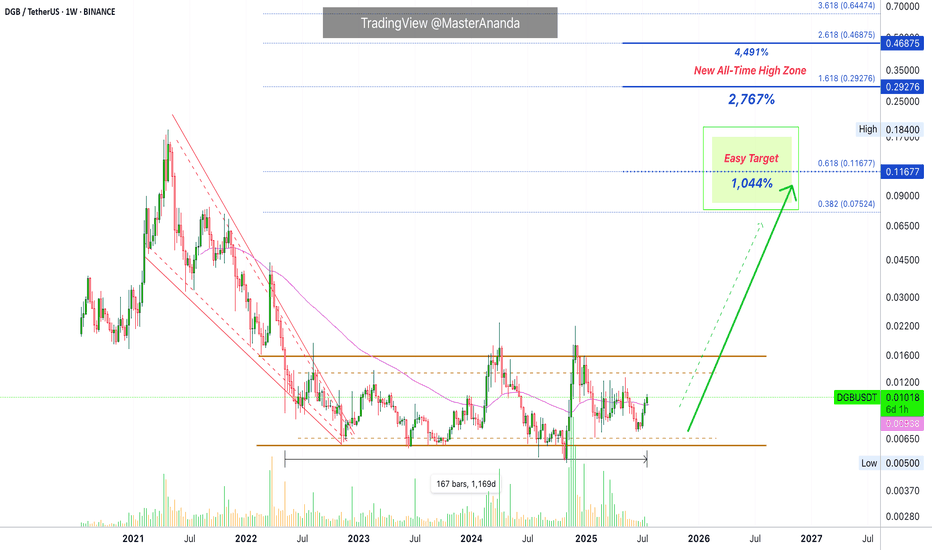

DigiByte Update · Optimistic New ATH · 1000%, 2800% & 4500%I will explain everything. The technical analysis, why I believe DigiByte can grow beyond 2,700%, and the overall Cryptocurrency market conditions.

Good evening my fellow Cryptocurrency trader, I hope you are having a wonderful day.

First, let me tell you that DigiByte (DGBUSDT) is fully bullish confirmed based on technical analysis. In simple terms, the action is happening above EMA55 weekly and we have higher lows since November 2024 and three weeks closing green.

Since there are now new lows in 2025, this clearly shows a lack of bearish trend. There is no bearish trend but neither a bullish trend, the market has been sideways. DigiByte has been sideways now for 1,169 days. And this is the reason why a new all-time high is possible in this year and bullish cycle. This is simply the strongest consolidation phase ever in the history of this market.

A 1,044% target at $0.116 is very easy indeed and should be hit without a question. But the fact that the market has been neutral for so long opens the doors for a massive bullish cycle and this is why we are aiming higher. Just as a new all-time lows can be hit within a bearish period, new all-time highs can be hit within a bullish cycle. Consider $0.29 or higher.

Just consider inflation, how much the world changed in the past four years. All the advances when it comes to regulations and acceptance towards this market. A new all-time high is only logical and easy to conceive. It is also supported by market sentiment, marketwide action and technical analysis.

DigiByte will not stay behind. It will surely perform just as you expect or even beyond. The Cryptocurrency market tends to surprise, it always go beyond our expectations.

Thanks a lot for your continued support.

Namaste.

