DHI D.R. Horton Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DHI D.R. Horton prior to the earnings report this week,

I would consider purchasing the 160usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $14.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DHI

$DHI Supercycle Nearing CompletionThe stock is expected to complete its final move to Wave 5 of (V) before undergoing a significant correction, constituting a substantial correction in my view.

My extended target for the upward trend is $143, with plans to consider short positions thereafter. The recent upward movement appears to be forming a rising wedge, adding to the overall wedgy appearance.

The RSI shows a substantial bearish divergence since the completion of Wave III, signaling that Wave V is still underway. While the situation evolves, my current stance is to maintain a long position.

DHI approaching meaningful supportD.R Horton Inc. (DHI) presently approaching meaningful support, able to absorb weekly selling pressures. From here, (DHI) can recover and turn higher to channel resistance, eliciting gains of 20-25% over the following 3-5 months. Inversely, a weekly settlement below the shown support would place (DHI) into a sell signal where losses of a similar magnitude would be expected over the same time horizon.

Warren Buffet buying homebuilders after huge runsNot sure what NYSE:BRK.A NYSE:BRK.B is thinking, Warren Buffet.

Is he expecting a huge demand for NEW HOMES?

There was increase in demand after large drop.

Maybe thinking that the Fed reduces #interestrates after things begin to crack, more?

TVC:TNX has been pumping (10 Yr), no signs of weakness.

They've all had huge runs NYSE:DHI NYSE:NVR NYSE:LEN.B

🤷♂️

#RealEstate

DHR - Interesting idea So DHR is very is incredibly interesting stock and it should cool down for a moment.

Levels:

To buy - 56 - 48 $

- Technically we have a picture of bearish prevalence and i recommend to take profit

If like my analysis like it and subscribe course u can miss my new analysis :). See ya

DHI ATH Break Weekly Options PlayDescription

DHI's primary bull trend remains well-intact and has raced up after entering it's corrective intermediate down-trend beginning with setting its previous ATH in May.

This is essentially a continuation play from the linked idea, when we played the break in the Descending Trend Channel, and gave the criteria for a new entry when the target was reached.

Today's break and close over its previous ATH close indicates that supply is exhausted and DHI is primed to make new ATHs.

Using Long Calls so as not to cap gains.

Long Call

Levels on Chart

SL < 104.45

PT : No price target set for the ATH, looking for a sharp move and then to roll a percentage of profits to more OTM calls.

*Stops based off underlying stock price, not mark to market loss

The Trade

BUY

12/17 106C

R/R & Breakevens vary on fill.

Manage Risk

Only invest what you are willing to lose

DHI Descending Channel Break for Long EntryDescription

DHI has been working this descending channel since hitting an ATH in May of this year, and off the earnings we may be seeing a break out.

A close > 94 triggers a long.

Using a call debit spread, because profits are always limited by time.

Will look to enter at EOD.

Call Debit Spread

Tentative Levels on Chart

SL is a daily close back in the channel.

*Stops based off underlying stock price, not mark to market loss

The Trade

BUY

12/3 95C

SELL

12/3 105C

R/R & Break-evens vary on fill.

The long call is placed ITM due to limited strikes but also offers good downside protection.

The short call is placed at the ATH. If DHI runs to ATH and holds, I'll look to roll the spread up.

Manage Risk

Only invest what you are willing to lose

11/8 Weekly Earnings Calendar Spreads (SYY, DHI, CAH, DIS)Description:

Some potentially attractive Calendar Spreads I'm looking at putting on based off of the close on Friday.

CAH looking especially attractive.

Announced Earnings Dates

SYY 11/9

DHI 11/9

CAH 11/9

DIS 11/10

Long Call Calendar Spread

Levels, break-evens, and R/R will be updated when positions are filled.

The boxes on the charts right now are the profit ranges at expiration for ATM Calls

You could always spread the puts instead of the calls if you want a slight bearish bias on the stock post earnings.

Criteria to enter:

At least 4:1 R/R, measured from max profit to debit required to enter.

