Silver Explosion | SLV for the long termWith crypto and stocks, many overlook that boring shiny thing that used to be the basis for sound money.

Personally, i like the actual physical silver...and it's a good idea to have some for a rainy day...or financial collapse....or a zombie apocalypse (and based on how many people are on side-effect laden meds, maybe that's not so far away, though i digress).

But for now, I wanted to draw your attention to some things to note for silver. In this SLV chart, you can see a bollinger band squeeze never seen before since SLV was created. You can see prior movements when the bollinger bands got anywhere near this close...

Also, there is a years long trend line on RSI.. and another trendline to notice on MACD.

I can't be sure, but just considering mining costs, the price of silver can only go so low.

Also, there is threat of inflation (as well as deflation) and there have long been publications about global dwindling supply of silver and COMEX rigging with JP Morgan and HSBC and a whole bunch of games with the paper price of silver while the real physical metal is acquired...on and on...

Anyway, be on a lookout for silver to finally spring after being coiled for so long.

Deflation

GoldCoin/USD (Goldcoin Token) Bye BUY GoldCoin ShortsGoldCoin/USD (Goldcoin Token) 05/12/18, 7:25 PM EST, by Michael Mansfield.

Hi trader friends, I iope your weekend is a fun or fulfilling one!

With practically all of the volume occuring on the up bars since the late March low, another good sized up move is in the cards onces this corrective wave is complete. Moreover, a with the large bullish volume on the up waves, a big down move is statistically less likely right now. But, we deal in probabilities not certainties, so it's still a possibility if the up move off the February low was was only a large corrective wave. But that certainly looks less likely now. Either way, uncertainty is why we always recommend the use of stop loss orders, not "HODLING" forever, in these digital markets.

CLARITY:

Without candlestick wicks, the price moves and waves look very clear to me: The January to late March decline was corrective. Conversely, the up move since the late March low looks very much like a bullish impulsive wave (uptrend, not up retracement).

CORRECTIVE WAVE:

This current correction is either a triangle, soon to be over, or a zigzag with one more wave lower to the Wave IV label.

BUY CONFIRMATION:

If 0.30 is exceeded on the upside, then the next upwave, Wave V, or Wave 3 of larger degree Wave (3) to the upside, will likely be underway.

CONCLUSION:

Once this short-term corrective Wave IV is complete, hopefully after one more push lower, then a Wave 5 up, or possibly 3 of (3) to the upside is likely.

NEGATED:

Should GoldCoin/USD break below 0.19, then this bullish outlook would be cancelled and GoldCoin/USD would likely fall back to below the March 2018 low.

DISCLOSURE:

This analysis is meant for educational purposes only. You trade at your own risk!

Michael Mansfield CIO

What will happen in the Netherlands and deflation or inflation?CHARTDESCRIPTION

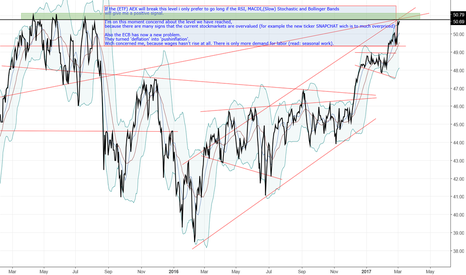

If the (ETF) AEX will break this level i only prefer to go long if the RSI, MACDI,(Slow) Stochastic and Bollinger Bands

will give me a positive signal.

I'm on this moment concernd about the level we have reached,

because there are many signs that the current stockmarkets are overvalued (for example the new ticker SNAPCHAT wich is to much overpriced)

Also the ECB has now a new problem.

They turned 'deflation' into 'pushinflation'.

Wich concerned me, because wages hasn't rise at all. There is only more demand for labor (read: seasonal work).

US2000: Tremendous 15 Consecutive Day Rally I have not been able to find any conclusive data regarding whether or not this rally has been all time record for the Russell 2000 Index. Investor confidence has soared to all time highs via 3 week rally. Although I am glad to see this rise occur, I do not seem to understand the logical or fundamental justification for it. How much longer can the Stock Market ignore the carnage in the Bond Market? Because interest rates have been so low for so long, I believe that an increase in rates at this time, a time when the market has been relatively stagnant for over a couple years, will have a strong deflationary effect on the Stock Market. This December, when the Federal Reserve Hikes interest rates, we will see whether this rally has been a genuine reflection of the supposed US recovery, or if it has simply been an impulsive pump after the election of Donald Trump. Please do not hesitate to leave your thoughts.