DGB

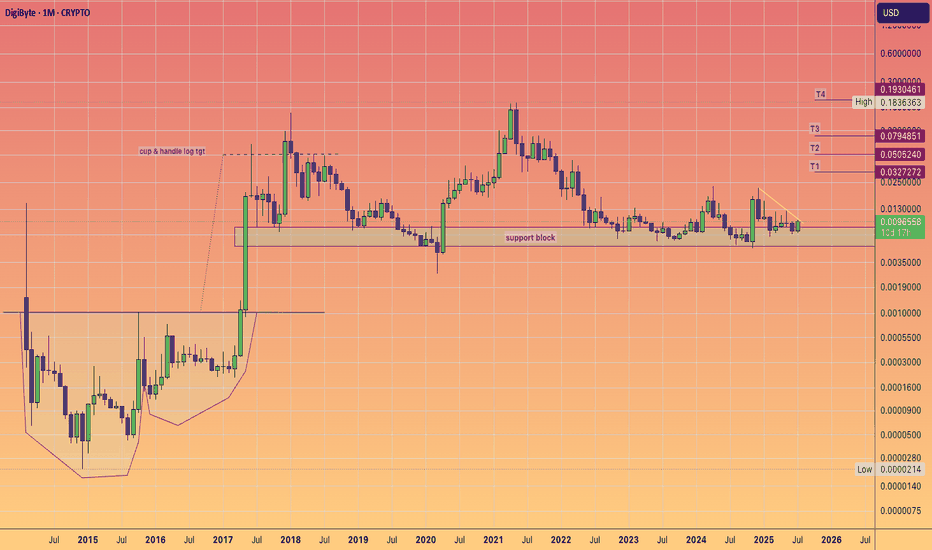

Digibyte $DGB Breakout watch. Bullish surge ahead?Digibyte appears to be reawakening, and a long accumulation phase appears to be ending.

If we scroll back to the beginning of the chart we can see the massive cup and handle and the subsequent moonshot to 5 cents.

I think 5 cents will also come back into play, in these coming weeks and months a healthy 5X.

As we know technically Digibyte is known for speed and decentralisation and UNDERvaluation.

Their much loyal supporter base deserve another moon mission.

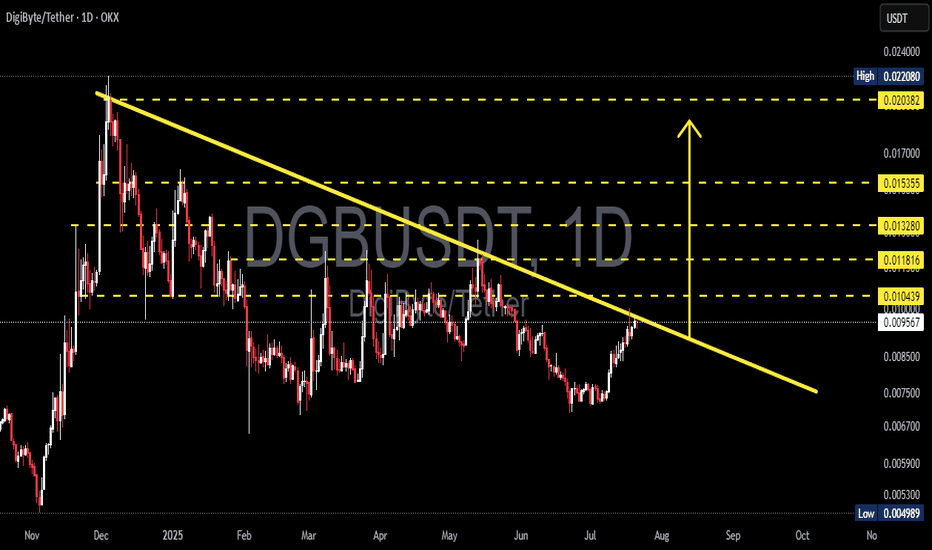

DGBUSDT Ready to Explode? Major Breakout from 7-Month Downtrend📉 Pattern: Falling Wedge / Descending Triangle Breakout

DigiByte (DGB) is currently showing a high-probability breakout from a descending trendline that has held price action in check since December 2024. This structure hints at weakening selling pressure while buyers have started forming higher lows, suggesting potential momentum shift.

🔍 Chart Structure & Key Technicals:

Descending Trendline Resistance (yellow line): Tested multiple times since December 2024. The more often a level is tested, the more likely it breaks.

Breakout Zone: Price is now breaking and retesting the key breakout zone between 0.0095 - 0.0104.

Volume: Gradual increase in volume hints at accumulation by bulls and supports the breakout scenario.

