Long Position (Trend Transfer) - Daily Interval -EURUSDHello Everyone,

The currency pair (EURUSD) has manifested a rejection (failed infiltration) at Support Level 1. Since this instance, the pair will continue to an upward momentum until Resistance Level 1.

Resistance Level 1 - (1.18125 - 1.18155) - 30 pip interval

Key Price Zone (KPZ) - (1.14410 - 1.14440) 30 pip interval

Support Level 1 - (1.11780 - 1.11810) 30 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Conscientious and Stick To Your Trading Principles)***

-LionGate

Discipline

Correction Imminent - 4hr Interval - ABILHello Fellow Traders,

The stock (ABIL) PA (Price Action) is exposed to a trend transfer within the next few days. Consider the previous uproars (bullish) in momentum. Further analysis and consideration is necessary prior to entering the market.

Resistance Level 2 - (14.40 - 14.65) 25 cent interval

Resistance Level 1 - (7.95 - 8.20) 25 cent interval

Blue Horizontal Line (KPZ) - (2.80 - 3.10) 30 cent interval

Support Level 1 (Significant Aide) - (1.40 - 1.65) 25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Conscientious and Stick To Your Trading Principles)***

-LionGate

Trend Transfer - 45min Interval - EURCHFHello Everyone,

The currency pair (EURCHF) appears to be shifting trend direction as numerous buyers (bulls) are entering the market. (Be cautious of a false reversal, wait for confirmation).

Resistance Level 2 - (1.12550 - 1.12580) 30 pip interval

Resistance Level 1 - (1.12185 - 1.1215) 30 pip interval

Blue Horizontal Line (KPZ) - (1.12105 - 12.130) 25 pip interval

Support Level 1 - (1.11610 - 1.11640) 30 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Potential Trend Continuation - 45min Interval - GTXIHello Fellow Traders,

The stock (GTXI) presents a subtle and "non-movement" position within the (4hr + intervals). In the 45min, however, the stock appears to be pulling northward (bullish) for a further continuation from previous average highs.

Resistance Level 2 - (2.45 - 2.65) 20 cent interval

Resistance Level 1 - (1.60 - 1.85) 25 cent interval

Blue Horizontal Line (KPZ) - (1.35 - 1.60) 25 cent interval

Support Level 1 - (0.95 - 1.20) 25 cent interval

Support Level 2 - (0.70 - 1.00) 30 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Volatile Past - 4hr Interval - ADMAHello Everyone,

The stock (ADMA) PA (Price Action) has been nothing but (IMO) an eye opener. As numerous traders were seeking to short the stock at price intervals (4.10 -4.15), there was another (bullish) penetration in the stock's trading average. This certainly is lesson for anyone interested or keen on investing in the stock market. (Avoid sporadic price fluctuations, be diligent and considerate of market catalysts)

Resistance Level 2 - (6.80 - 7.10) 30 cent interval

Resistance Level 1 - (5.80 - 6.10) 30 cent interval

Blue Horizontal Line (KPZ) - (4.30 - 4.55) 25 cent interval

Support Level 1 - (1.90 - 2.20) 30 cent interval

Furthermore, risk management is pivotal when attempting to trade such a stock. (Do not let impulsive actions wipe-out your account).

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Conscientious and Stick To Your Plan)***

-LionGate

Consolidation Taking Place - 30min - LINUFHello Everyone,

The stock (LINUF) has begun to consolidate at PA (Price Action) levels (0.037020 - 0.012578), which can be quite a discrepancy in value. There does not appear to be any (solidified) S/R levels that can implicate a viable position at this moment in time (IMO). Further analysis and patience is ideal within any trading strategy.

Resistance Level 3 - (0.131140 - 0.121170) .000030 cent interval

Resistance Level 2 - (0.099750 - 0.099790) 0.000040 cent interval

Resistance Level 1 - (0.039650 - 0.039680) 0.000030 cent intveral

Blue Horizon Line (KPZ) - (0.023985 - 0.023105) 0.000020 cent interval

Support Level 1 - (0.009920 -0.009950) 0.000030 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Position Formation - 4hr Interval - USDCADHello Everyone,

The currency pair (USDCAD) throughout the past week consolidated and then gained traction towards a downward (bearish) identity. A reversal or further consolidation may be imminent. Be cautious and let market action take place (Support Level 1 or Resistance 1).

Resistance Level 1 - (1.34680 - 1.34730) 50 pip interval

Blue Horizontal Line - (1.33200 -1.33250) 50 pip interval

Support Level 1 - (1.32430 - 1.32480) 50 pip interval

Support Level 2 - (1.31100 - 1.31150) 50 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Plan)***

-LionGate

Current Consolidation - Daily Interval - ONTXHello Everyone,

The stock (ONTX) began price consolidation after a tremendous push north (Bullish). As of currently PA is immensely volatile and I advise caution when longing or shorting this stock.

