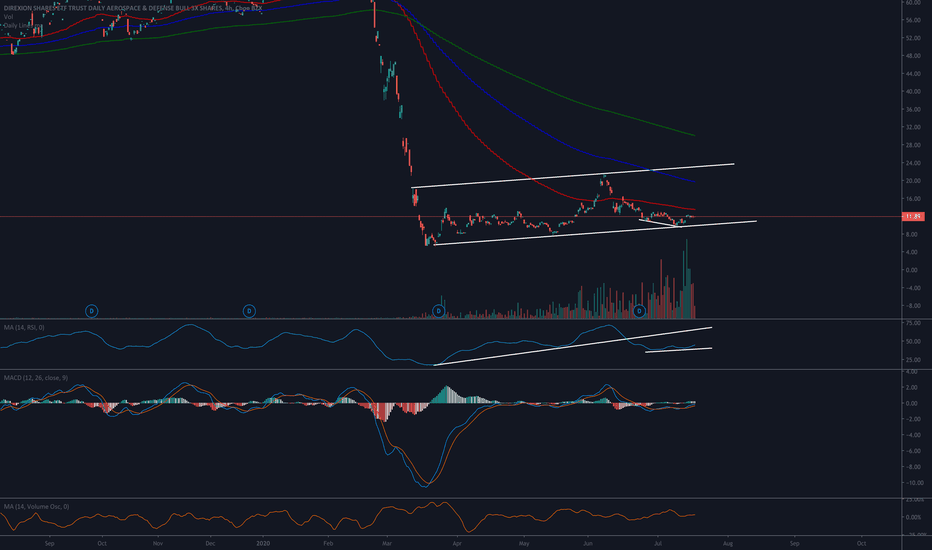

War is a Racket | DFEN | Long at $28.00The war machine keeps turning. Profits will reign. Direxion Aerospace and Defense 3x AMEX:DFEN never fully recovered from pandemic lows, but world peace is (unfortunately) far from reach. The uptrend in the chart has commenced. Personal entry point at $28.00.

Target #1 = $37.00

Target #2 = $50.00

Target #3 = $64.00

DFEN

LMT a defense large cap dips for buyers LONGLMT has been flat sideways since a good earnings beat 5 weeks ago. Lockheed Martin as a

defense contractor is in a growth environment with the US supplying arms to Ukraine as well

a Isreal. Domestic stockpiles and those of NATO are somewhat depleted. The contraacts will not

catch up for years. Gone are the days of making face masks and gowns during COVID to keep

revenues flowing in. I see this 2% dip as a change to get a small discount on what should

be a stock with upside for some years to come. This is a long swing trade not expectant of

a 3-4% profit in a week. I expect to hold this at least until the next earnings if not through

the presidential elections where the defense and national security perspectives of the

incoming or returning president may be a factor in the fundamentals of defense contractors.

MNTS- Momentus secures federal contract LONGMNTS is now contracted with the Pentagon and NASA for space exploration work including

satellites and a space station pages.optimallivingdynamics.com

Traders and investors reacted in the past day or two. MNTS is currently priced at about 99.9 %

of its ATH of about $1250 three years ago. Accordingly, it is a penny stock with a potential

1000X upside. That is to say $ 1000 could become $1 M. 135 million shares traded in the past

day. Revenue increased 4X quarter to quarter. The Price X Volime Trend had and impressive

pop I will take a speculative long trade here for a long duration swing trade to see if

MNTS can launch higher.

RTX a defense contractor large cap LONGRTX has earnings on April 23rd. It has been on a good trend higher since the last earnings. The

Russian war means US defense contractors will be in a growth mode for the intermediate

future. Depleted stores of weapons systems need to be replenished. Pieces and parts are

needed for damaged systems in need of maintenance. I see RTX and others such as GD and

LMT as good long-term trades or investments. Smaller companies in the areas of robotics and

drones may be worth a look. RTX is at its all-time high but it seems much higher is in its future.

