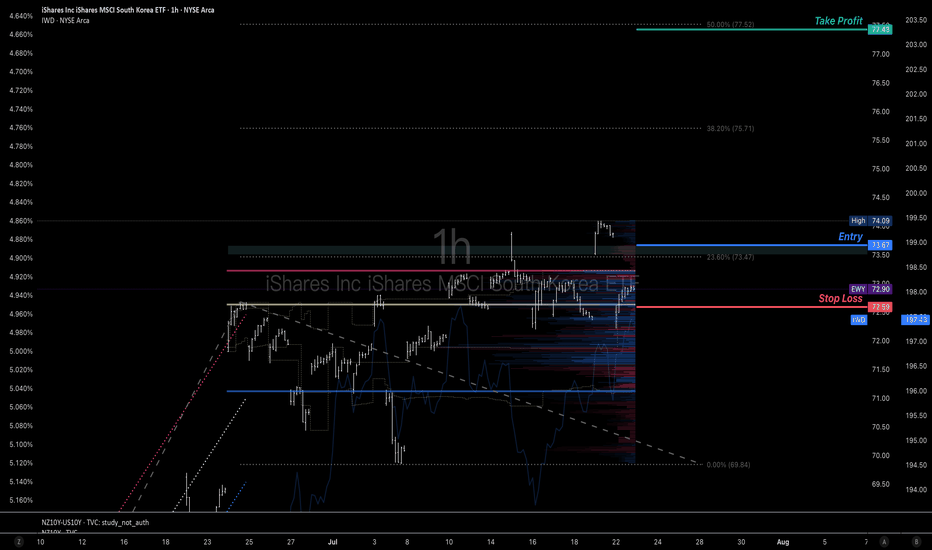

A potential chance to get long position of Korean equity marketsKorean economy and stock market emotion are well boosted by their regulation reform and new president elect. Many global traders miss the previous uptrend and the price is about to test the current resistance again.

Imma use a buy stop order @73.67 to try to get in the train to diverse my long position on equity market.

If you only do swing trades, there's a long swing trade plan on my chart. I may use the latest to take half of profit once the price hit the first or second resistance @77.43 above the current trading area to control the position size that can fit for long term trade.

Diversification

Warren Buffett's Approach to Long-Term Wealth BuildingUnderstanding Value Investing: Warren Buffett's Educational Approach to Long-Term Wealth Building

Learn the educational principles behind value investing and dollar-cost averaging strategies, based on historical market data and Warren Buffett's documented investment philosophy.

---

Introduction: The Million-Dollar Question Every Investor Asks

Warren Buffett—the Oracle of Omaha—has consistently advocated that index fund investing provides a simple, educational approach to long-term wealth building for most investors.

His famous 2007 bet against hedge funds proved this principle in dramatic fashion: Buffett wagered $1 million that a basic S&P 500 index fund would outperform a collection of hedge funds over 10 years. He crushed them. The S&P 500 returned 7.1% annually while the hedge funds averaged just 2.2%.

Today, we'll explore the educational principles behind this approach—examining historical data, mathematical concepts, and implementation strategies for learning purposes.

---

Part 1: Understanding Value Investing for Modern Markets

Value investing isn't about finding the next GameStop or Tesla. It's about buying quality assets at attractive prices and holding them for compound growth .

For beginners, this translates to:

Broad Market Exposure: Own a cross-section of businesses through low-cost index funds

Long-term Perspective: Think decades, not months

Disciplined Approach: Systematic investing regardless of market noise

"Time is the friend of the wonderful business, the enemy of the mediocre." - Warren Buffett

Real-World Application:

Instead of trying to pick between NASDAQ:AAPL , NASDAQ:MSFT , or NASDAQ:GOOGL , you simply buy AMEX:SPY (SPDR S&P 500 ETF) and own pieces of all 500 companies automatically.

---

Part 2: Dollar-Cost Averaging - Your Secret Weapon Against Market Timing

The Problem: Everyone tries to time the market. Studies show that even professional investors get this wrong 70% of the time.

The Solution: Dollar-Cost Averaging (DCA) eliminates timing risk entirely.

How DCA Works:

Decide on your total investment amount (e.g., $24,000)

Split it into equal parts (e.g., 12 months = $2,000/month)

Invest the same amount on the same day each month

Ignore market fluctuations completely

DCA in Action - Real Example:

Let's say you started DCA into AMEX:SPY in January 2022 (right before the bear market):

January 2022: AMEX:SPY at $450 → You buy $1,000 worth (2.22 shares)

June 2022: AMEX:SPY at $380 → You buy $1,000 worth (2.63 shares)

December 2022: AMEX:SPY at $385 → You buy $1,000 worth (2.60 shares)

Result: Your average cost per share was $405, significantly better than the $450 you would have paid with a lump sum in January.

---

Part 3: The Mathematics of Wealth Creation

Here's where value investing gets exciting. Let's run the actual numbers using historical S&P 500 returns:

Historical Performance:

- Average Annual Return: 10.3% (1957-2023)

- Inflation-Adjusted: ~6-7% real returns

- Conservative Estimate: 8% for planning purposes

Scenario 1: The $24K Start

Initial Investment: $24,000 | Annual Addition: $2,400 | Return: 8%

Calculation Summary:

- Initial Investment: $24,000

- Annual Contribution: $2,400 ($200/month)

- Expected Return: 8%

- Time Period: 20 years

Results:

- Year 10 Balance: $86,581

- Year 20 Balance: $221,692

- Total Contributed: $72,000

- Investment Gains: $149,692

Scenario 2: The Aggressive Investor

Initial Investment: $60,000 | Annual Addition: $6,000 | Return: 10%

Historical example after 20 years: $747,300

- Total Contributed: $180,000

- Calculated Investment Gains: $567,300

Educational Insight on Compound Returns:

This historical example illustrates how 2% higher returns (10% vs 8%) could dramatically impact long-term outcomes. This is why even small differences in return rates can create life-changing wealth over decades. The mathematics of compound growth are both simple and incredibly powerful.

---

Part 4: Investing vs. Savings - The Shocking Truth

Let's compare the same contributions invested in stocks vs. a high-yield savings account:

20-Year Comparison:

- Stock Investment (8% return): $221,692

- High-Yield Savings (5% return): $143,037

- Difference: $78,655 (55% more wealth!)

"Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't, pays it." - Often attributed to Einstein

Key Insight: That extra 3% annual return created an additional $78,655 over 20 years. Over 30-40 years, this difference becomes truly life-changing.

📍 Global Savings Reality - The Investment Advantage Worldwide:

The power of index fund investing becomes even more dramatic when we examine savings rates around the world. Here's how the same $24K initial + $2,400 annual investment compares globally:

🇯🇵 Japan (0.5% savings):

- Stock Investment: $221,692

- Savings Account: $76,868

- Advantage: $144,824 (188% more wealth)

🇪🇺 Western Europe Average (3% savings):

- Stock Investment: $221,692

- Savings Account: $107,834

- Advantage: $113,858 (106% more wealth)

🇬🇷 Greece/Southern Europe (2% savings):

- Stock Investment: $221,692

- Savings Account: $93,975

- Advantage: $127,717 (136% more wealth)

🇰🇷 South Korea (2.5% savings):

- Stock Investment: $221,692

- Savings Account: $100,634

- Advantage: $121,058 (120% more wealth)

💡 The Global Lesson:

The lower your country's savings rates, the MORE dramatic the advantage of global index fund investing becomes. For investors in countries with minimal savings returns, staying in cash is essentially guaranteed wealth destruction when compared to broad market investing.

This is exactly why Warren Buffett's advice transcends borders - mathematical principles of compound growth work the same whether you're in New York, London, or Athens.

Note: Savings rates shown are approximate regional averages and may vary by institution and current market conditions. Always check current rates in your specific market for precise calculations.