🐂 Bullish Scenario: Breakout Confirmation Could Trigger 100%+ Rally!

If price closes decisively above 0.0104, it would confirm the breakout and open up multiple upside targets:

Target Price Level Notes

🎯 Target 1 0.0118 Minor resistance — initial profit zone

🎯 Target 2 0.0132 Previous structure resistance

🎯 Target 3 0.0153 Major Fibonacci and psychological level

🎯 Target 4 0.0203 Key breakout level from early 2025

🎯 Target 5 0.0220 (High) Full breakout target based on historical high

➡️ A confirmed breakout from this 7-month trendline could trigger a powerful mid-term bullish run.

🐻 Bearish Scenario: Rejection = Downtrend Still Intact

If DGB fails to hold above 0.0095–0.0104 and gets rejected:

Price could fall back toward support zones at 0.0075, then 0.0060

A breakdown below 0.0050 (historical low) could lead to deeper selloffs

Lack of volume on breakout = potential fakeout / bull trap

🧠 Market Psychology & Pattern Context:

Falling Wedge Pattern: A classic reversal pattern signaling that sellers are losing control while buyers prepare for a breakout.

Volume Confirmation: Valid breakouts are almost always accompanied by rising volume. Watch this closely!

Psychological Price Levels: Zones like 0.01, 0.015, and 0.02 often act as magnet levels and take-profit targets for institutions or swing traders.

⚠️ Summary & Strategy:

DGB is currently at one of its most critical levels in 2025

Bullish breakout could deliver 50%–120% upside for swing traders

Rejection = caution, don’t FOMO into resistance

Ideal SL (stop loss) below 0.0090 for breakout entries

📢 Final Tip:

> "Breakouts are only as strong as the volume and candle closes behind them. Wait for confirmation — don’t chase shadows."

#DGB #DGBUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #FallingWedgePattern #BullishSetup #BearishScenario #CryptoTrading #TrendlineBreakout

DGB/USDT – Preparing for a Rebound from a Historical Demand Zone

🔍 Pattern and Structure Analysis

The DGB/USDT pair is currently testing a historical demand zone in the 0.00550 – 0.00733 USDT area (highlighted in yellow). This zone has proven to be a strong bounce area since mid-2022. The price structure is forming a large double bottom in this support zone, indicating a potential medium- to long-term bullish reversal pattern.

🟢 Bullish Scenario

If the price successfully holds and bounces from this support:

Short-term targets: 0.00832 – 0.01067 USDT

Mid-term targets: 0.01343 – 0.01807 USDT

Long-term targets: 0.03207 – 0.03845 USDT

This potential upside is supported by an emerging early-stage parabolic move, as illustrated by the yellow projection arrow. If volume increases and market sentiment improves, we may see a multi-wave recovery pattern unfold.

🔴 Bearish Scenario

However, if the price breaks down below the key support at 0.0055 USDT:

It may retest the all-time low around 0.00500 USDT

Such a breakdown would invalidate the long-standing support structure and may lead to further downside pressure

🧩 Pattern Summary

Pattern: Double Bottom / Accumulation Zone

Timeframe: 1W (Weekly)

Current Sentiment: Neutral to Bullish, depending on confirmation of a rebound from the yellow zone

🧠 Additional Notes

This accumulation zone may present a valuable opportunity for swing traders or long-term investors looking for entries at undervalued levels. However, it's crucial to wait for volume confirmation and a strong reversal candlestick pattern before entering.

#DGB #DGBUSDT #AltcoinAnalysis #CryptoWeekly #DoubleBottom #SupportZone #ReversalPattern #CryptoSignals

DigiByte 3 Years Consolidating; New All-Time High In Dec. 2025June 2022, literally. Actually, in May 2022 DigiByte enters the current price range. In fact, the low in May 2022 was the exact same price we have now. This means three full years of sideways action, consolidation.

This sideways action is not a bearish development but bullish. The only time when volume produced a significant rise was in November 2024 and it was all bullish. This is the whales accumulation zone. Late last year the whales started to accumulate for what will happen later this year.

