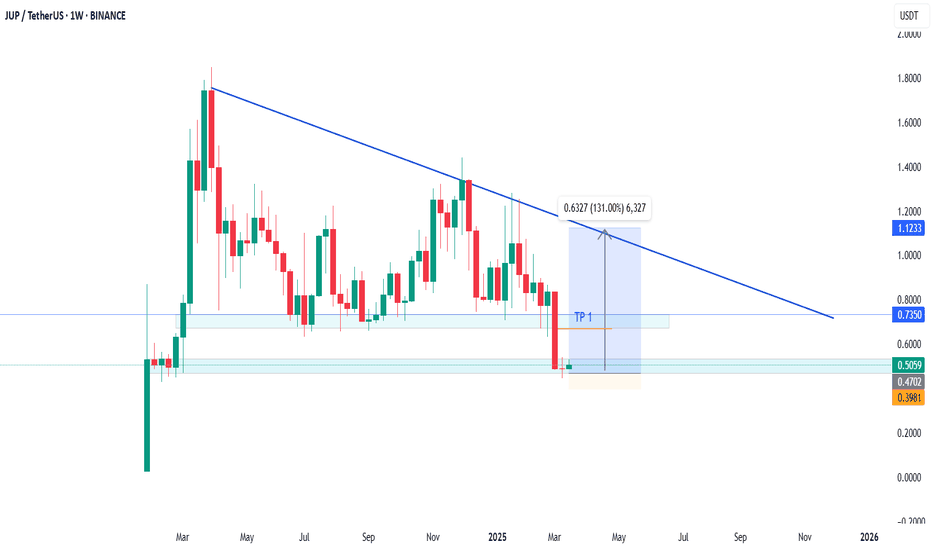

TradeCityPro | JUP Eyes Breakout as Altseason Momentum Builds👋 Welcome to TradeCity Pro!

In this analysis, I want to review the JUP coin for you. It’s one of the projects in the Solana ecosystem, currently ranked 59 on CoinMarketCap with a market cap of $1.65 billion.

📅 Daily Timeframe

On the daily timeframe, this coin is currently sitting below a very important resistance zone at 0.6312. This is a strong resistance area and serves as the main trigger for a trend reversal in this coin.

✔️ The main support floor for JUP is located at 0.3409, a level price has tested twice before. Now it has returned to 0.6312, and we can see increased market volume at this level, which indicates tension between buyers and sellers.

✨ A breakout of 0.6312 would be a good trigger for a long position, and I plan to open a long if this level breaks. This could potentially be a long-term position with a high risk-to-reward ratio.

🔔 The next major resistance zones are at 0.7858 and 1.1435, which we can use as targets for this position.

🔽 If the price gets rejected from the top and moves down, breaking 0.4186 and 0.3409, we can look to open a short position.

🧩 The break of 0.3409 would confirm the start of a downtrend, and it's one of the key zones where I’ll definitely look to hold a short position if it breaks.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

DEX

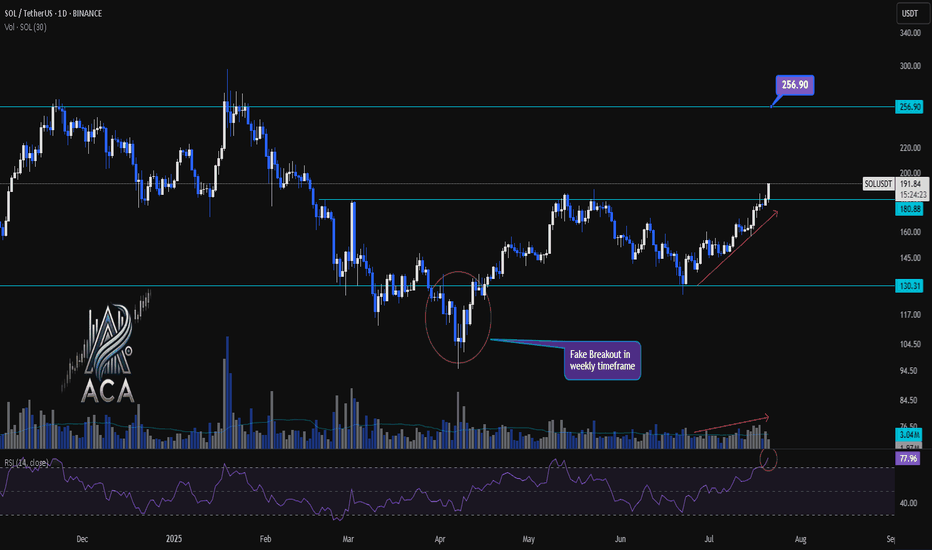

SOLUSDT 1D Chart Analysis | Accumulation Breakout Signals....SOLUSDT 1D Chart Analysis | Accumulation Breakout Signals Fresh Momentum

🔍 Let’s drill into the SOL/USDT daily chart, focusing on the recent breakout above the accumulation range, key support and resistance levels, RSI momentum, and volume confirmation for a robust bullish scenario.

