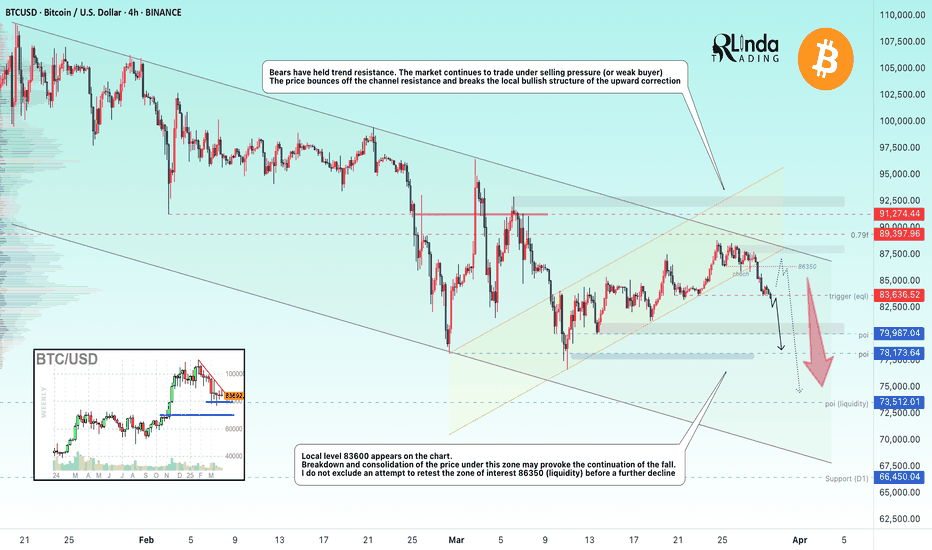

BITCOIN → Break of the bullish structure. Moving to 78-68KBINANCE:BTCUSD has been slowly recovering for the last two weeks, but failed to overcome the resistance. The bears held the trend. The price is breaking the local bullish structure and preparing for a strong fall.

Bitcoin's fundamental background is weak, expectations were not met by the crypto summits, nor by any major announcements or hints of a crypto reserve. The crypto community still didn't get what they expected from Trump. The strong drop was triggered by the SP500 index falling, driven by rising inflation, reduced consumer pressure and new trade tariffs. These factors have contributed to increased uncertainty in the markets, prompting investors to move to safer assets such as gold and government bonds

Technically, the price has been in consolidation (correction channel) for two weeks and after breaking the support of the figure, the price entered the realization phase within the global downtrend.

Resistance levels: 85300, 86350, 89400

Support levels: 83600, 81270, 79980, 78100

Emphasis on the support at 83600. The price fixing under this zone may provoke further fall to 80-78K. But I do not exclude the fact that a small correction to the zone of interest is possible (to capture liquidity) before a further fall to the previously identified key zones of interest.

Regards R. Linda!

