Understanding SMT Divergence In Trading1. Definition and Importance

SMT (Smart Money Technique) Divergence refers to a trading concept that involves identifying discrepancies between the price movement of correlated markets or instruments.

These discrepancies can signal potential market reversals or price manipulation. Specifically, it focuses on the divergence between price movements and indicators (like volume, momentum, or oscillators) in markets that typically move in sync.

In SMT Divergence, traders look for situations where two or more correlated instruments (like

Forex pairs, indices, or bonds) are moving in opposite directions. This "divergence" signals that

there may be a shift in market sentiment, liquidity manipulation, or an opportunity for price

correction.

The importance of SMT Divergence lies in its ability to detect hidden market dynamics that are

often manipulated by institutional players. By understanding these divergences, traders can

gain insights into potential market moves and position themselves accordingly.

2. The Relationship Between Correlated Markets

Understanding these relationships is crucial for identifying SMT Divergence:

Forex Pairs : Many Forex pairs have direct correlations. For example, EUR/USD and USD/JPY are often correlated in the sense that when the USD strengthens, both pairs may exhibit price movement in the same direction (EUR/USD decreases, USD/JPY increases). SMT

Divergence occurs when these pairs move in opposite directions, indicating that something

unusual is happening in the market (e.g., liquidity manipulation or market anticipation).

Indices : Stock market indices (like the S&P 500 or Dow Jones) and related instruments like futures or ETFs can show correlation. A divergence in these indices might indicate potential

trends or reversals, signaling that institutions are positioning themselves for a move in one

direction, and the market is showing resistance.

Bonds : The relationship between bond yields and currency pairs, for instance, can also show correlations. When bond yields move in one direction, certain currency pairs should

generally follow suit. Divergence in this relationship can reveal clues about market

intentions, such as shifts in interest rates or macroeconomic sentiment.

Commodities and Stocks : Commodities like oil and gold can often correlate with indices or specific stocks. For example, if oil prices rise and an energy sector index doesn’t move in the

same direction, this could be a sign of market inefficiencies or institutional positioning.

3. SMT Types

3.1. Bullish SMT Divergence

Bullish SMT (Smart Money Technique) Divergence occurs when one correlated asset forms a

higher low while another makes a lower low. This indicates that one market is showing hidden

strength, suggesting a potential reversal to the upside.

How to Spot Higher Lows in One Asset While the Other Makes Lower Lows:

1. Identify Two Correlated Markets – Choose two assets that typically move together, such as EUR/USD and GBP/USD or NASDAQ and S&P 500.

2. Look for Divergence – Observe when one asset makes a new lower low, while the other fails to do so, instead of forming a higher low.

3. Volume & Price Action Confirmation – Institutions may absorb liquidity in the weaker asset while the stronger one holds its ground.

4. Validate with Market Context – Look at macroeconomic conditions, liquidity pools, and institutional activity to confirm the setup.

3.2. Bearish SMT Divergence

Bearish SMT Divergence occurs when one correlated asset forms a lower high while another

makes a higher high. This signals hidden weakness, indicating that the market may be setting

up for a bearish reversal.

How to Spot Lower Highs in One Asset While the Other Makes Higher Highs:

1. Find Two Correlated Markets – Common pairs include NASDAQ vs. S&P 500 or EUR/USD vs. GBP/USD.

2. Identify the Divergence – One asset makes a higher high, while the other fails to follow and forms a lower high instead.

3. Liquidity & Volume Analysis – Smart money may be using the stronger asset to attract buyers before reversing.

4. Confirm with Institutional Order Flow – Watch for liquidity grabs and imbalance zones.

3.3. Intermarket SMT

Definition : Divergence between assets from different markets, such as Forex vs. Commodities, Stocks vs. Bonds, or Indices vs. the U.S. Dollar.

Examples :

EUR/USD vs. DXY (U.S. Dollar Index) – If EUR/USD forms a higher low while DXY makes a

higher high, this suggests USD weakness and potential EUR/USD strength.

NASDAQ vs. S&P 500 – If NASDAQ makes a higher high but S&P 500 doesn’t, it can indicate

a weakening stock market rally.

Strength & Validity :

High validity because institutions hedge positions across different markets.

3.4. Intramarket SMT

Definition : Divergence within the same market (e.g., multiple Forex pairs or stock indices).

Examples :

EUR/USD vs. GBP/USD – If EUR/USD makes a lower low but GBP/USD doesn’t, it could

indicate bullish strength.

Dow Jones vs. S&P 500 vs. NASDAQ – If NASDAQ is making new highs while the Dow lags, it

may signal weakness in the broader stock market.

Strength & Validity :

Still valid but needs additional confirmation (liquidity sweeps, volume analysis).

4. SMT Divergence vs. RSI Divergence

Why SMT Is Superior to Traditional RSI Divergences

1. RSI Measures Momentum, Not Liquidity – RSI divergence is based on momentum shifts,

which institutions can easily manipulate with fake breakouts or engineered price moves.

2. SMT Focuses on Market Structure & Liquidity – SMT divergence detects institutional

positioning by comparing correlated assets, making it harder to manipulate.

3. RSI Can Remain Overbought/Oversold for Long Periods – Markets can continue trending

despite RSI divergence, while SMT divergence often provides stronger reversal signals.

How Smart Money Manipulates Classic Divergence Traders

Liquidity Sweeps – Institutions use RSI divergence to lure retail traders into premature

reversals before executing stop hunts.

False RSI Signals – In trending markets, RSI divergences often fail, while SMT divergence

provides a more contextual view of smart money positioning.

5. Using TradingView for SMT Analysis

To effectively analyze SMT divergence, traders should monitor at least two correlated assets

simultaneously.

TradingView makes this easy by allowing multiple chart layouts. Steps to Set Up Multiple Charts in TradingView:

a. Open TradingView and click on the “Select Layout” button.

b. Choose a two-chart or four-chart layout to compare correlated assets.

c. Sync timeframes across all charts for consistency.

d. Adjust scaling to ensure price action is easily comparable.

