CAD/CHF BUY SIGNALHey tradomaniacs,

welcome to another free trade-plan.

Important: This is meant to be a preparation for you. As always we will have to wait for a breakout and confirmation.

Type: DAy-Swingtrade

Market Buy: 0,68800

Stop-loss: 0,67450

Target 1: 0,70200

Target 2: 0,71325

Target 3: 0,72185

Stop-Loss: 135 pips

Risk: 1-2%

Risk-Reward: 2,5

Notice: Waiting for breakout to buy the retest!

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

Diamondpattern

EUR/CAD SELL SIGNALHey tradomaniacs,

welcome to another free trade-plan.

Important: This is meant to be a preparation for you. As always we will have to wait for a breakout and confirmation of this Diamond-Pattern.

Market Sell: 1,55680

Stop-loss: 1,57600

Target 1: 1,52220

Target 2: 1,51000

Target 3: 1,48900

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

Bearish Diamond Formation in Parallel ChannelThe diamond top occurs mostly at the top of considerable uptrends. It effectively signals impending shortfalls and retracements with relative accuracy and ease.

The diamond top formation is established by first isolating an off-center head-and-shoulders formation and applying trendlines dependent on the subsequent peaks and troughs.

It gets its name from the fact that the pattern bears a striking resemblance to a four-sided diamond.

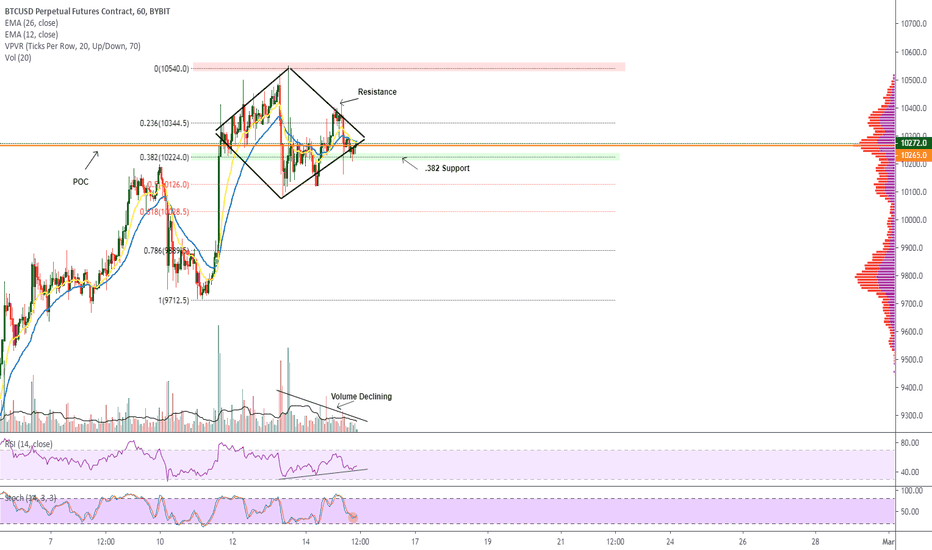

Diamond Continuation Pattern| Low volume| Bullish Continuation?Hello Traders,

Today’s chart update will on BTC’s immediate projection- we have a probable diamond formation which serves as a bullish continuation pattern.

Points to consider

- Trend travelling into apex

- .382 Fibonacci as local support

- RSI respecting trend

- Stochastics in lower regions

- Volume declining

- VPVR area being tested

BTC is closing in on its apex signalling a break from this formation is imminent as local support and resistances converge. Local support is the .382 Fibonacci; BTC has been respecting this level as buy pressure is evident.

The RSI is respecting its trend line, must hold for a bullish bias as this is in confluence with the stochastics being in lower regions. It can stay trading there for an extended period of time, however lots of stored momentum to the upside.

Volume is clearly declining; increase is highly probable upon breaking out of the Diamond formation. The VPVR confirms the .382 being a strong trade location for buy pressure.

Overall, in my opinion, a break bullish is probable as the Diamond Pattern serves as a bullish continuation pattern. BTC may have one more leg up before a proper correction as this trend is getting more extended.

What are your thoughts?

Please leave a like and comment,

And remember,

“The big ones take the psychology out of the game. Have a game plan, and stick to it.” Tim Erber

Bitcoin 1hr DiamondPotential diamond topping pattern on the Bitcoin 1-hour chart. Was expecting a run to $9,350 and a slight pullback this week and now it appears as though we may get the pullback going into the weekly close tomorrow. Level of support I'm watching for on any decline is $8,900(red line), as long as price remains above that level the trend should remain up.