⏳ Daily Overview

SOLUSDT has decisively broken out above a prolonged accumulation box, marking a significant shift in market structure. A daily close beyond this range now serves as a strong indicator for renewed bullish momentum. RSI is currently above 77, signaling that buyers are commanding momentum. Notably, volume has surged in tandem with price, confirming trader participation behind this breakout move.

📈 Technical Convergence and Trend Structure

- Accumulation Zone Break: After consolidating within a clear box for weeks, SOLUSDT closed above the upper boundary (around $180.88–$191.05), signaling a possible trend reversal or continuation.

- Daily Close Signal: A daily close outside the accumulation box offers high conviction for bullish continuation. This close acts as a potential entry signal for trend-followers.

- RSI Momentum: The RSI sits above 77—deep in the overbought territory. A close here not only confirms buyer strength but often precedes sustained uptrends when accompanied by price breakouts.

- Volume Surge: Volume has increased with the breakout, providing confirmation the move isn’t a false start, but likely fueled by real demand.

- Weekly Fake Breakout: There was a notable false breakout in the weekly timeframe, quickly reclaimed by bulls. This flip suggests buyers fended off downside attempts and now drive higher prices.

🔺 Bullish Setup & Targets

- First Target: $256.90 — marking the next major resistance on the chart and a logical upside objective for traders.

- Key Trigger: A confirmed daily (or weekly) close above the accumulation range with strong volume is essential for validating the upward trajectory.

📊 Key Highlights

- The breakdown of the accumulation box—now turned support—marks a pivotal structural change.

- RSI and price are making new local highs, solidifying the case for continued bullish momentum.

- Volume is climbing in sync with the move, offering real confirmation versus a potential fakeout.

- Recent fake breakout on the weekly chart, immediately negated, emphasizes that buyers are regaining—and likely maintaining—control.

🚨 Conclusion

SOLUSDT appears set for higher prices following the confirmed breakout above the accumulation range. Signs of trend health include an overbought RSI, volume confirmation, and the swift invalidation of a recent weekly fake breakout. As long as daily closes stay above the breakout level, the path remains clear for a rally toward $256.90. A strong daily close and continued volume will be your best signals for bullish continuation.

dYdX Hyper Bullish Market Conditions, $11.1 Next Target (1,671%)"Once we hit bottom, there is no other place left to go but up." dYdX hit bottom, a new all-time low last month and is turning ultra-hyper bullish this week. The action is already moving above EMA8 and EMA13 while breaking a local downtrend coming off the December 2024 peak price.

We have a full green candle and this candle signals a recovery and the start of the 2025 bull market cycle. This cycle can last 6-12 months for this specific pair or longer. Remember that each project, each trading pair, each altcoin can produce different price patterns and dynamics. This is easy to see because here we have a new all-time low, other pairs hit their all-time low in April this same year while others did so in August 2024, others in 2023, some others in 2022, etc. Each pair/project should be considered individually.

Good strong projects trading at bottom prices have higher potential for growth. For example, you can certainly make more money buying and holding dYdX tokens vs Solana or Ethereum. Because the latter two are trading much higher compared to their all-time high and because these projects are much bigger. Smaller projects have higher potential for growth.

So all is good in Crypto-world the market is going up. dYdX is turning bullish just now but the bias is confirmed based on marketwide action. Seeing how the other projects are performing predicts what comes next. When the week closes above EMA8 and EMA13, you have a full blown bullish confirmation. The action already recovered from the ATL range and is happening above the 10-March and 7-April lows. This is enough to secure/confirm growth.

We buy low to sell high. We buy when the market is red and hold.

We sell when prices are high. We sell when the market is green and there is lots of hype all around. Lots of profits to be made. At this point in time, all that is needed is to choose wisely and practice patience, patience will be the biggest earner; patience pays.

Thank you for reading.

Namaste.

CAKE : Are we left behind?Hello friends🙌

😉We came with a good currency analysis from the decentralized exchange Pancake Swap.

So you see that we have a good price support that buyers supported the price well after each collision.

🔊Now, considering the collision with this support, we can expect growth to the specified areas. Of course, don't forget that capital management and risk are the priority of trading.

🔥Follow us for more signals🔥

*Trade safely with us*

TradeCityPro | UNI Builds Pressure Below Key Resistance Zone👋 Welcome to TradeCity Pro!

In this analysis, I’ll be reviewing the UNI coin — one of the notable DeFi tokens, currently ranked 27th on CoinMarketCap with a market cap of $254 million.

⌛️ 4-Hour Timeframe

On the 4-hour chart, as you can see, UNI has formed a bottom around the 6.043 level, which is considered its key support zone. After reaching this level, the price began an upward move, though the trend appears very weak.

✔️ Currently, there’s a resistance zone just above the price that has previously caused multiple rejections. Once again, the price is moving toward this zone.

📊 The volume during this latest upward leg is very low, which is not a good sign for initiating a bullish trend. If the price reaches this resistance level with such low volume, there's a high likelihood of another rejection.

🔽 If that happens, we could consider opening a short position based on this rejection. However, my main trigger level for a short is the break below 6.896 — I personally would wait for this level to be breached before entering a short position.

