in December 2024 with the daily 50ema retracing back to the daily 200ema and then continuing the uptrend earlier this spring.

Defense

Is BigBear.ai the Next Titan of Defense AI?BigBear.ai (NYSE: BBAI) is emerging as a significant player in the artificial intelligence landscape, particularly within the critical national security and defense sectors. While often compared to industry giant Palantir, BigBear.ai carves its niche by intensely focusing on modern warfare applications, including guiding unmanned vehicles and optimizing missions. The company has recently garnered considerable investor attention, evidenced by its impressive 287% rally over the past year and a notable surge in public interest. This enthusiasm stems from several key factors, including a substantial 2.5x increase in backlog orders to $385 million by March 2025 and a significant ramp-up in research and development spending, signaling robust foundational growth.

BigBear.ai's technological prowess underpins its rising profile. The company develops sophisticated AI and machine learning models for diverse applications, from facial recognition systems deployed at major international airports like JFK and LAX to AI-augmented shipbuilding software for the U.S. Navy. Its Pangiam® Threat Detection and Decision Support Platform enhances airport security by integrating with advanced CT scanner technology, while its ConductorOS platform facilitates secure communication and coordination for drone swarm operations under the U.S. Army's Project Linchpin. These cutting-edge solutions position BigBear.ai at the forefront of AI-driven advancements crucial for evolving geopolitical landscapes and increasing defense AI investments.

Strategic collaborations and a favorable market environment further fuel BigBear.ai's ascent. The company recently formed a significant partnership in the UAE with Easy Lease and Vigilix Technology Investment to accelerate AI adoption across key industries like mobility and logistics, marking a major step in its international expansion. Additionally, multiple contracts with the U.S. Department of Defense, including those for J-35 fleet management and geopolitical risk assessment, underscore its vital role in government initiatives. While BigBear.ai faces challenges, including revenue stagnation, escalating losses, and stock volatility, its strategic market position, growing backlog, and continuous innovation in mission-critical AI solutions present a compelling high-risk, high-reward investment opportunity in the burgeoning defense AI sector.

War is a Racket | DFEN | Long at $28.00The war machine keeps turning. Profits will reign. Direxion Aerospace and Defense 3x AMEX:DFEN never fully recovered from pandemic lows, but world peace is (unfortunately) far from reach. The uptrend in the chart has commenced. Personal entry point at $28.00.

Target #1 = $37.00

Target #2 = $50.00

Target #3 = $64.00

KTOS BUY Kratos Defense (KTOS) is a buy due to escalating global conflicts driving demand for low-cost, high-tech defense systems. KTOS aligns with shifting military priorities. Strong government contracts and rising revenues position it to benefit from sustained geopolitical instability and defense modernization. KTOS is pioneering AI-powered drones and autonomous systems, areas the Pentagon is prioritizing for future warfare capabilities. earnings showed double-digit YoY revenue growth and a rising backlog, confirming increasing contract momentum.

The FY2025 U.S. defense budget remains robust, with a focus on next-gen warfare and drones.

World conflicts not seeing improvement : Russia-Ukraine .. Israel-Iran

LMT sky high rocket stock LMT has been experiencing some intense changes in geopolitical conflict for next week. Leading analysts to observe closely LMT price behavior according to avg volume. We’re al expecting LMT to rise just above $520 by next week in order to accommodate some liquidity. Keep buying if not yet more.

Why QuickLogic? Unpacking its Semiconductor Surge.QuickLogic Corporation, a vital developer of embedded FPGA (eFPGA) technology, currently navigates a rapidly evolving semiconductor landscape marked by intense technological innovation and shifting geopolitical priorities. Its recent inclusion in the Intel Foundry Chiplet Alliance signals a pivotal moment, affirming QuickLogic's expanding influence in both defense and high-volume commercial markets. This strategic collaboration, combined with QuickLogic’s advanced technological offerings, positions the company for significant growth as global requirements for secure and adaptable silicon intensify.

