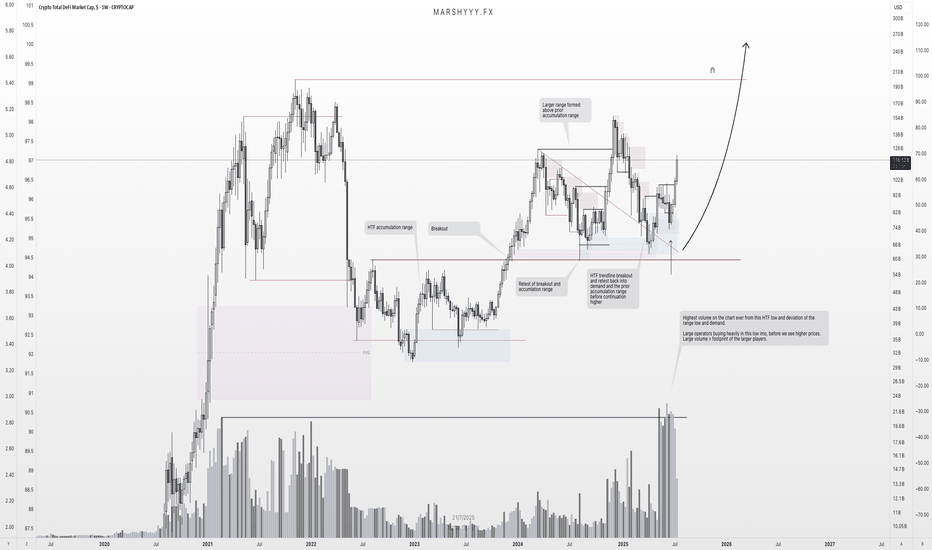

TOTAL DEFI: HTF Reaccumulation Underway — $200B+ In SightThis is one of the cleanest HTF setups in the market right now — and it’s flying under the radar.

We're looking at TOTAL DEFI market cap, and it’s showing all the signs of strong reaccumulation following a textbook breakout–retest structure off a larger HTF accumulation base.

Price broke out from the 2023–2024 accumulation range, retested that breakout zone and range highs in August 2024, swept liquidity, and tapped into unmitigated demand within the accumulation range — before climbing back to the $155B region, creating a larger range above the prior accumulation range it broke out from.

Since then, price pulled all the way back to range lows and HTF demand at $65B, forming a new bullish reversal from this key region and retesting the trendline breakout before continuing another leg higher — as we’re now seeing unfold.

But here’s the key:

🧠 That recent deviation came with the highest volume ever recorded on this chart — right off the range low and HTF demand.

That’s not retail. That’s large operators loading up, leaving their footprint ahead of the next expansion leg.

We’ve now:

- Broken the descending trendline cleanly

- Flipped key SR levels back into support

- Started pushing higher with strong HTF closes

📈 Expectation:

This is a spring + test setup within a reaccumulation range. I’m targeting continuation toward the range highs, followed by a macro breakout that could take DeFi market cap to $200B+ — especially once the prior distribution zone is reclaimed.

This aligns with the broader cycle narrative — liquidity rotating back into altcoins, particularly DeFi, as stablecoin dominance declines and the market shifts fully risk-on into the final phase of the bull cycle.

Key Structure Summary:

- HTF accumulation base → breakout → retest → demand sweep

- Largest volume spike = operator footprint

- Higher lows forming = market structure flipping

- Expecting expansion to $200B+ as trend continues

One to watch closely.

Don’t fade the volume. Don’t fade the structure.

Defiusdt

Arbitrage Opportunity!I believe I’ve identified an arbitrage opportunity involving the DEFI cryptocurrency: it trades at $0.003200 on Bybit, compared to only $0.002390 on MEXC.

I recall encountering a similar situation with Shiba Inu, when the price gap between Binance and Coinbase was as high as 8X. Feel free to play the chart below to see the outcome:

I also remember the 2016–2017 period, when such arbitrage opportunities existed even with Bitcoin, due to price discrepancies between Asian exchanges and those available to European traders.

