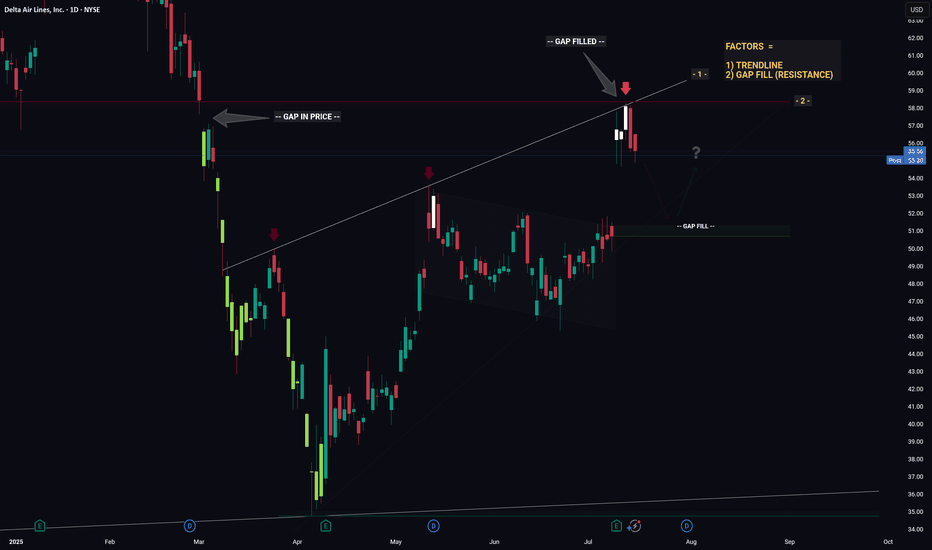

DELTA - Converging Levels Creates Huge Resistance - Retrace?Hello Traders!

Whichever Hedge Fund that is responsible for the recent price action in DELTA mustve been in a generous mood... because theyre giving us an excellent hint as to what price will likely do next.

And what hint might that be you ask...

1) Trendline (connecting the recent highs)

2) Gap Fill (Resistance)

Individually these factors are relatively strong, however when combined they essesntially create a strong barrier that will be very hard for price to break through. Think about it like a wall made from Captain Americas shield... now try and break through that.. aint gonna be easy.

So whats next for price? If I was a betting man (and I am, incase you were wondering) I would say theres a high probability that price is going to trade down from this resistance level then retrace to the gap fill below. From the gap fill level we will likely see a bounce.

Thanks, I hope you found this post educational or helpful and best of luck on your trading journey!

Delta

Delta Airlines - Long Term FlyerHey, all. Pretty intense idea here, but I am a buyer of NYSE:DAL at these levels. Obviously, the chart looks awful from a recent performance perspective. However, if you take a long term view, we could actually be rebalancing after an initial range expansion to the upside. Just like NASDAQ:RIVN , airlines are/have been a pretty brutal investment. I guess I have a thing for pain. Ha.

I am certainly a believer that airlines are undervalued here and can reverse back to the upside. Of course, it goes against the current narrative that the economy is showing signs of weakness. But I am just willing to take the risk on this one. I believe the consumer and culture shift in the US to have more experiences in life will continue to hold.

Are we going to come in for a hard landing, or take off to cruising altitude? We'll see what kind of lift the market will give us. Right now the turbulence is pretty intense.

NVDA GEX Earnings Outlook by OptionsNVDA reports earnings this Wednesday, and it’s a big deal. A major move could impact both the indexes and broader tech sector.

The OTM 16 delta curve essentially overlaps with both the GEX profile and the expected probability zone — signaling strong confluence.

📈 Rising IV with falling call skew: Volatility is rising into earnings, while the call skew is dropping — a sign of growing interest in downside hedging/speculation.

🔷 Key inflection zone (129): Above 129, the market is unlikely to surprise. Below it, however, a domino effect could trigger increased volatility and put-side flows.

Implied move into earnings is 6.62%, reflecting binary risk expectations from the options market.

Strong gamma squeeze territory exists between 140–145, with significant call wall buildup around 140.

The nearest expiry shows a positive net GEX — supporting short-term mean-reversion or hedging flow stability above 129, at least until the earnings print.

