Trading Idea: Buy Deutsche Bank (DB) StockDeutsche Bank's stock price has experienced a decline over the past 5 days. This trading idea proposes buying Deutsche Bank (DB) stock.

Core Logic

The trading idea is based on identifying companies with strong short-term profitability. The strategy focuses on three key factors:

Gross Profit Margin: A high gross profit margin indicates that the company is generating substantial profit from its core operations after deducting the cost of goods sold. This is a positive indicator of profitability.

Revenue: High revenue suggests that the company is generating substantial income from its business activities. A strong revenue stream indicates a healthy and growing business.

Cost of Revenue: A low cost of revenue indicates that the company is efficiently managing its expenses related to producing goods or services. Lower costs lead to higher profit margins and potentially higher profitability.

By considering these factors, the trading idea aims to identify companies with strong short-term profitability potential. Based on these insights, the idea suggests buying Deutsche Bank (DB) stock.

Please note that this trading idea is suitable for investors with an extremely short investment horizon and an exceptionally high risk tolerance.

Technical Outlook

Deutsche Bank Approaching Key Support Level

Deutsche Bank (DB) is currently trading at 12.09. The stock is approaching a key support level, just 5 cents away from 11.86. Breaking below this level could indicate further losses are ahead. However, if the stock fails to break below this level, it could be viewed positively by bulls, with a retracement being likely.

In spite of the current bearish market, market analysts expect Deutsche Bank's price action to test an important upper Bollinger Band® level at $12.47. This indicates that there is potential for a rebound in the stock's price.

Deutsche Bank's stock has seen a 10.61% increase in the past month and has outperformed the Nasdaq by 36.18% so far this year. The stock currently has a market cap of $24.29 billion.

Yesterday, a total of 1.48 million shares of Deutsche Bank were traded, which is below the multiday average of 2.39 million shares.

Today, Deutsche Bank's stock declined by 0.49%, falling from 12.15 to 12.09. This further reinforces the ongoing downtrend of the stock.

In summary, Deutsche Bank is approaching a critical support level and breaking below it could lead to further losses. However, failing to break below this level could signal a retracement. Market analysts expect the stock to test an upper Bollinger Band® level at $12.47.

Deutsche

Deutsche Bank DBK long will Go to 26$I have explained 2 bullish scenarios,1 bearish(worse case).

Bullish:

higher highs higher lows

poc uprising

volume increasing

capital flow rising

Inflation cooling down

Future Rates cuts

Rising Supports

In case the Take profits hit, and we have increased volume, I will ride the trend.

I will only take profit 10% of the Deutsche Bank portfolio and let the profit run.

Exit :Stop loss or trend change signal

The mid and long term horizon is bullish. If any Profit taking level reaches, and trend continuation is signalizing that the uptrend will be continued, I will increase agressively my positions and take only 10% profits of each position.I will let the prfoits run.

This trade setup is only for trend followers and on daily TF.