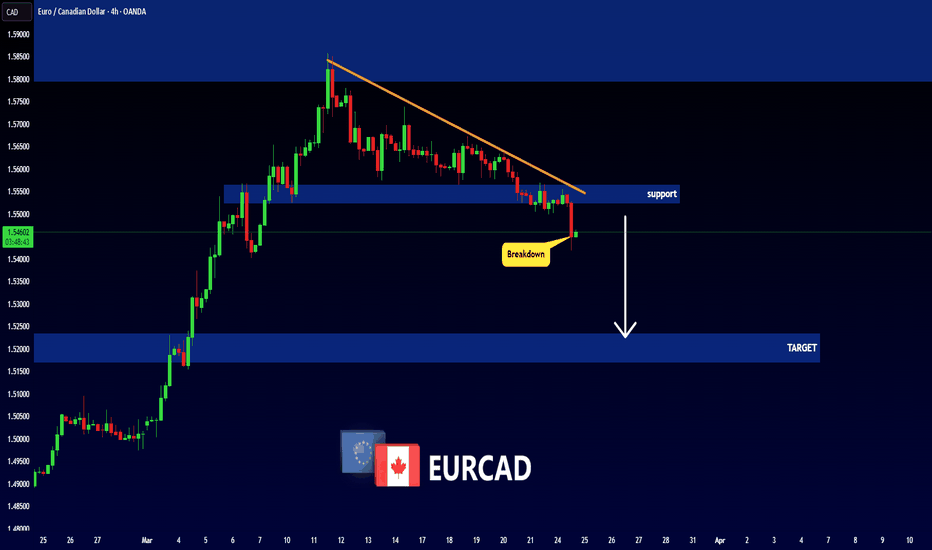

Descending Triangle

XAUUSD Weekly Analysis – Bearish Correction ExpectedGold (XAUUSD) has recently broken above a rising wedge resistance on the weekly timeframe but is now showing early signs of potential exhaustion. Price action is currently hovering around the $3,024 level after a strong bullish rally. However, historical patterns and structure suggest a possible bearish correction ahead.

📊 Key Technical Observations:

Rising Wedge Pattern: Price has been following an ascending channel with a sharp parabolic curve. The structure hints at overextension, making it vulnerable to a pullback.

Previous Corrections: Two notable corrections (-8.89% and -8.15%) provide a historical benchmark, reinforcing the possibility of a similar retracement.

Bearish Scenario :

A potential double-top formation and rejection zone is developing around the $3,050 area.

Target Zones:

TP1: $2,935.95 – first major support/resistance flip zone.

TP2: $2,782.94 – deeper retracement aligned with previous corrective structure.

🧠 Trading Bias:

Bearish bias in the short to medium term as gold may seek to correct before any continuation of the bullish trend.

XAUUSD Head And Shoulder pattern breakdownGold update 15m head and shoulder breakdown

Key Levels:

Resistance Levels:

3,040.000 (Immediate Resistance)

3,050.000

3,060.000

3,070.000 (Major Resistance)

Support Levels:

3,022.000 (Immediate Support)

3,014.000

3,006.500

2,999.000

2,991.000 (Major Support)

Price Action Overview:

Gold is currently trading at 3,033.785, showing a slight upward movement of +1.685 (+0.096%).

The price has been consolidating between 3,031.425 (Low) and 3,034.430 (High) in the last 15-minute candle. The market is testing the 3,035.410 level, which could act as a minor resistance.

Technical Indicators:

USB (Ultimate Support/Resistance Band):

Current Value: 38.301 (-1.279)

Indicates potential support/resistance zones around 3,830.4.

TAT & Skullers Indicator:

Current Value: -38.306 (-1.269)

Suggests a potential retest or breakdown level around 3,830.6.

Market Sentiment:

The market is showing slight bullish momentum, but the price remains within a tight range.

A breakout above 3,040.000 could signal a stronger bullish trend, while a breakdown below 3,022.000 may indicate bearish pressure.

Trading Strategy:

Bullish Scenario:

Entry: Consider a long position if the price breaks and sustains above 3,040.000.

Targets:

3,050.000 (First Target)

3,060.000 (Second Target)

3,070.000 (Major Resistance)

Stop Loss: Place below 3,022.000 to manage risk.

Bearish Scenario:

Entry: Consider a short position if the price breaks and sustains below 3,022.000.

Targets:

3,014.000 (First Target)

3,006.500 (Second Target)

2,999.000 (Major Support)

Stop Loss: Place above 3,035.410 to manage risk.

Risk Management:

Always use proper risk management techniques.

Risk no more than 1-2% of your trading capital per trade.

Adjust position sizes according to your risk tolerance and account size.

Bitcoin - This indicator is always right! Crash to 40k in 2026.What we can see on the chart is Bitcoin cycles. We can statistically predict Bitcoin moves with this simple chart, because it's always right and never wrong. What can we say with certainty?