---

Part 5: Building Your Value Investing Portfolio

Core Holdings (80% of portfolio):

AMEX:SPY - S&P 500 ETF (Large-cap US stocks)

AMEX:VTI - Total Stock Market ETF (Broader US exposure)

LSE:VUAA - S&P 500 UCITS Accumulating (Tax-efficient for international investors)

Satellite Holdings (20% of portfolio):

NASDAQ:QQQ - Technology-focused (Higher growth potential)

AMEX:VYM - Dividend-focused (Income generation)

NYSE:BRK.B - Berkshire Hathaway (Value investing & diversification)

---

Part 6: Implementation Strategy - Your Action Plan

Month 1: Foundation

Open a brokerage account (research low-cost brokers available in your region)

Set up automatic transfers from your bank

Buy your first AMEX:SPY shares

💡 Broker Selection Considerations:

Traditional Brokers: Interactive Brokers, Fidelity, Vanguard, Schwab

Digital Platforms: Revolut, Trading 212, eToro (check availability in your country)

Key Factors: Low fees, ETF access, automatic investing features, regulatory protection

Research: Compare costs and features for your specific location/needs

Month 2-12: Execution

Invest the same amount on the same day each month

Ignore market news and volatility

Track your progress in a simple spreadsheet

Year 2+: Optimization

Increase contributions with salary increases

Consider additional core holdings like LSE:VUAA for tax efficiency

Consider tax-loss harvesting opportunities

Visualizing Your DCA Strategy

Understanding DCA concepts is easier when you can visualize the results. TradingView offers various tools to help you understand investment strategies, including DCA tracking indicators like the DCA Investment Tracker Pro which help visualize long-term investment concepts.

🎯 Key Visualization Features:

These types of tools typically help visualize:

Historical Analysis: How your strategy would have performed using real market data

Growth Projections: Educational scenarios showing potential long-term outcomes

Performance Comparison: Comparing actual vs theoretical DCA performance

Volatility Understanding: How different stocks behave with DCA over time

📊 Real-World Examples from Live Users:

Stable Index Investing Success:

AMEX:SPY (S&P 500) Example: $60K initial + $500/month starting 2020. The indicator shows SPY's historical 10%+ returns, demonstrating how consistent broad market investing builds wealth over time. Notice the smooth theoretical growth line vs actual performance tracking.

Value Investing Approach:

NYSE:BRK.B (Berkshire Hathaway): Warren Buffett's legendary performance through DCA lens. The indicator demonstrates how quality value companies compound wealth over decades. Lower volatility = standard CAGR calculations used.

High-Volatility Stock Management:

NASDAQ:NVDA (NVIDIA): Shows smart volatility detection in action. NVIDIA's explosive AI boom creates extreme years that trigger automatic switch to "Median (High Vol): 50%" calculations for conservative projections, protecting against unrealistic future estimates.

Tech Stock Long-Term Analysis:

NASDAQ:META (Meta Platforms): Despite being a tech stock and experiencing the 2022 crash, META's 10-year history shows consistent enough performance (23.98% CAGR) that volatility detection doesn't trigger. Standard CAGR calculations demonstrate stable long-term growth.

⚡ Educational Application:

When using visualization tools on TradingView:

Select Your Asset: Choose the stock/ETF you want to analyze (like AMEX:SPY )

Input Parameters: Enter your investment amounts and time periods

Study Historical Data: See how your strategy would have performed in real markets

Understand Projections: Learn from educational growth scenarios

🎓 Educational Benefits:

This tool helps you understand:

- How compound growth actually works in real markets

- The difference between volatile and stable investment returns

- Why consistent DCA often outperforms timing strategies

- How your current performance compares to historical market patterns

- The visual power of long-term wealth building

As Warren Buffett said: "Someone's sitting in the shade today because someone planted a tree a long time ago." This tool helps you visualize your financial tree growing over time through actual market data and educational projections.

---

Part 7: Common Mistakes to Avoid

The "Perfect Timing" Trap

Waiting for the "perfect" entry point often means missing years of compound growth. Time in the market beats timing the market.

The "Hot Stock" Temptation

Chasing individual stocks like NASDAQ:NVDA or NASDAQ:TSLA might seem exciting, but it introduces unnecessary risk for beginners.

The "Market Crash" Panic

Every bear market feels like "this time is different." Historical data shows that patient investors who continued their DCA through 2008, 2020, and other crashes were handsomely rewarded.

---

Conclusion: Your Path to Financial Freedom

Value investing through broad index funds and dollar-cost averaging isn't glamorous. You won't get rich overnight, and you won't have exciting stories about your latest trade.

But here's what you will have:

Proven strategy backed by decades of data

Peace of mind during market volatility

Compound growth working in your favor 24/7

A realistic path to serious wealth creation

The Bottom Line: Warren Buffett's approach works because it's simple, sustainable, and based on fundamental economic principles. Start today, stay consistent, and let compound growth do the heavy lifting.

"Someone's sitting in the shade today because someone planted a tree a long time ago." - Warren Buffett

Educational Summary:

Understanding these principles provides a foundation for informed decision-making. As Warren Buffett noted: "The best time to plant a tree was 20 years ago. The second-best time is now" - emphasizing the educational value of understanding long-term investment principles early.

---

🙏 Personal Note & Acknowledgment

This article was not entirely my own work, but the result of artificial intelligence in-depth research and information gathering. I fine-tuned and brought it to my own vision and ideas. While working with AI, I found this research so valuable for myself that I could not avoid sharing it with all of you.

I hope this perspective gives you a different approach to long-term investing. It completely changed my style of thinking and my approach to the markets. As a father of 3 kids, I'm always seeking the best investment strategies for our future. While I was aware of the power of compound interest, I could never truly visualize its actual power.

That's exactly why I also created the open-source DCA Investment Tracker Pro indicator - so everyone can see and visualize the benefits of choosing a long, steady investment approach. Being able to see compound growth in action makes all the difference in staying committed to a strategy.

As someone truly said: compound interest is the 8th wonder of the world.

---

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Past performance does not guarantee future results. Always consult with a qualified financial advisor before making investment decisions.

Canadian Dollar vs US Dollar: Recovering from The Bearish HugsIn previous posts, we have already begun to look at the key factors that have driven the U.S. outperformance over the past decade.

The U.S. market dominance is largely due to the rapid rise of tech giants (such as Apple, Microsoft, Amazon, and Alphabet), which have benefited from strong profit growth, global market reach, and significant investor inflows.

Underperforming Internationally

Markets outside the U.S. have faced challenges such as multiple stifling sanctions and tariffs, slowing economic growth, political uncertainty (especially in Europe), a stronger U.S. dollar, and the decline of high-growth tech sectors.

The Valuation Gap

By 2025, U.S. equities will be considered relatively expensive compared to their international peers, which may offer more attractive valuations in the future.

Recent Shifts (2025 Trend)

Since early 2025, international equities have begun to outperform the S&P 500, and European and Asian equities have regained investor interest. Global market currencies are also heavily dependent on the US dollar.

Factors include optimism around the following three main themes.

DE-DOLLARIZATION. DE-AMERICANIZATION. DIVERSIFICATION.

De-dollarization is the process by which countries reduce their reliance on the US dollar (USD) as the dominant global reserve currency, medium of exchange, and unit of account in international trade and finance. This trend involves a shift away from the centrality of the US dollar in global economic transactions and towards alternative currencies, assets or financial systems.

Reasons for De-dollarization

The move towards de-dollarization is driven by geopolitical and economic factors:

Backlash against US economic hegemony: The US often uses the dollar's dominance to impose sanctions and exert political pressure, encouraging countries to seek financial sovereignty.

Rise of emerging economic powers: Emerging economies such as China and groups such as the BRICS are seeking to reduce their vulnerability to US influence and promote regional integration and alternative financial infrastructures.