✨ The next key support, in case 6.896 is broken, is the 6.043 zone. This is a major support level and could serve as the target for the short trade. If this level is broken as well, it could mark the beginning of a strong downward trend.

🔍 On the other hand, if volume starts to pick up and the resistance zone is broken, we could open a long position. The target for this could be around 8.678 — or even a setup in anticipation of a breakout above 8.678.

🔔 Which scenario you choose depends largely on your market perspective. If you're looking for a short-term trade, the first scenario is more appropriate. But if you're aiming for a long-term position with a wider stop loss, the second scenario would be the better choice.

💥 In either of the long scenarios, I strongly recommend confirming the move with volume. For further confirmation, you can also check if RSI enters the overbought zone.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Ishi Go (DEX) — strong support zone & bullish setup!This low-cap DEX gem just tapped a key support level on the Ethereum network . The chart is forming a clean structure with strong historical demand — and we’re already seeing signs of a potential bounce.

After a deep correction, price has entered the green support zone

A potential move of +51.47% is on the table if the bounce continues

DEX - SOLX/WETH On the chart — Solaxy, a token that’s beautifully forming a support zone after a sharp dump. A potential recovery is already taking shape: a trendline breakout and a retest of the green support zone suggest a strong bounce could follow.

Projected move: +47.99% toward the nearest resistance level.

PULSEX TO DO A 17XPulseX DEX received one of the biggest public funding rounds in crypto history at 1 billion dollars.

It also is one of the few crypto tokens to receive regulatory clarity as been determined not to be a security.

It also trades at a 40% discount to that raise!

It also exhibits a wonderful technical pattern that is YET to trigger and breakout.

Which other crypto setup right now is giving you this kind of risk/reward?

What if...What if instead of a 6-12 months long bull market instead we see a 2-3 years long bull market? What if...

Instead of one big extended bullish wave we see slow and steady growth long-term, with no more huge crashes as the market evolves. This already happened in the past leading to the 2017 cycle top. The market grew in 2015, 2016, 2017...

Here we have DYDX producing lower lows. Maybe supply is expanding, maybe something with the way the token works, I don't know, the chart is showing lower lows, but this is still a transition period, other charts are producing higher highs and higher lows.

The recent drop below the lower trendline is called an "excess," a market excess and this type of move tends to be corrected almost right away. The action will move back above the trendline and then produce strong growth.

What if instead of a super fast and strong bull market we get a long-term drawn out one. The latter scenario would be the best. What if... I am open to seeing it happen, what about you?

Thank you for reading.

Namaste.

ONLY WAY IS UP - SUNDAEHear me now, the only way is up for SUNDAE. May drop down to the .004cent range but that will be a perfect buying opportunity.

- current market cap is 12million

- current TVL is 14.3million

- Sundae Labs is already familiar with Hydra (which is under construction) but would drastically reduce fees and increase transaction speed

- Governance to come

- Reduced fees for SUNDAE holders to come

SUPER UNDERVALUED. This will likely be a 200million DEX at minimum during the next bull run

ALTCOIN BOOM FOR SAROS 2025-2026 PROPOSALIntro & Core Info SAROS ($SAROS) is a decentralized finance (DeFi) ecosystem built on Solana, focusing on liquidity solutions, decentralized exchange (DEX) aggregation, and cross-chain swaps. It aims to solve fragmented liquidity across Solana-based protocols while offering low fees and near-instant transactions. Think of it as the "Uniswap of Solana," but with ambitions to bridge ecosystems like Ethereum and Cosmos.

Recent News Launched "Saros Super Pool," a concentrated liquidity protocol with $50M TVL in its first week. Partnered with Jupiter Exchange to integrate Solana’s largest DEX aggregator into Saros’ interface. SAROS price jumped 60% in July, fueled by Solana’s resurgence.

Deep Dive Solana’s DeFi TVL has tripled in 2024, and SAROS is riding the wave. The Super Pool launch taps into Solana’s speed to attract yield farmers, while the Jupiter collab positions SAROS as a one-stop trading hub. However, Solana’s history of network outages remains a risk. If SAROS can’t ensure uptime during congestion, users might flock to rivals like Raydium.

Latest Tech or Utility Update

Update Details Saros deployed "Cross-Chain Swaps" this month, enabling asset transfers between Solana, Ethereum, and Binance Smart Chain via Wormhole bridges. Also introduced "Dynamic Fees," which adjust based on network congestion.

Implications Cross-chain swaps could make SAROS a hub for multi-chain traders, but reliance on bridges like Wormhole introduces security risks. Dynamic Fees help retain users during Solana’s traffic spikes, but if fees rise too high, it might negate Solana’s low-cost advantage.

Biggest Partner & How Much Was Invested

Partnership Spotlight Jupiter Exchange invested $5M in SAROS’ liquidity incentives program, locked for 12 months.

Impact Analysis Jupiter’s liquidity dominance on Solana gives SAROS instant access to deep order books. This partnership could funnel Jupiter’s user base into SAROS’ Super Pools, creating a flywheel effect. If successful, SAROS becomes the go-to for Solana yield farming.

