Robert Half | RHI | Long at $37.58Robert Half NYSE:RHI is a company that provides talent solutions and business consulting services in the US and internationally. It's a cyclical stock. Currently, the price has entered my "crash" simple moving average zone ($37-$33) and has historical bounced from this area. This doesn't mean the "major crash" area won't be reached ($26-$21 or below), but the company has been around since 1948 and survived many hurdles along the way.

Earnings are forecast to grow 8% annually and it has a 6.3% dividend. P/E = 21x and financially healthy (low debt-to-equity: .2x, low bankruptcy risk/Altmans Z Score: 5; and enough cash to pay current bills/quick ratio: 1.6).

Regardless of bottom predictions, I think there is a high chance the stock may reach $33 before a slight bounce. If the market flips for a bit, that "major crash" area ($20s) may be hit.

So, a starter position for NYSE:RHI has been created at $37.58 with additional entries near $33 and $25-$26.

Targets into 2028:

$46.00 (+22.4%)

$53.00 (+41.0%)

Dividend

DOW: Dow Inc. cut its dividends in half !High dividends no longer !

I was waiting the stock to reach the support level to benefit from the 10% high dividends yield... but the company cuts its dividends yield from 10% to 5%, so it is no longer valid to me.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

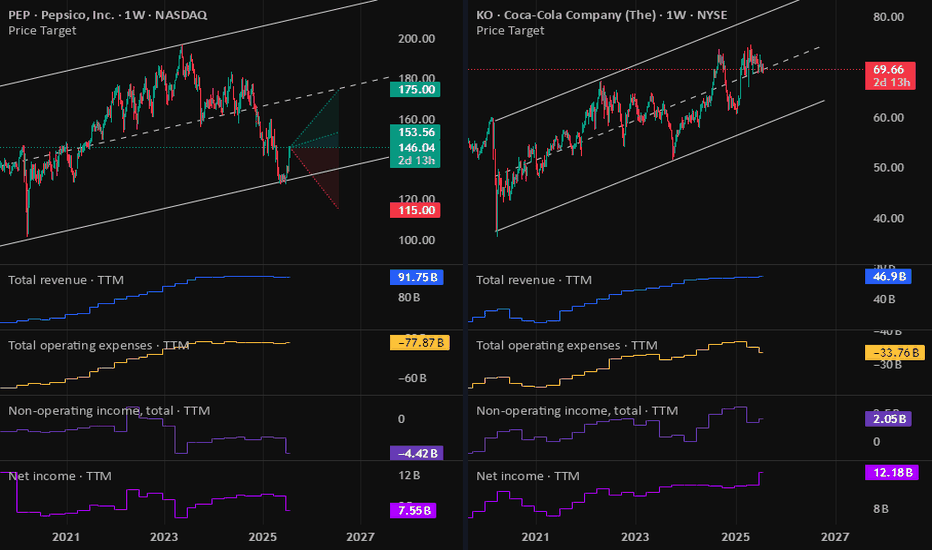

KO: Coca-Cola (CFD) Earnings 23-07-2025Yesterday we have the Coca-Cola earnings report came out and beat on both earning and revenue. But due to the technical position I do not see it a good entry on the stock CFD, still see PepsiCo stock CFD is a better option.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

High Dividend Stock on the Move? COH – Eyes on 351.51 Cochlear Limited (ASX: COH) is showing strong bullish potential after price tapped into a respected Monthly Order Block (OB). This region aligns with a historically strong demand zone, offering a prime entry opportunity for longer-term investors and SMC traders alike.

From a Smart Money Concept (SMC) perspective, the structure remains bullish:

- Price swept a low into the Monthly OB, indicating engineered liquidity grab.

- The reaction shows strong displacement to the upside, validating the OB.

- Volume also suggests institutional interest at this level.

- There’s now a clean path toward Equal Highs at 351.51, a natural draw for buy-side liquidity.

With COH offering consistent dividend payouts, this could be a double win – capital appreciation + income.

🧠 As always: Do Your Own Research (DYOR).

PEP: Long Buy OpportunityPEP is about to touch the 200 Monthly Moving Average. This last 2009.

The RSI is touching less than 30, which last happened in 1973.