Geopolitical tensions: Conflicts such as the war in Ukraine have increased efforts by countries such as Russia to withdraw dollars from their reserves to avoid sanctions.

Summary

De-dollarization is a complex, ongoing process that reflects a gradual shift away from the global dominance of the US dollar. It involves diversifying reserves, using alternative currencies and assets, and creating new financial systems to reduce reliance on the dollar.

Driven by geopolitical tensions and the rise of emerging economic powers, de-dollarization is challenging the entrenched role of the dollar, but is unlikely to completely replace it anytime soon.

Instead, it is leading to a more multi-polar monetary system in international finance, increasing demand for alternative investments in the US.

Technical Test

The main technical chart is presented in a weekly perspective, reflecting the performance of the Canadian dollar against the US dollar FX_IDC:CADUSD over the long term.

With the positive dynamics of the relative strength indicator RSI(14) continuing, a breakout of flat resistance near the level of 0.72 is noted, with the prospect of a possible price increase to 0.80, parity in the currency pair and strengthening of the Canadian dollar to historical maximums, in the horizon of the next five years.

--

Best wishes,

@PandorraResearch Team 😎

Rolling Correlations and Applications for Traders and Investors1. Introduction

Markets are dynamic, and the relationships between assets are constantly shifting. Static correlation values, calculated over fixed periods, may fail to capture these changes, leading traders to miss critical insights. Rolling correlations, on the other hand, provide a continuous view of how correlations evolve over time, making them a powerful tool for dynamic market analysis.

This article explores the concept of rolling correlations, illustrates key trends with examples like ZN (10-Year Treasuries), GC (Gold Futures), and 6J (Japanese Yen Futures), and discusses their practical applications for portfolio diversification, risk management, and timing market entries and exits.

2. Understanding Rolling Correlations

o What Are Rolling Correlations?

Rolling correlations measure the relationship between two assets over a moving window of time. By recalculating correlations at each step, traders can observe how asset relationships strengthen, weaken, or even reverse.

For example, the rolling correlation between ZN and GC reveals periods of alignment (strong correlation) during economic uncertainty and divergence when driven by differing macro forces.

o Why Rolling Correlations Matter:

Capture dynamic changes in market relationships.

Detect regime shifts, such as transitions from risk-on to risk-off sentiment.

Provide context for recent price movements and their alignment with historical trends.

o Impact of Window Length: The length of the rolling window (e.g., 63 days for daily, 26 weeks for weekly) impacts the sensitivity of correlations:

Shorter Windows: Capture rapid changes but may introduce noise.

Longer Windows: Smooth out fluctuations, focusing on sustained trends.

3. Case Study: ZN (Treasuries) vs GC (Gold Futures)

Examining the rolling correlation between ZN and GC reveals valuable insights into their behavior as safe-haven assets:

o Daily Rolling Correlation:

High variability reflects the influence of short-term market drivers like inflation data or central bank announcements.

Peaks in correlation align with periods of heightened risk aversion, such as in early 2020 during the onset of the COVID-19 pandemic.

o Weekly Rolling Correlation:

Provides a clearer view of their shared response to macroeconomic conditions.

For example, the correlation strengthens during sustained inflationary periods when both assets are sought as hedges.

o Monthly Rolling Correlation:

Reflects structural trends, such as prolonged periods of monetary easing or tightening.

Divergences, such as during mid-2023, may indicate unique demand drivers for each asset.

These observations highlight how rolling correlations help traders understand the evolving relationship between key assets and their implications for broader market trends.

4. Applications of Rolling Correlations

Rolling correlations are more than just an analytical tool; they offer practical applications for traders and investors:

1. Portfolio Diversification:

By monitoring rolling correlations, traders can identify periods when traditionally uncorrelated assets start aligning, reducing diversification benefits.

2. Risk Management:

Rolling correlations help traders detect concentration risks. For example, if ZN and 6J correlations remain persistently high, it could indicate overexposure to safe-haven assets.

Conversely, weakening correlations may signal increasing portfolio diversification.

3. Timing Market Entry/Exit:

Strengthening correlations can confirm macroeconomic trends, helping traders align their strategies with market sentiment.

5. Practical Insights for Traders

Incorporating rolling correlation analysis into trading workflows can enhance decision-making:

Shorter rolling windows (e.g., daily) are suitable for short-term traders, while longer windows (e.g., monthly) cater to long-term investors.

Adjust portfolio weights dynamically based on correlation trends.

Hedge risks by identifying assets with diverging rolling correlations (e.g., if ZN-GC correlations weaken, consider adding other uncorrelated assets).

6. Practical Example: Applying Rolling Correlations to Trading Decisions

To illustrate the real-world application of rolling correlations, let’s analyze a hypothetical scenario involving ZN (Treasuries) and GC (Gold), and 6J (Yen Futures):

1. Portfolio Diversification:

A trader holding ZN notices a decline in its rolling correlation with GC, indicating that the two assets are diverging in response to unique drivers. Adding GC to the portfolio during this period enhances diversification by reducing risk concentration.

2. Risk Management:

During periods of heightened geopolitical uncertainty (e.g., late 2022), rolling correlations between ZN and 6J rise sharply, indicating a shared safe-haven demand. Recognizing this, the trader reduces exposure to both assets to mitigate over-reliance on risk-off sentiment.

3. Market Entry/Exit Timing:

Periods where the rolling correlation between ZN (Treasuries) and GC (Gold Futures) transitions from negative to positive signal that the two assets are potentially regaining their historical correlation after a phase of divergence. During these moments, traders can utilize a simple moving average (SMA) crossover on each asset to confirm synchronized directional movement. For instance, as shown in the main chart, the crossover highlights key points where both ZN and GC aligned directionally, allowing traders to confidently initiate positions based on this corroborative setup. This approach leverages both correlation dynamics and technical validation to align trades with prevailing market trends.

These examples highlight how rolling correlations provide actionable insights that improve portfolio strategy, risk management, and trade timing.

7. Conclusion

Rolling correlations offer a dynamic lens through which traders and investors can observe evolving market relationships. Unlike static correlations, rolling correlations adapt to shifting macroeconomic forces, revealing trends that might otherwise go unnoticed.

By incorporating rolling correlations into their analysis, market participants can:

Identify diversification opportunities and mitigate concentration risks.

Detect early signs of market regime shifts.

Align their portfolios with dominant trends to enhance performance.

In a world of constant market changes, rolling correlations can be a powerful tool for navigating complexity and making smarter trading decisions.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

High Potenzial Invest Flow/EurAfter years and month of downtrend, now the important volume comes in and also the trendline broke through with this massiv volumen. In my eyes a no brainer, now investing some money and in the next month to years in combination with the industry / german / europe crisis it´s a very good way to diversify your money. The potenzial is up to x 40 maybe a new higher high x 70, but with a easy attitude and a realistic mind first realization from x8 - x10 because the volatility of crypto assets and then buying back with cost average. gl & hf

Diversify Your Crypto InvestmentsCryptocurrency markets are known for their volatility, where prices can rise and fall dramatically within a short period. To manage the risks and capitalize on potential gains, diversifying your cryptocurrency portfolio is crucial. Just as in traditional investing, spreading your investments across different crypto assets helps reduce exposure to extreme price movements in any single asset and ensures you can benefit from the growth of various sectors within the market.

In this idea, we’ll explore the concept of crypto diversification, the importance of spreading risk, and a recommended percentage allocation for building a balanced portfolio across Bitcoin, Ethereum, altcoins, and meme coins.

Why Crypto Diversification Matters

Risk Management: Cryptocurrencies are notoriously volatile. By diversifying, you reduce the risk of one asset dramatically impacting your portfolio. If one cryptocurrency underperforms or crashes, others might perform well enough to offset potential losses.