Most Recent Added Partner & Details

New Collaboration Saros partnered with marginfi (Solana lending protocol) to enable leveraged yield farming. No direct investment, but revenue-sharing on margin trading fees for 18 months.

Future Prospects Leveraged farming could attract degens and boost TVL, but overcollateralization risks could backfire during market crashes. Short-term, this adds hype; long-term, it tests SAROS’ risk management.

Tokenomics Update

Token Dynamics Burned 1.5M $SAROS (3% of supply) in July via protocol revenue. Staking rewards now include 20% of swap fees (up from 10%). DAO voted to extend token vesting for team tokens by 2 years.

Deep Analysis Burns + fee-sharing make $SAROS more deflationary, but the token’s value hinges on volume. Extended vesting reduces sell pressure, signaling team commitment. However, if trading activity stalls, stakers could dump rewards.

Overall Sentiment Analysis

Market Behavior Retail traders are FOMO-ing into $SAROS (social mentions up 300%), while whales are taking partial profits. Funding rates turned negative on derivatives, suggesting short-term caution.

Driving Forces Hype around Solana’s comeback and leveraged farming. Concerns linger about Saros’ ability to scale without Solana-level outages.

Deeper Insights Sentiment is overly tied to Solana’s performance. If SOL dips, SAROS could crash harder. But if Solana’s DeFi summer continues, SAROS might outperform.

Recent Popular Holders & Their Influence

Key Investors Alameda Research survivor wallet bought 500K $SAROS. Solana co-founder Raj Gokal praised Saros’ UX in a tweet.

Why Follow Them? Alameda’s remnants are known for trading Solana ecosystem gems aggressively. Raj’s endorsement signals insider confidence, which could attract more builders to Saros.

Summary & Final Verdict

Recap SAROS is Solana’s liquidity aggregator on steroids, combining cross-chain swaps, leveraged farming, and deep Jupiter integration. Its tokenomics are tightening, and Solana’s revival gives it tailwinds.

Final Judgment $SAROS is a high-beta Solana play . If you’re bullish on SOL’s comeback, this could 3x-5x. But if Solana stumbles, SAROS will bleed harder than blue chips.

Considerations Can Saros’ infrastructure handle Solana’s next congestion crisis? Will leveraged farming lead to cascading liquidations in a crash? How dependent is SAROS on Jupiter’s continued dominance?

If you’re riding the Solana wave, buy the dip. If skeptical about Solana’s reliability, stay clear.

TradeCityPro | CAKE: Triangle Squeeze Nears Breakout Decision👋 Welcome to TradeCity Pro!

In this analysis, I want to review the CAKE coin for you. This project is one of the crypto DEXs that operates on the BNB network and is among the most popular projects on that chain.

💫 This project’s token, CAKE, has a market cap of $747 million and ranks 95th on CoinMarketCap.

📅 Daily Timeframe

As you can see in the daily timeframe, a symmetrical triangle has formed, and the price is moving near the end of this triangle.

💥 Personally, I don’t trade when the price is in this area of the triangle and prefer to wait for the triangle to break, because there’s a high chance of random volatility that can cause missed opportunities due to incorrect entries.

✅ I recommend that you also wait for a breakout from this triangle and open a position only after it breaks—whether to the upside or downside.

✨ For a long position, you can enter after a breakout above 2.5. The main trigger will be the 2.847 zone. An RSI move into the Overbuy zone would also be a great confirmation for this position.

🔽 For a short position, our first trigger is the 1.909 level. If this level is broken, the price could start a downtrend toward 1.461. The main confirmation of a bearish trend will be a breakdown below 1.461.

📊 In any case, whichever trigger gets activated, I believe volume confirmation is essential. If volume increases along with price movement, the likelihood of that move being a fakeout decreases.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Could PEPE reach a staggering 3000X and hit a market cap of 69B...this year?

YES 69 BILLION Dollars for a Frog coin!

To assess the potential growth of a cryptocurrency, we first need to identify its all-time low price.

Coinpedia reports that PEPE's all-time low was $0.00000005514 on ETH via Uniswap on April 18, 2023, marking the lowest price recorded on a decentralized exchange.

For PEPE to achieve a 3000X increase, it would need to rise to $0.00016542 by December 31st.

Given its current price of $0.000014238, this represents an 11.5X increase from its present value.

With a total supply of 420.69 trillion tokens, reaching the target price would result in a market cap of $69.58 billion.

While this may seem ambitious for a memecoin lacking utility, the idea of hitting such a whimsical market cap is tempting.

I estimate the likelihood of this happening at around 2.5%.

(This scenario also suggests a reasonable portfolio allocation for those primarily holding #BTC and #ETH and I highly suggest rebalancing above 5%)

TradeCityPro | HYPE: Bullish Momentum Builds Near Resistance👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the HYPE coin for you. The Hyperliquid project is one of the DEX projects in the crypto space that also functions as a Derivatives platform, and it currently holds the highest 24-hour volume among all DEXs.