Resistance Level 3 - (11.15 - 11.35) 20 cent interval

Resistance Level 2 - (5.90 - 6.15) 25 cent interval

Resistance Level 1 - (4.70 - 495) 25 cent interval

Blue Horizontal Line (KPZ) - (3.35 - 3.65) 30 cent interval

Support Level 1 - (1.55 - 1.80) 25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

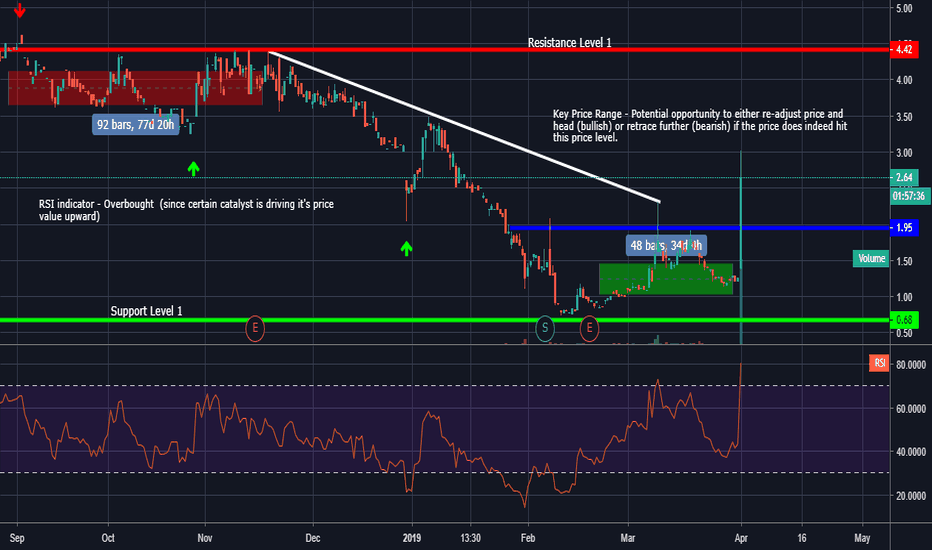

Potential Short Position - 4h Interval - PULMHello Everyone,

The stock (PULM) experienced rapid growth (bull) within today's market. Considering the current sporadic momentum upwards, there is none-the-less an opportunity to short the stock till price consolidation.

Resistance Level 1 - (4.30 - 4.50) 20 pip interval

Blue Horizontal Line - (1.80 - 2.10) 30 pip interval

Support Level 1 - (0.50 - 0.80) 30 pip interval

Furthermore, (PULM)'s Net Income: -18.056M which can be quite alarming, as their return on assets is negative as well (-1.1653). If they can revitalize the negative totals (into positive), there still may be hope for them in the coming months and year.

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Potential Correction - 4hr Interval - ADXSHello Everyone,

The stock (ADXS) has none-the-less presented an immense amount of volatility within the last few days (2). The overall trend of the stock, however, is pulling downwards (Bearish) towards territory that hasn’t been contest since (2009).

Resistance Level 2 - (14.70 - 15.00) 30 cent interval

Resistance Level 1 - (10.75 - 11.00) 25 cent interval

Blue Horizontal Line - (8.00 - 8.30 ) 30 cent interval

Support Level 1 - (2.55 - 2.80) 25 cent interval

Furthermore, this is highly sporadic stock and should be handled with immense caution. (Wait for PA confirmation prior to entering a position)

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Principles)***

-LionGate

Position Developing - 45min Interval - CELHello Everyone,

The stock (CEL) has appearing to garner a modest amount of upward momentum. In the very least, PA is either attempting to consolidate at current price levels or formulate a breakout position. (Let Market Action Take Place and Then Form Your Decision).

