Dow Jones Testing Key Support – Bounce or Crash Ahead?The Dow Jones Industrial Average (DJIA) is currently testing a key rising trendline support, which has been a strong foundation for its uptrend since 2023. Holding this level could signal a continuation of the bullish momentum, while a breakdown may lead to a deeper correction. If the price fails to hold above this trendline, the next significant support lies around 41,000-40,000, a zone that previously acted as resistance and is now a psychological support level. In case of further weakness, the long-term trendline support around 38,000-39,000 could come into play, aligning with the Ichimoku cloud support.

For the bullish scenario to remain valid, DJIA needs to sustain above the rising trendline and reclaim recent highs. However, if sellers gain control and push prices lower, a broader pullback could unfold. Overall, the market remains in an uptrend as long as key support levels hold, but price action in the coming weeks will determine whether the index continues upward or undergoes a deeper correction.

Do like, comment and follow

Djialong

NDQ/DJI - Short; Significant Statistical Arbitrage opportunity!While the NDQ/DJI, itself, represents a significant trade opportunity here, even more notably, a number of the index components display remarkably skewed "Greeks"! (For example, APPL-GOOGL, CAT-PEP, TSLA-BA, etc..) E.g., It is a rather strait forward process - at these levels - to assemble baskets of stocks (Long) in each index (Short) with rather juicy, +30%-40% near term (<7 months!) profit targets.

All this is a strait forward process - once one starts looking :-)

p.s. Will provide ideas for some of these stock baskets if/as time allows.

Dow Jones: Playing the Triangle 🎼Dow Jones has joined an orchestra and is currently making use of our pink triangle. We expect it to play it a little bit longer until the bottom of the orange zone between 33518 and 32614 points, where wave Z in green as well as wave iv in orange should end and give Dow Jones new drive to take off, aiming for the resistance at 35521 points.

Still, there is a 30% chance that Dow Jones could fall though the orange zone and below 32500 points. From there, it should drop further downwards.

Dow Jones: The Second Time Around 🎤“ Love is lovelier the second time around… ”, so they say in the Oscar-nominated song “The Second Time Around”. First performed by Bing Crosby in the 1960 musical-movie “High Time”, the song became even more popular when Frank Sinatra added it to his repertoire one year later.

The song’s message might also ring true for Dow Jones as the index tries to climb above the resistance line at 35521 points for the second time. We expect it to make it above this mark soon and to thus affirm further upwards movement. The index should then rise farther, even above 36446 points.

However, as long as Dow Jones has not managed to conquer the resistance at 35521 points, we must not disregard our secondary scenario. There is a 40% chance that the index could fall below 33532 points and head for the bottom of the orange zone between 33518 and 32614 points.

Dow Jones: Industrial but not average!It is currently not really easy for the Dow Jones. The bears are bothering the course. However, we expect the course to rise again and surge past the resistance at 36446 points. If the course falls below 33928 points, we will see another round of corrections.

Got all your gifts already?

Dow Jones gained 0.39% what's next ?Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

U.S. stocks were higher after the close on Tuesday, as gains in the Basic Materials, Technology, and Healthcare sectors led shares higher.

The Dow Jones Industrial Average rose 138.79 points, or 0.39%, to 36,052.63

Possible Scenario for the market :

The market is trading right now at $36052.64 and the trend is moving with a strong Bullish momentum that started on the 28th of October, After a sudden drop in the market.

This Bullish movement will probably be reaching the $36115.86 resistance level where it will be aiming to breakout that level to reach the resistance at $36380.11.

In case the Bears tried to make a move then we could be seeing a drop that most likely won't reach any further than $35456.54.

Technical indicators show :

1) The market is above the 5 10 20 50 100 and 200 MA and EMA (Strong Bullish signs)

2) The MACD is above the 0 line indicating a Bullish state in the market, with a positive crossover between the MACD line and Signal line.

3) The STOCH is in overbought zone with a positive crossover between K% (97.80) and D% (96.21)

Weekly Support & Resistance points :

support Resistance

1) 35575.99 1) 35978.05

2) 35332.38 2) 36136.50

3) 35173.93 3) 36380.11

Fundamental point of view :

The Fed will release a statement at the end of its two-day meeting on Wednesday when it is expected to announce the start of tapering its bond-buying program. Markets also are pricing an interest rate hike at the Bank of England meeting on Thursday.

"Most times, markets are happiest when they get predictability when they get what they expect, and I think the expectation is that they are going to taper," said Randy Frederick, vice president of trading and derivatives for Charles Schwab (NYSE:SCHW) in Austin, Texas.

This is my personal opinion done with technical analysis of the market price and research online from Fundamental Analysts and News for The Fundamental point of view, not financial advice.

If you have any questions please ask and have a great day !!

Thank you for reading.

Dow: Aaaaand Action! 📽📽📽The Dow Jones has a hard time pushing for an offensive to overcome the resistance at 35547 points. However, sooner or later we see the course moving above that resistance and gradually build up new all-time highs until the area around 37607 points is reached.

Good times coming!

Dow Jones: Recovery! 🚑🚑🚑After the recent correction, the Dow Jones is recovering again. However, we believe that there is still some potential on the downside until somewhere around 33299 points. Once within that area, the Dow can start its final recovery and push for new all-time highs above 35000 points. It is only important that it stays above 32902 points.

Exciting times!