Best Pairs to Compare for SMT Analysis:

Forex : EUR/USD vs. GBP/USD, USD/JPY vs. DXY

Indices : NASDAQ vs. S&P 500, Dow Jones vs. S&P 500

Commodities & FX : Gold (XAU/USD) vs. USD/JPY

Bonds & Equities : 10-Year Treasury Yield vs. S&P 500

6. Key Takeaways

SMT divergence reveals institutional intent by showing liquidity accumulation or

distribution through correlated assets.

Bullish SMT occurs when one asset makes a lower low while the other does not, signaling a

potential reversal up.

Bearish SMT occurs when one asset makes a higher high while the other does not, signaling

a potential reversal down.

Best markets for SMT analysis include Forex pairs, indices, commodities, and bonds, where

correlations are strongest.

SMT is most effective near key liquidity levels, such as session highs/lows, order blocks, and

fair value gaps.

SMT is more reliable during high-impact news events, London & New York sessions, and

quarterly shifts, where institutional activity is highest.

SMT is superior to RSI divergence because it reflects real liquidity dynamics, whereas RSI

can produce false signals.

Combining SMT with market structure shifts like BOS and CHoCH increases trade accuracy

and reliability.

Risk management in SMT trading requires stop-loss placement beyond liquidity grabs and a

minimum 2:1 risk-reward ratio.

Mastering SMT helps traders avoid liquidity traps, improve precision, and align with smart

money moves.

SMT divergence is the footprint of smart money—where one market whispers the truth while the other follows the herd.

Divergence

Xmoon Indicator Tutorial – Part 2 – Pivots🔻🔻🔻+ Persian translation below 🔻🔻🔻

🔹 What Is a Pivot?

In the Xmoon strategy, every high or low that forms on the chart is considered a pivot.

The number of candles between two highs or two lows defines the size of the pivot.

The more candles there are between them, the larger and more reliable the pivot becomes.

🔸 Types of Pivots in the Xmoon Indicator Settings

In the settings panel, you can choose which types of pivots the patterns should be based on.

There are 4 pivot types :

• Super Minor → the smallest pivot

• Minor

• Mid Major

• Major → the largest pivot

⏫ As you move from Super Minor to Major, the strength of the pivot increases — but the number of signals decreases.

⚖️ Choosing the Right Pivot = Your Trading Style

• Want more signals? → Use smaller pivots like Minor or Super Minor

• Prefer higher accuracy and lower risk? → Use larger pivots like Major or Mid Major

💡 Pro Tip: On higher timeframes, pivots perform better and help reduce risk.

✍️ Summary

If you're looking for frequent signals, trade on lower timeframes, and can handle higher volatility and pressure, then smaller pivots like Super Minor and Minor are a better choice.

But if you prefer quality over quantity, work on higher timeframes, and value clarity, peace of mind, and higher success rates, then larger pivots like Mid Major and Major are the way to go.

📣 If you have any questions or need guidance, feel free to ask us. We’d be happy to help.

🔻🔻🔻 Persian Section – بخش فارسی 🔻🔻🔻

🔹 پیوت چیست؟

در استراتژی ایکسمون، هر قله یا درهای که روی چارت شکل میگیرد، یک پیوت محسوب می شود

فاصله زمانی بین دو قله یا دو دره (یعنی تعداد کندلهایی که بینشان قرار دارد) اندازهی پیوت را مشخص میکند

هرچه تعداد کندل بین دو سقف یا کف بیشتر باشد، آن پیوت بزرگتر و معتبرتر است

🔸 انواع پیوت در تنظیمات اندیکاتور ایکسمون

در بخش تنظیمات، میتوانید مشخص کنید که الگوها بر اساس چه نوع پیوتهایی شناسایی شوند

ما ۴ نوع پیوت داریم

• سوپر مینور ← کوچکترین پیوت

• مینور

• میدماژور

• ماژور ← بزرگترین پیوت

⏫ هرچه از سوپرمینور به سمت ماژور برویم، قدرت پیوت بیشتر میشود، ولی تعداد سیگنالها کمتر می شود

⚖️ انتخاب پیوت مناسب = سبک معاملاتی شما

• به دنبال سیگنال زیاد هستید ← پیوت کوچک تر = مینور و سوپرمینور

• به دنبال دقت بیشتر و ریسک کمتر هستید← پیوت بزرگتر = ماژور و میدماژور

💡 نکته حرفهای: در تایمفریمهای بالا، پیوتها عملکرد بهتری دارند و به کنترل ریسک کمک میکنند

✍️ جمعبندی

اگر دنبال سیگنالهای زیاد هستید، در تایمفریمهای کوچکتر کار میکنید و میتونید نوسانات و فشار روانی بالاتر رو تحمل کنید، پیوتهای کوچکتر مثل سوپرمینور و مینور انتخاب مناسبتری هستند

اما اگر در تایم فریم های بزرگتر کار می کنید و کیفیت سیگنال، آرامش ذهنی و احتمال موفقیت برایتان مهمتر است، پیوتهای بزرگتر مثل میدماژور و ماژور انتخاب بهتری هستند