Statistically:

Bitcoin's bull markets last for 742 to 1065 days

Bitcoin's bear markets last for 364 to 413 days

Correction is every time weaker, but still huge

The recent uptrend on Bitcoin started in December 2022 and ended in January 2025 (791 days). We know that statistically bull markets last for 742 to 1065 days, so this indicator tells us that the bull market ended! This indicator was never wrong, so do your own research. It's always like this. Moon boys calling for 300k, 500k, or 1M in 2025 do not follow my TradingView profile because otherwise they would know this strong fundamental fact. The market cap of Bitcoin is already too big, so forget about 500K or 1M in the short term because the market cap would be higher than gold. Gold is the number 1 asset in the world.

Statistically, Bitcoin crashes every 4 years by 86% to 77%. The market cap is getting bigger as institutions step in, so this time I expect a weaker crash (around 65%). Still, it's a huge crash, and many investors will sell at a loss as usual. Knowledge of the Bitcoin cycles will save you a lot of money.

Bitcoin halving is coded to occur once every 210,000 blocks, or roughly every four years, and will continue in this fashion until the final supply of 21 million BTC is reached. It is assumed that the last BTC will be mined in 2140. After that, transaction fees are supposed to be the only source of block rewards for miners.

Write a comment with your altcoin, and I will make an analysis for you in response. Also, please hit boost and follow for more ideas. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

OMUSDT → Paranormal behavior. Rally readinessBINANCE:OMUSDT as a whole looks stronger than the market. After a strong rally a correction in the format of a bearish wedge is formed, subsequently the price broke the resistance and is trying to consolidate above the key support

Against the background of a weak market OM coin has good prospects as technically someone is interested in this project and the coin as a whole behaves strongly and looks stronger than the market.

A breakout of the bearish wedge (consolidation pattern within the correction) is forming. If the bulls keep the coin above the previously broken figure resistance and above the base of the 6.752 reversal pattern, the growth may continue in the short to medium term

Resistance levels: 7.39, 7.98

Support levels: 6.752, 6.51

One of the few coins that is rising while bitcoin is falling. Focus on the previously mentioned support levels, as well as on the local resistance 7.05, the break of which may provoke a prolongation of growth

Regards R. Linda!

BITCOIN → Short-squeeze 86-89K before falling further to 75KBINANCE:BTCUSD continues to form a downtrend after breaking the bullish structure on the weekly timeframe. There is no bullish driver yet, and technically, the price is heading to the global imbalance zone of 75-73K

The past crypto summit and any other talk of cryptovalt support cannot support the market. Such events end with further market decline.

Technically, the market continues to form a downtrend (global counter-trend), based on this alone, we can say that the price is now going against the crowd and this is generally logical behavior. Globally, the zone of interest is located in the following zones - 75K, 73K and order block 69-66K

Locally, I would emphasize the nearest liquidity zones, located at the top, which can be tested before the further fall: 86697, 89.397

Resistance levels: 85135, 86678, 89397

Support levels: 79987, 78173, 73512

After the false break of 78K support there is no strong reaction, the market is forming a struggle for 84-85K zone, which generally indicates buying weakness. Before the further fall there may be a short-squeeze relative to the above mentioned zones of liquidity, which may lead to a further fall

Regards R. Linda!

BITCOIN → The fall continues... 82K → 76K → 73KBINANCE:BTCUSD is in a sell zone. Trump's comments on the federal reserve, crypto summit failed to impact the crypto market other than a global shakeup and liquidation...

The market has failed to see a proper bullish driver, so far. Trump's comments on the Fed ended in a global shakeup (liquidation). Yesterday's summit went so far as to prevent the cryptovalt market from turning green.

Technically. Global growth is temporarily halted, the flagship is moving into a deep correction phase, with 73K still the primary target. The market needs liquidity, as it will not be possible to grow at the expense of buyers and only bullish leverage all the time.

Price is forming a 90K - 82K range in the short zone after exiting the global consolidation. False break of 91K resistance ( global consolidation support ) ended with a fall, which may continue to both 82K and 73.5K.