🔴 Downside risk scenario:

In the event of a downward move, the market is most heavily hedged around the 125 level, which aligns with the deepest put support.

💡 Wheeling Opportunity Idea

ONLY IF you want to own NVDA long-term around the $130 level (even if it drops short/mid-term), this might be a great time to start the wheeling strategy.

Because earnings inflate volatility, you can sell a near-term cash-secured put (CSP) for solid premium — even on a 53DTE (July) option.

Based on current GEX levels, we’re seeing:

-Support (squeeze zone) around $125

-Call resistance around $140

-A potential upside squeeze extending to $145-$150

These align roughly with ~20 delta OTM options, so the premium is attractive.

How would I personally start this:

Sell a CSP for May 30 with the intention to get assigned if NVDA drops.

If I do get assigned, I’m happy to own shares.

Then, I sell a 60DTE covered call right after to collect another round of premium.

If I’m not assigned, I sell a new 45–60DTE put the following week — still benefiting from the relatively high IV.

👉 Remember: High IV = synthetic time value. With this two-step method, you can harvest premium twice in quick succession.

I used the same technique with NASDAQ:INTC , and it’s been performing well.

💥 ONLY IF you want to own NVDA long-term around the $130 level (even if it drops short/mid-term)!

Breaking: Delta Air Lines, Inc. (NYSE: $DAL) Surged 8% TodayShares of Delta Airlines, Inc (NYSE: NYSE:DAL ) surges 8% today after the company reported adjusted earnings per share (EPS) of $0.46 on operating revenue of $14.04 billion. Analysts polled by Visible Alpha had forecast $0.39 and $13.89 billion, respectively.

The company which provides scheduled air transportation for passengers and cargo in the United States and internationally reported passenger revenue per available seat mile (PRASM) of 16.78 cents and cost per available seat mile (CASM) of 19.69 cents; analysts had expected Delta to lose about 2.8 cents per ASM transporting passengers. Delta and domestic rivals United Airlines (UAL), American Airlines (AAL), and Southwest Airlines (LUV) all were profitable but lost money flying passengers in 2024.

Delta said it expects second-quarter revenue to rise or decline by 2% and adjusted EPS from $1.70 to $2.30, below the $2.41 consensus. The airline said it is not affirming or updating full-year projections at this time "given current uncertainty."

Analyst Forecast

According to 14 analysts, the average rating for DAL stock is "Strong Buy." The 12-month stock price forecast is $64.56, which is an increase of 68.30% from the latest price.

Technical Outlook

As of the time of writing, NYSE:DAL shares are up 6.69% trading within a bullish pattern. The asset has more to run as hinted by the RSI at 31. NYSE:DAL 's chart pattern shows a bullish engulfing candlestick and a break above the $45 pivot point could cement the path for a bullish move to the 1-month high.

DAL... We have take offGood morning traders,

If you have been following my predictions on DAL and UAL, well... WE HAVE TAKE OFF! OB has been tested, we could see a pullback testing the previous red candle but should be a decent flight from there on out. Some turbulence along the way, but shouldn't be big enough to knock this plane down.

All previous areas have been tested and structurally it looks great. Hang on tight a bit more we are almost there. Keep UAL on your sights, this has much more traveling to do which means bigger profits as well.

Hope you enjoy the rest of your day, and don't forget to follow for all my other predictions. Have a great rest of your week, happy trading & God Bless!

Weekly GEX of SPX | Option Chain Analysis for Option TradersI’d like to share my thoughts below after analyzing the SPX option chain. In this analysis, I focus exclusively on the weekly time range, examining the SPX option chain and the changes in top-tier options metrics.

🔶 Breakout and Bullish Outlook

Last Friday's price action saw the SPX break through the 5800 call gamma wall, generating strong bullish momentum . This breakout opens the door for further upward movement throughout the week, especially if buying pressure persists. Breaking through a call gamma wall often leads to a rapid price increase, as these levels act as resistance, but once broken, they support further upward moves.

However, caution is advised, as additional call gamma levels (around 5850 and 5875) could act as resistance, where the price may stall. These levels can reverse roles and, if the price falters, could act as significant resistance, potentially leading to a pullback toward the 5800 level.