PEP is a Dividend King which has increased it's dividend for 53 years. Did Warren Buffett say compounding is the 8th wonder of the world? Oh no, it was Einstein.

Evidence suggests great Long Term BUY opportunity on the price and momentum signals. Compelling.

#PEPSICO (PEP)

Bitcoin Income: STRK vs IBIT – Dividends, Covered CallsThis video provides a performance breakdown between two Bitcoin-related financial instruments—STRK (Strike) and IBIT—through the lens of passive income generation. I compare traditional buy-and-hold strategies with more active income tactics such as covered calls. Key insights include:

STRK provided the best return YTD (26%) and yielded approximately 1.54% in passive dividends, requiring minimal effort—just buy, hold, and collect.

IBIT, while slightly trailing in growth (13%), is optimized for a covered call strategy, offering an impressive 6% income yield through active options trading.

The analysis highlights the trade-off between simplicity and engagement—STRK is more passive-friendly, while IBIT offers higher yields for those willing to manage options.

This is ideal for tech-savvy investors exploring Bitcoin ETFs and derivative income strategies, weighing convenience versus return potential.

9 Simple Ratios Every Great Investor Uses - Buffett Included!Forget the hype, headlines, or hope. These 9 financial ratios are what real investors actually use to pick winners, but...

P/E? ROE? EPS? 🧐

- What are they, or better yet, WHO are they? 🤯

- How high is “too high”?

- Is a low number always good, or just a trap?

- Do all industries follow the same rules… or is that another myth?

Buffett. Greenblatt. Graham. Lynch.

They didn’t rely on vibes — they trusted fundamentals

After years of relying on charts, I built a 9-point fundamentals checklist to filter stocks faster and smarter. Now I’m sharing it with real-life examples and key insights to help you spot what really makes a stock worth owning:

Easy enough for new investors diving into fundamentals

Sharp enough to level up seasoned pros

Real enough to avoid hype

…but the truth is: these numbers did flag companies like Amazon, Apple, and Nvidia before the market gave them credit.

-----------------------------------------------------

✅ Quick Reference Table

Scan the table, then dive into the stories…

First Pro Tip: Bookmark this. You’ll check these before every stock pick.

-----------------------------------------------------

📊 1. P/E Ratio | Price-to-Earnings

What it tells you: How much you pay for each dollar of a company’s profit.

Short Example: A P/E of 20 means you pay $20 for $1 of profit. High P/E? Expect big growth or risk overpaying.

Strong: Between 15 and 25

Caution: Above 30 (unless fast growth)

Industry Averages:

- Tech: 25–40

- Utilities: 10–15

- Consumer Staples: 15–20

- Energy: 10–20

- Healthcare: 20–30

Story: In early 2023, NVIDIA’s P/E ratio hovered around 25, near the low end for tech stocks. Investors who saw this as a steal amid the AI boom were rewarded—NVIDIA’s stock made 4x by the end of 2024 as AI chip demand soared.

Contrast that with Tesla in Q1 2025, when its P/E spiked above 40 with slowing sales and Tesla’s stock dropped 50% in weeks.

Pro tip: A low P/E is not always good. If growth is weak or falling, it's often a trap.

Example: A utility company with a P/E of 30 is probably overpriced. A tech stock with 35 might still be fair — if growth justifies it.

-----------------------------------------------------

🧠 2. PEG Ratio | Price-to-Earnings-to-Growth

What it tells you: If a high P/E is worth it based on future profit growth. Whether the earnings growth justifies the price.

Short Example: A PEG below 1 means you’re getting growth at a fair price. High PEG? You’re overpaying.

Strong: Below 1

Caution: Above 2

Industry Averages:

- Software: below 1.5 is solid

- Consumer Goods: Below 2 is more realistic

- Tech: Below 1

- Consumer Staples: Below 1.5

- Healthcare: Below 1.2

- Financials: Below 1.5

- Energy: Below 1.3

Story: In mid-2022, Salesforce’s PEG was 0.8 (P/E 35, forward EPS growth 45%) as cloud demand surged. Investors who spotted this steal saw the stock climb 130% by the end of 2024. Meanwhile, Peloton in 2023 had a P/E of 20 but near-zero growth (PEG above 3). Its stock cratered -50% as fitness trends faded.