🔍 The token for this project, with the symbol HYPE, has a market cap of $7.23 billion and is ranked 20th on CoinMarketCap.

⏳ 4-Hour Timeframe

In the 4-hour timeframe, as you can see, this coin is in an uptrend with an ascending trendline, and it’s currently encountering resistance at 21.48.

📈 If the price stabilizes above this zone, a new bullish wave can begin, with the next resistance being at 22.799.

✔️ You can enter a long position using the 21.48 breakout trigger. Buying volume has increased significantly, which raises the chances of this level breaking.

📊 For short positions and a potential bearish trend in this coin, the first trigger would be a rejection from the 21.48 resistance. If the price gets rejected at this level, the likelihood of breaking the trendline increases.

⭐ A break of the trendline itself can also serve as a trigger. Breaking this trendline would eliminate bullish momentum in the market, and a breakdown below the 39.29 level on the RSI would further support bearish momentum.

🔽 The main short position can be opened upon breaking the 19.552 level. This is a very strong support, and if the price closes below it, it could drop further to 17.88.

👀 Overall, the long setup on this coin looks quite logical, and if the 4-hour candle closes as is and doesn’t turn out to be a fakeout, it could be a great entry opportunity.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | CAKE: Slicing Through the Market's Range Box👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices, focusing today on the CAKE coin, as requested in the comments. This coin holds a market cap of $511 million, ranking 93rd on CoinMarketCap.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, there's a very large range box existing from 1.093 to 4.753. This box represents a substantial range, and the price has been in this box for almost three years.

🔍 There's a significant area within this box at 1.549, which currently acts as a very important support. The price has hit this level several times but has yet to break through it.

⚡️ In this timeframe, indicators are not very useful because it's a ranging trend, and in ranging trends, these tools don't perform well. The best tool we can use to analyze a ranging market is support and resistance.

📊 Currently, there is a support at 1.549, as mentioned, which the price has hit several times and has been supported by. If this support breaks, there's another very important support at 1.093, which will be the last support area for the price.

🛒 For buying this coin in spot, there is a very strong supply zone near 4.753. I recommend waiting until this area is broken to start the main bullish trend. This break would signify a potentially strong upward move, so entering before this break could expose you to unnecessary risks given the current ranging conditions.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

dYdX: Your Altcoin ChoiceIs it just me, or does anybody else think that charts look great when they trade at bottom prices?

I highly doubt that I am alone on this one; Once we hit bottom... The market is ready for growth; huge growth, massive growth.

Welcome my dear friend and thank you for reminding me to visit dYdX, a pair/project/exchange (DEX) that we love and will continue to love long-term.

What does the chart say?

The chart says, "Buy when others are fearful." "There is no moment like this now." "Opportunities are endless."

The chart is saying, "I've been going down but the last down has no force. I can go down for a while but never forever done. Once the correction is over, I am going up."

The chart is saying, "The last low is nothing more than a break of support. It is a market move, the whales are looking for liquidity before massive growth."

The chart says, "The best time to buy is now. Focus on the long-term; buy and hold."

Well, it is me saying all these things based on the data coming from the chart.

dYdX looks great.

A great buy.

Thanks a lot for your continued support.

Namaste.

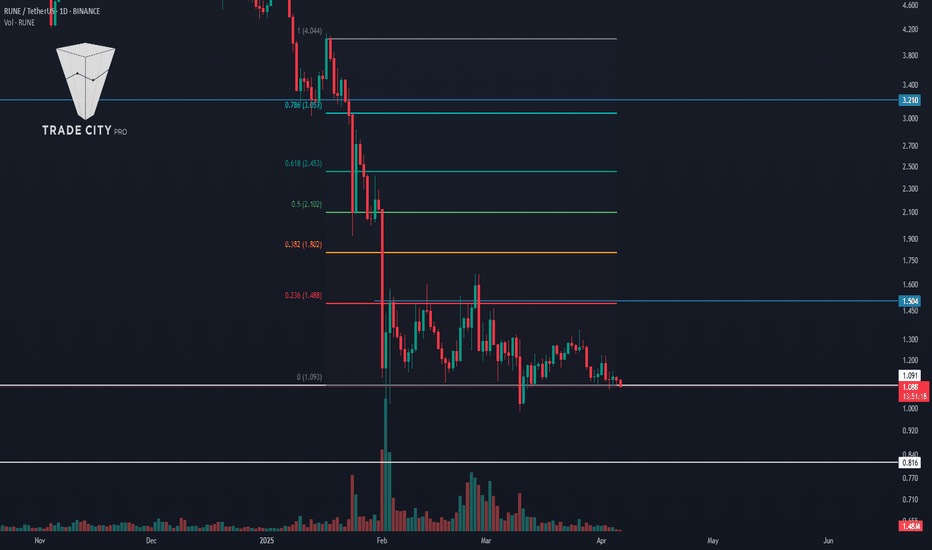

TradeCityPro | RUNE: Decoding Its Descent in DeFi Markets👋 Welcome to TradeCity Pro!

