10/17/21 DELLDell Technologies Inc. ( NYSE:DELL )

Sector: Electronic Technology (Computer Processing Hardware)

Current Price: $107.71

Breakout price trigger: $107.71 (hold above)

Buy Zone (Top/Bottom Range): $105.40-$102.90

Price Target: $111.00-$112.00 (1st), $124.00-$125.40 (2nd)

Estimated Duration to Target: 27-30d (1st), 145-150d (2nd)

Contract of Interest: $DELL 11/19/21 110c, $DELL 4/14/22 115c

Trade price as of publish date: $2.17/cnt, $5.55/cnt

Dell

$DELL Another ER setupTo keep it simple, a short term trade to the upside is best over the monthly high, 102.68. Over that level, DELL should run to test the ATH. Flow positioning shows short term bearishness whilst long term remains extremely bullish. DELL looks ready for a run up towards ER in November. The daily flag looks strongly supported by Feb VWAP as well as April's gap up VWAP. Demand seems to be increasing with average volume spiking a few times in September. No prediction for ER. If Monday the market gaps down, it wouldn't surprise me if the dip gets bought heavily under the 50MA.

DELL- moving upwardChart posted 8-3-2021 as of 10:48am - DELL has been selling off but harmonics suggest it has sold out enough to move in very profitable direction upsisde. Got some good triggers this am.. and all in. Just came off a micro bearish shark and the maco being a bullish shark. I like this. Targets listed on chart. Lets see what we can do.

Dell Low Volume Melt UpDell has continue this long melt up from a stiff drop in November of 2020. With COVID-19 making the world more digital centric I am very bullish on DELL. As all time high have just been set look for a continual melt up. I have a price target of $100 in the short to intermediate future. Look for a support line at around the $92 mark.

$DELL Before ERIs Dell due another pull-back, or will it continue the run-up higher after ER? I personally like Dell, but it finds itself near ATH and 3 days away from reporting earnings. It's important to note the anchored VWAP from October's pull-back as well as the strength above the 1-12 EMA clouds and climbing RSI/almost MACD cross on the 4h chart. Won't be considering any positions until after ER. Good luck to whoever plays this.

Dell in Ascending triangle to retest all time high.Stock of Dell is in a daily ascending triangle which is a formation with a bias to break to the upside.

MACD has given a buy signal.

RSI found support at 60, which is a buy signal.

Buy on the uptrend line or the break of ATH $70.55

My target is $74.

Good luck!

Tibor

$DELL can rise in the next daysContextual immersion trading strategy idea.

Dell Technologies Inc. designs, develops, manufactures, markets, sells, and supports information technology (IT) products and services

The demand for shares of the company still looks higher than the supply.

This and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $53,08;

stop-loss — $51,71.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

$DELL can rise in the next daysContextual immersion trading strategy idea.

Dell Technologies Inc. designs, develops, manufactures, markets, sells, and supports information technology (IT) products and services worldwide.

The share price rose after good earnings. I see some preconditions the share price will continue growing.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $49,36;

stop-loss — $48,28.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Dell: Next Retracement Wave: Take Profit at $48First off, please don't take anything I say seriously. As always, this is on opinion based basis. That being said, let me get into a few insights. I believe that Dell looks like it may be on a bullish or breakout period for a retracement wave from March's bearish "panic sell decline". This is a guess that I am taking given the Covid19 period and the patterns prior. I believe it is about to pass its $48 threshold and then continue to a similar pattern upwards towards is February price. Its looks like a climb may be happening.

Dell has an awful balance sheetDell has been on the down for a year, now they are really going down. And they are still doing stock buy-backs. The stock is way too high. Dell will be the main stock dragging down the XLK ETF for the next two weeks, and the next two months. They could get in serious debt trouble here.

Dell is my number one short position with out-of-the-money put options into June.

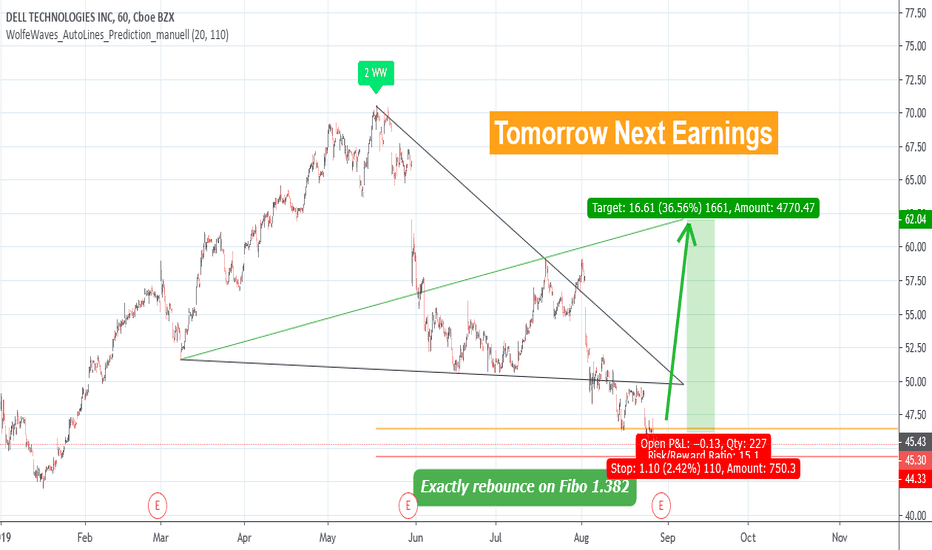

DELL, BULLISH WOLFE WAVE, BIG #RRR 1:15 (AUTOLINES TEST 8)HI BIG PLAYERS,

I've like to show you this nice bullish Wolfe Wave in the Dell Chart.

Tomorrow are the next earnings and the chart has a currently little rebounce exactly on a typical Wolfe Wave Point 5 Fibonacci line 1.382 - it's the beginning of a bullish trend.

This early publishing can be a big advantage for you. Look, for every invested 1 $ you can earn 15 $ ... without pyramiding. This is why, the risk-return-ratio are 1:15 - this are a huge potential.

If you like to know more about a pyramiding idea, then visit my post here:

ATTENTION: I WILL SOON PUBLISHING MY WOLFE WAVE AUTOLINE INDICATOR - DON'T MISS IT - FOLLOW ME .

King regards

NXT2017

Dell $82.50 Short Market CallI believe Dell is a strong positive correlation and a strong buy. Most likely it will soon surpass $80, then also surpass a price point of $82.50 as a short market call. It is one of those conservative stock picks that have little risk of steep negative correlations in market price. It has a long entry signal of continued positive spreads as it did its last earnings quarter, with the potential of a wave recouping some of the stock's recent losses.