DJI Future Map - A Correction is Imminent$DJI has been on an absolutely MASSIVE bull run since the collapse back in 2008-2009; a decade ago!

We all know what goes up must come down though and the DJI is due for another +50% correction.

This chart is on the Weekly. I usually prefer using the Day charts however I noticed some interesting trends that I hoped to share.

2008-2009

-The correction in 2008 was 55% from top to bottom

-The RSI at the peak was slightly Overbought so a little surprised the price tanked -7784 points

2016-2018

-The 1.618 ratio (19008) took 8 years to be hit

-The 2.618 ratio (26793) took 1 year, 2016-2017

-The RSI at the 2.618 level was 95 – Super Overbought which made sense to see the beginning of a huge correction however that wasn’t the case. A double top formed at the same level and then -

the price corrected roughly -5000 points, -18-20% towards the end of 2018-2019

-This correction pinged off possibly the 1.702-1.786 level (21712) from the first FIB (08-09)

-The RSI was once again just slightly Overbought at 70-72 level

-Price has continued to climb due to various political measures; volatility between Trump and China (Tariffs) as well as the beginning of the Impeachment talk

-The FED also injecting the ‘NOT QE’ funds into the REPO arena has stimulated the economy as well

-The current RSI is at 67 so it’s getting once again very close to those Overbought levels that haven’t been met since a year ago when the correction occurred

-Trump officially Impeached on December 18th and the $DJI keeps pumping

Beyond

I can’t predict the future but based on my FIB mapping, I’m expecting the possibility of a massive recession/depression type correction to be made when the 3.618 (34577) level is met. This is based on the FIB calculation from 2008-2009.

The current movements are lining up quite nicely with this FIB chart and the new FIB chart if calculated from the future ‘top’ indicates that we will see a re-tracement to the 0.618 (26627) level and in my opinion ultimately back down to the 1.618 (13761) level where I believe a good amount of resistance will be met. This is a negative 60% drop!

In the event 2.618 (896) level is met (worse than a Depression) that’s a negative 96% dump. I dunno if this will happen, but my guess is that we'll see this drop in-between 2021-2022.

Djianalysis

A Super Wild Guess for DJI (DEC 2019 and Early 2020)In the daily chart DJI shows RSI divergence and the index is due for a correction to previous major support level 26600 to 26800.

LONG the market around 26600 to 26800 level, preferably with bullish divergence in the 1-hour chart.

The SUPER WILD GUESS:

- Target ONE: DJI 30000, the TRUMP TARGET.

- Target TWO: 30720, bonus, target based on Fib Time Zone.

Why I'm Rooting For A Stock Market Crash I think we're about to end a 90 year cycle for global markets, meaning that we could get a crash similar in magnitude to the Great Depression. There are just too many technical sell signals to ignore, and fundamentally there is no reason for the market to continue rising if data shows that growth is slowing down. Both indexes are well above their long term trends, the DJI is at a long term trendline resistance, and we have a glaring bearish divergence on the monthly oscillators. All large market crashes in history were preceded with a bearish divergence on the monthly chart. This is when price makes a higher high, but the oscillator makes a lower high, showing lack of confidence in the move. I've even drawn those out for your viewing pleasure. On the recent high, we can observe what is arguably the largest bearish divergence the stock market has sever seen, even when compared with The Great Depression! Check it out:

Above, I drew what could easily happen to the DJI if it breaks down. We're now even further from all our moving averages AND the timeframe is longer. What this means is that it may take us at least 4 years to even reach bottom, and by that time, the Dow Jones may have declined back towards 10,000 or below. I think it does need to test the long term uptrend, which hasn't happened since 1982. We're long overdue for an extended period of stagnation, in my opinion.

Aside from indicators, there's also this fractal that I've been talking about for a year now. On this speculative chart, I outlined a possible move towards 40,000 or above, but we may actually never get up there, given the size of this divergence. The higher we go, I think the larger the drop will be.

The market has been cannibalized by big tech, and supported by lazy and complacent consumers. Suicide and drug addiction has exploded in the United States over the last decade, and this is because we have a population that doesn't have the resources to take care of itself. All they can do is buy. And buy on credit, obviously. Would a stock market crash make things worse? Perhaps in the short term, but I argue that this kind of "shakeup" is exactly what our disillusioned population needs. Something like that would provide more incentive to make change, and for people to really fight for their families and each other's lives.