Exposure to Different Technologies: The cryptocurrency space is vast, with Bitcoin leading as a store of value, Ethereum as a smart contract platform, and altcoins offering innovations in areas like decentralized finance (DeFi), NFTs, and blockchain scalability. Diversification allows you to participate in the growth of these different technologies.

Hedge Against Market Swings: Different cryptocurrencies may react to market conditions in various ways. For example, during market corrections, Bitcoin and Ethereum might drop less sharply than smaller altcoins or meme coins. A diversified portfolio allows you to hedge against such market swings.

Suggested Crypto Portfolio Diversification

When it comes to diversifying your crypto portfolio, a strategic approach can help you balance between established coins, emerging altcoins, and more speculative assets. Here’s an example of a diversified crypto portfolio with percentage allocations:

1. 50% Bitcoin (BTC)

Bitcoin is often referred to as "digital gold" and is considered the most stable and established cryptocurrency. As the largest cryptocurrency by market capitalization, it has the least volatility compared to altcoins and meme coins. A 50% allocation to Bitcoin provides a solid foundation for your portfolio, acting as a safer hedge in the volatile world of crypto.

2. 20% Ethereum (ETH)

Ethereum is the second-largest cryptocurrency and the leading platform for decentralized applications (dApps), smart contracts, and DeFi protocols. With its growing ecosystem and the shift to Ethereum 2.0 (which promises greater scalability), Ethereum offers significant growth potential while maintaining more stability than smaller altcoins. A 20% allocation in Ethereum allows you to participate in the innovation and expansion of decentralized finance and other blockchain applications.

3. 25% Altcoins:

Altcoins are any cryptocurrencies other than Bitcoin, many of which offer unique technological innovations. For this part of the portfolio, you could include assets such as SOL, FET, INJ, UNI, LINK, etc.

Allocating 25% of your portfolio to altcoins offers exposure to innovative technologies with potentially high returns, though they come with higher risks compared to Bitcoin or Ethereum.

4. 5% Meme Coins (DOGE, SHIB, etc.)

Meme coins like Dogecoin (DOGE) or Shiba Inu (SHIB) are speculative assets that often gain value due to community support, social media hype, or celebrity endorsements. They are extremely volatile, with the potential for short-term gains but also significant risks. Keeping only 5% of your portfolio in meme coins ensures you don’t overexpose yourself to their high volatility, while still allowing you to benefit if these coins surge in value.

Example of a Diversified Crypto Portfolio Allocation

Let’s assume you have $10,000 to invest in cryptocurrencies. Here's how you might allocate your funds based on the diversification strategy above:

$5,000 in Bitcoin (50%)

$2,000 in Ethereum (20%)

$2,500 in Altcoins (25%)

$500 in Meme Coins (5%)

This allocation offers a balanced approach, giving you exposure to the relative safety of Bitcoin and Ethereum while also allowing you to take advantage of the potential high growth from altcoins and meme coins.

Why This Allocation Strategy Works

- Stability with Growth Potential: With 50% allocated to Bitcoin and 20% to Ethereum, you are investing in two of the most established and widely adopted cryptocurrencies. These are often seen as the "safer" options in the crypto world, and their long-term potential is generally considered strong.

- Exposure to Innovation: The 25% allocation to altcoins provides exposure to emerging sectors like DeFi, AI, and blockchain interoperability. While altcoins tend to be more volatile, they offer significant growth potential if their underlying technologies gain widespread adoption.

- High-Risk, High-Reward: The 5% allocation to meme coins adds a speculative aspect to the portfolio. Meme coins have a history of spiking in value, often due to online hype. Although risky, keeping a small portion of your portfolio in these assets can offer the opportunity for outsized gains while limiting your risk.

Key Tips for Managing a Diversified Crypto Portfolio

- Rebalance Regularly: The crypto market is highly volatile, and the value of different assets can fluctuate dramatically. Periodically rebalance your portfolio to ensure that your allocations remain aligned with your goals. For example, if the value of your meme coins spikes, they might occupy a larger percentage of your portfolio than desired. Rebalancing ensures that you take profits and stick to your original diversification strategy.

- Do Your Own Research (DYOR): While diversification helps mitigate risk, it's essential to research the coins you're investing in. Don’t blindly invest in an asset just because it’s trending. Understand the project, its use case, the team behind it, and its long-term potential.

- Avoid Over-Diversification: While diversification is important, spreading your investments too thin can dilute your returns. Focus on quality projects rather than trying to invest in every available cryptocurrency.

- Have a Long-Term Mindset: The crypto market can be volatile in the short term, but having a long-term mindset is critical for success. Don’t panic during market dips—if you have a well-diversified portfolio, you’re better positioned to ride out the volatility and potentially benefit from long-term growth.

Diversifying your cryptocurrency portfolio is a smart strategy for managing risk and taking advantage of the crypto market's various opportunities. A balanced allocation—such as 50% Bitcoin, 20% Ethereum, 25% altcoins, and 5% meme coins—helps you mitigate the risks of volatility while allowing you to participate in the growth of different sectors.

From Tokyo with Love: Key Opportunities with Japan's Top Index1. Introduction

The Nikkei 225 is Japan's premier stock market index and one of the most widely followed indexes in the world. As the representative of Japan's economy, the Nikkei 225 includes many of the country’s most influential companies across various industries, such as Toyota, Sony, and SoftBank. With Japan being the third-largest economy globally, traders who seek exposure to the Asian market find the Nikkei 225 to be a crucial addition to their portfolios.

Now is an opportune time to study and potentially add the Nikkei 225 to your watchlist, as Micro contracts are set to launch later this year, offering greater accessibility to both institutional and retail traders. These micro contracts will allow traders to manage their positions with more precision, capital efficiency, and reduced exposure. With the futures contracts denominated in both US Dollars and Japanese Yen, traders can select their currency exposure based on market preferences.

Contract Specifications:

# Nikkei/USD Futures:

Contract size: $5 USD per index point

Tick size: 5 points = $25 USD per contract

Margin: USD $12,000 per contract at the time of producing this article

Trading hours: Almost 24-hour trading, covering Asian, European, and US sessions

# Nikkei/YEN Futures:

Contract size: ¥500 per index point

Tick size: 5 points = ¥2,500 per contract

Margin: JPY ¥1,200,000 per contract at the time of producing this article

Trading hours: Mirrors the USD futures trading hours for global reach

For traders looking for exposure to Japan’s economy, these contracts offer versatile trading opportunities with sufficient liquidity, price movement, and round-the-clock accessibility. You can access real-time data on these contracts through TradingView - view the data package at www.tradingview.com

2. Global Market Diversification

The Nikkei 225 Index offers more than just exposure to the Japanese market; it’s a portal into Asia’s largest and most developed economy. With Japan being an export-driven economy, exposure to the Nikkei 225 allows traders to capitalize on trends in global manufacturing, technology, and industrials.

Additionally, during periods of macroeconomic divergence—where the economic performance of regions like the US and Asia deviate—the Nikkei 225 can provide a non-correlated trading opportunity.

3. Correlation and Hedge Against US Equities

While Japan is a developed economy like the United States, its market dynamics differ substantially. The Nikkei 225 often shows a lower correlation with US equity markets, meaning that the index tends to react differently to global and local economic events compared to indices like the S&P 500.

This graph illustrates the rolling 30-day correlation between the Nikkei 225 and the S&P 500, highlighting the fluctuating relationship between the two indices and how they decouple at times, especially during periods of heightened market volatility.

4. Japanese Yen and US Dollar Denominated Contracts

One of the unique aspects of the Nikkei futures is the ability to trade the index in either US Dollars or Japanese Yen. This flexibility allows traders to choose the contract that best suits their currency exposure preferences, providing a powerful tool for those who also wish to hedge or capitalize on currency movements.