BTC (Y20.P1.E5).MACRO.Trend.ForecastHi all,

** Note: This POST is only about the MACRO level.

> After looking at the bottom and drawing some trend lines, it occurred to me that we possibly have a "DIAMOND reversal trend" , at the Macro level.

> Beyond what most have have accepted and pretty much confirmed is that a inv. H&S took place, which is not the whole story.

> FYI I define inv. H&S as a Micro or Medium level move (just to make sure my language is with consistent meaning).

Below are some of my observations\hypothesis and the rest I leave to you to come up with your conclusions.

Enjoy.

Please give a thumbs up or a like if you agree or just appreciate the effort.

Regards,

S.Sari /CryptoProspa

I'll just put in the micro level observations to give a case for the "DIAMOND bottom formation"

At the big structure level, what we had in 2019 was a continuation pattern. A big year next year and on-wards?

(note red vertical line represents BTC halving time line)

Also not key details about macro fib. levels and their confluences.

I like this MA, which does a good representation of the segment from bearish to bullish indicator.

The RSI also has some points on supporting the bullish thesis on the daily and weekly which I wont go into.

My thoughts at the MEDIUM LEVEL with a DIAMON support structure

Supporting this post, is the PREVIOUS POST and the explanations to go with it for bottom channel trend

AUDNZD - long the diamondAnother diamond pattern, just confirming that holidays are all over the place :)

I'll start longing in green area or on breakout to upside from here with marked targets, where I'd wait for re-enter, and stop loss below previous low or even more loose because of high volatility at the moment.

Disclaimer: this idea is solely for my own purposes, to satisfy the ego, if it will work out ;)

CADCHF - Diamonds are a girl's best friendCarol Channing was singing this already in 1957. Usually this pattern means reversal and that's what I'll be tracking in the beginning of 2020 - until the end of this year there may be just fakeouts with all the holidays in place.

After a clearly defined direction there's an opportunity for basket of pips. As charted, I'll offload some parts of position at marked areas. So just on radar for the time being.

Disclaimer: this idea is solely for my own purposes, to satisfy the ego, if it will work out ;)

Pepsi bullflagPepsi is currently in a large upward channel on the weekly timeframe, on the daily timeframe a bull flag can be observed, this will lead to upsides. Other patterns include a diamond bottom reversal after a short term bearish run, a double top, and a double bottom. A great buy long term.

Spotify diamond topSpotify is showing mixed signals with the formation of a diamond top which is indicative of a bearish reversal, evident on the chart. Also, formation of an island top which are a quite reliable bearish reversal chart pattern. The uncertainty in this chart may be evident to investors which choose to capitalise on this or sit out.

Personally I use Spotify myself..

Ark diamond topArk diamond top formation, the 'diamond forms after an upward price trend. Breakout is upward' results in a short-term bullish continuation. Very consistent in a bull market with 21/23 Performance rank however in a bear market quite inconsistent with a rank of 2/19.

More bad news looming- diamond Pattern set up now or earnings?I bought Dec 27th 280/300/320 for .60 last Friday due to $BA not acting right - news came that they are halting production. I have been trying to enter long trades but yet news never gets any better - so I decided to switch it up and buy a put fly. The trade was trading at 3.25 this AM - I left my position on. I will cover half if stock closes green tomorrow and possibly enter a short term call fly targeting the 350 area.

Let me know what you think?

-- I strictly place options trades.

Silver LongHere we have a classic by textbook diamond formation, sign of an equal power between bulls and bears,

Long term the price will follow the direction of the break out in which case that direction points upwards.

The macro scale of the price action also shows a bullish divergence inside a descending channel that price has been consolidating for the last couple of months since that high at 18.67 on September 23rd .

Oscillators a bit noisy on the 4H but the divergence comes through on this time frame connecting the lows at 16.835 and 16.635 and 16.49 we can clearly see a bullish divergence on the MACD and a bullish divergence on the 16.635 and 2649 on the RSI - which also gives Bulls the upper hand for the long term. Switching on the Daily the same divergence comes through pretty clear.

Happy Trading , Volatile markets ahead, keep safe : )

BTC (Y19.P2.E11).v3.Something to watch out forPotentially a diamond formation taking place.

Quotes from 3 sources.

1) This can be a reversal or a continuation. where break up is 70% chance, and the chance of a break down is 30%.

2)

How much has #Bitcoin rallied as a result of its Halvings to date?

Halving 1:

+13,378%

Halving 2:

+12,160%

3)

The market has a way of inflicting pain on late entrants, always.

It does not care about your plans.

Keep an eye out for the signs of total negativity and complacency by bears.

Diamond bottom formation reference > www.profitf.com