NZDJPY Daily - Trading Within A ChannelNZDJPY Daily – Since the start of 2016, this pair has entered a downwards trending channel which it has followed well. Recently, it tested the bottom of the channel but was unsuccessful in breaking out and is now heading towards the top of the channel which is crossing over with the 78.6% Fibonacci level. This upwards movement is supported by a fairly strong New Zealand economy which is in a good position to make changes if the uncertainty in the world economy increases due to the exit of the UK from the European Union. New Zealand have room to cut their interest rates without going into negative territory and with a strong Kiwi keeping inflation at a low rate, there is a large amount of pressure on the Reserve Bank of New Zealand to lower interest rates. Meanwhile, Japan’s economy struggles are not improving as growth is continuing to fall. The MoM retail sales figures for May were unchanged from the previous month and the Yen is continuing to strengthen despite the negative interest rates. This is adding a lot of pressure on to the economy, with investors predicting that Japan’s economy may be pushed back towards deflation. We could now see NZDJPY head towards the 75.83 level before coming back down to once again test the bottom of the channel. Alternatively, if the world economy situation continues to worsen, we may see this pair drop towards 69.2 and then 57.

As #OPEC Meets, #Crude May Feel DisappointedTomorrow, members of OPEC will meet in Vienna, and it is unlikely there will be any policy shifts. Despite the dire straits some OPEC members are in, such as Venezuela, the current crude production policy will likely remain until Iran and Russia agree to some sort of production resolution.

MacroView has been overly bearish since June 2014 but indicating that the one key dynamic factor in crude prices would be supply (same goes for Brent and OPEC). Essentially, West Texas Intermediate would continue to see woes until there were meaningful cutbacks in crude production, which finally began to filter through on a combination of record-low rig counts and bankruptcies (yes, bankruptcies are bullish). Crude output levels in the U.S. are at levels last seen during the second-half of 2014.

West Texas Intermediate has been trading within the current supply range between $48/50 for the last 12 trading sessions, and price action is currently treating the current trend support on narrowing price action. If OPEC disappoints tomorrow, and break through trend would cause traders to seek out support near $42, while a confirmed breakout of the supply zone could trigger buying to $55.

The weekly chart picture for crude:

OPEC's production has largely offset declines seen by U.S. shale producers, and members will continue to press on. Iran has said they look to achieve 2.2 Mbbl/day to compete with Saudi for market share; Iraq and Kuwait both look to increase their production meaningfully. Non-OPEC member Russia continues to keep oil production at post-Soviet highs.

Side note: expect volatility in commodities currencies on headline risk. The Canadian dollar has pulled back after gaining 18 percent on crude's rally, but it remains vulnerable.

For more information on MacroView's products, or general questions and comments, feel free to message us.

Also, readers are encouraged to post their thoughts and charts!

Unapologetically BearishA series of events took place causing me sit back and contemplate market participants (in)sanity. First, it is known that I've was one of the first to stick my neck out and tell it how it is – the U.S. Is facing a recession in 2016 – last April. Soon after, various investment banks flirted with the potential but gave the very realistic situation very low probability of happening.

Needless to say, critics (unfortunately those that “manage” money) have come out to chastise the recession call, which is not backed up hard data but backed subjectively by a rally in equity prices. They repeat the mantra “don't fight the Fed.” Unfortunately, we've already witnessed the carnage bred from the same ignorant complacency as equity markets halve themselves twice in less than 15 years.

Secondarily, last Friday, I watched Mark Zandi, Moody's chief economist, in conjunction with CNBC reporter Steve Liesman, say that the data depicting the sad state of economic affairs was wrong and that we should simply follow the non-farm payroll numbers.

Whoa! This is a classic case of narrative over fact. But, lets look at key economic data points that have already hit cycle highs and rolled over:

Key Data Point Post-Great Recession Peak, YoY %

Non-Farm Payrolls First Quarter, 2015

ISM Non-Manufacturing PMI Third Quarter, 2015

Real Consumption First Quarter, 2015

Agg. Private Sector Wages & Income Fourth Quarter, 2014

Retail Sales and Food Servicess Third Quarter, 2011

Business Sales Second Quarter, 2010

Business Inventory-to-Sales Ratio First Quarter, 2016 (Cycle High)

ISM Manufacturing PMI Fourth Quarter, 2009

Additionally, all is not well in the corporate sector. Last month, market participants saw corporate profits drop 8.4%, nearly 3x more than expected and the third quarter in a row. Furthermore, profits for all of 2015 fell 5.1 percent - the largest drop since 2008. This is much higher then the .6 percent decline the year before.