🔴 Put Skew and IVx Changes

The put pricing skew on the Options Oscillator shows a declining trend, meaning that while put options are still more expensive than calls at equivalent strikes, this trend is softening when looking at the November expiration. This indicates a weakening of put options relative to calls, which could be another bullish signal as demand for puts may be declining.

The five-day IVx average declining , indicating a decrease in market volatility = VIX is melting down.

🟨 Backwardation and Diagonal/Calendar Strategy Opportunities

It's also worth noting the 10.5% backwardation based on the IV skew for the expirations between 10/18 and 10/21 (4/7DTE). This backwardation (downward sloping volatility curve) could benefit calendar and diagonal spread strategies, as options with different expirations have varying volatility conditions.

🔶 GEX Wall Levels: Where Is Support and Resistance?

🔹Gamma Exposure (GEX) levels continue to play a crucial role in the market’s movements:

🔹On the upside, the largest call gamma wall for the next 7 days is at 5850, while the 5875 level may also act as significant resistance. The 5875 is a more likely a realistic bullish target, supported by the Options Overlay’s blue OTM delta 16 probability curve.

🔹On the downside, the 5750 put support level currently offers strong support, with sellers forming a barrier here. The 5800 level is also interesting because it was the largest call gamma level last week, meaning there could be significant volatility as bulls and bears battle around this point.

(NOTE: GEX levels is not part of the TanukiTrade Options Overlay indicator yet. The automatic GEX levels will be available by the end of October.)

🟨 How Delta 16 Curves Define My Rational Price Range in Options Trading

The blue OTM Delta 16 curves from the Options Overlay define the rational probability range for me based on a lognormal distribution. This is important because there’s a 68% chance the price will stay within this range by expiration. These values are also visible in the Overlay Expiry table.

This represents the 68% probability range defined by OTM 16 delta PUTs and OTM 16 delta CALLs, showing a clear directional expected move value. It provides an insightful view of the expected price movement’s directional range, often used by delta-neutral strangle traders like those at TastyTrade.

⅀ SPX Summary

The SPX options chain is showing a bullish direction with the breakout above 5800, but it will be key to watch the gamma levels where the market might stall this week. The rising IV and declining put skew trend could provide further signals that the bull market might continue, but the possibility of resistance or a pullback remains. For those considering diagonal strategies, the backwardation may offer interesting opportunities to capitalize on.

(NOTE: GEX levels is not part of the TanukiTrade Options Overlay indicator yet. The automatic GEX levels will be available soon, by the end of October!)

Options Blueprint Series [Intermediate]: Vega-Neutral Gold Play1. Introduction

Gold is currently in an uptrend, presenting a potentially favorable environment for bullish traders. However, with implied volatility (IV) sitting around its mean, there’s uncertainty about whether IV will rise or fall in the near future. In such a scenario, traders may want to neutralize their vega exposure to avoid being negatively affected by changes in volatility.

This article focuses on setting up a Call Ratio Spread, a bullish option strategy that provides positive delta while allowing for further adjustments that could keep vega neutral. This allows traders to capitalize on Gold’s potential uptrend while minimizing risk from changes in implied volatility.

2. Current Market Context

The Gold futures market shows strong levels of support, which reinforces the bullish outlook. On the continuous Gold futures chart above GC1!, we observe key support levels at 2646.2 and 2627.2-2572.5. These levels could act as price floors, helping the uptrend continue if tested.

Similarly, when examining the contract-specific below chart for GCQ2025, we identify supports at 2725.4 and 2729.5-2705.5. These levels provide solid ground for bullish trades on this specific contract, giving traders additional confidence in entering long positions.

With implied volatility near its average (see the chart below), the market’s future volatility direction is unclear. Traders using options may choose adapt to this environment, ensuring that changes in volatility do not work against them.

3. Options Strategy: Call Ratio Spread

To take advantage of Gold’s uptrend while neutralizing the risk from changes in volatility, we could employ a Call Ratio Spread. This strategy offers a bullish stance while maintaining vega neutrality, protecting the trader from swings in implied volatility.

