Deutsche Bank - next stop at 5.60 - SHORTIn June I was writing: " Below 9 DEUTSCHE BANK IS DEAD! I also had an update suggesting for a speculative short- term buy long till 10.88.

I hit both the predictions. Now I see the bank going to 5.60 Euro.

Every month some bad news about this bank. It is a catastroph. Lot of corruption and dirty stuff around this bank. If it was not for politicians,

they would already be closing the activity. Stay aside from this bank unless you wanna lose money. They only way to speculate is being short.

See you soon guys,

Simone

Deutschebank

DAX30: Weekly - Long-term chart targeting 1566 till year 2020This is the main idea of the final wave for DAX30 and the indices similar to it based on the 90-year cycle from 1929 (Great Depression) + 90 years = 2019

90 years as in 90°down in the markets. The 90-year cycle is also the 90-year debt cycle.

The 90-year cycle is one of the most powerful cycles out there and it causes huge drops as DAX30 and other indices similar to its pattern has reached a triangle formation, the steam off the bull market runs out and the only way becomes down when the formation is so prevalent on the log chart.

At the same time a 'Wolfe Wave' pattern has been in the making for the past 30 years and is now finalizing the triangle just before it drops till year 2020 with the 90-year debt cycle.

Wolfe Wave Example

i.imgur.com

This crash will most likely be a fast one because of the algorithms in the markets today. The fundamentals can be linked to anything associated at the time but Deutsche Bank ($DBK) which is the most obvious contagion to date will likely be the cause to this next financial crisis because of the amount of debt that the bank holds within the banking system.

What's important to remember is that a graph is a graph and that technicals shows you everything you need to know about the future, regardless of the time frame when a pattern like the 'Wolfe Wave' is so prevalent on the Weekly log chart a drop follows, especially when a big cycle like the 90-year debt cycle expires around that date together with this wave.

After year 2020 it will be a good time to re-invest in the world's stock markets again till year 2026 and 2033.

Deutsche Bank ($DBK): Weekly - Default Risk before year 2020 This is the real market risk, the most obvious contagion to date that will most likely cause the next financial crisis because of the amount of debt that the bank holds within the banking system when this stock moves down the market also follows.

Technically below that trendline and Deutsche Bank moves towards default and 0.11€

DB may face another decline...DB may face another decline. German Deutsche Bank AG. there were better times in exchange rates as well. Last week, he left his biggest shareholder. The exchange rate is expected in the coming days. Thereafter, we expect a larger downward wave, with a target price of 6.17 usd.

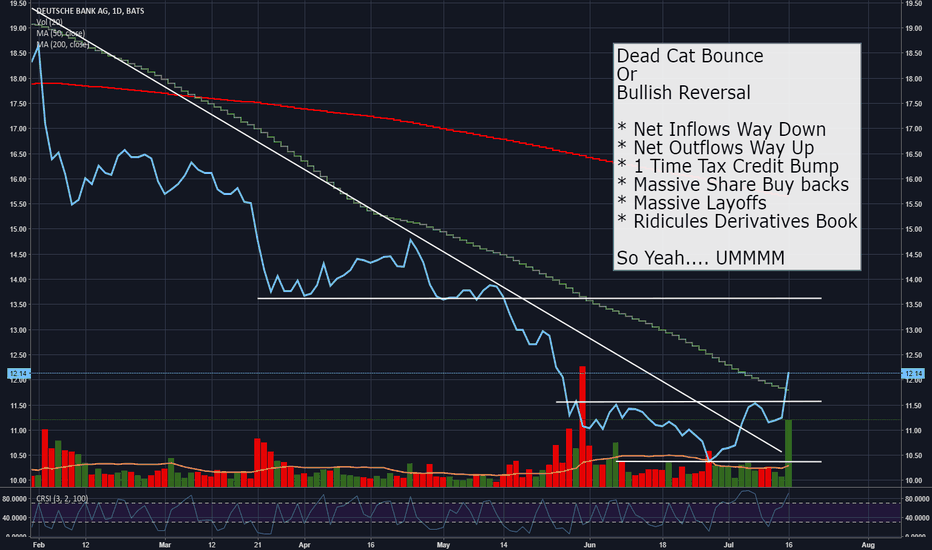

DB Long- Not much to say about this Bank, except to state the obvious, it has been battered over the last few years

- Will allocate long

- I am looking for pull-backs to enter on(might change, depending on price action)

- Time horizon for this allocation is medium term

The counter

- I like the talk of the 'new' `CEO, however talk is cheap, action is not.

Deutsche Bank (DBK) going bust - Banking Crisis in EUWith volatility coming back and with the VIX seriously threatening with a "fear spike", I am now looking at Deutsche Bank DBK .

It seems like it could fail, which would agree with the DAX wave count and the overall Market Crash pattern.

Could this be the next Banking Crisis ?

Deutsche - Bottom not yet reachedDeutsche Bank has been in a long-term downtrend since May 2007 and is still in tact. A short backlash should, however, be taken into account and bring the shareprice again in the range of about 11 €, before the final low can be formed and the correction pattern will end with the 5 of the 5 of the C.

'german bank'could be a 6-36 month play and this could drop to single digits but TONS of volume around this area shows for interest in making a return play

down over 90% from highs

I would buy here and all the way down to 7.5 and start selling above 25. Risky becauase it's some yung price discovery

/snatched this idea from @cryptohustle and did my own analysis. Give him a follow!