Mainstream economists don't forecast a looming recession, but when have they ever? Every recession since the early 1980's began with growth above one percent. In 2007, growth expansion was at 1.87 percent, only .13 percent lower than it was in 2015.

When one steps back from market nuances and models for potential of all risks, not only does the picture become more clearer but the ability to adjust when needed becomes more simpler.

In " SPX Pullbacks Are Volumeless, Stay the Course ," I pointed out the lackluster conviction of the equity rally. This still remains the case. Those that "don't fight the Fed" will be sorely disappointed when the only volume swarms in on the elevator drop.

Notice that price action and accumulation on SPY hit a wall and appears to be pealing back:

In April 2015, I issued a 2016 recession call between Q2-Q3 for the U.S. (following my January call for 1,810 on the SPX). After being laughed at, I wonder who will have the last laugh as Atlanta Fed's GDPNow is modeling a mere .4% (with a potential to go negative) for Q1.

At 22.87x trailing 12-months earnings, equities remains extremely expensive and only have been at these levels prior to market crashes, including the market panic of 1893/96, flash crash of 1962, early 1990's recession, the Dot Com bubble and the Great Recession.

Do you feel lucky?

.... I remain unapologetically bearish.

Reiterating my 1,546 SPX target for 2017.

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytr

The Dollar Paradox Pt. 1: Unintended ConsequencesIt is clear that the U.S. dollar has been one of the biggest hedge fund crowded trades, and still remains despite recent pullbacks in the greenback.

And, although, the DXY saw a violent decent following last week's dovish FOMC-minutes report, there is still an underlying dynamic that supports a much higher dollar.

History may not repeat, but it often rhymes. And, those who look back into historical context for potential clues of today should find interest in the "Law of Unintended Consequences." This concept dates back to John Locke, who discussed the unintended consequences of interest rate regulation in his letter to Sir John Somers, Member of Parliament during the 17th century.

In 1936, socialogist Robert K. Merton wrote "The Unanticipated Consequences of Purpose Social Action," which discussed unintended consequences of deliberate acts intended to cause social change.

We don't have to look any further to globalized manipulation of interest rates by central banks with the sole purpose to deliberately change actions (or inaction) of consumers. Low interest rates have been designed to force those into riskier assets who may not have accumulated previously. The suppression has also "enticed" individuals to buy homes, cars, take on student loans and other interest rate sensitive loans to unsustainable levels, essentially robbing tomorrow's growth to consume today.

Furthermore, market participants are underestimating the ongoing global currency debasement on the race to zero. Since the financial crisis - on a global scale - there has been $12.3 trillion (and growing) in quantitative easing and 650-plus (and growing) rate cute. Yet, central banks are unwilling to admit their policies have failed. And they won't.

In Merton's paper, he stated that ignorance stems from unintended consequences. Those that are objective ponder why economists are consistently wrong and never forecast recessions (Fed included). There is a degree of ignorance that shields them off from from anticipating the potential from future events, thus this leaves their analysis incomplete.

Moreover, short-term interests are clearly overtaking long-term interests. As former Dallas Fed Reserve Bank President Dick Fisher has stated on TV numerous times, the Federal Reserve front-loaded risk appetite in order to develop a "wealth effect." Instead of focusing on longer-term solutions for the growth of American, it was imperative for the Fed to spoon feed quantitative easing to investment banks and their crony peers.

The hubristic nature of Ben Bernanke, Janet Yellen, Mario Draghi or Haruhiko Kuroda in believing they can manipulate "free" markets like a volume dial on a radio is foolhardy and create unintended consequences that will cause a panic buying of the global reserve currency, the U.S. dollar.

Stay tuned for additional Dollar Paradox additions.

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

Gold Miners Could Pullback Before Resumption of Trend.Gold prices have been volatile, flucuating between $1,275 and $1,220 as markets remain indecisive on what stance to take: is the Federal Reserve going to continue hiking assuming the economy will "gradually improve," or with traders continue to look for safer locations to place there cash?