Setup:

Buy 1x 2600 Call at 256.15

Sell 2x 3500 Calls at 23.32

Expiration: July 28, 2025

This configuration generates positive delta, meaning the strategy will benefit from upward price movement. At the same time, by selling two calls at a higher strike, we offset the vega exposure, ensuring that changes in volatility won’t dramatically affect the position.

The strike prices and expiration selected help create a risk profile that works well in a bullish market. The maximum gain potential occurs if Gold continues to rise but stays below the higher 3500 strike, while the vega neutrality minimizes any volatility risks as the trade begins.

Notice the breakeven point for this strategy is 2809.5, meaning the trade becomes profitable if Gold exceeds this level by expiration.

4. Why Use Micros?

Traders looking for a more flexible approach can consider using Micro Gold Futures (symbol: MGC) instead of standard Gold futures contracts. Micro Gold Futures offer smaller contract sizes, which translate into lower margin requirements and a more precise way to control risk. This makes them an attractive alternative for traders with smaller accounts or those looking to scale into positions gradually.

Additionally, Micro Gold Futures allow traders to fine-tune their exposure to Gold without the larger capital commitment required by standard contracts. For those implementing strategies like the Call Ratio Spread, Micros provide a cost-effective way to execute similar trades with a lower financial commitment.

Contract Specs and Margin Requirements

Gold Futures (symbol: GC) represent 100 troy ounces of gold, and their margin requirements can vary depending on market volatility and the broker. Typically, the initial margin requirement for a standard Gold futures contract is around $10,000 to $12,000, but this can fluctuate. For traders seeking more flexibility, Micro Gold Futures (symbol: MGC) offer a smaller contract size, representing 10 troy ounces of gold. The margin requirement for Micro Gold Futures is significantly lower, usually in the range of $1,000 to $1,200, making it a more accessible option for those with smaller accounts or those looking to fine-tune their exposure.

5. Risk Management

As with any options trade, managing risk is essential. In the case of a Call Ratio Spread, the primary risk comes from the naked short calls at the 3500 strike price. If Gold rallies aggressively beyond 3500, the trader faces unlimited risk due to the uncovered nature of the short positions.

To mitigate this risk, traders should consider using stop-loss orders or adjusting the trade if Gold's price approaches the 3500 level too quickly. Another way to eliminate the unlimited risk component to the upside would be to convert the Call Ratio Spread into a Call Butterfly by buying an additional call above the 3500 strike price, effectively capping the risk. This adjustment still allows for positive delta exposure while limiting potential losses if Gold moves sharply higher.

Additionally, monitoring implied volatility is key. While the position starts with neutral vega exposure, this will change as the underlying asset price moves and time passes, especially as expiration approaches. The vega exposure can increase or decrease depending on these factors. If maintaining the vega-neutral characteristic is a priority, further adjustments—such as rolling options or modifying strike prices—could be made to keep the position aligned with the trader’s volatility outlook.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

$BABA volatility pricing skew on CALL side before earningsThe high vertical CALL pricing skew on the options chain shows that the CALL options for the September expiration are already much more expensive than the PUT options at the same expected move distance. This suggests that market participants are pricing in an upward move.

Let's take a closer look at the probability curve formed by the options chain. I'm very curious to see whether the 8/8 to +1/8 quadrant line will hold the price for BABA, or if it will continue to surge into the Upper Extreme quadrant, heading towards +4/8 until $100.

If everything stays the same, something like this could be an interesting lottery ticket for me. I'm thinking about an OTM call butterfly with a short expiration before earnings.

I have to admit, I’m not a big fan of risking on this red/black roulette type of play, but if things stay as they are, I might consider combining it with a 40 or 68DTE credit put ratio below and the call butterfly above before earnings.

But we'll see how things look on the day before earnings!

Options Blueprint Series: Tailoring Yen Futures Delta ExposureIntroduction

In options trading, a Bull Call Spread is a popular strategy used to capitalize on price increases in the underlying asset. This strategy involves buying a call option at a lower strike price while simultaneously selling another call option at a higher strike price. The net effect is a debit trade, meaning the trader pays for the spread, but the risk is limited to this initial cost, and the profit potential is capped by the sold call option's strike price.