DEFI the Next Crypto Sleeper? Trump Jr. & O’Leary Back on Stage!Fundamental Bullish Case:

1. Huge Names Are Paying Attention

Earlier this year, De.Fi held a high-profile event attended by Donald Trump Jr. and Kevin O’Leary. Regardless of political views, this kind of exposure brings:

Mainstream visibility to a previously overlooked microcap.

Credibility among non-crypto retail investors.

The possibility of future partnerships or integrations with major capital players.

When figures like O’Leary (a former FTX critic turned crypto backer) show up, it means the project is on the radar.

2. De.Fi = A Web3 Security & Aggregator Suite

The DEFI token powers the De.Fi “super app”, which combines:

Smart contract security auditing (via their Scanner tool).

Cross-chain asset dashboard — track DeFi investments in one place.

Swap and bridge functionality — a unified DeFi experience.

In a post-FTX world, security + simplicity is the future of Web3 adoption — and De.Fi is positioning itself at that intersection.

3. Microcap with Moonshot Potential

Market cap under $3 million, fully diluted cap still under $30 million.

Token has already proven it can reach $1.00 — and even a partial recovery gives 100x potential from current prices.

Strong upside asymmetry compared to overbought majors.

4. 2025 = Altcoin Season Potential

As Bitcoin cools and liquidity rotates, microcaps historically outperform in the late-stage bull cycle. DEFI could ride this wave as attention flows from BTC to altcoins with good narratives and active dev teams.

Technical Analysis: Reversal in Progress?

All-Time Low was just 2 days ago ($0.0016).

Since then, price has jumped over 57%, showing early-stage accumulation and short-squeeze activity.

A move above $0.0030 could confirm a breakout from this capitulation bottom.

If momentum sustains, initial resistance targets are $0.006, $0.01, and $0.025 — still just a fraction of ATH.

Price Target Scenarios:

Target % Upside from $0.0026 Reasoning

$0.006 +130% Technical breakout level

$0.01 +280% Psychological + chart level

$0.10 +3,700% Mid-tier recovery, low float

$1.00 (ATH) +38,000% Full retrace (moonshot)

Final Thoughts:

DEFI is not a sure thing - it’s volatile, it’s tiny, and it was forgotten for months. But with renewed attention from major names, an actual working product in the DeFi space, and a chart that just bounced 50% off its lows, it may be gearing up for a new chapter.

If you're looking for an early-stage altcoin with real upside potential in this cycle, DEFI is one to watch.

DEFI altcoin - The Trump Crypto ConnectionThe relationship between decentralized finance (DeFi), the Trump family, and Kevin O’Leary in 2025 centers around their public involvement in the crypto and blockchain space, particularly highlighted by their participation in events like DeFi World 2025 and specific DeFi projects tied to their names or influence.

The Trump family, notably Donald Trump Jr. and former President Donald Trump, has increasingly engaged with DeFi and cryptocurrency. Donald Trump Jr. spoke at the DeFi World 2025 Conference in Denver on February 26, alongside Kevin O’Leary, signaling a growing interest in blockchain’s potential to shape finance. Posts on X from DeFi confirm their appearances, with Trump Jr. scheduled at 3:00 PM and O’Leary at 3:45 PM, reflecting a shared platform to promote DeFi’s future. Beyond this event, the Trump family is linked to World Liberty Financial (WLFI), a DeFi project launched in September 2024. WLFI aims to democratize crypto lending and borrowing while reinforcing the U.S. dollar’s dominance, operating on Aave’s v3 protocol.

Kevin O’Leary, a Canadian investor and “Shark Tank” star, has been a vocal DeFi advocate since at least 2021, when he invested heavily in DeFi Ventures (later renamed WonderFi), targeting 4.5–8% yields on crypto assets. His participation in DeFi World 2025 alongside Trump Jr. underscores his ongoing commitment. O’Leary sees DeFi as a way to bypass financial middlemen, predicting it could transform trading within years. His practical involvement contrasts with the Trump family’s more symbolic and policy-driven engagement, though both share a bullish stance on crypto’s future.