📣 اگر سوالی دارید یا نیاز به راهنمایی دارید، خوشحال میشویم از ما بپرسید

با کمال میل در خدمتتان هستیم

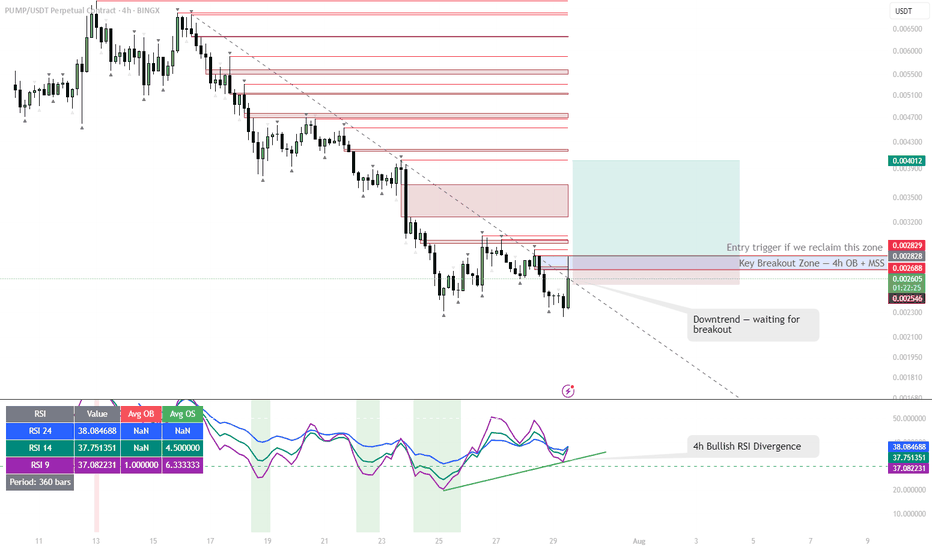

PUMP | #4h #long — Watching for Breakout Confirmation Early signals for a reversal, but not rushing in.

Some clear bullish divergence on the 4h RSI — first positive sign after an extended downtrend. Price can pop from here, but my plan is to wait for a break and hold above the 4h Order Block + MSS zone (red box) before taking any long entry.

Confirmation is key — I only want to get involved if we reclaim this area with momentum.

Scenario:

If we get a strong breakout and close above the red OB + MSS zone, that’s the first entry trigger for a potential trend reversal.

Until then — standing aside, letting the setup prove itself.

Reasoning:

Bullish RSI divergence often marks the beginning of a reversal, but without a structural breakout, the move can easily fail.

Patience pays off in these high-risk, low-liquidity coins.

EUR/CAD: Shorting the Climactic Rally Near 1.6000The strong rally in EUR/CAD has pushed the pair into extreme territory, approaching a major psychological and structural resistance zone. While momentum has been strong, this looks like a potential climactic or "blow-off" top, offering a highly favorable risk/reward opportunity to short the pair in alignment with the weak underlying Euro fundamentals.

The Fundamental Why 📰

The core thesis remains bearish for the Euro. The European Central Bank (ECB) maintains a distinctly dovish tone, signaling a willingness to ease policy further to support a slowing Eurozone economy. This fundamental headwind suggests that extreme rallies in Euro pairs are often exhaustive and present prime shorting opportunities.

The Technical Picture 📊

Major Supply Zone: The price is entering a critical multi-month supply zone between 1.5950 and the key psychological level of 1.6000. This is a major ceiling where significant selling pressure is anticipated.

Fibonacci Extension: This area aligns with a key Fibonacci extension level (1.272) from the last major impulse wave, a common zone where trending moves become exhausted and reversals begin.

Pronounced RSI Divergence: A clear bearish divergence is forming on the daily chart. As price makes this final push to a new high, the Relative Strength Index (RSI) is making a significantly lower high, signaling a deep exhaustion of buying momentum.

The Counter-Trade Rationale 🧠

This is a high-level fade. We are positioning for a reversal at a major, technically significant ceiling. The extreme price extension, combined with clear momentum divergence, indicates that the risk of buying at these highs is substantial. By shorting here, we are betting that the powerful technical resistance and weak fundamentals will trigger a significant correction.

The Setup ✅

📉 Pair: EUR/CAD

👉 Direction: Short

⛔️ Stop Loss: 1.63230

🎯 Entry: 1.59490

✅ Take Profit: 1.52008

⚖️ Risk/Reward: ≈ 2:1

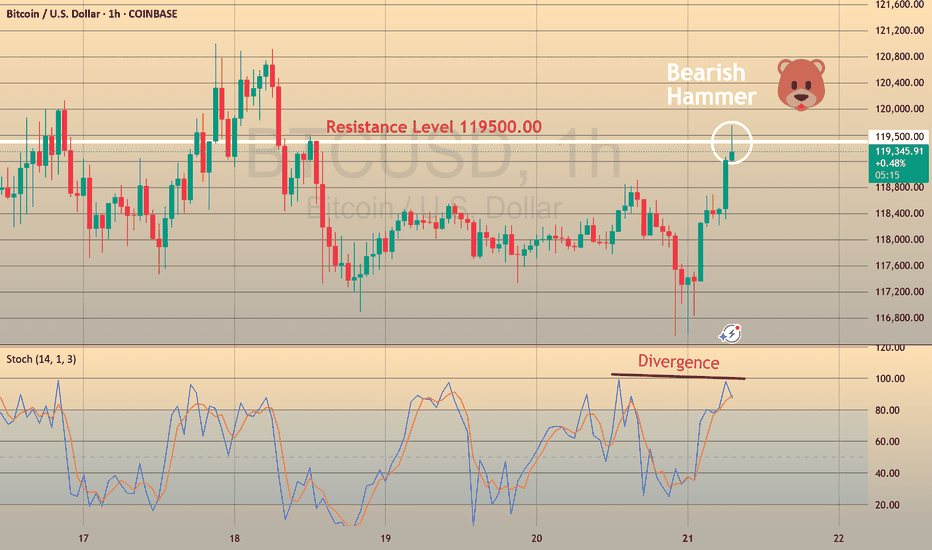

BTCUSD - BEARISH DIVERGENCE DETECTEDCAPITALCOM:BTCUSD

BTCUSD has been in a bullish trend over the past few hours and is now approaching the resistance at 119,500.00.

On the hourly chart, a bearish hammer has formed alongside a stochastic divergence, signaling potential downside.

⚡ This signal is reinforced by a strong resistance level above, adding weight to a possible pullback scenario.

📉 If BTCUSD rebounds from this level, consider Sell setups with take profit at the nearest support.

📈 If it breaks out, look for Buy opportunities on confirmation.

⚡ We use Stoch (14) to spot potential reversals when it exits overbought or oversold zones — helping you catch clear, confident entries.