Nikkei/USD Futures: These contracts are settled in US dollars.

Nikkei/YEN Futures: Conversely, for traders who want to factor in currency risk, the Yen-denominated futures offer exposure not just to the Nikkei 225’s price movements but also to the Yen's fluctuations against the US dollar or other currencies.

As the introduction of Micro contracts approaches, this will add even more flexibility for traders, particularly retail traders who prefer smaller contract sizes and more precise risk management. These contracts will enable traders to adjust their positions with greater capital efficiency, allowing for a wider range of strategies—from short-term speculative trades to long-term hedging positions.

5. Monetary Policy Divergence

Japan's monetary policy, led by the Bank of Japan (BoJ), has been historically distinct from the policies of the US Federal Reserve and European Central Bank (ECB).

Understanding Japan's monetary policy divergence allows traders to better time their entry and exit points in the Nikkei 225, especially as the Bank of Japan navigates its unique approach to economic stimulus and potential shifts in strategy.

6. Sector Opportunities

The Nikkei 225 is heavily weighted towards key sectors that represent the backbone of Japan’s economy, offering traders exposure to industries that may be underrepresented in other global indices. Some of the most prominent sectors within the Nikkei 225 include:

Technology: Japan is a leader in technology and innovation, with major companies such as SoftBank and Sony leading the charge.

Automotive: Japan’s automotive sector is world-renowned, with giants like Toyota, Honda and Nissan among the top constituents of the index. As global trends shift toward electric vehicles and sustainable manufacturing, Japan’s automotive industry stands to benefit.

Manufacturing: As a global manufacturing powerhouse, Japan's output is closely tied to global demand.

The Nikkei futures provide traders with a way to express their views on these industries, capitalizing on global demand trends in high-tech products, automobiles, and industrial manufacturing.

7. Volatility Trading

One of the key attractions of the Nikkei 225 futures is the index's volatility, which is often higher than that of its Western counterparts, such as the S&P 500. Traders who thrive in volatile environments will find the Nikkei 225 particularly appealing, as it presents more frequent and larger price swings. This heightened volatility is especially noticeable during global economic shocks or shifts in local economic policy.

Additionally, since Japan's market opens several hours before European and US markets, traders can use the Nikkei 225 to capture early momentum shifts that may influence sentiment in Western markets as they open.

This graph highlights the elevated volatility of the Nikkei 225 compared to the S&P 500.

8. Japan’s Political and Economic Landscape

Japan has been taking proactive steps toward economic reform in recent years. With initiatives aimed at corporate governance improvements, stimulus packages, and structural reforms. Several factors make Japan's political and economic landscape appealing for traders:

Corporate governance reforms: Japan has been improving its corporate governance structure, making its market more attractive to both domestic and foreign investors.

Economic stimulus packages: These government-led initiatives have provided a tailwind for many sectors within the Nikkei 225.

Weakening Yen: Japan’s export-driven economy has benefited from a weaker Yen, which boosts the competitiveness of Japanese goods on the global stage.

The potential for long-term growth makes the Nikkei 225 an appealing market for those who follow macro-driven opportunities.

9. Geopolitical Events and Trade Dynamics

Japan remains one of the world’s largest exporters, and as such, the Nikkei 225 is heavily influenced by global trade relations, particularly with the US and China. Traders can use the Nikkei 225 to take positions based on their views of the global geopolitical landscape. For example:

US-China trade tensions: Japan, being a major exporter to both countries, finds itself deeply connected to global trade trends.

Global demand for Japanese exports: Changes in global trade agreements or tariff structures could either boost or harm the performance of these industries.

10. Liquidity

Liquidity remains an important consideration, as the S&P 500 contracts offer greater liquidity, but the growing interest in the Nikkei 225 has resulted in increased volumes in recent months. As Micro contracts are introduced, the liquidity of the Nikkei 225 is likely to improve, making it an even more attractive trading instrument for all types of traders.

This graph highlights the trading volumes for both Nikkei 225 and S&P 500 futures.

11. Cumulative Returns Comparison

When comparing cumulative returns over time, the Nikkei 225 has demonstrated significant growth. However, this growth has come with a higher level of volatility than the S&P 500.

The Nikkei 225's higher risk-reward profile makes it an attractive option for traders looking to capture short- to medium-term gains during periods of economic growth or policy shifts in Japan.

This graph shows the cumulative returns of the Nikkei 225 versus the S&P 500.

12. Price Range Opportunities

The average daily price range of the Nikkei 225 is another compelling factor for active traders. The Nikkei 225 frequently exhibits larger daily price movements than the S&P 500, especially during periods of high volatility. This makes it an ideal market for short-term traders looking to capitalize on intraday price swings.

The graph, where daily price ranges have been multiplied by their corresponding point values, demonstrates how the Nikkei 225 has exhibited wider price ranges.

13. Conclusion

The Nikkei futures offer a unique set of opportunities for traders looking to diversify their portfolios, capitalize on volatility, and gain exposure to Japan’s leading industries. It is a powerful tool for both short-term traders and those with longer-term macro views.

In addition, the forthcoming Micro contracts will make the Nikkei 225 accessible to a wider range of traders, allowing for more precise risk management and exposure adjustments.

Key takeaways for traders considering the Nikkei futures include:

Global diversification beyond US and European markets.

The ability to hedge against US equity volatility.

Opportunities in high-growth sectors such as technology and automotive.

The potential for higher volatility, offering both risk and reward.

Flexible contract options in both USD and Yen, allowing for currency risk management.

For traders looking to add a new dynamic instrument to their watchlist, the Nikkei/USD and the Nikkei/YEN futures are a potentially ideal candidate, combining diversification, volatility, and sectoral exposure into a powerful trading product.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Be greedy when others are fearful - © Warren BuffettAs the cryptocurrency market gears up for a potential alt season, savvy investors are positioning themselves to capitalize on the gains of altcoins. This article will explore six promising altcoins and the significance of sector diversification in maximizing returns.

Be Greedy When Others Are Fearful, Fearful When Others Are Greedy:

This timeless adage by Warren Buffett highlights the importance of contrarian investing. During alt seasons, when the market is euphoric and prices are rising, it's crucial to maintain a level head and avoid overextending. Conversely, when the market is in a downtrend and fear is prevalent, it's an opportunity to accumulate undervalued assets.

Top 6 Altcoins for Alt Season:

Dogecoin (DOGE): Forming a bullish ascending triangle pattern, DOGE is poised for a breakout. The triangle's squeeze indicates a potential surge in price. Respecting the ascending trend and avoiding new lows suggests an upward breakout.

Sector: Meme Coin

Chainlink (LINK): With an accumulation period spanning 518 days, LINK is primed for a significant pump. The longer the consolidation, the stronger the potential breakout, adhering to the golden rule of accumulation. The ideal shakeout beneath the accumulation range followed by price appreciation reinforces the bullish outlook.

Sector: Oracle

Optimism (OP): Trading within an ascending channel and consistently respecting the lows, OP exhibits strong bullish momentum. The pattern and price action suggest a continuation of the uptrend.

Sector: Layer 2 Scaling Solution

Immutable X (IMX): Breaking above local highs and retesting the upper resistance trendline, IMX confirms a trend reversal to the bullish side. This price action signifies a shift in market sentiment.

Sector: NFT Marketplace

Avalanche (AVAX): Coiling within a descending wedge (bullish pattern), AVAX experienced a shakeout below a crucial support level ($9) before resuming its upward trajectory. Respecting old support levels is essential.

Sector: Layer 1 Blockchain

VeChain (VET): Epitomizing a textbook bullish run, VET adheres strictly to the ascending trend. Each cycle consists of price appreciation, accumulation, and further growth.

