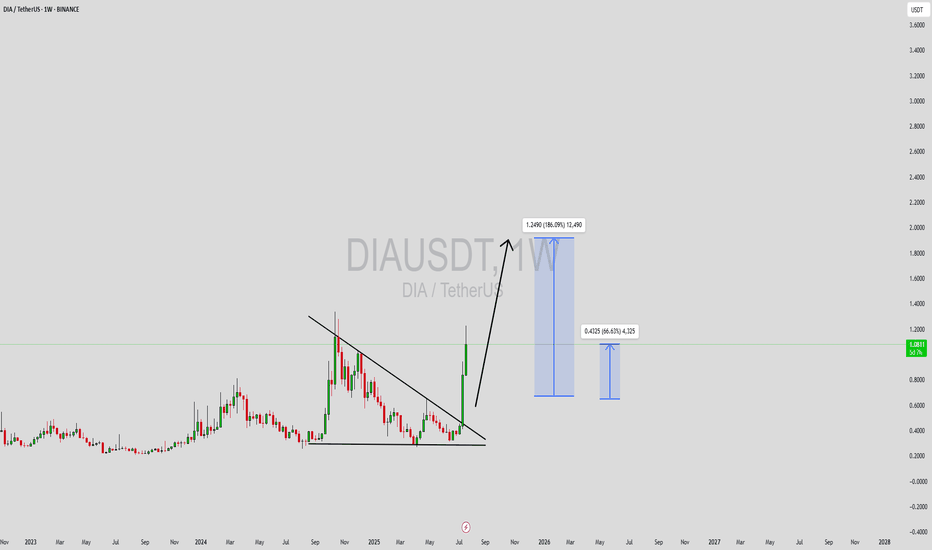

DIAUSDT Forming Descending ChannelDIAUSDT has recently broken out of a well-defined descending channel pattern on the weekly timeframe, signaling the start of a major bullish reversal. This breakout, accompanied by a strong surge in volume, suggests that buying momentum is entering the market decisively. The DIA token, which underpins the DIA data oracle platform, is starting to gain traction again as attention shifts toward real-world DeFi infrastructure and decentralized data solutions.

Technical indicators further support the bullish thesis. After consolidating within the descending channel for several months, the breakout candle has closed above resistance with conviction, pointing to a shift in sentiment. Projections based on technical targets suggest an upside potential ranging from 140% to 150%, with the possibility of price reaching as high as $2.50 in the coming months if momentum sustains. The long accumulation phase visible on the chart strengthens the case for this extended rally.

The market has also shown a renewed interest in fundamental oracles and trusted data feeds, which puts DIA back in the spotlight. As DeFi protocols evolve, the role of decentralized data becomes increasingly critical—positioning DIA to benefit from this narrative. With investor interest returning and the token breaking structure on the macro chart, DIA is now on many traders’ watchlists.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with