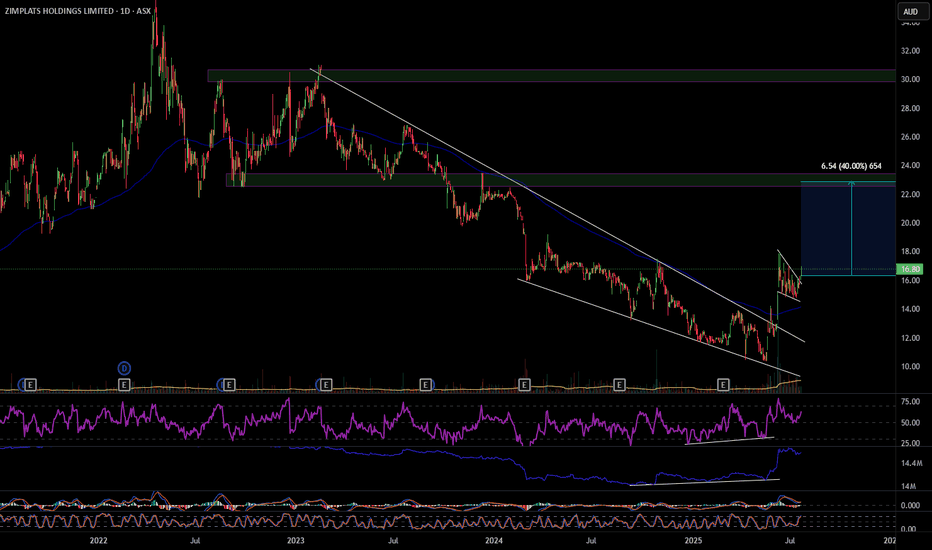

ZIM 40% move up

ZIM has broken out of a descending wedge with bullish RSI and OBV divergence, also multiple divergences on smaller time frames. On the hourly it's had a pull back and formed a bull flag that it has also broken out of. ZIM looks to have formed a change of structure forming higher highs and higher lows, my first target will be $22.90 a move of 40%. Definitely one to consider. Good luck and happy trading 🍀

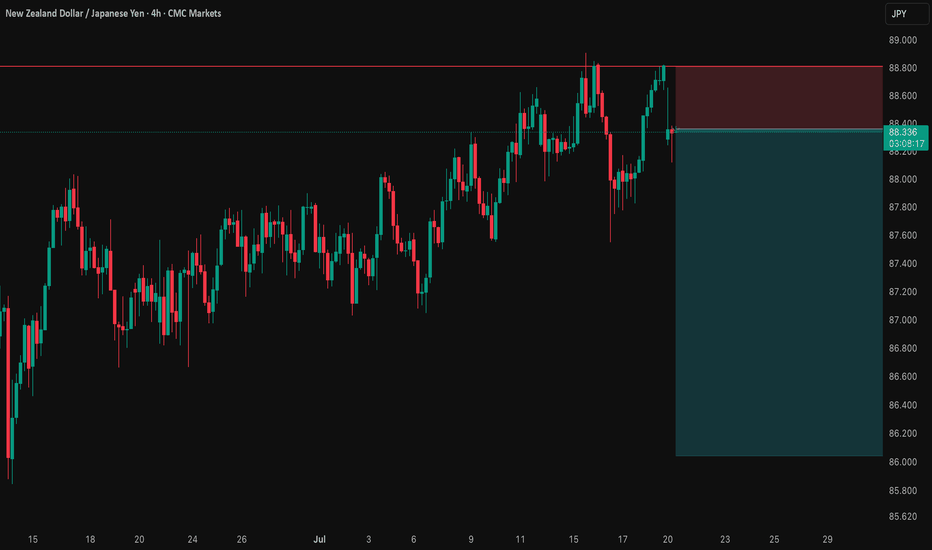

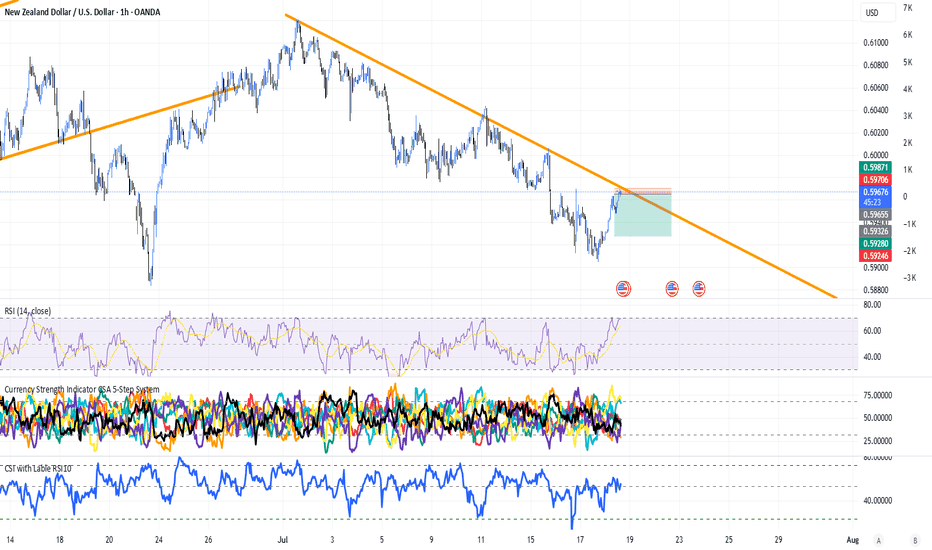

NZD/JPY: A Data-Driven Short SignalBefore I post a trade, I put it through a rigorous, multi-step analysis. Here’s exactly what I did for this NZD/JPY setup to build a data-driven case.

I Started with the 'Why': The Fundamental Story 📰

First, I identified the powerful divergence between the dovish RBNZ and the hawkish BoJ. This gave me my core bearish thesis for the pair.