DJIA long trade ideaPlan: resistance level breakout --> wait for the price to bounce off from support level --> wait for the rejection candle pattern to form e.g. bullish engulfing, pinbar, etc --> BUY

**Disclaimer** the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

Traders!! if you like my ideas and do take the same trade as I do, please write it in a comment so we can manage the trade together.

_____________________________________________________________________________________________________________________

Thank you for your support ;)

GWBFX

DOW JONES INDUSTRIAL AVERAGE INDEX (DJI) DailyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

My Outlook On The DOW (DJI)Ascending wedge break to the right of long term upward support with highs being hit at 24150 key area of Resistance to test for an attempt at an upward breakout.

23000 is support area for the current range.

Weekly crossover for bullish shift and the ema dots are firing green.

But, keep in mind that we don't have a close on the weekly till may 4th.

Overall the weekly is in development and trying to recover from the crash.

We want to watch the open and see if it can push through 24150 with good volume pushing on the books.

Currently the one hour is green. If I get a Crossover on the 1 hr to the downside from rejection I'd than look for a 24000 break for a short to test 23000

If breaks to the upside your going to want to see it push towards the old wedge support and see if it rejects as new Resistance. That would be a good place to take profits.

We need to keep in mind that the monthly and the 3 month are overall bear pressure.

We now scout the weekly to try and find a good long term position to enter here, but it results in if we want to make higher highs or lower lows on the smaller timeframes

We still have to be conservative with the higher timeframes.

If this ranges breaks down than it could be a Distribution play and could result in a good size drop.

I hope this helps, I wish you all the best of luck trading this week!

Have a blessed day. 😁

$DIA Bears VS BULL Final Round (Bears are against the ropes)Possible start of a bull market or just a reprieve for the bulls? Will the Bears strike a knockout punch? Or do the Bulls have Aaron Rodgers for the hail Mary? The war is nail biting and only the victors write history.

Technical Analysis: I think the market is in a very important place facing 3 major resistance after its latest run up. From a technical perspective the run up in equities is still well within what is expected for a re-tracement and what I believe to be the B wave in an ABC correction. I have noted the major resistances I feel we need to hurdle past before we can call this a new Bull market. Next week will be telling and I would not go into next week short or long any positions (unless they are long term trades). A lot can happen over the long weekend but I fail to see how things can be assumed as okay in the financial world even after (and hopefully soon) we get past covid and people get back to work.

A lot of damage has been done to the world and we could be headed to a global recession.

For the bulls, if we do break above R3 then we can expect shorter bull market before the bears regroup to fight another war.

Please do your DD

Rally on DJI (Dow Jones)The Dow Jones Industrial Average rose more than 11% to clock its biggest advance since 1933. Dow Jones futures jumped Tuesday morning, along with S&P 500 futures and Nasdaq futures, amid optimism about a massive stimulus deal.

New support at 20,000 for DJI. Not sure how long this rally will last because its basically akin to printing money to keep the economy going. I feel the fundamentals are weakening but the artificial support might keep the market alive for a short period of time but long term wise, might be harmful for the economy. Just my 2 cents. hmm..

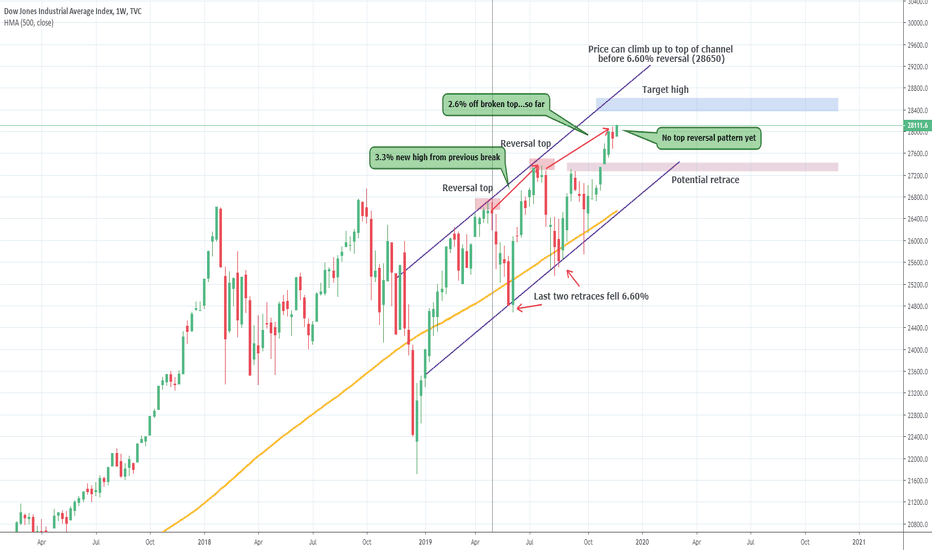

DOW JONES NOT REVERSING YET: WEEKLYThe Dow Jones Industrial Average is still looking like a strong bull on the weekly timeframe. The candles have not yet formed a reversal pattern, there is still potential for the upside after breaking the previous top. On a weekly candle once a pin bar formation of a strong reversal Doji forms then we can talk about the potential downside. For now, the target is still the top of the channel at 28650-28700.

There is a potential for a slight retrace but price should not get much below 27300 on a long-term perspective. That will ensure structure holds well bullish. Each failure off the top of the channel was followed by a 6.60% retrace, for that to occur price has to move up to the top of the channel, IF there is a 6+% retrace, the channel and bull structure is broken and the move lower can price the Dow Jones into correction territory.