Story: NVIDIA’s PEG hit 0.9 in Q3 2023 (P/E 30, growth 35%) during AI hype, a steal for tech (average PEG below 1.2).

PEG filters hype. A stock can look expensive until you factor in growth.

-----------------------------------------------------

🧱 3. P/B Ratio | Price-to-Book

What it tells you: How much you pay compared to what the company owns (like buildings or cash).

Short Example: A P/B below 1.5 means you’re paying close to the company’s asset value. High P/B? Expect strong profits or risk.

Strong: Below 1.5

Caution: Below 1 + poor earnings = value trap

Industry Averages:

- Banks: Below 1.5

- Insurance: Below 1.3

- REITs: Use NAV (aim below 1.2)

- Tech: Often ignored

- Energy: Below 2

Story: In 2024, JPMorgan Chase’s P/B was 1.4, solid for banks (average below 1.5). Investors who bought enjoyed 100% gains.

n 2023, Bed Bath & Beyond’s P/B fell below 1 with collapsing earnings. It looked cheap but filed for bankruptcy that year.

Tip: Only use this in asset-heavy sectors like banking or real estate.

-----------------------------------------------------

⚙️ 4. ROE | Return on Equity

What it tells you: How well a company turns investor money into profits.

Short Example: An ROE above 15% means the company makes good money from your investment. Low ROE? Weak returns.

Strong: Above 15%

Caution: Below 10% unless in slow-growth industries

Industry Averages:

- Tech: 20–30%

- Consumer Staples: 15–25%

- Utilities: 8–12%

- Financials: 10–15%

- Healthcare: 15–20%

Story: Coca-Cola (KO) has kept ROE above 35% for years, a sign of brand power and pricing strength.

Eli Lilly’s (LLY) ROE stayed above 25% from 2022–2024, a healthcare leader (average 15–20%). Its weight-loss drug Mounjaro drove consistent profits, lifting the stock 150%+ in two years. Checking ROE trends helped investors spot this winner.

Tip: If ROE is high but D/E is also high, be careful, it might just be leverage.

-----------------------------------------------------

💰 5. Net Margin | Profitability

What it tells you: How much profit a company keeps from its sales or what % of revenue ends up as pure profit.

Short Example: A 10% margin means $10 profit per $100 in sales. Low margin? Tough business or high costs.

Strong: Above 10-15%+

Caution: Below 5%

Industry Averages:

- Software: 20–30%

- Retail: 2–5%

- Manufacturing: 8–12%

- Consumer Staples: 10–15%

- Energy: 5–10%

- Healthcare: 8–15%

Story: Walmart’s (WMT) 2% net margin looks tiny — but it’s expected in retail.

A software firm with 5%? That’s a warning — high costs or weak pricing.

In 2023, Zoom’s (ZM) net margin fell to 5% (down from 25% in 2021), well below software’s 20–30% average. Pricing pressure and competition crushed its stock quite a lot. Meanwhile, Apple’s 25% margin in 2024 (tech average 20%) remained a cash cow.

Tip: Margins show whether the company owns its pricing or competes on price.

-----------------------------------------------------

💣 6. D/E Ratio | Debt-to-Equity

What it tells you: How much debt a company uses compared to investor money.

Short Example: A D/E below 1 means more investor cash than debt. High D/E? Risky if profits dip.

Strong: Below 1

Caution: Above 2 (except REITs or utilities)

Industry Averages:

- Tech: 0–0.5

- Industrials: 0.5–1.5

- REITs: 1.5–2.5 (manageable due to structure)

- Utilities: 1–2

- Energy: 0.5–1.5

Story: In 2024, Tesla’s D/E dropped below 0.3 (tech average 0–0.5) as it paid down debt, signaling strength despite sales dips - a massive rally afterward.

Tip: Rising debt + falling profits = a storm coming. Always check both.

-----------------------------------------------------

💵 7. Free Cash Flow (FCF)

What it tells you: Cash left after paying for operations and growth investments.

Short Example: Apple’s $100 billion cash pile in 2024 funded stock buybacks, boosting shares. Low cash? Trouble looms.