Resistance levels: 89400, 91K, 93K

Support levels: 82K, 78K, 73K

The key zone of interest and liquidity is 73-66K. The price is working on a false break of resistance, the imbalance of forces in favor of bears, thus the first stop may happen in the zone of 82K ( lower boundary of the range ). Further it is necessary to observe the reaction to the support. Consolidation, breakdown and consolidation below 82K will provoke a fall to lower targets.

Regards R. Linda!

CRUDE is looking weak. Price connection is expected#CRUDE #Analysis

Description

---------------------------------------------------------------

+ Crude has formed a nice descending triangle pattern and price has broken down the support line which formed over the years.

+ A clear breakdown from this support would push down the prices further.

+ Next target is 50-40$ range.

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

USDJPY → Readiness to break the daily support levelFX:USDJPY is testing strong key support at 148.64 for a breakdown. A falling dollar could affect further movement

The falling dollar is supporting the Japanese Yen, thus we may see the currency pair falling.

The price is trying to break the support of the daily level. A pre-breakdown consolidation of 150.3 - 148.64 is formed relative to this support. The last retest of the level ended with a small false breakdown, indicating that there is no one to defend the support anymore, there was no reaction except for another local consolidation, the purpose of which is to accumulate the potential to break the support.

Resistance levels: 150.3, 150.95

Support levels: 148.64, 147.17

The focus is on the level of 148.64 concerning which the market is struggling. The bulls have little chance to hold this level, as the dollar's fall exerts quite a lot of pressure.

The breakdown and fixing of the price below 148.64 may provoke a fall to 147 - 144.

Regards R. Linda!

USDJPY → Retest of key resistance before fallingFX:USDJPY breaks the bullish structure of the market. Dolla in the correction phase has a favorable impact on the market. The currency pair is forming a retest of the previously broken trendline after a strong impulse

The yen reached a 10-week high on Thursday, causing the USDJPY pair to fall to 149.5. Investors are looking for safe-haven assets due to increased trade tensions caused by Donald Trump's aggressive tariff policy.

The Japanese currency received additional support due to expectations of an interest rate hike by the Bank of Japan, which will increase its attractiveness for investors

For now, the focus is on the 0.5 fibo resistance zone, 150.95, and previously broken upside support

Support levels: 149.5, 148.64

Resistance levels: 150.95, 151.4

Most likely, before a possible fall, the price will be able to test the previously broken support, and now it is resistance 150.95 - 151.4. False breakdown of the key Fibo zones may provoke further fall.

Regards R. Linda!

SOL on the Slide: Is a Bounce from $150 in the Cards?Solana has been in a downtrend for over 30 days after reaching its ATH at $295.83. For the past two weeks, SOL was stuck in a trading range that formed a descending triangle (a bearish pattern) which eventually broke down, confirming the downtrend. Additionally, SOL lost its yearly support level at $189.31. Where is SOL heading next? Let's find out!

Key Support Zone

Our main long opportunity is around the $150 level, where several confluences align:

Fibonacci Levels:

The 0.5 fib retracement of the entire 5-wave structure sits at $151.92.

The 0.786 fib retracement from the 5th wave is at $149.77.

A fib extension 1.618 of the descending triangle is at $148.65, which is very close to the $150 mark.

Volume Profile:

The Point of Control (POC), highlighted by the red horizontal ray, is around $144, adding another layer of support.

Trade Setup

Currently waiting for SOL to reach the support zone between $152 and $144. An alarm is set when price nears these levels for a long opportunity.

A Bearish Case for Diageo: Breaking Critical Support LevelsThe descending triangle pattern on Diageo’s weekly chart presents a strong bearish signal, suggesting that the stock may be poised for a deeper decline. Historically, descending triangles indicate mounting selling pressure, and with price action nearing critical support levels, the risk of a breakdown is significantly high.

Currently, Diageo is approaching key lows last seen in 2020, around 2050, a level that previously acted as a strong support zone. However, the confluence of technical factors suggests this support may not hold:

1️⃣ Fibonacci Retracement Confluence – Just below 2050, the 2026 level aligns with a key long-term Fibonacci retracement. While this could act as a temporary support zone, the broader technical setup suggests further weakness.