I Challenged My Idea with Data: The Stress Test 🧠

A good story isn't enough. So, I ran this bearish idea through my mathematical models . My goal was to find any hidden risks and see if the hard data supported my fundamental view.

What My Analysis Revealed: A Warning and a Confirmation ⚠️

The data came back with two critical insights:

Confirmation: The models strongly validated the bearish direction with a high degree of mathematical probability.

Warning: They exposed a hidden danger—a standard entry had a very high probability of getting stopped out in the current market.

I Engineered the Solution: The Optimized Plan 🛠️

This is the most important step. I used these data insights to build a new trade plan from the ground up. The entry, stop loss, and take profit below are not guesses; they are the output of my analysis, specifically designed to navigate the risk the data uncovered.

The result is a trade with a huge 5.15-to-1 Risk-to-Reward ratio , where my fundamental view is now backed by a data-driven execution strategy. Let's get into it. 👇

The Complete Trade Plan

Strategy & Trade Parameters ✅

📉 Pair: NZD/JPY

👉 Direction: Short

⛔️ Entry: 88.35800

🎯 Take Profit: 86.04347

🛡️ Stop Loss: 88.80723

⚖️ Risk-Reward: 5.15

This setup represents my ideal trading approach: forming a strong fundamental thesis and then using disciplined, mathematical analysis to define the execution. The result is a plan where the direction is clear and the risk is precisely managed. Trade safe.

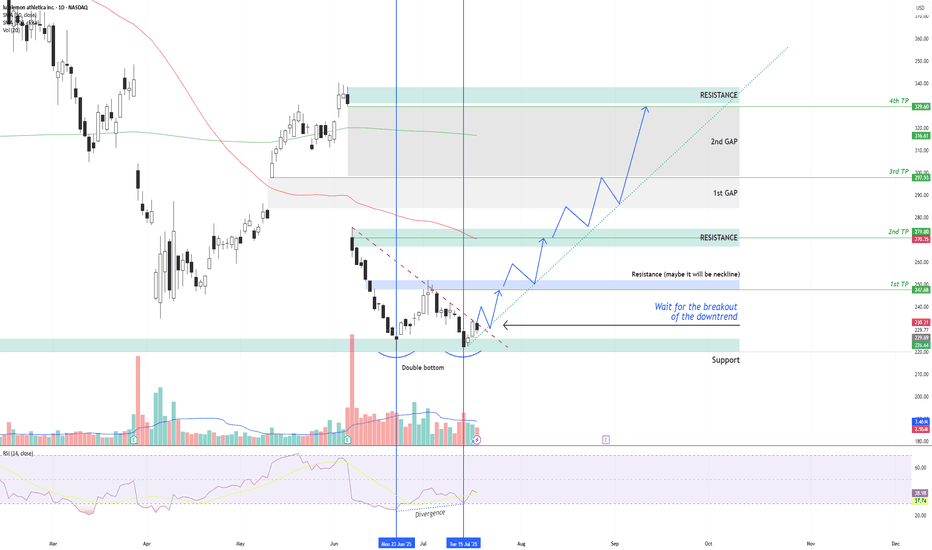

LULU – Double Bottom + RSI Divergence: Multi-Target Setup After LULU NASDAQ:LULU is showing signs of a potential bullish reversal after forming a double bottom structure around the $220 support zone , along with a bullish divergence on the RSI indicator.

Two vertical lines highlight the divergence: while price made a lower low, RSI formed a higher low – indicating a possible momentum shift in favor of buyers.

Currently, price is moving just below a descending trendline, which has been acting as dynamic resistance. The first condition for a long setup is a confirmed breakout above this trendline followed by a successful retest. If that happens, an entry can be considered .

📌 Entry Plan:

Entry: After a breakout and retest of the descending trendline.

1st TP: ~$247 — This level coincides with a local resistance zone, which may act as a neckline of the double bottom.

If price breaks above $247 and retests, it confirms bullish continuation.

📈 Target Structure:

2nd TP: ~$271 — next major resistance zone.

3rd TP: ~$297 — aligns with the first major gap zone.

4th TP: ~$329 — final gap resistance from previous sell-off levels.

This structure allows for scaling into the trade in stages — each breakout and retest offers a new confirmation and extension to the next target zone.

Volume analysis, price action, and RSI momentum all support the probability of a trend reversal — but confirmation is key.

Not financial advice. Always conduct your own research and risk management.

EUR/CAD: Quant-Verified ReversalThe fundamental catalyst has been triggered. The anticipated strong Canadian CPI data was released as expected, confirming the primary driver for this trade thesis. Now, the focus shifts to the technical structure, where price is showing clear exhaustion at a generational resistance wall. 🧱

Our core thesis is that the confirmed fundamental strength of the CAD will now fuel the technically-indicated bearish reversal from this critical price ceiling.

The Data-Driven Case 📊

This trade is supported by a confluence of technical, fundamental, and quantitative data points.

Primary Technical Structure: The pair is being aggressively rejected from a multi-year resistance zone (1.6000 - 1.6100). This price action is supported by a clear bearish divergence on the 4H chart's Relative Strength Index (RSI), a classic signal that indicates buying momentum is fading despite higher prices.

Internal Momentum Models: Our internal trend and momentum models have flagged a definitive bearish shift. Specifically, the MACD indicator has crossed below its signal line into negative territory, confirming that short-term momentum is now bearish. This is layered with a crossover in our moving average module, where the short-term SMA has fallen below the long-term SMA, indicating the prevailing trend structure is now downward.

Quantitative Probability & Volatility Analysis: To quantify the potential outcome of this setup, we ran a Monte Carlo simulation projecting several thousand potential price paths. The simulation returned a 79.13% probability of the trade reaching our Take Profit target before hitting the Stop Loss. Furthermore, our GARCH volatility model forecasts that the expected price fluctuations are well-contained within our defined risk parameters, reinforcing the asymmetric risk-reward profile of this trade.