According to recent capital flow data, the GLD has seen redemption as market participants choose to overlook the weakening global economy and its implications. Nevertheless, with inflows into risk ETFs like SPY and HYG, gold miners could see their shares pull back from this historic gold run.

Technically, after GDX broke out of a longer-term downtrend, price action began to oscillate within a narrow ascending channel. Prices are likely to pullback to channel and price action support of $19.80, while a confirmed break (or daily close below support), miners could fall to $18.85 and, potentially, $17.85 - also nearing the 50-day EMA.

However, if the popular mining ETFs can remain above support, price action could challenge $21.88 and $23.03.

Overall price action and trend momentum still remain rather supportive to the upside.

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

Gold to $8,000?Despite what so-called gold bugs have been trying to predict for years, it still remains seen how valuable the most "hated" asset on Wall Street can be. Calls of $10- or $50,000 gold have made headlines and often laughs, but when investors take into account the supporting fundamentals, gold can be extremely beneficial during these centrally-planned economies.

Recently, Pierre Lassonde said that gold could have the potential to reach $8,000 per ounce when looking at the gold-to-Dow ratio. He mentions how tangible assets tend to regain parity after previous bull-markets, and the potential for his forecast is supported if the gold-to-Dow ratio his .5 while expressing that the quick and expansive adaptation of NIRP will fuel the fire.

As central banks continue to ease ($12.3 trillion in quantitative easing and 650 rate cuts since the financial crisis), there is a potential for a prolonged bull market in gold. As I noted in "Demand for Gold Rockets Higher ," if the renewed momentum were to match nominal gains investors seen between 2009-2011, spot prices would near $2,230 - which is not $8,000 but very respectable.

The 1.61 Fib. extension from the current multi-year low and the 2011 high is $2,460.

In " Gold Looks Promising Long Term ," I posted last February that the longer-term outlook for the yellow metal remains in tact. Price action continued to trend in the descending channel until it bottomed in December.

What strengthens the cased for renewed optimism is that price action convincingly broke out of the descending channel and back above the 2003 trend line.

In " Gold to Retest $1,130 as Dollar Strengthens ," I pointed out last March that the dollar strengthening is trouble and the velocity of such would be meaningful. As we've seen throughout last year, U.S. multinationals have been crushed due to the strength in the DXY,

I also pointed out the descending wedge on the daily chart, which is a bullish reversal pattern. After finding support where I thought the last line of defense was before $1,000 oz., gold rallied hard and broke out.

However, even through wedges are strong indicators of price reversals, the real test is that price tends to quickly retest the broken resistance. If that hold, it could be off to the races.

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

Demand for Gold Rockets HigherIs the once Goldman Sachs "slam dunk sell" turning into a layup buy?

I cannot hate the initial call from many investment bank analysts it to sink to $1,000 because, in 2013, I issued a $1,035 bear-call. However, I do ridicule these analysts for unwillingly (either through ignorance or moral hazard) understanding the dynamics of gold.

But in 2014 I turned rather bullish on the precious metal. As readers know, I developed a hybrid approach: bullish on physical bullion while understanding that prices are sentiment drive. It was hard to deny that the longer-term fundamentals for gold were strengthening between global stagnation and misguided central banking policies.

Despite central banks, primarily the Federal Reserve, trying to fill in the ever-widening gaps via patchwork, market participants remains highly negative up until late December.

This year, traders saw absolute carnage for risk assets and the strongest demand for gold in years. GLD has seen massive inflows, only second to SPY. IAU has seen inflows everyday this year. The demand has been so strong, BlackRock (which manages the iShares Gold Trust) suspended share issuance.

Secondly, inflows to both popular gold-backed ETFs have not been this strong since the SPX fell 18 percent and the Federal Reserve were mere months from starting quantitative easing in 2009. And, we know what happened after that.

Now, the recent move will likely remain volatile as gains on consolidated and traders buy on pullbacks. As you can see in the weekly chart of GLD, the entire move from 2008 to 2011 remained in demand to overbought. If the fund sees a similar nominal gain over the next couple years, traders could see $2,230 for spot gold prices.

Considering that the top three central banks have gone over the deep-end to appease risk assets, we could be seeing a resumption of the gold bull market.

