S&P 500 Next Week Expected Move ($53) and Gravity Points$53 expected move. Larger than prior week despite going pretty much nowhere. More interestingly, there's a $35 expected move for Monday (marked in gray)

The $35 Monday move is the result of the G20. We might hit $3,000 next week.

Goodluck next week gentlemen

- RH

Last week:

$SPY $SPX $NDX $QQQ $RUT $IWM $DIA $DJT

DIA

S&P 500 Next Week Expected Move ($45) and Gravity PointsLeaning slightly bullish due to the weight of the evidence but there are too many binary events coming up in the coming week that could throw off my thesis. Plus we rallied so strongly the last 3 weeks that I wouldn't discount the fact that the market might just consolidate while it waits for the G20 meeting.

Blew through last week's expected move ($41) and had a $63 gain on the week. This next week the options market is pricing in a $45 move higher or $45 lower, nondirectional. Amazingly, for the first time in 18 months I have no Gravity Points lurking above us to target. They have served me very well and I hope they have for you. I will continue to locate Gravity Points going forward as we make them.

Many significant things occurred this week. I'll list those I'm aware of:

(Negative) - Economic data is now definitively weakening - shown by the Empire Manufacturing Data and several others

(Positive) - The Dollar; $DXY, $UUP is on the brink of breaking down

(Neutral) - Most interestingly; $GOLD, $GLD is breaking out of a 5 year base which adds to the bearish case on the USD

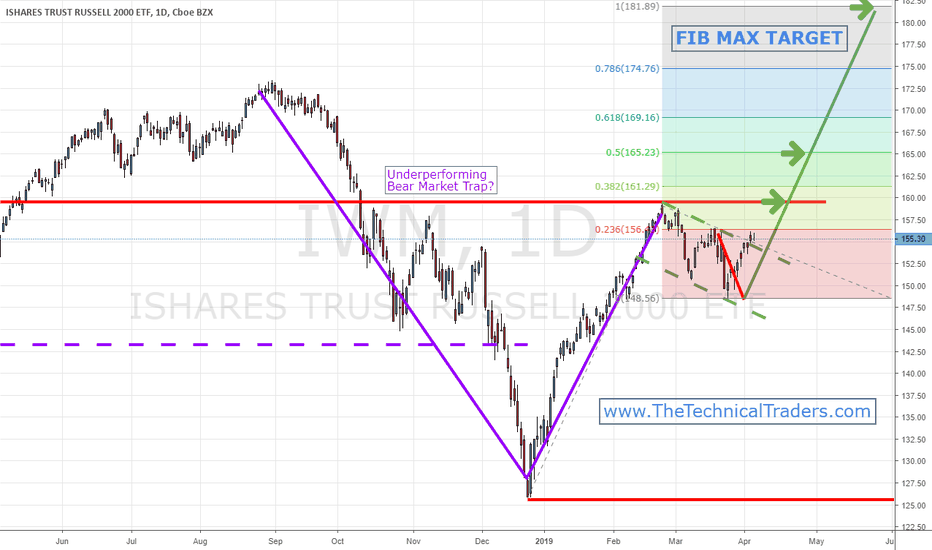

(Neutral) - I think Small Caps $IWM might turn the corner and start leading relatively soon here, the ratio between the $IWM and the $DIA is at the low end of its historical range, however my two favorite market leading indicators the IWM and DJT weekly charts failed at the moving averages and is nowhere near all time highs which is bearish.

(Positive) - Market Sentiment is very neutral, which is odd given that we are making new all time highs and a positive omen going forward

(Positive) - Copper is staging a bullish reversal which is a relief for foreign equities

(Positive) - OIL; $USOIL is staging a bullish reversal which is also bullish

(Neutral) - Quadruple Witching occurred this week which means there's a lot of rebalancing going on

(Negative) - The $VVIX and $VIX are both back to considerably low levels

(Neutral) - The correlation between bonds and stocks is very high and unsustainable; typically I trust the debt market over the equity market but not this time

(Positive) - Bonds; $TLT created a significant bearish divergence after rallying for nearly 20% in 6 months

(Positive) - Related to the TLT, the $TNX had a capitulation low at 1.95. Now that the FOMC is out of the way, I think bonds will stop advancing in the near term.

Scorecard:

Bullish - 6

Neutral - 4

Bearish - 2

Last Week's Post:

I'm not sure if this makes any difference for getting this post out there or not but I'm going to try it out anyways. Don't know how the system works.

$SPY SPY $ES1! ES1! $SPX SPX $DIA DIA $QQQ QQQ $NDX NDX $IWM IWM $RUT RUT $IYT IYT $DJT DJT

S&P 500 Expected Move ($58.25) and Gravity PointI was wrong on my neutral call last week. Should have been bearish. Mexico tariffs or not, doesn't matter.

Honestly have no clue what's going to happen this week. Had a bunch of mimosa's this morning and don't have the mental energy.

Green box was something I put there weeks ago. Maybe target the gravity point for a bullish bounce.