Sector: Supply Chain Management

Sector Diversification:

Diversifying across sectors is crucial, as different sectors tend to perform differently based on market trends and events. For instance, during periods of DeFi dominance, DeFi-focused altcoins may outperform. Conversely, when NFT mania takes hold, NFT marketplace tokens could surge.

Diversification: What It Is, Why It Matters & How to Do ItDiversification is a market strategy that enables you to spread your money across a variety of assets and investments in pursuit of uncorrelated returns, hedging, and risk control.

Table of Contents

What is portfolio diversification?

Brief history of the modern portfolio theory

Why is diversification important?

An example of diversification at work

How to diversify your portfolio

Components of a diversified portfolio

Build wealth through diversification

Diversification vs concentration

Summary

📍 What is portfolio diversification?

Portfolio diversification is the strategy of spreading your money across diverse investments in order to mitigate risk, hedge and balance your exposure in pursuit of uncorrelated returns. While it may sound complex at first, portfolio diversification could be your greatest strength when you set out to trade and invest in the financial markets.

As a matter of fact, once you immerse yourself into the markets, you will be overwhelmed by the wide horizons waiting for you. That’s when you’ll need to know about diversification.

There are thousands of stocks available for trading, dozens of indices, and a sea of cryptocurrencies. Choosing your investments will invariably lead to relying on diversification in order to protect and grow your money.

Diversifying well will enable you to go into different sectors, markets and asset classes. Together, all of these will build up your diversified portfolio.

📍 Brief history of the modern portfolio theory

“ Diversification is both observed and sensible; a rule of behavior which does not imply the superiority of diversification must be rejected both as a hypothesis and as a maxim. ” These are the words of the father of the modern portfolio theory, Harry Markowitz.

His paper on diversification called “Portfolio Selection” was published in The Journal of Finance in 1952. The theory, which helped Mr. Markowitz win a Nobel prize in 1990, posits that a rational investor should aim to maximize their returns relative to risk.

The most significant feature from the modern portfolio theory was the discovery that you can reduce volatility without sacrificing returns. In other words, Mr. Markowitz argued that a well-diverse portfolio would still hold volatile assets. But relative to each other, their volatility would balance out because they all comprise one portfolio.

Therefore, the volatility of a single asset, Mr. Markowitz discovered, is not as significant as the contribution it makes to the volatility of the entire portfolio.

Let’s dive in and see how this works.

📍 Why is diversification important?

Diversification is important for any trader and investor because it builds out a mix of assets working together to yield returns. In practice, all assets contained in your portfolio will play a role in shaping the total performance of your portfolio.

However, these same assets out there in the market may or may not be correlated. The interrelationship of those assets within your portfolio is what will allow you to reduce your overall risk profile.

With this in mind, the total return of your investments will depend on the performance of all assets in your portfolio. Let’s give an example.

📍 An example of diversification at work

Say you want to own two different stocks, Apple (ticker: AAPL ) and Coca-Cola (ticker: KO ). In order to easily track your performance, you invest an equal amount of funds into each one—$500.

While you expect to reap handsome profits from both investments, Coca-Cola happens to deliver a disappointing earnings report and shares go down 5%. Your investment is now worth $475, provided no leverage is used.

Apple, on the other hand, posts a blowout report for the last quarter and its stock soars 10%. This move would propel your investment to a valuation of $550 thanks to $50 added as profits.

So, how does your portfolio look now? In total, your investment of $1000 is now $1,025, or a gain of 2.5% to your capital. You have taken a loss in Coca-Cola but your profit in Apple has compensated for it.

The more assets you add to your portfolio, the more complex the correlation would be between them. In practice, you could be diversifying to infinity. But beyond a certain point, diversification would be more likely to water down your portfolio instead of helping you get more returns.

📍 How to diversify your portfolio

The way to diversify your portfolio is to add a variety of different assets from different markets and see how they perform relative to one another. A single asset in your portfolio would mean that you rely on it entirely and how it performs will define your total investment result.

If you diversify, however, you will have a broader exposure to financial markets and ultimately enjoy more probabilities for winning trades, increased returns and decreased overall risks.

You can optimize your asset choices by going into different asset classes. Let’s check some of the most popular ones.

📍 Components of a diversified portfolio

Stocks

A great way to add diversification to your portfolio is to include world stocks , also called equities. You can look virtually anywhere—US stocks such as technology giants , the world’s biggest car manufacturers , and even Reddit’s favorite meme darlings .

Stock selection is among the most difficult and demanding tasks in trading and investing. But if you do it well, you will reap hefty profits.

Every stock sector is fashionable in different times. Your job as an investor (or day trader) is to analyze market sentiment and increase your probabilities of being in the right stock at the right time.

Currencies

The forex market , short for foreign exchange, is the market for currency pairs floating against each other. Trading currencies and having them sit in your portfolio is another way to add diversification to your market exposure.

Forex is the world’s biggest marketplace with more than $7.5 trillion in daily volume traded between participants.

Unlike stock markets that have specific trading hours, the forex market operates 24 hours a day, five days a week. Continuous trading allows for more opportunities for price fluctuations as events occurring in different time zones can impact currency values at any given moment.

Cryptocurrencies

A relatively new (but booming) market, the cryptocurrency space is quickly gaining traction. As digital assets become increasingly more mainstream, newcomers enter the space and the Big Dogs on Wall Street join too , improving the odds of growth and adoption.

Adding crypto assets to your portfolio is a great way to diversify and shoot for long-term returns. There’s incentive in there for day traders as well. Crypto coins are notorious for their aggressive swings even on a daily basis. It’s not unusual for a crypto asset to skyrocket 20% or even double in size in a matter of hours.

But that inherent volatility holds sharpened risks, so make sure to always do your research before you decide to YOLO in any particular token.

Commodities

Commodities, the likes of gold ( XAU/USD ) and silver ( XAG/USD ) bring technicolor to any portfolio in need of diversification. Unlike traditional stocks, commodities provide a hedge against inflation as their values tend to rise with increasing prices.

Commodities exhibit low correlation with other asset classes, too, thereby enhancing portfolio diversification and reducing overall risk.

Incorporating commodities into a diversified portfolio can help mitigate risk, enhance returns, and preserve purchasing power in the face of inflationary pressures, geopolitical uncertainty and other macroeconomic risks.

ETFs

ETFs , short for exchange-traded funds, are investment vehicles which offer a convenient and cost-effective way to gain exposure to a number of assets all packaged in the same instrument. These funds pull a bunch of similar stocks, commodities and—more recently— crypto assets , into the same bundle and launch it out there in the public markets. Owning an ETF means owning everything inside it, or whatever it’s made of.

ETFs typically have lower expense ratios compared to mutual funds, making them affordable investment options.

Whether you seek broad market exposure, niche sectors, or thematic investing opportunities, ETFs are a convenient way to build a diversified portfolio tailored to your investment objectives and risk preferences.

Bonds

Bonds are fixed-income investments available through various issuers with the most common one being the US government. Bonds are a fairly complex financial product but at the same time are considered a no-brainer for investors pursuing the path of least risk.

Bonds have different rates of creditworthiness and maturity terms, allowing investors to pick what fits their style best. Bonds with longer maturity—10 to 30 years—generally offer a better yield than short-term bonds.

Government bonds offer stability and low risk because they’re backed by the government and the risk of bankruptcy is low.

Cash

Cash may seem like a strange allocation asset but it’s actually a relatively safe bet when it comes to managing your own money. Sitting in cash is among the best things you can do when stocks are falling and valuations are coming down to earth.

And vice versa—when you have cash on-hand, you can be ready to scoop up attractive shares when they’ve bottomed out and are ready to fire up again (if only it was that easy, right?).

Finally, cash on its own is a risk-free investment in a high interest-rate environment. If you shove it into a high-yield savings account, you can easily generate passive income (yield) and withdraw if you need cash quickly.