The Execution Plan ✅

Based on the synthesis of all data, here is the actionable trade plan:

📉 Trade: Sell (Short) EUR/CAD

👉 Entry: 1.6030

⛔️ Stop Loss: 1.6125

🎯 Take Profit: 1.5850

The data has spoken, and the setup is active. Trade with discipline.

USDJPY: Bearish Divergence – Eyeing Shorts to 143 CAPITALCOM:USDJPY

We’re seeing strong bearish divergence in USDJPY near the 148 resistance zone, shifting our focus to short opportunities with a medium-term target at 142.

📈 Trading Plan:

🔻 SELL Stop: 147.040

❌ Stop Loss: 149.220

✅ Take Profit: 143.000

(Click 👉 Trade Now 👈 on your mobile to copy SL & TP easily)

🔍 Why am I short here?

✅ Technical: Clear bearish divergence on the H4 (RSI & MACD), indicating potential reversal signals.

✅ Resistance Zone: Price is testing the key 148 resistance, providing an ideal risk-reward location for shorts.

✅ Macro Event: Ahead of tomorrow’s US CPI release, a conservative trade structure is maintained to manage volatility risks.

📰 Fundamental Snapshot:

Japan’s economy shows signs of stabilization:

Core machinery orders fell only 0.6% MoM in May to ¥913.5B, much better than April’s -9.1% and forecasts of -1.5%.

Despite the headline decline, it indicates resilience in Japan’s capital spending, supporting the JPY’s medium-term outlook amid global trade and growth risks.

Trade cautiously!

AUD/USD: Short Setup to 0.6450This trade idea is rooted in a data-driven approach, leveraging a rare asymmetry in the economic calendar and specific quantitative models to identify a high-clarity opportunity.

📊 The Thesis by the Numbers

My model assigns clear probabilities to the potential scenarios for this week, based on the scheduled U.S. data releases.

60% Probability: Base Case (USD Strength). Triggered by a U.S. Core CPI reading at or above 0.3% MoM.

30% Probability: Alternative Case (USD Weakness).

10% Probability: Wildcard Scenario (Risk-On Rally).

🧠 The Data-Driven Rationale

This setup scored a -5 on my quantitative thesis model, indicating a strong bearish conviction. The core of this is the one-sided event risk. With Australia's calendar completely empty, the AUD is a sitting duck. Meanwhile, a volley of tier-one U.S. data (CPI, PPI, Retail Sales) is expected to confirm a robust economy. This fundamental divergence, combined with a technical picture of price coiling below long-term resistance, creates the conditions for a catalyst-driven drop.

⛓️ Intermarket & Statistical Edge

Further analysis of market correlations and forward-looking models reinforces the bearish bias.

🌐 Correlations: The positive correlation of AUD/USD with equities (SPY: +0.31) suggests that a strong USD report, which could pressure stocks, would create a direct headwind for the Aussie.

🎲 Monte Carlo Simulation: While the mean outcome is neutral, the model's 5th percentile for price is down at 0.6503 , highlighting the statistical risk of a significant downside move if the catalyst fires.

✅ The Trade Setup

📉 Bias: Bearish / Short

👉 Entry: Watch for a bearish reversal pattern on the 1H or 4H chart within the $0.6550 resistance zone.

⛔️ Stop Loss: A decisive daily close above the 0.6622 resistance level.

🎯 Target: 0.6458 (June low-day close).

Good luck, and trade safe.

GBP/USD: Path to 1.3200 on Policy DivergenceThis trade idea outlines a high-conviction bearish thesis for GBP/USD. The core of this analysis is a significant and growing divergence between the fundamental outlooks of the UK and US economies, which is now being confirmed by a bearish technical structure. We anticipate the upcoming UK economic data releases during the week of July 14-18 to act as a catalyst for the next leg down.

The Fundamental Why 📰

The primary driver for this trade is the widening policy and economic divergence. The UK is facing a triad of headwinds while the US economy exhibits greater resilience. This fundamental imbalance favors the US Dollar and is expected to intensify.

Dovish Bank of England: The BoE is clearly signaling a dovish pivot towards monetary easing in response to a weakening labor market and sluggish growth prospects. This contrasts with the Federal Reserve's more patient, data-dependent stance.

Widening Rate Differentials: The divergence in central bank policy is leading to a widening interest rate differential that favors the US Dollar.

Geopolitical Headwinds: Fiscal policy from the new UK government and ongoing trade tensions are creating additional headwinds for the Pound.

The Technical Picture 📊

Price action provides strong confirmation of the bearish fundamental thesis, showing a clear loss of upward momentum and the formation of a new downtrend.

📉 Death Cross: The 50-day moving average has crossed below the 200-day moving average, forming a "death cross," which is a strong bearish indicator.

📉 Key Level Lost: The price has recently broken and is holding below the critical 200-day moving average, a classic bearish signal.

📉 Bearish Momentum: Both the RSI (below 50) and the MACD (below its signal line and zero) indicate that bearish momentum is in control.

The Trade Setup 📉

👉 Entry: 1.3540 - 1.3610

🎯 Take Profit: 1.3200

⛔️ Stop Loss: 1.3665

A New Chapter Begins with EURUSD’s ABC Wave Formation!🎯 Hey Guys,

I’ve prepared a fresh EURUSD analysis for you.

The market has shifted direction, and an ABC wave structure has emerged.

I’ve placed a Buy Limit order based on my entry level.

Below, you’ll find my detailed target zones and entry specifics:

🟩 Buy Limit Order: 1.17197

🟥 Stop Loss: 1.16903

📌 Targets:

🔹 TP1: 1.17344

🔹 TP2: 1.17538

🔹 TP3: 1.17869

📊 Risk/Reward Ratio: 2.27

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

EUR/USD: A High-Probability Short Setup at 1.1829At its core, this trade is driven by a powerful and growing divergence between the US and European economies. While technicals tell us where to trade, fundamentals tell us why we're trading.

1️⃣ The Interest Rate Gap: The U.S. currently offers significantly higher interest rates (4.25% - 4.50%) compared to the Eurozone (2.15%). This makes holding the US Dollar more attractive, creating natural downward pressure on the EUR/USD.