DIAUSDT

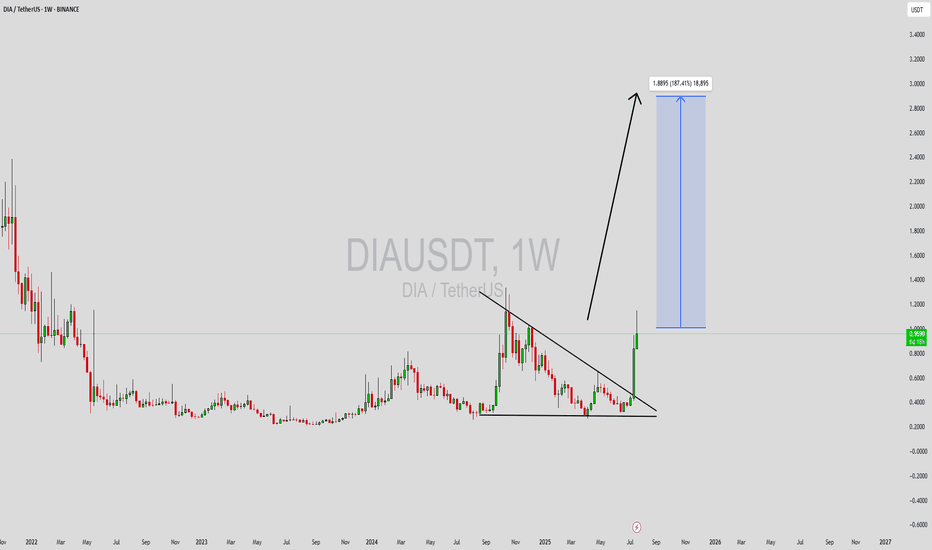

DIAUSDT Forming Powerful BreakoutDIAUSDT (DIA/USDT) has just completed a powerful breakout from a long-standing descending triangle pattern on the weekly timeframe. This move signals a potential shift from accumulation to expansion as bulls regain control. The breakout is accompanied by a significant surge in trading volume, suggesting that both retail and institutional investors are beginning to accumulate positions in anticipation of a broader rally. Technically, the pattern break targets a potential upside of 140% to 150%, supported by historical resistance levels shown on the chart.

DIA, a decentralized oracle platform, plays a vital role in bridging off-chain data to blockchain networks. As the DeFi space continues to expand, reliable data oracles like DIA are gaining increased relevance. This fundamental strength, combined with the bullish technical setup, makes DIA a solid candidate for medium- to long-term portfolio consideration. The recent price action could be the beginning of a major trend reversal, especially as on-chain metrics show growth in active wallet interaction.

The structure of the current breakout also reflects a clean technical progression—multiple higher lows leading into resistance, followed by a strong breakout candle with volume confirmation. If DIA can hold above its breakout level and establish support, the next leg higher could be rapid. The market sentiment is clearly shifting as more market participants recognize DIA's potential in the growing Web3 infrastructure.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Today is oct 14th 1929 I have moved back to Long puts at 105%The chart posted was in the forecast written dec 8th 2024 We have now reached my targets of 5669 area I have been buying the dips in calls and made $ I am now 105 % long in the money puts and I do Not see a bottom until july once we break and a second bottom mid oct The market should see a drop of 38 % into july and form a small double bottom in oct at 41 % off the highs . I will move to 125 % long puts on a sell stop at 5300 even the math at 5334 is key Best of trades WAVETIMER

DIA / USDT looks great, holding to 5 usdt ?DIA is an Ethereum token that governs Decentralized Information Asset (DIA), an open source Web3 data and oracle platform. This platform allows smart contracts to connect to external data sources, such as DeFi market data and centralized APIs. DIA can be used to propose and vote on platform upgrades. Lasernet is DIA.

World’s First Oracle Rollup

Access oracle data trustlessly and permissionlessly, via a rollup chain engineered for oracles.

Celková ponuka: 168,81M DIA

Maximálna ponuka: 200M DIA

Obehová ponuka: 119,67M DIA

Take Profit (TP):

1.7 usdt

3.4 usdt

5 usdt

Good entry now or over 0.25 usdt.

This is only my idea guys.

This is not financial advice !

Please do your analysis and consider investing !! Thanks for supp.

DIAUSDT Analysis: Volume Spike with a Strong Demand ZoneDIAUSDT Analysis: Volume Spike with a Strong Demand Zone

Daily Volume Increase: DIAUSDT shows a significant 96% spike in daily volume, indicating heightened interest.

Volume-to-Market Cap Ratio: The 60% ratio suggests active trading relative to its market cap.

Blue Box Entry Zone: The blue box is identified as a meaningful demand zone for potential entries.

Confirmation Checklist:

Before entering, I will look for confirmations using:

Cumulative Delta Volume (CDV)

Liquidity Heatmap

Volume Profile

Volume Footprint

Upward Market Structure Breaks on Lower Time Frames

Additional Insights:

DIAUSDT is showing strong signals, but risk management remains crucial, especially in volatile markets. Entries in the blue box should be approached with confirmation for the best risk-to-reward ratio.

Learn Advanced Techniques:

Want to master entries like this? DM me to learn how to utilize CDV, liquidity heatmaps, volume profiles, and volume footprints effectively.