I think a stock market crash would mean we would finally have the opportunity to make headway as a species. Rising market valuations lead to complacency, which leads to lack of policy change and the neglect of important issues like the wealth disparity and climate disaster. A big collapse would finally get people thinking ACTIVELY - and we'd be able to begin a new cycle with hopefully some positive direction. We must also be careful, because events like this can also lead to violence and the rise of fascism. Arguably, we're already seeing a rise in fascism on BOTH ends of the political spectrum. But these unstable periods also allow for art and culture to flourish in ways they haven't in quite some time. New opportunities for music, film, and visual art may present themselves, for people who need communities and activities to pass the time. Most people would probably agree that we're not seeing any sort of artistic Renaissance right now.

Anyway, that's it from me. I'm really curious to see if something like this ends up playing out. Linked below are my other write-ups on the stock market, including where I discuss a fractal I noticed in the Dow Jones.

This is not financial advice! This represents my opinion and one version of reality that may or may not be substantiated in truth. I like think I do my best to speak the truth, but I'm only a guy with an imagination. I do love to speculate though.

-Victor Cobra

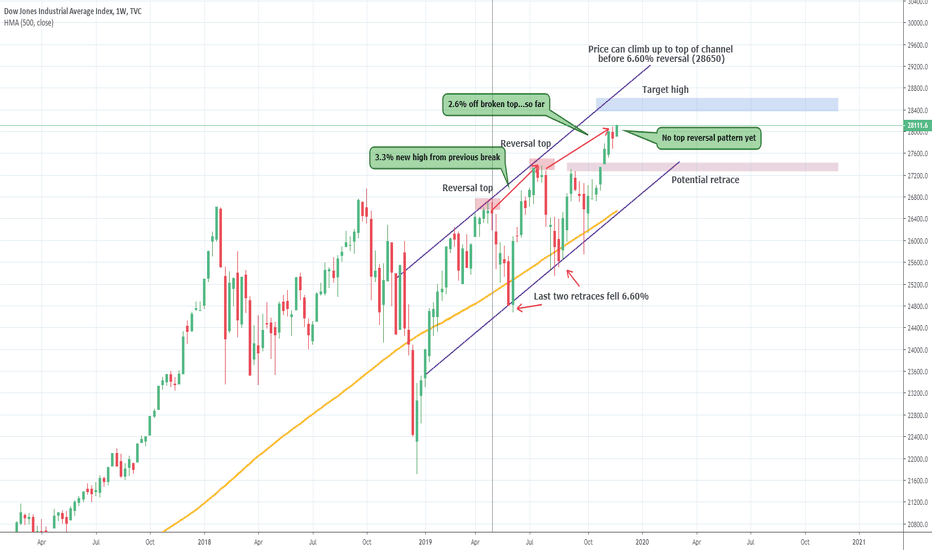

DOW JONES NOT REVERSING YET: WEEKLYThe Dow Jones Industrial Average is still looking like a strong bull on the weekly timeframe. The candles have not yet formed a reversal pattern, there is still potential for the upside after breaking the previous top. On a weekly candle once a pin bar formation of a strong reversal Doji forms then we can talk about the potential downside. For now, the target is still the top of the channel at 28650-28700.

There is a potential for a slight retrace but price should not get much below 27300 on a long-term perspective. That will ensure structure holds well bullish. Each failure off the top of the channel was followed by a 6.60% retrace, for that to occur price has to move up to the top of the channel, IF there is a 6+% retrace, the channel and bull structure is broken and the move lower can price the Dow Jones into correction territory.

Dow Jones, trending upwardsTVC:DJI has got on the uptrend on the weekly charts, mimicking the uptrend seen on Weekly charts on the S&P 500

The charts shows a series of higher highs and higher lows, confirming the current uptrend and the recently weekly candle has closed over the previous high indicating continuation of the uptrend. Watch for any retracements to see if the lows are higher than the previous lows.

Post the entry signal, Dow jones has given a positive return of nearly 6% so far.

if higher lows are confirmed, one may treat this as an fresh entry point by also looking at lower time frame charts

Linking below my last analysis on S&P.

If you like what you see, please share a thumbs up and a comment in the section below

If you want any specific analysis, drop a comment below and I will come up with various time frame analysis for you

Cheers

Dow Jones Trading 2 HR Chart Oktober EducationHere i show you a simple trading stragety

on a 2 HR Chart.

So only a few trades in a month.

Trading Long if you have a high high

anmd trading short if you have a lower low.