Fully diluted Market Cap of only $2.64Mil.

From MAGA to DEFI: The Trump Crypto ConnectionThe relationship between decentralized finance (DeFi), the Trump family, and Kevin O’Leary in 2025 centers around their public involvement in the crypto and blockchain space, particularly highlighted by their participation in events like DeFi World 2025 and specific DeFi projects tied to their names or influence.

The Trump family, notably Donald Trump Jr. and former President Donald Trump, has increasingly engaged with DeFi and cryptocurrency. Donald Trump Jr. spoke at the DeFi World 2025 Conference in Denver on February 26, alongside Kevin O’Leary, signaling a growing interest in blockchain’s potential to shape finance. Posts on X from DeFi confirm their appearances, with Trump Jr. scheduled at 3:00 PM and O’Leary at 3:45 PM, reflecting a shared platform to promote DeFi’s future. Beyond this event, the Trump family is linked to World Liberty Financial (WLFI), a DeFi project launched in September 2024. WLFI aims to democratize crypto lending and borrowing while reinforcing the U.S. dollar’s dominance, operating on Aave’s v3 protocol.

Although Donald Trump and his family are not direct operators of WLFI, the project leverages the Trump brand, with 70% of its token supply held by insiders and 75% of revenues directed to DT Marks DEFI LLC, a Trump-connected entity. Trump himself has pushed pro-crypto policies, including banning central bank digital currencies and exploring a national crypto stockpile, aligning with DeFi’s ethos of decentralization.

Kevin O’Leary, a Canadian investor and “Shark Tank” star, has been a vocal DeFi advocate since at least 2021, when he invested heavily in DeFi Ventures (later renamed WonderFi), targeting 4.5–8% yields on crypto assets. His participation in DeFi World 2025 alongside Trump Jr. underscores his ongoing commitment. O’Leary sees DeFi as a way to bypass financial middlemen, predicting it could transform trading within years. His practical involvement contrasts with the Trump family’s more symbolic and policy-driven engagement, though both share a bullish stance on crypto’s future.

I`m extremely bullish on this coin at this level.

DEFI Crypto Set to Skyrocket: Listing on 10 Exchanges TodayThe cryptocurrency space is buzzing with excitement as DEFI, the groundbreaking token powering the DeFi Web3 AI SuperApp, gears up for listings on 10 major exchanges today. This milestone marks a significant leap forward for the project, founded in 2020, which has steadily gained recognition for its innovation and utility in the decentralized finance (DeFi) ecosystem.

The Backbone of Web3 Innovation:

Backed by heavyweights such as Consensys, 21Shares, OKX, and HOF Capital, DeFi has positioned itself as a leader in the DeFi and Web3 revolution. With a cutting-edge AI-powered SuperApp, DeFi aims to simplify and amplify user experiences across decentralized finance, enabling seamless access to DeFi tools, analytics, and services—all in one intuitive platform.

Strong Institutional Backing:

What sets DEFI apart is its robust backing from top-tier venture capital firms and prominent DeFi investors across the globe. This level of support not only validates the project’s vision but also bolsters its credibility as it expands into mainstream markets.

Today’s Exchange Listings: A Catalyst for Growth:

The 10 exchange listings set to happen today are expected to significantly increase DEFI’s liquidity and visibility, paving the way for broader adoption and market participation. With the involvement of major exchanges like OKX, DEFI is primed to become one of the most accessible and widely traded tokens in the market.

What Makes DeFi Unique?

Under the leadership of CTO artemDeFi, DeFi combines the power of artificial intelligence with decentralized finance, delivering next-generation solutions for both individual users and institutional investors. The SuperApp’s comprehensive suite of Web3 tools is designed to redefine how users interact with DeFi protocols, ensuring security, transparency, and efficiency.