Break-evens outside the expected move

Intend to close directly following earnings.

*Stops based off underlying stock price, not mark to market loss

Only invest what you are willing to lose

Break-evens and R/R vary on fill

Daily Market Update for 6/14Summary: The Nasdaq continued its march higher while the other major indices paused or pulled back. The gains focused on mid and large-cap growth stocks.

Notes

Ideas always welcome in the comments. Errors will be amended as comments on TradingView or corrected inline in my blog.

-=x=-=x=-=x=-=x=-=x=-=x=-=x=-

Monday, June 14, 2021

Facts: +0.74%, Volume higher, Closing range: 99%, Body: 76%

Good: High closing range, higher volume, large green body

Bad: Advance/decline ratio below 1.0

Highs/Lows: Higher high, lower low

Candle: Short lower wick filled opening gap, thick green body, no upper wick

Advanced/Decline: 0.86, More declining stocks than advancing stocks

Indexes: SPX (+0.18%), DJI (-0.25%), RUT (-0.41%), VIX (+4.73%)

Sectors: Technology (XLK +1.01%) and, Communications (XLC +0.66%) were top. Financials (XLF -1.04%) and Materials (XLB -1.23%) were bottom.

Expectation: Sideways

-=x=-=x=-=x=-=x=-=x=-=x=-=x=-

Market Overview

The Nasdaq continued its march higher while the other major indices paused or pulled back. The gains focused on mid and large-cap growth stocks.

The index closed with a +0.75% gain on higher volume than Friday. The closing range reached 99% in the last 30 minutes of trading, while the 76% green body represents a steady climb throughout the day. The higher high marks the seventh session in a row to reach a higher high. The close is only 0.25% below a new all-time high. However, there were more declining stocks than advancing stocks.

The S&P 500 (SPX) closed at another all-time high with a +0.18% advance today. The Dow Jones Industrial Average (DJI) declined -0.25%, while the Russell 2000 (RUT) lost -0.41%.

The VIX volatility index rose +4.73%.

Technology (XLK +1.01%) and Communications (XLC +0.66%) were top, helped by mid and large-cap growth stocks. Financials (XLF -1.04%) and Materials (XLB -1.23%) were the bottom sectors for the day.

-=x=-=x=-=x=-=x=-=x=-=x=-=x=-

Economic Indicators

The US Dollar (DXY) was flat with only a -0.01% decline.

The US 30y, 10y, and 2y Treasury yields rose for a second day.

High Yield Corporate Bond (HYG) and Investment Grade Corporate Bond (LQD) prices declined slightly.

Silver (SILVER) and Gold (GOLD) declined.

Crude Oil (CRUDEOIL1!) declined.

Timber (Wood) declined.

Copper (COPPER1!) declined, Aluminum (ALI1!) advanced.

Bitcoin (BTCUSD) rose +3.89%. Ethereum (ETHUSD) advanced +2.89%.

-=x=-=x=-=x=-=x=-=x=-=x=-=x=-

Investor Sentiment

The put/call ratio declined to 0.469. The put/call ratio (PCCE) is a contrarian indicator that shows overly bullish or overly bearish investor behavior. The 0.7 level is considered normal. Below that level is overly bullish.

The CNN Fear & Greed index is on the greed side but still near neutral.

-=x=-=x=-=x=-=x=-=x=-=x=-=x=-

Market Leaders

Apple (AAPL) broke out today with a +2.46% gain taking the price above the 50d MA. All four largest mega-caps are now above their 50d MA and 21d EMA. Amazon (AMZN) added to recent gains with a +1.11% advance today. Microsoft (MSFT) gained +0.78%. Alphabet (GOOGL) gained +0.77%.

Adobe (ADBE), Salesforce.com (CRM), Apple, and Taiwan Semiconductor (TSM) topped the mega-cap list. At the bottom of the list were Cisco Systems (CSCO), Bank of America (BAC), Pfizer (PFE), and JP Morgan Chase (JPM).