Critical geopolitical imperatives and a profound shift in semiconductor technology fundamentally drive the company's ascent. Nations are increasingly prioritizing robust, secure, and domestically sourced semiconductor supply chains, particularly for sensitive aerospace, defense, and government applications. Intel Foundry's efforts, including the Chiplet Alliance, directly support these strategic demands by cultivating a secure, standards-based ecosystem within the U.S. QuickLogic’s alignment with this initiative enhances its status as a trusted domestic supplier, expanding its reach within markets that value security and reliability above all else.

Technologically, the industry's embrace of chiplet-based architectures plays directly into QuickLogic’s strengths. As traditional monolithic scaling faces mounting challenges, the modular chiplet approach gains traction, allowing for the integration of separately manufactured functional blocks. QuickLogic's eFPGA technology provides configurable logic, perfectly suited for seamless integration within these multi-chip packages. Its proprietary Australis™ IP Generator rapidly develops eFPGA Hard IP for advanced nodes like Intel’s 18A, optimizing power, performance, and area. Beyond defense, QuickLogic's eFPGA integrates into platforms like Faraday Technology's FlashKit™-22RRAM SoC, offering unparalleled flexibility for IoT and edge AI applications by enabling post-silicon hardware customization and extending product lifecycles.

Membership in the Intel Foundry Chiplet Alliance offers QuickLogic tangible advantages, including early access to Intel Foundry's advanced processes and packaging, reduced prototyping costs through multi-project-wafer shuttles, and participation in defining interoperable standards via the UCIe standard. This strategic positioning solidifies QuickLogic’s competitive edge in the advanced semiconductor manufacturing landscape. Its consistent innovation and robust strategic alliances underscore the company’s strong future trajectory in a world hungry for adaptable and secure silicon solutions.

Geospatial Technology: A Catalyst for Modern InnovationBeyond Earth-based uses, geospatial tools are now integral to advancements in autonomous vehicles, drone technology, and even space exploration. As data becomes increasingly abundant, the ability to tie that data to a physical location adds powerful context that static information cannot provide.

Geospatial technology enhances safety, efficiency, and scalability. It enables vehicles and systems to operate with spatial awareness, supports AI-driven decision-making, and ultimately helps automate logistics in a reliable and responsive way.

FedEx has recently emphasized its commitment to integrating autonomous technologies to enhance logistics efficiency and resilience. These initiatives aim to streamline operations and reduce costs, contributing to a $6 billion reduction in the company's cost base over three years. XYO happens to be a partner at the FedEx institute of tech.

XYO is also rumored to be integrated with Tesla vehicles -- just like with Bitcoin mining. The hope is to use the XYO blockchain to address location spoofing issues where validity of data and safety is paramount. This goes in hand with Tesla's goals to make your care work for you. In fact, the goal for XYO is to pay users for creating and validating data.

Key Developments in the Past 12 Months:

1. Launch of XYO Layer One and Dual-Token Economy

2. Expansion to Solana

3. Introduction of the XYO Platform Node

4. Gamification and User Engagement

5. Developer Resources and Community Building

XYO launched the "Build the Future" initiative, aimed at fostering a robust developer community. This program provides resources, documentation, and incentives for developers to build applications and tools on the XYO network.

Looking ahead, XYO plans to continue enhancing its Layer-1 blockchain capabilities, expanding interoperability with other blockchain networks, and introducing more user-centric applications. The focus remains on building a decentralized, user-owned geospatial data network that empowers individuals and developers alike. A network-effect-like-potential for this technology is worth paying attention to.

From a military standpoint, geospatial technology is critical because it provides the foundation for situational awareness, precision, and operational dominance in modern warfare:

GPS and satellite imagery

Real-time geospatial intelligence (GEOINT) ensures that moving or hidden targets can be tracked and re-verified before engagement.

Terrain analysis

Topographic and environmental data

Autonomous surveillance drones need GPS and HD geospatial mapping to patrol borders or conflict zones.

Logistics bots and unmanned vehicles rely on route optimization for resupply missions under fire or in denied environments.

Geospatial analytics can identify unusual patterns (e.g., IED placements, enemy camps) from satellite data.

Geofencing can alert personnel when enemies or drones breach a protected area.

Before any mission, simulations and war games based on real-world geospatial data improve planning and reduce risks.