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

SPX Pullbacks Are Volumeless, Stay the CourseTraders have seen this before, and it continues to play out as the global economic climate breaks down. Although these pullbacks in the SPX are often lofty and swift, it is important to realize volume is the most import factor when considering the validity of a pullback.

Here , we can see that the move in SPY is volumeless. The entire squeeze from the Feb. 11 low has seen volume under the 20-day average. On balance volume is not supporting this move.

Next, when deciphering a mere pullback following a steep decline or an inflection point, think what is the "smart money" doing?

Simple. They've been selling to the dumb money for the last five weeks . Corporate buybacks continue to be the only demand in US equities.

Fundamentally, the index is highly expensive versus historical valuations. At a 21.79 P/E, the SPX is over 5 points over its mean. It's over 11 points higher that the "sweet spot." Shiller P/E, which tracks 10 years of inflation-adjusted earnings, is at 24.98 (also, historically expensive outside a recession).

Furthermore, earnings are, indeed, rolling over (along with the business cycle) while real earnings growth is cratering at -14.5 percent. Last time that happen, the US saw a recession in the early-90s, the recession following the tech bubble and the 2008 financial crisis.

See that here !

Aside from there lack of conviction with permabulls being scooped up in buyback fever, the index is about 160 points of its most recent low. Yesterday, price action closed at daily resistance at 1,978 and near the 50% Fib. level from this years epic start.

If it can close above these two levels, the next level that is key is 2,020. If bulls overtake this level a potential retest of 2,071 is probable.

However, this is how I believe it will go as the dollar continues to strengthen and the Fed continues to be out of place:

A bear market scenario like those that followed the tech bubble and financial crisis would put the SPX near 1,078.

This year, we've also seen SocGen's Albert Edwards forecast a potential 75% decline for the broader index.

17 months ago, I published a chart showing a whopping 71% potential decline in SPY from then current levels .

Granted, this was merely based on historical references and calculation, but interesting nontheless.

Will you get a chair when the music stops?

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

A Turning Point for USDCAD?The recent risk rally has encouraged commodity currencies higher. As crude ignores the globalized downturn in economic output and ongoing "pump at all costs" mantra of producers, the Canadian dollar has hit a three-month high against the dollar.

Crude aside, traders have also factored in the fact that the potential for a rate cut from the Bank of Canada had dropped from 60 to 32 percent. Nevertheless, on a macro-standpoint, the slowdown in both the US and Canadian economies will strengthen; and traders could ditch the loonie for the save-haven greenback.

The recent strength in the CAD does allow a more balance, two-way market. We are likely to see the USDCAD continue trending lower until risk appetite wanes.

Price action has broken the upward trend that has lasted since May 2015. Support at 1.34 will likely be challenged prior to testing the 200-day EMA. The 20-day EMA has bearishly crossed the 50- and about to cross the 72-day EMA.

The only problem I see with the current down move is: volume is increasingly dropping off and the pair is no longer overbought on longer time frames. This could cause traders to re-enter longs if the risk environment wanes causing a move back to 1.3770.

Sentiment around crude and equities will remain important.

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

Gold Intraday TechnicalsGold has pulled back slightly, but still up almost 15 percent since 2016. Traders don't believe the current rally as they look hopeful of more central bank quantitative easing, which is exactly why gold has had its run this year; and it is why I have been saying fundamentals have been strengthening for gold for roughly 16 months.

After gold volatility hit multi-year highs, it is beginning to moderate a bit. I expect it to remain elevated:

Technically, gold downside may remain limited with minor trend and price support at $1,205 and dynamic support at the 72-4H EMA nearing $1,198. Deeper support levels are seen at $1,190 and $1,177.

Volume has tapered off since the Feb. 11 high, but positive bars still remain on top. Near-term resistance can be seen at $1,214, while stronger resistance is $1,220. If gold can retake these levels, price action would challenge the recent downtrend from the recent high. At that point, bulls can look toward $1,240.

What has been beneficial is that gold has been able to work off its highly overbought level while still remaining about key support.

This Friday, traders are anticipating the US preliminary GDP print. Consensus is at a nauseating .4 percent, following Q4 .7 percent that is likely to be revised lower. Even if the prelim data meets consensus, it would be over two percent lower than the Atlanta Fed's GDPNow model.

Not only is it ironic that the Federal Reserve's first rate high in seven years was in a corporate profits recession and sub-one percent growth, but it also could have been done going into a recession.