Final Thoughts:

The blue box provides a great entry opportunity for DIAUSDT. Stay patient and precise. Good luck trading!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis (the list is long but I think it's kinda good : )

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

DIAUSDT.2HLooking at the DATA/USDT chart, the price appears to be fluctuating within a fairly well-defined range, indicative of a consolidation phase in the market.

The Ichimoku Cloud is present but not providing a clear trend signal since the price action is choppy and overlapping with the cloud. The Conversion Line and the Base Line are intertwined, which typically indicates a lack of directional momentum. Moreover, the Lagging Span is within the price action, not offering a clear bullish or bearish signal.

The RSI is at approximately 50, reinforcing the indecision observed in the price action and Ichimoku Cloud. It's neither in the overbought nor the oversold region, suggesting the absence of immediate buying or selling pressure.

The MACD is showing very little separation between the MACD line and the signal line, accompanied by a flat histogram, which further confirms the current market indecision.

Resistance levels are identified at R1 (0.0891 USDT) and R2 (0.10295 USDT), while support levels are denoted by S1 (0.06279 USDT). Given these observations, my trading plan would involve waiting for a decisive breakout above R1 or a breakdown below S1 before establishing a position. A breakout above R1 could suggest potential long entries with targets near R2, while a breakdown below S1 may indicate potential short entries with considerations for further support at lower levels.

In light of the current market structure, it's important to note that the consolidation pattern can persist until a catalyst induces a breakout. Trading within the range can be risky due to the possibility of a false breakout, so I would prefer to wait for a strong volume move confirming the breakout direction. As always, I would keep an eye on broader market news and sentiment as these can heavily influence price action outside of technical patterns.

DIAUSDT.4HAnalyzing the DIA/USDT chart, I observe a few key technical elements. The price is currently trading in a narrow range, which is encapsulated within the Ichimoku Cloud. This often indicates indecision in the market as traders wait for a clearer signal on the direction of the trend.

The Ichimoku Cloud is flat, which reinforces the indecisive sentiment, indicating a lack of strong trend. The Conversion Line (blue) is above the Base Line (red), which typically suggests bullish sentiment; however, the price being within the cloud doesn't give a clear bullish signal just yet.

The RSI is at a neutral 51, which doesn't suggest overbought or oversold conditions and aligns with the market's current consolidation phase.

The MACD indicates a recent bearish crossover, with the MACD line crossing below the signal line. While this could suggest some bearish momentum, the closeness of the lines and the small histogram values indicate that the bearish momentum is not strong.

The chart indicates resistance at R1 (0.7480 USDT) and R2 (0.8196 USDT), while support levels are marked at S1 (0.6469 USDT) and a further significant level at SZ (0.5346 USDT). These levels will be important to watch for potential breakouts or breakdowns.

From a trading perspective, I would remain on the sidelines until a clearer signal emerges. A breakout above the Ichimoku Cloud and the resistance at R1 might suggest a potential long position with targets at R2. Conversely, a breakdown below the cloud and S1 could signal a short position with the target at SZ. Given the MACD's recent bearish crossover, I would be cautious of a potential downward move, but without a significant momentum indicator, I would wait for additional confirmation before entering a trade.

DIAUSDT.4H

For the DIA/USDT chart you've provided, here's what stands out in the analysis:

Timeframe: The chart is set to a 4-hour timeframe, which gives insights into medium-term trends and potential inflection points.

Ichimoku Cloud: Since the price appears to be trading within the Ichimoku Cloud, this usually suggests a lack of a strong trend and a potential consolidation phase.

Support and Resistance Levels:

R1 (Resistance 1) is around 0.6880 USDT, which might act as a ceiling for price action.

S1 (Support 1) marked at 0.6471 and lower, potentially offering floors where price bounces could occur.

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line and hovering around the zero line, indicating a neutral to slightly bearish momentum. The histogram being close to zero confirms this neutrality.

RSI (Relative Strength Index): The RSI is at 56.12, which is relatively neutral. It indicates neither overbought nor oversold conditions.

Price Action: The price has experienced volatility with several spikes up and down. It appears to be moving sideways currently, within a range marked by the support and resistance levels.