In this analysis, I want to discuss the RUNE coin, which was requested in the comments of yesterday's analysis. This project is one of the DeFi projects, with a market cap of $383 million, ranking 118th.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, it has started a downward leg from the peak of 6.894 and is moving downwards, reaching the area of 1.110.

✔️ Currently, it seems that the downward momentum has slightly decreased, and the price is moving downward more slowly. The RSI oscillator is also near the 30 area, ready to enter into Oversell and introduce a new downward momentum into the market.

💫 If this occurs and the price consolidates below 1.110, the next support will be 0.816, which is a very important floor, and if this area breaks, the last support the price will have is 0.386.

🔑 On the other hand, if the price is supported at 1.110 and breaks the trend line that the price has, we can confirm a trend change and the start of a new upward trend. The main trigger will still be 6.894.

📅 Daily Timeframe

In the daily timeframe, the price has a range box between 1.091 and 1.504, and after the downward leg following the break of 3.210, it has now entered a ranging phase and is ranging in this area.

🔽 For a short position, given that the price has hit a lower high compared to 1.504, the likelihood of breaking the floor of the box is high, and with the break of 1.091, we can enter a short position.

📊 An important point is that the market volume in this range box has decreased significantly and keeps decreasing. With the entry of volume in any direction, the market can start moving in that direction.

📈 If buying volume enters the market, the first long trigger is the break of the 1.504 area. This area overlaps with the 0.236 Fibonacci, and breaking this area, the next important levels are 0.382, 0.5, and 0.618 Fibonacci.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

JUP/USDT

Area entry: blue zone

Sl: 0.42

TP 1: 0.68

About Jupiter

As one of the industry's most advanced swap aggregation engines, Jupiter excels in delivering essential liquidity infrastructure for the Solana ecosystem. Moreover, Jupiter is actively expanding its DeFi product offerings, featuring a comprehensive suite that includes Limit Order, DCA/TWAP, Bridge Comparator, and Perpetuals Trading.

TradeCityPro | Deep Search: In-Depth Of Uniswap👋 Welcome to TradeCity Pro

Today, we have a Deep Research on the Uniswap project. In this analysis, I will fully review this project. First, let's go over the project's details, and then I'll analyze UNI technically.

🔍 What is Uniswap?

Uniswap is a decentralized exchange (DEX) operating on the Ethereum blockchain that allows users to swap ERC-20 tokens without relying on traditional order books. Instead, it uses an Automated Market Maker (AMM) model, where liquidity providers add funds to pools and earn trading fees.

Uniswap was founded by Hayden Adams and launched in 2018. Since then, it has gone through multiple upgrades, with Uniswap V3 being the most recent version, offering improved capital efficiency.

🗝 Key Features:

Decentralized & Permissionless: No central authority controls trading.

Liquidity Pools: Users provide liquidity and earn a share of trading fees.

AMM Model: Uses the x*y = k formula to maintain price balance.

Non-Custodial: Users retain control over their assets.

No Listing Fees: Anyone can list tokens, unlike centralized exchanges.

🔍 UNI Token Overview

UNI is the governance token of Uniswap, allowing holders to vote on protocol upgrades and treasury decisions.

🔹Tokenomics

Total Supply: 1 billion UNI

Inflation Rate: After September 2024, a 2% perpetual annual inflation will be introduced.

Circulating Supply: UNI is released gradually over 4 years.

Current Circulating Supply: About 550M UNI

🔹Token Allocation

Governance: 45% - 450M UNI

Team: 21.3% -212.66M UNI

Investors: 18%- 180.44M UNI

Community Token Distribution:15%- 150M UNI

Advisors: 0.69%- 6.9M UNI

Now that we have reviewed the project, let’s move on to the chart to analyze it from a technical perspective.

🔹Uniswap’s Evolution: V1, V2, V3

Uniswap V3 Innovations

-Concentrated Liquidity: LPs can set price ranges for providing liquidity.

-Multiple Fee Tiers: Traders can select different fee levels (0.05%, 0.3%, 1%).

-Capital Efficiency: More precise liquidity allocation for better returns.

—

🔒Token Unlock & Vesting Schedule

Current Unlock Progress

- Unlocked: 55% (549.94M UNI)

- Untracked: 45% (450M UNI)

- Locked: 0% (All tokens are being tracked or unlocked)

—

🔹Vesting Schedule

Group - Vesting Duration - Unlock

Team : 47 months (ended Aug 2024) -2.08% monthly

Investors: 47 months (ended Aug 2024)- 2.08% monthly

Community Distribution:Fully unlocked- 100% at TGE

Advisors: 47 months- 2.08% monthly

⚠️Important: The untracked 450M UNI tokens can be unlocked at any time, making them a potential source of market volatility.

—

Uniswap Governance & DAO

The Uniswap DAO allows token holders to participate in protocol decisions.

Governance Process:

1) Proposal Submission – Requires 25,000 UNI votes to enter deliberation.

2) Consensus Check – Needs 50,000 UNI votes to proceed.

3) Final Governance Vote – 40M yes-votes required for approval.