2️⃣ The Psychological 2000 Level – Round numbers often serve as psychological barriers in the market, but with a descending triangle breakdown, this level may fail to provide meaningful support.

3️⃣ Measured Move Target: 1875 – When analysing the height of the descending triangle pattern, its projected move suggests a breakdown well beyond the above-mentioned support levels. A clean breach of 2050 could see a swift move lower, with 1885 emerging as the next major target.

With the weight of these technical indicators aligning, the path of least resistance appears to be downward. Unless Diageo finds an unexpected catalyst for recovery, breaking these key levels could trigger further selling momentum, forcing the stock into deeper correction territory. Traders and investors should approach this setup with caution, as the evidence strongly favours a bearish continuation. 🚨📉

N.B. Understanding the Descending Triangle Pattern

A descending triangle is a bearish chart pattern that forms when the price action is characterized by a series of lower highs converging towards a horizontal support level. This pattern signals increasing selling pressure, as buyers fail to push prices higher while sellers continuously drive prices downward.

Key Features of a Descending Triangle

1️⃣ Horizontal Support Line – The price consistently finds support at a particular level, creating a flat base.

2️⃣ Lower Highs – Price fails to reach previous highs, forming a descending trendline.

3️⃣ Breakout Expectation – A descending triangle typically breaks downward once sellers overwhelm buyers at the support level.

4️⃣ Volume Decline & Expansion – Volume usually declines as the pattern develops and increases significantly at the breakout.

________________________________________

How to Measure the Descending Triangle

To predict a potential price target, traders measure the height of the triangle and project it downward from the breakout point.

✅ Step 1: Identify the Pattern

• Find the flat support level where price repeatedly bounces.

• Draw a descending trendline connecting the lower highs.

✅ Step 2: Measure the Height

• Take the distance from the highest point of the triangle (initial peak before lower highs start forming) to the horizontal support level.

• Example: If the high of the triangle is 2675 and the support level is 2275, the height is 400 points.

✅ Step 3: Project the Breakdown Target

• Once price breaks below the support level, subtract the measured height from the breakdown point.

• Example: If the breakdown occurs at 2275, then:

o 2275 - 400 = 1875 (expected price target).

________________________________________

Confirming the Breakout

📉 Bearish Confirmation:

• A daily or weekly close below support, ideally with an increase in volume.

• Retests of the broken support level that now act as resistance.

⚠️ False Breakouts:

• Sometimes, price may briefly dip below support and reverse higher.

• Confirmation is key before entering trades based on the descending triangle pattern.

________________________________________

Final Thoughts

A descending triangle is a powerful bearish signal, particularly when seen in downtrends. Traders use it to identify potential breakdown opportunities and set realistic price targets. Risk management is crucial, as false breakouts can occur, and waiting for confirmation increases the probability of a successful trade.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Hitting a bottom on MATIC?...I don't really trade Crypto's however this one stood out to me as a potential opportunity on the weekly time scale.

MATIC has been trending down since late 2021 but it has always shown a bounce around the $0.30 zone, ultimately creating a very large descending triangle coupled with a MACD that has been diverging up.

Could we see a rally ahead towards $1.00+? well that remains to be seen but I liked the setup and took the opportunity. Should be interesting in how this develops and thus, I'll be keeping an eye on this one.

I'm also checking out DOGE and XRP.

As always, Good Luck & Trade Safe.

XAUUSD 15-Minute Chart Analysis! 2840!Overview:

Gold is currently trading around $2,900, showing a potential bearish setup based on key technical levels. The chart highlights an important Fair Value Gap (FVG), support and resistance levels, and a possible price movement scenario.

Key Levels:

🔸 Resistance Zone: $2,940 - $2,950

A strong supply zone where price previously reversed.

If price reaches this level, sellers might step in.

🔸 Fair Value Gap (FVG: $2,915 - $2,918)

A price imbalance that could act as a short-term resistance.

If price taps into this zone, it may reject downward.

🔸 Support Level: $2,879

A key horizontal level that has acted as support before.

