UTX: Modern Dividend Dog of the DowUTX posted a Valentine's Day dividend, and now it's time to consider buying back into them. Despite an earnings miss, they're going strong with high winds on the US Federal budget negotiations in Washington yielding to compromise and better news for their Carrier and Otis Elevator brands appearing stronger through higher revenues favoring better terms on their plan to spin those off in 2020 to form a more aerospace oriented firm. With strong fundamentals, and a good position in the Dow 30, the time to buy after ex-dividend dates is now.

Technicals show a strong but methodical plod upward with both MACD and ADX and directional movement showing no signs of the trend slowing down even if RSI appears slightly overbought hovering over 75 for the last two days, but that's OK around dividend payouts. The stochastic oscillator is very flat indicating that a strong breakout either up or down couple happen any day. Expect resistance at previous highs with strong signs of continuation if UTX can close and remain over the previous one of 132 and again at 140, 144 as well as potential profit taking swings from those that bought in post-earnings. Short interest is roughly 15% the average daily trading volume but appears to have no hold on the upward price momentum.

Dividend

$WHF long term dividend playWHF - WhiteHorse Financial

This is one of my long term dividend holdings that I picked up today (400 shares). It pays a 10% annual dividend and is in the process of breaking above a major trendline after a multi-week double bottom.

I bought right under resistance in anticipation of a move higher.

My entry of 400 shares was at $14.20 today, February 12th, 2019. More info at wingtrades.com

$NLY long term dividend play!NLY - Annaly Capital

This is one of my long term dividend holdings that I picked up today (600 shares). It pays a 10% dividend on a mostly flat chart (9.70-10.00). I like the move back above the 200 daily moving average (red line).

My entry of 600 shares was at $10.47 today, February 12th, 2019. More info at wingtrades.com

$CPLP long term dividend play off the $2.00 support!CPLP - Capital Product

This is one of my long term dividend holdings that I picked up on Friday (4,000 shares). It pays a 15% annual dividend with a solid and mostly stable chart.

Biggest reason for my entry is this fantastic hold above 2 dollars. My true test is a move above $2.40 and that next wedge resistance, but I'm willing to risk the entry early.

My entry of 4,000 shares was at $1.27 on Friday, February 8th, 2019. More info at wingtrades.com

$NYMT long term dividend play!NYMT - New York Mortgage Trust

This is one of my dividend holdings that I picked up today (1,000 shares). Not only does it pay a fantastic dividend, but we are right on the cusp of a long-term breakout and constantly above earnings expectations. Multi-year hold.

My entry of 1,000 shares was at $6.33 on Friday, February 8th 2019. More info at wingtrades.com

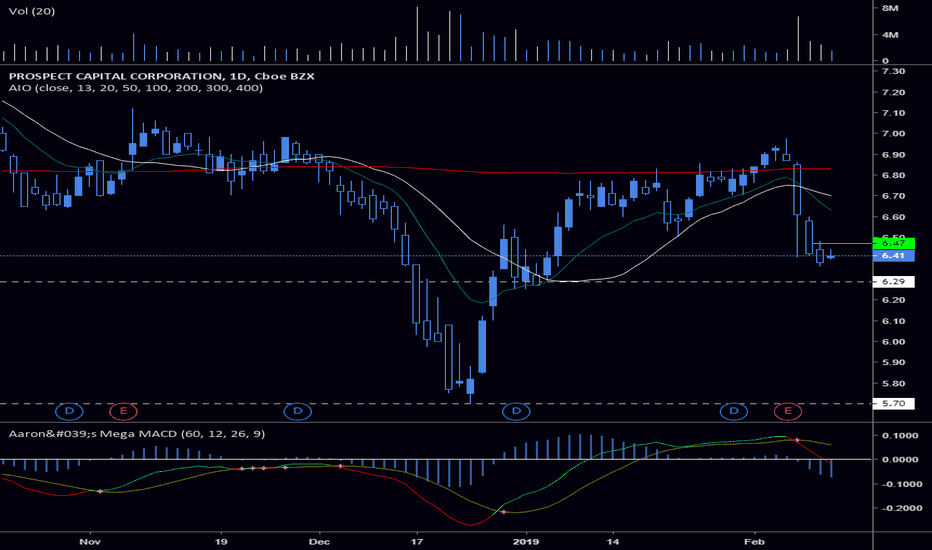

$PSEC long term dividend. This is one of my dividend holdings that I picked up on Friday (1,000 shares). It pays an 11% annual dividend, but also enjoys movements of quick bearish drops and equally quick recoveries.