Ehang Holdings (EH), FUTU Holdings (FUTU), Fastly (FSLY), and Square (SQ) were the top four growth stocks in the daily update list. At the bottom of the list were Sumo Digital (SUMO), Draft Kings (DKNG), Penn National Gaming (PENN), and Digital Turbine (APPS). The growth list is mostly advancing stocks.

-=x=-=x=-=x=-=x=-=x=-=x=-=x=-

Looking ahead

Producer Price Index data is scheduled for release on Tuesday. We will also get an update on Retail sales data. Both sets of data come before the market open. API Weekly Crude Oil Stock data will be released after the market close.

Earnings reports for Tuesday include Oracle (ORCL), H&R Block (HRB), and La-Z-Boy (LZB).

-=x=-=x=-=x=-=x=-=x=-=x=-=x=-

Trends, Support, and Resistance

The index came within 0.25% of a new all-time high today. Expect some resistance at the all-time high area before moving higher.

The one-day trend-line points to a +0.13% gain for Tuesday.

The five-day trend-line leads to a small loss of -0.04%.

The trend-line from the 5/12 low points to a -0.28% decline for tomorrow.

-=x=-=x=-=x=-=x=-=x=-=x=-=x=-

Wrap-up

The momentum for the Nasdaq continues, albeit at lower volume today. The index is getting close to a new all-time high where we can expect some resistance before it moves higher. The expectation is for sideways tomorrow. Higher would be a positive surprise and indicate a very bullish market. Lower will need to be evaluated but would likely come from caution as we head into the Fed comments on Wednesday.

Stay healthy and trade safe!

$LEN Bullish Descending Megaphone$LEN Bullish Descending Megaphone

$LEN has formed a beautiful descending broadening wedge or descending megaphone into its earnings report Monday after close. This pattern retested previous highs and bounced, showing support on a perfect retest of $71.30. First target is previous highs around $79.50 which I am looking for Monday into Earnings. I am looking to stay long LEN & homebuilders in general through earnings but will take some profits at first target.

$XHB on the whole looks decent

Component $DHI looks good

$TOL broke out & looks fantastic

BTO $LEN 9/18 $80c

No Time for Comfort As Brakes Screech On the Oversold BounceAT40 = 35.5% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 34.8% of stocks are trading above their respective 200DMAs

VIX = 17.4

Short-term Trading Call: bullish

Commentary

Hold up. Pump the brakes. The bounce from oversold conditions just got more difficult as sellers forced buyers to come to a screeching halt.

The S&P 500 (SPY) fell 0.9% in what looks like a “close enough” failure at downtrending 50-day moving average (DMA) resistance. In a bit of good news, the index also bounced picture-perfect style off its 200DMA support. I will call it a stalemate.

{The S&P 500 (SPY) looks like it is caught in a trading range as buyers fail to punch through the previous peak or 50DMA resistance. The bounce from 200DMA support was a bit of good news.}

The tech-laden NASDAQ and the Invesco QQQ Trust (QQQ) were not as fortunate as the S&P 500. Both lost 200DMA support with the NASDAQ gapping down for a 1.7% loss and QQQ slicing through support for its own 1.7% loss. Adding insult to injury, at their intraday lows, both indices reversed their post-election gains.

{Momentum for the NASDAQ came to a screeching halt after gapping below 200DMA support.

The Invesco QQQ Trust (QQQ) bounced from its low of the day, but the buying was not enough to recover 200DMA support.}

The selling was not enough to rattle the volatility index, the VIX. The VIX only gained 3.8% and even fell sharply from its high of the day. The VIX still looks ready to continue its post oversold implosion. Accordingly, I bought a fresh tranche of put options on ProShares Ultra VIX Short-Term Futures (UVXY) with a 2-week expiration.

{The volatility index, the VIX, gained for the second straight day but could not even manage a close above Wednesday's intraday high.}

The currency markets showed some signs of stress in-line with a risk-off day. The Australian dollar (FXA) weakened and the Japanese yen (FXY). As a result, AUD/JPY suffered a notable pullback. I will not get concerned until/unless 200DMA support gives way. I used the pullback to build a slightly larger long position on AUD/JPY.