Strong: Positive and growing

Caution: Negative for multiple years

Sector notes:

- Tech: Lots of cash (think billions)

- Industrials: Up and down, check trends

- REITs: Look at FFO (cash from properties), aim high

- Energy: Has cash, but swings with oil prices

- Healthcare: Steady cash, not too high

Story: Netflix had negative FCF while scaling content. Once costs stabilized, FCF turned positive and stock re-rated sharply.

Pro tip: Profits don’t mean much without real cash. FCF is often more honest.

Cash is king: Companies need cash to pay bills, reduce debt, or fund growth. If FCF is falling, they might be burning through cash reserves or borrowing, which isn’t sustainable.

Potential issues : This mismatch could signal problems like poor cash collection, heavy spending, or even accounting tricks to inflate profits.

-----------------------------------------------------

🚀 8. EPS Growth | Earnings Power

What it tells you: How fast a company’s profits per share are growing.

Short Example: EPS up 10% yearly means more profit per share, lifting stock prices. Flat EPS? No growth, no gains.

Strong: Above 10%

Caution: Below 5%, flat/negative for 3+ years

Industry Averages:

- Tech: 15–30%

- Staples: 5–10%

- REITs: 3–6% (via FFO growth)

- Healthcare: 10–15%

- Financials: 5–10%

- Energy: 5–15% (cyclical)

Story: In Q1 2024, NVIDIA’s forward EPS growth of 30% (tech average 20%+) fueled a rally as AI chips dominated. Checking forward estimates helped investors avoid traps like Intel, with flat EPS and a drop.

Pro tip: A stock with flat EPS and no dividend? There’s no reason to own it.

-----------------------------------------------------

💵 9. Dividend Yield | Passive Income

What it tells you: How much cash you get yearly from dividends per dollar invested.

Short Example: A 3% yield means $3 per $100 invested. High yield? Check if it’s sustainable.

Good: ~3–4%

Red Flag: Above 6% with a payout ratio above 80-90%

Industry Averages:

- Utilities: 3–5%

- REITs: 3–6%

- Consumer Staples: 2–4%

- Tech: 0–2%

- Energy: 2–5%

-----------------------------------------------------

💡 Final Thought: How to Use All of This

Top investors don’t use just one metric. They look at the whole picture:

Good growth? Check PEG.

Good profits? Confirm with ROE and margin.

Safe balance sheet? Look at D/E and cash flow.

Fair valuation? P/E + FCF Yield + P/B.

Real power = Combining metrics.

A company with P/E 15, PEG 0.8, ROE 20%, low debt, and positive FCF? That’s your winner.

A stock with P/E 8, but no growth, high debt, and negative cash flow? That’s a trap.

-----------------------------------------------------

Real-World Combos

🎯Winners:

Tech Gem: P/E 20, PEG 0.8, ROE 25%, D/E 0.4, growing FCF, EPS 20%+ (e.g., NVIDIA 2023: AI-driven growth, stock soared).

Energy Steal: P/E 15, P/B 1.5, FCF positive, Dividend Yield 3.5% (e.g., Chevron 2023: Cash flow king).

⚠️Traps:

Value Trap: P/E 8, flat EPS, D/E 2.5, negative FCF (e.g., Peloton 2023).

Overhyped Tech: P/E 50, PEG 3, Net Margin 5%, D/E 1.5 (e.g., Rivian 2024).

-----------------------------------------------------

🚀 Share your own combos!

What do you personally look for when picking a stock?

If you spotted something off in the numbers, or have a valuable insight to add — please, drop it in the comments.👇

💡 Let’s turn this into a thread that’s not just good but superb and genuinely helpful for everyone.

-----------------------------------------------------

Final Thought

“Buy great companies at fair prices, not fair companies at great prices.” – Warren Buffett

This guide gives you the map.

Charts, tell you when.

These numbers tell you what, and why.

And this post?

It’s just the beginning!

These 9 metrics are part one of a bigger series I’m building — where we’ll go even deeper, with more advanced ratios, smarter combos, and real case studies.

If this guide helped you see financial numbers a little clearer, there’s a good chance it’ll help your investor friend too, especially if they’re just starting their journey...🤝Share it with them!