For traders interested in Japanese Yen Futures, the Bull Call Spread offers a way to potentially profit from expected upward movements while managing risk effectively. Delta exposure, which measures the sensitivity of an option's price to changes in the price of the underlying asset, is a crucial aspect of this strategy. By carefully selecting the strike prices of the options involved, traders can tailor their delta exposure to match their market outlook and risk tolerance.

In this article, we will delve into the mechanics of Bull Call Spreads, explore how varying the sold unit's strike price impacts delta exposure, and present a practical case study using Japanese Yen Futures to illustrate these concepts.

Mechanics of Bull Call Spreads

A Bull Call Spread is typically constructed by purchasing an at-the-money (ATM) call option and selling an out-of-the-money (OTM) call option. This strategy is designed to take advantage of a moderate rise in the price of the underlying asset, in this case, Japanese Yen Futures.

Components of a Bull Call Spread:

Buying the ATM Call Option: This option is purchased at a strike price close to the current price of the underlying asset. The ATM call option has a higher delta, meaning its price is more sensitive to changes in the price of the underlying asset.

Selling the OTM Call Option: This option is sold at a higher strike price. The OTM call option has a lower delta, reducing the overall cost of the spread but also capping the profit potential.

Delta in Options Trading:

Delta represents the rate of change in an option's price concerning a one-unit change in the price of the underlying asset. For call options, delta ranges from 0 to 1:

ATM Call Option: Typically has a delta around 0.5, meaning if the underlying asset's price increases by one unit, the call option's price is expected to increase by 0.5 units.

OTM Call Option: Has a lower delta, typically less than 0.5, indicating less sensitivity to changes in the price of the underlying asset.

By combining these two options, traders can create a position with a desired delta exposure, managing both risk and potential reward. The selection of strike prices is crucial as it determines the overall delta exposure of the Bull Call Spread.

Impact of Strike Price on Delta Exposure

Delta exposure in a Bull Call Spread is a crucial factor in determining the overall sensitivity of the position to changes in the price of the underlying asset. By adjusting the strike price of the sold call option, traders can fine-tune their delta exposure to align with their market expectations and risk management preferences.

How Delta Exposure Works:

Higher Strike Price for the Sold Call Option: When the strike price of the sold call option is higher, the overall delta exposure of the Bull Call Spread increases. This is because the sold option has a lower delta, contributing less to offsetting the delta of the purchased call option.

Lower Strike Price for the Sold Call Option: Conversely, a lower strike price for the sold call option decreases the overall delta exposure. The sold option's higher delta offsets more of the delta from the purchased option, resulting in a lower net delta for the spread.

Examples of Delta Exposure:

Example 1: Buying a call option with a strike price of 0.0064 and selling a call option with a strike price of 0.0065.

Purchased call option delta: 0.51

Sold call option delta: 0.34

Net delta: 0.51 - 0.34 = 0.17

Example 2: Buying a call option with a strike price of 0.0064 and selling a call option with a strike price of 0.0066.

Purchased call option delta: 0.51

Sold call option delta: 0.21

Net delta: 0.51 - 0.21 = 0.29

As illustrated, the higher the strike price of the sold call option, the greater the net delta exposure. This increased delta indicates that the position is more sensitive to changes in the price of Japanese Yen Futures, allowing traders to capitalize on more significant price movements. Conversely, a lower strike price reduces delta exposure, making the position less sensitive to price changes but also limiting potential gains.

Case Study: Japanese Yen Futures

Market Scenario: Recently, a downtrend in Japanese Yen Futures appears to have potentially reversed, presenting an opportunity to capitalize on a new potential upward movement. To take advantage of this potential uptrend, we will construct a Bull Call Spread with specific entry, stop loss, and target prices based on Yen Futures prices (underlying).

Underlying Trade Setup

Entry Price: 0.0064

Stop Loss Price: 0.00633

Target Price: 0.00674

Point Values and Margin Requirements

Point Values: For Japanese Yen Futures, each tick (0.0000005) equals $6.25. Therefore, a movement from 0.0064 to 0.0065 represents a 200-tick change, which equals $1,250 per contract.

Margin Requirements: Margin requirements for Japanese Yen Futures vary but are currently set at $2,800 per contract on the CME Group website. This amount represents the minimum amount of funds required to maintain the futures position.