2️⃣ Central Bank Policy: The US Federal Reserve remains hawkish, focused on strength and fighting inflation. Meanwhile, the European Central Bank is dovish, signaling a willingness to keep conditions loose to support a weaker economy.

3️⃣ Labor Market Strength: The US enjoys a robust labor market with unemployment at just 4.1%, while the Eurozone's is significantly higher at 6.3%. This points to a stronger US economy.

In simple terms, the US economy is strong, and its central bank is acting like it. The Eurozone economy is weaker, and its central bank is acting accordingly. This fundamental imbalance is the fuel for a potential significant move down in EUR/USD.

The Technical Picture: The Wall at 1.1829

As you can see on the 4H chart, the price has run into a major wall of resistance at the 52-week high of 1.1829 . After a long uptrend, the momentum has stalled, and the price is now consolidating inside a symmetrical triangle . This coiling of price action often precedes a strong breakout.

Our strategy is not to guess the breakout, but to act on a high-probability retest of resistance. We are looking to enter a short position as the price pulls back towards the upper boundary of this triangle, anticipating a failure at resistance and a subsequent break to the downside.

The Actionable Trade Plan

This setup offers an excellent risk/reward profile.

📉 Asset: EUR/USD

👉 Entry (Limit Sell): 1.1780

⛔️ Stop Loss: 1.1850

🎯 Take Profit: 1.1600

📈 Risk/Reward Ratio: ~2.57:1

Trade safe and manage your risk.

NZD/JPY: Bearish Wedge Before RBNZ CatalystThis is a high-conviction trade idea for NZD/JPY , where a perfect storm of technical and fundamental factors is aligning for a significant short opportunity. The setup is clean, the reasoning is strong, and we have a clear catalyst on the horizon. 🚀

Fundamental Analysis 🌪️

The macro picture is the primary driver here, creating a powerful bearish case.

1️⃣ Monetary Policy Divergence (🇳🇿 vs 🇯🇵): This is the core engine of the trade. The Reserve Bank of New Zealand (RBNZ) is dovish, signaling rate cuts amid a fragile domestic economy. In stark contrast, the Bank of Japan (BoJ) is hawkish, having started a historic policy normalization to combat persistent inflation. This fundamental clash is strongly bearish for NZD/JPY.

2️⃣ Risk-Off Catalyst (🇺🇸): The market is nervous ahead of the July 9th US tariff deadline . This uncertainty is creating a classic "risk-off" environment, which typically strengthens the safe-haven JPY and weakens risk-sensitive currencies like the NZD.

3️⃣ The RBNZ Decision (🏦): The main event on July 9. The market expects a "dovish hold," meaning even if rates are unchanged, the forward guidance will likely be very cautious, highlighting economic risks and signaling future cuts. This is the catalyst that could trigger the sell-off.

Technical Analysis 📉

The 4H chart provides crystal-clear confirmation of the fundamental weakness.

1️⃣ Bearish Rising Wedge: Price is being squeezed into a classic bearish reversal pattern. This shows that buying pressure is exhausted, and the market is preparing for a move to the downside.

2️⃣ Key Resistance Zone: The wedge is pushing directly into a heavy supply zone between 87.80 and 88.00 . This area has acted as a firm brick wall 🧱, rejecting multiple attempts to move higher.

3️⃣ RSI Momentum: The RSI below the chart confirms the weakening momentum. It's failing to show strong bullish power, which supports the price action and signals that the uptrend is running out of steam. 💨

The Trade Plan 🎯

Based on this analysis, the plan is to enter with a limit order to get an optimal entry price on a potential final spike into resistance.

Direction: Short (Sell) 📉

Order Type: Limit Sell

Entry: 87.80 📍

Stop Loss: 88.40 🛡️

Take Profit: 86.00 💰

Risk/Reward Ratio: 1:3 ⭐⭐⭐

This setup presents a rare confluence of fundamental divergence, technical weakness, and a clear catalyst.

Trade safe and manage your risk.

What’s EURUSD Telling Us on the 30-Minute Chart?🌅 Good morning, my friends,

EURUSD just made a pullback within the last 30 minutes, so I entered a sell position based on that move.

🎯 Targets:

- TP1: 1.17607

- TP2: 1.17475

- TP3: 1.17174

🛑 Stop Loss: 1.17938

📊 Risk/Reward Ratio: 2.00

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

AUD/JPY: Rejection at Key ResistanceThis is a high-conviction short setup on AUD/JPY based on a powerful rejection pattern that has formed on the 4-hour chart. As you can see, the price spiked into the critical resistance zone between 95.00 and 95.55 but was immediately and forcefully rejected, leaving behind a long "Exhaustion Spike."

This is a classic sign of buyer exhaustion and seller dominance. It tells us that despite the recent rally, there is significant supply waiting at these higher levels. This price action provides a clear opportunity to short the pair in anticipation of a significant move down.

🏦 Fundamental Analysis

The fundamental backdrop provides a strong tailwind for this trade, with two key drivers:

1️⃣ Central Bank Divergence: The Reserve Bank of Australia (RBA) is in an easing cycle, having recently cut rates to 3.85% with more cuts expected. In stark contrast, the Bank of Japan (BoJ) is on a path of normalization, having already raised its rate to 0.50%. This divergence in monetary policy is structurally bearish for AUD/JPY.

2️⃣ Imminent Catalysts: This week is packed with event risk that is skewed to the downside for this pair. We have the RBA interest rate decision on Tuesday, July 8th , and the U.S. tariff deadline on Wednesday, July 9th . A dovish RBA or a "risk-off" move from the tariff news would likely accelerate the decline in AUD (a risk currency) and strengthen the JPY (a safe-haven currency).

📊 Technical Analysis

The price action on the chart confirms the bearish bias:

1️⃣ 4-Hour Rejection: The "Exhaustion Spike" at the 95.00 - 95.55 supply zone is the primary signal. It shows a clear failure by buyers and a strong takeover by sellers at a key level.