I built this as much for myself as for anyone else who wants to get better.👊

If you made it this far — thank you! 🙏

...and super thankful if you hit "The Boost" on this post 🚀

Cheers,

Vaido

Omnichart - Dividend pays - 2 - DSL,CCIF,JAAA,BUCK,TBIL,BNDJAAA has been the best stable performer. If you want to take risk and earn higher dividend then the right value for them is when their dividend adjusted performance meets JAAA's dividend adjusted performance. Till then stay in JAAA (Its the Janus Henderson AAA CLO ETF), the other closer alternatives are BUCK and TBIL. JAAA and BUCK provide excess returns over risk free return of TBIL. JAAA seems to outperform BUCK.

For a long term investor who wants to come out of equities during market turning events on a long term basis (lets say monthly chart) the following strategy may be help grow your wealth/ earn income :

Transfer from equities or risky assets into JAAA (or BUCK/TBIL depending on your preference) and another turn on a long term basis like on a monthly chart slowly scale out of JAAA back into the risk assets of choice.

Rising Costs & Economic Uncertainty: What January Taught Us and And then there’s UPS. A 20% drop is not just a stock market hiccup—it’s a symptom. The logistics giant, a bellwether for commerce, is struggling under the weight of declining demand, operational cost increases, and shifting consumer behavior. The question is, who’s next? If a company as ingrained in global trade as UPS is faltering, what does that signal for the rest of the economy? Retail? Small businesses? Tech?

February looms with uncertainty. Will we see further price hikes, layoffs, or corporate contractions? Or will there be a recalibration, an attempt to stabilize? If January was a lesson in upheaval, February may well be a test of resilience.

economy update, cost of living, milk and egg prices, gas prices 2025, UPS stock drop, inflation impact, economic downturn, market analysis, America First policy, supply chain crisis, financial news, economic forecast February 2025, stock market trends, political economy, consumer prices

MBSB Cup & Handle Formation in the MakingShort term MBSB could be heading to support area around 0.700

If Cup and Handle pattern forms, TPs are the greenline marked on the chart.

Dividends have been good from this stock, plus it's a Banking stock.. with interest rates stable and potentially going down from here, loans are going to be cheaper and banks profit will grow Q-on-Q. It's also one of the only two Banking stocks that are Shariah Compliant.

I am looking to add position at 0.690 (support area) and keep it on my portfolio long term.

Alexandria Real Estate | ARE | Long at $97.41Alexandria Real Estate NYSE:ARE

Pros:

Pays a high and reliable dividend of 5.56%

Earnings are forecast to grow 18.52% per year

Revenue rose from $1.5 billion to $3 billion by Q3 2024

Insiders recently awarded a large amount of options in January 2025

Historically cyclical and bottom cycle may be ending soon

Cons:

Debt is not well covered by operating cash flow

P/E of 57.93x

May see further near-term declines in share price with poor earnings ($60s-$70s, bottom is unconfirmed)

Targets (into 2027)

$120.00

$140.00

$149.00

$199.00

$220.00 (long-term outlook)

Can We Get +EV from EV? With stocks like FCX, sometimes the answer isn’t just about gold—it’s about finding the copper that holds everything together.

While everyone scrambles for the gold nuggets in the mainstream Electric Vehicle (EV) market, you might be missing opportunities further upstream in the feeder streams. These are the overlooked areas that quietly power the whole operation. As I work on my 2025 guide to researching and finding hidden gems in this very market, I stumbled upon a curious situation that’s sometimes overlooked when researching a stock: a well-timed opportunity to combine deeper research with the possibility of an early position.

What is that opportunity, you ask? Well, it’s all about timing and understanding the mechanics of dividends, coupled with an upcoming earnings catalyst.

The Hidden Value in Copper

Let’s face it—copper wire isn’t exactly the sexiest investment out there. But sometimes, the dressed-down stock has a greater long-term value precisely because it spans multiple industries. Copper isn’t just critical for EV motors and renewable energy—it’s a foundation material for infrastructure, electronics, and more.