Why This Matters:

Today’s listings are more than just a market event—they signal the arrival of DeFi as a major player in the cryptocurrency and Web3 space. With its innovative technology, strong team, and powerful backing, DEFI is not just another cryptocurrency; it’s a gateway to the future of decentralized finance.

As the listings go live, the market will be watching closely. Will DEFI be the next big thing in the crypto world? With its unparalleled vision and support, all signs point to yes.

De.Fi - a complete undervalued projectDe.Fi launched end of January 2024 their token, but they aren't complete beginners.

Starting with their smart contract checking tool they are in the market since 2020.

Quote from de.fi

"De.Fi (DeDotFi) was founded during the DeFi Summer of 2020 by a group of DeFi natives with just two goals in mind: make DeFi a safer and more convenient space for everyone. During three years of development, the De.Fi team has grown to 50+ team members worldwide. We work daily to build life-saving products for DeFi investors around the world.

The De.Fi team has created Crypto’s First Antivirus - the most advanced security system in the crypto space, as well a range of other products including our crypto wallet tracker, NFT portfolio tracker, REKT Database, Audit Databases, the largest multichain dashboard/APY aggregator, and more. "

"The De.Fi SuperApp is an ultimate gateway to web3: it includes the biggest DeFi tracker that supports 45+ blockchains, 8+ centralized exchanges, and 450+ protocols, as well as the largest DeFi yield farming APY aggregator, that tracks live and historical data of 10,000+ LPs and Vaults on 300+ DeFi protocols.

The DeFi dashboard by De.Fi is the most convenient way to track your multichain positions & balances: simply create a bundle of all your DeFi wallet crypto addresses and exchange accounts, and track your whole crypto portfolio in 1 place."

Let us see where their journey goes

DEFI/USDTDespite the current challenges faced by DeFi since the time of publication, it is supported by a robust foundation and a dedicated team. Long-term prospects appear promising. In the short term, if DeFi maintains support above $0.2 after a retest, the next targets to watch for are the $0.27 zone followed by the $0.38 zone.

TRADE ALERT - LONG JOEYes, I know. The altcoin market is very nervous. And rightfully so. But Defi does especially well comparatively when regional banks are faltering. Right now, regional banks (KRE) are moving down and becoming weaker once again. Could we see more defaults? Probably. But this isn't about regional banks is it. We're looking at JOEUSD, a nifty little Defi play. So, aside from fundamentals, let's take a quick look at what the technicals might be showing us here:

#1. Bullish divergence on the RSI. And everytime we hit that slowly ascending RED TL, price moves up rapidly. I like the probability here.

#2. Price support on that RED TL which intersects with a nice level AND the bottom of that triangle, making it a huge area of confluence where support is strong.

#3. That triangle though.

I have entered here at .265 and will be pulling profits along the way (especially at those moving averages). Final target is around .45 with a SL at .235.

This is not financial advice. Just showing you all what I am doing here.

Best,

Stew

DeFiChain Looks Extremely BullishOn the USD pair (left) three breakout attempts including current can be identified, the current one presents a nice bullflag to buy into on this daily timeframe

I dont have much to say about the BTC pair

Long term health of DEFI in a critical moment - VWAP versionAnchored VWAP measures the average profitability of the selected period.

In a nutshell, if price is above the VWAP line, majority of traders are in profit. This shows that there is a bullish momentum and can attract more and more people (money attracts money). However, when many traders are in profit, the selling pressure can be higher which can result in a price decline.

Same way goes for when price is below VWAP line, majority of traders are in a loss, which show the bearish momentum as people are trying to exit on each pull-back and get their money back. However, when sellers are exhauster we can see a bottom and change of trend.

Right now, traders are almost at break-even.

The million dollar question is : Are traders going to take advantage of the low price to buy at discounted prices and break this resistance at 1,900 usd OR sell, get their money back and buy again later on?

There is a big support level at 1,110 usd in case bears take control.

Follow for more Updates.