Best of luck next week gentlemen

- RH

S&P Next Week Expected Move ($47.25) and Gravity PointsNeutral Call. I think the ' h-Pattern ' we have here will provide a nice bump in price but I think selling pressure will keep the market relatively rangebound especially during next week's shortened 4-day week.

Our Standard Deviation trend lines have been working quite well. I believe we have enough data to call them reliable.

I highlighted in a green circle what was a nice trade setup that I missed. Had a confluence of support there from the Gravity Point, Expected Move, and SD after the completion of a 5-wave move.

Best of luck next week gentlemen and have a nice Memorial Day weekend!

- RH

$SPY SPY $SPX SPX $ES! $ES1! ES1!

Next Week Gravity Points & Expected Move ($54.50)Expecting a bit of a relief rally early in the week.

My standard deviation trendline broke the 3rd SD last week, first time since we bottomed. So I recreated it for the new hypothetical downtrend. It's most useful for an established trend and right now I need more weeks of data before I feel confident in this.

$55.5 expected move is large.

Busy chart, forgive me for the clutter this week.

- RH

S&P 500 Next Week Expected Move ($34) & Gravity PointsNo call again... been a pretty directionless last 3-4 weeks.

SPY $300 right around the corner.

VIX got totally rejected.

Sell in May and Go Away articles coming out.

Buffett interested in Amazon

GDP was 3.2%

Unemployment Strong.

IPO's coming out. Uber Next week.

Smallcaps looking like a bit of a breakout, waiting to see if it's sustained. But would be very positive if there's continuation.

Goodluck next week gentlemen

- RH

Time to Accumulate MylanShares of generic drug manufacturer Mylan has become very attractive, especially after today's overdone selloff.

While the company has some hurdles legally (what drug company doesn't?) and has some internal housekeeping to tend to, the shares are becoming too cheap to pass up. At the time of writing, shares are trading at $23.30, down about 17% on the heals of it's latest earnings report. I don't believe this sort of selling is warranted but it gives value investors an attractive entry point to begin accumulating shares.

It's blown thru supports, such as the 61.8% retracement (dark blue line) of a multi-year climb higher and some previous major resistance-turned-support levels (white dashed lines), which I've left on the chart for reference. The recent bounce gave some extensions to use, but today's selloff has pushed shares right past the first one, the 127.2% extension at $24.39. The next extension, the 141.4% at $21.75, is interesting because it coincides closely with the 78.6% retracement of the aforementioned multi-year swing higher at $20.63. Should those fail, we have one last extension to target, the 161.8% extension at $17.95.

In essence, I'm buying a starter position today and will be adding if it dips to the lower levels, which really should be viewed as a major support zone between $18 and $21.

With so many patents expiring for blockbuster drugs, Mylan will soon be able to pump out cheaper generics of them and they have an excellent track record of cranking out pills that are in demand.

It'll be important to watch the headlines on this one, as there are legitimate concerns, but with P/E's at 5.3x next years estimates and 5.0x 2020 estimates, this is just too cheap to ignore.

Be sure to have a game plan, including a stop loss appropriate to your risk tolerance (say, a back-to-back weekly close below $17.95, or a percentage you're comfortable with like -10%).

Once I see some sustained uptrend taking place, or a major change in my thesis, I'll let you know! Until then, happy trading!

Bullish H&S in 3M Corp. Shares of MMM look to be forming an inverse H&S pattern that looks it could be a favorable setup for the bull camp. It's deeply oversold with an R.S.I. reading of 22.9 and is holding the neckline support, so I think it's headed higher.

Shares are in the buy zone right now at $185, which is the neck of the pattern. Look for minor resistance around the gap down at $197-200. I doubt this will pose much of a challenge for the shares, although it may provide another buying point.

Major resistance comes in at the target of the pattern at $218-224, which I believe will be reached prior to the next earnings release on July 25th.

Set your stop-loss beneath the head, around $177-179. That gives you a nice risk-reward ratio... -$8 (-4.3%) to the downside and +$39 (+21.8%). That's a 5.1:1 bullish ratio. I'm a buyer for sure!

S&P 500 Next Week Expected Move ($37.50) & Gravity PointsHappy all time highs. No call.

Google + Apple reporting next week. Microsoft reached 1 trillion market cap.

Majority of companies reporting earnings beats and revenue misses. How is that possible? Buybacks.

Keep an eye on Semiconductors, smallcaps, oil, and China.

Natural gas looking interesting.

Maybe check on the VIX positioning. Record number. When commercial hedgers start to decrease longs, it's game time.

finviz.com

$IWM $RUT $TNA $TZA Small Caps About to Lead The Markets!While the large-cap stock indexes like the $SPY $SPX $QQQ $DIA have been running higher, they are now at resistance and should stall out or at least slowdown. Small-cap stocks have been building a base for a mega rally that could make the large-cap run look like chump change!

See more analysis on the small cap sector: www.thetechnicaltraders.com