2️⃣ Long-Term Trend: On the daily chart, the price is trading below the critical 200-day moving average , confirming the long-term trend remains bearish.

3️⃣ Waning Momentum: There is a clear bearish divergence on the daily RSI. The price made a higher high, but the momentum indicator made a lower high, signaling that the rally is internally weak and losing steam.

📋 Trading Setup

This is a swing trade designed to capture a significant correction with a simple "set and forget" plan.

📉 Direction: SHORT / SELL

👉 Entry: Sell Limit @ 94.85

⛔️ Stop Loss: 95.60

🎯 Take Profit: 91.10

💡 Rationale: The entry is placed strategically to capitalize on a potential retest of the rejection area. The stop loss is placed safely above the rejection wick and the major resistance zone. The take profit targets the major structural support from the May 2025 lows, offering an excellent risk-to-reward ratio.

SP500 - Cycle Analysis; New V-Bottom24 Dec 2018 - V-Bottom Trough:

This marks a clean V-bottom. Both the 227-ROC and 114-ROC showed simultaneous positive acceleration after price reacing its low. Shortly after, both crossed their 57-SMA almost in sync — increasing the probability of a sustained bullish move. Price confirmed this by breaking resistance and forming a V pattern. This was further validated by the centered moving average crossover (114-CMA crossing above 227-CMA).

25 Mar 2020 - Deep COVID Crash Trough:

During this phase the priced broke below the support, creating a deep trough. Altough both ROC lines initially showed strong negative acceleration due to the COVID-19 crash, they soon reversed above their 57-SMAs, signaling a major shift in momentum. This coincided with the price breaking above the key resistance which was also crossed in 2019 when confirming the old V-pattern. After this breakout, a brief pullback followed before the uptrend resumed with increasing strength.

22 Jun 2021 to 19 Dec 2023 - Pattern

During the initial period a bearish divergence was visible in the ROC, nevertheless price and rate of change both declined making a low in early October 2022. A technical pattern began to form, which appears to align more closely with a symmetrical triangle; So when measuring its height and projecting it from the breakout point aligns with the new all-time highs that were reached on 27 June 2025.

21 Mar 2025 - New Cycle Trough

A new V-bottom formed shortly after the current cycle began. Both ROC indicators had already crossed their SMAs to the upside, showing early signs of positive acceleration, days before of price broke through the resistance and reached the new record high.

The 227-SMA is likely to cross from below the fast SMA while a possibility of a pullback increase.

Following that, the 114-CMA will probably has the chance to cross back the 227-CMA, with the price potentially confirming a new support level and resuming its uptrend - in line with the broader cycle timeline.

US–Iran Conflict Triggers a Potential Nasdaq Bearish Setup🟣 Geopolitical Flashpoint Meets Technical Confluence

The U.S. weekend airstrike on Iranian nuclear facilities has reignited geopolitical instability across the Middle East. While broader markets often absorb news cycles quickly, high-beta assets like Nasdaq futures (NQ) tend to react more dramatically—especially when uncertainty meets existing technical vulnerability.

Monday’s session opened with a notable gap to the downside, reflecting immediate risk-off sentiment among futures traders. While the initial drop is being retraced intraday, historical patterns suggest that such gap-fills can often serve as ideal shorting zones—particularly when other bearish signals confirm the narrative. The backdrop is clear: this is no ordinary Monday open.

🟣 Bearish Divergence on CCI Builds the Case

From a technical standpoint, the setup gains weight through a clear bearish divergence on the Commodity Channel Index (CCI) using a 20-period setting. While prices recently pushed higher, momentum failed to follow—an early indication that buyers may be running out of steam. This divergence appears just as price approaches the origin of Friday’s gap, a level that frequently acts as a resistance magnet in such contexts. This confluence of weakening momentum and overhead supply aligns perfectly with the geopolitical catalyst, offering traders a compelling argument for a potential reversal in the short term.

🟣 Gap Origin: The Line in the Sand

The origin of the gap sits at 21844.75, a price level now acting as potential resistance. As the market attempts to climb back toward this zone, the likelihood of encountering institutional selling pressure increases. Gap origins often represent unfinished business—zones where prior bullish control was suddenly interrupted. In this case, the added layer of global tension only strengthens the conviction that sellers may look to reassert dominance here. If price action stalls or rejects at this zone, it could become the pivot point for a swift move lower, especially with bearish momentum already flashing caution signals.

🟣 Trade Plan and Reward-to-Risk Breakdown

A potential short trade could be structured using 21844.75 as the entry point—precisely at the gap origin. A conservative stop placement would rest just above the most recent swing high at 22222.00, offering protection against a temporary squeeze. The downside target aligns with a prior UFO support area near 20288.75, where demand previously showed presence. This sets up a risk of 377.25 points versus a potential reward of 1556.00 points, resulting in a reward-to-risk ratio of 4.12:1. For traders seeking asymmetrical opportunity, this ratio stands out as a strong incentive to engage with discipline.

🟣 Futures Specs: Know What You’re Trading

Traders should be aware of contract specifics before engaging. The E-mini Nasdaq-100 Futures (NQ) represent $20 per point, with a minimum tick of 0.25 worth $5.00. Typical margin requirements hover around $31,000, depending on the broker.

For smaller accounts, the Micro Nasdaq-100 Futures (MNQ) offer 1/10th the exposure. Each point is worth $2, with a $0.50 tick value and much lower margins near $3,100.

🟣 Discipline First: Why Risk Management Matters

Volatility driven by geopolitical events can deliver fast gains—but just as easily, fast losses. That’s why stop-loss orders are non-negotiable. Without one, traders expose themselves to unlimited downside, especially in leveraged instruments like futures. Equally critical is the precision of entry and exit levels. Acting too early or too late—even by a few points—can compromise an otherwise solid trade. Always size positions according to your account, and never let emotion override logic. Risk management isn’t a side-note—it’s the foundation that separates professionals from those who simply speculate.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.