Valid Bull Call Spread Setup

Given the current market scenario, the following setup is selected:

1. Purchased Call Option

Strike Price: 0.0064 (ATM)

Delta: 0.51

2. Sold Call Option Variations

Strike Price 0.0068:

Delta: 0.08

3. Net Delta: 0.42

Reward-to-Risk Ratio Calculation

Due to the limited risk profile of Debit Spreads, where the maximum potential loss is confined to the initial debit paid, stop loss orders will not be factored into this reward-to-risk ratio calculation.

Debit Paid: 0.000085 (call purchased) - 0.000015 (call sold) = 0.00007

Potential Gain: Sold Strike - Strike Bought - Debit Paid = 0.0068 - 0.0064 - 0.00007 = 0.00033

Potential Loss: Debit Paid = 0.00007

Reward-to-Risk Ratio: 0.00033 / 0.00007 ≈ 4.71

This ratio indicates a favorable risk-reward setup, as the potential reward is significantly higher than the risk.

Conclusion

In this article, we have explored the intricacies of using Bull Call Spreads to tailor delta exposure in Japanese Yen Futures trading. By strategically selecting the strike prices for the options involved, traders can effectively manage their delta exposure, aligning their positions with their market outlook and risk tolerance.

Key Points Recapped:

Bull Call Spreads: This strategy involves buying an at-the-money (ATM) call option and selling an out-of-the-money (OTM) call option to capitalize on moderate upward price movements.

Delta Exposure: The delta of the options involved plays a crucial role in determining the overall sensitivity of the spread to price changes in the underlying asset.

Strike Price Variations: Adjusting the strike price of the sold call option can significantly impact the net delta exposure, offering traders the flexibility to fine-tune their positions.

Case Study: A practical example using Japanese Yen Futures illustrated how varying the sold unit's strike price changes the delta exposure, providing concrete insights into the strategy.

Risk Management: We always emphasize the importance of stop loss orders, hedging techniques, avoiding undefined risk exposure, and precise entries and exits ensures that trades are structured with proper risk controls.

By understanding and applying these principles, traders can enhance their ability to navigate the complexities of options trading, making informed decisions that align with their trading objectives.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Buy call option – at the money / in the money / out of the moneyDefinitions

Buy call option – a stock option is the right to buy a stock (but not the obligation) at a certain price for a limited period of time. The price at which the stock may be bought is called the striking price.

Three terms describe the relationship between the stock price and the options striking price: At the money / In the money / Out of the money

For example; stock XYZ trade at $100

At the money – the strike price of the option is $100

In the money - the strike price of the option is $90

Out of the money – the strike price of the option is $110

The strike price is one of the 6 factors that determine the price of the option.

Those factors are:

1. The price of the stock

2. The strike price of the option

3. The time until the option expires

4. The volatility of the stock also called “implied volatility”

5. The risk-free interest rate (usually the 90-day treasury bills)

6. The dividend rate of the stock.

The last two have less influence on the option price.

The option pricing has two elements, “time premium” and “intrinsic value”.

In this post, I’m not going to elaborate on those two. (But they are important to understand).

The Delta

The delta of an option is the amount by which the call option will increase or decrease in price if the stock moves by 1 point. The values of the delta are between zero to one, if the call option is in the money the delta is closer to 1 if the call option is out of the money the delta is closer to 0.

For example; if the stock option has a delta value of 0.8, this means that if the stock increases or decreases in price by $1 per share, the option price will rise or fall by $0.8.

The option pricing is based on a partial differential equation because of that the behaver of the option pricing is not linear, as we can see from the charts.

In the right chart, we see In the money option with a delta of 0.92, meaning the option price is behaving very similar to the stock price, we see that the lines are nearly flat.

In the left chart, we see Out of the money option with a delta of 0.12, meaning the option price does not move like the stock price, for every $1 the stock will move the option price will move $0.12.

Also, note the difference between the profit lines, to make 3 points with In the money option the stock needs to move to above $190, but the Out of the money option needs only to move above $145.

This was the profit side, the losing side as you can see if the stock will remain at the same place the In the money options will break-even while the Out of the money options will expire worthless and will lose 1 point.