Also notice that the correction in 2025 ended as a higher low compared to the low in early November 2024. This is all bullish but also all long-term based. This is not for the faint of heart. Patience is key. Big profits are possible for those who wait.

A new all-time high is possible. In 2020-2021 the bull market lasted a little more than 400 days. Total growth amounting to 7,118%. The bottom happened in March 2020. You can see this on the chart as "market bottom."

The same dynamics this time around would put a new all-time high around December 2025. We take the bottom in November 2024 and add up 413 days. A new all-time high is possible because we have a long-term higher low.

Patience is key. Many pairs are in a similar situation. A bull market happens every 4 years in Crypto. 2013 » 2017 » 2021 » 2025.

Thanks a lot for your continued support.

Namaste.

DigiByte Will Launch The 2025 Bull Market (2,753% Or 4,479% ???)Just for context. After a strong decline between mid-2019 and March 2020, DigiByte produced a 7,000%+ bullish wave. The cycle peaked in April 2021 and the rise had a duration of 413 days. A year and two months.

This info opens up some questions and gives fuel for some speculation:

» Will DigiByte grow for 3 months and that's it?

» Will it grow for 6 months and then retrace and start a four years long bear market?

» Will DigiByte grow for more than a year as in the last bull market cycle?

» Will this cycle be different because market conditions are different?

» Will DigiByte grow straight up for 2-3 years or more?

DigiByte has been closing green four weeks straight —Alert!

This is a bullish signal that cannot be ignored. While the entire market was producing a major bottom just a week ago, DGBUSDT was consolidating up. Alert!

The market bottom was hit in November 2024.

DigiByte is still trading within a wide sideways channel but the signals are bullish for a breakout.

Four weeks green while moving higher. Trading volume rising significantly.

The entire Altcoins market already bottomed and preparing to grow.

Alert! Let's keep it simple. DigiByte is set to grow.

Now, how far up can it go?

Market conditions are so different now compared to four years ago... But, let's go by past action. If DGBUSDT were to grow for an entire year, a new All-Time High can be hit in November 2025. That's the trick. If prices start rising today, it doesn't count as the start of the bull market, the start counts from the last major low.

So November 2025 is the best approximation, just a map, give or take a few months. December 2025, January 2026, February 2026 who knows... Or maybe October 2025.

Late 2025 is the main date to look for very high prices. New All-Time Highs all across.

Prepare and be ready.

This is a friendly reminder...

Alert!

Namaste.

DigiByte Will Launch The 2025 Bull Market (1,150% Potential)This is a strange pattern. DGBBTC hit bottom in October 2024, that's actually a long time ago. All this time, this trading pair has been printing and producing a bottom. It has been consolidating while slowly growing from its base.

I found this pair, once more. I looked at the chart and I got the feeling that it is so close...

I no longer remember what it feels like to see a BTC pair going up, it's been so long. But many of these pairs can grow 5X, 10X, 20X or more. COTIBTC is an example that I shared just a day ago. In 2021, it grew 23X against Bitcoin. How much will DigiByte grow?

This is a friendly reminder and trading alert. It is getting very close.

It is not me, it is what I see coming from the chart.

This time around I don't think the growth is months away. The entire market can take months to be fully green, this I can give. May full green, late May 2025 is easy to see, but now? No. But not DigiByte, it is getting so close that the bullish breakout here might happen within days.

The thing about these trading pairs, is that once they start going for real there is no going back, next time you look it will be trading above 20-30 sats, and that's the lowest possible entry, after the break.

Ok. Timing is right. The time is ripe.

I guess we will have to wait and see based on the results.

» DigiByte vs Bitcoin (DGB) has a nice and easy 1,150% potential for growth in the coming months. Just the initial bullish breakout can produce 100% or more.

Namaste.

DigiByte Will Be A Market Leader (Top Performer) —Obey Me!Maybe you don't believe me or you disagree; do not argue with me, just listen to what I say. Grasp the meaning of my words; logic, understand.