{AUD/JPY pulled back on a risk-off day across financial markets. The pair is still holding onto a bullish 200DMA breakout.}

A reversal like Friday’s makes bulls doubt their rationale for excitement just two days ago and gives bears reason for fresh skepticism. AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, tells me to be cautious, but not to downgrade my short-term trading call of bullish. AT40 dropped back to 35.5% and is still in the early stages of a rebound from oversold conditions. AT200 (T2107), the percentage of stocks trading above their respective 40DMAs, only dropped to 34.8% from Wednesday’s peak of 37.4%. I am more inclined to think that the market will churn and digest gains from the rebound. I will reconsider the bearish case if the S&P 500 closes below its 200DMA support.

I stuck to my post oversold strategy of buying the dips and bought SPY call options. I plan to sell these into the next bounce. However, my core position in iShares Russell 2000 ETF (IWM) call options experienced a big setback. With just a week to go before expiration, Friday’s 1.8% pullback was enough to wipe out most of the profits in those call options. I will now need to sell into the next bounce rather than wait for what I still think is an imminent retest of 50DMA resistance.

{The iShares Russell 2000 ETF (IWM) lost 1.9% but bounced off its 20DMA support. }

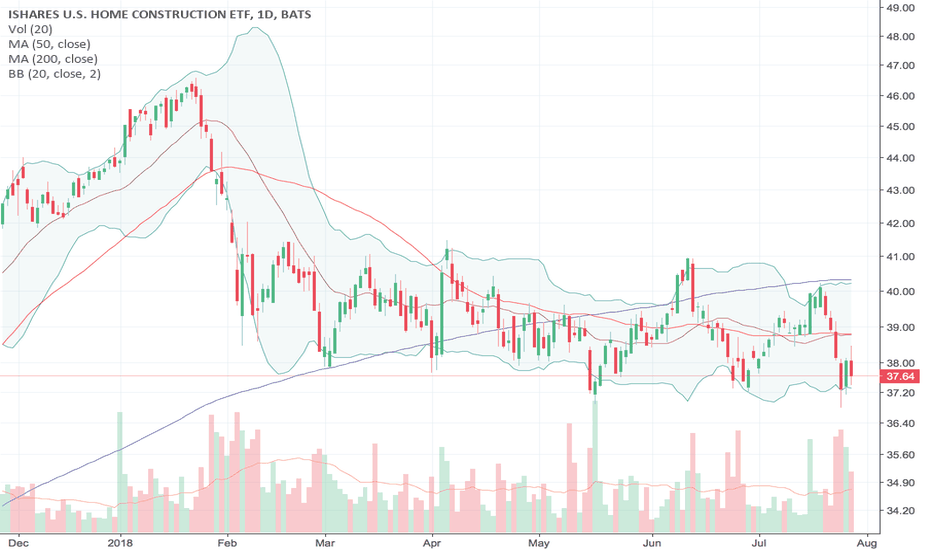

Housing Market Review – A Wobbly Edifice As Builders Break Down Alongside bearish trading action in builder stocks, July’s housing market data may have delivered confirmation of persistent investor fears.

"Housing Market Review – A Wobbly Edifice As Builders Break Down And Data Weaken" drduru.com $ITB $DHI $MTH $KBH $PHM $TOL $TPH #housingmarket #housingwatch #homebuilders #stockmarket #economy #gdp

Housing Market Review (May, 2018) - A Fresh Flicker of LifeHousing Market Review (May, 2018) - A Fresh Flicker of Life As Sentiment Turns Without A Change in Data. The housing data continue to plod along but the market for home builder stocks is suddenly warming up all over again.

drduru.com $ITB $CCS $DHI $PHM $LEN $FPH $LGIH $MTH $XHB

Home Builders to sell with rising interest rates and lower salesTurning very bearish on the home builders. Increasing interest rates will increase costs. Delinquencies are rising and creditors are contracting. Most activity in mortgage applications is either refi - due from recent fall in 30-year, or existing home sales. Builders are falling behind and sales goals will not be met.