Lockheed Martin... Time to move?With tensions rising in the Middle East and the gaining of military activity here in the United States, it could be assumed that the government spending to grow the defense will mostly be seen by large defense firms. Specifically, we will be looking at NYSE:LMT but that doesn't rule out any other defense contractors from this trade ( NYSE:NOC , NASDAQ:HON , NYSE:RTX , NYSE:BA , NYSE:GD ). Firstly, let's examine the charts before reviewing anything fundamental from the company.

This is the 4h chart looking back into late-mid January

Simply put, this is just two of many possible paths that the NYSE:LMT price action could take. However, these two should be the most expected especially considering its violent downtrend that appears to be "cooling" and not "consolidating". It also appears that NYSE:LMT price action likes to reclaim any Fair Value Gap that it creates quite quickly as of recent trading terms. The good news is that two large FVG's have been created by a rather lackluster earnings report.

Now, as for a fundamental analysis POV, we can firstly examine the defense industry's cyclical movement throughout the years. This means that the industry is facing booms and busts. So lets see what the 1 week chart has to say about that...

With the chart shown above, you're probably thinking that a quick rebound seems unlikely as the other "BUST" sequences seem to last longer than the "BOOM" sequences. To this I would agree, however being first (or being early) is something I can settle for as there is no possible way to buy the exact bottom penny. When prompted with this dilemma of timing, think back to the Margin Call famous quote...

"There are only three ways to make a living in this business: be first ; be smarter; or cheat... it sure is a hell of a lot easier to just be first."

Can AI Weather the Storm of Volatility?BigBear.ai has captured the market's attention with its dramatic stock performance, navigating through a sea of volatility with recent gains fueled by significant contract wins and positive AI sector developments. The company's journey reflects a broader narrative in the tech industry: the high stakes of betting on AI innovation. With its stock soaring over 378% in the last year, BigBear.ai demonstrates the potential for rapid growth in an era where AI is increasingly central to strategic sectors like defense, security, and space exploration.

However, the narrative isn't without its twists. Analyst warnings about cyclical business patterns and valuation concerns introduce a layer of complexity to the investment thesis. BigBear.ai's ability to secure pivotal contracts with the U.S. Department of Defense showcases its technological prowess, yet the challenge lies in converting this into sustainable profitability. This scenario invites investors to ponder the delicate balance between innovation, market sentiment, and financial stability in the AI landscape.

The strategic acquisition of Pangiam and partnerships like the one with Virgin Orbit illustrate BigBear.ai's ambition to not only ride the wave of AI hype but also to steer it into new territories. These moves are about expanding market presence and redefining what AI can achieve in practical, real-world applications. As BigBear.ai continues to evolve, it challenges us to consider how far AI can go in reshaping industries and whether the market can keep pace with such rapid technological advancements. This saga of BigBear.ai is a microcosm of the broader AI investment landscape, urging us to look beyond immediate gains to the long-term vision and viability of AI-driven companies.

BBAI - Trying to fully BreakoutPrice has moved above Fib 1 at 4.80. If it can close above that today will be watching post and pre market. This is currently one of my larger trades using shares, calls, puts and LEAPS. If it breaks a big win. If not still a win but not the high 3-4 figure % return targeted. Good luck if playing.

Mobix Labs is gearing up for a bull market!We're back with a new stonk after doing about a 7x on SEALSQ! I don't have much time to write an in depth analysis so please do your own research on this company.

Mobix Labs looks to be settling in their growth market, defense contracts signed and a possible acquisition. Earnings are TOMORROW Dec 19th, so of course this is risky - bad earnings could dump the stock significantly. If however, earnings are good and the investor call brings some good news, this one could fly. Technical breakout target is $10 and I like the nice retest on the bull market support band. $2.16 is the first resistance to break and to retest for a first move towards $3.5.

Let's see, remember these are low caps and risky!

Could BA be a wrinkle in the market?BA seems to be facing challenges. However, advancements in technology, along with opportunities in space and defense spending, present a gap that could benefit the company. While I don't have a specific time horizon, I see an opportunity to profit by going against the grain. It's a difficult path, but the potential is there.