Resistance Level 1 - (7.45 - 7.75) 30 cent interval

Blue Horizontal Line - (4.25 - 4. 55) 30 cent interval

Support Level 1 - (5.30 - 5.55) 25 cent interval

Support Level 2 - (3.40 - 3.70) 25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Reversal Impending - 4hr Interval -VUZIHello Everyone,

The stock (VUZI) appears to have endured a significant amount of sellers over consuming buyers (bearish market). In this regard, an immediate (or within the next formation) reversal may be in order to either consolidate at current PA (Price Action) level or breakout to lower lows (or higher highs). Further is always necessary prior to trading transfers

Resistance Level 3 - (7.15 - 7.45) 30 cent interval

Resistance Level 2 - (5.25 - 5.65) 40 cent interval

Resistance Level 1 - (3.70 - 4.10) 30 cent interval

Blue Horizontal Line - (3.15 - 3.35) 20 cent interval

Support Level 1 - (2.45 - 2.75) 30 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Reversal Imminent - 45min Interval - EURUSDHello Everyone,

The currency pair (EURUSD) has been on a (bearish) trend since (March 20th -21st). Considering the present PA at Support Level 1, there is a plausible opportunity to believe that the pair will be in an uptrend (or consolidation) within the next few days. Wait for further price confirmation. The PA has broken numerous consolidation levels to further progress downwards (March 25th -26th, March 28th - April 1st).

Resistance Level 1 - (1.13915 - 1.13945) 30 pip interval

Support Level 1 - (1.11890 - 1.11920) 30 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Diligent and Stick To Your Trading Plan)***

-LionGate

Long Position - 4 hr Interval - CBKHello Everyone,

The stock (CBK) appears to be attracting a bullish formation for the next couple of weeks. Since the stock has been oversold for arguably 2 - 3 weeks, there is only "reason" to believe that a reversal is imminent. As what goes down, must essentially come up (basic physics).

For Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)

Long Position - Daily Interval- ASNAHello Everyone,

The Stock (ASNA) has been experiencing a downward momentum for quite some duration (November 2018 - March 2019). Considering the current fluctuation in PA, there is a viable opportunity to enter a long (bull) position for the next 2 - 3 months.

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

Position Formation - 1hr interval - EURJPYHello Everyone,

Bullish Formation - (125.00-125.50) 50 pip interval

Bearish Formation - (123.625-123.675) 50 pip interval

Consolidation Current Price - (124.300-124.400) 100 pip interval

RSI - indicating a strong consolidation currently being manifested within the last (5-6 Days)

Overall, be diligent of the current momentum shift and fundamental releases soon taking place this (later) week.

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Principles)***

-LionGate

Potential Long Position - EUHello Friends,

Over the recent days, EU has continued to receive a bearish momentum. The currency pair is appearing to head towards the (1.12100-1.12150) support line. There may be a rejection here, deriving a long position within the next few days. The Relative Strength Index is also signifying that the sellers have been an overriding force. Stay diligent

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

Every Strategy Can Be Successful, But Not All Can Be Executed Successfully

-LionGate

Retracement Imminent - 45min Interval - AEZSHello Everyone,

In-regards to the data generated from the RSI indicator, (AEZS) appears to be in overbought price territory (4.65 - 4.75) within the last few days. There is strong implication to acknowledge a correction is in-order. Which could either a-test previous structure highs (as far back as 2017-2018).

Entry Point - (4.70 - 4.75) pay attention to open price - Short Position

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Position Forming OBCIHello Everyone,

The value of the stock could either re-test the value at (4.20-4.30) or considering retracing below the current price location (3.20-3.30). Be Diligent

Not Investment Advice. For Educational and Analytical Purposes Only. (Stick To Your Trading Regimine).

-LionGate

Break OUT OpportunityHello Everyone,

Within previous months we have begun to witness the formation of upward moment. If the continued trend were to continue bullish then (112.50-112.100) would be a solid entry point. However, a reversal would indicate a viable entry at the (109.750-109.800).

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Cautious and Stick To Your Trading Regimine).

- LionGate

Consolidation - Possible Long Term ProfitConsidering how previous trends indicate a downward direction, the overall moment of MRKR could indicate either a bullish or bearish formation within the next couple of months. Eventually re-adjusting it’s current consolidation value.

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Cautious and Stick To Your Plan Rigorously).

Trading Plan February 2019This is my trading plan for February 2019.

Will be working this plan for the rest of the year, and review December 31 2019.

This is based on:

- 2 years of crypto trading

- realisation that I suck at daytrading

- suspicion I could be good at macro swing trading

- recent education on Babypips and other trusted sources

The focus of the year is on:

- learning

- refining a system that plays to my strengths

- understanding risk management and R:R

- becoming effective at pulling the trigger on entries/exits

Profit is really not a concern for this year. Profit will come when I'm competent as a trader and can consistently show a meaningful, non-negligible winrate, net of fees.

Buy USDCAD TP 1.33619 | Best Chart UpadtedUSDCAD follows exactly my prediction of the breakout for a long term Sell until the good support for a Buy TP 1.33619 that you can currently do.

But Pay attention about the USD, I think this movement can go only for a scalping due to the affection of the USD by the Shutdown News next week Monday 14.

USDCAD will be in my plan next week, feel free to join my channel for free trade.

Enjoy!!