📍 Build wealth through diversification

In the current context of market events, elevated interest rates and looming uncertainty, you need to be careful in your market approach. To this end, many experts advise that the best strategy you could go with in order to build wealth is to have a well-diversified portfolio.

“ Diversifying well is the most important thing you need to do in order to invest well ,” says Ray Dalio , founder of the world’s biggest hedge fund Bridgewater Associates.

“ This is true because 1) in the markets, that which is unknown is much greater than that which can be known (relative to what is already discounted in the markets), and 2) diversification can improve your expected return-to-risk ratio by more than anything else you can do. ”

📍 Diversification vs concentration

The opposite of portfolio diversification is portfolio concentration. Think about diversification as “ don’t put your eggs in one basket. ” Concentration, on the flip side, is “ put all your eggs in one basket, and watch it carefully. ”

In practice, concentration is focusing your investment into a single financial asset. Or having a few large bets that would assume higher risk but higher, or quicker, return.

While diversification is a recommended investment strategy for all seasons, concentration comes with bigger risks and is not always the right approach. Still, at times when you have a high conviction on a trade and have thoroughly analyzed the market, you may decide to bet heavily, thus concentrating your investment.

However, you need to be careful with concentrated bets as they can turn against your portfolio and wreck it if you’re overexposed and underprepared. Diversification, however, promises to cushion your overall risk by a carefully balanced approach to various financial assets.

📍 Summary

A diversified portfolio is essentially your best bet for coordinated and sustainable returns over the long term. Choosing a mix of various types of investments, such as stocks, ETFs, currencies, and crypto assets, would spread your exposure and provide different avenues for growth potential. Not only that, but it would also protect you from outsized risks, sudden economic shocks, or unforeseen events.

While you decrease your risk tolerance, you raise your probability of having winning positions. Regardless of your style and approach to markets, diversifying well will increase your chances of being right. You can be a trader and bet on currencies and gold for the short term. Or you can be an investor and allocate funds to stocks and crypto assets for years ahead.

Potential sources of diversification are everywhere in the financial markets. Ultimately, diversifying gives you thousands of opportunities to balance your portfolio and position yourself for risk-adjusted returns.

🙋🏾♂️ FAQ

❔ What is portfolio diversification?

► Portfolio diversification is the strategy of spreading your money across diverse investments in order to mitigate risk, hedge and balance your exposure in pursuit of uncorrelated returns.

❔ Why is diversification important?

► Diversification is important for any trader and investor because it creates a mix of assets working together to yield high, uncorrelated returns.

❔ How to diversify your portfolio?

► The way to diversify your portfolio is to add a variety of different assets and see how they perform relative to one another. If you diversify, you will have a broader exposure to financial markets and ultimately enjoy more probabilities for winning trades, increased returns, and decreased overall risks.

Do you diversify? What is your strategy? Do you rebalance? Let us know in the comments.

Liked this article? Give it a boost 🚀 and don't forget to follow us if you want to be among the first to be informed.

SPX 🗝Diversify YOUR Portfolio: EVERYONE Needs to Know❕📉Hi Traders, Investors and Speculators of Charts📈

HAVE YOU EVER CONSIDERED DIVERSIFYING YOUR PORTFOLIO?

Given the high risk nature of trading, having a finger in every pie is a good idea. Stocks generally are less volatile than crypto, and index funds are a great way to gain exposure to a variety of top notch stocks.

If you have ever wondered about trading stonks, today's update is for YOU. Cryptocurrencies are the largest part of our focus, but that doesn't mean we don't consider other markets such as forex, commodities and stocks. So today, let's take a look at the SPX / S&P 500.

Index investing, especially in the S&P 500, streamlines stock market engagement. Investing here means tapping into America's corporate giants, offering long-term returns and simplicity, often outperforming active stock picking. Since 1957, the S&P 500 has offered a global economic snapshot, including key international corporations. Its careful selection process reflects market trends, focusing on criteria like market cap and liquidity.

The top 4 stocks in the SPX by weight are :

1) Microsoft Corporation / NASDAQ:MSFT

2) Apple Inc. / $AAPLE

3) Nvidia Corp / NASDAQ:NVDA

4) Amazon.com Inc. / NASDAQ:AMZN

# Company Portfolio%

1 Microsoft Corp 7.14%

2 Apple Inc. 6.36%

3 Nvidia Corp 4.24%

4 Amazon.com Inc 3.65%

To put it into perspective, the last 4 stocks are:

500) NASDAQ:NWL / Newell Brands Inc. Producer Manufacturing

501) NYSE:DXC / DXC Technology Company Technology Services

502) NYSE:AAP / Advance Auto Parts Inc. Retail Trade

503) NYSE:TPR / Tapestry, Inc. Retail Trade / with a market cap of 4,017,225,400

(There are actually 503 stocks in the S&P500).

From the above, we can clearly conclude that what happens in those top 4 markets, holds quite a lot more weight than the rest. This should give you a clue which ones to look at if you want to invest in additional stocks and not necessarily a fund.

To correctly identify the macro phase is to have power - this will eliminate fear and greed, and cancel out the noise you hear from news and "influencers". Looking at SPX from a monthly perspective, we can clearly identify a strong bullish trend as the market loses makes what seems to be UP ONLY and keeps on making higher highs.

By using the S&P 500 or the AMEX:VTI , you can more easily spot the macro trend of the stock market, and which way MOST of the stocks will go, especially the top few.

If you found this content helpful, please remember to hit like and subscribe and never miss a moment in the markets.

_______________________

📢Follow us here on TradingView for daily updates📢

👍Hit like & Follow 👍

CryptoCheck

SP:SPX NASDAQ:MSFT NASDAQ:AAPL NASDAQ:NVDA NASDAQ:AMZN

CAKE Basic trend. Working with reversal zones. Money management.Logarithm. Time frame 1 week. Major trend. Combined education and potential trade in ideas.

Pivot zones from key liquidity zones.

The main idea and meaning of this idea is to show the logic of working with reversal zones from key resistance support levels, which will determine the further development of the trend. I have shown all possible scenarios of secondary trend development from more probable and logical to less probable, but which have the right to be realized. You should always keep even unlikely scenarios in your mind, even if you do not believe in them. Few people calculate different variants of trend development ahead of time. In most, as a rule, there is one scenario of price movement, but it is built in most cases on the desire that it was exactly as profitable.

This is how this trend looks like on a line chart.

Exchanges and surprises. Money management.

CAKE (PancakeSwap) is a decentralized exchange (DEX) token on the Binance Smart Chain, launched by anonymous developers

The coin as an example of similar crypto of the third liquidity group, which lose capitalization, that is, people's faith in the project itself - "the faith of the community is killed". It is quite possible that at one moment the faith in anonymous developers will be "killed" and they will use the existing liquidity for the last time.

I emphasize what blockchain the token is made on and how many bad triggers (FUD and not only) in the info space, not only with the designation “4”.

The idea (long-term trend) is more educational than trading because of the degree of risk (liquidity, “ugly chart” for the future, large depreciation, breaking a long horizontal channel at a very large %). My desire is to trace on a live chart how the fate of two exchanges will be reflected on the price of this token in the future. Liquid, popular, reliable and conditionally decentralized with “anonymous developers”.

Local trend. Work in it (only in it and nothing else). Risk Management.

But, in the local trend at the moment, this coin is interesting to work, especially since the triangle is almost formed and soon the dénouement. Stops will be quite short in the direction of the breakout, that is work. I will post an idea for local-medium term work below.

Take a local profit (maybe substantial) and forget once and for all about crypto fantasies and what will happen to the price next. No regrets if you took a relatively small profit and further development of the trend showed an order of magnitude more. In the end, it may be the other way around, you will be the lucky one who “made it” before the “sunset”. Learn to take profit from the market, it is better to take a little bit at a time, limiting risks, than to take a potentially large profit (which is what most “sectarians” are waiting for).