Full details of this play at https://wingtrades.com!

My entry of 1,000 shares was at $6.47 on Friday, February 8, 2019.

Dividend Capture Strategy for easy cash flowDividend Capture strategy for easy cash flow on XOM

Exxon Mobil pays .82 per share quarterly and the ex-dividend date is this Friday (2/8/2019) the dividend pay date is on 3/11/19. So yearly Will get $3.28 (.82x4)for a dividend yield of 4.4% not bad.

But by selling the ATM Put for $1.02 I will increase the premium plus dividend paid for the year to $4.30 and increase the yield to 5.77%. That alone is an improvement of 31%.

If I don't get assigned I get to keep the premium and make over $500 in a couple of days and if I do get assigned then I will sell some calls to keep reducing my basis and improve my yield even more.

The Trade: XOM

Sold 5 ATM Puts @ 74.5 for $1.02

4 days to expiration

NYSE:NOK NOKIA daily chart could be a good run NYSE:NOK price is above MA200 and I pay attention if is approaching resistance zone .

Resistance zone it is a TA point of view and I can say it is psychological level as well and it is proved that can influence price direction depends of circumstances .

Good time to buy FRED? Channel Support + Gap DownI like this setup. Good R/R. Entry around $5.75 stop loss around $5.50-5.60 - depending on position size and pain tolerance. Fred's is a solid company with descent dividends and call options look super cheap at the moment. A good a bet as any, especially with those gaps around $2.50. That would be my first target.

Don't get in a pickle!

The Shill Pickle

XOM- Back down to 2015 prices. Great Dividend investmentI'm always on the lookout for good dividend investments The energy sector is catching hell right now and it may be a good time to revisit some of the equities on the watch list For my dividend stocks I like to go back atleast 5 years to see trends. This may be a good time to snatch up Exxon. It has a very attractive dividend as well.

Newell Brands up 23% on heavy volume and recommended buyingNewell Brands, a high-profile consumer products brand owner, is up just above 786fibretracement on breakout volume.

About: Newell Brands Inc. is a marketer of consumer and commercial products. The Company's segments include Writing, Home Solutions, Commercial Products, Baby & Parenting, Branded Consumables, Consumer Solutions, Outdoor Solutions and Process Solutions. Its products are marketed under a portfolio of brands, including Paper Mate, Sharpie, Dymo, Expo, Parker, Elmer's, Coleman, Jostens, Marmot, Mr. Coffee, Rubbermaid Commercial Products, Graco, Baby Jogger, NUK, Calphalon, Rubbermaid, Contigo, First Alert and Yankee Candle. Writing segment consists of the Writing and Creative Expression business.

Monday will likely be a slightly down day, so get in below 18.39 on limit order and solid long hold with 5.5% dividend yield, which has an 8.9% growth rate the last 5-years. Div. payout is typically the 2nd week of Nov. and likely why the jump today. Or buy-in at market and set some for low buy-in.

SIRI - Fibretrace at 0.618SIRI has acquired Pandora (P) and will likely increase subscriptions in coming quarters.

Earnings coming Oct. 26th

Dividend currently measly $0.01/Qtr or $0.04, or 0.64% with current price.

Unless market further corrects this should bounce to 0.500 fibretrace next week for 5% jump, ideally 382 for 10% target.

Placing low ball open order below this at $6.15.

China Mobile: If you have to own 1 name...If you have to own one name today right now, this is IT. Boring old cash rich China Mobile has been trading in this channel since 2009 and this is the 3x time 941 is testing the lower end of the range. There is 5% to pick up before it hits the 1st resistance and potentially +35% if it tests the top of the range. To sweeten the deal, if you hang on till the end of the month, specifically the 25th, the kind folks at China Mobile will cut you a check for 2.1% yield. If you need more convincing, China Mobile owns 38% of China Tower which just filed for a $10bn IPO in HK. State-own IPOs in HK are just like butter on popcorn, nothing will taste better than China Mobile when China Tower starts popping on IPO day.