Enter Freeport-McMoRan Inc. (FCX). This copper powerhouse caught my attention for two key reasons:

1. A dividend payout date approaching on Jan 15, offering a 1.6% yield.

2. An earnings report set for Jan 23, creating the potential for amplified movement shortly after the dividend window.

Now, before you jump in, remember: this isn’t about chasing dividends or speculative hype. Instead, it’s an opportunity to observe, research, and learn. Here’s why FCX is a fascinating case study and what to watch for.

Why FCX Is a Great Study

1. **Dividend Catalyst (Jan 15)

- Watching the stock’s behavior leading up to and after the ex-dividend date could give insights into how investors value the dividend.

- Track whether the stock trades with increased volume or volatility as traders position themselves to collect the dividend.

2. **Earnings Catalyst (Jan 23)

- With earnings just a week after the ex-dividend date, you have a rare overlap of events that could amplify price movement.

- Depending on sentiment, the stock could rebound from the ex-dividend price drop—or face additional pressure if earnings or guidance disappoint.

3. **Copper Exposure

- FCX is already on our radar for its ties to EVs, renewable energy, and infrastructure projects.

- Broader copper demand, influenced by economic sentiment or supply chain news, could add another layer of movement to this stock.

What to Watch

1. Pre-Dividend Price Action (Now through Jan 14)

- Look for increased buying as traders position for the dividend.

- Monitor volume trends and whether FCX breaks key technical levels.

- Keep an eye on market sentiment and copper-related news.

2. Ex-Dividend Price Adjustment (Jan 15)

- Observe if the stock drops by exactly the dividend amount ($0.15) or if external factors cause a different adjustment.

- Watch for recovery post-drop—does buying interest resume, or does the stock stall?

3. Earnings Anticipation (Jan 16–23)

- Monitor implied volatility (IV) for options, as IV typically rises before earnings.

- Consider how copper prices or macroeconomic trends (like China reopening or U.S. infrastructure spending) might affect sentiment heading into earnings.

4. Post-Earnings Reaction (Jan 23 and Beyond)

- Listen to the earnings call for insights on copper demand, production costs, and forward contracts.

- Note whether the stock aligns with broader copper and EV trends or diverges based on the results.

Possible Outcomes

1. Bullish Scenario

- Dividend buying drives interest, and earnings provide a strong catalyst for growth.

- The stock rebounds quickly after the ex-dividend date and continues upward momentum post-earnings.

2. Bearish Scenario

- Dividend adjustment leads to further downside pressure, and earnings fail to meet expectations.

- The stock underperforms compared to copper peers.

3. Neutral Scenario

- Dividend adjustment happens as expected, and earnings provide no surprises.

- FCX trades sideways, maintaining a range-bound pattern.

How to Track and Document

1. **Price & Volume:**

- Record closing prices from now through Jan 23.

- Note volume spikes and their timing relative to events.

2. **Options Activity:**

- Monitor the options chain for changes in implied volatility as earnings approach.

- Look for unusual activity around certain strikes or expirations.

3. **Copper Prices:**

- Track global copper prices, as they could influence sentiment for FCX.

4. **News Flow:**

- Stay updated on copper demand, EV adoption, and infrastructure-related headlines.

A Practical Exercise in +EV Thinking

FCX presents a unique opportunity to explore the layered dynamics of dividends, earnings, and macroeconomic trends. Even if you don’t take a position, tracking these events can sharpen your understanding of how catalysts play out in real time.

And, of course, this study aligns perfectly with the philosophy behind my upcoming eBook and print guide:

**“Adding to Your Nest with EV in 2025 – A guide for researching the hidden gems in the EV market sector of trading.”**

So, can we get +EV from EV? The answer lies upstream, in the copper that holds everything together.

-Bob Cavin 3

VALE: Elliott Wave AnalysisWe're looking at an Expanded Flat correction in Wave 2, with Wave C forming a Complex Corrective ABCDE triangle pattern

After breaking down from the triangle pattern, Wave C is likely to terminate near major support levels (~$7.50-$6).

Implications for Wave (3):

Once Wave (2) concludes, a powerful impulsive Wave (3) is expected, with targets around:

$27-29 (161.8% extension).

~$40 (261.8% extension).

The triangle within Wave C suggests exhaustion of the bearish trend, setting the stage for a multi-year rally.