RTX falls on good earnings and defense budget issuesRTX is part of the boom defense sector thriving because of back orders created by

the Russian war against Ukraine. No matter good earnings it fell this week because

of the defense budget debate in Congress. No matter good intents to rein in the

defend spending escalation and spend in other areas such as social and infrastructure,

Russia has made the world more dangerous and national security of the US and its allies

trumps most spending except perhaps insterest on the national debt and paying the

holders of Treasuries. RTX dropped more than 10% from its tight consolidation range,

I see this dip as an excellent buying opportunity into a leader in the defense sector.

LMT a defense sector leader setup LONGOn the daily LMT, over the long term is shown to have descended into the support

of the ascending support trendline in what appears to be an ascending wedge.

Confluent with the support trendline is the mean VWAP and the mean band of

the Bollinger Bands. I see an opening for a long trade targeting the resistance

trendline and also the second standard deviation of the anchored VWAP ( red

thick line) Fundamentally, LMT just beat on both the top and bottom lines.

It is in a obvious growth industry with a bakclog of production in the setting

of the Russian Ukraine war and the need for US and NATO to replenish their

stockpiles. This long trade is best for investors content with slow moving blue

chip Dow Jones type stocks or alternatively agile options traders able to leverage

low magnitude up trends. I see about 10% upside and will buy some call options

to exploit this setup.

Is the DFEN dip buyable?I think that the dip is very buyable. Fundamentally, Russia has made the world more

dangerous. Shipments of weapons to Ukraine have depleted US and European stockpiles.

NATO is in a growth mode as proposed by former president Trump some years ago.

While many would like less defense spending and shift it into social spending or

infrastructure or clean technology government funding. the pragmatics are that

national security is generally higher on the priority list. DFEN just dropped below

the high volume area of the volume profile on the 15 minute chart in a VWAP breakdown.

The relative strength lines did a bottom bounce on the indicator. I will exploit this

as a long buying opportunity looking to a modest 5% upside target at minimal risk.

GD Swing Short SetupBMV:GD

GD has bounced down from resistance of sell order blocks.

Relative Strengh downturn confirms.

This is setup as a swing short with a Reward to Risk of 4.

GD will recover from this reversal as this defense contractor

is in a boom sector, giving the geopolitical /macro overlay.

Also check RTX and LMT.

ITA Aero-Defence etf bottommed if 93 holds & it BO channel @103ITA has been in a downchannel even before invasion. It only overshot during invasion to make an ATH @113.37. Since then, it made an ABC corrective wave & came back down to retest channel base near the 93 zone.

BULLISH CASE: it bounced after retesting channel base @93 but was stalled by ma50.. 93 is a VOLUME PROFILE zone & is the Fib 0.382 retracement level. It is also the vwap from 2009 low. If 93 holds,

ITA will break above ma50 & target the 103 yellow resistance zone & try to BO of the downchannel started in May2021. 103 is the 0.382 Fib level.

BEARISH CASE WARNING: if ITA fails 93 zone & break down from the channel, there is very low volume below until 85, with only a small support at 90. Measuring the H&S move from ATH will send ITA to as low as the 80 zone.

Not trading advice

Ducommun - technical/fundamental bullDCO has a beautiful looking chart!

It has been in an uptrend channel since the beginning of 2017. (check chart for more details)

Earnings report trend are usually positive surprises, that have maintained the trend so far.

-------

I would consider entering a position if we brake SMA(50) on a daily chart, with strong volume. (currently at $45.3)

Have a great weekend!

Happy trading,

dorfmanmaster

RADA on Radar within #Defense & AeroRADA looks to be forming cup and handle pattern on daily chart. Looks to have already completed 1st and second wave in uptrend (2 of 5), which also filled a previous gap.

This stock seems to be flying under the radar ; )

Please Like and Follow so I can continue finding trade setups. Thank you in advance =)

Check me out on Instagram or Twitter @VolatilityWatch

Disclosure: I do not own RADA. I may buy/ sell within the next 72 hours. This is NOT a note to buy or sell. Please do your homework before investing.