If price holds here, a bounce is possible.

A break below could trigger further downside movement.

🔸 Target Zone: $2,840 - $2,830

A demand zone where buyers could re-enter.

Projected Price Movement:

📉 Bearish Scenario (Main Outlook):

1️⃣ Price moves into FVG ($2,915 - $2,918) and rejects.

2️⃣ Drops towards support at $2,879 for a retest.

3️⃣ A break below $2,879 confirms further downside.

4️⃣ Targeting the $2,840 - $2,830 zone.

📈 Bullish Invalidations:

If price breaks and holds above $2,920, it could push higher toward $2,940 - $2,950 resistance.

A breakout above $2,950 would shift bias to bullish.

How to Use This on TradingView:

✅ Look for bearish signals (rejection wicks, strong red candles) near FVG before shorting.

✅ Watch for a breakdown below $2,879 to confirm further downside.

✅ If price holds above $2,920, reconsider bearish bias.

EURUSD → Pending a breakout of resistanceFX:EURUSD is trying to take a chance amid the dollar correction. The price is forming a retest of consolidation resistance for a breakout and further growth

After an attempt to break the downtrend resistance, the price moves into consolidation and forms a range of 1.053 - 1.021. Inside this set-up a local channel (consolidation) is formed and the price tests the resistance at 1.038. The market is still trying to confirm the change of trend and get stronger on the background of the dollar correction.

The fundamental background is complicated due to the tariff war and economic crisis....

Resistance levels: 1.038, 1.053

Support levels: 1.033, 1.021

A breakthrough of the resistance at 1.038 and price consolidation above this area may trigger further growth within the distribution of the accumulated potential

Regards R. Linda!

SBICARD – Descending Triangle Breakout 920 to 1100+ TargetSBICARD has been trading within a descending triangle pattern for an extended period, with lower highs and a strong horizontal support. This pattern is typically bearish but can lead to bullish breakouts when resistance is breached, as seen in this case.

Breakout Confirmation & Key Levels

Resistance Breakout:

The stock has successfully broken above the descending trendline resistance, indicating a potential trend reversal.

Buying Zone:

Above ₹800 – A sustained move above this level confirms the breakout.

Stop-Loss Level:

Below ₹750 – Any close below this level could invalidate the bullish setup.

Target Levels:

Initial Target: ₹920+

Projected Target: ₹1100+ (based on pattern height projection)

BITCOIN → Down to $90,000. Downside risks are risingBINANCE:BTCUSD feels the change of mood and continues to form set-ups hinting at a possible continuation of the correction. Another retest of the 90K risk zone is possible.

On the medium-term timeframe bitcoin failed to hold near ATH, in the upper consolidation range and entered the local selling zone, under the level of 99800. A negative note is felt in the cryptocurrency market, as well as a change in sentiment. Altcoins continue to break through bottom after bottom without any positive prospects. Bitcoin at this time is most likely resentful of the US governing apparatus due to the fact that no promises from Trump have been kept so far, and the price is moving into a protracted correction in the local perspective

Briefly, here's what's going on:

Expectations: Bitcoin reserve, cryptocurrency market support, transparent regulation, pumping the market ...

Reality: new scam coins created before the US election that sucked all liquidity, market manipulation, trade war with almost every country on the planet, dumping the market into the abyss.

Support levels: 95.8 (trigger), 91300, 90K

Resistance levels: 100.2, 102.67

Technically, the situation is that bitcoin may continue its decline and test 90K again, from which the risks around 90K will grow.

At the moment, the price is in consolidation between 95.8 - 100.2. A pre-breakdown consolidation is forming near the support, foreshadowing the support breakdown and further fall to 90K. But, due to the dependence of the asset before the actions of politicians in the U.S., the price may shake out to 100.2 before further falling

Regards R. Linda!

OMUSDT → Consolidation in a triangle before the rallyBINANCE:OMUSDT is a paranormal coin in this case, as it is one of the few projects that shows bullish dynamics while all altcoins are finding bottom after bottom.