Way to go, Janet!

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

Will the BoJ Increase QE In Two Weeks? Doesn't Matter.With markets on edge and Japanese inflation data this week, those short the yen are hoping the Bank of Japan Governor, Haruhiko " Kamikaze " Kuroda, will further increase the balance sheet through more quantitative easing. Because when everything else fails, he'll try to go all in.

Or will he? Essentially, his brilliant idea to implement negative rates, or NIRP, was seen as a policy error even quicker than the Fed's first rate hike in seven years. Economists, bulls and bears alike, said that NIRP would do absolutely nothing for the Japanese economy. But, Kuroda didn't go from no NIRP to NIRP in a week's time to strengthen the economy. It was to deter yen strength and perk up hemorrhaging risk assets, which failed miserably.

If inflation data comes in soft, we are likely to hear the threat of quantitative easing but it is unlikely that the BoJ can match the most bang for the yen traders saw when this whole quasi-policy began. Analysts expect that Kuroda may increase the level of exchange-traded funds, a market where the BoJ already owns 52 percent , since there is virtually no more debt to purchase do to existing quantitative easing measures.

It's possible, but does not matter in the end. The global marco downturn is in the drivers seat, and a single central bank cannot change that, especially when $12.3 trillion in QE and 600-plus rate cuts since the financial crisis have barely kept the global economy spuddering along.

With global trade continuing to collapse, the weak yen facade is crumbling. January's exports fell a whopping 12.9 percent and imports dropping 18 percent. GDP contracted 1.5 percent in 2015 on an annual basis, and Japan has seen three recessions since PM Shinzo Abe took over in 2012.

External debt and the BoJ balance sheet hit all-time highs (unlike the Nikkei) .

Those nickel-and-diming headlines - be careful. As we've seen in February alone, the actions of the BoJ erased nearly eight months of gains.

Do macro, or macro will do you HARD.

I reiterate a target of 110 by Q3 and 105 by early-2017. That will likely be for starters if the US falls into recession, as forecasted . Potential pullbacks to 114.55 and 116 on central bank induced risk taking probable.

The problem with this crusade for inflation, and this goes for all central banks, by reckless measures is fiscal calamity will arise when inflation takes hold. Rates will have to increase, and debt will not be payable.

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

Brent Near-Term OutlookBrent crude has been able to rally on little volume during the U.S. banking holiday and rumors surrounding a potential unified OPEC production cut, issued by the UAE energy minister just as WTI was carving out a 12 year low (and in the middle of the night, local time, no less.)

Four days later, there has been no new reports of said production cut proposal, but something interesting has been reported by Charles Kennedy at Oilprice.com - " UAE Offers India Free Oil To Ease Storage Woes ."

There is still no reason why OPEC would cut production now given the distress its tactics are already causing in the U.S. shale space. To cave in now, OPEC's squeeze on U.S. shale would be a failure and U.S. shale would be a beneficiary.

The same UAE that sparked the latest crude short-squeeze has so much oil, it's bribing India with free oil in order to access a underground Indian storage facility to park abundant reserves. Go figure.

Despite OPEC's true unwillingness to cut production, the technical outlook for Brent could prove positive unless risk sentiment is turned off.

Currently testing price resistance at $33.81, Brent crude has found support at two key weekly support levels: $27.83 and $31.59. The ADX is showing a lack of momentum in the current move, but +/- DMI could, potentially, have a bullish convergence.

The growing tensions between Saudi, Turkey and Syria could reignite risk premium, but many analysts have suggest that any substantial premium is unlikely due to the current supply glut. Even so, resistance at the 50-day EMA coincides with a minor downtrend.

However, a break north could test $38.46 to $40.34. If price breaks down, Brent could easily retest $27.83, while more talk of not cutting production would send the international benchmark to $22.98.

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

XAUUSD: Weekly and 12h view of GoldGold is in a long term downtrend in monthly scale, but right now we're in a strong 12h chart uptrend. The weekly has a few signals that tell me it's of paramount importance to get short at the top of this trend.

In the next 3 weeks we will be offered with the perfect opportunity for a weekly short in gold.

Target is in the short term a retest of the 12h uptrend high volume price at 1077, but in the longer term, if's highly probable to see continuation of the monthly downtrend, which aims initially for 913, but it can reach all the way down, below 700 if we cross the support at 913.