In the long run, I highly recommend not getting involved with this or other similar cryptocurrencies. You will be playing casino, and not so much with risk management (risk/profit ratio in trading) but with money management (money management in general, places to store and trade). So stops can be useless in some not quite trading situations.

Note how I've written a lot of information that doesn't really apply to this cryptocurrency directly, but only indirectly, as a potential consequence of more global yet equally potential events .

Observe money management and risk management in trading, diversify where you trade and store crypto assets, this will guarantee a sound sleep in the future. .

Secondary trend + local work. Time frame 3 days. 08 2023

Reduce risk in portfolios without hampering returns Asset allocation is ultimately about balancing returns with risks. While it is relatively easy to reduce risk in a portfolio, it is harder to do so without diminishing its return potential. Diversification, that is, adding uncorrelated assets to the portfolio, is one of the main tools available to investors to lower such risk, but it often comes at the cost of returns. The 60/40 portfolio, a mix between 60% equities and 40% fixed income, is the bedrock of asset allocation for many investors.

Adding fixed income to equities does lower volatility and improve the Sharpe ratio, in line with Markowitz’s findings in this Nobel Prize-winning work and due to the historically negative correlation between equities and investment-grade fixed income. However, it is also true that a 60/40 portfolio has tended to deliver lower returns than a 100% equity portfolio.

Does it mean that investors have to choose between higher returns with increased volatility or lower returns with decreased volatility?

Cliff Asness’ thought experiment: the levered 60/40

As with any problem, the solutions usually require out-of-the-box thinking. In our case, it requires to start thinking about leverage. Cliff Asness, co-founder of AQR Capital, provided such a solution in December 1996 when serving as Goldman Sachs Asset Management’s director of quantitative research with his paper ‘Why Not 100% Equities: A Diversified Portfolio Provides More Expected Return per Unit of Risk’.

In his paper, Asness argues that investors can achieve competitive returns while managing risk more effectively by diversifying their portfolios with a combination of equities and bonds and using leverage. Asness designs the ‘Levered 60/40’ portfolio which leverages a 60/40 portfolio so that the volatility of the leveraged portfolio is equal to those of equities. The applied leverage is, therefore 155%. The borrowing rate used for leveraging his 60/40 portfolio is proxied by the one-month t-bill rate.

In his original paper, Asness finds that, over the period 1926 to 1993, the Levered 60/40 portfolio returns 11.1% on average per year with 20% volatility. Equities, in contrast, return only 10.3% with the same volatility. For reference, the 60/40 portfolio (unleveraged) returns 8.9% with 12.9% volatility.

We extended the Asness analysis to the most recent period. We observe that over this longer period, the results still hold true. The Levered 60/40 delivers higher returns than equities with similar volatility. The Sharpe ratio of the Levered 60/40 benefits from the diversification and is improved, compared to equities, with no cost to returns themselves.

Leveraging the 60/40 around the world, a successful extension

In Figure 2, we extend the analyses to other regions to test the robustness of such results. While the history is not as deep, Figure 2 shows similar results. Across all the tested regions, the returns and Sharpe ratio of the Levered 60/40 portfolio exceeds those of the equities alone. At the same time, the volatility is identical, and the max drawdown is reduced.

Note that we do not use a 155% leverage in all those analyses; we use the relevant leverage to match the volatility of the equities in the region. Having said that, the leverage remains very similar across regions as it oscillates between 160% for global equities and 170% for Japanese equities.

The theory behind the Levered 60/40

From a theoretical point of view, the idea of focusing on the most efficient portfolio possible and leveraging it to create the most suited investment for a given investor is well anchored in financial theory. When he introduced the Modern Portfolio Theory (MPT) in 1952, Harry Markowitz had already outlined the concept through the Capital Allocation Line (Markowitz, March 1952).

The efficient frontier for a mix of 2 assets: US equities and US high investment-grade bonds. Note that each portfolio on the efficient frontier is the most efficient for a given level of volatility, assuming no leverage. All portfolios on the efficient frontier are not equal and have, in fact, different Sharpe ratios. Along this efficient frontier, there is a portfolio with the highest Sharpe ratio of all, called the ‘Tangential Portfolio’. This most efficient of all the efficient portfolios happens to be found where the Capital Allocation Line touches the efficient frontier. The Capital Allocation Line is the line that is tangential to the efficient frontier and crosses the Y axis (the 0% volatility axis) at a return level equal to the risk-free rate.

When it comes to building the most efficient portfolio for a given level of volatility, investors have two choices. Without leverage, they can pick the portfolio with the highest return for that volatility level on the efficient frontier. If investors look for strategies with a volatility level equal to equities, equities are the most efficient portfolio. Considering potential leverage, the answer is quite different. With leverage, an investor can pick the portfolio with the relevant volatility level (in this case, the equity volatility) on the Capital Allocation Line. Portfolios on this line happen to have a Sharpe ratio equal to the Sharpe ratio of the Tangential portfolio (that is, the best Sharpe ratio of all the portfolio combinations without leverage) but with any level of volatility that may be required. We called the Leveraged Tangency Portfolio the portfolio on the Capital Allocation Line with the same volatility as the equity portfolio. This portfolio is a ‘more efficient portfolio’. The return is improved by almost 2% for the same volatility, leading the Sharpe ratio to jump from 0.27 to 0.45.

Key Takeaways

“Diversification is the only free lunch in Finance”, whether a real or fake H. Markowitz’s quote, epitomises the philosophy that underpins the 60/40 portfolio. It is also one of the main lessons from Markowitz's Nobel prize-winning work. Having said that, the second lesson has not been heeded as well: leveraging a good portfolio can make an even better portfolio. Overall, by leveraging a traditional 60/40 portfolio, an idea that, at WisdomTree, we call ‘Efficient Core’, investors could potentially receive a similar level of volatility present in a portfolio 100% allocated to equities but with the better Sharpe ratio of a 60/40 portfolio.

Possible examples of where such Efficient Core portfolios may be used widely in multi-asset portfolios include:

An equity replacement

A core equity solution designed to replace existing core equity exposures. By offering return enhancement, improved risk management and diversification potential compared to a 100% equity portfolio, Efficient Core can also be used to complement existing equity exposures.

A capital efficiency tool

By delivering equity and bond exposure in a capital-efficient manner, Efficient Core can help free up space in the portfolio for alternatives and diversifiers. In line with the illustrations above, allocating 10% of a portfolio to this idea, investors would aim to get 9% exposure to US equities and 6% exposure to US Treasuries. This could allow investors to divest 6% from existing fixed income exposures and consider alternative assets (such as broad commodities, gold, carbon or other assets). In this scenario it could potentially be achieved without losing the diversifying benefits of their fixed income exposure.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Educational : Diversification, systematic vs unsystematic riskWhen it comes to investing and trading, risk is a constant factor that requires careful consideration. Let's explore the concepts of systematic and non-systematic risk:

Deeper Dive

Market risk and non-diversifiable risk are other names for systematic risk. It is the kind of risk that is intrinsic to the entire market or a particular area within it and cannot be completely avoided by diversification. This means that you cannot totally protect yourself from systematic risk, regardless of how diversified your investment portfolio is. There are many ways of mitigating risk in the market but due to the nature of the market there is no way to completely eliminate this risk element. There will also be a certain level of risk that you need to account for.

Unpredictability:

The unpredictability of systemic risk is one of its difficult elements. These risk factors frequently come as a surprise and can appear quickly, making it challenging to plan for their effects. Even seasoned investors can be caught off guard by events like global economic crises or political turmoil because of the intricate network of interconnected factors that affect financial markets. There is also the fact that markets are inherently fractal. You can read more about this in my publication on how the market is fractal. (Will be in related ideas)