10 Trades

+ 330

+ 60

+ 400

- 270

- 45

+ 30

+ 45

- 110

- 190

+ 250

6 Gewinner + 1115 Points

4 Verlierer - - 715 Points

SUMMARY 400 POINTS

with only 4 times a day to watch the chart

It would be even better in a 1 HR chart

with more trades and better Results

Good trades.

if you want to support my work, please like them

My analyes here are all NOT a request to buy or sell

seomething. Allways do you own research.

Renkotrade

LONG DJI Dow Jones How to trade DJI before open

Hello to all watching my charts.

Dow Jones is fine to trade by support / resistance and also trendline

Trading.

Look at the chrt for today.

We have support in the aerea 26730 (blue line) and we do have

a LONG trendline which is now 26855.

But the the support levels to watch out.

I count only END of 1 HR information.

So a level below that which is only in the Hour is not counted

in my system.

Good trades

If you want to support my work , please be so kind and like them

-

My posts are not and advice to buy or sell something

always do your own research

-

Renkotrade

DOW JONES/SPX500 - EU woke up with a strong downwards moveHello traders

I. Wisdom of the day

I heard a lot of trading saying that trading INDICES (CFD) is only interesting when the USA wakes up.

Nothing could be further from the truth...

It's not common knowledge that the DOW JONES/SPX500 often give an interesting move when the Europeans wake up.

This interesting trade often happens between 6:30 and 8:30 am (UTC+2)

II. Why a 1-minute chart?

This is not a scalping trading method, it's intraday and based on smoothed indicators for entering in a strong trend only.

The Algorithm Builder method won't give more than 3/5 trades per day even.

Those are the most secure trades possible because:

- the system waits for a strong confirmation and will avoid the fakeouts

- the 1 minute allows to enter very early. This point is crucial.

I made it so that to enter early but with a minimum of security.

III. Signals of the day

3.1 Morning trade

No trade is easy. Especially when I just woke up, signal given in front of supports but... you know the drill... What's a decent way to reduce one's risk?

Answer : Wait for a pullback.

I usually wait for a pullback near the EMA(20) - symbolized by the red circles on my screenshot.

Pullbacks and invalidations are keys to reduce one's risk - which put more weight on the opportunity side of the opportunity/risk scale

3.2 Afternoon trades

The first signal was in front of resistances and against a leading trend. A leading trend in a bigger timeframe also increases the trade security => less risk

IV. Last words

Do you think that looking first to decrease the risk and then capturing the opportunity is the way to go?

All the best,

Dave

Algorithm Builder - INDICES - DOW JONES - Review Oct 18th, 2019Hello traders

I. Daily tutorial publishing challenge officially begins

Starting today, I'll be publishing every night what were the setups given by the Algorithm Builder Indices .

----------------------------------------------------------------------------------------------------

You'll find more information about that script in this script signature.

----------------------------------------------------------------------------------------------------

II. Wisdom of the day

Last Friday was the Triple witching hour day. That is the day where the US contracts come to expiration on the US market - this event happens once a month.

Hopefully, only once a month, because this day is often particularly hard for traders to trade.

Those days are the expiration of three kinds of securities:

1. Stock market index futures;

2. Stock market index options;

3. Stock options.

The simultaneous expirations generally increases the trading volume of options, futures and the underlying stocks, and occasionally increases volatility of prices of related securities.

III. Signals of the day

2.1 Morning trade

We had a difficult move to take because in front of multi-timeframes resistances. What I usually do, is to wait for a pullback near the EMA 20 which has a few huge benefits:

- generally gets me a better entry price (lower for a long, higher for a short)

- reduce the distance between my entry price and stop-loss - hence reducing the risk of the trade

The Algorithm Builder - INDICES calculates the stop-loss internally, based on the price where the signal appears

2.2 Afternoon trades

1. 8:45 am

The first SHORT was given against the leading trend. Around 2:45 pm the background is green, meaning the leading trend is still bullish but as we got a short trade, we had to take it.

Plus we were just below a ton of supports which tells us that a pullback near the EMA 20 is really required.

Before getting invalidated by the brown vertical bar, we had an 84 pips opportunity .

It's usually a good practice to set the stop-loss to breakeven or exit completely a position before the opening at 9:30 am.

We often see violent and unpredictable wicks a few minutes before and after the US stocks open.

2. 4:05 pm (UTC+2)

The IDEAL scenario for the Algorithm Builder. Leading trend is red, short signal, no supports near, a great setup with a decent risk-to-reward ratio.

When we're in the same direction as the leading trend and the next algorithmic SMAs are a bit far, those are the moments where I know that my reward is far greater than my risk.