I'll be sharing the specifics for entry and also short term long trades in gold to my group, contact me for info on how to join. I'm currently giving signals but will also start managing accounts via a PAMM at hotforex (covering stocks, commodities and forex); you get Bitcoin trade signals as part of the pack as well.

Cheers,

Ivan Labrie.

FXE and FXY: Carry trade unwind triggers longterm rallyIn my previous FXY chart, I detailed the weekly/monthly time at mode trend signals and with Tim West's help I noticed that the downtrend was expiring during August.

After seeing the reaction to this event, I conclude that both FXE and FXY are reversing the longterm downtrend, judging by post pattern behavior after forming a clear bottom.

This currently eludes traditional Elliott Wave analysts (save for a select few like our local AndyM who did a great job with his analysis). I recently began studying neowave from Glenn Neely's book, and read his updates on the new chart patterns he discovered in the 90s, and the one that concluded the impulsive tops/bottoms in most major instruments is a diametric corrective structure. A 7 wave pattern, with similar time between swings and an expanding/contracting or contracting/expanding price range during its progression.

Time at mode forewarned us of this situation, and it's now confirmed based on the last week and this week's behavior that the trend is done for.

I estimate a return to the monthly mode as a safe bet target for these instruments, which would be an impressive rally in the euro and yen, so, I'll be looking for opportunities on the long side on both.

Gold is unclear to me yet, but it's possible that the impulse that we recently saw was the beginning of a new uptrend as well, just that it has a complex bottom formation, which I haven't analyzed in this light in the proper depth required yet. (proper Elliott Wave analysis is really time consuming, and not too practical for trading, but I like keeping it as a secondary tool)

I guess that you could purchase calls or sell puts to profit from these instruments reversal, or trade the Forex pairs with leverage as well.

Good luck, and see you at the top.

Cheers,

Ivan.

Crude Technical OutlookCrude started the new year with volatility, as prices initially rebounded into price resistance near $38/bbl on geopolitical tensions between Iran and Saudi Arabia. However, the rally was short-lived and there looks to be no follow through in today's session.

There are a few key factors to take into account: slow global growth, a decline in global demand growth and a supported dollar.

As posted here and here , near-term resistance is near $38/bbl which has been tested and failed twice in the last two days. Technical breadth still remains negative, and the lower have of the demand zone is the next area of support between $33-34/bbl.

If the bottom of the range breaks, $27 is open for the taking. As mentioned in August :

"On a market technician's viewpoint, if fundamentals do not shape up quick with support from consumption economies, like the U.S. and China, crude could break 2009's low of $33.20 per barrel.

I also expect the dollar to continue to rise, increasing deflationary pressure throughout 2016.

Price support is currently $42.02, just $2.22 per barrel less from where it is trading today. 2008's high of $147.27 per barrel creates a "V" shaped support and resistance price channel, which will likely hold prices.

If prices break through this key support level, selling could amplify if there is no catalyst to bring prices back north. A "demand" zone - an area where confirmed buying took place - between $38.34 and $34.04 will be the last line of defense for crude prices.

A close below this level, and a target of $27.14 per barrel is initiated."

Take it back further to last February :

"A bottom in crude will be formed when a series of indicators and data show confluence."

"Growth has been lacking, and it is concerning that China – the largest consumer of oil – is showing real signs of trouble. GDP recently hit two decade lows, and the most recent import/export data is troubling. China saw a 3.3 percent decline in exports and a whopping 19.9 percent decline in imports YoY, the worst since 2009. It was was 16 percent lower than the general consensus.

There is also disinflation. Whether it is in the US, Eurozone, or China, prices for commodities will remain low. Crude is no exception.

A bottom in crude will not likely begin until fundamentals mingle with price action. Inventory builds of 5, 6, 10 million barrels per week will not help the case for higher prices, and oil companies could be forced to further slash rigs, jobs and CAPEX.

And considering the deteriorating economic data, more so in the US, 2008’s low could be retested."

If bulls could retake momentum, upside potential could reside at $42.75 and, potentially, $48.55. The situation remains dynamic as an unexpected production cut from a large producer could spark huge short-covering (unlikely to change long-term sentiment). Although, OPEC and Russia look to remain active, while production in the US is still near historical highs .