MOBX resistance / support flip, target: +100% nextMobix Labs had volatile pa after earnings, an overreaction as revenue was up over 400% beating estimates. They're still at an operating loss, which is normal for a startup.

Story is simple, they did multiple acquisitions this year:

RaGE Systems:

Revenue for 2024: Not specified.

Acquisition Cost: Approximately $2 million in cash, $10 million in Mobix Labs stock, and possible earn-out payments up to $8 million over eight fiscal quarters.

Description: Provides radio frequency joint design and manufacturing services.

J-Mark Connectors Inc.:

Revenue for 2024: Not specified.

Acquisition Cost: Financial terms remain undisclosed.

Description: Specializes in custom interconnect solutions for industries like aerospace, military, and defense.

Spacecraft Components Corp.:

Revenue for 2024: Not specified, but 2023 unaudited revenues were $18.1 million with forecasted growth for the next two years.

Acquisition Cost: Between $18 million and $24 million, with consideration to be paid in a combination of cash and equity, subject to earnout provisions.

Description: Manufactures mission-critical electronics for the aerospace, defense, and transportation sectors.

Now especially Spacecraft Components Corp. is notably as they do 18.1 million in revenue and are worth roughly 22 million. Mobix Labs reported about 3 million in revenue yesterday.

This means they will do 7x the revenue after the acquisition is completed in Q1 2025. Next to that they secured the following contracts in 2024 that are not part of the current revenue:

In 2024, Mobix Labs, Inc. secured the following contracts:

M-1 Abrams Tank Army Contract: for filtered connectors.

Sole Source Supply Contract: with Gulfstream Aerospace Corp. for custom filtered connectors used in their business-jet aircraft.

GE HealthCare and PerkinElmer Contract: for the sale of proprietary electromagnetic filtering products used in pharmaceutical diagnostics and digital imaging solutions.

Tomahawk Missile System Contract: for filtered connector parts.

Javelin Missile System Contract: for guidance system components.

A 15-month Contract: to supply critical components for aerospace and defense applications, though specific details about the customer or components were not specified.

EMI Interconnect Solutions: announced new filtered ARINC connectors and secured aerospace customers.

These contracts span various sectors, focusing mainly on military, defense, aerospace, and medical applications.

---

Looks to me this company is undervalued and has a lot of growth ahead in 2025... I added on the dip and any buy under $2 should be good long term.

Short term pa looks like a support resistance flip and a next target of $3.52 - I also like that this stock isn't popular whatsoever, similar to LAES (SEALSQ) when I found it.

A patient hold for me, DYOR, happy holidays!

Raytehon (RTX) Head and Shoulders. Fundamental reasoning: DJT is a peace president vs Biden who allowed build of geopolitical tensions and warfare.

D.O.G.E dept. to radically overhaul the deep state and waste.

Other notable Military contractors include:.

#LMT

Northrup Grumman

Avic

Boeing

General Dynamics

BAE

PLTR Back to ATHsBounced off the .382 fib retracement with only ATH remaining. Lots of bullish momentum and TA has been smooth as well. Possible S&P 500 inclusion in September could also be driving price action from "smart money."

Flow into calls has been increasing with a few big orders above ATH have been spotted

$NYSE:RTX Rebound After a Healthy PullbackNYSE:RTX is currently in an uptrend, as evidenced by its strong upward movement, followed by a period of consolidation. This phase is crucial as it allows the stock to gather strength and form a stable base before potentially continuing its upward trajectory.

The RSI indicates that the stock is approaching a neutral range, which suggests it is neither overbought nor oversold at this point. Given the overall trend and the current consolidation, it would be prudent to allow this phase to fully mature. This will provide a clearer indication of whether the stock is ready for a breakout or if it needs further time to stabilize before continuing its trend.

Patience during this phase is key, I'm looking for a breakout beyond 121.40$ to reconsider a position.

Breakout day for QinetiQ - expect pullback to retestWeekly chart: Triangle formed with 2 or more touches to both its upper and lower lines. Early breakout too and could signal a rise to 587. However, if this goes to form, it will retest the upper triangle line at 339 before heading higher.

WARNING: This is not trading advice and just my own technical analysis. Do your own research and trade your own rules.