Uniswap DAO Treasury

$1.6 Billion worth of assets.

Previously largest DAO, now second (behind BitDAO).

—

❗️Security & Risks

🔹Security Measures

1) Smart Contracts Audited – Regular security reviews.

2) Decentralized Governance – Protocol updates are voted on by UNI holders.

3) Non-Custodial – Users always control their own funds.

🔹Risks

1)Ethereum Gas Fees – High network congestion leads to expensive swaps.

2) Impermanent Loss – LPs may lose value if token prices shift.

3) Governance Risks – Power concentrated among whales.

4) Smart Contract Exploits – DeFi platforms remain high-risk targets.

🖼NFT Expansion – Uniswap Acquires Genie

Uniswap acquired Genie, an NFT marketplace aggregator, to integrate NFT trading into its ecosystem.

🔹Genie Features:

-Aggregates NFTs from multiple marketplaces.

-Batch NFT purchases in one transaction (reducing gas fees).

-Plans for USDC airdrops to early Genie users.

Uniswap had previously launched NFT-backed Unisocks (2019), linking real-world assets to NFTs.

—

👛Best UNI Wallets

MetaMask

Trust Wallet

Ledger

Coinbase Wallet

SafePal

Solflare

OKX Wallet

—

💲Uniswap Team & Key Investors

Hayden Adams: Founder & CEO

Mary-Catherine Lader: COO

Marvin Ammori: CLO

💵Major Investors

Coinbase Ventures

Defiance Capital

Paradigm

ParaFi Capital

Delphi Digital

💰Total Funding Raised: $188.80M

🎯Uniswap's 2025 Roadmap and UNI Token Developments

In early 2025, Uniswap introduced Uniswap v4, marking a pivotal evolution in its protocol. This version emphasizes developer flexibility through the integration of "hooks," modular plugins that allow for tailored functionalities such as dynamic fees and automated liquidity management. These enhancements position Uniswap v4 as a versatile platform for DeFi developers, fostering innovation and adaptability within the ecosystem.

Unichain: Uniswap's Layer-2 Scaling Solution

To address scalability and transaction efficiency, Uniswap launched Unichain, its proprietary Layer-2 solution, on January 6, 2025. Built on the OP Stack, Unichain aims to deliver faster transactions and reduced fees, enhancing the overall user experience. The mainnet launch follows a successful testnet phase that processed over 50 million test transactions, underscoring its readiness for broader adoption.

—

🔹Several reputable platforms for creating liquidity pools

Uniswap

Pancakeswap

Raydium

Shibaswap

Biswap

MDEX

Balancer

Thena

Quickswap

Defiswap

Honeyswap

Warden

—

🔹Certik: 94.28

📈On-Chain Analysis of UNI

Analyzing Uniswap’s on-chain data, we observe key trends in profit and loss positioning, whale activity, and network engagement:

Around the $7.40 price level, approximately 39.55 million UNI tokens are in a loss position, indicating a potential resistance zone. Meanwhile, support levels remain weak due to a lower volume of profitable tokens.

Large transactions show slight spikes during price declines, suggesting a lack of strong buying interest from major investors.

Whales hold 51% of the total supply, making their trading activity crucial. Currently, addresses with holdings between 100 million to 1 billion UNI and 10 million to 100 million UNI are engaging in selling, adding downward pressure on price.

Network activity, including active and new addresses, is on a declining trend, signaling reduced user engagement and transaction volume.

Based on on-chain metrics, there is no significant buying pressure or demand at the moment, raising concerns over short-term price recovery.

📊Uniswap TVL Analysis

Since early December, Uniswap's Total Value Locked (TVL) has shown a slight increase, rising from 1.72 million ETH to 1.94 million ETH. However, this growth remains considerably lower compared to the levels observed in 2021, reflecting a slower pace of liquidity accumulation.

Now that we have reviewed the project, let’s move on to the chart to analyze it from a technical perspective.

📅 Weekly Timeframe

In the weekly timeframe, we observe a long-term range-bound trend with a slight upward slope. Currently, the price is experiencing a downward move, with the primary support at 5.841.

💫 If this level breaks, the price may continue declining, and the next key support is at 4.025. On the other hand, if RSI does not drop below 38.74 and the price holds above 5.841, we can have more confidence in a potential price increase.

🎲 In this scenario, the key resistance levels are 11.638 and 18.794. The main trigger for buying is the breakout of 18.794, and the major sharp price movement will occur after breaking the ATH resistance at 42.92.

🔽 The critical support level that should not be lost is 4.025, as breaking below this level could result in a sharp bearish movement, and in that case, we will use Fibonacci tools to determine the bearish targets.

📅 Daily Timeframe

Now, let’s move to the daily timeframe for a more detailed view.

🔍 As seen in this timeframe, after price consolidation below 12.559, the second corrective wave has begun, and the price has currently fully retraced the previous bullish wave, reaching 6.670.

📉 If this level breaks, the next key supports are 5.556 and 4.025, with 4.025 overlapping with the 1.5 Fibonacci extension.