Based on Vale's goals in producing and expanding on their "energy transition" metals like nickel (currently the second largest nickel miner in the world) and copper, and the demand for EV batteries. It's likely that Vale will benefit.

This is a long projection so Vale will have to execute on all its timelines and goals for production capacity.

Best of luck all.

BOUNCE FOLLOWED BY LOWER PRICES FORECASTEDWhile the higher degree long-term outlook for this dividend giant is bullish, the short-term outlook is not likely to bring new all-time highs. Earlier this year we anticipated new all-time highs, but that changed when KO hit it’s 63.18 low last week. What changed the forecast was the technicals surrounding that low. While the price action is currently cooked to the downside, there are no clear indications of a reversal, with the weekly RSI indicating more room to the downside, and the MACD supporting that theory. This tells us to turn to the most telling indicator, which is volume, which indicates there is still strength to the downside. That said, we know the market does not move in straight lines and a strong bounce off the 63.18 low is likely. We currently forecast that bounce to target the round number zone of 70, forming a B-Wave rejection of higher prices, that will be followed by a C-wave, which will likely target the weekly point of control around 60. With that in mind, C-waves can truncate their targets, especially when the ticket involved is a popular long-term dividend target like KO, and we are talking about a long-term low that will create a significant buying opportunity. That said, if you can deal with the near-term volatility, the 63 zone may not be a bad entry zone.

Opening (IRA): EWZ July 19th 31 Monied Covered Call... for a 30.31 debit.

Comments: Decent 30-day IV at 34.0%, but I'm primarily looking to position myself to grab the June dividend. IV is skewed to the put side in this underlying, so the general go-to would be short put, but to grab the dividend, you have to be in stock.

Because I want the extrinsic in the short call to exceed any dividend, I'm basically going at-the-money/slightly monied with the short call and will look to manage the position after the dividend drops. Unfortunately, the distribution has been wildly variant, so it's hard to tell how much extrinsic to keep in the short call to diminish the prospect of being called away early due to some dick exercising their long call early to grab the dividend.

Metrics (Sans Dividend):

Break Even/Buying Power Effect: 30.31

Max Profit: .69

ROC at Max: 2.28%

ROC at 50% Max: 1.14%

BHP, Rio Tinto (commodities): Highly exposed to the prices of miBHP, Rio Tinto (commodities): Highly exposed to the prices of minerals and metals (iron, copper, coal). Their performance is closely tied to global demand, particularly in China.

Rewards

Trading at 27.1% below our estimate of its fair value

Earnings are forecast to grow 4.76% per year

Risk Analysis

Profit margins (14.1%) are lower than last year (23.8%)

Dividend of 5.17% is not well covered by earnings

Volkswagen, Stellantis, BMW, Mercedes (automobile)Volkswagen, Stellantis, BMW, Mercedes (automobile): The automotive industry is undergoing a transition to electric vehicles. These companies hold strong positions, but they need to successfully navigate this transformation against competitors like Tesla and Polestar (lol).

Trading at 43.1% below estimate of its fair value

Trading at good value compared to peers and industry

Risk Analysis

Debt is not well covered by operating cash flow

Dividend of 7.95% is not well covered by free cash flows

CMS Infosystem: Triangular Breakout with Dividend BoostChart Pattern:

CMS Infosystem is forming a triangular pattern, a potential indicator of upcoming price movement.

Support Levels:

The stock has built a strong base at key support levels, suggesting a solid foundation for upward movement.

Critical Resistance:

A close above 435 could trigger a significant price increase, breaking out from the triangular pattern and signaling bullish momentum.

Upcoming Catalyst:

The upcoming dividend declaration could serve as a positive catalyst, potentially driving the stock price higher.

Trade Setup:

Entry Point: Consider initiating a long position if the stock closes above the 435 level, confirming the breakout.

Stop Loss (SL): Set a stop loss below the lower trendline of the triangular pattern to manage risk.

Target Levels: Identify initial targets at previous resistance levels. Adjust further targets based on the stock’s performance and market conditions.

Disclaimer:

Before taking any position, consult your financial advisor to ensure the trade aligns with your investment strategy and risk tolerance. This analysis is for educational purposes only and does not constitute financial advice.

Happy Trading!