Perhaps the situation partly depends on BINANCE:BTCUSD . If it starts to fall even deeper, nothing and no one will help here. But locally bitcoin is forming a resistance breakout and if the bulls hold this trend, the BINANCE:OMUSDT.P coin may have a bullish driver that can support the bullish movement.

At the moment, the focus is on the triangle (wedge) resistance and the base of the 5.6756 pattern. Two bullish scenarios should be considered: Growth after a resistance breakout or growth after a false breakdown of support.

Resistance levels: 5.9821, 6.30

Support levels: 5.75, 5.6756

At the moment, a consolidation within the triangle boundaries is being formed. But when the resistance is broken, the market may move to the realization phase and the impulse may be quite sharp. Ahead, beyond 6.3, there is no resistance...

Regards R. Linda!

BITCOIN → The price is getting ready to drop to 100K - 97KBINANCE:BTCUSD is facing strong resistance. The price is being pushed away from the 105-107K zone as much as possible, forming a defense conglomerate. But, this resistance cannot overshadow the global bullish situation yet

A controversial situation is forming on H1-H4: a descending channel and a symmetrical triangle. And everything depends on what part of the market sees which figure. The primary reaction to the triangle support may be accompanied by a rebound, but based on the situation with the resistance, we can assume that the rebound from the triangle will not be deep and the price will try to go down.

If we look at the descending channel, the price is held back from falling by the support at 101.600.

Yes, technically, it is the support of 101.600 that plays the main role now. The main question is whether this level will hold the price or not.

Fundamentally, the situation is debatable, as the situation mainly depends on America, on how Trump and officials will use rhetoric regarding cryptocurrencies. It could be a bubble, a scam to win an election, or empty talk. Or it could be an actual strategy

Resistance levels: 103.4K, 105.8K

Support levels: 101.6K, 99.6K

Emphasis on 101.6. In the short term, I expect a breakdown and price consolidation below the level followed by a drop to 100-97K

BUT! Since there is a symmetrical triangle on the chart, a false breakdown of 101.6 may lead to a small upward bounce before a further fall to 100K

Regards R. Linda!

USDCHF → The bullish trend may get its continuationOANDA:USDCHF is entering the realization phase after a prolonged correction. A favorable background is created by the uptrend and rising dollar

The technical outlook on the daily timeframe is very good. The price after breaking the trend resistance tested the previously broken line. The currency pair after the false breakout managed to consolidate above the key point, marking an interim bottom and further prospects.

Technically, the focus is on the resistance at 0.911, if the bulls can overcome this area and consolidate above this level, the currency pair will be able to realize a rise to 0.918 - 0.93.

Resistance levels: 0.911

Support levels: 0.90555

Before breaking the resistance, the currency pair could test 0.90555 due to the liquidity generated below this area. But, the trigger that can provoke further growth is 0.911

Regards MARKET ANALYZER

WILL #GRT MAKE IT!!!

Currently #GRT is facing a resistance which was previously strong support of descending triangle.

#grtusdt needs to break above this resistance, then we can probably see rally up to 0.5$ region after breaking out resistance of previously formed descending triangle.

In case of any further dip, we can see #grt heading towards its major support region.

NZDUSD → The bearish trend may get its continuationFX:NZDUSD failed to realize the chance when the dollar went into correction. Buyers do not believe in the realization of the bullish scenario at the moment. The price continues to succumb to pressure

On the weekly timeframe the price approached the strong support level 0.5545 - 0.55. Accordingly, a reaction in the form of a small correction is possible. Small, because the dollar continues its bull run, and Trump's policy allows to keep this scenario in the medium term.

On H4, the price continues to test the support at 0.5588 and a local descending triangle is forming amid pressure from the bears. Possible retest of the channel resistance before further decline.

Resistance levels: 0.563, 0.567

Support levels: 0.5588, 0.5511

Technically, a breakdown and consolidation of the price below 0.5588 will provoke further sales against the background of the current local and global downtrend.

Regards R. Linda!