⚡️ If the price finds support at the current level, an appropriate trigger for a long position would be the breakout of 43.54 in RSI, which can serve as a momentum confirmation. Once RSI breaks this level, we can look at lower timeframes to define a precise entry trigger.

🔽 On the other hand, if RSI enters the Oversold zone, the likelihood of breaking 6.670 or even 5.556 increases.

🛒 For a spot buy, the current valid trigger is a breakout of the $10 level, which is the last local high in this timeframe. The exact number for this breakout level will be determined based on price action and its reaction when it approaches the area.

💥 If the price experiences further decline and establishes new highs and lows, the spot buy entry should be based on the breakout of the newly formed high in the downtrend.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | SUSHI: Key Levels and Market Outlook👋 Welcome to TradeCity Pro!

In this analysis, I want to review SUSHI for you. SushiSwap is a DeFi protocol operating in the DEX sector, with its token currently ranked 195th on CoinMarketCap and a market cap of $58 million.

📅 Weekly Timeframe

On the weekly timeframe, we can see a consolidation box between $0.534 and $1.959. Since 2022, the price has been fluctuating within this range, forming a large consolidation zone, with multiple touches to both the upper and lower boundaries of this box.

🔍 As observed, in the last bullish leg, the price broke above the box's upper boundary with a large weekly candle. However, it quickly retraced back into the range after being rejected at $2.734, resulting in a fake breakout.

🧩 Currently, the price is near the lower boundary of the range at $0.534. If this support level breaks, the price could initiate another bearish leg and move toward a new all-time low (ATL). On the other hand, if the upper boundary of the box is broken and price stabilizes above it, we could see an upward movement in SUSHI.

⚡️ The largest and most significant resistance ahead is at $20.444, which is the all-time high (ATH). Reaching this level would be extremely difficult, as it would require a significant increase in market capitalization, meaning a substantial capital inflow into the coin.

✨ Let’s now analyze the daily timeframe to gain more insight into price movement.

📅 Daily Timeframe

On the daily timeframe, as seen in the last bullish leg, the price bounced from the $0.534 support and moved upward. After breaking $0.803, strong bullish momentum entered the market. Additionally, RSI reaching the oversold zone contributed to a stronger bullish push.

🔽 Following this movement, the fake breakout at $1.855 led to the start of a corrective and bearish phase, with the price initially declining to $1.347.

📊 After breaking below $1.347 and retesting it as resistance, the price entered another bearish leg, reaching $0.803. Currently, after some range-bound movement around this level, RSI has exited the oversold zone, and the price seems to be retesting this level as resistance.

✅ If RSI re-enters the oversold zone, the price could drop further to the lower boundary of the range at $0.534, which would not be a good sign for SUSHI. As observed, buying volume has significantly decreased, and most traders in this market are sellers.

🛒 For spot buying, I recommend avoiding this coin for now and waiting for a clear bullish structure to form. At a minimum, SUSHI should start showing strength against Bitcoin.

🧲 From a USDT perspective, if the upper boundary of the range ($1.855) breaks, then $2.734 could serve as a trigger for a buying opportunity.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the com

TradeCityPro | INCH: Delving into a Leading DEX Project👋 Welcome to TradeCityPro!

In this analysis, I want to review the INCH coin for you. It's one of the DEX projects in crypto, active in the DeFi space, and considered one of the successful projects in this category.

📅 Weekly Timeframe

As you can see in the weekly timeframe, after its launch, the price began a downward trend and is currently in a consolidation box between $0.2098 and $0.6270.

⚡️ The bottom of this box is a very important support, arguably the only and last support for this coin. Conversely, the top of this box, as you can see, is a very strong supply zone. The price has approached this area several times with high momentum, but it has been rejected each time and returned to the bottom of the box.

🔍 Currently, as you observe, the price, after being rejected from this level, has moved downward and reached the bottom of the box, where it has been ranging for about three weeks. If this bottom breaks, the price could move lower and set a new all-time low (ATL), which would worsen the project's situation.

📈 However, if the price can rise from this area, finally moving upwards and breaking the supply zone, it could successfully start its bullish trend after several years.

🚀 The targets for the bullish trend are initially at $0.8438 and then at $2.0175. The ATH area is at $7.1331, which seems far from the current price and out of reach unless the market cap of 1inch significantly increases.

📅 Daily Timeframe

In the daily timeframe, as we observe, we can see more details about the last downward movement. As you see, after entering the correction phase, the price first corrected to $0.3638. However, after stabilizing below this area, the next downward leg started, and currently, the price has reached $0.25 and has formed a small box between $0.25 and $0.2756.

🔽 For short positions, we have a very suitable trigger at $0.25, where if this area breaks, the price could move down to its main support at $0.2226.

✅ On the other hand, if this box that the price has formed breaks upwards and the price can stabilize above $0.2756, forming a higher low and higher high, we could say it has risen from the bottom of the box and could move higher.

💥 Overall, the price is in a very large weekly box, and any spot purchases and positions taken within this box are highly risky. So, be sure to not engage in excessive risk with this coin and wait until the large weekly box is broken either upwards or downwards.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️