$DEFI/USDT 1h (#BinanceFutures) Falling channel breakoutDeFi Composite Index looks ready for short-term recovery after regaining 50MA support.

www.binance.com

Current Price= 2177.1

Buy Entry= 2176.3 - 2150.3

Take Profit= 2258.6 | 2356.2 | 2474.0

Stop Loss= 2098.9

Risk/Reward= 1:1.5 | 1:3 | 1:4.82

Expected Profit= +26.46% | +53.52% | +86.16%

Possible Loss= -17.64%

Fib. Retracement= 0.5 | 0.786 | 1.117

Margin Leverage= 6x

Estimated Gain-time= 5 days

Crypto Total DeFi Market Cap Setting Up To Push HigherWhile we didn't get the 'DeFi Summer' that many expected, things appear to be heating up in DeFi right now, going into 2022.

The Crypto Total DeFi Market Cap chart in TradingView here is showing bullish signals both on the daily candle (which is sitting nicely on the uptrending 21 day EMA, which I call a 'Rocket on the Launchpad') -- but also our custom indicators are showing an upswing in DEFI projects right now.

We created an 'Early Reversal Indicator' which correctly called the mid-summer low on July 21st and also the September 30th lows. While it's not 100%, as with anything, the nuances are everything.

Our 'Trend Indicator' is also printing a fresh 'Bell' signal, which indicates a longer swing trend is setting up (5-7 days or longer).

Should be interesting to see if we do see DeFi push higher here as one of the newest leading sectors of 2022.

Let me know your thoughts below!

FARM - my worst trade with some bullish signsI'm down with FARM trade approx. 60%.

I missed stop loss point and now I'm stuck with it.

With 60 million M. Cap it is good buy now considering falling wedge formation, RSI oversold with potential breakout and Stoch RSI nailed to the bottom for long time.

Price reached almost historic lows and there is no point to sell here.

Coin is available on Binance, Coinbase, Poloniex and 30 more exchanges.

Once DeFi gain some traction again, FARM will also get a piece of the cake and considering that is now available on much more exchanges, it will probable reach new high.

Red boxes I see as major resistance points for FARM to reach new ATH.

Even my position will be in green, I hope! 😅

BOND IS NOT ABOUT IF OR WHEN IS ABOUT X3 NOW YOUR MONEYHi everyone, i not post often but when i do, if you follow me u know it, is because i think that my word worth, and my money and yours worth too.

Today we analyze BOND. Bond is a DEFI CRYPTO TOKEN, use in BARNBRIDGE BLOCKCHAIN, that would help traders to discorve defi-crypto average levels of risk, and returns, that they would assumere. In a few words others defi protocls like AAVE give you a determinate levels of risk or returns when you staking while BOND give you a portofilio of possibility, also traders can choise their preferite investement.

This a very UNIQUE approch to defi and a new wave in this area.

As we know, i write last time about this, DEFI is the most hot trend and in these days the 'defi index' DEFIPERP, an index that give us the total funds on crypto defi token, break an important resistence and is explore new horizons with new ATH.

Not only. BOND, as u can see in the chart, break a descending time line (when Bond took is high low) and is approach new ascending time line with volumes that , as Coinmarket say in its chart, are incresing so far from september.

In the chart i only put the 1 TP at 50, but i think that it can EXPLODE in the next days, also we only have to hold for the next 4 months, and i think that will have an extraordinary return that no one coin can u give in this area.

last but not least, this coin have a LOW SUPPLY that means double or more the value in little time. People are focused on coin more notable but with a big supply of millions and milions (trillions) of coin that take many times for X2 - X3 - X5 their value.

THIS COIN HAVE ONLY 4 MILIONS OF COIN AROUND, NOTHING.

reassume

DEFI HOT TREND + BREAKED DESCENDING LINE + INCRESE VOLUME SO FAR + LOW SUPPLY = X3 (or more) MINE AND YOUR MONEY.

DON'T MISS THIS COIN, BUY NOW THIS LIFE MONEY GAME CHANGER.