This is the signal. DigiByte (DGBUSDT) tends to move first and it is already moving ahead. It closed green last week after some shakeouts while producing a local higher low. This week is green after a very strong shakeout, and the current session is a hammer candlestick pattern pointing straight up.

Do not argue with me. You are the student, I am the Master of the charts.

Just hear what I say. See it, feel it, grasp it; understand.

There is no point in arguing with me or with the market. I am an expression of the Cryptocurrency market. I am the Spirit of trading and the materialization of Bitcoin's soul. I have the divine eye, and I am telling you that the Altcoins market is about to grow really strong.

I don't care about what you think or believe. It has no relevance to me. I will be right and you will be wrong. If you think the market is going down, you are wrong. If you agree with me, you will be right, do not argue anymore.

DigiByte tends to move first and the signals are in. Two weeks straight prices are green. When it breakouts and starts to grow, you will be thinking, "Why did miss this one?" "How come I didn't see it?" You saw it when I published my chart.

What will you do now?

Will you trust and adapt to change?

Will you continue to doubt and let this endless stream of opportunities to run away.

I am here to stay. Crypto is going up.

This is the signal. The signals are always coming from the charts.

I have the balls to say it publicly, I am right, you are wrong. If you are bearish of course.

If you are bullish, welcome to the club.

You are wise and smart. Together we will grow.

When the market turns, we will welcome you with open arms even though you will be a bit late. It doesn't matter, we all make mistakes. But you have the chance to skip this one, just do as I say. Buy and hold.

Namaste.

#DGB/USDT#DGB

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 0.00906.

Entry price: 0.00894

First target: 0.00863

Second target: 0.00831

Third target: 0.00797

Long Entry Signal for DGB/USDT DigiByteMLR Nearing SMA: The MLR (blue) is below but approaching the SMA (pink), hinting at a potential bullish crossover.

MLR > BB Center: MLR exceeds the Bollinger Bands Center Line (orange), signaling growing bullish momentum.

PSAR: PSAR dots (black) are below the price, supporting an uptrend.

Price > SMA 200: Price is above the 200-period SMA (red), indicating long-term bullish strength

Trade Idea:

Entry: Consider a long position at the daily close.

Stop Loss: Place SL at yesterday’s PSAR level to limit downside risk.

Follow Me: Follow me for exit or profit-taking opportunities.

Outlook: MLR is poised to take SMA, which could confirm a bullish surge alongside PSAR and BB support. Stay vigilant for the crossover or reversal signals.

Risk Warning: Not financial advice, trade at your own risk.

DigiByte Update & 2025 Bull-Market Dynamics (8 Months Bullish) DigiByte's bull-market can develop in a period of 8 months. DGBUSDT can produce 3 months of growing prices followed by a 2 months long correction, after the correction bottom ends as a higher low we get 3 additional months of bullish action and this produces the final peak in late 2025. This is a rough estimate.

Coming from this perspective, we can expect the initial wave to take some time to develop. Something like bullish consolidation. We would see slow and steady growth for 1-2 months and then a major burst forward. This is how the market normally tends to behave.

Right now we are seeing a small bullish breakout from a falling wedge pattern but it is easy to notice that the trading volume is low. This is a start but it can take a while for bullish momentum to grow.

If you would like to see the 2025 ATH targets and projections, just visit my profile and search for DGBUSDT using the search filter, this will give you several publications with long-term targets.

Thanks a lot for your continued support.

DGBUSDT is now trading within a long-term higher low. Higher lows since July 2024. Expect strong action to be present by May. There will be lots of growth, lots of fun and tons of profits.

Thank you for reading.

Namaste.