Overall Interpretation: The DIA/USDT pair is showing signs of consolidation with no clear directional trend in the medium term as indicated by the Ichimoku Cloud and MACD. It’s trading between established support and resistance levels, which could be used for range-bound strategies unless a breakout occurs. The lack of a strong trend suggests traders might wait for clearer signals such as a breakout above R1 or a drop below S2 for directional trades. Remember, it’s important to consider updates in the market that might affect the sentiment and to apply proper risk management strategies in trading.

DIAUSDT.4HOn the 4-hour chart for DIA/USDT, the technical analysis suggests that the price action is currently within a bullish phase but experiencing a pullback.

Uptrend Line: A rising support trendline is visible, indicating an established uptrend. The price has recently pulled back to this line, which could provide a springboard for further upward movement if the trend remains intact.

Resistance Levels (R1, R2): The resistance levels are marked at 0.7557 USDT (R1) and higher (R2), which is not fully shown on the chart. These are the prices where the asset previously faced selling pressure.

Support Level (S1): The immediate support level is at 0.6191 USDT (S1). This level may act as a floor in the short term, where buyers might come in to uphold the price.

MACD (Moving Average Convergence Divergence): The MACD is slightly above the signal line, indicating that the bullish momentum might still be in play, although it appears to be weakening as the histogram is quite flat.

RSI (Relative Strength Index): The RSI is around 62, which is neither in the overbought nor in the oversold territory. This indicates that there may still be room for price movement in either direction without immediate pressure from these extremes.

Conclusion:

As a trader, I would view the approach to the rising support trendline as a potential buying opportunity, with the understanding that the trend might continue. However, I would also set a stop loss below the support level to protect my position against a potential breakdown of the trend. If the price bounces off the support trendline and moves upward, I would look to the resistance levels as targets for taking profits. On the other hand, a break below the trendline could indicate a shift in trend, and I would reassess my strategy accordingly, potentially looking for shorting opportunities. As always, it's important to stay updated with the latest market developments and news that could affect the sentiment and price action.

DIA is Ready For an Explosive Bull Rally | DIA Analysis Today💎Paradisers, turn your attention to DIA/USDT! The asset has just escaped a well-defined trading range and is setting the stage for a likely bullish surge.

💎If this breakout unfolds as we expect, get ready for a significant upward rally with DIA.

💎It's important to highlight the two verified order blocks in the shorter time frame. These zones are probable targets for the DIA, considering the liquidity present there.

💎Reflecting on past trends, we saw a transition from a demand to a supply zone, resulting in a significant price drop and targeting the previous Order Block (OB).

💎In the ever-evolving landscape of crypto, staying vigilant and flexible is essential. Keep those charts refreshed and stay tuned for more updates!

The #DIA has hit a low and is poised for a WEDGE breakout!

Hello, fellow crypto enthusiasts! I'm CryptoMojo, the name you can trust when it comes to trading views. As the captain of one of the most vibrant and rapidly growing crypto communities, I invite you to join me for the latest updates and expert long and short calls across a wide range of exchanges. I've got your trading needs covered with setups for the short-, mid-, and long-term. Let's dive into the charts together!

I've dedicated my time and effort to crafting this chart, but remember, what you see here is crypto insight, not financial advice. 🚀💰 #CryptoMojo #CryptoTrading

🚀 Brace yourselves for the exciting #DIA update! 📈 The mighty DIA is currently flexing its muscles, striving to shatter the confines of its falling wedge pattern. And guess what? If this breakout unfolds as we anticipate, we're looking at the potential for a jaw-dropping +200–240% bullish rally in the midterm.

Picture the thrill of riding this crypto rollercoaster to newfound heights!

Our charts are buzzing with anticipation, and it's a thrilling journey we'd love for you to join. Keep a close eye on DIA, because this could be the trade that makes your crypto dreams come true. 🚀💰 #CryptoGains #BullishDIA

This chart is likely to help you make better trade decisions if it does consider upvoting it.

I would also love to know your charts and views in the comment section.

Thank you