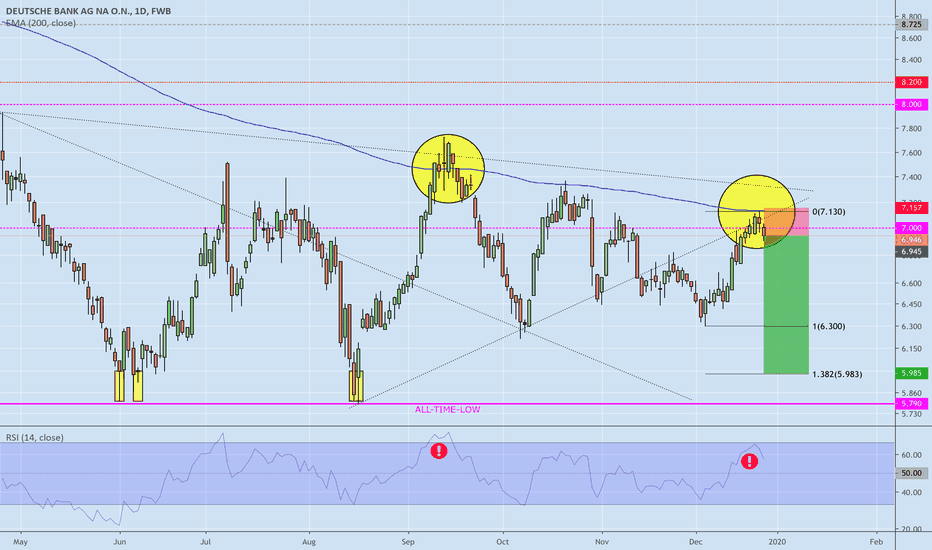

Trading Idea - #DeutscheBankMy trading idea for Deutsche Bank - Sell / SHORT

Target: EUR 5.80

Deutsche Bank with a mixed outlook for the year.

Although DB performed well in investment banking, earnings were lower than in the second quarter of last year due to higher costs.

The sell target is based on last year's support levels.

GER40 (DAX40) Weekly Gann Analysis. Will it BREAKOUT? CAPITALCOM:DE40 Falling Wedge Pattern (Weekly)

The index is testing resistance of the falling wedge once again for 5 weeks in a row.

Weekly candle close above 400 will indicate a breakout from the downward trend with a target of 16,200 if the breakout sustains.

Good Luck!

GER40 (DAX) Index Gann Predictions for Today with Options StratsCAPITALCOM:DE40 trading below support 14110 and testing 14060 support at the moment.

Support Levels: 14110, 14060, 14040, and 14,000

Resistance Levels: 14,110, 14,133, 14,140, 14,150, and 14,160

Seems like a sideways market today!

Possible Options Strategies:

1) Iron Condor

2) Iron Butterfly

3) Short Strangle

4) Short Straddle

Good Luck!

Deutsche Bank buying opportuntyWith hopes that during Easter time G20 and OPEC will solve the differences and come up with aid solution, time could be to buy stocks.

Here we have Deutsche converging higher, bouncing from 61.8%, refusing to sell further.

A break and close through resistance would be confirming bulls taking charge.

Of course fundamentals still affect this. If EU finally agrees on aid package, this could break upside quickly.

Please leave a like and share your thoughts on stocks!

Good Luck and Stay Healthy!

Deutsche Bank: Projected top and long term Sell Entry.Deutsche Bank (DB) has been on a strong medium term rise on the 1W chart since the August low (RSI = 65.146, MACD = 0.232, ADX = 21.619, Highs/Lows = 0.9691). This rise is the bullish leg of the long term Channel Down (since 2012), that is aiming for a Lower High inside the pattern.

The previous Lower High bounces have been 85% on average and the last one made a peak on the 0.500 Fibonacci retracement level. Currently this level is at 11.35, which fits the +85% rise model. This is also where the price meets the technical rejection point of the 1W MA200 (orange line) which has been acting as a Resistance since May 2008.

With the RSI already inside the Sell Zone, we believe it is best to wait for this top to form and sell back towards the 6.45 Low.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Deutsche Bank - Next Target € 8,50 or 24 PercentOnly the chart counts and without the following fundamental things in mind: feelings, financial crisis 2.0, zero or negative interest rates, margin erosion, Dr. Markus Krall, Zombibanken, personell overcapacities, Overbanking - too many branches, target 2 balances, Google Pay, Paypal, Alipay, Payoneer, Skrill, WePay, Wirecard, Adyen, FinTecs, IoT, Blockchain, RTP, BS PayOne, .....

If shareprice hit € 7.00 again, target of € 8.50 will be activated. However, shareprice should not fall below € 6.44 any more. At a current entry price of € 6.82, the chance/risk ratio CRR would be 4.2 to 1.

Deutsche Bank - disaster or restartDeutsche Bank is now in the buying zone already announced last year. Not that I would be able to beat myself, I am not convinced of the sustainability of the business model here, especially with the steady negative interest rate, but you can see first reactions at € 5.80 in June and € 5.77 last week.

Bullish Signals will come in my opinion only with a weekly and a monthly close above €6,87!

Greetings from Hannover

Stefan Bode