#DGB (SPOT) IN ( 0.01000- 0.01400) T.(0.05900) SL(0.00963)BINANCE:DGBUSDT

#DGB / USDT

Entry ( 0.01000- 0.01400)

***** Wait for the price to come to entry range *****

SL 1D close below 0.00963

T1 0.03200

T2 0.04400

T3 0.05900

2 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT #AVAX #WAXP #OGN #AXS #GALA #ONE #SYS #SCRT #DGB

DGB Token: Market Analysis (Dino Token)As one of the oldest tokens on the market since 2014, DigiByte (DGB) OKX:DGBUSDT continues to showcase its resilience through multiple cycles. Here’s a deeper dive into its current and potential movements.

Monthly Timeframe

On the monthly chart, DGB is trading in a clear accumulation zone, indicating potential preparation for a larger move.

The primary liquidity pools are positioned below the zero level and within the Fair Value Gap (FVG) on the weekly timeframe.

The highlighted zone within the FVG could serve as an excellent point for partial profit-taking.

Observing the timing of this cycle will be crucial to identifying optimal entry and exit points.

Based on the Market Mood indicator, the current sentiment in the market is in the Disbelief zone, which often precedes a potential trend reversal.

Large players accumulated significant positions back in December 2022, as shown by strong inflows during that period based on my money power indicator

A potential breakout toward historical highs remains a possibility, provided strong capital inflows.

Hope you enjoyed the content I created! You can support this idea with your likes and comments so more people can see it.

✅ Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only, not for financial investment purposes.

Check out my ideas about interesting altcoins in the related section below ↓

For more ideas, please hit "Like" and "Follow"!

#DGB/USDT Ready to launch upwards#DGB

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.0111

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.01234

First target 0.01305

Second target 0.01358

Third target 0.1432

Bullish Alert: DGB's Path to 300% Gains!DigiByte (DGB) recently saw its price surge dramatically. Now, it's testing a key price level that acts as support. Think of this support level as a safety net; if the price falls below it, the drop could be more significant. Successfully holding above this support would be a positive sign for the cryptocurrency.

If DGB manages to maintain its position at this support level, we believe it could lead to another significant price rise, potentially up to 300% over the medium term. A successful retest would likely encourage more buying activity, pushing the price higher and creating a bullish trend for DGB.

Digibyte looks like it’s validating the invh&s breakoutDigibyte shown here on the daily chart showing a nice bullish impulse firmly above the neckline of its inverse head and shoulders pattern. Already well on the way to the breakout target here so very likely validating the breakout. Also doing so a day or so before it has its golden cross. Once it reaches the full breakout target it’s likely to test the next potential resistance of the yellow horizontal trendline. That trendline is actually the neckline of a larger double bottom pattern. Wouldn’t be surprised with the golden cross so close by that whatever resistance that double bottom neckline provides doesn’t last very long *not financiala dvice*

DigiByte (DGB)DigiByte is an open source blockchain and asset creation platform and the DGB token was mined as a fork of Bitcoin. DigiByte consists of three layers: a smart contract “App Store,” a public ledger and the core protocol featuring nodes communicating to relay transactions.

Anyway, it is clear that DGB was in a descendig channel/trend. After DGB broke the major downtrend line, it came down to retest the lowest low two more times; thus creating a tripple bottom. Then, DGB broke the minor downtrend line and the upward phase started.

DGB blasts above double bottom target; invh&s now in play.Digibyte reached the double bottom breakout target and then some with yesterday’s big green candle. Now that it has spent the current daily candle consolidating, it has already consolidated long enough to make it so there is currently a valid inverse head and shoulders pattern in play on the 4 hour chart. If it takes a few more daily candles of consolidation before the next leg up then that inverse head and shoulders pattern will probably also qualify as a daily chart pattern as well. Digibyte has room for lots of upside, and now that I’m realizing it is a US based cryptocurrency, if Trump truly were to exempt US cryptos from capital gains tax, then I think it is a high probability digibyte could see new all time highs this bull run, which would mean tremendous upside from here. Even if digiibyte were simply to just trigger the breakout of this currently developing inverse head and shoulders pattern though, the target for that would almost double digibyte’s current value. So yes tremendous upside potential here. *not financial advice*