Would I overleverage or increase my position size drastically anyway knowing this is the Triple witching hour day? Maybe not :)

Maybe I should have (kidding) :( ... it was a 162 pips move :)

All the best,

Dave

ECONOMIC RESET IS NEAR - LEVEL PLAYING FIELD IS NEARDJI VS GOLD

You probably noticed news media screaming about upcoming recession recently... Weird right? Sure is, because that's not exactly what is happening behind the scenes. In reality we are witnessing what is called 'economic reset' also known as financial systems reset. That means that even though recession like impacts are likely, you're not exactly going to see a full follow through this time.

Sure it's easy to make comparisons towards 2008 and say that due to negative yields and other indications that we will have 2008 on steroids... While those people would be correct in a way, we see it a bit differently.

Crypto currency was not invented by mistake and released in the form of Bitcoin in 2008. It was created to 'beta test' a new type of economic system which would result in a 'levels playing field worldwide' and ensure near instant money transfers from point A to point B, eliminating third parties while at the same time increasing control over money flow. I'm not here to suggest that Bitcoin or some crypto coin will be used as global currency in near future and all that, but I am here to suggest that blockchain on which cryptocurrencies run today, might very well be used in the next generation of our global financial systems.

I'll dive deeper into that sometime in the future again, but let me quickly get back to the chart itself...

What do you see there?

On chart we see pre 2008 and mid 2008 crash money flowing out of stocks and into precious metals such as Gold. We then observe that same money slowly flow out during the 2011 - 2015 Mega stock market bull run but then we see Gold begin stabilizing around March 2016 and resuming the uptrend going into today, while the stock market slowly comes to a stall as we see an increase in the trade wars, negative yields, increase in debt and continued world political instability. What does all that mean? It means that the rich are slowly but surely migrating from the traditional stock market into precious metals ones again such as Gold. That also indicates that they potentially see more profits being made in Gold value rise vs the traditional stock markets. We have also heard IMF, World Bank and some of the G20 governments indicate that economic 'reset' is coming and we've heard some leaders express worry in regards to current economic state. Although it might be difficult to wrap your head around exactly what is going on and what is to come, it's surely alarming to see some of the top stock holders such as Warren Buffett unloading on the market while telling the average investor to continue buying.

Conclusion? Be ready for a transition between the old and the new economic/financial systems. There's no guarantee that we will see a shift or a price correlation in the traditional stock markets however its nearly safe to say that something is going to move sooner than later and to be prepared financially.

I will expand more on the upcoming resets soon, but at this time keep in mind that I am not a financial advisor, do not invest what you're not able to afford to lose.

Dow: Just Over 25,000 Monday; Then Brief Relief Rally; Then DownOn Monday I am targeting a finish just over 25,000 but not by much, followed by a slight relief rally to trap bulls further before coming down further.

My target is near 24,000 +/- 50pts by the Fed meeting in mid September where as a result of the stock market on the verge of collapsing, and the trade war escalation, there will likely be a 25bps cut. However, I do not see the Fed providing more immediate relief by proposing a 50bps cut. Therefore, I don't see a huge relief rally off the cut.

At this point, if the Fed cuts 50bps, this will induce more scare into the market as a confirmation of a failing economy. So a one day relief will turn into a potential melt-down. Moreover, I do not believe the Fed can rescue the market at this point (nor can the ECB).

Ultimately, to rescue the market from full melt-down and collapse, you will see huge fiat currency money printing in expense of the USD (and other currencies around the world). For this reason, people should have significant entries in Gold/Silver.

- zSplit

*Note: I will continue to update this idea incase Trump issues some "fake news trade updates", in which case relief rallies may extend further than I have suggested here.

Thoughts on the Dow Jones Heading Into the WeekendHope you guys enjoy the video, be sure to leave a like, comment, and follow for future posts!

The Dow Jones was down about 600 points today as President Trump continued his sparring session with China, and increased tariffs yet again. We can see a dangerous M forming on our 1 day time frame and I indicated crucial support levels with the fibonacci as well as the dashed red line. If those levels do not hold, we will see the Dow take a plummet in the next week, and the talk of a recession may become a reality. Looking at our shorter time frame, we can see the Megalodon timer giving us a green. I hope that this is a sign that buyers will hold the support levels for the Dow Jones, and hopefully the US and China can come to an agreement soon, so that we may continue our bullish run in the stock market!

Our most powerful indicator called the bottom on Bitcoin! Check it out here!