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

Gold Trends Near Resistance After Consecutive Session GainsCurrently, gold is budding up against intraday resistance, following two consecutive sessions of gains on a weaker dollar. As the rate hike came and went, many – even those who ushered in the hike with excitement – are beginning to wonder if the Federal Reserve waited far too long to boost interest rates.

The yellow metal had began its two-day rally by finding bidders on the weekly support level of $1,046. Even though gold has seen nice gains following the FOMC, the paradigm has been to sell rallies despite whether or not it fundamentally makes sense. According to the Commitment of Traders data, large speculators are the most short gold ever.

This could cause for a disastrous 2016 for hedge funds if fundamentals for owning gold improve, as we have already seen what happen when crowded trades unravel in the euro.

On the four-hour chart, gold is hovering just under $1,080 and the 200-4H EMA, which will act as dynamic resistance until a confirmed breakout occurs. Price action is trading at the upper-end of a symmetrical triangle, while a minor descending support within the pattern is found (dotted line). Within the pattern, support is found at $1,074 and $1,066, while a confirmed breakout could signal a move higher to $1,088 and $1,095, potentially $1,111, per ounce.

If gold prices do see selling pressure and close beneath trend support, weekly support levels will remain key. $1,000 and $955 are technical targets.

Please feel free to comment and share charts! And follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

Precious Metals Jump Ahead of FOMCPrecious metals jump higher ahead of today’s FOMC minutes and potentially the first rate hike in the U.S. since 2007. Why? It’s most likely contributed to the fact that the majority of market participants believe Fed Chair Janet Yellen will remain extremely dovish post-rate increase.

A dovish hike may be a hard sell , as Nomura suggests, but precious metals may have already priced in a specific rate trajectory. The U.S. dollar carry trade is the most crowded trade and by significant margins, according to Bank of America Merrill Lynch Survey of Global Fund Managers.

If Yellen choreographs a dovish hike, the dollar trade could begin to unwind causing relief in battered commodities; and gold and silver will benefit.

Gold has been trading in a range, and price action is forming a small, symmetrical triangle on the daily chart. The results of the FOMC, and surrounding rhetoric, will pave the way for the yellow metal. If there is a more hawkish tone, gold could trade lower to $1,035, while a more dovish tone may send gold to restest resistance at $1,194/97.

Silver is a little tricky because it is more tied in with economic growth than monetary policy. The beaten down commodity will see relief if the dollar bulls take some off the table, but poor economic data may still be a hindered to silver. If inflation were to pick up, consider that bullish for silver.

If commodities can get a boost, expect silver to trade higher to $14.52 with the potential of $15.30 (highly dependent on the outcome of the dollar). Conversely, selling pressure could cause silver to test significant support levels at $13.12.

Please follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com

www.teachingcurrencytrading.com

oilpro.com

Gold Miners Run Up to Key ResistanceGold mining stocks have been trending higher, along with the overall U.S. equity market, of late. The recent support in gold prices allowed the Market Vectors Gold Miners ETF (GDX) a strong close last week, pushing 15 percent off the November 18 low.

Gold mining stocks really get a pass from traders, and it is still early to determine whether the move will last or not. And, this could depend largely on whether or not the Federal Reserve tightens monetary policy for the first time since 2006. If the Fed does hike rates, gold prices could suffer.

Currently, GDX has been able to close around the 50 percent Fib. retracement on the October 15 high. The daily candle closed near the top of its range on strong volume. The ADX is ticking upwards with a concurrent upward movement in + DMI, and this can garner stronger upside potential.

Conversely, the GDX could see resistance at the 50 percent Fib. level, which also coincides with trend resistance (broken support). A reversal at current levels could send the mining ETF $14.20/00, while deeper price support lies at $13.38.

Further upside momentum would cause the GDX to test the larger, downside trend line between $15.50 and $15.75. If the Fed fails to hike rates in a mere week, the GDX will retest the 200-daily EMA.

Stock pickers could find undervalued gems in the mining space. Meera Shawn, Market Realist, points out that some miners have down quite well this year: Agnico-Eagle Mines (AEM), up 11.2 percent; Centerra Gold (CG), up 31.2 percent and Alacer Gold (ASR), up 8.4 percent versus a 23 percent decline in GDX as a whole. It is important when choosing commodity producers to look for strong balance sheets and low operation costs. This helps producers whether pricing declines

Please follow me @Lemieux_26

Check my posts out at:

bullion.directory

www.investing.com