The options that were used (input):

Right chart: Option price -> $25.9, Stock price -> $115 , Strike price -> 90$ , Interest rate -> 0 , Days to expire -> 56 , Implied volatility -> 40.8%

Left chart: Option price -> $1.17, Stock price -> $115 , Strike price -> $140 , Interest rate -> 0 , Days to expire -> 56 , Implied volatility -> 40.8%

One option contract is the right to buy 100 shares so the cost for the options would be: $2590 and $117 respectively, not include commissions.

For clarification: If you hold it to expiration and it is not worthless, that means you need to buy 100 shares at the strike price, $9000 in the right chart, $14,000 in the left chart. (not include what you already paid)

DAL Delta Air Lines Options Ahead of EarningsIf you haven`t bought the dip on DAL:

Now analyzing the options chain and the chart patterns of DAL Delta Air Lines prior to the earnings report this week,

I would consider purchasing the 46usd strike price Calls with

an expiration date of 2024-7-19,

for a premium of approximately $1.74.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

=

Out perform Sector This week 7/06/24Hello All, ETRON Sector that is first leading sector this week, Stronger than others.

look that it seem price break accumulation ready to test EMA200, please closely look at that point.

Delta already bull little bit.

KCE Already break accu. phase just starting.

HANA Follow ...

CCET That is leading stock for this sector

Looking for a bullish swing on DAL today at close!🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Bearish Movement expected. Dont be the Liquidity! pt4Look to all this Negative Delta. We are on Daily TF. BTC will fall and I strongly suggest that you protect your capital.

When media is fully bullish, and everybody is talking about BTC going to the moon and the bullish effect of Halving.. thats the moment when MMakers will rekt almost everybody.

Remember this wise phrase: buy with the rumor and sell with the new.

Even if we see a bullish manipulation to the upside, everything is pointing to lower prices.

Below actual price there is a lot of available Liquidity and it needs to be recapitalized.

Bearish signs are present since days ago. This is my 4th Update trying to warn people.

Be careful.

Delta corp is bottoming out Soon Delta Corp is Bottoming out soon irrespective of any news !!

Stock is near long term support of 90-100

Currently stock is in a falling channel and prices may continue to go down unless it don't breaks the upper resistance of the channel

Every time stock comes around long term support we can see huge upside of 200-250% in few months

Keep it in watchlist and take your own decisions !!

Disclaimer : We are not SEBI registered analyst. Do your own research before taking any investment decision.

LONG AIRLINES ACDVF, AC, JETS, AAL, DALTSX:AC Technical and Fundamental Reasons for going Long AC Air Canada, and AAL and JETS and DAL:

We are in a tightening 3 Month range in all airline names (And even in broader markets)

Given how we have come straight down from the highs, a multi week bounce with legs is likely and positioning in here would be a strong Risk / Reward entry.

While DXY the dollar is set for monthly consolidation along with oil (Despite the knee jerk reaction to Israel which will likely fade. Markets are holding up well and have priced in peak rates with yields all coming down sharply after capitulating last week.

While DXY OIL and Yields drop.

Airlines are huge laggards (and after good selling and bad news being well priced in) it is time for major bounces. It is a highly volatile sector so a big drop the way it did warrants a big pop.

With capitulation following analyst downgrades, and company outlook drops to adjust estimates for rising fuel costs and labor costs. The discounts of this bad news is very well priced in and has capitulated with huge volume climaxes Monday after the Israel situation over the weekend.

As with 9/11 and Russia invasion, the knee jerk reaction last about a week, before the entire dip is re bought up. Assuming no escalation in Iran to push oil even higher, airlines will care most about earnings and forward guidance to see demand outlook for Q4 and 2024 company guidance.

With DAL reporting Thursday and more coming in next few weeks, I'd expect that the reported results for Q3 are very strong, and more importantly that Q4 and 2024 outlooks won't be as bad as markets are pricing. Resulting in a swift 10-15% bounce on many airline names.

Again: The bad news is very well priced in, and markets will begin to find good value for entrance pre earnings and post earnings as we are very oversold and surprised to the upside with earnings that weren't even close to as bad as markets are expecting as well as strong forward guidance.

NASDAQ:AAL

TSX:AC

AMEX:JETS

NYSE:DAL